- Home

- »

- Clinical Diagnostics

- »

-

Direct-to-Consumer Genetic Testing Market Size Report 2030GVR Report cover

![Direct-to-Consumer Genetic Testing Market Size, Share & Trends Report]()

Direct-to-Consumer Genetic Testing Market Size, Share & Trends Analysis Report By Test Type (Nutrigenomics, Carrier), By Technology (Whole Genome Sequencing), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-065-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global direct-to-consumer genetic testing market size was valued at USD 1.93 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 24.4% from 2024 to 2030. Direct-to-consumer (DTC) genetic testing has become increasingly popular in recent years, as advancements in technology have made genealogy screening more accessible and affordable. Additionally, the rising interest in pharmacogenetics is anticipated to expand the DTC gene testing space.

In recent years, there has been a significant rise in awareness and demand for personalized healthcare services. Personalized medicine is an approach to healthcare that takes into account an individual's unique gene makeup and environmental factors to tailor medical treatments and interventions. Such trends are expected to increase the demand for genetic testing. Moreover, the development of NGS has accelerated the pace of accessibility and affordability of genome sequencing. Large-scale genomic investigations have been made possible by these developments, which have also made it easier to find genetic markers linked to illness and medication responses.

Growing public awareness about the gene-based screening is also expected to have positive impact on the market growth. For instance, according to the MIT Technology Review, more than 26 million people in the U.S. have already taken DNA tests. The increasing interest of the public in ancestry and genetic testing is driven by increasing advertisements in digital media and online marketing. Key market players, such as 23andMe and Ancestry, are spending heavily on the advertisement of DTC genetic testing to spread awareness about their products and benefits associated with it.

Increasing awareness campaigns regarding the benefits of genomic screening are projected to increase the uptake of cost-effective DTC genetic testing. Moreover, the involvement of market players and regulatory bodies to promote the testing and integration of these services in healthcare settings to reduce overall healthcare expenditure are supporting the market growth. Genetic testing can help manage the rising burden of various targeted diseases by reducing the need for unnecessary screening to detect life-threatening diseases. According to the survey conducted by WebMD in June 2023, most people and doctors agreed that genetic testing is important for personalized healthcare. Around 92% of the doctors said genetic information is important for the patient’s complete health picture, and it could help lead to better outcomes for patients. Moreover, in June 2020, the Australian Medical Association Limited (AMA) stated that genetic testing is likely to transform healthcare services by offering more cost-effective treatments and improving patient outcomes. Such instances are expected to fuel the demand for DTC genetic tests across the globe.

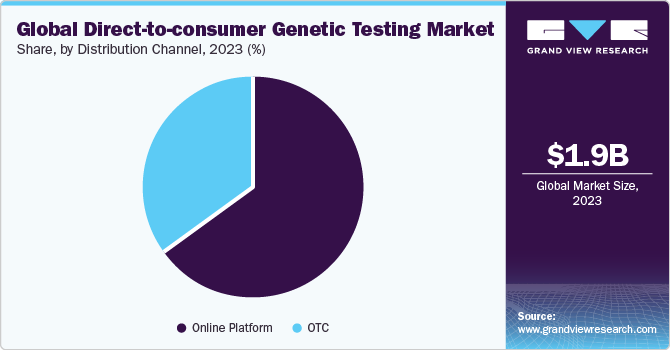

Distribution Channel Insights

Based on the distribution channel, the online platform segment dominated the market and held the largest revenue share of 64.7% in 2023. This segment is also anticipated to witness the fastest CAGR over the forecast period. As per the Journal of Community Genetics in 2023, 75% of DTC DNA online news articles state that the DTC GT testing was majorly being used for familial connection or to understand hereditary traits. In addition, 77.0% of these articles asserted that DTC DNA testing enhances awareness regarding genetic diseases. Nearly 60.0% of the articles stated that DTC DNA results have the potential to inspire people to adopt a more proactive approach toward their health.

OTC platform is anticipated to grow at a significant CAGR over the forecast period since many underdeveloped countries rely more on OTC over the online platform. Consumer preference is shifting from physician-prescribed genetic tests to readily available. This paradigm shift is projected to propel the market growth of DTC genetic tests available at go-to places, such as department stores & supermarkets. Major supermarkets such as Walgreen Co. and Walmart already have these tests on the shelves.

Market Dynamics

The progress of DTC genetic testing has been aided by the revolution in genome screening technologies, which are useful in preventing, maintaining, and treating genetic conditions. It is a useful tool for prompt intervention to treat diseases when detected early in infancy through newborn screening. Moreover, the increasing penetration of novel technologies, such as NGS, is supporting market growth.

The regulatory framework related to DTC genetic testing is unclear in most countries. Such a regulatory scenario makes it easy to get market authorization for novel DTC genetic testing products across the globe. Moreover, these tests can be purchased through online platforms from overseas locations.

Increasing demand for genetic tests to detect diseases, nutrigenomics, and others is encouraging market players to introduce novel and improved testing products. For instance, in April 2023, Genesis Healthcare introduced upgraded ancestry services in Japan.

Factors such as lack of awareness about DTC genetic testing products and privacy & security concerns related to genetic data may adversely impact the market growth over the forecast period.

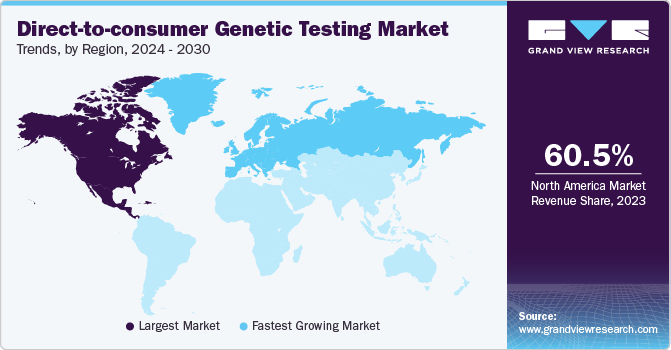

Regional Insights

North America dominated the direct-to-consumer genetic testing market and held the largest revenue share of 60.46% in 2023. The dominance is attributed to the significant shift in the outlook of consumers toward genomic examination. The rapid development of next-generation sequencing and reproductive genetics is a key factor driving the market growth. Advancements in genetic technology have made genetic testing more affordable, accessible, and accurate. Moreover, there is a high demand for personalized treatment in the region, which has further improved market growth.For instance, in July 2023, Quest Diagnostics launched Genetic Insights, its first DTC-GT. The test uses a saliva sample to analyze the potential risk of up to 24 genetically inheritable illnesses, including colon & breast cancer, blood & heart disorders, carrier status for cystic fibrosis, sickle cell anemia, and Tay-Sachs disease.

Europe is expected to show the fastest growth over the forecast period. Market growth can be attributed to the rising prevalence of genetic conditions, improved genetic testing technology, and growing knowledge and acceptance of personalized treatment. Additionally, supporting reimbursement policies and beneficial government efforts have contributed to the market's growth.Key players are constantly focusing on developing novel technologies to meet the rising demand for early diagnosis. For instance, in January 2023, Unilabs entered into agreement with Ambry Genetics to enhance genetic testing services across Europe, Latin America, and the Middle East.

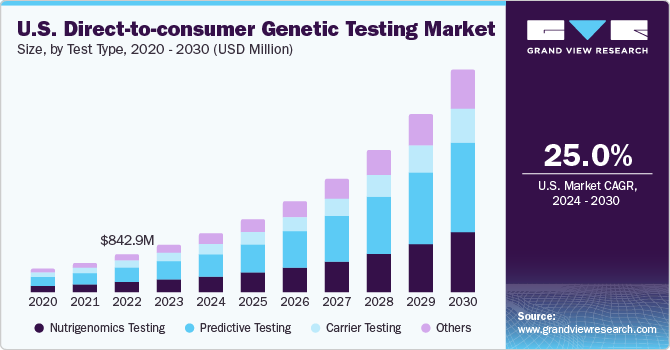

Test Type Insights

The predictive testing segment dominated the market with the largest revenue share of 38.1% in 2023 and is expected to grow at the fastest CAGR over the forecast period. DTC predictive genetic tests have gained significant popularity in the past decade by offering individuals insights into their genetic predispositions for various health conditions. 23andMe's Health + Ancestry DNA test is an example. In addition, an increasing number of product launches are also expected to offer a favorable environment for segment growth. For instance, in February 2022, Invitae Corporation announced the launch of its new genetic testing kits for cancer diagnosis, LiquidPlex Dx and FusionPlex Dx in Europe.

Nutrigenomics testing segment is anticipated to show lucrative growth over the forecast period. The rising prevalence of polygenic diseases like cardiovascular disease, obesity, and type 2 diabetes in recent years is attributable to lifestyle changes. In the emerging field of precision medicine, nutritional genomics offers personalized nutrition to prevent & manage these polygenic diseases efficiently.More companies are entering this segment in developing countries to tap the emerging & growing markets. For instance, in June 2023, Xcode Life announced the launch of its gene nutrition test in India, which covers 50 aspects of nutrition.

Technology Insights

The whole genome sequencing segment dominated the DTC genetic testing market and accounted for the maximum revenue share of 39.2% in 2023. It is expected to grow at the fastest CAGR. Whole genome sequencing provides a complete view of an individual's entire genome, including all genes and non-coding regions. For instance, in February 2023, the NIH researchers launched an innovative software Verkko, which is capable of assembling the complete genome sequence more easily and economically. Moreover, the increase in cancer-causing mutations further boosts the whole genome sequencing segment.

The targeted analysis segment is expected to show lucrative growth over the forecast period. In contrast to broader genetic testing, which analyses a wide range of genetic markers & traits, targeted analysis focuses on specific genetic markers or genes associated with particular health conditions or traits of interest. This allows consumers to receive genetic information tailored to their specific concerns or interests. Multiple tests are available in this category, including BRCA1 & BRCA2 mutation testing, celiac disease genetic testing, Alzheimer’s disease risk assessment, lactose intolerance genetic testing, skin aging genetic analysis, and melanoma risk genetic testing.

Key Companies & Market Share Insights

The market is moderately fragmented, with a large number of medium and large-sized companies accounting for the majority revenue of the market. These entities are undertaking various strategic initiatives to strengthen their market presence.

-

In April 2023, Genesis Healthcare Co., through its GeneLife brand, launched a significant upgrade to its ancestry services by introducing Haplo 3.0 in Japan.

-

In July 2023, Quest Diagnostics launched Genetic Insights, its first DTC-GT. The test uses a saliva sample to analyze the potential risk of up to 24 genetically inheritable illnesses, including colon & breast cancer, blood & heart disorders, carrier status for cystic fibrosis, sickle cell anemia, and Tay-Sachs disease.

Key Direct-to-Consumer Genetic Testing Companies:

- 23andMe

- Family Tree DNA

- Ancestry

- Genesis HealthCare

- EasyDNA,

- Veritas

- Myriad Genetics Inc.

- Full Genomes Corporation, Inc

- Living DNA Ltd.

- Color Health, Inc.

Direct-to-Consumer Genetic Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.38 billion

Revenue forecast in 2030

USD 8.82 billion

Growth rate

CAGR of 24.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Test type, technology, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

23andMe; Family Tree DNA; Ancestry; Genesis HealthCare; EasyDNA; Veritas; Myriad Genetics Inc.; Full Genomes Corporation, Inc.; Living DNA Ltd.; Color Health, Inc.,

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Direct-to-Consumer Genetic Testing Market Report Segmentation

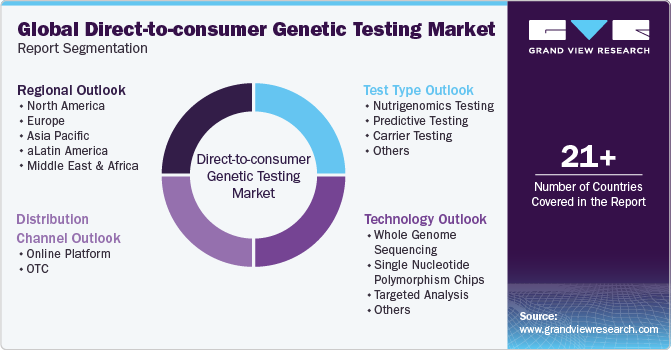

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global direct-to-consumer genetic testing market report based on test type, technology, distribution channel, and region.

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Nutrigenomics Testing

-

Predictive Testing

-

Carrier Testing

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Whole Genome Sequencing

-

Single Nucleotide Polymorphism Chips

-

Targeted Analysis

-

Others

-

-

Distributional Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Platform

-

OTC

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global direct-to-consumer genetic testing market size was estimated at USD 1.93 billion in 2023 and is expected to reach USD 2.38 billion in 2024.

b. The global direct-to-consumer genetic testing market is expected to grow at a compound annual growth rate of 24.4% from 2024 to 2030 to reach USD 8.82 billion by 2030.

b. North America dominated the direct-to-consumer genetic testing market with a share of 60.46% in 2023. This is attributable to rising healthcare awareness coupled with high demand and constant research and development initiatives.

b. Some key players operating in the direct-to-consumer genetic testing market include 23andMe, Family Tree DNA, Ancestry, Genesis HealthCare, EasyDNA, Veritas, Myriad Genetics Inc., Full Genomes Corporation, Inc., Living DNA Ltd., Color Health, Inc.

b. Key factors that are driving the market growth include advancements in technology and rising interest in pharmacogenetics is anticipated to expand the DTC testing space.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."