- Home

- »

- Biotechnology

- »

-

Nutrigenomics Market Size, Share & Growth Report, 2030GVR Report cover

![Nutrigenomics Market Size, Share & Trends Report]()

Nutrigenomics Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Obesity, Cardiovascular Diseases, Cancer Research), By Product, By Technique, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-791-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nutrigenomics Market Size & Trends

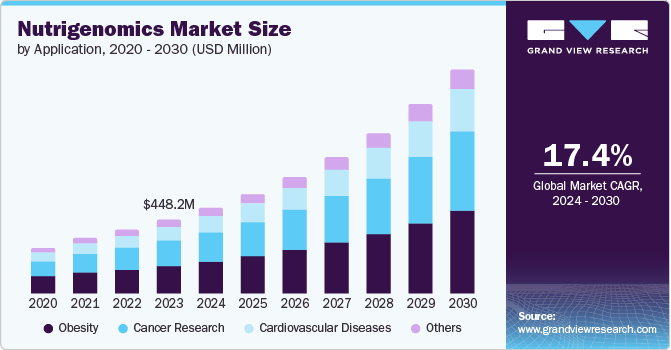

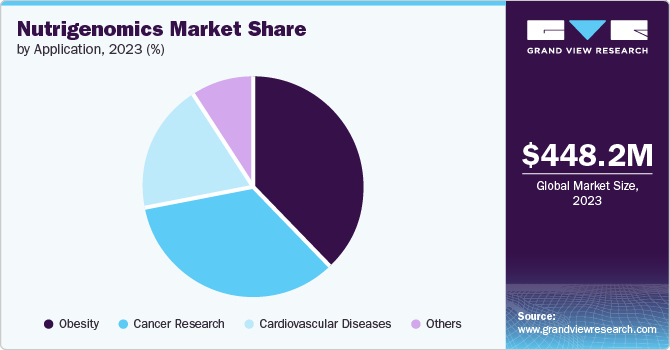

The global nutrigenomics market size was valued at USD 448.2 million in 2023 and is projected to grow at a CAGR of 17.4% from 2024 to 2030. Increasing prevalence of obesity, growing awareness of the importance of a healthy diet, and rising prevalence of chronic diseases are the driving factors for the global nutrigenomics market growth.

The nutrigenomics industry has gained significant attention in recent years, driven by the growing demand for personalized treatments and the increasing awareness of the importance of diet-nutrition interactions on human health. This sub-discipline of medicine focuses on analyzing the relationships between genes, diet, and health, with the goal of identifying genetic predispositions to common diseases such as cancer, cardiovascular diseases (CVD), and obesity. By understanding how genes respond to different nutrients, nutrigenomics can help create tailored dietary approaches to prevent or mitigate these conditions.

The rise of next-generation sequencing (NGS) technologies has enabled researchers to study the human genome's interactions with nutrients on a molecular scale. With approximately 20,000 genes in the human body, each having some form of interaction with diet, nutrigenomics holds significant potential for precision medicine. The success of the Human Genome Project has also contributed to the growth of this industry, as it has paved the way for detailed genomic analysis and personalized treatment strategies.

The affordability of healthcare has been a major factor driving the development of the nutrigenomics industry. According to the CDC, heart disease accounted for a staggering 695,000 fatalities in the U.S. in 2021, emphasizing the urgent need for patients to seek affordable alternatives. As brand drugs often come with a hefty price tag, consumers are increasingly opting for nutrigenomics as a more economical approach to addressing underlying health issues. By adopting nutrigenomics technologies, individuals can make data-driven dietary decisions, thereby improving their overall well-being and reducing healthcare expenditures, ultimately leading to enhanced quality of life and reduced healthcare costs.

Product Insights

Reagents & kits accounted for the largest market revenue share in 2023. The increasing interest in tailor-made nutrition and deciphering the impact of genetics on dietary reactions has led to a surge in the need for nutrigenomic testing. Reagents and kits are essential in assisting with the gathering and examination of genetic samples, enabling people to acquire tailored information about their dietary requirements. Therefore, these factors will increase the need within this category.

The services segment is expected to register the fastest growth over the forecast period. Services have a crucial part in conveying nutrition solutions that will suit the genetic makeup of customers. In addition, these services involve genetic testing, the evaluation of data, and the determination of the effects of genetic variations on metabolism and diet. Further, genetics testing services need samples such as saliva or blood to be taken and then the DNA is identified through better sequencing or genotyping methodologies. In addition, genetic data is processed by data analysis platforms to determine the relevant variant and the relationship it has with tailored dietary recommendations.

Technique Insights

In 2023, buccal swabs dominated the market due to their reliability and comfort. Buccal swab testing is a non-invasive method that collects cells from the inner cheek, making it suitable for self-testing kits and clinical care centers. Its simplicity and accuracy have led to widespread adoption in nutrigenomics, enabling the investigation of gene traits linked to nutrient metabolism and dietary responses.

The blood segment is expected to register the fastest growth during the forecast period. Blood testing continues to be a crucial element in nutrigenomics, providing detailed genetic data for customized nutrition advice. Blood samples are rich in DNA of high quality, allowing for in-depth examination of the relationship between genes and nutrients, metabolic processes, and factors that influence the risk of disease. Even though blood collection is more intrusive than saliva and buccal swab techniques, it offers important information on genetic differences related to nutrition and health. Breakthroughs in blood-based testing methods, such as next-generation sequencing (NGS), improve the accuracy and effectiveness of genetic examination in the field of nutrigenomics, leading to ongoing acceptance in this specific market category.

Application Insights

Obesity dominated the market and accounted for a share of 38.0% in 2023. The growing global obesity epidemic has led to a surge in demand for personalized weight loss approaches. Nutrigenomics offers tailored solutions based on an individual's genetic profile, catering to this need. With the World Obesity Atlas 2023, published by World Obesity Federation, forecasting 51% of the global population will be obese or overweight by 2035, and health issues linked to obesity projected to cost USD 4 trillion annually by 2035, nutrigenomics is poised for significant growth.

Cancer research is projected to be the fastest-growing application of nutrigenomics over the forecast period, registering a CAGR of 18.0%. By understanding how diet interacts with genes, researchers can identify people at higher risk of developing cancer due to their genetics. Early detection and dietary modifications based on this information can potentially prevent cancer or slow its progression. Nutrigenomics research is helping develop targeted dietary recommendations that can address specific genetic risk factors for cancer. This offer new tools for managing the disease alongside traditional treatments.

End Use Insights

Hospitals & clinics dominated the market share in 2023 primarily due to the quickly changing and unpredictable regulatory environment of telehealth. Hospitals and clinics are the primary drivers of the nutrigenomics market, leveraging their ability to integrate personalized nutrition into patient care. By utilizing nutrigenomic insights, healthcare professionals in these settings can provide tailored dietary recommendations based on individual genetic profiles, resulting in enhanced treatment efficacy for various health issues, including obesity and chronic diseases.

With access to advanced technologies and expert resources, hospitals and clinics foster collaboration among healthcare professionals, enabling the development of comprehensive nutritional strategies that address unique patient needs. As demand for personalized health solutions continues to grow, hospitals and clinics are poised to remain market leaders, driving the adoption of nutrigenomics into mainstream healthcare. This leadership position enables them to stay at the forefront of innovation, driving better patient outcomes and improved health outcomes.

Regional Insights

North America nutrigenomics market dominated the global nutrigenomics market in 2023 with 40.2% of the total revenue share. Market growth in the region is fueled by the emergence and advancement of direct-to-consumer nutrigenomics kits as well as a rise in the consumption of specialized foods and diets. In addition, increasing obesity rates, an elderly population, growing healthcare expenses, and the existence of a well-developed healthcare system influence the trend.

U.S. Nutrigenomics Market Trends

The nutrigenomics market in the U.S. dominated the North America nutrigenomics market with a share of 87.3% in 2023, driven by the country's largest market size. The U.S. market is expected to grow due to the rising prevalence of obesity and chronic diseases, presenting opportunities for nutrigenomics companies to capitalize on the trend towards personalized health and wellness solutions.

Europe Nutrigenomics Market Trends

Europe nutrigenomics market was identified as a lucrative region in 2023. The region is experiencing a surge in demand for specialized testing services, moving beyond standard genetic testing kits. These premium services provide in-depth analysis of genetic factors influencing nutrition, empowering consumers with personalized dietary recommendations. The integration of gut microbiome examination is another key development, enabling a more comprehensive understanding of individual nutritional needs.

The nutrigenomics market in the UK is poised for rapid growth, driven by the escalating incidence of CVD. This emerging field can identify genetic predispositions that increase the risk of CVD, enabling individuals to take preventative measures and make informed lifestyle choices. By leveraging nutrigenomics, healthcare providers can offer targeted interventions and improve patient outcomes.

Asia Pacific Nutrigenomics Market Trends

Asia Pacific nutrigenomics market is expected to experience the fastest growth of 18.1%, driven by the increasing prevalence of chronic diseases such as diabetes, obesity, and heart disease. As regional economies develop and disposable income rises, consumers are increasingly investing in health and wellness products and services, including nutrigenomics testing, fueling market expansion in this region.

The nutrigenomics market in China held a substantial share in 2023, driven by its vast and genetically diverse population. With tailored research focused on the Chinese market, nutrigenomics companies can unlock valuable insights and personalized dietary recommendations, creating a significant opportunity for growth and revenue expansion in this lucrative market.

Key Nutrigenomics Company Insights

Some key companies in nutrigenomics market include Nutrigenomix; The Gene Box; Metagenics; Xcode Life; and others. The competitive landscape is transforming rapidly, fueled by consumer demand for personalized nutrition and growing diet-related diseases. Companies are leveraging partnerships, innovation, and expansion to solidify their market position.

-

The Gene Box offers personalized genetic testing services using DNA spit tests to determine one's genetic predisposition to food tolerance, food aversion, and sporting or fitness tendencies. Company offers the report with the insights and recommended strategies on nutrigenomics, fitness genomics, and health genomics.

-

dnalife offers genetic testing to improve health and well-being and lower the chances of illness. Company offer nutrigenomics and pharmacogenomics tests to offer more personalized healthcare according to a person's genetic capabilities. Their findings provide clinicians with valuable insights that can lower the risk of disease and improve patient well-being.

Key Nutrigenomics Companies:

The following are the leading companies in the nutrigenomics market. These companies collectively hold the largest market share and dictate industry trends.

- Nutrigenomix

- The Gene Box

- Metagenics

- Xcode Life

- GX Sciences, LLC (Fagron)

- Cura Integrative Medicine

- dnalife

- Genova Diagnostics (GDX)

- HOLISTIC HEALTH INTERNATIONAL, LLC

Recent Developments

-

In June 2023, Xcode Life introduced a genetic Nutrition test in India. The exam assesses close to 50 factors related to nutrition such as breakdown of macros (carbs, protein, fats) based on genes, risk of vitamin and mineral deficiencies, eating habits, managing weight through nutrition, food preferences, reactions to diets, and sensitivities to foods.

-

In June 2023, GX Sciences partnered with GetHairMD to offer a specialized oral swab genetic test for patients, enabling practitioners to develop tailored treatment plans based on patients' unique genetic profiles, providing a more effective and personalized approach to care.

Nutrigenomics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 519.9 million

Revenue forecast in 2030

USD 1.4 billion

Growth rate

CAGR of 17.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, technique, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Nutrigenomix; The Gene Box; Metagenics; Xcode Life; GX Sciences, LLC (Fagron); Cura Integrative Medicine; dnalife; Genova Diagnostics (GDX); HOLISTIC HEALTH INTERNATIONAL, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nutrigenomics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nutrigenomics market report based on application, product, technique, end use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obesity

-

Cardiovascular Diseases

-

Cancer Research

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Kits

-

Services

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Saliva

-

Buccal Swab

-

Blood

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.