- Home

- »

- Clinical Diagnostics

- »

-

Genetic Testing Market Size & Share, Industry Report, 2030GVR Report cover

![Genetic Testing Market Size, Share & Trends Report]()

Genetic Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (NGS, PCR-based Testing, Array Technology), By Application, By Product, By Channel (Online, Offline), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-040-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Genetic Testing Market Summary

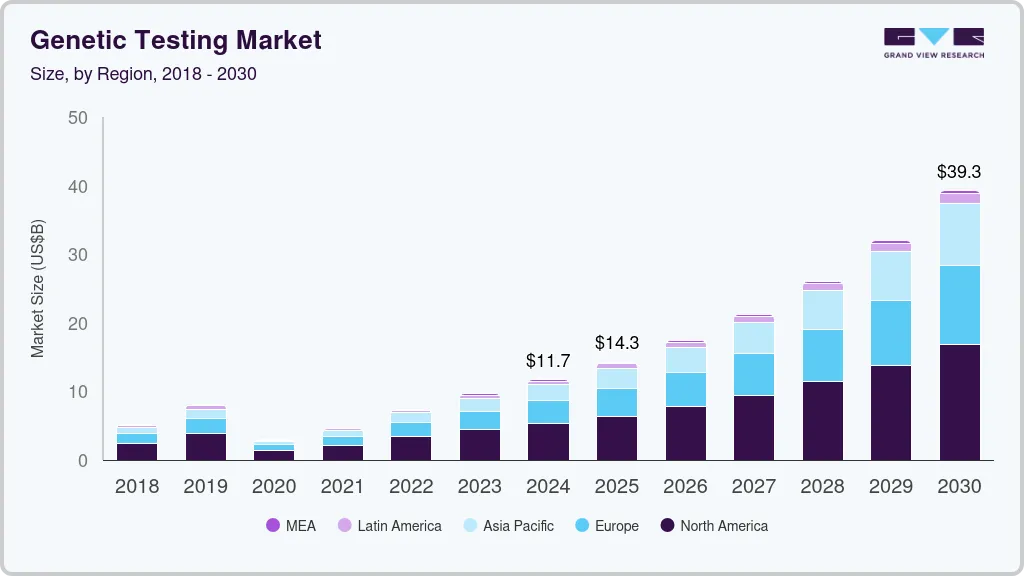

The global genetic testing market size was estimated at USD 11.71 billion in 2024 and is anticipated to reach USD 39.25 billion by 2030, growing at a CAGR of 22.5% from 2025 to 2030. The growing demand for newborn screening is likely to fuel the market for the genetic testing industry. In the United States, for example, newborn screening programs evaluate infants for over 60 different conditions, as highlighted by the American Association for Clinical Chemistry.

Key Market Trends & Insights

- North America genetic testing market dominated the global market with the largest revenue share of 45.38% in 2024.

- The genetic testing market in Asia Pacific is expected to experience at the fastest CAGR of 25.7% during the forecast period.

- Based on technology, the next generation sequencing segment led the market with the largest revenue share of 49.3% in 2024.

- Based on application, the health and wellness-predisposition/risk/tendency segment led the market with the largest revenue share at 52.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.71 Billion

- 2030 Projected Market Size: USD 39.25 Billion

- CAGR (2025-2030): 22.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The U.S. Department of Health and Human Services maintains a Recommended Uniform Screening Panel (RUSP), which lists specific genetic disorders that are recommended for mandatory screening. These recommendations are based on prior data on disease prevalence and incidence, supporting the push for early detection and intervention. Pharmacogenomics testing is increasingly vital in helping clinicians choose the most effective medications and appropriate dosages for patients. The Association for Molecular Pathology (AMP) has made strides toward standardizing these tests across laboratories. In August 2022, the AMP released recommendations for designing and validating clinical genotyping assays for genes like NUDT15 and TPMT. These guidelines provide a minimum set of alleles for labs to identify patients who may have a higher risk of thiopurine toxicity, thereby improving treatment safety and efficacy.

Pharmacogenomics testing is increasingly vital in helping clinicians choose the most effective medications and appropriate dosages for patients. The Association for Molecular Pathology (AMP) has made strides toward standardizing these tests across laboratories. In August 2022, the AMP released recommendations for designing and validating clinical genotyping assays for genes like NUDT15 and TPMT. These guidelines provide a minimum set of alleles for labs to identify patients who may have a higher risk of thiopurine toxicity, thereby improving treatment safety and efficacy.

The COVID-19 pandemic severely impacted public health systems and economies globally, yet it has spurred a moderate positive effect on the genetic testing industry. Researchers, for example, have used genotoxic testing to study the efficacy of drugs against COVID-19. In September 2020, a research team evaluated Chloroquine (CQ) and Hydroxychloroquine (HCQ) for potential use as prophylactic agents against the virus, highlighting the role of genetic toxicology tests in drug assessment, which is likely to contribute to stable market growth post-pandemic.

Despite these advancements, the high cost of genetic testing may impede market growth in developing countries. Depending on the test's complexity, costs can range from under $100 to over $2,000, and higher costs are associated with tests requiring multiple family samples. Results may also take weeks to arrive. In some instances, health insurance covers these tests when prescribed by a medical professional, but coverage varies widely across insurers and policies.

Technology Insights

Based on technology, the next generation sequencing segment led the market with the largest revenue share of 49.3% in 2024. The expansion of genetic testing is being driven by an increase in genome mapping initiatives, higher healthcare spending, advancements in technology, and broader applications of next-generation sequencing (NGS). DNA sequencing is increasingly utilized to identify and analyze various cancers and genetic disorders, with tumor DNA sequencing playing a critical role in detecting unique DNA changes. This insight into genetic alterations supports the development of precisely targeted treatment plans, making genetic testing essential in both clinical and research settings as the incidence of cancer and genetic disorders rises.

The array technology segment is expected to grow at a significant CAGR during the forecast period. This growth is fueled by the rising incidence of cancer, which has increased the adoption of DNA-based arrays in diagnosing genetic diseases and advancing personalized medicine. Arrays allow for the simultaneous analysis of thousands of gene sequences, making them highly valuable for early-stage cancer detection, gene expression studies, and drug discovery.

Application Insights

Based on application, the health and wellness-predisposition/risk/tendency segment led the market with the largest revenue share at 52.3% in 2024. This trend reflects the growing demand for predictive genetic testing and consumer wellness genomics, driven by a heightened focus on healthy lifestyles and increased healthcare awareness. Genetic testing is highly beneficial for assessing potential disease risks and understanding genetic information, including a child’s genetic makeup. It is especially valuable for individuals with a family history of genetic disorders. Nonetheless, the industry faces challenges such as the high cost of genomic research equipment and the complexity of predictive and wellness genomics, which may limit growth.

The genetic disease carrier status segment is also expected to grow at a significant CAGR of 22.5% over the forecast period. Carrier testing evaluates ancestral DNA to identify potential genetic conditions, making it increasingly popular as the field of genetics advances. As a result, demand for carrier testing is likely to increase, further supporting overall genetic testing industry growth.

Product Insights

The consumables segment led the market with the largest revenue share at 60.2% in 2024. The consumables market is poised for strong growth, driven by the consistent demand for reagents and accessories essential in testing processes. Many companies in this sector are pursuing both organic and inorganic strategies to expand their product lines and broaden their geographic reach.

The software & services segment is also expected to experience at a substantial CAGR of 24.8% during the forecast period, largely fueled by strategic investments from contract research organizations (CROs). For instance, in January 2022, Inotiv Inc. enhanced its toxicology research capabilities by acquiring an Integrated Laboratory System (ILS) for USD 56 million. This acquisition is anticipated to expand Inotiv’s capacity and foster growth in in-vivo and in-vitro toxicology services. In addition, the increasing array of services, including those in skin and genetic testing, further supports growth in this segment.

Channel Insights

Based on channel, the offline segment led the market with the largest revenue share of 62.3% in 2024. The rapid development of molecular genetic testing technologies has significantly expanded the genetic testing industry. This progress has also spurred the growth of private diagnostic laboratories offering diverse solutions. A notable trend in molecular-based testing services is the availability of buccal swab collection kits, and saliva-based tests sold over-the-counter in pharmacies, providing convenient options for consumers.

The online channel is expected to exhibit at the fastest CAGR of 23.6% during the forecast period. This growth is driven by increased research funding in molecular biology, the rising popularity of direct-to-consumer testing, and greater awareness and acceptance of personalized medicine. Direct-to-consumer companies leverage both online and over-the-counter (OTC) channels to offer accessible genetic testing solutions. In 2020, online channels accounted for 77.8% of the global direct-to-consumer market, while OTC sales comprised 22.2%. By 2030, online channels are anticipated to dominate further, capturing 80% of the genetic testing industry share.

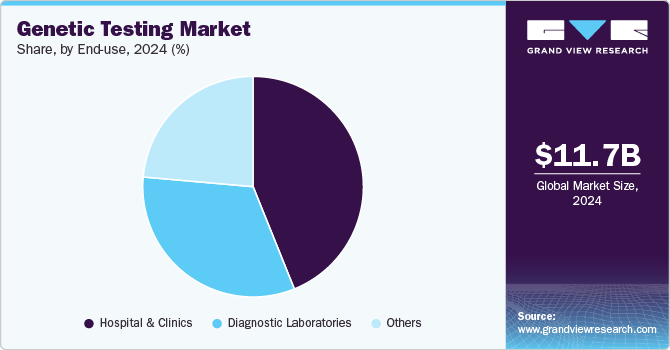

End-use Insights

Based on end use, the hospitals and clinics segment led the market with the largest revenue share at 43.9% in 2024. The genetic testing industry is being propelled by mandatory newborn screening for genetic disorders and a growing prevalence of cancer across various regions. In the U.S., approximately 98% of births occur in hospitals, and an increase in hospital and clinic capacities is expected to further drive testing demand. Supporting this growth, the Australian government announced a healthcare budget of USD 70.12 billion for 2022-2023, marking a 5.7% increase from the previous year, with USD 26.27 million dedicated specifically to expanding newborn screening programs.

The adoption of telehealth and in-hospital services is also fueling market expansion. For instance, in December 2021, Intermountain, a U.S.-based healthcare company, reported an increase in telehealth visits from 7,000 in March 2020 to over 73,000 monthly. This shift was implemented across 225 clinics, 25 hospitals, and affiliated partner hospitals, reflecting a broader trend toward telehealth in healthcare.

The diagnostic laboratories segment is expected to grow at the fastest CAGR of 22.7% during the forecast period, driven by increased partnerships and collaborations with genetic testing companies. For instance, Thermo Fisher Scientific supports laboratories in conducting genetic research by providing advanced technologies like next-generation sequencing (NGS) and quantitative PCR. These collaborations enable diagnostic labs to enhance their testing capabilities and expand their service offerings, contributing to the overall market growth.

Regional Insights

North America genetic testing market dominated the global market with the largest revenue share of 45.38%% in 2024. The rising demand for diagnostic services is largely driven by the growing prevalence of chronic illnesses and the advancement of diagnostic technologies. In addition, the increasing cases of infectious diseases, such as tuberculosis, HIV, and influenza, is expected to heighten the need for effective detection and treatment options. This demand is further supported by well-established healthcare infrastructure and government funding for research in the region, which together are anticipated to bolster market growth.

U.S. Genetic Testing Market Trends

The genetic testing market in U.S. is projected to grow at a significant CAGR during the forecast period, driven by combination of factors, including increasing awareness of the benefits of early disease detection, advancements in molecular biology, and a growing emphasis on personalized medicine.

Europe Genetic Testing Market Trends

The genetic testing market in Europe is likely to emerge as a lucrative region in the industry. Advances in genetic testing technologies, such as next-generation sequencing (NGS), have made testing more accurate, accessible, and cost-effective, fueling demand across both clinical and research settings. Furthermore, government initiatives and funding for genetic research and healthcare improvements, along with an increased focus on preventative care and early diagnosis, are accelerating market expansion.

The UK genetic testing market is projected to grow at the fastest CAGR during the forecast period. The UK government's commitment to healthcare innovation, including funding for genomic research and initiatives like the 100,000 Genomes Project, is accelerating the development and use of genetic testing. In addition, the increasing prevalence of genetic diseases and the growing adoption of direct-to-consumer genetic testing are further contributing to market expansion.

The genetic testing market in France is expected to grow at a steady CAGR over the forecast period, driven by advancements in medical research, an increasing focus on personalized healthcare, and rising awareness of genetic disorders. The French healthcare system is placing greater emphasis on precision medicine, which is driving the demand for genetic testing services, especially for oncology, hereditary diseases, and prenatal testing.

The Germany genetic testing market is projected to expand at a significant CAGR during the forecast period. The country's strong healthcare infrastructure and commitment to integrating genomic technologies into clinical practice are driving the adoption of genetic testing, particularly for oncology, rare diseases, and prenatal screening. Government funding for genomics research and the expansion of healthcare initiatives aimed at early disease detection further support market growth.

Asia Pacific Genetic Testing Market Trends

The genetic testing market in Asia Pacific is expected to experience at the fastest CAGR of 25.7% during the forecast period. The growing prevalence of chronic and genetic diseases, along with the rising demand for personalized medicine, is fueling the need for genetic testing services. Governments in several countries are also supporting the market by funding genomics research and integrating genetic testing into public health programs. Furthermore, the increasing adoption of direct-to-consumer genetic testing and the expansion of healthcare access in emerging economies are contributing to the overall market growth in the Asia Pacific region.

The China genetic testing market is projected to expand at a significant CAGR throughout the forecast period, driven by several key factors, including increasing healthcare investments, rising prevalence of genetic disorders, and advancements in medical research. The Chinese government is actively promoting the development of precision medicine and genomics research, which is driving the demand for genetic testing services.

The genetic testing market in Japan is anticipated to grow at the fastest CAGR during the forecast period, due to advancements in genomic research, increasing demand for personalized medicine, and a rising focus on preventive healthcare. The Japanese government has made significant investments in genomic healthcare, promoting initiatives to integrate genetic testing into public health programs and clinical practice.

Latin America Genetic Testing Market Trends

The genetic testing market in Latin Americais expected to experience at a significant CAGR throughout the forecast period. There is a growing demand for genetic testing services, particularly in countries with stronger healthcare infrastructure, like Brazil and Argentina. The expanding adoption of personalized medicine, coupled with government initiatives to enhance healthcare access and funding for genetic research, is further supporting the market. Moreover, the rising middle class, increasing healthcare investments, and greater access to direct-to-consumer genetic tests are fueling market expansion across the region.

The Brazil genetic testing market is anticipated to grow at the fastest CAGR during the forecast period, mainly due to increasing demand for personalized medicine, rising awareness of genetic disorders, and advancements in healthcare technology.

The genetic testing market in Saudi Arabia is anticipated to experience at a substantial CAGR during the forecast period. Saudi Arabia's government is actively supporting genetic research and the integration of genomic technologies into healthcare systems, aiming to improve early disease detection and personalized treatments. With a growing incidence of genetic disorders and chronic diseases, there is an increasing demand for genetic testing, particularly for prenatal screening, oncology, and rare diseases.

Key Genetic Testing Company Insights

The global genetic testing industry is highly competitive, with numerous players striving to maintain market leadership through innovation, product diversification, and strategic investments. These companies boast extensive product portfolios, a broad geographic presence, and robust distribution networks, allowing them to cater to a wide range of customer needs across both clinical and direct-to-consumer markets. To stay ahead of the competition, many industry leaders have made substantial investments in research and development, enabling them to introduce advanced and cutting-edge genetic testing solutions. These efforts not only enhance their market position but also drive the continuous evolution of the industry, meeting the growing demand for personalized medicine, early disease detection, and genomic research. For instance, in June 2023, Devyser announced the launch of LynchFAP and BRCA PALB2 which are used in Lynch syndrome diagnosis and cancers.

Key Genetic Testing Companies:

The following are the leading companies in the genetic testing market. These companies collectively hold the largest market share and dictate industry trends.

- 24 genetics

- Circle DNA

- Tellmegen

- 23andme

- AncestryDNA

- MyDNA

- Everly Well

- Igenomix

- VitaGen

- Myriad Genetics, Inc.

- Mapmygenome

- Helix OpCo LLC

- MyHeritage Ltd.

- Illumina, Inc.

- Color Genomics, Inc.

- Amgen, Inc.

- Beyond Nutrition Health and Wellness Services DMCC

Recent Developments

-

In October 2024, EpiMedTech announced launch of epiGeneComplete which is a complete profile test providing insight into aging, metabolism issues, inflammation, stress, and more. The test uses NGS platform along with DNA methylation & SNP markers for higher accuracy

-

In November 2024, ProPhase Labs, Inc announced that they have launched DNA Complete, Inc which will be a wholly owned subsidiary offering D2C DNA tests

-

In November 2024, Myriad Genetics, Inc. launched SneakPeek which is a at home gender test and available across 8800 retailers across the U.S.

Genetic Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.25 billion

Revenue forecast in 2030

USD 39.25 billion

Growth rate

CAGR of 22.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, product, channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden ; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa.

Key companies profiled

24 genetics; Circle DNA; tellmegene; 23andme; AncestryDNA; MyDNA; Everly Well; Igenomix; VitaGen; Myriad Genetics Inc.; Mapmygenome; Helix OpCo LLC; MyHeritage Ltd.; Illumina, Inc.; Color Genomics, Inc.; Amgen, Inc.; Beyond Nutrition Health and Wellness Services DMCC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Genetic Testing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global genetic testing market report on the basis of technology, application, product, channel, end-use and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Next Generation Sequencing

-

Array Technology

-

PCR-based Testing

-

FISH

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Ancestry & Ethnicity

-

Traits Screening

-

Genetic Disease Carrier Status

-

New Baby Screening

-

Health and Wellness-Predisposition/Risk/Tendency

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Equipment

-

Software & Services

-

-

Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global genetic testing market size was estimated at USD 11.71 billion in 2024 and is expected to reach USD 14.25 billion in 2025.

b. The global genetic testing market is expected to grow at a compound annual growth rate of 22.5% from 2025 to 2030 to reach USD 39.25 billion by 2030.

b. North America dominated the genetic testing market with a share of 45.4% in 2024. This is attributable to increasing technological developments in sequencing, decreasing costs of sequencing, and growing awareness about the benefits of genetic testing.

b. Some key players operating in the genetic testing market include 24 genetics; Circle DNA; Illumina Inc.; tellmegene; 23andme; AncestryDNA; MyDNA; Everly Well; Igenomix; VitaGen; and Myriad Genetics, Inc.;

b. Key factors that are driving the market growth include factors such as increasing awareness of newborn screening and the rising prevalence rate of genetic disorders are directly impacting the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.