- Home

- »

- Next Generation Technologies

- »

-

Enterprise Software Market Size, Share, Growth Report 2030GVR Report cover

![Enterprise Software Market Size, Share, & Trends Report]()

Enterprise Software Market (2025 - 2030) Size, Share, & Trends Analysis Report By Software (Enterprise Resource Planning (ERP) Software), By Deployment (On-premise, Cloud), By Enterprise Size (Large Enterprise), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-991-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Software Market Summary

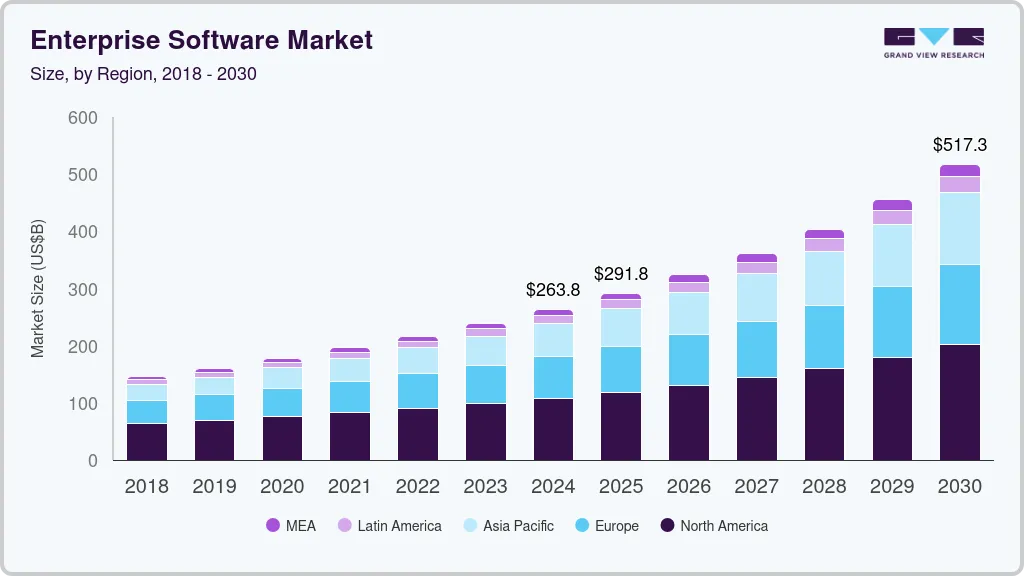

The global enterprise software market size was estimated at USD 263.79 billion in 2024 and is projected to reach USD 517.26 billion by 2030, growing at a CAGR of 12.1% from 2025 to 2030. The increasing preference for automated and integrated solutions is driving the growth of the market.

Key Market Trends & Insights

- The North America enterprise software market held a market share of over 41% in 2024.

- The U.S. enterprise software market is growing significantly at a CAGR of 11.6% from 2025 to 2030.

- Based on deployment, the cloud segment accounted for the largest market share of over 55% in 2024.

- In terms of enterprise size, the large enterprise segment accounted for the largest market share of over 62% in 2024.

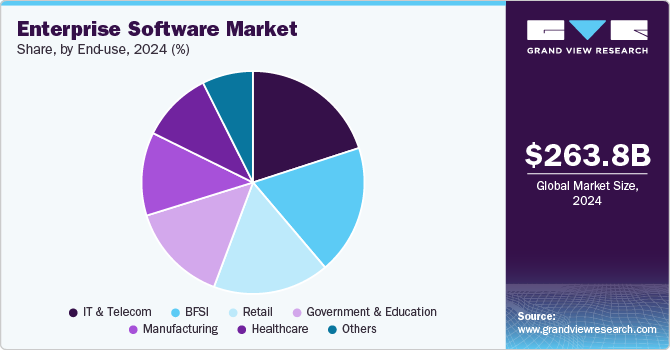

- Based on end-use, the IT & Telecom segment accounted for the largest market share of over 20% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 263.79 Billion

- 2030 Projected Market Size: USD 517.26 Billion

- CAGR (2025-2030): 12.1%

- North America: Largest market in 2024

As more organizations seek streamlined, reliable software to reduce reliance on human resources, automate routine tasks, and minimize manual errors, the demand for enterprise software solutions continues to rise. This shift is aimed at enhancing overall operational efficiency across industries. In response, market players are recognizing the growing need for advanced enterprise resource planning (ERP), customer relationship management (CRM), and data analytics software, positioning themselves to meet this demand with innovative offerings. Enterprise software is widely utilized across various industries and sectors, including BFSI, healthcare, retail, manufacturing, government, and education. Organizations in these fields often manage vast databases containing critical information and face complex business processes, such as financial management, patient data updates, customer relationship management, official record documentation, and internal workflow management. As a result, there is a growing demand for advanced software solutions among businesses.

Key industry trends such as Industry 4.0, digitization, modern manufacturing, robotics, and the rise of connected devices are driving the demand for advanced technology solutions across sectors like BFSI, manufacturing, healthcare, and government. Additionally, the growing shift toward hybrid work models, accelerated by the COVID-19 pandemic, has significantly boosted the adoption of enterprise software in industries such as healthcare, education, and retail.

For example, in the healthcare sector, enterprise software solutions support crucial functions like hospital management, patient care, and electronic health records management. This expanding use of enterprise software across industries underscores its critical role in optimizing operations and enhancing efficiency in the evolving digital landscape.

Data safety and privacy are critical drivers in the market, as organizations increasingly prioritize the protection of sensitive information and compliance with stringent regulations. With rising concerns over data breaches and cyberattacks, businesses across various sectors are turning to enterprise software solutions that offer robust security features, including encryption, multi-factor authentication, and advanced monitoring tools.

Regulatory frameworks such as GDPR, HIPAA, and other data protection laws have heightened the need for compliance-focused software, driving demand for solutions that ensure secure handling and storage of personal and financial data. This focus on data privacy has opened new opportunities for vendors offering specialized software that integrates strong security protocols while maintaining operational efficiency. The growing trend of hybrid work environments has further emphasized the importance of secure, remote access, making data protection an essential factor in the continued growth of the market.

Software Insights

The enterprise resource planning (ERP) software segment accounted for the largest market share of over 29% in 2024. Enterprise Resource Planning (ERP) software is an integrated and comprehensive suite of applications that streamline and optimize critical business processes within organizations. ERP software acts as a centralized platform that ensures the management of core organizational functions, including finance, supply chain, HR, manufacturing, sales, and customer relationship management. Moreover, it enables smooth communication and information sharing among various departments and teams within enterprises.

The service segment is expected to grow at a significant rate during the forecast period. Customer Relationship Management (CRM) software assists organizations in effectively managing customer interactions, streamlining processes, and enhancing overall customer experience. CRM software, with its advanced capabilities, helps enterprises effectively manage customer data in a centralized database. This enables organizations to comprehensively view each customer's history, preferences, and interactions across different touchpoints. By looking at this historical information, organizations can modify their offerings to meet specific customer requirements, leading to more personalized and relevant interactions.

Deployment Insights

The cloud segment accounted for the largest market share of over 55% in 2024. The demand for cloud-based enterprise software is increasing significantly as it can be hosted on the vendor’s servers and accessed remotely from any location. Cloud-based software eliminates the need for regular manual updates of software solutions in enterprises and enables users to access data easily from any location. The adoption of cloud-based software solutions has increased over the past few years owing to their affordability and ease of usage. Moreover, cloud-based software offers several services, including system customization, data backup, threat protection, and automatic software upgrades, which support organizations in automating their workflows.

The on-premise segment is expected to grow at a significant rate during the forecast period. The on-premise enterprise software is witnessing ample demand from various organizations owing to the rising emphasis of organizations on compliance and data security. With the increasing business requirements, organizations look for software with higher customizations and specifications that can be installed in their preferred locations. On-premise software solutions provide enhanced customization and integration capabilities, offering greater control over sensitive data and ensuring adherence to industry regulations.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of over 62% in 2024. With the increasing customer expectations towards fast service delivery and rising use of technologies, large enterprises often struggle to manage complex and diverse workflows across various departments, which makes it essential to invest in advanced software solutions that can integrate and automate these processes. The enterprise software offers tools for resource management, data analysis, and collaboration, enabling large enterprises to enhance their operational efficiency, streamline business, and reduce manual errors.

The SMEs segment is expected to grow at a significant rate over the forecast period. Business software provides end-to-end software solutions for ease of setup and usage, intuitive design and price, and simple application integration. With the increasing demand for expandable and customizable enterprise software, organizations are providing tailored enterprise software adaptable for projects, industries, and interfaces, along with several well-known third-party technology business tools and solutions.

End-use Insights

The IT & Telecom segment accounted for the largest market share of over 20% in 2024. The increasing adoption of mobile devices, IoT devices, and the rollout of 5G networks has increased the demand for enterprise software to manage the vast amount of data, ensure uninterrupted connectivity, and enable smooth technological innovations and rollouts. Enterprise software solutions are emerging as a robust tool, helping businesses deliver high-quality services, meet evolving customer needs, and stay competitive in a rapidly changing business environment.

The healthcare segment is expected to grow at a significant rate during the forecast period. The demand for enterprise software in the healthcare sector is increasing significantly owing to the rising emphasis on digital transformation, data-driven decision-making, and improved patient care. Healthcare organizations such as hospitals, clinics, and medical institutions are recognizing the need for sophisticated software solutions to streamline operations, enhance patient outcomes, and comply with stringent regulatory requirements. These solutions allow healthcare providers to store, manage, and exchange patient health information digitally, improving the accuracy and accessibility of medical records.

Regional Insights

The North America enterprise software market held a market share of over 41% in 2024. The promising pace of technological advancements in the region, coupled with the heightened adoption of cloud-based enterprise solutions among organizations, is expected to drive the demand for enterprise software. Organizations in the region are compelled to adopt enterprise software to enhance their operational capabilities, improve decision-making, and optimize efficiency. This scenario is expected to drive the growth of the North America market.

U.S. Enterprise Software Market Trends

The U.S.enterprise software market is growing significantly at a CAGR of 11.6% from 2025 to 2030. The fast-paced innovations introduced by key players in the market are expected to strengthen the growth of the enterprise software market in the U.S.

Asia Pacific Enterprise Software Market Trends

The Asia Pacific enterprise software market is growing significantly at a CAGR of 13.7% from 2025 to 2030. The growth of the Asia Pacific market can be attributed to the implementation of advanced technologies such as AI, ML, IoT, and robotics in business processes across industries such as manufacturing, retail, BFSI, and healthcare.

The China enterprise software market is significant growing owing to the digitization and availability of large manufacturing businesses are driving the growth of the market in China. The government's support initiatives to improve the digital ecosystem also attract key players to the market.

The India enterprise software market is driven by the presence of leading industry players and the rising number of international conventions in the country. Companies operating in the Indian enterprise software market emphasize strengthening their product portfolio and increasing their market share.

Europe Enterprise Software Market Trends

The enterprise software market in Europe is growing significantly at a CAGR of 11.7% from 2025 to 2030. In Europe, organizations are adopting enterprise software to make the transaction process seamless and automated. Technological advancements and innovations enable European businesses to make data-driven decisions by integrating insights from various business processes, including sales, marketing, finance, human resources, and customer support teams.

The enterprise software market in the UK is expected to grow considerably over the forecast period owing to the growing emphasis on adopting advanced software solutions, helping organizations become more agile, customer-centric, and efficient. Furthermore, the UK market has seen significant technological advancements in recent years, driven by the increasing demand for more effective and efficient enterprise software such as ERP, HCM, and CRM, among others.

The enterprise software market in Germany is expected to grow at a significant rate driven by initiatives such as Industry 4.0, increasing digitization, and the growing need to reduce reliance on physical processes. Businesses are increasingly adopting enterprise software to integrate IoT, data analytics, and AI into their operations, aiming for smarter and more efficient manufacturing. This push towards advanced technology solutions is transforming industries, making automation and digital transformation essential components for future competitiveness.

Key Enterprise Software Company Insights

Some of the key players operating in the market include Accenture, Broadcom Inc., Cisco Systems Inc., Deltek, Inc., Epicor Software Corporation, Hewlett Packard Enterprise, IBM Corporation, Infor, Microsoft Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, SYSPRO, TIBCO Software Inc., and VMware, Inc. among others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2024, Salesforce.com, Inc., the leading AI-powered CRM platform, announced its agreement to acquire Own Company, a premier provider of data protection and management solutions. Own Company assists organizations in ensuring data security, availability, and compliance while offering advanced insights from critical data. Therefore, the expertise and solutions provided by Own Company are expected to enhance Salesforce.com, Inc.'s ability to deliver comprehensive data protection and management services to its customers.

-

In May 2024, Capgemini, a global leader in consulting, technology, and digital transformation solutions and services, announced the acquisition of Syniti, a provider of enterprise data management software and services specializing in offering platform and migration solutions. This acquisition is aimed at enhancing Capgemini's data-driven solutions for clients globally, particularly in large-scale SAP transformations, including the transition to SAP S/4HANA.

-

In June 2023, TIBCO Software Inc.’s holding company, Cloud Software Group, announced a partnership with Midis Group. The partnership was aimed at ensuring local resources to meet customers’ needs and drive the scalability required to expand the company’s reach in the Middle East, Eastern Europe, and African regions. Midis Group is a group of 170 companies in 70 countries globally, which offers managed IT and consultation services.

Key Enterprise Software Companies:

The following are the leading companies in the enterprise software market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Broadcom Inc. (CA Technologies, Inc.)

- Cisco Systems Inc.

- Deltek, Inc.

- Epicor Software Corporation

- Hewlett Packard Enterprise

- IBM Corporation

- Infor

- Microsoft Corporation

- Oracle Corporation

- Salesforce.com, Inc.

- SAP SE

- SYSPRO

- TIBCO Software Inc.

- VMware, Inc.

Enterprise Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 291.75 billion

Revenue forecast in 2030

USD 517.26 billion

Growth Rate

CAGR of 12.1% from 2025 to 2030

Base Year Estimation

2024

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Software, deployment, enterprise size, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Broadcom Inc.; Epicor Software Corp.; Hewlett Packard Enterprise; IBM Corporation; Microsoft Corporation; Oracle Corp.; Salesforce.com, Inc.; SAP SE; SYSPRO; and Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global enterprise software market report based on software, deployment, enterprise size, end-use, and region:

-

Software Outlook (Revenue; USD Billion; 2018 - 2030)

-

Enterprise Resource Planning (ERP) Software

-

Business Intelligence Software

-

Content Management Software

-

Supply Chain Management Software

-

Customer Relationship Management Software

-

Others

-

-

Deployment Outlook (Revenue; USD Billion; 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue; USD Billion; 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-use Outlook (Revenue; USD Billion; 2018 - 2030)

-

BFSI

-

Retail

-

Healthcare

-

IT & Telecom

-

Government & Education

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue: USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise software market size was estimated at USD 263.79 billion in 2024 and is expected to reach USD 291.75 billion in 2025.

b. The global enterprise software market is expected to witness a compound annual growth rate of 12.1% from 2025 to 2030 to reach USD 517.26 billion by 2030.

b. The enterprise resource planning (ERP) software segment accounted for the largest market share of over 29% in 2024. Enterprise Resource Planning (ERP) software is an integrated and comprehensive suite of applications that streamline and optimize critical business processes within organizations.

b. Some of the key players operating in the market include Accenture, Broadcom Inc., Cisco Systems Inc., Deltek, Inc., Epicor Software Corporation, Hewlett Packard Enterprise, IBM Corporation, Infor, Microsoft Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, SYSPRO, TIBCO Software Inc., and VMware, Inc. among others.

b. The increasing preference for automated and integrated solutions is driving the growth of the enterprise software market. As more organizations seek streamlined, reliable software to reduce reliance on human resources, automate routine tasks, and minimize manual errors, the demand for enterprise software solutions continues to rise. This shift is aimed at enhancing overall operational efficiency across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.