- Home

- »

- Next Generation Technologies

- »

-

ERP Software Market Size & Share, Industry Report, 2030GVR Report cover

![ERP Software Market Size, Share, & Trends Report]()

ERP Software Market (2025 - 2030) Size, Share, & Trends Analysis Report By Deployment (On-premise, Cloud), By Function (Finance, HR), By Enterprise Size, ByVertical, By Region, And Segment Forecasts

- Report ID: 978-1-68038-669-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

ERP Software Market Summary

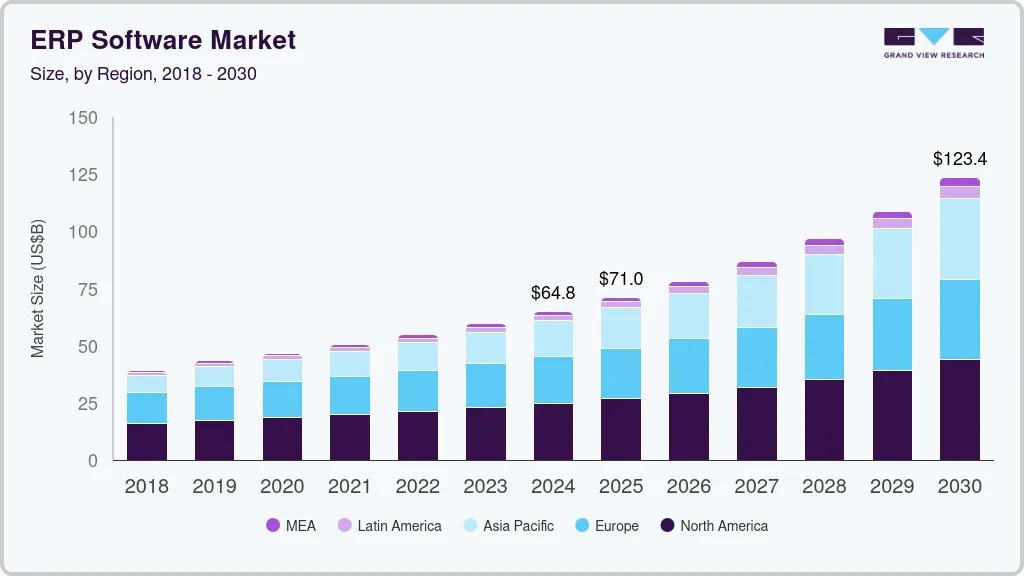

The global ERP software market size was estimated at USD 64.83 billion in 2024 and is projected to reach USD 123.41 billion by 2030, growing at a CAGR of 11.7% from 2025 to 2030. The increasing demand for data-driven decision-making and streamlined operations across various industries drive market growth.

Key Market Trends & Insights

- The North America ERP software market held a share of 38.0% in 2024 due to the growing integration of artificial intelligence (AI).

- The ERP software market in the U.S. is expected to grow significantly at a CAGR of 9.8% from 2025 to 2030.

- Based on deployment, the on-premise segment accounted for the largest revenue share in 2024 in the erp software industry.

- Based on function, the finance segment accounted for a significant revenue share of 29.0% in 2024.

- Based on enterprise, the large enterprises segment accounted for the largest revenue share of over 37.0% in 2024

Market Size & Forecast

- 2024 Market Size: USD 64.83 Billion

- 2030 Projected Market Size: USD 123.41 Billion

- CAGR (2025-2030): 11.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Companies today need to manage and integrate complex processes across departments, including finance, HR, inventory, sales, and supply chain. ERP software consolidates these operations into a unified system, enabling real-time data sharing and analysis across the organization. This transparency and accessibility make ERP software attractive for enterprises looking to improve efficiency, reduce operational costs, and make faster, more informed decisions.

The increasing adoption of mobile and cloud applications is a major growth driver for the ERP software industry, as these technologies enable unprecedented accessibility, flexibility, and scalability. Mobile ERP apps allow employees to access critical data and perform tasks from anywhere, significantly enhancing productivity by enabling real-time decision-making and on-the-go task management. Cloud-based ERP solutions reduce infrastructure costs and provide scalable, subscription-based options, making ERP systems more affordable and accessible to small and medium-sized businesses. Cloud ERP also enables seamless data sharing across departments, fostering better collaboration and allowing businesses to quickly adapt to changes.

The growth of ERP software industry is further fueled by the increasing adoption of digital transformation initiatives across industries. As businesses strive to modernize and digitize their operations, ERP solutions become critical for unifying fragmented processes and delivering actionable insights. Digital transformation efforts require centralized data management, which ERP systems are designed to provide. By integrating data from multiple departments, ERP software supports seamless collaboration and enables faster adaptation to market changes. Companies can leverage ERP data for better forecasting, resource allocation, and overall decision-making, positioning themselves more competitively in their respective markets. This trend is particularly prominent in industries undergoing rapid digitalization, such as retail, healthcare, and manufacturing.

Deployment Insights

The on-premise segment accounted for the largest revenue share in 2024 in the ERP software industry, driven by the need for data security and control. Industries that handle sensitive information, such as healthcare, finance, and government sectors, often prefer on-premise ERP because it allows them to manage data within their infrastructure, reducing concerns about third-party access.

The cloud segment is expected to grow at a CAGR of 13.5% over the forecast period due to the increasing demand for digital transformation across industries. Companies are looking to modernize their processes and adopt digital solutions to stay competitive, and cloud ERP offers an efficient, scalable, and flexible option. With cloud ERP, organizations can remotely manage core business functions like finance, HR, procurement, and supply chain management without investing heavily in IT infrastructure.

Function Insights

The finance segment accounted for a significant revenue share of 29.0% in 2024. The rising demand for enhanced data security and cybersecurity in financial operations propels ERP adoption. With cyber threats rising, finance departments prioritize software that protects sensitive financial data. ERP vendors increasingly incorporate advanced security features, such as multi-factor authentication, data encryption, and regular security updates, to address these concerns.

The HR segment is expected to grow significantly over the forecast period due to growing demand for remote and hybrid work solutions. The shift toward flexible work arrangements has highlighted the importance of remote access to HR tools and resources. ERP systems help HR departments manage distributed teams, track productivity, and ensure compliance, regardless of location.

Enterprise Insights

The large enterprises segment accounted for the largest revenue share of over 37.0% in 2024, driven by the increasing complexity of organizational processes that require streamlined integration and efficient data management in the ERP software industry. Large companies typically operate across multiple regions, manage numerous departments, and oversee vast supply chains, each with specific functions and needs. ERP solutions offer these enterprises the tools to integrate diverse systems into a single, unified platform, providing end-to-end visibility into operations.

The medium enterprises segment is expected to grow significantly over the forecast period. The increasing affordability and flexibility of ERP solutions, particularly cloud-based ERP, appeal to medium enterprises that may lack the IT resources of larger corporations. Cloud-based ERP solutions offer lower upfront costs and reduced infrastructure requirements, ideal for medium-sized businesses with limited budgets. The scalability of these solutions also means that medium enterprises can add features and functionality as their needs evolve, supporting their growth without requiring major system overhauls.

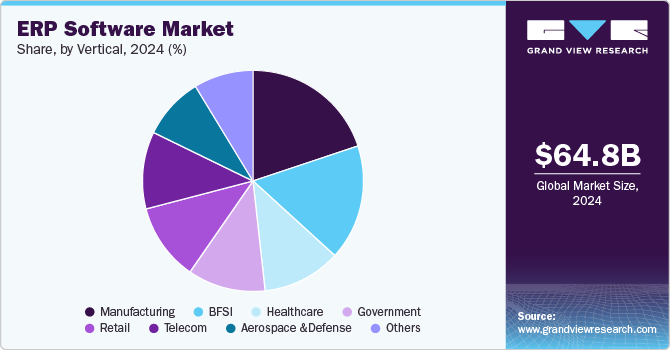

Vertical Insights

The manufacturing segment accounted for the largest revenue share of over 19.0% in 2024. The rise of Industry 4.0 has emphasized smart manufacturing, where ERP systems facilitate the seamless integration of machines and systems on the production floor. Cloud-based ERP solutions also play a significant role in the ERP software industry’s growth, as they provide scalability, flexibility, and remote accessibility, making them ideal for manufacturers with multiple plants or geographically dispersed operations.

The government segment is expected to grow significantly over the forecast period. The government sector is increasingly adopting ERP software as a solution to streamline operations, enhance transparency, and improve service delivery to citizens. The pressing need for governments to modernize legacy systems is a significant driver, as many of them are outdated and unable to support the volume and complexity of contemporary public sector demands.

Regional Insights

The North America ERP software market held a share of 38.0% in 2024 due to the growing integration of artificial intelligence (AI) and machine learning within ERP systems. AI-powered tools are being integrated to automate routine tasks, analyze large data sets, and provide actionable insights. These capabilities are helping businesses optimize processes, predict market trends, and enhance customer experiences. Moreover, AI and machine learning are becoming crucial in financial forecasting, inventory management, and predictive maintenance.

U.S. ERP Software Market Trends

The ERP software market in the U.S. is expected to grow significantly at a CAGR of 9.8% from 2025 to 2030. Many companies are incorporating sustainability features into their ERP systems, with an increasing focus on environmental, social, and governance (ESG) goals. These include tools for tracking carbon footprints, waste reduction, and energy consumption, helping organizations meet regulatory requirements and align with consumer preferences for eco-friendly practices.

Europe ERP Software Market Trends

The ERP software market in Europe is growing with a significant CAGR from 2025 to 2030. Data protection regulations such as the GDPR (General Data Protection Regulation) have strongly emphasized data privacy and security, directly impacting ERP solutions. European businesses are increasingly prioritizing ERP vendors that comply with these stringent regulations. Cloud ERP providers also invest heavily in ensuring robust security features to protect sensitive data and meet legal requirements.

The UK ERP software market is expected to grow rapidly in the coming years. ERP systems in the UK are increasingly being integrated with other emerging technologies like the Internet of Things (IoT), blockchain, and advanced analytics. These integrations help businesses gain more insight into their operations, improve traceability, and enable real-time decision-making. For instance, IoT integration allows businesses to monitor equipment and inventory levels in real-time, while blockchain enhances supply chain transparency.

The ERP software market in Germany held a substantial market share in 2024.IoT is increasingly incorporated into ERP systems, particularly manufacturing and logistics. Devices can now communicate directly with ERP software, offering real-time data on production processes, inventory levels, and maintenance needs. This integration leads to more precise monitoring and proactive decision-making, which is crucial for industries aiming to optimize operations.

Asia Pacific ERP Software Market Trends

The ERP software market in Asia Pacific is growing significantly at a CAGR of 15.6% from 2025 to 2030.Many regional organizations are undergoing digital transformation, and ERP systems are central to these efforts. By providing integrated platforms that support data management and process automation, ERPs are facilitating greater operational efficiency and business agility.

Japan ERP software market is expected to grow rapidly in the coming years.Japan’s aging population and shrinking workforce are prompting companies to focus on HR management solutions integrated into ERP systems. With a need to manage a smaller labor pool more effectively, ERP systems that assist in workforce optimization, employee engagement, and talent retention are becoming increasingly important.

The ERP software market in China held a substantial market share in 2024. Chinese government's supportive policies aimed at fostering the development of smart manufacturing and Industry 4.0. Initiatives such as "Made in China 2025" encourage the adoption of advanced technologies, including ERP systems, to improve productivity and enhance competitiveness. In addition, the increasing adoption of cloud computing solutions has made ERP software more accessible to small and medium-sized enterprises (SMEs), a key segment of China’s economy. Cloud-based ERP platforms' flexibility, scalability, and cost-effectiveness have further accelerated market growth, allowing businesses to implement ERP without the heavy upfront costs associated with traditional on-premise solutions.

Key ERP Software Company Insights

Key players in the ERP software industry are SAP SE, Oracle, Microsoft, Infor Inc., and Epicor Software Corporation. These companies focus on various strategic initiatives, including new product development, partnerships, collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key ERP Software Companies:

The following are the leading companies in the ERP software market. These companies collectively hold the largest market share and dictate industry trends.

- Epicor Software Corporation

- Hewlett-Packard Development Company, L.P.

- Infor Inc.

- IBM Corporation

- Microsoft

- NetSuite Inc.

- Oracle

- Sage Group, plc

- SAP SE

- Unit4

Recent Developments

-

In June 2024, Epicor Software Corporation acquired KYKLO, a U.S.-based Product Information Management (PIM) provider, and content-driven lead generation solutions to enhance sales for manufacturers and distributors. The acquisition is set to strengthen Epicor's AI-driven cognitive ERP strategy. This acquisition aims to enable Epicor to evolve its ERP offerings from traditional record systems to advanced platforms that provide actionable insights and drive business outcomes. Integrating practical, responsible AI aims to keep employees at the forefront, ensuring these tools are easy to use and focused on results.

-

In March 2024, IBM partnered with NVIDIA to accelerate the large-scale adoption of enterprise AI solutions. By combining IBM Consulting’s extensive expertise in industry and technology with NVIDIA's cutting-edge technologies, including NVIDIA AI Enterprise software, NVIDIA NIM microservices, and NVIDIA Omniverse, the collaboration aims to optimize AI workflows. This initiative focuses on refining models for specific use cases and creating tailored AI applications for industries like banking, public services, and industrial sectors, enabling businesses to implement generative AI more effectively.

ERP Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 70.99 billion

Revenue forecast in 2030

USD 123.41 billion

Growth rate

CAGR of 11.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment, function, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Epicor Software Corporation; Hewlett-Packard Development Company, L.P.; Infor Inc.; IBM Corporation; Microsoft; NetSuite Inc.; Oracle; Sage Group, plc; SAP SE; Unit4

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global ERP Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ERP software market report based on deployment, function, enterprise size, vertical, and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance

-

HR

-

Supply Chain

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Medium Enterprises

-

Small Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manufacturing & Services

-

BFSI

-

Healthcare

-

Retail

-

Government

-

Aerospace & Defense

-

Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ERP software market size was estimated at USD 64.83 billion in 2024 and is expected to reach USD 70.99 billion in 2025.

b. The global ERP software market is expected to grow at a compound annual growth rate of 11.7% from 2025 to 2030 to reach USD 123.41 billion by 2030.

b. North America dominated the ERP software market with a share of over 38.0% in 2024. This is attributable to rapid technological advancement in ERP software coupled with the presence of numerous market players.

b. Some key players operating in the ERP software market include Epicor Software Corporation, Hewlett-Packard Development Company, L.P., Infor Inc., IBM Corporation, Microsoft, NetSuite Inc., Oracle, Sage Group, plc, SAP SE, and Unit4.

b. Key factors that are driving the ERP software market growth include rising demand for data-driven decision-making and streamlined operations across various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.