- Home

- »

- Plastics, Polymers & Resins

- »

-

Fluid Dispensing Equipment Market Size, Share Report 2030GVR Report cover

![Fluid Dispensing Equipment Market Size, Share & Trends Report]()

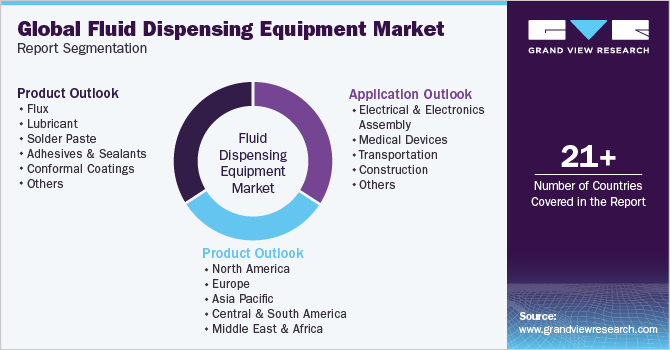

Fluid Dispensing Equipment Market Size, Share & Trends Analysis Report By Product (Flux, Lubricant, Solder Paste, Adhesives & Sealants, Conformal Coatings), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-148-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Fluid Dispensing Equipment Market Trends

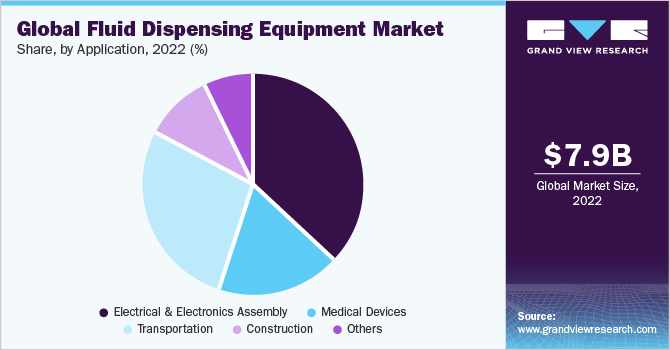

The global fluid dispensing equipment size was valued at USD 7,931.7 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. The high demand for sustainable manufacturing practices to reduce material wastage and optimize the efficiency and accuracy of processes is a key growth driving factor. Moreover, key benefits of sustainable manufacturing are lower resources & production costs, lower regulatory compliance costs, and greater access to financing and capital. Furthermore, technology advancements targeted at automating industrial processes are projected to play a significant role in determining the industry's future. Organizations, for instance, will save operational expenses by 30% by 2024 by integrating hyper-automation technology with improved operational processes. Furthermore, more than 70% of the world's largest corporations will have over 70 concurrent hyper-automation activities requiring control or risking considerable instability. Moreover, Fisnar Inc. provides industrial robotics and automation solutions for fluid dispensing equipment, fueling industry demand.

Manufacturers are able to meet specific industrial criteria with the emergence of highly modern technology that can manage fluid volumes & patterns, which has fueled product demand in numerous sectors. Furthermore, end-use sectors such as automotive, aerospace, electrical & electronics, and construction are expanding, notably in the U.S., creating a demand for technologically improved quality fluid dispensing equipment.

Furthermore, increased demand in semiconductor packaging and circuit assembly would have an impact on the fluid dispensing equipment market's growth rate. Companies in the semiconductor assembly and packaging equipment industry, for instance, are focusing on the deployment of new semiconductor inspection machines that use big data and AI. Applied Materials, for example, developed optical semiconductor wafer inspection tools combining AI and big data technology in August 2021. These machines are used in semiconductor manufacturing to inspect chips automatically and find critical flaws that can damage chips.

The need for fluid dispensing equipment will rise along with the introduction of more precise and effective techniques for fluid dispensing. Other factors such as rising urbanization and a rise in disposable income are also driving the market for fluid dispensing equipment. Moreover, severe rules on manufacturing facilities will accelerate the market for fluid dispensing equipment's growth. The market for fluid dispensing equipment will be greatly impacted by fast-expanding industrialization as well.

The consumer electronics industry has demonstrated a sustained and stable development trend in recent years, driven by factors like the ongoing advancement of mobile internet technology, the improvement of the manufacturing level of consumer electronic products, and the rise in resident income levels. Thus, there is a sizable market for fluid dispensing machinery used in the electronics manufacturing process.

Since the stability, dependability, and safety of electronic products are directly impacted by the technical level of the fluid dispensing equipment used in the electronics manufacturing process, electronics manufacturing enterprises are also continuously upgrading their production machinery. For instance, Nordson EFD offers precise fluid dispensing solutions for numerous manufacturing processes, including the production of mobile devices, LiDAR sensors for automobiles, and even life-saving medical equipment.

Future consumer electronics products will be upgraded faster, new product shapes will be created, and the consumer electronics sector will develop thanks to the integration of upcoming technologies like 5G, the Internet of Things, artificial intelligence, virtual reality, and new displays. Also, this will significantly increase the demand for fluid dispensing equipment used in consumer electronics manufacturing processes.

Product Insights

The adhesives and sealants segment led the market and accounted for 31.9% of the global revenue share in 2022. Favorable outlook on future automotive and electronics manufacturing landscapes is expected to drive adhesive consumption; this trend is primarily a growth driving factor for dispensing equipment in the product category.

Superior qualities of adhesives and sealants include fast drying, chemical resistance, exceptional abrasion, and excellent binding strength on a variety of substrates including metal, plastic, rubber, wood, and glass. These ingredients give adhesive firmness, low viscosity, and a shorter cure time. Over the projection period, the aforementioned factors will drive demand for adhesives and sealants.

Fluids such as lubricants, adhesives, sealants, underfill, solder paste, coatings, and flux are commonly applied using dispensing equipment. The level of usage of the fluid-specific equipment is significantly depending on the end-user. Lubricants, adhesives, sealants, and varnishes are commonly utilized in automotive component manufacturing applications. Although solder paste, epoxy underfill, flux, and epoxy adhesives are more often used in the production of electronic components. These aforementioned reasons will propel market growth in the coming years.

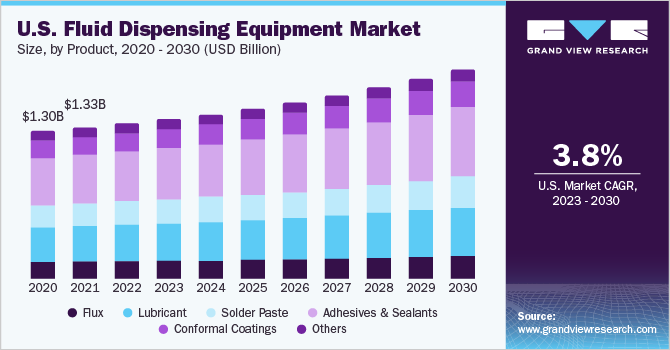

Lubricant segment is expected to grow at a CAGR of 3.8% over the forecast period. This is attributed to the growing demand for automotive oils and greases as a result of the growing trade of vehicles and their spare parts. Lubricants are an essential part of rapidly expanding industries. They are used between two relatively moving parts of machinery to reduce friction and wear & tear. They can be either petroleum-based or water-based and are essential for proper machinery functioning. Lubricants also decrease operational downtime and eventually increase overall productivity, thereby driving market demand over the forecast period.

Application Insights

The electrical & electronics assembly segment led the market and accounted for 36.6% of the global revenue share in 2022. The high rate of electronic technological innovation is driving continual demand for better and faster electrical and electronic devices. This is predicted to raise demand for electrical and electronics assembly, driving market demand even further. Nordson Electronics Solutions, for instance, launched a system fluid for providing single-component thermal interface materials by combining the ASYMTEK Helios SD-960 Series fluid dispensing with the FS-EP1 Fluid Supply.

TianHao Dispensing, for instance, provides industrial manufacturing solutions to assist electronics manufacturers in increasing profitability through fluid dispensing solutions developed for the most demanding production settings. TianHao dispensing systems also increase yields and lower costs in electronics and electro-mechanical manufacturing. Component assembly, PCB assembly, packaging, fiber optics, SMT assembly, computer hardware, communications, mobile phone assembly, communications, security system controllers, visual display panels, and infrared sensors are examples of common uses.

The medical segment accounted for 17.6 % of the global revenue share in 2022. The medical device and life sciences industries must adhere to severe quality and product consistency rules, making process control a crucial concern. For total traceability and process validation, all materials and production processes, including machining, assembly, and packaging, must be documented. This is especially relevant in fluid dispensing applications in medical device construction. In order to be manufactured, these applications require exact and consistent deposition of fluid quantities of cyanoacrylates, UV-cure adhesives, silicones, and other fluids.

Given the recent change in construction processes, the infrastructure sector has enormous growth potential. The introduction of prefabricated structures, the use of high-tech equipment for accurate measurement of structural components, and decreased masonry activity on the job site have transformed construction from a labor-intensive practice to an assembly line procedure. This operational shift has boosted the use of robotic systems and machines, notably in large infrastructure projects such as reservoirs, high-rise buildings, pavements, bridges, and other steel structures.

A crucial step in ensuring semiconductor packages are protected against radio frequency radiation, electrostatic discharge, mechanical damage, and heat is provided by fluid dispensing systems with a variety of pumps and valves. Applications requiring heat dissipation, underfill, and micro-dispensing of conductive epoxies, solder-paste, and encapsulates for multi-level packages and MEMS devices require fluid dispensing accuracy, speed, and dependability.

Regional Insights

Asia Pacific region led the market and accounted for over 43.8% of the global revenue in 2022. The Asia Pacific market growth is likely to be spurred by the rapid expansion of the healthcare industry, as hospital, medical & dental service industry revenues have been rising at a rapid rate in recent years. Soaring demand for medical and surgical equipment and many new hospital construction projects have also fostered regional growth. Furthermore, major regional electronics players are introducing ground-breaking designs, with brands such as Xiaomi & Asus making great innovations in the lower end and flooding the marketplace with value-for-money gadgets & devices. These factors are driving the demand for precision fluid dispensers in the electrical & electronics industry.

The need for controlled applicators and robotic dispensing systems has increased as a result of legislative intervention supporting sustainable and renewable products in the transportation sector in Europe. Due to increasing funding and technology harmonization offered by governments of various area-member countries for conducting automation research and development operations, the region is also one of the world's top producers of motor vehicles. The industry will probably benefit from this in the long run.

The U.S. Centers for Medicare & Medicaid Services estimate that between 2014 and 2020, personal healthcare spending in the U.S. increased by an average of 4.8% per year, with Arizona having the quickest growth (6.6%) and Vermont having the slowest growth (2.7%). Moreover, national healthcare spending increased by 2.7% to USD 4.3 trillion in 2021, which equates to USD 12,914 per person and 18.3% of GDP. The rapidly expanding medical sector in the U.S. is anticipated to be the market driver for fluid dispensing equipment in North America. In the case of medical devices, electronics, and other industries, Nordson EFD provides a wide variety of products & systems used for dispensing adhesives, coatings, sealants, biomaterials, and other fluids for the assembly of crucial components.

The Middle East and North Africa (MENA) region is expanding at a rate of 36%, according to the International Trade Administration, with Saudi Arabia serving as the principal regional market. In the Gulf Cooperation Council (GCC) and the MENA area, Saudi Arabia sold over 52% and 35%, respectively, of the automobiles sold in 2020. In Saudi Arabia, a total of 556,000 and 436,000 vehicles were sold in 2019 and 2020, respectively. In the upcoming years, the fluid dispensing equipment market is predicted to be driven by the expanding automotive sector in the Middle East and Africa. For instance, to maintain high-quality requirements, the automobile industry demands enhanced precision fluid dispensing technologies that produce smaller deposits, more accuracy, and lower dispense tolerances. A precise, repeatable production process that delivers a durable finished good with few rejects is made possible by fluid dispensing.

Key Companies & Market Share Insights

To obtain a competitive edge in the market, major corporations are concentrating on strategic activities like mergers and acquisitions, joint ventures, collaborations, and facility expansion. For instance, the acquisition of American Chemical, a local provider of adhesives, was announced by APPLIED Adhesives in 2021, a manufacturer & distributor of adhesives in the U.S. This acquisition is anticipated to assist the business in growing its sales in the region by providing greater technical support and a substantial customer base since APPLIED Adhesives is a crucial supply chain partner to top manufacturers. Some prominent players in the global fluid dispensing equipment market include:

-

Nordson Corporation

-

Asymtek; Protec Co. Ltd.

-

AdvanJet

-

Speedline Technologies

-

Musashi Engineering Inc.

-

GPD Global Inc.

-

Fisnar Inc.

-

Henkel AG & Co. KGaA

-

Techcon Systems

-

Intertronics

-

Valco Melton Inc.

-

Dymax Corporation

-

Henline Adhesive Equipment Corporation

-

ITW Dynatec

Fluid Dispensing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8,225.2 million

Revenue forecast in 2030

USD 11.47 billion

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Germany; U.K.; China; Japan; India

Key companies profiled

Nordson Corporation; Asymtek; Protec Co. Ltd.; AdvanJet; Speedline Technologies; Musashi Engineering Inc.; GPD Global Inc.; Fisnar Inc.; Henkel AG & Co. KGaA; Techcon Systems; Intertronics; Valco Melton Inc.; Dymax Corporation; Henline Adhesive Equipment Corporation; ITW Dynatec

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluid Dispensing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels, and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global fluid dispensing equipment market report on based on product, application, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Flux

-

Lubricant

-

Solder Paste

-

Adhesives & Sealants

-

Epoxy Adhesives

-

Epoxy Underfill

-

Others

-

-

Conformal Coatings

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Electrical & Electronics Assembly

-

Semiconductor Packaging

-

Printed Circuit Boards

-

Others

-

-

Medical Devices

-

Transportation

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global fluid dispensing equipment market size was estimated at USD 7,931.7 million in 2022 and is expected to reach USD 8,225.2 million in 2023.

b. The fluid dispensing equipment market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 11,473.5 million by 2030.

b. The electrical & electronics assembly segment led the market and accounted for 36.6% of the global revenue share in 2022. The rapid pace of innovations in electronics technology is stimulating consistent demand for newer and faster electrical and electronics products. This is expected to increase the demand for electrical & electronics assembly which will further drive market demand.

b. Some of the key players operating in the fluid dispensing equipment market include Nordson Corporation; Asymtek; Protec Co. Ltd.; AdvanJet; Speedline Technologies; Musashi Engineering Inc.; GPD Global Inc.; Fisnar Inc.; Henkel AG & Co. KGaA; Techcon Systems; Intertronics; Valco Melton Inc.; Dymax Corporation; Henline Adhesive Equipment Corporation; ITW Dynatec.

b. The high demand for sustainable manufacturing practices to reduce material wastage and optimize efficiency and accuracy of processes is a key growth driving factor.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."