- Home

- »

- Advanced Interior Materials

- »

-

Epoxy Adhesives Market Share Report, 2021-2028GVR Report cover

![Epoxy Adhesives Market Size, Share & Trends Report]()

Epoxy Adhesives Market (2021 - 2028) Size, Share & Trends Analysis Report By Application (Automotive & Transportation, Building & Construction), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-369-0

- Number of Report Pages: 111

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Epoxy Adhesives Market Summary

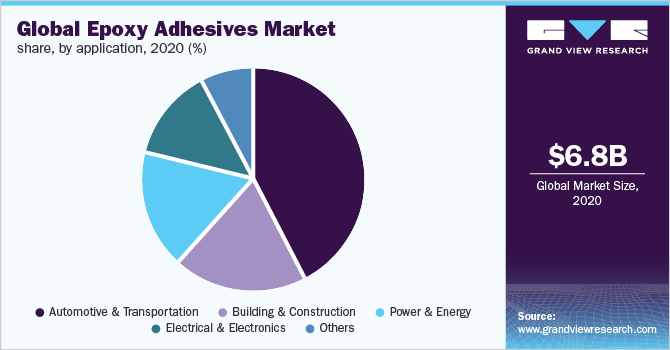

The global epoxy adhesives market size was valued at USD 6.8 billion in 2020 and is expected to reach USD 10.5 billion by 2028, expanding at a compound annual growth rate (CAGR) of 5.6% from 2021 to 2028. The growth in major end-use industries such as energy, construction, and automotive is expected to boost the demand for epoxy adhesives over the forecast period.

Key Market Trends & Insights

- The Asia Pacific dominated the market and held the largest revenue share of over 45.0% in 2020.

- By technology, the two component segment accounted for a volume share of more than 44.0% in 2020.

- By application, the automotive and transportation segment accounted for the largest revenue share of more than 42.0% in 2020.

Market Size & Forecast

- 2020 Market Size: USD 6.8 Billion

- 2028 Projected Market Size: USD 10.5 Billion

- CAGR (2021-2028): 5.6%

- Asia Pacific: Largest market in 2020

Increasing focus on infrastructural developments to propel economic growth, coupled with growing investments in producing Electric Vehicles (EVs) and incorporation of lightweight materials in the automotive industry, is expected to benefit market growth across the forecast period.The U.S. manufacturing sector was largely impacted in 2020 on account of the increasing spread of the coronavirus. Companies were compelled to suspend operations, thereby affecting the demand for raw materials. However, the market for epoxy adhesives is projected to pick up pace owing to growth in EVs and housing projects in the U.S. For instance, in November 2020, Pepper Construction began the construction of a new multi-family residential project in Wisconsin, U.S.

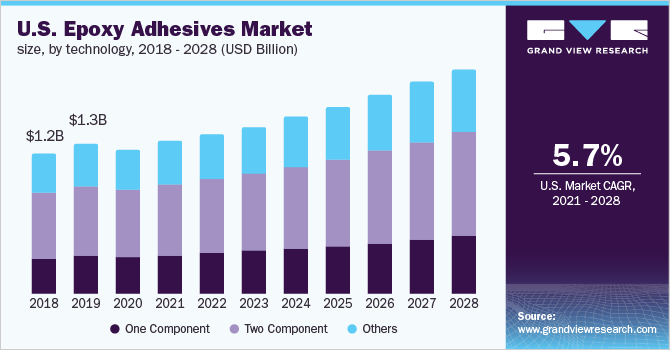

The U.S. manufacturing sector was largely impacted in 2020 on account of the increasing spread of the coronavirus. Companies were compelled to suspend operations, thereby affecting the demand for raw materials. However, the market for epoxy adhesives is projected to pick up pace owing to growth in EVs and housing projects in the U.S. For instance, in November 2020, Pepper Construction began the construction of a new multi-family residential project in Wisconsin, U.S.

The emergence of the COVID-19 pandemic is an ongoing challenge for the industry, which led to a decline in market growth in 2020. A large number of industries have largely been impacted by the pandemic and witnessed a significant downfall in the first half of 2020. The crisis led to the emergence of new challenges for industries, which includes cost escalation of raw materials, disruption of the supply chain, production stoppages, and workforce minimal capacities.

The market scenario started recovering in the second half of 2020. However, with the continuing second and third waves of the virus, restrictions were seen in the first quarter of 2021. Demand from end-use industries but restrictions in transportation and minimal production led to an increase in prices of materials such as phenols, epichlorohydrin, and solvents, which are used in epoxy resins and curing agents.

Technology Insights

The two component segment accounted for a volume share of more than 44.0% in 2020. The high share can be attributed to its preference, owing to advantages such as vibration & shock resistance, tolerance to thermal cycling, long-term durability, strong adhesion to different substrates, uniform stress distribution, fast curing at ambient temperatures, ease of application, and dimensional stability. The two component epoxies are widely used structural adhesives in applications that require high strength.

The one component segment is expected to witness a faster growth rate of 6.2%, in terms of revenue, during the forecast period. It is used in applications for structural bonding, repairing, hemming adhesion, bonding, and others in various industries including automotive, aerospace, electronics, and metal fabrication industries. One component epoxy adhesive offers excellent performance against high temperature & resistance against strong chemicals and harsh environmental conditions, which makes it preferable for heavy wear-and-tear applications such as tools & machinery and heavy industries.

The others’ segment includes waterborne and radiation-cured epoxy adhesives. The waterborne epoxy adhesives are gaining preference owing to stringent regulations against solvent-based adhesives due to their harmful VOCs. Waterborne epoxy resins also offer high performance and reduce the risk of VOCs and enhance worker safety.

Application Insights

Based on application, the automotive and transportation segment accounted for the largest revenue share of more than 42.0% in 2020. Epoxy adhesives adhere to a variety of substrates and offer strong bonds, which makes them applicable in vehicles and aircraft. In May 2021, Airbus announced its plan to increase the production of A320neo planes by 10% by the end of 2021. Growth in aircraft production is expected to augment segment growth across the forecast period.

The building and construction segment is another major application of the market, where epoxy adhesives are used as structural adhesives owing to their high performance. They provide versatility, long durability, and a high degree of heat resistance for binding a wide range of materials including wood, metal, plastic, and masonry. As a result, they find application in walls, roofs, laminated wood for decks, and other building applications such as attaching countertops to substrates, fastening concrete elements, and other materials.

The power and energy segment is expected to be the fastest-growing segment in the epoxy adhesives market over the forecast period. Growth in wind power installations accelerates the usage of epoxy adhesives; for instance, wind turbine blade assemblies are made of many bonded and fastened elements. Other applications include bonding, metal insert attachment, thread locking, and joining of external parts and components. Growth in wind power installations in the coming years is anticipated to augment the growth of the market for epoxy adhesives over the forecast period.

Furthermore, the thermal and electrical conductive properties of epoxy adhesives have augmented their usage in electricals and electronics as well. Electrically conductive adhesives provide strong components and interconnections to gain long-term and reliable performance from electronics. This is anticipated to fuel product demand in the electrical & electronics industry across the forecast period.

Regional Insights

In terms of revenue, Asia Pacific is expected to witness a revenue-based CAGR of 6.2% over the forecast period. The region holds potential growth opportunities from the construction and automotive industries. Factors such as rapid economic growth, rising disposable incomes, and a subsequent increase in the demand for residential housing and solar installations are expected to benefit the demand for epoxy adhesives in the region.

China accounts for a significant share in the market for epoxy adhesives considering the widespread presence of end-use industries. China accounted for the largest share of 32.5% in global vehicle production in 2020. Whereas the global vehicle production declined by 16% from 2019 to 2020 owing to the pandemic, the decline in China was merely 2%. This is a positive aspect for the market to further grow in the country.

Europe held the second-largest revenue share of the market for epoxy adhesives in 2020. The focus on reducing CO2 emissions in Europe by the implementation of Euro 6d emission standards in 2020 is creating a strong growth potential for lightweight materials in the region. Emphasis towards lightweight materials is anticipated to augment demand for adhesives in Europe’s automotive industry over the coming years.

Investments in the energy sector of Europe are further anticipated to benefit market growth. For instance, as of 2020, Germany is the largest energy consumer in Europe and thus, it is encouraging energy projects to meet the growing demand. For instance, in June 2021, Germany awarded 1,161 MW of onshore wind capacity, after the auction that took place on May 1, 2021.

Key Companies & Market Share Insights

Major companies operating in the competitive landscape are primarily focusing on regional expansion, merger and acquisition, and high profit-margin segments along with developing bio-based adhesives to comply with the increasingly stringent environmental regulations.

For instance, in April 2021, Meridian Adhesive Group acquired Pacific Adhesive Systems (PAS), a Malaysia-based company offering high-performance adhesive and coating solutions. PAS has joined Meridian’s Electronic division comprising of Epoxy technology. The vendors are aiming toward more sustainable solutions and accelerating the digital transformation. Some of the prominent players in the epoxy adhesives market include:

-

3M

-

Ashland

-

Bostik

-

Dow

-

H.B. Fuller Company

-

Henkel AG & Co. KGaA

-

Mapei S.P.A

-

Parker Hannifin Corp

-

Permabond LLC

-

Sika AG

Epoxy Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 7.2 billion

Revenue forecast in 2028

USD 10.5 billion

Growth Rate

CAGR of 5.6% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Turkey; China; Japan; India; South Korea; Brazil; GCC

Key companies profiled

3M; Ashland; Bostik; Dow; H.B. Fuller Company; Henkel AG & Co. KGaA; Mapei S.P.A; Parker Hannifin Corp; Permabond LLC; Sika AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global epoxy adhesives market report on the basis of technology, application, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

One Component

-

Two Component

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

Automotive & Transportation

-

Building & Construction

-

Power & Energy

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The epoxy adhesives market size was estimated at USD 6.8 billion in 2020 and is expected to reach USD 7.2 billion in 2021.

b. The epoxy adhesives market is expected to grow at a compound annual growth rate of 5.6% from 2021 to 2028 to reach USD 10.5 billion by 2028.

b. Based on technology, a two-component segment dominated the epoxy adhesives market with a volume share of over 44% in 2020, owing to its versatile performance in terms of application as the resin and hardener formulations provide various optical, electrical, thermal, and mechanical properties.

b. Some of the key players operating in the epoxy adhesives market include 3M, Ashland, Bostik, Dow, H.B. Fuller Company, Henkel AG & Co. KGaA, Mapei S.P.A, Parker Hannifin Corp, Permabond LLC, and Sika AG.

b. Increasing investment in building & construction industry along with growing demand for electric vehicles are the major factors attributed to the growth epoxy adhesives market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.