- Home

- »

- Petrochemicals

- »

-

Lubricants Market Size And Share, Industry Report, 2033GVR Report cover

![Lubricants Market Size, Share & Trends Report]()

Lubricants Market (2026 - 2033) Size, Share & Trends Analysis Report Product (Industrial, Automotive, Marine, and Aerospace), By Region (North America, Europe, Asia Pacific, Middle East & Africa, Latin America), And Segment Forecasts

- Report ID: 978-1-68038-123-8

- Number of Report Pages: 196

- Format: PDF

- Historical Range: 2018 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lubricants Market Summary

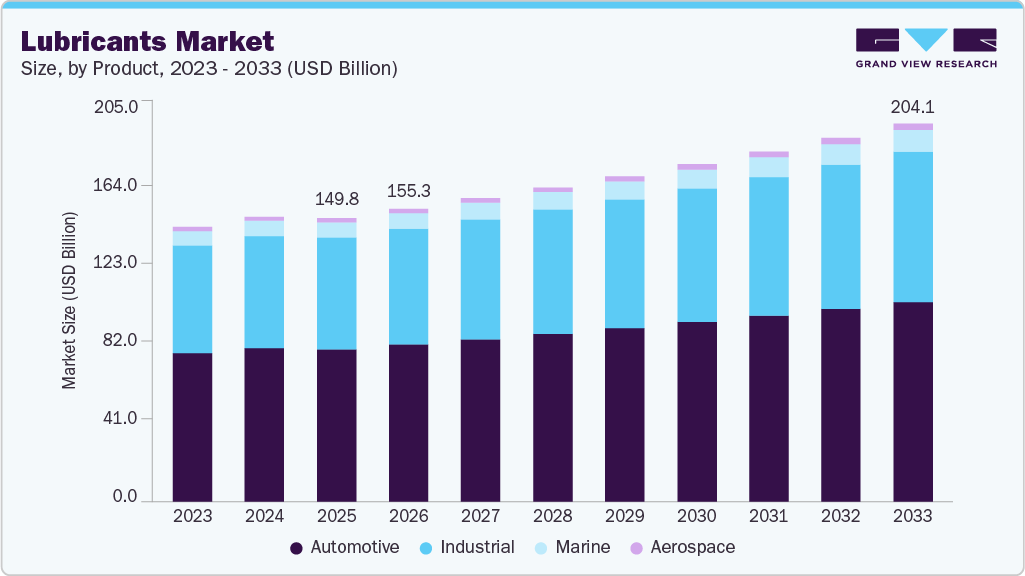

The global lubricants market size was estimated at USD 149,790.0 million in 2025 and is projected to reach USD 204,141.7 million, growing at a CAGR of 4.0% from 2026 to 2033. The market is primarily driven by the expanding automotive fleet, increasing industrial production, and rising demand from sectors such as manufacturing, heavy equipment, marine transport, and power generation.

Key Market Trends & Insights

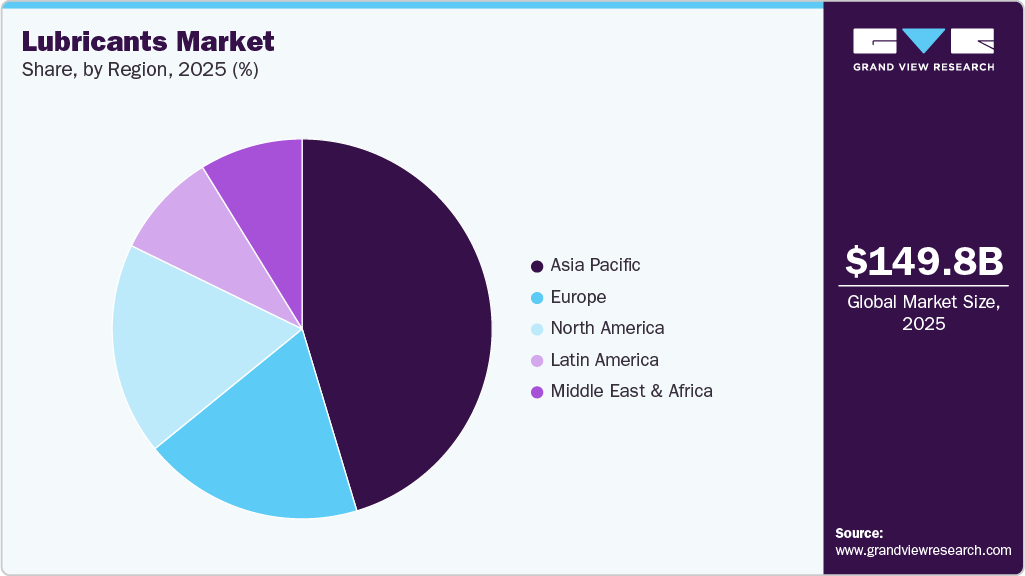

- Asia Pacific dominated the global lubricants market with the largest revenue share of 45.4% in 2025.

- China accounted for 42.2% of the regional market in 2025.

- By product, the automotive segment held the largest revenue share of 53.2% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: 149,790.0 Million

- 2033 Projected Market Size: USD 204,141.7 Million

- CAGR (2026-2033): 4.0%

- Asia Pacific: Largest market in 2025

Growing focus on efficiency improvement, equipment protection, and extended maintenance intervals is supporting the use of advanced lubricant formulations across automotive engines, industrial machinery, and commercial transportation. The adoption of high performance, durable, and thermally stable lubricants is increasing as end use industries aim to reduce downtime and enhance operational reliability. Environmental regulations are further encouraging the shift toward cleaner and energy efficient lubricant solutions in Europe and North America, while rapid industrialization and manufacturing growth in Asia Pacific continue to create strong and sustained volume demand across both automotive and industrial lubricant applications.

Significant opportunities are emerging from the rising demand for high performance and energy efficient lubricants, driven by regulatory emphasis on emissions reduction and the growing shift toward sustainable and cleaner formulations. Advancements in lubricant technologies, including synthetic and semi synthetic products with superior oxidation resistance, thermal stability, and extended service life, are expanding their adoption across automotive engines, industrial machinery, marine systems, and heavy duty equipment. Increasing investments in manufacturing, construction, logistics, and infrastructure development in Southeast Asia, India, and Latin America continue to create favorable growth prospects, while the rising penetration of electric vehicles is promoting demand for specialized lubricants such as thermal management fluids and gear lubricants designed for advanced mobility applications.

The market faces challenges related to fluctuating crude oil prices, stringent environmental regulations, and the rising cost of producing low emission and high efficiency formulations. Manufacturers must comply with complex performance standards and lubricant quality certifications, which increase production and testing expenses. Lubricants also face competitive pressure from alternative solutions such as solid lubricants and maintenance free equipment components that may reduce long term fluid consumption. Technical limitations in meeting extreme temperature conditions, oxidation stability, and compatibility requirements in certain applications add to operational constraints, while high research and development investments and increasing formulation complexities create entry barriers for new participants and margin pressures for existing suppliers.

Market Concentration & Characteristics

The competitive landscape of the global lubricants market is fairly consolidated, defined by the presence of multinational energy and oil corporations operating alongside established specialty lubricant manufacturers. Competition is centered on product performance, technological capability, global supply networks, brand strength, and long-term partnerships with automotive, industrial, marine, and commercial sectors. Leading companies including Shell, ExxonMobil, BP Castrol, Total, Chevron, and PetroChina focus on expanding their portfolios of synthetic and high performance lubricants to meet the increasing demand for advanced engine oils, industrial fluids, and environmentally responsible formulations. These players benefit from strong research and development infrastructure, broad distribution channels, and integrated refining and blending operations that enhance cost efficiency and ensure consistent product quality. Continuous investment in cleaner lubricant technologies, energy efficient formulations, and compliance with evolving emission and performance standards remains a strategic priority to strengthen global market presence and support long-term customer partnerships.

In parallel, emerging and mid-sized players such as Sinopec, Idemitsu, and Fuchs are strengthening their global presence through capacity expansions, technology upgrades, and export-oriented strategies across Asia, the Middle East, and Africa. These companies are increasingly focusing on specialized formulations, sector-specific product lines, and collaborative partnerships to capture growth opportunities in automotive, industrial, and marine lubricant applications. Competitive dynamics continue to be shaped by pricing pressure from low-cost suppliers, frequent product enhancements aimed at improving oxidation stability, thermal performance, and wear protection, and the rising emphasis on environmentally responsible lubricant solutions. As sustainability and regulatory compliance become central to procurement decisions, companies are competing not only on cost and performance but also on lifecycle efficiency, supply chain transparency, and adherence to international quality and environmental standards.

Product Insights

The automotive segment dominated the global lubricants market by product in 2025, accounting for 53.2% of total revenue, supported by the expanding global vehicle fleet, increasing maintenance requirements, and rising demand for high-performance engine oils and transmission fluids. Automotive lubricants remain essential due to their role in reducing friction, improving fuel efficiency, and extending engine life, with ongoing advancements in synthetic and semi-synthetic formulations further strengthening their market position. Additionally, the product segment is further divided into industrial, marine, and aerospace lubricants, which collectively contribute to the overall demand and highlight the broad application scope of lubricants across global end-use sectors.

Global Industrial Lubricants Market Overview

The global industrial lubricants market encompasses a wide range of product sub-segments designed to support the operational efficiency of manufacturing and heavy-duty industries. Process oils serve as key formulation components and performance enhancers across various industrial applications. General industrial oils ensure smooth machinery operation and enhance equipment reliability in day-to-day processes. Metalworking fluids are essential for cooling, lubrication, and maintaining precision during cutting, shaping, and machining activities.

Industrial engine oils play a vital role in supporting the performance of engines used in construction, mining, and power-generation equipment, ensuring durability under demanding conditions. Greases provide long-lasting protection where high loads, vibration, and harsh environments are common. The others category includes specialized lubricants developed for specific industrial needs, offering tailored performance benefits for niche applications and advanced operational requirements.

Global Automotive Lubricants Market Overview

The global automotive lubricants market is structured across several key product categories, including engine oils, gear oils, transmission fluids, brake fluids, coolants, and greases, all of which play critical roles in ensuring vehicle reliability, efficiency, and long-term performance. These lubricants support essential functions such as friction reduction, heat dissipation, and component protection, making them indispensable across passenger cars, commercial vehicles, and two-wheelers. Among these, engine oil remains the largest and most influential product segment due to its central role in engine health and maintenance cycles.

Within the engine oil category, a wide range of viscosity grades is available to meet diverse engine designs, OEM standards, and operating environments. This includes 0W-20, 0W-30, 0W-40, 5W-20, 5W-30, 5W-40, 10W-60, 10W-40, 15W-40, and other specialized formulations designed for modern and high-performance engines. These grades provide optimized lubrication, superior thermal stability, and enhanced wear protection, ensuring consistent engine performance across varying temperatures, driving conditions, and regional climates.

Global Marine Lubricants Market Overview

The global marine lubricants market is structured across key product categories, including engine oils, hydraulic oils, gear oils, turbine oils, greases, and other specialty lubricants, each serving essential functions in marine vessel operations. Engine oils remain the dominant segment, driven by their critical role in maintaining the performance and durability of two-stroke and four-stroke engines used across cargo ships, tankers, and offshore vessels. These oils support efficient combustion, deposit control, and wear protection under demanding marine conditions.

Beyond engine oils, hydraulic and gear oils are vital for the smooth functioning of onboard machinery, steering systems, and propulsion equipment, ensuring operational reliability in harsh marine environments. Turbine oils support auxiliary power systems and contribute to vessel energy efficiency, while greases provide long-lasting protection for components exposed to high loads and saltwater exposure. The segment further includes specialty products such as compressor oils, refrigeration oils, and heat transfer oils, which address specific equipment needs and help maintain safe, efficient, and continuous marine operations.

Global Aerospace Lubricants Market Overview

The global aerospace lubricants market is segmented into gas turbine oils, piston engine oils, hydraulic fluids, and other specialty lubricants, each tailored to meet the stringent performance and safety requirements of the aviation industry. Gas turbine oils dominate the market, driven by their critical role in supporting the extreme temperatures, oxidation resistance, and high-load conditions characteristic of modern commercial and military jet engines. These lubricants ensure thermal stability, reduced wear, and long operational life in demanding flight environments.

Piston engine oils serve the needs of smaller aircraft, helicopters, and general aviation fleets by delivering reliable lubrication and protection under diverse operating conditions. Hydraulic fluids are central to the performance of flight control systems, landing gear actuation, and braking mechanisms, ensuring precise and safe aircraft operations. The market also includes specialized products such as advanced greases and high-performance lubricants designed to withstand extreme temperature variations, vibration, and aerospace regulatory requirements, supporting overall aircraft safety and efficiency.

Regional Insights

Asia Pacific dominated the global lubricants market in 2025 with a substantial revenue share of 45.4% supported by rapid industrial expansion, strong automotive production, and the steady growth of manufacturing, construction, and transportation sectors. The region benefits from cost-efficient refining and blending capabilities, large-scale industrial activity, and the presence of major lubricant producers and expanding distribution networks across China, India, and Southeast Asia. Rising vehicle ownership, increasing infrastructure investment, and the continued development of export-oriented industries further strengthen Asia Pacific as the primary demand and production center for lubricants.

China Lubricants Market Trends

China accounted for 42.2 % of the Asia Pacific lubricants market in 2025, supported by its strong position in global automotive manufacturing, industrial production, and heavy machinery operations. The country’s extensive refining and lubricant blending infrastructure, competitive production capabilities, and large domestic demand from transportation, manufacturing, construction, and marine sectors contribute to its leadership. Continuous investments in high performance synthetic and energy efficient lubricant formulations, along with rising adoption of advanced industrial machinery, are further enabling Chinese manufacturers and suppliers to strengthen their presence across both domestic and international markets.

Europe Lubricants Market Trends

Europe held an 18.8 % share of the global lubricants market in 2025, supported by consistent demand for high performance and environmentally responsible lubricant formulations across automotive, industrial, and commercial sectors. The region maintains a strong focus on regulatory compliance, innovation in low emission and energy efficient lubricants, and the adoption of advanced synthetic products that enhance equipment reliability. Technological progress in automotive engineering, industrial automation, and premium machinery continues to support lubricant consumption, while growing emphasis on sustainability and cleaner production practices reinforces steady market adoption across Europe.

The Germany lubricants market remains a key contributor to the European lubricants market due to its advanced automotive industry, extensive industrial manufacturing base, and leadership in high precision engineering. The country’s strong focus on sustainability, energy efficiency, and superior equipment performance drives the demand for high quality synthetic and semi synthetic lubricants across automotive, machinery, metalworking, and industrial automation applications. Germany also operates as an important innovation center, supported by continuous research and development investments aimed at producing cleaner, more durable, and regulatory compliant lubricant formulations that meet the evolving needs of modern powertrain systems and industrial equipment.

North America Lubricants Market Trends

North America accounted for 18.2 % of the global lubricants market in 2025, supported by steady demand from automotive services, industrial manufacturing, construction equipment, and commercial transportation sectors. The region benefits from advanced technological capabilities, strong quality standards, and widespread adoption of high performance synthetic and semi synthetic lubricant formulations. Growth is further reinforced by ongoing infrastructure development, rising investment in industrial automation, and the increasing need for energy efficient and environmentally responsible lubricants across both automotive and industrial applications.

The U.S. lubricants market dominated the North American lubricants market with an 80.2 % regional share in 2025, supported by strong consumption across automotive servicing, industrial machinery, heavy equipment, and commercial transportation. The country benefits from the presence of established lubricant manufacturers, advanced research and development facilities, and a mature automotive maintenance ecosystem that drives continuous product demand. High adoption of synthetic and high performance lubricants, along with stringent quality and emission standards, continues to support market growth. Increasing focus on energy efficient, environmentally responsible, and low emission formulations is further encouraging innovation and product enhancement across the United States market.

Middle East & Africa Lubricants Market Trends

The Middle East and Africa lubricants market is experiencing steady growth, supported by expanding construction activity, rising infrastructure investment, and increasing demand from industrial machinery, transportation fleets, and energy sector operations. Growth is particularly driven by large scale development projects and economic diversification initiatives in countries such as Saudi Arabia, the United Arab Emirates, and South Africa, which are contributing to higher consumption of automotive and industrial lubricants. However, the market continues to face challenges related to limited domestic refining and blending capacities in several countries and a strong reliance on imported high performance and specialized lubricant formulations.

Latin America Lubricants Market Trends

Latin America represents an emerging market for lubricants, supported by rising demand from construction equipment, automotive servicing, manufacturing operations, and transportation fleets in major economies such as Brazil and Mexico. Increasing urbanization, growth in consumer goods production, and the expansion of industrial and commercial vehicle activity are contributing to higher lubricant consumption. Although economic volatility presents challenges, growing industrial investment, infrastructure development, and strengthening manufacturing capabilities are expected to create long-term opportunities for lubricant suppliers across the region.

Key Lubricants Company Insights

Key players, such as Shell, ExxonMobil, BP/Castrol, Total, Chevron, PetroChina, and Huntsman Corporation are dominating the market.

Shell

-

Shell is one of the leading players in the global lubricants market, known for its extensive portfolio of high performance synthetic, semi synthetic, and mineral lubricant solutions designed for automotive, industrial, marine, and energy sector applications. The company places strong emphasis on innovation and advanced formulation technologies, with a strategic focus on energy efficient, long life, and environmentally responsible lubricants that enhance equipment reliability and support emission reduction targets. Through its robust research and development capabilities, integrated global manufacturing network, and strong customer engagement programs, Shell continues to reinforce its competitive position. The company’s commitment to sustainability, digital lubrication management solutions, and performance driven formulations enables it to address evolving industry requirements across diverse end use sectors.

Key Lubricants Companies:

The following are the leading companies in the lubricant market. These companies collectively hold the largest market share and dictate industry trends.

- Shell

- ExxonMobil

- BP/Castrol

- Total Energies

- Chevron

- PetroChina

- Sinopec

- Idemitsu

- Fuchs

Recent Developments

-

On 16 July 2025, Castrol, one of the leading global lubricant brands, introduced its new Castrol MHP lubricant range designed for the next generation of four stroke medium speed engines operating on distillate fuels. The new series, which includes Castrol MHP 1 30 and MHP 1 40, features a reformulated composition with a lower base number to better address evolving engine requirements. The formulation includes carefully selected detergents that deliver proven oxidation resistance and strong detergency performance, supporting enhanced engine cleanliness and long term operational reliability in marine and power generation applications.

-

On 22 April 2024, the FUCHS Group, a globally active company in the lubricants industry, signed an agreement to acquire the international LUBCON Group. LUBCON, a family owned German company headquartered in Maintal, Hesse, brings decades of expertise in the development, production, and distribution of high quality greases, oils, and pastes. Its product portfolio serves a wide range of sectors including railway, roller bearings, paper, textiles, food, pharmaceutical, and wind industries. The acquisition strengthens the technological capabilities, sectoral reach, and global supply network of FUCHS, supporting its strategic objective of expanding its position in specialty lubrication solutions.

Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 155,289.2 million

Revenue forecast in 2033

USD 204,141.7 million

Growth rate

CAGR of 4.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product and Region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Shell; ExxonMobil; BP/Castrol; Total Energies; Chevron; PetroChina; Sinopec; Idemitsu; Fuchs

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lubricants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global lubricants market report based on product and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Industrial

-

Process Oils

-

General Industrial Oils

-

Metalworking Fluids

-

Industrial Engine Oils

-

Greases

-

Others

-

-

Automotive

-

Engine Oil

-

0W-20

-

0W-30

-

0W-40

-

5W-20

-

5W-30

-

5W-40

-

10W-60

-

10W-40

-

15W-40

-

Other

-

-

Gear Oil

-

Transmission Fluids

-

Brake Fluids

-

Coolants

-

Greases

-

-

Marine

-

Engine oil

-

Hydraulic oil

-

Gear oil

-

Turbine oil

-

Greases

-

Others (compressor oil, refrigeration oil, heat transfer oil)

-

-

Aerospace

-

Gas turbine oils

-

Piston engine oils

-

Hydraulic fluids

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global lubricants market size was estimated at USD 149,790.0 million in 2025 and is expected to reach USD 155,289.2 million in 2026.

b. The global lubricants market is expected to grow at a compound annual growth rate of 4.0% from 2026 to 2033 to reach USD 204,141.7 million by 2033.

b. The automotive segment dominated the lubricants market in 2025 due to its essential role in ensuring engine protection, fuel efficiency, and long-term equipment reliability across passenger vehicles, commercial fleets, and two wheelers. High performance characteristics such as oxidation resistance, thermal stability, and wear protection drive strong demand for engine oils, transmission fluids, and gear oils within this segment.

b. Asia Pacific region dominated the market with a revenue share of more than 45.4% in 2025. The government initiatives of various countries in the Asia Pacific region to boost domestic manufacturing activities as an attempt to reduce the reliance on imports and improve the sustainability of the industrial sector in emerging economies, such as India, Vietnam, Indonesia, and Thailand, are expected to drive the consumption of lubricants in the expanding industrial sector.

b. Some of the key players operating in the lubricants market include Shell, ExxonMobil, BP Castrol, Total, Chevron, PetroChina, Sinopec, Idemitsu, and Fuchs.

b. The lubricants market is primarily driven by rising demand from automotive servicing, industrial machinery, metalworking, construction equipment, and commercial transportation, supported by expanding manufacturing activity and rapid urbanization. Increasing adoption of high performance synthetic and semi synthetic lubricants, driven by stringent emission norms, fuel efficiency requirements, and the need for improved equipment reliability, further accelerates market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.