- Home

- »

- Plastics, Polymers & Resins

- »

-

Fluid Dispensing Systems Market Size & Share Report, 2030GVR Report cover

![Fluid Dispensing Systems Market Size, Share & Trends Report]()

Fluid Dispensing Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Flux, Lubricant, Solder Paste, Adhesives & Sealants, Conformal Coatings), By Region, By Application, And Segment Forecasts

- Report ID: GVR-1-68038-147-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

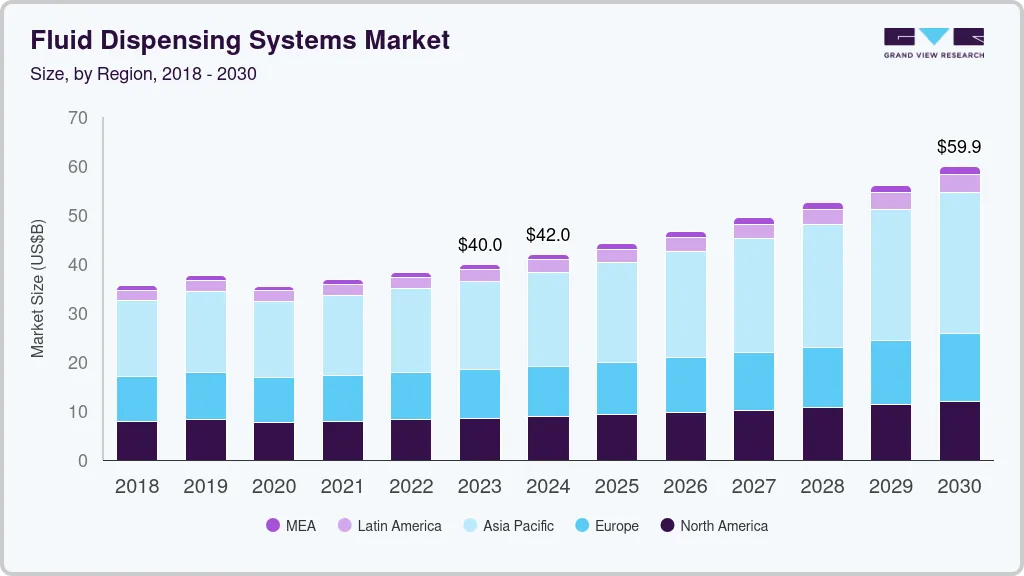

The global fluid dispensing systems market size was valued at USD 39,978.4 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2024 to 2030. Growing demand for systems in end use industries such as electrical and electronics, automotive, and construction applications is anticipated to drive the growth. Proliferation of the latest technologies enabling automation in industries has fueled growth of fluid dispensing systems (FDS) and equipment market. The market has been gaining impetus from increasing adoption of novel technologies in the automotive sector. With the technological advancements and growing demand from various end-use industries, new products with better efficiencies are being developed by manufacturers to meet specific requirements. Growing electrical and electronics industry in Asia Pacific and Middle East & Africa is anticipated to boost demand for fluid dispensing systems in semiconductor packaging and circuit assembly.

The FDS deliver high quality, repeatable, and reliable solutions to various end-users thereby improving their manufacturing process. Manufacturers are focusing on R&D activities to provide customized solutions to industries for carrying out diverse operations.

Rising environmental concerns and favorable regulations regarding carbon emissions, by agencies such as the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) and Environmental Protection Agency (EPA) have nurtured the development of bio-based hot melt adhesives. This trend is expected to boost demand for dispensers such as hot-melt application guns, pattern controllers, and others. Growing preference for packaged foods and increasing spending on construction projects are also major growth drivers.

The U.S. fluid dispensing systems market is primarily driven by the growing demand from electronics, transportation, and medical device industries, owing to government regulations that encourage and support lower resource wastage that contribute to cost and energy savings. Robotic fluid dispensers are increasingly replacing manual applicators owing to their high level of control, ability to create repeated and standardized fluid patterns on substrates and overall efficiency.

Dispersing systems are basically equipment that help in applying precise and controlled amount of assembly fluids along with adhesives, sealants, and lubricants in manufacturing processes. The continuous evolution in dispensing systems manufacturing techniques has resulted in a continuously improving and widening application scenario as compared to the traditional techniques.

Automated fluid dispensing has been utilized in semi-conductor manufacturing and circuit assembly such as development of the Advanced Integrated Circuit Encapsulation (AICE) and Surface Mount Technology (SMT). Pertaining to these applications, four kinds of dispensing technologies are majorly employed, namely, time-pressure dispensing, auger-pump dispensing, true positive displacement dispensing, and jet dispensing.

Product Insights

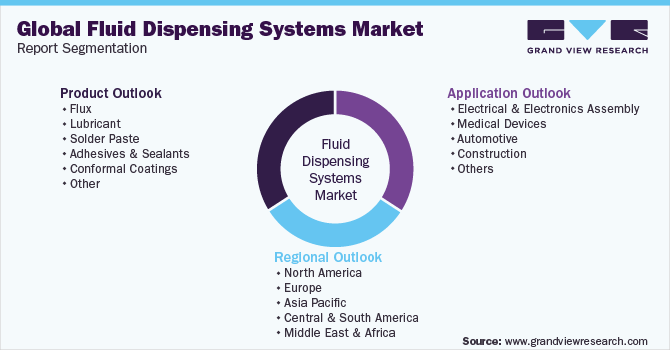

On the basis of product, the FDS market has been segmented into flux, lubricant, solder paste, adhesives and sealants, conformal coatings, and other products which include solvents, powders, and inks.

Adhesive and sealant segment held the highest market share of 32.0% in terms of revenue, in 2022, attributed to the wide application scope of the product across almost all industry verticals including automotive, building and construction, packaging, medical and healthcare, and electrical and electronics.

Lubricants emerged as the second largest product segment accounting for 26.5% of the market share in terms of revenue in 2022. Lubricants are used in diverse applications requiring the components to work in an efficient manner. They help reduce friction between parts thereby enhancing performance resulting in improved output.

Application Insights

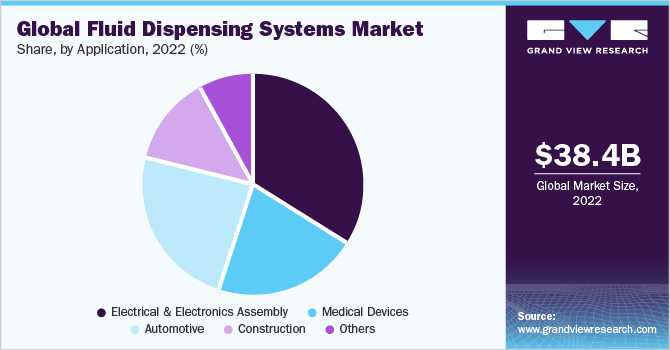

Based on application, the market has been segmented into electrical and electronics assembly, medical devices, automotive, construction, and others. Electrical and electronics has been further segmented into semiconductor packaging, PCB assembly, and others.

In 2022, electrical and electronics assembly was the dominant application segment with a market share of 34.6% in terms of revenue, owing to rising consumer disposable income and preference for miniaturized and pocket friendly devices at an affordable cost.

Automotive was the second largest application segment accounting for 24.1% of the global market share in terms of revenue in 2022. They find application primarily in automotive, marine, and aerospace industries. Automotive sector is witnessing significant growth owing to the continuously evolving technologies such as automation, attracting consumers in mature markets.

Regional Insights

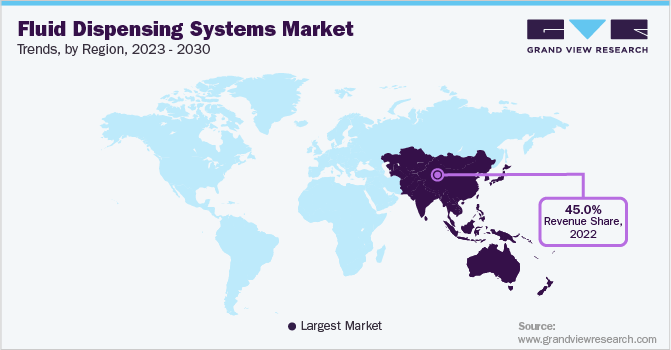

Asia Pacific is estimated to lead the market over the forecast period owing to strong demand from end-use industries such as electrical and electronics, medical devices, and automotive. The region accounts for 45.0% of the total revenue share in 2022. China, India, and Japan are among the largest markets in Asia Pacific that are anticipated to positively influence the global fluid dispensing systems market. Increasing per capita disposable income along with strong growth of manufacturing sector are projected to further drive the growth.

Europe was the second largest region in terms of revenue, with 25.0% market share in 2022, owing to high demand from numerous end-user industries. Recovering regional economies, such as Germany have witnessed an increase in consumer disposable income and GDP growth rates. Other countries such as the U.K. and France are also expected to witness high demand for advanced consumer electronics with high multi-functionality and wearability.

High growth in consumer electronics in the Middle East and Africa, fostered by increasing demand for multi-functional, wearable, and miniaturized devices is anticipated to drive the regional market for fluid dispensing systems. Rising awareness regarding carbon emissions in automotive industries of Brazil, Argentina, Venezuela, and other CSA countries is likely to drive FDS demand in adhesive applications, since they lower overall vehicle weight and improve engine efficiency.

Key Companies & Market Share Insights

Key industry participants include Graco, Protec Co. Ltd.; Speedline Technologies; Musashi Engineering Inc.; GPD Global Inc.; Fisnar Inc.; Techcon Systems; Intertronics; Valco Melton; Dymax Corp.; Henline Adhesive Equipment Corp.; ITW Dynatec; Sulzer Mixpac; and IVEK Corp.

These companies focus on optimum business expansion by introducing numerous growth strategies. Some of the major FDS manufacturers are exploring new markets and expanding their presence in emerging economies, such as India, Brazil, Mexico, Saudi Arabia, and UAE. Many companies are investing heavily in R&D and continue to launch new products. Some prominent players in the global fluid dispensing systems market include:

-

Graco, Protec Co. Ltd.

-

Speedline Technologies

-

Musashi Engineering Inc.

-

GPD Global Inc.

-

Fisnar Inc.

-

Techcon Systems

-

Intertronics

-

Valco Melton

-

Dymax Corp.

-

Henline Adhesive Equipment Corp.

-

ITW Dynatec

-

Sulzer Mixpac

-

IVEK Corp.

Fluid Dispensing Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41,977.4 million

Revenue forecast in 2030

USD 59,943.4 million

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country Scope

U.S.; Germany; U.K.; China; India; Japan

Key companies profiled

Graco, Protec Co. Ltd.; Speedline Technologies; Musashi Engineering Inc.; GPD Global Inc.; Fisnar Inc.; Techcon Systems; Intertronics; Valco Melton; Dymax Corp.; Henline Adhesive Equipment Corp.; ITW Dynatec; Sulzer Mixpac; IVEK Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluid Dispensing Systems Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels, and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global fluid dispensing systems market report on the basis of product, application, and region:

- Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flux

-

Lubricant

-

Assembly Lubricants

-

Others

-

-

Solder Paste

-

Adhesives & Sealants

-

Epoxy Adhesives

-

Epoxy Underfill

-

Others

-

-

Conformal Coatings

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrical & Electronics Assembly

-

Semiconductor Packaging

-

Printed Circuit Boards

-

Others

-

-

Medical Devices

-

Automotive

-

Light Motor Vehicles

-

Heavy Motor Vehicles

-

Motorcycles

-

Trains

-

RVs

-

-

Construction

-

Construction Equipment

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global FDS market size was estimated at USD 37.69 billion in 2019 and is expected to reach USD 39.99 billion in 2020.

b. The global FDS market is expected to grow at a compound annual growth rate of 6.7% from 2019 to 2025 to reach USD 56.09 billion by 2025.

b. Asia Pacific dominated the FDS market with a share of 43.8% in 2019. This is attributable to the strong demand from end-use industries such as electrical and electronics, medical devices, and automotive.

b. Some key players operating in the FDS market include Graco, Protec Co. Ltd.; Speedline Technologies; Musashi Engineering Inc.; GPD Global Inc.; Fisnar Inc.; Techcon Systems; Intertronics; Valco Melton; Dymax Corp.; Henline Adhesive Equipment Corp.; ITW Dynatec; Sulzer Mixpac; and IVEK Corp.

b. Key factors that are driving the FDS market growth include growing demand for systems in end-use industries such as electrical and electronics, automotive, and construction applications and increasing adoption of novel technologies in the automotive sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.