- Home

- »

- Advanced Interior Materials

- »

-

Freeze Drying Equipment Market Size & Trends Report, 2030GVR Report cover

![Freeze Drying Equipment Market Size, Share & Trends Report]()

Freeze Drying Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Bench Top Freeze Dryers, Laboratory Freeze Dryers), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-205-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Freeze Drying Equipment Market Summary

The global freeze drying equipment market size was estimated at USD 1.75 billion in 2022 and is projected to reach USD 3.50 billion by 2030, growing at a CAGR of 9.1% from 2023 to 2030. Freeze drying equipment is widely used to protect, among other things, food, medications, and biological components that are sensitive to heat.

Key Market Trends & Insights

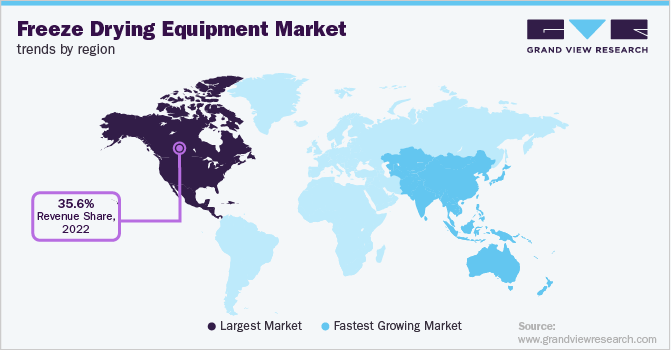

- North America led the market and accounted for over 35.6% of the global revenue share in 2022.

- In terms of product, the industrial freeze dryers product segment led the market and accounted for 35.7% of the global revenue share in 2022.

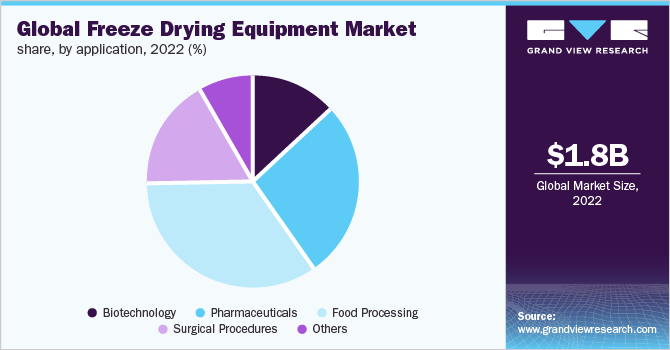

- In terms of application, the food processing application led the market and accounted for 34.0% of the global revenue share in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.75 Billion

- 2030 Projected Market Size: USD 3.50 Billion

- CAGR (2023-2030): 9.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Thus, growing end-use industries such as biotechnology, pharmaceuticals, and food processing will drive the demand. While the global battle against COVID-19 continues, substantial changes in the freeze drying equipment business have emerged in recent months. Due to the unexpected COVID-19 pandemic and the need for testing, there has been an increase in the use of freeze-drying technology to meet the demand for diagnostic kits. In the coming years, the market is expected to be further driven by researchers' increasing attention to creating more sophisticated techniques that integrate freeze drying technology with electron microscopy, biochemistry, and advanced surgery.

The U.S. is responsible for about 45% of the world's pharmaceutical market and 22% of its manufacturing in 2022, according to an Atradius report. In 2022, the U.S. pharmaceutical industry's output and sales will be driven by the ongoing global vaccination campaign and unmet demand for both necessary and optional medical treatments. This will also boost the market for freeze drying equipment.

The standard method used in the pharmaceutical sector to stabilize and store medication goods is freeze-drying. Additionally, freeze dryers are utilized in the pharmaceutical sector to reduce product temperatures. They entail the technique of using a high-pressure vacuum to extract water vapor. In the U.S., poor & middle-class households have more purchasing power and access to high-quality healthcare and medications, which is driving up demand for freeze drying equipment.

The largest number of food processing facilities are spread across the U.S. In 2019, California had the most food & beverage production facilities (6,041), followed by New York (2,611) and Texas (2,485), according to the Census Bureau's County Business Patterns (CBP). Due to consumers' growing preference for custom-built food businesses, freeze-drying equipment is being used more frequently in the food processing industry.

The government programs aimed at modernizing the regulatory environment, enhancing approval procedures and reimbursement practices, and standardizing clinical research support the U.S. biotechnology market actively. For instance, the U.S. Department of Energy, in 2022, will increase its support for the expansion of biotechnology and bio-manufacturing by USD 120 million, which will result in the commercialization of bio-refineries. These aforementioned factors will drive the demand for freeze drying equipment in the U.S.

Product Insights

The industrial freeze dryers product segment led the market and accounted for 35.7% of the global revenue share in 2022. Food processing and dairy industries can preserve items that are extremely sensitive and cannot be dried via evaporation, due to industrial freeze dryers. These enormous devices can hold vast amounts of food to preserve to create dry items with reliable quality.

In the laboratory, the freeze drying process is crucial for stabilizing, storing, or lengthening the shelf life of delicate biological materials. To remove water from sensitive biological products without affecting their chemical structure, laboratory freeze drying is utilized. This enables simple preservation and later reconstitution by the addition of water or solvents.

Freeze drying is a process of dehydrating at low temperatures. Most of the time, materials are kept at a negative temperature during the procedure. As a result, freeze drying has less of an impact on the original features of the product, preserving the biological activity, vitamins, flavor, taste, and appearance. They can be easily and swiftly reconstituted by adding water or other solvents.

The mobile freeze dryers product segment is expected to expand at a CAGR of 11.0% over the forecast period owing to their ease of use, portability, and multi-functionality benefits. Freeze drying is a method of removing water from perishable products in order to extend their shelf life. The process of freeze drying is required for the frozen water in the material to directly transform into vapor.

Application Insights

The food processing application led the market and accounted for 34.0% of the global revenue share in 2022. The food can maintain its original size and shape during the freeze drying process with little cell damage. As a result, shrinkage is reduced or completely avoided, allowing the food to be maintained in almost perfect condition for an extended time, which will further drive the product demand in food processing applications.

The growth of surgical procedures is majorly driven by the growth in the geriatric population, the rising prevalence of cancer, and the rise in incidences of chronic diseases. Due to the use of freeze-dried platelet-rich plasma (PRP) in surgical procedures, which maintains PRP's efficacy and bioactivity for a longer period of time, the number of surgical procedures will increase, which will fuel demand for freeze drying equipment.

The demand for freeze drying equipment in pharmaceuticals application is expected to expand at a CAGR of 11.0% in the forecast period owing to the extensive usage of freeze drying equipment to preserve biologicals such as enzymes, proteins, viruses & bacteria, and penicillin. Drugs and biologics that are delicate, unstable, or heat-sensitive can be dried at low temperatures using freeze drying without having structural damage. In the case of emergency vaccinations and antibodies to be given on an immediate basis, the freeze-dried goods are simply and swiftly transported, thus driving market demand.

According to the Alliance for Regenerative Medicine, firms focusing on cell and gene therapies raised around USD 23.1 billion in funding globally in 2021, an increase of nearly 16% over the previous year's total of USD 19.9 billion. Furthermore, the government is actively supporting the biotechnology industry through steps to modernize the regulatory environment, enhance approval & reimbursement procedures, and standardize clinical trials. The removal of aqueous and solvent solutions from biologics during freeze drying prevents deterioration and maintains the proteins required for their drug delivery mechanism, thus driving market growth.

Regional Insights

North America led the market and accounted for over 35.6% of the global revenue share in 2022. Customer requirements in the food & beverage industry are defined by dynamic trends in food preferences, food safety, security issues, and costs. These requirements are changing F&B manufacturers' processing and supply chain models, enabling market interruptions such as product differentiation, consolidation, and a greater emphasis on food safety and security, thereby driving the market growth.

Increased R&D investments, increasing healthcare spending, and the emergence of biologics & biosimilars are some of the drivers propelling the European pharmaceuticals industry. According to the EU, France (12.2%) and Germany (12.8%) had the greatest healthcare spending relative to GDP in 2020 among EU Member States. Furthermore, the presence of a favorable regulatory environment and reimbursement policies is projected to promote pharmaceutical product demand in this area, helping the expansion of the freeze drying equipment market.

The demand for freeze drying equipment is estimated to witness the fastest CAGR of 11.2% in Asia Pacific over the forecast period. The presence of major pharmaceutical industries in the region such as Livzon Pharmaceutical Group, Guangzhou Baiyunshan Pharmaceutical Holdings, and Dr. Reddy's Laboratories, Ltd. drives the pharmaceutical industry. These companies use freeze-drying technology to keep biological products such as biological fluids, medicines, proteins, enzymes, and hormones safe. Freeze dryers extend the shelf-life of a live viral vaccine, which is in high demand by pharmaceutical companies, especially post-COVID-19.

Due to busy lifestyles, there is a significant demand for convenience foods & other ready-to-eat food and beverage products in the Central and South American region, which is further driving up consumption. In order to meet the region's growing demand for freeze-dried foods, producers supply them because they help preserve the majority of the nutrients that would otherwise be lost using heat-based preservation processes.

Key Companies & Market Share Insights

The global market can be described as a highly consolidated and competitive market dominated by major players. Moreover, they are making high investments in R&D for developing innovative solutions and gaining a competitive advantage. For instance, in February 2022, food maker Pol's handed GEA its 3rd contract to install and source RAY freeze drying equipment at the firm's 4,000 m2 vegetable & fruit freeze drying factory in Ermenek, Karaman, Turkey. This will enable the production of freeze drying to be increased from 200 tonnes to 300 tonnes annually. Some prominent players in the global freeze drying equipment market include:

-

GEA Group

-

Tofflon Science and Technology Co., Ltd

-

Azbil Corporation

-

Labconco Corporation

-

Cuddon Freeze Dry

-

Harvest Right

-

HOF Sonderanlagenbau GmbH

-

Hitachi, Ltd.

Freeze Drying Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.85 billion

Revenue forecast in 2030

USD 3.50 billion

Growth Rate

CAGR of 9.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Azbil Corporation; Cuddon Freeze Dry; GEA Group; Aktiengesellschaft; Harvest Right; HOF Sonderanlagenbau GmbH; Hitachi, Ltd.; Labconco; Martin Christ Gefriertrocknungsanlagen GmbH; Millrock Technology, Inc.; Optima Packaging Group GmbH; Shanghai Tofflon Science andTechnology Co., Ltd.; SP Industries; ZIRBUS Technology GmbH; Scala Scientific; Freeze Drying Systems Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Freeze Drying Equipment Market Segmentation

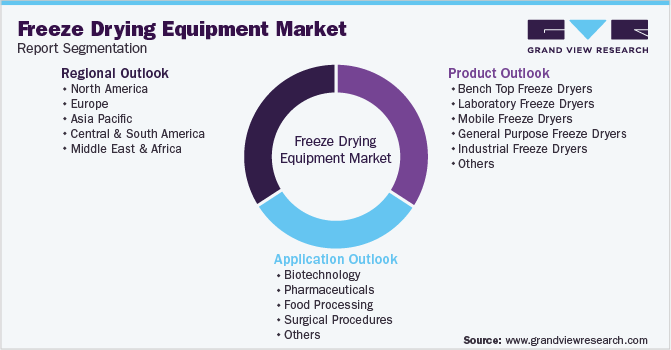

This report forecasts revenue growth at global, regional & country levels, and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global freeze drying equipment market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bench Top Freeze Dryers

-

Laboratory Freeze Dryers

-

Mobile Freeze Dryers

-

General Purpose Freeze Dryers

-

Industrial Freeze Dryers

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biotechnology

-

Pharmaceuticals

-

Food Processing

-

Surgical Procedures

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global freeze drying equipment market size was estimated at USD 1.75 billion in 2022 and is expected to reach USD 1.85 billion in 2023.

b. The freeze drying equipment market is expected to grow at a compound annual growth rate of 9.1% from 2023 to 2030 to reach USD 3.50 billion by 2030.

b. North America region dominated the freeze drying equipment market with a share of 35.6% in 2022. Customer requirements in the food & beverage industry are defined by dynamic trends in food preferences, food safety, and costs. These requirements are changing F&B manufacturers' processing, and supply chain models, enabling market interruptions such as product differentiation, consolidation, and a greater emphasis on food safety and security, thereby driving market growth.

b. Some of the key players operating in the freeze drying equipment market include Azbil Corporation, Cuddon Freeze Dry, GEA Group Aktiengesellschaft, Harvest Right, HOF Sonderanlagenbau GmbH, Hitachi, Ltd., Labconco, Martin Christ Gefriertrocknungsanlagen GmbH, Millrock Technology, Inc., Optima Packaging Group GmbH, Shanghai Tofflon Science and Technology Co., Ltd., SP Industries, ZIRBUS Technology GmbH, Scala Scientific, Freeze Drying Systems Pvt. Ltd.

b. The key factors that is driving the freeze drying equipment market includes growing end-use industries such as biotechnology, pharmaceuticals, and food processing will drive the demand for freeze drying equipment market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.