- Home

- »

- Healthcare IT

- »

-

Healthcare IT Market Size, Share And Growth Report, 2030GVR Report cover

![Healthcare IT Market Size, Share & Trends Report]()

Healthcare IT Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (EHR, CPOE, Electronic prescribing systems, Medical Imaging Information), By Delivery Mode, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-071-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare IT Market Summary

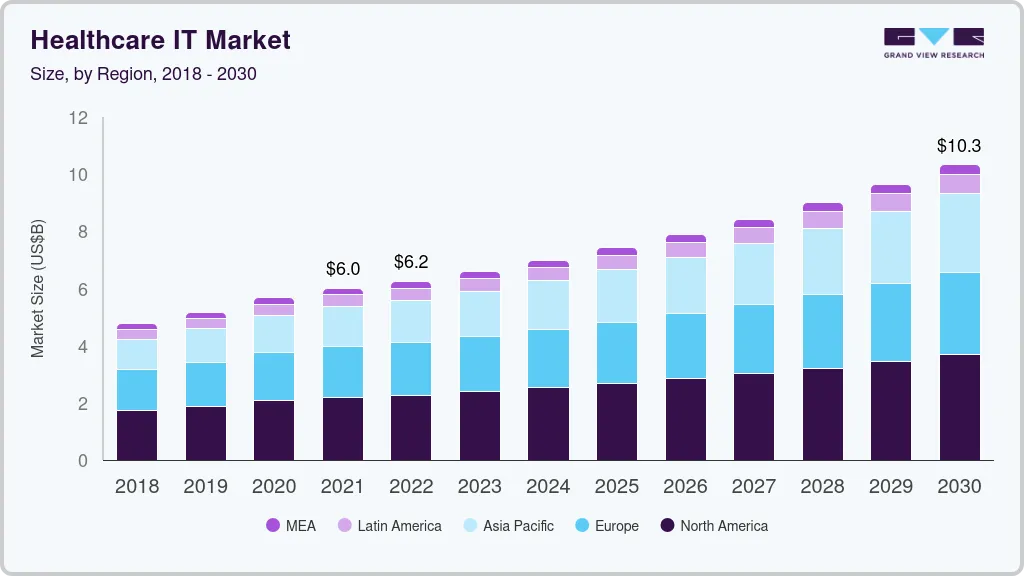

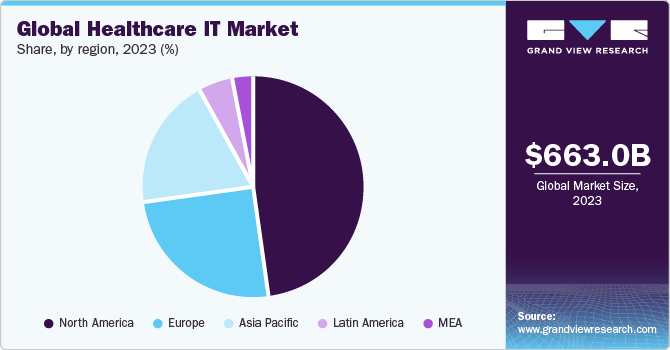

The global healthcare IT market size was estimated at USD 663.0 billion in 2023 and is projected to reach USD 1,834.3 billion by 2030, growing at a CAGR of 15.8% from 2024 to 2030. Increasing usage of smartphones, a growing demand for remote patient monitoring for improved out-of-hospital care, technologically advanced healthcare IT infrastructure, and an increase in the number of initiatives and investments supporting eHealth and digital are driving overall market growth.

Key Market Trends & Insights

- North America dominated the global healthcare IT market with a revenue share of over 40.0% in 2023.

- The region's growth is fueled by extensive adoption of healthcare IT solutions and services, especially in the U.S.

- By application, the electronic prescribing system segment is growing at a fastest CAGR of 26.8% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 663.0 Billion

- 2030 Projected Market Size: USD 1,834.3 Billion

- CAGR (2024-2030): 15.8%

- North America: Largest market in 2023

For instance, in May 2022, Microsoft collaborated with BeeKeeperAI, a healthcare AI solutions developer, enabling Microsoft Azure users to explore confidential computing's advantages in healthcare AI solutions. Ease of use, cost-effectiveness, and time efficiency are driving the widespread adoption of healthcare IT in hospitals. The market's expansion is also supported by continuous improvements in services provided by industry players to cater to consumer demands. For example, in August 2021, Change Healthcare introduced its cloud-based software as a service (SaaS) solution, Change Healthcare Stratus Imaging PACS, tailored for radiological practices. This innovative solution is in beta testing, with plans for future expansion into hospitals in the coming years.

Rising government initiatives to promote technologically advanced systems, including those addressing COVID-19 and other primary healthcare challenges, are also driving overall market expansion. For instance, growing economies such as India, have taken significant steps towards digitalization. In September 2021, India's Prime Minister introduced the Pradhan Mantri Digital Health Mission, an initiative aimed at digitizing healthcare services nationwide. This mission seeks to establish a secure and accessible digital healthcare system, enabling individuals to store, access, and authorize the sharing of their health records.

Growing smartphone penetration and improving internet coverage are directly contributing to the adoption of healthcare IT solutions. Smartphone penetration has improved chronic disease management, owing to an extensive usage of mHealth applications. As per a Mass Media Data report, 5.31 billion unique consumers were using mobile phones at the beginning of 2022, indicating that over two-thirds of the global population is currently utilizing these devices. Moreover, at the beginning of 2022, the number of Internet users worldwide stood at 4.95 billion, indicating that 62.5% of the global population had Internet access.

Surging demand for centralized medical records to help improve care delivery, particularly in developed nations such as the United States, where there has been a noticeable shift towards value-based care, is enabling the adoption of health management systems such as EHR. This contributes greatly to market expansion. For instance, in March 2022, Google Health collaborated with MEDITECH with an aim to use its search & summarization capabilities within MEDITECH's Expanse EHR platform to help clinicians provide the best care via easy and quick access to information from multiple sources.

Market Concentration & Characteristics

Growth Momentum: Growth momentum is a qualitative concept that describes the current rate or speed of growth at a particular point in time, often reflecting recent trends in growth. It is more focused on

assessing the pace of growth in the near term.

In recent years, the healthcare IT market has witnessed a surge in innovation, marking a transformative shift in healthcare delivery and management. Artificial intelligence, big data analytics, and the widespread adoption of electronic health records (EHRs) have reshaped the sector. These advancements not only streamline administrative processes but also significantly enhance patient care through personalized treatment.

For instance, Oracle announced substantial enhancements to its healthcare solutions in September 2023. The company showcased new features in its next-generation EHR platform, designed to enhance both provider and patient experiences through user-friendly, consumer-grade applications. The modern UI and guided workflows of the new Oracle Health EHR platform will offer accessible self-service options, empowering patients and reducing clinician strain and administrative burdens.

Several market players are engaging in M&A activities to enhance their capabilities and expand their geographic reach. For example, in March 2023, Osigu announced an agreement to acquire Servinte, recognized in Colombia as one of the largest Electronic Health Record (EHR) and healthcare software providers. This strategic acquisition aims to bolster Servinte's capabilities through the integration of cutting-edge technologies and the addition of transactional capabilities.

Government regulations are favoring growth of digital health. It is regulated by FDA’s Center for Devices and Radiological Health (CDRH) in the US. In 2017, the U.S. FDA launched its Digital Health Innovation Action Plan that provides timelines and details regarding the implementation of the 21st Century Cures Act. Federal laws applicable to mobile app developers are Health Insurance Portability and Accountability Act (HIPAA) and FTC’s Health Breach Notification Rule. To promote the adoption of healthcare IT, the Health Information Technology for Economic and Clinical Health Act was passed in 2009. The Meaningful Use (MU) directives for the use of certified EHRs have led to complete adoption of EHRs in healthcare.

In February 2019, Executive Order on Maintaining American Leadership in Artificial Intelligence was introduced by the government to reduce barriers to the usage of AI technology, enhancing access to traceable, high-quality federal data, while maintaining privacy, confidentiality of data, and safety & security with applicable laws & policies.

The threat of substitutes in this market is expected to be low, given that IT solutions and services provide greater advantages in terms of enhanced efficiency and lower labor costs compared to potential alternatives. Consequently, the threat of substitutes is projected to remain low throughout the forecast period.

Application Insights

Based on application, the market is segmented into Electronic Health Records (EHR), Computerized Provider Order Entry (CPOE) Systems, Electronic Prescribing Systems (E-Prescribing Solutions), Medical Imaging Information Systems, Laboratory Informatics, Clinical Information Systems, Tele-healthcare, Regulatory Information Management (RIM) Systems, Population Health Management (PHM, Revenue cycle management (RCM), Clinical alarm management. eClinical Solutions, Digital Healthcare Supply Chain Management, Healthcare Customer relationship management (CRM), Technology Solutions in the Healthcare Payers and healthcare analytics. The tele-healthcare segment is further divided into tele-care and telehealth. The segment holds notable market revenue share in 2023. This growth can be attributed to increasing demand for streamlined electronic healthcare systems, advancements in healthcare IT, and the need for technology-integrated tools.

The increasing health consciousness, rising demand for cost-effective care, and growing geriatric population are other key factors contributing to tele-healthcare segment growth. For instance, Independa, a TV-based platform specializing in remote engagement, care, and education, conducted a survey in November 2022 to examine smart TV users' behavior & attitude toward telehealth. Findings released in March 2023 revealed that over 90% of Americans had utilized telehealth services in the past year, with a satisfaction rate of 90%. These services included doctor's appointments, tele-dentistry, and vision appointments. The survey also highlighted the significance of increased smartphone penetration, as 71% of users accessed telehealth services using their smartphones. These findings indicate a growing awareness and positive reception of telehealth, which is expected to drive market growth, as telehealth adoption continues to rise during the forecast period.

The electronic prescribing system segment is anticipated to experience one of the fastest CAGR of 26.8% over the forecast period. An increase in awareness of the advantages of e-prescribing is fueling the adoption of e-prescribing systems. In a study titled “Perception of physicians towards electronic prescription systems and associated factors at resource-limited settings" published in PLOS ONE in March 2021, survey participants expressed positive perceptions of electronic prescriptions, with 76.5% providing a favorable response. Furthermore, approximately 70.8% of participants had over 5 years of computer usage experience. The study also revealed that nearly 90% of participants considered their electronic prescriptions to be legible.

The medical imaging information systems segment is sub segmented into monitoring analysis software, radiology information systems, and picture archiving and communication systems (PACS). Factors such as an increasing need for streamlining healthcare operations, rising awareness about these systems in tracking billing information and orders of radiology imaging, and a growing prevalence of chronic diseases globally are significantly contributing to the overall medical imaging information systems segment growth.

Regional Insights

North America dominated the market with a revenue share of over 40.0% in 2023. The region's market growth is fueled by extensive adoption of healthcare IT solutions and services, especially in the U.S., as providers strive to enhance patient care while reducing costs. Adoption of healthcare IT solutions varies among providers due to various factors. A case in point is the high adoption of Electronic Health Records (EHR) in Oregon, where healthcare providers demonstrate varying adoption rates influenced by distinct digital divisions.

The increase in adoption of electronic health records is increasing significantly in the U.S. As per Health IT reports, until 2021, nearly 9 out of 10 U.S.-based physicians had adopted EHR. Thus, high adoption rates also play a crucial role in boosting market growth.

Asia Pacific is anticipated to hold the fastest CAGR of over 22% during the forecast, with high demand for healthcare IT services, owing to increased government spending on healthcare. Furthermore, demand for healthcare IT systems has been increasing, as it enables efficient management of clinical, financial, and administrative aspects of hospitals.

Several government initiatives and supportive programs are also boosting the adoption of such technologies. For instance, in Australia, state as well as federal governments support healthcare IT at their level. State-level programs, such as HealthSmart, and nationwide programs, such as HealthConnect, are examples of government programs undertaken to increase the integration of IT in healthcare. In addition, South Africa is also focusing on the development of fully integrated health record systems via its careconnect.sa program. Such initiatives and policies in various nations are supporting market growth in the region, and expanding business opportunities are leading to many players entering the market.

Survey/Case Study Insights

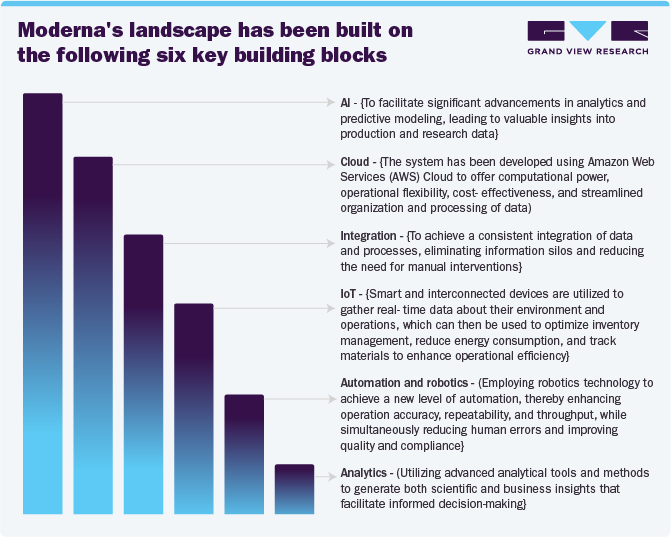

Moderna Therapeutics has made digitalization a central part of its business strategy and is utilizing these technologies to enable large-scale production of RNA-based therapeutics

Moderna opened its Moderna Technology Center (MTC) manufacturing facility in Norwood, MA in July 2018. The facility is state-of-the-art and is enabled with digital capabilities. It has been designed to comply with Current Good Manufacturing Practice (cGMP) specifications.

Result - Moderna's digital strategy facilitates seamless data exchange, reducing response time, error-proofing, and improving compliance across all manufacturing activities.

Digital Healthcare Supply Chain Management Market Opportunities - Key Insights from Grand View Research Survey

Note - To provide Insights on market opportunities, below are key notes on the benefits of implementing digital supply chain management in healthcare:

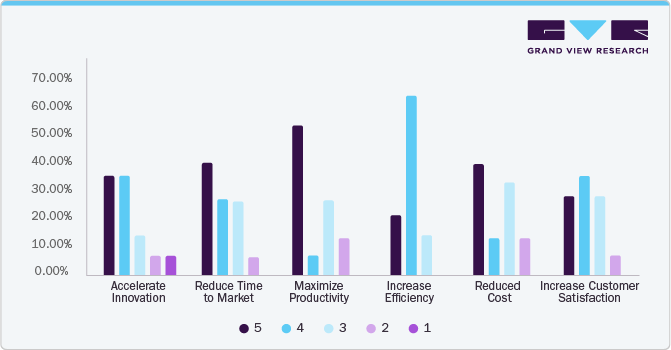

Question- What are the benefits of your existing supply chain (Digital Supply Chain)? (5 being the highest and 1 being the lowest)

Response -

Analyst Insights - “The survey results indicate that respondents who have implemented digital supply chain software in their organizations reported significant benefits, such as accelerated innovation (35.7% rated it the highest at “5”), reduced time to market for products, and maximized productivity.

In addition, the survey highlighted other advantages of supply chain digitalization and transformation programs, including increased efficiency (64.3% rated it the highest at “4”), reduced cost (40% rated it the highest at “5”), and increased customer satisfaction (35.7% rated it the highest at “4”).”Key Healthcare IT Company Insights

Notable market players such as Philips Healthcare, McKesson Corporation, eMDs, Inc., Veradigm Inc. (formerly Allscripts, Healthcare Solutions, Inc.), Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital), Carestream Health, GE Healthcare are implementing different strategies, including new product development, collaborations, and partnerships, to bolster their market presence. The market is fiercely competitive, offering various applications like EHR and e-prescribing, with multiple vendors providing solutions.

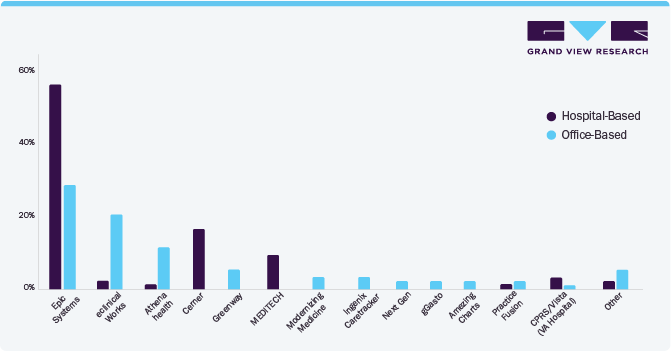

As an example shown below, we have analyzed EHR vendors in prominent U.S. states, highlighting the variations in market dominance among providers based on published research data.

Competitive Insights

State of Rhode Island - The 2021 Health Information Technology (HIT) Survey report from the State of Rhode Island Department of Health revealed that Epic Systems is the leading EHR vendor, being utilized by a significant number of hospital-based physicians (55%) and a notable portion of office-based physicians (28%). Among the respondents, Cerner (16%) and MEDITECH (9%) were the only other vendors with considerable inpatient usage.

Moreover, the adoption of EHR vendors extends to other states like Oregon. As stated in the segment outlook section, EHR adoption in Oregon's hospitals is nearly 100%.

Increased strategic acquisitions and partnerships deals in eClinical solutions market

Companies utilizing strategic partnerships with eConsent solution providers and other eClinical firms are poised to gain a competitive edge across various sectors, driving market growth.

For instance, in June 2022, uMotif and ClinOne announced a partnership to streamline patient and clinical research coordinator experiences by offering an integrated eCOA and eConsent technology solution, addressing the challenges of navigating multiple systems, apps, and sensors for each protocol.

Insight from Industry expert:

“It is encouraging & refreshing to see so many sponsors and CROs adopt patient-first technologies like eCOA, ePRO (Patient Reported Outcomes), and eConsent but too often they are frustrated by disjointed solutions that place a high burden on users and limit effectiveness.

“Together, uMotif and ClinOne are setting out to directly address these pain points with a seamless and comprehensive solution that trial participants actually want to use. In this way, we will add immediate value to increase data quality and reduce risk while improving convenience and comfort for everyone involved with the trial.”

- Steve Rosenberg, CEO, uMotif.

This partnership was expected to provide an intuitive user experience and streamline clinical trial participation, positioning uMotif & ClinOne to maintain a competitive presence in the market over the forecast period.

Key Healthcare IT Companies:

The following are the leading companies in the healthcare IT market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these healthcare IT companies are analyzed to map the supply network.

- Philips Healthcare

- McKesson Corporation

- eMDs, Inc.

- Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.)

- Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital)

- Carestream Health

- GE Healthcare

- Agfa- Gevaert Group

- Hewlett Packard Enterprise Development LP

- Novarad

- Optum, Inc.

- IBM

- Oracle

- SAS Institute, Inc.

- IQVIA

- Verisk Analytics, Inc.

- SAP

- Accenture

Recent Developments

-

In June 2023, BoomerangFX, a cloud-based SaaS provider specializing in comprehensive practice management solutions for healthcare sectors such as cosmetic dentistry, cosmetic surgery, dermatology, medical spa, vision care, and women's health, unveiled a strategic collaboration with health technology pioneer DrFirst. The aim of this partnership is to introduce an innovative e-prescribing solution tailored for aesthetic medicine practices throughout North America.

-

In May 2023, athenahealth made a significant announcement regarding its 'athenaOne' integrated cloud-based EHR, medical billing, and patient engagement solution. This solution, along with 'athenaOne Dental,' was chosen by LCH Health and Community Services to enhance provider and patient experiences while advancing its growth strategy.

-

In April 2023, Epic and Microsoft partnered to leverage generative AI for enhanced EHRs. This partnership involves integrating the Microsoft Azure OpenAI Service into Epic's EHR platform, enhancing functionalities like interactive data analysis, and natural language queries, extending to Epic’s SlicerDicer, a self-service reporting tool.

Healthcare IT Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 760.2 billion

Revenue forecast in 2030

USD 1,834.3 billion

Growth Rate

CAGR of 15.8% from 2024 to 2030

Actual estimates/Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment Covered

Application, delivery mode, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Russia, Sweden, Norway, China, Japan, India, Singapore, Australia, Thailand, South Korea, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

(Philips Healthcare, McKesson Corporation, eMDs, Inc., Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.), Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital), Carestream Health, GE Healthcare, Agfa- Gevaert Group, Hewlett Packard Enterprise Development LP, Novarad, Optum, Inc., IBM, Oracle, SAS Institute, Inc., IQVIA, Verisk Analytics, Inc., SAP, Accenture)

15% free customization scope (equivalent to 5-analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

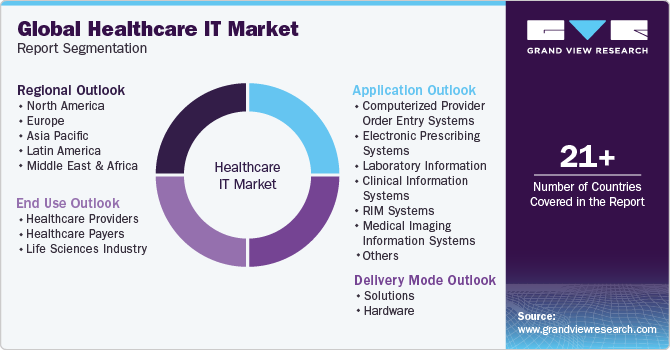

Global Healthcare IT Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the Healthcare IT market report on the basis of application, delivery mode, end use and region.

-

Healthcare IT Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Computerized Provider Order Entry Systems

-

Electronic Prescribing Systems (E-Prescribing Solutions)

-

Laboratory Information

-

Clinical Information Systems

-

Regulatory Information Management (RIM) Systems

-

Medical Imaging Information Systems

-

Radiology Information Systems

-

Monitoring Analysis Software

-

Picture Archiving and Communication Systems

-

-

Electronic Health Records

-

Licensed Software

-

Technology Resale

-

Subscriptions

-

Professional Services

-

Others

-

-

Tele-healthcare

-

Tele-care

-

Tele-Health

-

-

Revenue Cycle Management

-

Integrated

-

Standalone

-

-

eClinical Solutions

-

Electronic Clinical Outcome Assessment (eCOA)

-

Electronic Data Capture (EDC) & CDMS

-

Clinical Analytics Platforms

-

Clinical Data Integration Platforms

-

Safety Solutions

-

Clinical Trial Management System (CTMS)

-

Randomization and Trial Supply Management (RTSM)

-

Electronic Trial Master File (eTMF)

-

eConsent

-

-

Population Health Management (PHM)

-

Digital Healthcare Supply Chain Management

-

Software

-

Hardware

-

Barcodes

-

RFID Tags

-

-

Services

-

-

Clinical alarm management

-

Nurse Call Systems

-

Physiological Monitors

-

Bed Alarms

-

EMR Integration Systems

-

Ventilators

-

Others

-

-

Healthcare Customer relationship management (CRM)

-

Customer Service and Support

-

Digital Commerce

-

Marketing

-

Sales

-

Cross -CRM

-

-

Technology Solutions in the Healthcare Payers

-

Enrollment and Member Management

-

Provider Management

-

Claims Management

-

Value based Payments

-

Revenue Management and Billing

-

Analytics

-

Personalize/CRM

-

Clinical Decision Support

-

Data management and support

-

Others

-

-

Healthcare Analytics

-

Descriptive Analysis

-

Predictive Analysis

-

Prescriptive Analysis

-

-

-

Healthcare IT Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Software

-

On-Demand/On-premise

-

Cloud-based/ Web-based

-

-

Services

-

-

Hardware

-

-

Healthcare IT End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Hospitals & Clinics

-

Home Care Settings

-

Outpatient Facilities

-

Ambulatory surgery centers (ASCs)

-

Physician’s Clinic

-

Others (Laboratories, Pharmacy, etc.)

-

-

Long-term Care Facilities

-

Specialty Centers

-

-

Healthcare Payers

-

Government

-

Commercial

-

-

Life Sciences Industry

-

Pharma & Biotech Organizations

-

Medical Device Manufacturers

-

Contract Research Organizations (CROs)

-

Academic institutes

-

-

-

Healthcare IT regional Outlook by (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Denmark

-

Norway

-

-

Asia-Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare IT market size was estimated at USD 663.0 billion in 2023 and is expected to reach USD 760.2 billion in 2024.

b. The global healthcare IT market is expected to grow at a compound annual growth rate of 15.8% from 2024 to 2030 to reach USD 1,834.3 billion by 2030.

b. North America dominated healthcare IT market in 2023 with the revenue share of over 40%. The region's market growth is fueled by the extensive adoption of healthcare IT solutions and services, especially in the U.S., as providers strive to enhance patient care while reducing costs.

b. Some key players operating in the healthcare IT market include Philips Healthcare; McKesson Corporation; eMDs, Inc.; Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.); Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital); Carestream Health; GE Healthcare; Agfa- Gevaert Group; Hewlett Packard Enterprise Development LP; eClinicalWorks; Novarad.

b. Key factors that are driving the healthcare IT market growth include the increasing usage of smartphones, growing demand for remote patient monitoring for improved out-of-hospital care, technologically advanced healthcare IT infrastructure, and an increase in the number of initiatives and investments supporting eHealth and digital health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.