- Home

- »

- Medical Devices

- »

-

Hyaluronic Acid Market Size & Share, Industry Report, 2030GVR Report cover

![Hyaluronic Acid Market Size, Share & Trends Report]()

Hyaluronic Acid Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Application (Dermal Fillers, Osteoarthritis, Ophthalmic, Vesicoureteral Reflux), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: 978-1-68038-333-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hyaluronic Acid Market Summary

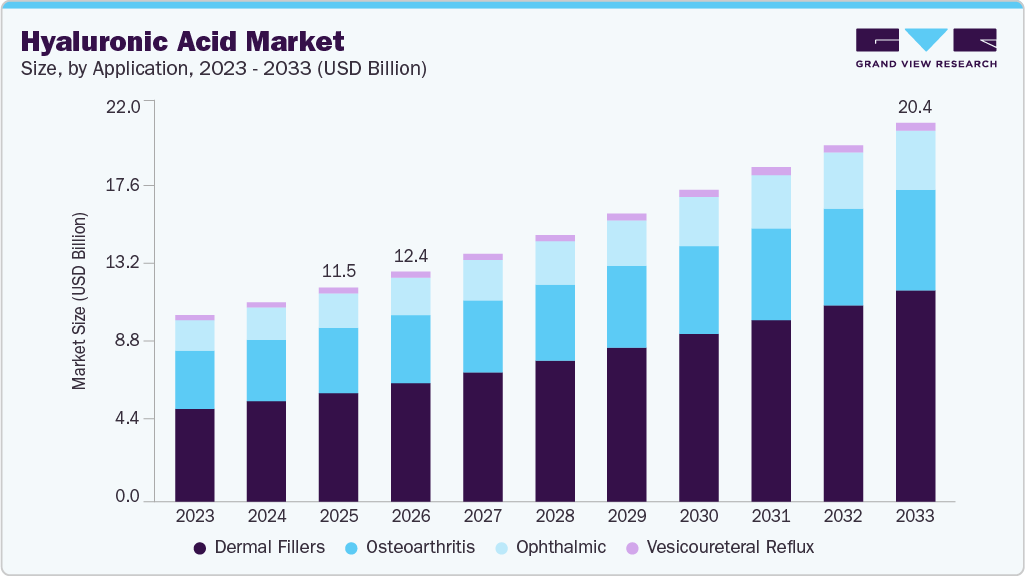

The global hyaluronic acid market size was estimated at USD 10.73 billion in 2024 and is projected to reach USD 16.7 billion by 2030, growing at a CAGR of 7.81% from 2025 to 2030. The growing demand for anti-aging treatments, coupled with increasing awareness of the benefits of hyaluronic acid for skin hydration, wound healing, and joint health, has significantly contributed to the rising popularity and growth of the hyaluronic acid market.

Key Market Trends & Insights

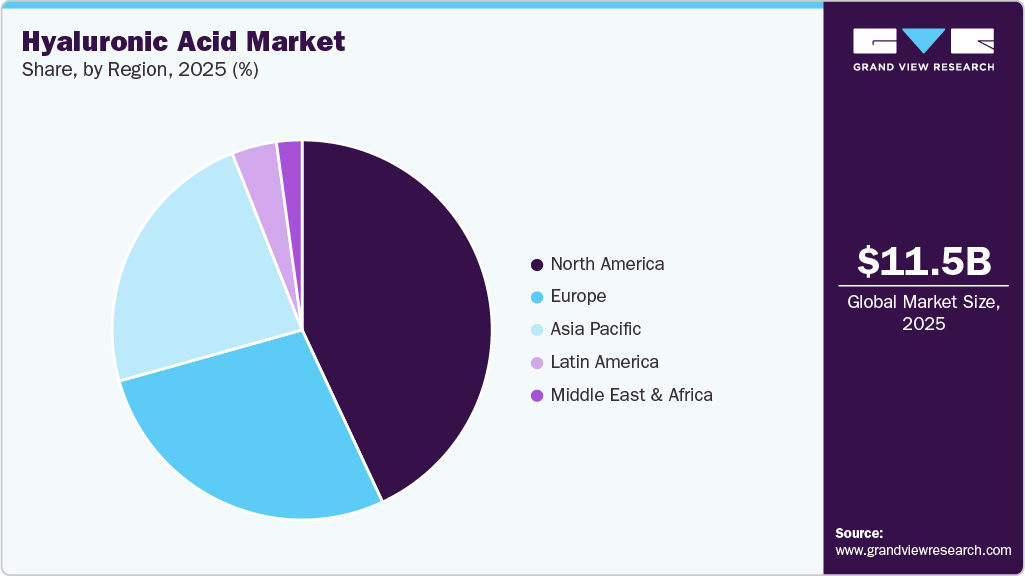

- North America dominated the market and accounted for 42.08% share in 2024.

- The U.S. hyaluronic acid market is experiencing robust growth.

- By application, the dermal fillers segment dominated the market and obtained the largest revenue share of 41.82% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.73 Billion

- 2030 Projected Market Size: USD 16.7 Billion

- CAGR (2025-2030): 7.81%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, increasing geriatric population seeking treatment for joint health are also contributing towards the market’s growth. According to the United Nations, by mid-2030, the global population of geriatrics (80 years and above) is expected to reach 265 million. The developing countries are expected to witness a surge in number of elderly people over the next 30 years.Rising demand for anti-aging and cosmetic applications is the major driver for the hyaluronic acid (HA) market, which helps increase consumer focus on non-invasive facial aesthetics and anti-aging treatments. HA-based dermal fillers are gaining popularity among youngsters due to their effectiveness in wrinkle reduction and skin hydration. An injectable HA is a dermal filler that reduces fine lines and facial folds and creates a structure to add volume to the injection site. Technological advancements in these fillers, such as cross-linked and nano-encapsulated forms, enhance their efficacy and appeal.

Calcium hydroxylapatite, poly-L-lactic acid, polymethyl methacrylate, and autologous fat are used as dermal fillers for their biodegradable properties. It is hydrating and anti-aging properties, particularly in moisturizers, serums, and masks, make it a vital ingredient in beauty and cosmetics. For instance, in October 2024, Abbvie launched JUVÉDERM VOLUMA XC, the only hyaluronic acid dermal filler specifically indicated for treating the cheeks, chin, and now, moderate to severe temple hollow. As consumers gain insights into the benefits of hyaluronic acid, the demand for such products is projected to continue to rise, contributing significantly to market growth.

Growing awareness about anti-aging products propels the demand for cosmetic and aesthetic treatments. Due to their distinctive properties, such as hygroscopicity, viscoelasticity, biocompatibility, and non-immunogenicity, there is a rising demand for hyaluronic acid products for minimally invasive anti-aging solutions. As concerns about aesthetics and maintaining a youthful appearance continue to rise, especially among women, the demand for anti-aging products is gaining significant momentum.

This growing awareness drives the popularity of products such as hyaluronic acid, which are known for their effectiveness in enhancing skin health and promoting a youthful look. The rise of clean beauty trends emphasizing cruelty-free, sustainably sourced, and biotech-derived HA products also influence consumer choices. Several new products have been launched recently, which includes Bloomage Biotech launching MitoPQQ, a water-soluble ingredient designed to support mitochondrial function and promote healthy aging in July 2024. MitoPQQ positions itself as a functional food additive that addresses aging-related metabolic decline, combating aging through its antioxidant properties and supporting overall health.

Hyaluronic acid (HA) is known for medical applications primarily due to its versatile therapeutic benefits in treating chronic diseases and facilitating minimally invasive procedures. Hyaluronic acid plays a crucial role in managing osteoarthritis, in ophthalmic surgeries as a viscoelastic agent to protect delicate eye tissues during procedures such as cataract removal and wound healing and tissue engineering, as HA promotes cell migration, tissue repair, and hydration and accelerating recovery in chronic wounds and burns. Hyaluronic acid acts as a shock absorber or a cushion and lubricates the joints, thus helping them function properly.

A clinical trial published in April 2024 compared the dosage frequency of HA between two regimens: a single dose of 60 mg high-molecular weight hyaluronic acid and three doses of 30 mg high-molecular HA. Though both regimens effectively relieve pain and stiffness, the three-dose frequency showed greater efficacy. The growing aging population, along with a rise in joint-related disorders, is contributing to the increasing demand for hyaluronic acid-based therapies. Thus, the increasing prevalence of chronic diseases, aging populations, and the trend toward minimally invasive treatments further amplify HA’s demand in medical fields, driving market growth.

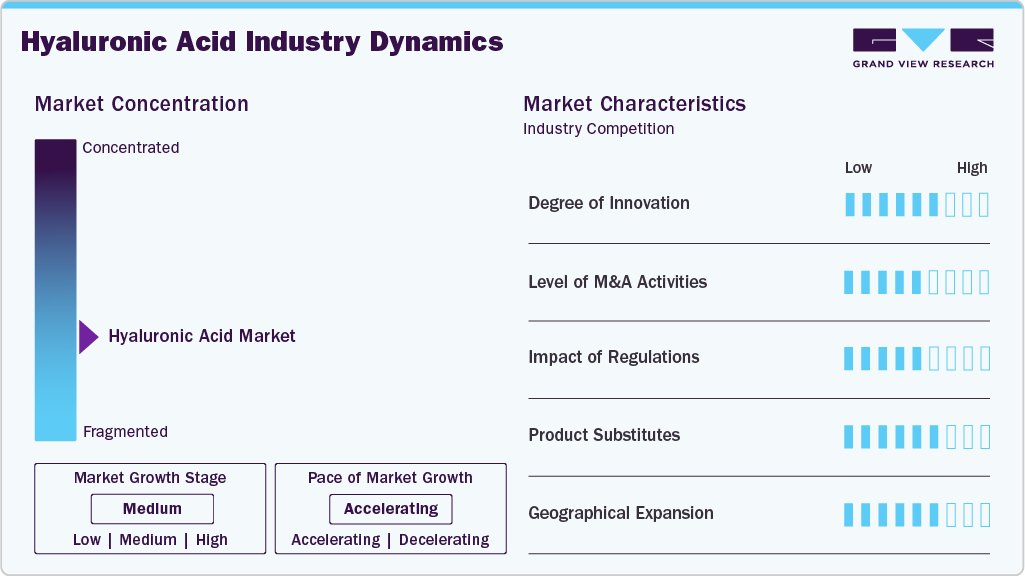

Market Concentration & Characteristics

The market experiences a moderate level of degree of innovation. Innovations such as cross-linked hyaluronic acid and cationic hyaluronic acid have enhanced the efficacy, longevity, and hydration properties of products. In addition, the introduction of hyaluronic acid-based products for new therapeutic areas, such as joint health and ophthalmic treatments, reflects the ongoing progress and innovation within the market.

The hyaluronic acid market is relatively fragmented, with many specialized players offering niche products. This makes large-scale acquisitions less frequent as companies prefer to focus on specific product areas rather than consolidate into larger entities. As the market for hyaluronic acid, particularly in dermal fillers, is already well-established, many leading companies focus more on product innovation and expansion rather than pursuing mergers or acquisitions.

Regulatory bodies such as the FDA and EMA set stringent guidelines for developing, manufacturing, and marketing hyaluronic acid-based products, especially in the aesthetic and medical fields. As regulations evolve to address emerging concerns, firms must stay compliant with both local and global standards, which can influence product development timelines and market access.

Product substitutes challenge the hyaluronic acid market, with alternatives such as collagen injections, platelet-rich plasma (PRP) treatments, and other dermal fillers competing for market share. Collagen-based dermal fillers are still popular in certain regions despite the growing preference for hyaluronic acid. In addition, non-invasive treatments such as Botox provide competition in the aesthetic market.

The hyaluronic acid market companies are increasingly focusing on emerging markets in APAC, Latin America, and the Middle East, where rising disposable incomes, aging populations, and increasing awareness of aesthetic treatments are driving demand. In particular, countries such as China, India, and Brazil are becoming key markets due to their growing healthcare infrastructure and interest in non-invasive aesthetic procedures. Moreover, as regulatory frameworks become more favorable, companies can enter new regions, further expanding their customer base.

Application Insights

The dermal fillers segment dominated the market and obtained the largest revenue share of 41.82% in 2024. Cosmetic facial surgeons commonly utilize dermal fillers to combat the visible signs of aging, smooth out skin depressions, and improve the appearance of scars. They are also effective in minimizing fine lines, deep wrinkles, and folds in the facial skin, helping to restore a more youthful and refreshed appearance. These injectable treatments work by replenishing lost volume and enhancing the skin's structure, providing a non-surgical solution for facial rejuvenation.

The U.S. FDA has approved dermal fillers for various applications, including correction and restoration of lipoatrophy in HIV-infected people. For instance, in February 2025, Evolus announced U.S. FDA approval for its Evolysse Form and Evolysse Smooth Injectable Hyaluronic Acid Gels that incorporates the advanced Cold-X technology, designed to better maintain the natural structure of the HA molecule, ensuring long-lasting and natural-looking results. The hyaluronic acid fillers market witnesses promising growth prospects and offers opportunities for players operating in the market.

Ophthalmic segment is anticipated to witness modest market growth over the forecast period. The demand for hyaluronic acid is accelerating due to frequent use in treating various eye conditions, particularly in procedures involving the cornea, conjunctiva, and lens. It is commonly used in ophthalmic surgeries, such as cataract surgery, vitreoretinal surgery, and corneal transplantation, due to its unique lubrication, hydration, and tissue protection properties. Hyaluronic acid (HA) helps maintain the viscoelasticity of the eye during surgery, reducing friction and protecting delicate tissues. HA is also used in managing dry eye disease, as it acts as a hydrating agent, soothing irritation and promoting better tear film stability. Thea Pharma Inc, in April 2022, announced the launch of the iVIZIA line of over the counter (OTC) eye-care products which provide effective solutions for a variety of eye conditions, offering advanced formulations to help with dryness, irritation, and overall eye health. With the increasing prevalence of eye conditions like cataracts and dry eye disease, the demand for ophthalmic hyaluronic acid continues to grow, driving advancements in its formulation and expanding its application in both therapeutic and surgical settings.

Regional Insights

North America Hyaluronic Acid Market Trends

North America dominated the market and accounted for 42.08% share in 2024. The hyaluronic acid market is driven by increasing demand for anti-aging treatments, rising osteoarthritis cases, and growing awareness of minimally invasive procedures. Key players such as Allergan, Galderma, and Revance Therapeutics lead the market. Advancements in formulations, such as longer-lasting and more natural-looking products, continue to fuel market growth and innovation.

U.S. Hyaluronic Acid Market Trends

The U.S. hyaluronic acid market is experiencing robust growth, driven by increasing demand for non-surgical aesthetic procedures and advancements in medical applications, particularly hyaluronic acid-based dermal fillers. The growing prevalence of osteoarthritis is leading to a higher demand for joint therapies. Recent advancements include the FDA-approved Skinvive by Juvéderm in May 2023 by AbbVie, a hyaluronic acid intradermal microdroplet injection designed to enhance skin smoothness and hydration.

Europe Hyaluronic Acid Market Trends

The European hyaluronic acid market experiences steady growth, driven by rising demand for non-surgical cosmetic procedures and increasing awareness of HA’s benefits in aesthetics and joint health. Key players lead the market with advanced HA formulations offering improved safety and longevity. Technological advancements, including next-generation fillers and sustainable production methods, enhance product efficacy and consumer acceptance, fueling market expansion across all European countries.

The UK hyaluronic acid market is growing rapidly, driven by rising demand for dermal fillers and the increasing popularity of cosmetic procedures among younger consumers. Technological advancements, including single-injection formulations and bioengineered HA, enhance treatment outcomes and patient convenience. In addition, the high prevalence of osteoarthritis in the UK boosts demand for HA in medical applications. Growing disposable incomes and increased awareness of aesthetic and therapeutic benefits further accelerate market expansion across the UK.

The hyaluronic acid market in Germany is experiencing significant growth driven by the aging population, fueling demand for HA-based viscosupplements for osteoarthritis and anti-aging skincare products. Germany leads in HA innovation with advanced formulations in orthopedics, ophthalmology, and aesthetics. In this market, collaborations and mergers are the strategic tools of growth.

The France hyaluronic acid market is experiencing robust growth, driven by increasing demand for anti-aging treatments, rising osteoarthritis cases, and growing awareness of minimally invasive procedures. Key players such as Allergan, Galderma, and Revance Therapeutics lead the market. Advancements in formulations, such as longer-lasting and more natural-looking products, continue to fuel market growth and innovation.

Asia Pacific Hyaluronic Acid Market Trends

APAC hyaluronic acid market is anticipated grow with a CAGR of 8.25% over the forecast period. The Asia Pacific hyaluronic acid market is rapidly expanding, driven by increasing demand for skincare and aesthetic products, rising geriatric population, and growing awareness of HA’s benefits in joint health and cosmetic procedures. Key markets such as China, Japan, South Korea, and India lead growth due to urbanization, higher disposable incomes, and beauty-conscious consumers seeking “glass skin” effects. Technological advancements such as single-injection therapies and nano-encapsulation improve efficacy and patient compliance, fueling market growth. In addition, expanding medical applications in osteoarthritis and ophthalmology contribute to the market’s robust trajectory across the region.

Japan held the largest market share in Asia Pacific in 2024. Japan hyaluronic acid market is driven by innovations in cosmeceuticals, healthcare, and an aging population demanding anti-aging and orthopedic treatments. Key players include Shiseido, Kewpie Corporation, Rohto Pharmaceutical, Allergan, and Galderma. Advancements focus on high-purity, low-molecular-weight HA formulations, single-injection therapies, and HA integration in nutraceuticals and ophthalmology, positioning Japan as a leader in premium, scientifically advanced HA products with strong regulatory standards and consumer trust.

The hyaluronic acid market in China is rapidly expanding in 2024. Significant drivers include the booming cosmetic surgery industry fueled by rising middle-class income, increasing demand for anti-aging skincare, and a growing geriatric population requiring osteoarthritis treatments. Advancements in biotechnology have led to innovations such as Givaudan's PrimalHyal Hydra[+], a cationic hyaluronic acid developed through white biotechnology, offering enhanced hydration for skincare applications. These developments underscore China's pivotal role in the global hyaluronic acid market, focusing on innovation and expanding applications across various sectors.

Latin America Hyaluronic Acid Market Trends

The Latin America hyaluronic acid market is growing steadily, driven by increasing aging populations prone to joint disorders, rising awareness of anti-aging skincare, and expanding demand for minimally invasive cosmetic procedures. Technological advancements include improved cross-linking techniques and thixotropic technology, which enhances product stability and durability. Despite challenges such as limited specialist availability and product costs in some countries, ongoing innovations and growing health consciousness are propelling market growth across dermatology clinics, hospitals, and beauty institutes in Latin America.

The Brazil hyaluronic market is driven by high demand for dermal fillers, fueled by Brazil’s position as the second-largest country for nonsurgical cosmetic procedures globally. Significant drivers include rising awareness of anti-aging treatments, a large aging population with osteoarthritis, and growing medical tourism. Strategic partnerships between global and local manufacturers enhance product accessibility and innovation.

Middle East & Africa Hyaluronic Acid Market Trends

The Middle East and Africa region is experiencing lucrative growth driven by rising demand for dermal fillers fueled by social media influence, increasing acceptance of cosmetic procedures, and a growing aging population with osteoarthritis and ophthalmic disorders. Advancements focus on safer, longer-lasting HA fillers and injections in osteoarthritis treatments, supported by expanding pharmaceutical manufacturing and increasing awareness across countries like UAE, Saudi Arabia, and South Africa.

The hyaluronic acid market in Saudi Arabia is experiencing robust growth driven by increasing demand for aesthetic procedures and the rising prevalence of osteoarthritis. Advancements in technology and novel innovations are boosting the market growth. Global players such as Allergan, Sanofi, and Anika Therapeutics are prominent in the Saudi market.

Key Hyaluronic Acid Company Insights

Major players such as F. Hoffmann-La Roche Ag, Galderma Laboratories L.P., and Sanofi lead the market, capitalizing on strong brand recognition, regulatory approvals, and extensive global distribution networks. Competitive dynamics are shaped by pricing strategies, supply chain efficiency, and product differentiation. In addition, manufacturers in emerging markets, especially in Asia Pacific, are increasing their presence with cost-effective formulations. As healthcare systems focus on affordable oncology treatments, competition in the market is expected to intensify. Overall, the docetaxel market is projected to experience significant growth throughout the forecast period.

Key Hyaluronic Acid Companies:

The following are the leading companies in the hyaluronic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Allergan

- Sanofi

- Genzyme Corporation

- Salix Pharmaceuticals

- F. Hoffmann-La Roche Ag

- Galderma Laboratories L.P.

- Zimmer Biomet

- Smith & Nephew Plc

- Ferring B.V.

- Lifecore Biomedical, Llc

- HTL Biotechnology

- Shiseido Company, Limited

- Bloomage Biotechnology Corporation Limited

- LG Life Sciences Ltd (LG Chem.)

- Maruha Nichiro, Inc.

Recent Developments

-

In February 2025, FDA granted approval for Evolus' Evolysse Form and Evolysse Smooth, two injectable hyaluronic acid gels developed for dermal filling applications. These innovative products are designed to address aesthetic concerns such as fine lines and wrinkles, offering a minimally invasive solution for facial rejuvenation.

-

In July 2024, LG Chem announced that its Chinese partner, Yifan Pharmaceutical, has launched Synovian (known as Hyruan One in China), a single-injection osteoarthritis treatment, in the Chinese market. Synovian is a cross-linked hyaluronic acid (HA) therapy designed for knee osteoarthritis, offering an innovative and minimally invasive option to relieve pain and improve joint function in patients suffering from this condition.

-

In June 2024 Nordic Group BV's subsidiary, Nordic Pharma, announced the commercial launch of its Lacrifill canalicular gel, a groundbreaking therapy for dry eye disease (DED) in the U.S. This innovative treatment offers a new option for managing DED, providing relief to patients suffering from this common and often chronic condition.

Hyaluronic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.5 billion

Revenue forecast in 2030

USD 16.7 billion

Growth rate

CAGR of 7.81% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Allergan; Sanofi; Genzyme Corporation; Anika Therapeutics, Inc.; Salix Pharmaceuticals; Seikagaku Corporation; F. Hoffmann-La Roche Ag; Galderma Laboratories L.P.; Zimmer Biomet; Smith & Nephew Plc; Ferring B.V.; Lifecore Biomedical, LLC; HTL Biotechnology; Shiseido Company, Limited; Bloomage Biotechnology Corporation Limited; LG Life Sciences Ltd (LG Chem.); Maruha Nichiro, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hyaluronic Acid Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hyaluronic acid market report on the basis of application and region:

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Dermal fillers

-

Osteoarthritis

-

Single-injection

-

Three-injection

-

Five-injection

-

-

Ophthalmic

-

Vesicoureteral reflux

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.