- Home

- »

- Medical Devices

- »

-

Dermal Fillers Market Size & Share, Industry Report, 2033GVR Report cover

![Dermal Fillers Market Size, Share & Trends Report]()

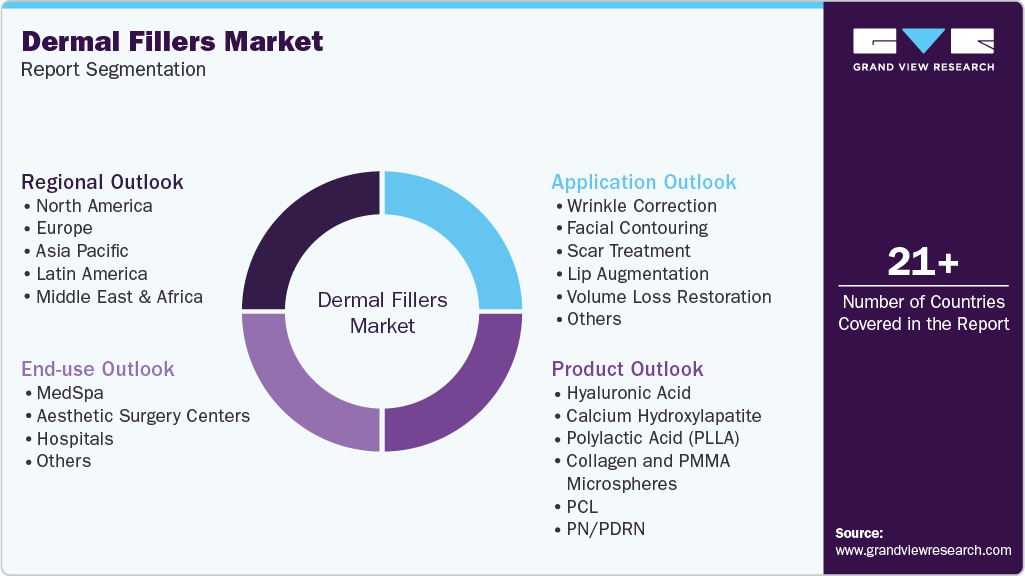

Dermal Fillers Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Hyaluronic Acid, Polylactic Acid, PCL), By Application (Wrinkle Correction, Facial Contouring, Lip Augmentation), By End-use (Hospitals, MedSpa, Aesthetic Surgery Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-051-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dermal Fillers Market Summary

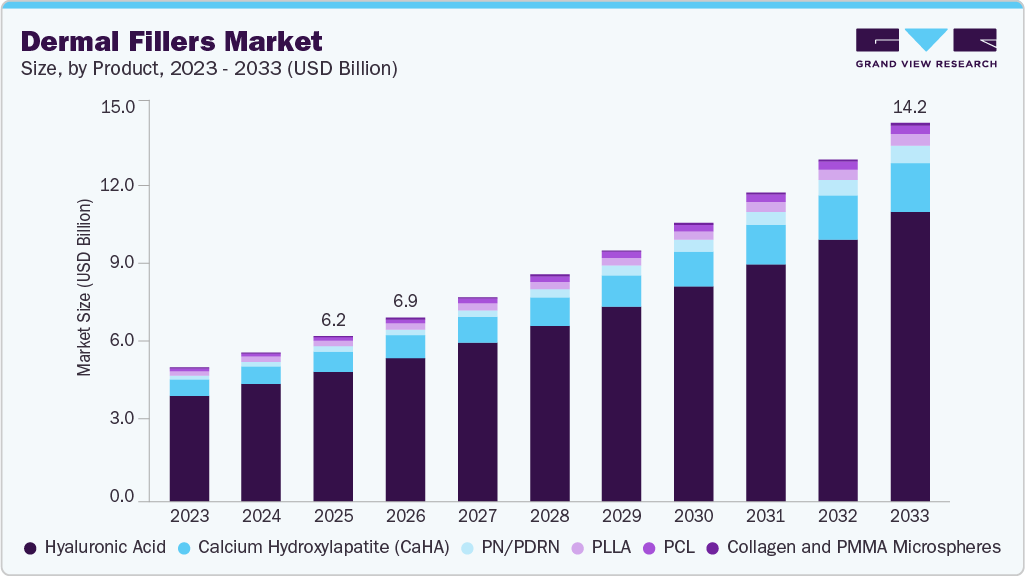

The global dermal fillers market size was estimated at USD 6.21 billion in 2025 and is projected to reach USD 14.19 billion by 2033, growing at a CAGR of 10.9% from 2026 to 2033. The rising demand for minimally invasive aesthetic procedures, the growing trend of ageless beauty, and increasing awareness among the young population about physical appearance are some of the major factors driving the growth of the market.

Key Market Trends & Insights

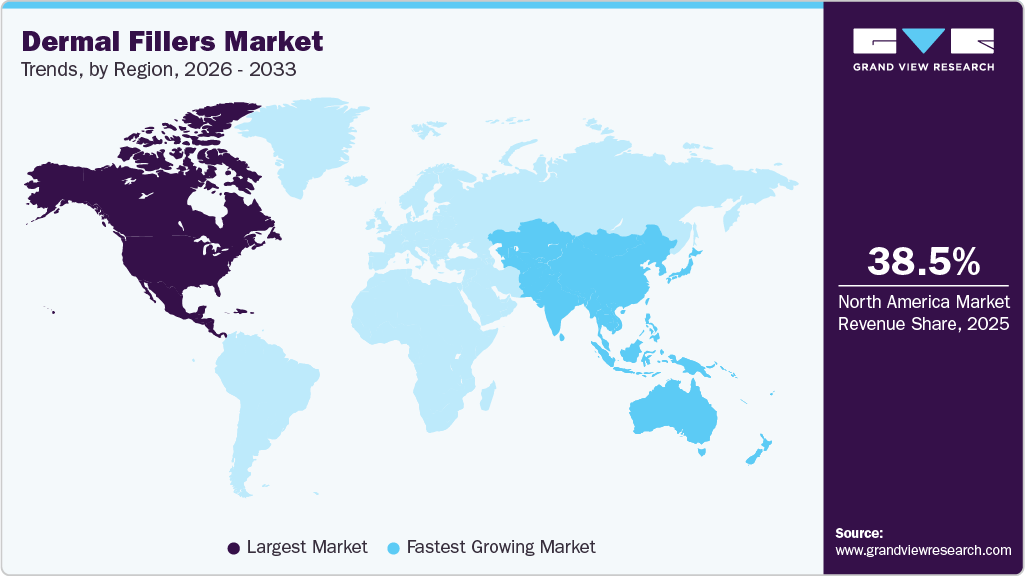

- North America's dermal fillers market held the largest share of 38.5% of the global market in 2025.

- The U.S. dermal fillers industry is expected to grow significantly over the forecast period.

- By product type, the hyaluronic acid segment held the highest market share of 78.4% in 2025.

- By application, the wrinkle correction segment dominated the market and held the largest revenue share of 31.8% in 2025.

- By end-use, the aesthetic surgery centers segment dominated the industry and held the largest revenue share of 42.9% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.21 Billion

- 2033 Projected Market Size: USD 14.19 Billion

- CAGR (2026-2033): 10.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Dermal fillers are a non-invasive alternative to surgical procedures such as facelifts, brow lifts, and other aesthetic procedures. Many people prefer to avoid surgery, and dermal fillers provide a way to achieve a more youthful appearance without going under the knife. They address various concerns, including wrinkles, volume loss, and sagging skin.

They can also be used on different areas of the face, including the lips, cheeks, and under the eyes. Furthermore, the increasing global geriatric population and technological developments in medical aesthetic products are expected to further propel the market’s growth. Dermal fillers can be customized to meet the unique needs and desires of each patient. Different types of fillers can be used to achieve various effects, and the amount and placement of the filler can be adjusted to achieve the desired result. They are injectable treatments that can be performed in a doctor's office to treat wrinkles and replace lost volume, giving the face a more youthful look.

Age-related bone damage in the face over time can cause the jawline to retract, the forehead to descend, and the loss of high cheekbones. In addition, the decrease in the elasticity & volume of the facial muscles and the reduction in the movement of facial fat further emphasize the signs of aging. Ultimately, the skin stretches and lowers its elasticity, combined with the loss of scaffolding supported by muscle, fat, and bone, which may lead to wrinkles, sagging skin, and other common signs of aging. As per the report by The Aesthetic Society, Americans spent over USD 14.6 billion on aesthetic treatments in 2021, with surgical revenues increasing by 63%. The use of dermal fillers for facial aesthetics procedures has become increasingly popular in recent years.

The younger population under 18 years of age is also a significant consumer. In 2020, as per the American Society of Plastic and Reconstructive Surgeons, teens aged 13-19 years accounted for around 230,000 aesthetic surgical treatments and approximately 140,000 non-invasive procedures, with many other unreported procedures that a certified medical practitioner didn’t perform. Breast surgeries and nose jobs were the most common among teens, as per the study.

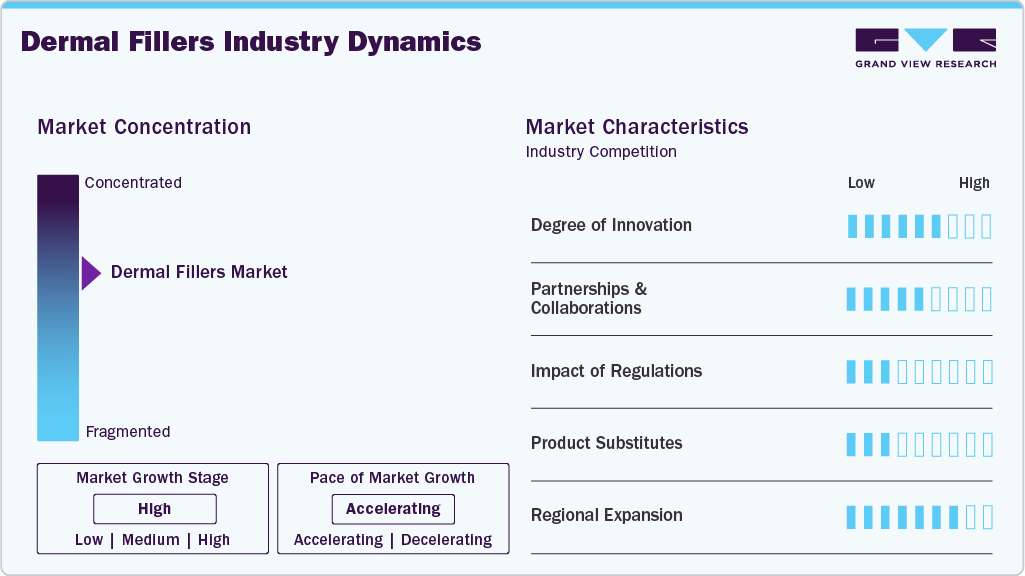

Market Concentration & Characteristics

The global dermal fillers market is moderately concentrated, with leading companies such as Allergan Aesthetics (AbbVie), Galderma, Merz Pharma, Sinclair, and Teoxane holding a significant share of the market. These players offer advanced filler products based on hyaluronic acid, calcium hydroxylapatite, and other biocompatible materials that deliver natural-looking results, longer durability, and improved safety. The market is continuously evolving due to product innovations, improved cross-linking technologies, and a focus on minimally invasive aesthetic procedures. In addition, rising demand for facial rejuvenation, lip enhancement, and anti-aging treatments across all age groups is driving market growth and encouraging new entrants with differentiated and specialized filler solutions.

The dermal fillers market is undergoing major innovations and advancements. For instance, in October 2024, Merz Pharma inaugurated its new Research & Development Innovation Center (RDIC, North America) in Raleigh, North Carolina. Serving as a counterpart to its RDIC in Frankfurt, the facility includes specialized labs for energy-based device (EBD) innovation. This shows key market players are increasingly focusing on developing innovative products to fulfill market demand.

Partnering and collaborating play a major role in learning how to get access to the new, different technological ways, and also being able to enhance the dermal fillers. For instance, in March 2025, Laboratoires VIVACY and Burgeon Biotechnology formed a strategic partnership combining STYLAGE dermal fillers with NOVUMA biostimulator. This collaboration merges hyaluronic acid and calcium hydroxyapatite technologies to advance regenerative aesthetics, offering physicians innovative, high-performance injectable solutions that enhance skin quality and meet growing patient demand globally.

The dermal fillers industry is regulated strictly to ensure diagnostic device safety, efficacy, and reliability. Strict approval processes require manufacturers to meet high standards for testing, labeling, and clinical evidence before products can be sold. These rules build patient trust and reduce risks linked to unsafe or counterfeit fillers. However, complex regulatory requirements can increase costs and delay product launches, especially for smaller companies. Overall, regulation supports long-term market growth by encouraging innovation, promoting safer treatments, and improving confidence among consumers, clinics, and doctors.

Product substitutes in the dermal fillers market include other non-surgical and surgical aesthetic treatments that offer similar cosmetic outcomes. These substitutes include botulinum toxin injections (Botox), laser and energy-based skin treatments, chemical peels, fat grafting, and cosmetic surgery such as facelifts. Skincare products and anti-aging creams are also considered mild substitutes for early-stage cosmetic concerns. Many consumers choose these alternatives based on cost, treatment duration, recovery time, and desired results. The availability of multiple aesthetic options increases competitive pressure, encouraging dermal filler manufacturers to focus on safety, effectiveness, and longer-lasting results.

The dermal fillers market is expanding across all major regions, supported by growing awareness of aesthetic treatments and rising demand for non-surgical cosmetic procedures. For instance, in May 2025, Teoxane expanded its presence in the U.S. market by launching its dermocosmetics line directly to consumers online. Previously accessible only through aesthetic professionals, this move allows broader consumer access to Teoxane’s advanced skincare products featuring patented Resilient Hyaluronic Acid technology, marking a strategic shift beyond their established dermal filler offerings.

Product Insights

The hyaluronic acid segment dominated the market in 2025 and accounted for the largest share of 78.4% of the overall revenue.The segment is anticipated to continue its dominance over the forecast period. Hyaluronic acid occurs naturally in the body, found in the skin, eyes, and connective tissue. It is a sugar molecule that attracts and retains water, which keeps skin plump and hydrated. As hyaluronic acid is a natural substance, it is well-tolerated by the body and is less likely to cause allergic reactions or other adverse effects. Hyaluronic acid dermal fillers can be used to treat a variety of concerns, including fine lines, wrinkles, volume loss, and deep folds. They can also be used to enhance the lips and cheeks and to improve the appearance of scars and other skin imperfections. They are available in different formulations, allowing practitioners to customize treatments to each patient’s individual needs. Hyaluronic acid dermal fillers have a low risk of complications when administered by a trained and experienced practitioner. Any adverse effects are typically temporary and can be easily corrected.

The PN/PDRN segment is expected to witness the fastest CAGR over the forecast period. PN/PDRN consists of natural DNA fragments, typically derived from salmon, known for their excellent biocompatibility with human tissue. These molecules stimulate fibroblast activity, promote collagen and elastin production, and trigger tissue repair at a cellular level. Polynucleotides regenerate and revitalize the skin, targeting fine lines, wrinkles, scars, and stretch marks while improving skin tone and hydration. Clinical evidence strongly supports their efficacy. A recent trial involving 20 women showed visible improvement in skin texture and wrinkle reduction within six weeks without side effects. Another 20-week study demonstrated reduced stretch mark width and volume after PN injections, highlighting their regenerative capacity. Their low downtime and natural outcomes make them particularly attractive to both patients and practitioners. The PN/PDRN filler segment aligns with the rising demand for minimally invasive treatments with biological action. Applications span face, eye area, and body, with particular effectiveness for periorbital rejuvenation. As a pre-treatment, polynucleotides also enhance results from laser, microneedling, or surgical procedures.

Application Insights

The wrinkle correction segment dominated the market and held the largest revenue share of 31.8% in 2025. Dermal fillers are designed to provide a subtle, natural-looking enhancement that does not appear overdone. This makes them a popular choice among consumers. They provide a non-surgical option for correcting wrinkles and other signs of aging. However, the duration of results can vary depending on the specific product used.Most dermal fillers provide results that last from 6 to 18 months. This makes them a convenient and cost-effective option for many consumers who want to maintain a youthful appearance without undergoing surgery or more invasive procedures.

The lip augmentation segment is expected to witness the fastest CAGR over the forecast period. Lip augmentation utilizes injectable dermal fillers to enhance the fullness, shape, and definition of the lips. This procedure appeals to those aiming for a more balanced facial appearance by achieving plumper, well-contoured lips. As a minimally invasive alternative to surgery, dermal filler lip augmentation has gained significant popularity due to its quick, visible results. Clinicians often combine this treatment with other dermal fillers for overall facial rejuvenation. In August 2024, the Journal of Cutaneous and Aesthetic Surgery published a scoping review highlighting recent advancements in both injectable and surgical methods for lip augmentation. The review found that dermal filler injections remain the predominant approach due to their minimally invasive nature and immediate results, though their effects tend to be temporary. This technique ensures the lips harmonize with the rest of the face’s aesthetics. Increasingly, younger patients are turning to dermal fillers for lip enhancement as a preventive measure to maintain youthful contours or subtly boost their natural features, highlighting a trend toward early, proactive cosmetic care. Therefore, the rising preference for dermal fillers in lip augmentation is anticipated to fuel market expansion during the forecast period.

End-use Insights

The aesthetic surgery centers segment dominated the industry and held the largest revenue share of 42.9% in 2025. The large share is due to their specialization, patient trust, and broad treatment offerings. These clinics serve as the primary point of care for aesthetic and skin-related procedures. Rising disposable incomes, medical tourism, and increasing acceptance of cosmetic procedures among both men and women have further boosted procedure volumes in aesthetic surgery centers. Many centers now offer personalized treatment plans using advanced imaging technologies and injection protocols, improving patient satisfaction and outcomes. Furthermore, aesthetic centers serve as strategic distribution channels for dermal filler manufacturers, accelerating product adoption and market penetration.

The medSpas segmentis anticipated to grow at the fastest CAGR of 11.5% over the forecast period. Medical spas are staffed by licensed medical professionals, such as doctors or nurse practitioners, who have specialized training in administering dermal fillers. Patients may feel more comfortable knowing that a qualified and experienced medical professional is performing their treatment. They are designed to provide a soothing environment for patients. Many offer amenities, such as soft music, aromatherapy, and comfortable seating, to help patients feel relaxed and at ease during their treatment.

Regional Insights

North America's dermal fillers market accounted for the largest revenue share of 38.5% in 2025. This is owing to the increasing demand for non-surgical aesthetic procedures, increasing popularity among men, and the growing trend of ageless beauty in the region. The population in North America is highly concerned with physical appearance and beauty standards. This has led to a high demand for dermal fillers to enhance facial features and reduce the signs of aging. Furthermore, the region has many skilled practitioners, including dermatologists, plastic surgeons, and medical aestheticians, who are trained in administering dermal fillers. Rising disposable incomes and the strong presence of aesthetic service providers have further supported market expansion. In July 2024, according to Statistics Canada, the median age in Canada was 40.3 years, reflecting a large working-age population between 20 and 65 years. This demographic is a key driver of demand for dermal fillers, as adults in this age range increasingly seek minimally invasive aesthetic treatments to address early signs of aging and maintain youthful skin without surgery.

U.S. Dermal Fillers Market Trends

Dermal fillers market in the U.S. is experiencing steady growth, driven by strong physician networks, surgeon/dermatologist procedural volumes, and rapid incorporation of new, indication-specific HA products into practice. The growing geriatric population in the U.S. is a key factor accelerating demand for dermal fillers. The Population Reference Bureau anticipates a 69% increase in individuals aged 65 and older between 2020 and 2060. As age-related skin concerns such as volume loss and deep wrinkles become more prevalent, HA-based fillers are emerging as a preferred aesthetic intervention among older adults. Thus, higher clinician confidence and faster uptake of clinically differentiated HA dermal fillers drive the growth of the market across the country.

Europe Dermal Fillers Market Trends

Stringent regulatory frameworks and elevated product-safety scrutiny across member states are reshaping theEuropean dermal fillers market. In October 2024, Evolus announced that it received EU Medical Device Regulation (MDR) certification for its Estyme injectable hyaluronic acid gels, marking a key regulatory milestone. This approval under the stricter MDR framework allows Evolus to enter the European dermal filler market, doubling its addressable market outside the U.S. The company plans a limited experience program with selected physicians in Europe, followed by a broader launch in the second half of 2025. The market is projected to grow at a lucrative rate during the forecast period. This growth is supported by a robust base of skilled medical professionals, an increasing geriatric population seeking anti-aging treatments, and heightened demand for advanced aesthetic solutions.

The UK dermal fillers market is steadily growing, due to the rising number of nonsurgical procedures is expected to drive the dermal fillers market over the forecast period. According to the ISAPS 2023 report, nearly 63,130 nonsurgical aesthetic treatments were performed, with approximately 28,680 hyaluronic acid dermal filler procedures carried out in 2023. The report also estimated that nearly 717 surgeons were registered in the country, contributing to improved accessibility of dermal filler treatments. In August 2024, Alma announced a collaboration with Prollenium to exclusively distribute Revanesse dermal fillers and SoftFil cannulas in the UK. Alma is expected to provide comprehensive training and support through Harley Academy and Alma Studios. This partnership aims to combine advanced injectables with energy-based technologies to enhance patient outcomes and clinic success.

Dermal fillers market in Spain is experiencing a significant growth in theglobal dermal fillers market. The country ranks fifth among European countries in terms of cosmetics and perfume consumption, which can be attributed to increasing aesthetic consciousness. Moreover, the growing urban population, rising number of novel approved products, easy availability of affordable treatments, rapid advancements in noninvasive procedures, and increasing number of cosmetic professionals are among the factors contributing to the market growth in Spain. However, the growing number of shipments of unregulated products from Spain is expected to impede international confidence in dermal fillers. For instance, in May 2023, more than 70 shipments of unregulated Botox and Juvederm were identified on the U.S. coast, with products originating from four primary locations: Spain, Bulgaria, China, and South Korea. The combined value of the shipment was estimated to be USD 175,400.

Germany dermal fillers market is steadily growing, owing to the rising demand for facial rejuvenation, increasing acceptance of aesthetic enhancements, and a strong preference for minimally invasive procedures. The country also benefits from rapid urbanization, skilled aesthetic practitioners, technological innovation in dermal filler formulations, and a growing number of aesthetic clinics. According to the ISAPS 2023 report, Germany recorded 781,440 nonsurgical procedures, with 286,285 involving hyaluronic acid-based fillers, underlining their widespread usage in aesthetic practice. However, the high cost of such treatments remains a barrier for broader patient uptake.

Dermal fillers market in France is growing significantly. Increased awareness among customers about the potential benefits of aesthetic procedures, coupled with the growing adoption of minimally invasive treatments, is boosting the dermal fillers market in the country. Furthermore, rising purchasing power, growing involvement of international players, increasing spending on cosmetics and personal care, and a rising number of beauty clinics are among the factors fueling market growth. According to the ISAPS 2023 report, around 560,100 non-surgical treatments were performed in the country, with 234,900 hyaluronic acid-based dermal filler procedures. Hyaluronic acid-based dermal fillers are the most frequently performed procedures in the country, accounting for 41.9% of commonly performed minimally invasive aesthetic treatments. These factors contribute to the growth of the hyaluronic acid-based dermal fillers market.

Asia Pacific Dermal Fillers Market Trends

Dermal fillers are gaining traction in the APAC region, which has turned out to be a major market due to consumer fascination with beauty and anti-aging treatments, the quick expansion of aesthetic clinics, and the establishment of local innovation hubs. The region is also benefiting from a concerted effort to improve safety and efficacy standards specific to hyaluronic acid-based dermal fillers. In June 2023, Croma-Pharma enrolled the first patient in a Phase 3 clinical trial in China for its hyaluronic acid dermal filler, Princess Volume Plus Lidocaine. The randomized, multi-center study aims to confirm the product’s safety and efficacy for mid-facial volume restoration, with around 600 patients expected across 15 sites. This effort is part of a joint venture with China National Biotech Group to expand their aesthetic portfolio in China and Hong Kong, responding to growing demand in the Asia-Pacific dermal filler market.

Thailand dermal fillers market is shaped by the availability of advanced and noninvasive dermal filler solutions, and the rising number of cosmetic procedures is driving demand in Thailand’s dermal fillers market. The presence of 500 surgeons further supports the accessibility and growth of dermal filler treatments, highlighting a thriving market for aesthetic enhancements in Thailand. The expanding hospital infrastructure provides a supportive environment for dermal filler procedures, while the high proportion of international patients underscores Thailand’s appeal as a medical tourism destination for these treatments.

Dermal fillers market in China benefits from rising demand for minimally invasive procedures and strong local innovation in dermal fillers. Key players such as Bloomage Biotechnology, a global leader in HA fillers, drive product adoption domestically and internationally. In June 2023, Bloomage announced a USD 37 billion investment with Jinan High-tech Zone to develop a hyaluronic acid production ecosystem, showing long-term market confidence. That same month, Croma-Pharma began a Phase 3 clinical trial for its HA dermal filler in China, aiming to address mid-facial volume loss with around 600 patients across 15 sites, reflecting robust market momentum.

South Korea dermal fillers market is driven by continuous product innovation, growing consumer demand, and international expansion strategies. The country has emerged as a global leader in aesthetic advancements, often setting benchmarks for safety, formulation precision, and treatment versatility. For instance, in August 2023, UK distributor LPharm Overseas Ltd. partnered with local biotech firm CGBio to launch a line of HA fillers under the AiLEENE brand globally. The product range is designed with varying levels of viscosity and elasticity to cater to different aesthetic needs, highlighting South Korea's innovation-driven approach in the dermal fillers space.

Dermal fillers market in India is driven by increasing affordability of aesthetic treatments, rising disposable income, and heightened awareness of cosmetic procedures. According to the ISAPS 2023 report, India recorded 496,931 nonsurgical procedures, with hyaluronic acid dermal fillers ranking second at 107,100 procedures, representing 21.6% of the total. The expanding network of cosmetic clinics and the growing influence of social media in educating consumers are key factors encouraging uptake of these treatments.

Latin America Dermal Fillers Market Trends

A significant rise in medical tourism is expected to accelerate the growth of the dermal fillers market across Latin America. Key contributors to regional revenue include Brazil and Argentina. These countries are increasingly recognized for offering high-quality aesthetic procedures at considerably lower costs, often 30% to 70% less than those in North America and Europe. This cost advantage, along with the availability of skilled practitioners and well-established medical infrastructure, continues to attract international patients seeking cosmetic treatments, including dermal fillers.

The Brazil dermal fillers market is growing in 2025. The growth can be attributed to the societal emphasis has driven the widespread use and acceptance of hyaluronic acid-based dermal fillers for enhancing or preserving facial features. According to the ISAPS 2023 report, Brazil recorded 2,185,038 surgical procedures and 1,196,513 nonsurgical procedures, with hyaluronic acid-based treatments ranking second among nonsurgical interventions, accounting for 429,391 procedures. This underscores the high demand for dermal fillers within the country’s aesthetic landscape. The country’s growing medical tourism sector, combined with the availability of advanced yet affordable aesthetic treatments, continues to attract both domestic and international patients.

Middle East & Africa Dermal Fillers Market Trends

The demand for dermal fillers in the Middle East is growing steadily due to rising demand for non-surgical cosmetic treatments, increasing beauty awareness, and a growing middle-income population. Countries such as Saudi Arabia, the UAE, and South Africa are key markets, supported by well-established aesthetic clinics and skilled practitioners. Facial rejuvenation, lip enhancement, and wrinkle reduction are the most common procedures. Medical tourism, especially in the Gulf region, further supports market growth.

Saudi Arabia dermal fillers market growth isdriven by rising disposable income, Vision 2030-linked healthcare and retail modernization, and increasing female participation in the workforce, all of which lead to higher discretionary spending on aesthetics. A young population, higher disposable incomes, and strong social media influence are encouraging more consumers to opt for minimally invasive cosmetic enhancements. Clinics and dermatology centers are expanding their aesthetic service offerings, especially in major cities like Riyadh and Jeddah. The market is also benefiting from the presence of international filler brands and trained medical professionals.

Key Dermal Fillers Company Insights

The dermal fillers market is highly competitive and has several key players. The major market players are focused on expanding their geographical presence, forming partnerships to enhance imaging services and patient care, taking advantage of important cooperation activities, and exploring mergers and acquisitions.

Key Dermal Fillers Companies:

The following are the leading companies in the dermal fillers market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie

- Galderma

- Merz Pharma

- Sinclair Pharma

- Revance

- Teoxane

- Laboratories Vivacy

- IBSA Farmaceutici Italia Srl

- Hugel

- Across Co.

- BioPlus Co.

- LG Chem

- Medytox

- Caregen

- Prollenium Medical

- Evolus

- Daewoong Pharmaceutical

- Koru Pharmaceuticals

- Tiger Aesthetics Medical (Suneva Medical)

Recent Development

-

In August 2025, Revance launched the Teoxane RHA Collection with Mepivacaine in the U.S., marking the first major anesthetic shift in fillers in nearly 20 years. Replacing lidocaine with mepivacaine offers equal pain relief but less bruising. FDA-approved in 2023, this innovation enhances patient comfort while maintaining proven safety and aesthetic outcomes.

-

In August 2025, Evolus submitted its Evolysse Sculpt HA dermal filler for FDA approval, targeting mid-face volume restoration, with approval expected in late 2026. Supported by a 24-month pivotal study comparing it to Restylane-Lyft, Evolysse Sculpt uses Cold-X technology for natural, long-lasting results, expanding Evolus’ HA filler portfolio alongside Evolysse Form and Smooth.

-

In February 2025, Evolus, Inc. received FDA approval for Evolysse Form and Evolysse Smooth, two hyaluronic acid-based injectable gels, signaling its entry into the U.S. dermal filler market with a planned launch in Q2 2025. In a 140-patient clinical trial, both products demonstrated superior longevity and effectiveness compared to Restylane-L.

Dermal Fillers Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.89 billion

Revenue forecast in 2033

USD 14.19 billion

Growth rate

CAGR of 10.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use,region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Russia: Japan; China; India; Australia; Thailand; South Korea; Singapore; Malaysia; Taiwan; Vietnam; Philippines; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie; Galderma; Merz Pharma; Sinclair Pharma; Revance; Teoxane; Laboratories Vivacy; IBSA Farmaceutici Italia Srl; Hugel; Across Co.; BioPlus Co.; LG Chem; Medytox; Caregen; Prollenium Medical; Evolus; Daewoong Pharmaceutical; Koru Pharmaceuticals; Tiger Aesthetics Medical (Suneva Medical)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to the country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dermal Fillers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. Forthis study, Grand View Research has segmented the global dermal fillers market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Hyaluronic Acid

-

Monophasic

-

Biphasic

-

-

Calcium Hydroxylapatite

-

Polylactic Acid (PLLA)

-

Collagen and PMMA Microspheres

-

PCL

-

PN/PDRN

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Wrinkle Correction

-

Facial Contouring

-

Scar Treatment

-

Lip Augmentation

-

Volume Loss Restoration

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

MedSpa

-

Aesthetic Surgery Centers

-

Hospitals

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Thailand

-

Australia

-

Singapore

-

Malaysia

-

Taiwan

-

India

-

Vietnam

-

Philippines

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dermal fillers market size was estimated at USD 6.21 billion in 2025 and is expected to reach USD 6.89 billion in 2026.

b. The global dermal fillers market is expected to grow at a compound annual growth rate of 10.9% from 2026 to 2033 to reach USD 14.19 billion by 2033.

b. North America dominated the dermal fillers market and accounted for the largest revenue share of 38.5% in 2025. This is owing to the increasing demand for non-surgical aesthetic procedures, increasing popularity among men, and the growing trend of ageless beauty in the region

b. Some key players operating in the dermal fillers market include AbbVie; Galderma; Merz Pharma; Sinclair Pharma; Revance; Teoxane; Laboratories Vivacy; IBSA Farmaceutici Italia Srl; Hugel; Across Co.; BioPlus Co.; LG Chem; Medytox; Caregen; Prollenium Medical; Evolus; Daewoong Pharmaceutical; Koru Pharmaceuticals; Tiger Aesthetics Medical (Suneva Medical)

b. Rising demand for minimally invasive aesthetic procedures, the growing trend of ageless beauty, and increasing awareness among the young population about physical appearance are some of the major factors driving the growth of the dermal fillers market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.