- Home

- »

- Medical Devices

- »

-

Hyaluronic Acid-based Dermal Fillers Market Report, 2030GVR Report cover

![Hyaluronic Acid-based Dermal Fillers Market Size, Share & Trends Report]()

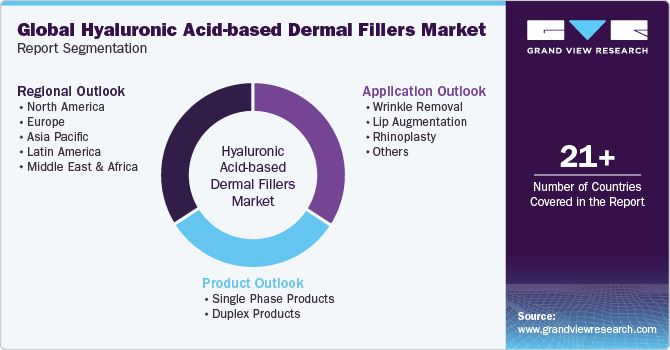

Hyaluronic Acid-based Dermal Fillers Market Size, Share & Trends Analysis Report By Application (Wrinkle Removal, Lip Augmentation, Rhinoplasty), By Product, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-999-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global hyaluronic acid-based dermal fillers market is estimated at USD 4.08 billion in 2023 and is projected to grow at a CAGR of 10.5% from 2024 to 2030. The primary factors driving the market growth are the growing demand for non-invasive aesthetic treatment procedures and increasing awareness regarding the application of HA in the beauty segment. In addition, the increased investment in R&D for novel advanced innovations in dermal products is propelling the market's growth.

The increasing aging population globally is driving the market growth. Major economies are undergoing a demographic shift as more individuals enter the older age brackets, and demand for cosmetic solutions is growing to combat the visible signs of aging and maintain a youthful appearance. This led to a significant surge in demand for injectable that effectively reduce wrinkles, fine lines, and other age-related concerns. According to Australia's 2023 Intergenerational Report, by 2050, the country's population aged 65 to 84 years is projected to more than double, and the population of those aged 85 years & over is expected to quadruple. This demographic shift is increasing the number of specialized clinics that cater to the needs of the elderly.

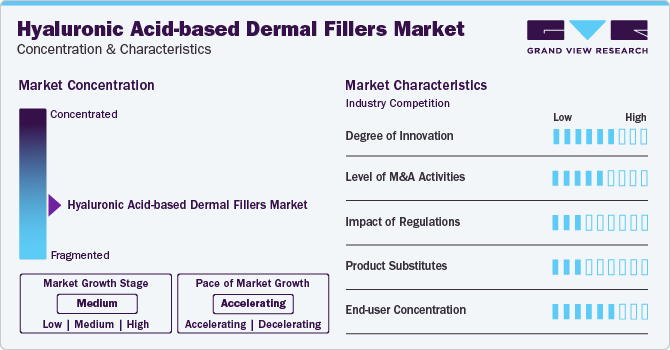

Market Concentration & Characteristics

The growth stage in market is high, and the pace is accelerating. The trend of aesthetic procedures is growing among men. More men are concerned regarding the negative impact of aging on their appearance & facial features. This is increasing the demand for facial dermal fillers, as per the ISPAS global survey, 12.2 % population opting for non-surgical procedures involving HA based fillers, accounted for men.

The market is witnessing outstanding growth due to the increasing awareness and acceptance of esthetic treatments. As attitude toward cosmetic procedures is shifting, emphasis on physical appearance and self-care is growing. People are becoming more active, informed, & knowledgeable about utilizing fillers to enhance their appearance and address cosmetic concerns. In addition, the introduction of various insurance schemes for esthetic & cosmetic procedures contributed to an increase in the awareness and acceptance of dermal fillers, driving the market growth.

The advent of technology is shaping the market. Key players are dedicated to the development of advanced solutions to have a competitive edge in the hyaluronic acid market. In 2021, laser resurfacing treatment was introduced in the market having higher efficiency in addressing various skin concerns. The technology applies laser for solving all the dermal issues at once. In addition, the new technology is lower-invasive in response to the demand for non-invasive techniques.

The increasing number of new product approvals is propelling market opportunities. For instance, in January 2022, RHA Redensity, a novel dermal filler for reducing the wrinkles on skin, received U.S. FDA approval RHA Redensity is a gel implant produced from sodium hyaluronic acid which is injected into particular locations of the facial tissue for smoothening out lines & wrinkles.

The stringent government guidelines & regulations in the U.S., Europe Union & international markets for the development, branding & production of HA-based products are restraining the market growth. These stringent laws enable that quality products are utilized by healthcare facilities, including doctors as well as other end users. For instance, according to a 2018 FDA report, Juvederm must only be available for sale as well as injected with a licensed healthcare provider's recommendation. The FDA has also recommended patients and their doctors to refrain from using Juvederm Ultra 2, 3, & 4 due to non-approval of the product by U.S. FDA. This is restricting the accessibility latest products.

Application Insights

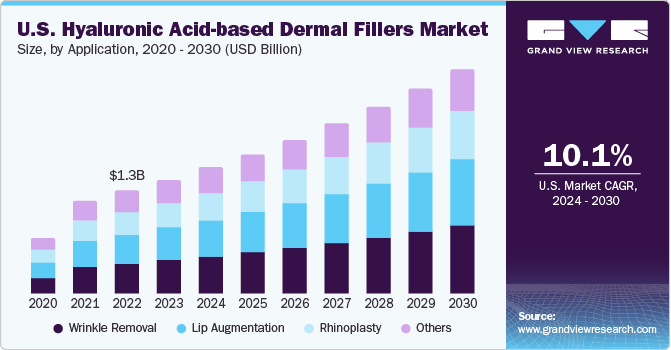

Based on application, the market is segmented into wrinkle removal, lip augmentation, rhinoplasty, and others. The wrinkle removal segment led the market with the largest revenue share of 29.53% in 2023 and is estimated to grow at a significant CAGR during the forecast period, owing to growing customer awareness & desire for youthful appearance, technological advancements in hyaluronic acid-based treatment and growing number of new products & procedures for antiwrinkle treatment.

The lip augmentation segment is expected to grow at a lucrative CAGR during the forecast period, owing to increasing contributions from key market players. Lip augmentation is a cosmetic procedure performed for enhancing the volume of lips through enlargement by application of fillers that may be temporary or permanent. Hyaluronic acid-based fillers are widely applied injections for plumping and defining lips. Hyaluronic acid facilitates a thickening appearance of lips by attaching to the water molecules present inside the skin. Increasing awareness, growth in disposable income, change in lifestyle & surging demand for filler are expected to further propel the market growth.

Dermal fillers based involving hyaluronic acid are applied in revision rhinoplasty for smoothing irregularities/asymmetries of nose. The procedure is considered as the most complicated procedure in plastic procedures. This procedure is mandatory for 5-12% of Rhinoplasty patients. It is also gaining popularity among the population desiring to change their nasal appearance. Rising awareness of aesthetic procedures, launch of advanced treatment procedures like 3D computer-assisted technologies is propelling the demand for rhinoplasty market.

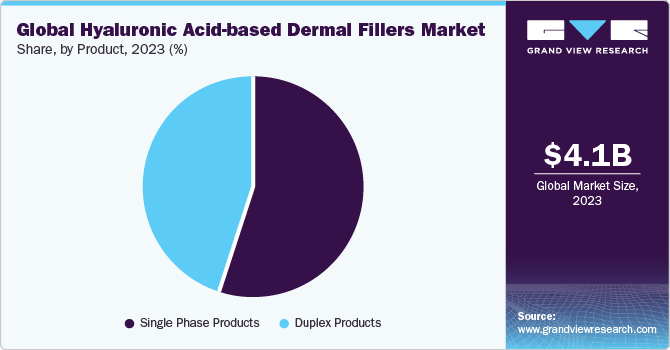

Products Insights

The market is segmented into single-phase & duplex products. The single-phase segment led the market with the largest revenue share of 54.76% in 2023 and is estimated to grow at the fastest CAGR during the forecast period. The segmented is estimated to grow rapidly owing to variety of applications in skin & facial procedures, lower side effects & advancement of technology resulting in the development of novel fillers.

Dermatologists are preferring single-phase products for the repair of soft tissue facial issues as the uncross-linked hyaluronic acid boosts production of collagen & elastin providing the skin a younger and healthy glow. Single-phase products don't go through the sizing technique, breaking down the gel, during the production process. Hylacross technology is applied to the production of single-phase fillers like Juvederm Ultra, resulting in product durability with potential benefits.

Cohesive Intensified Matrix technique is applied to make duplex hyaluronic acid products. The enhanced durability, duplex products is resulting in them being employed for treating glabellar lines & nasolabial folds. According to a study on Belotero HA filler, CPM technological solutions have soft flowing characteristics allowing for smooth injection as well as integration of homogeneous tissue integration.

Regional Insights

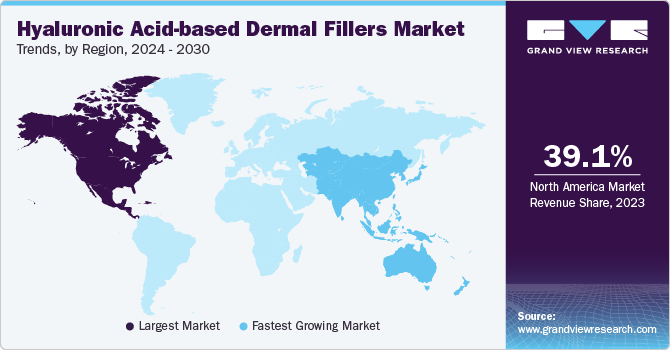

North America dominated the hyaluronic acid-based dermal filler market with the largest revenue share of 39.1% in 2023, due to the increased no of non-invasive cosmetic procedures performed, growing investment on research & great infrastructure. Furthermore, the presence of key market leaders in the region is driving market opportunities in the region.

U.S. Hyaluronic Acid-based Dermal Fillers Market Trends

The hyaluronic acid-based dermal fillers market in U.S. held 88.58% share of North America in 2023. According to the American Society of Plastic Surgeons (ASPS) article published in September 2023, in 2022, there was a significant increase of 19% in cosmetic surgeries and procedures in the U.S. as compared to 2019, totaling 26.2 million. This indicates that more people are now open to and choosing aesthetic enhancements. The article also revealed that nearly 23.7 million less invasive cosmetic procedures were performed in 2022, with hyaluronic acid fillers being the second most preferred option.

Europe Hyaluronic Acid-based Dermal Fillers Market Trends

The hyaluronic acid-based dermal fillers market in Europe is expected to grow at a lucrative CAGR during the forecast period. This can be attributed to the rising of the aging population, and increasing preference for anti-aging procedures involving hyaluronic acid-based fillers.

The Germany hyaluronic acid-based dermal fillers market is expected to grow at the fastest CAGR during the forecast period. The country's growing number of nonsurgical procedures is expected to boost the market growth over the forecast period. Germany is one of the leading countries in Europe in terms of no of hyaluronic acid-based dermal filler procedures. As per the International Society of Plastic Surgery 236,778 surgeries were carried out in Germany in 2020.According to the ISAPS 2022 report, nearly 77,924 nonsurgical procedures were performed in the country. In addition, nearly 27,015 HA-based procedures were performed in 2022. According to the same report, it was estimated that nearly 600 surgeons were registered in the country.

The hyaluronic acid-based dermal fillers market in France is expected to grow at a significant CAGR during the forecast period. Increased awareness among customers about the potential benefits of aesthetic procedures, coupled with the growing adoption of minimally invasive procedures, is boosting the market growth in France. Furthermore, rising purchasing power, growing involvement of international players, increasing spending on cosmetics and personal care, & rising number of beauty clinics are among the factors fueling the market growth in France.

Asia Pacific Hyaluronic Acid-based Dermal Filler Market Trends

The hyaluronic acid-based dermal fillers market in Asia Pacific is expected to grow at a rapid CAGR over the forecast period, with swiftly evolving economies. This can be attributed to the rising medical tourism industry, especially in Southeast Asia. According to the ISAPS 2022 report, 29% of patients who underwent aesthetic treatments in Thailand were foreign nationals, while in Japan, the figure was 4%. The Asia Pacific is witnessing robust market growth, driven by a concerted effort to advance treatment practices. According to the NCBI article published in July 2022, a survey in 2021 encompassing practitioners from 10 regions in Asia Pacific highlighted a collective push for safe & ethical use of HA dermal fillers.

The Australia hyaluronic acid-based dermal fillers market is expected to grow at the fastest CAGR over the forecast period. The growing focus on antiaging cosmetic services is expected to boost market growth. According to the Australian College of Cosmetic Surgery, Australia's per capita spending on cosmetic procedures is over 40% higher than that of the U.S. This significant increase in spending is driving market growth in the cosmetic surgery industry in Australia. Various nonsurgical procedures, such as antiwrinkle treatments, microdermabrasion, and laser hair removal, are popular procedures in Australia. According to the ISAPS report 2022, Australia has a total of 425 surgeons, constituting 0.8% of the overall number of surgeons.

The hyaluronic acid-based dermal fillers market in India is driven by the increasing affordability of aesthetic procedures along with growing disposable income & awareness about these procedures. According to the ISAPS 2022 report, in India, the total count of nonsurgical procedures is 324,155, among which hyaluronic acid treatments secured the third position with 50,365 procedures, representing 15.5% of the overall total. Easy accessibility of cosmetic clinics, growing awareness about procedures through social media, rising disposable income, and growing awareness about various cosmetic procedures drive the market growth.

Latin America Hyaluronic Acid-based Dermal Fillers Market Trends

The hyaluronic acid-based dermal fillers market in Latin America is anticipated to grow at a significant CAGR over the forecast period. A significant growth in medical tourism is expected to accelerate the development of the cosmetic industry. Latin American countries majorly contributing to the revenue generation include Brazil, Argentina, Colombia, Chile, and Mexico. The presence of untapped opportunities in developing countries, such as Mexico & Brazil, is expected to propel the market growth in the region during the forecast period.

The Mexico hyaluronic acid-based dermal fillers market is a key destination for medical tourism, including cosmetic procedures. Many individuals from the U.S. and other countries visit Mexico for more affordable aesthetic treatments, including hyaluronic acid-based dermal fillers. According to various sources, the cost of plastic surgery in Mexico is nearly 50% to 70% cheaper than that in the U.S. Furthermore, the ISAPS 2022 report estimates that nearly 33.8% of all cosmetic procedures in Mexico are performed on foreign nationals.

Middle East & Africa Hyaluronic Acid-based Dermal Fillers Market Trends

The hyaluronic acid-based dermal fillers market in Middle East & Africa is anticipated to grow at a moderate CAGR over the forecast period. Key countries in the MEA include South Africa, Saudi Arabia, and the UAE. Middle Eastern countries such as Saudi Arabia, Qatar, UAE, Kuwait, and Oman are prospering economies. This region is technologically developed; however, there is insignificant awareness relating to hyaluronic acid-based dermal fillers and other aesthetic treatments. Moreover, some countries in the African region lack healthcare infrastructure.

The South Africa hyaluronic acid-based dermal fillers market is anticipated to grow at the rapid CAGR over the forecast period. The growing population and increasing investments in the aesthetic & cosmetic sectors are among the key factors expected to boost the market growth in the country. According to Africa Business Pages, there has been a three-fold increase in the middle-class population, which has created opportunities for various local & international companies.

Key Hyaluronic Acid-based Dermal Fillers Company Insights

The market is fragmented & highly competitive. To key market players are focusing on regional expansion & new product development. For Instance, A. Menarini plans to introduce a line of HA-based fillers with Lidocaine in October 2021. The line of products would be produced using Menarini's proprietary or exclusive XTR new tech, enabling fillers having distinct rheological characteristics for supporting variety of clinical indications for rejuvenation & facial volume restoration.

Key Hyaluronic Acid-based Dermal Fillers Companies:

The following are the leading companies in the hyaluronic acid-based dermal fillers market. These companies collectively hold the largest market share and dictate industry trends.

- Allergan; Galderma Laboratories

- L.P.; Merz Pharmaceuticals

- Genzyme Corporation

- Anika Therapeutics Inc.

- LG Life Sciences

- LTD (LG Chem)

- Bio plus Co. Ltd.

- Sculpt Luxury

- Dermal Fillers Ltd.

- Bioxis Pharmaceutical

- Sinclair Pharma; Laboratories

- Vivacy; Bohus Biotech AB

Recent Developments

-

In August 2022, AbbVie received FDA approval for JUVÉDERM VOLUX XC, as a hyaluronic acid based filler to improve jawline definition. It is the first product to receive this certification

-

In June 2022, Prollenium Medical Technologies acquired SoftFil for an undisclosed amount. SoftFil is a France-based aesthetic medicine company

-

In April 2022, Sinclair Company introduced Perfectha Lidocaine, a hyaluronic acid-based dermal filler for wrinkle removal, facial contouring, and facial volume restoration

-

In December 2018, Galderma announced a marketing collaboration with SENTE, a privately held aesthetics company and producer of science-based skin care products. Through this collaboration, the company will offer SENTE’s professional skincare products to patients

Hyaluronic Acid-based Dermal Fillers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.53 billion

Revenue forecast in 2030

USD 8.24 billion

Growth Rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie; Galderma Laboratories, L.P.; Merz Pharmaceuticals , Genzyme Corporation, Anika Therapeutics Inc., LG Life Sciences, LTD (LG Chem), Bio plus Co. Ltd., Sculpt Luxury, Dermal Fillers Ltd;, Bioxis Pharmaceutical; Sinclair Pharma; Laboratories, Vivacy; Bohus Biotech AB

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hyaluronic Acid-based Dermal Fillers Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the hyaluronic acid-based dermal fillers market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Phase Products

-

Duplex Products

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wrinkle Removal

-

Lip Augmentation

-

Rhinoplasty

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hyaluronic acid-based dermal fillers market size was estimated at USD 4.08 billion in 2023 and is expected to reach USD 4.53 billion in 2024..

b. The global hyaluronic acid-based dermal fillers market is expected to grow at a compound annual growth rate of 10.5% from 2024 to 2030 to reach USD 8.24 billion by 2030.

b. The wrinkle removal segment dominated the hyaluronic acid-based dermal fillers market with a share of around 28.6% in 2023. This can be attributed to the increasing trend of social networking websites, insistent peer pressure, and popularity of the procedure among women as well as men of all age groups.

b. Some key players operating in the hyaluronic acid-based dermal fillers market include Allergan; Galderma Laboratories L.P.; Merz Pharmaceuticals; Genzyme Corporation; Anika Therapeutics Inc.; LG Life Sciences, LTD (LG Chem); Bioplus Co. Ltd.; Sculpt Luxury Dermal Fillers Ltd; Bioxis Pharmaceutical; Sinclair Pharma; Laboratories Vivacy; and Bohus Biotech AB.

b. Key factors that are driving the hyaluronic acid-based dermal fillers market growth include increasing demand for youthful and flawless skin via noninvasive and outpatient aesthetic dermatology techniques and a rise in medical tourism for aesthetic procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."