- Home

- »

- Catalysts & Enzymes

- »

-

Industrial Enzymes Market Size, Share, Industry Report, 2033GVR Report cover

![Industrial Enzymes Market Size, Share & Trends Report]()

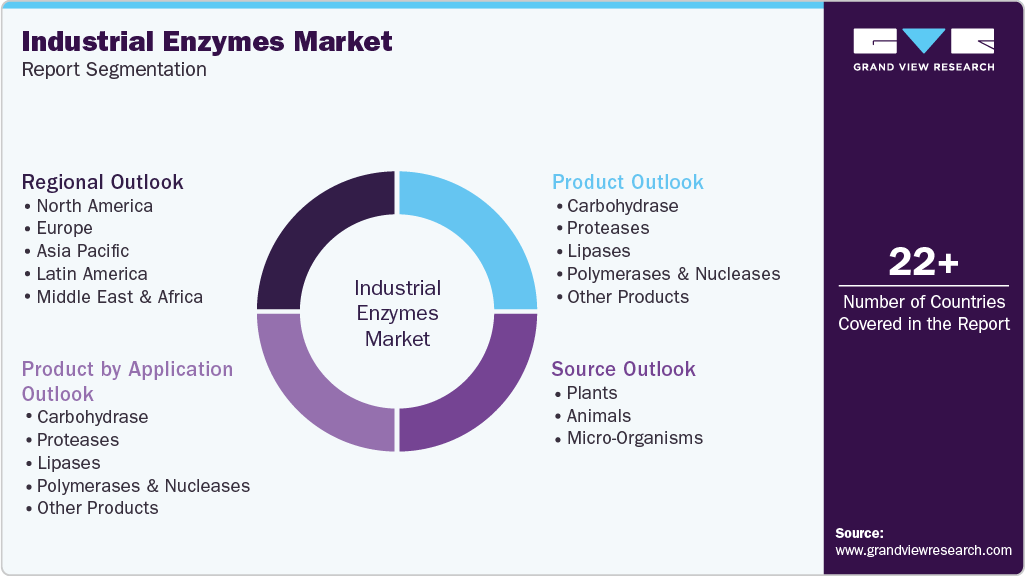

Industrial Enzymes Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Proteases, Lipases), By Source (Plants, Animals), By Application (Food & Beverage, Detergents), By Region, And Segment Forecasts

- Report ID: 978-1-68038-844-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Enzymes Market Summary

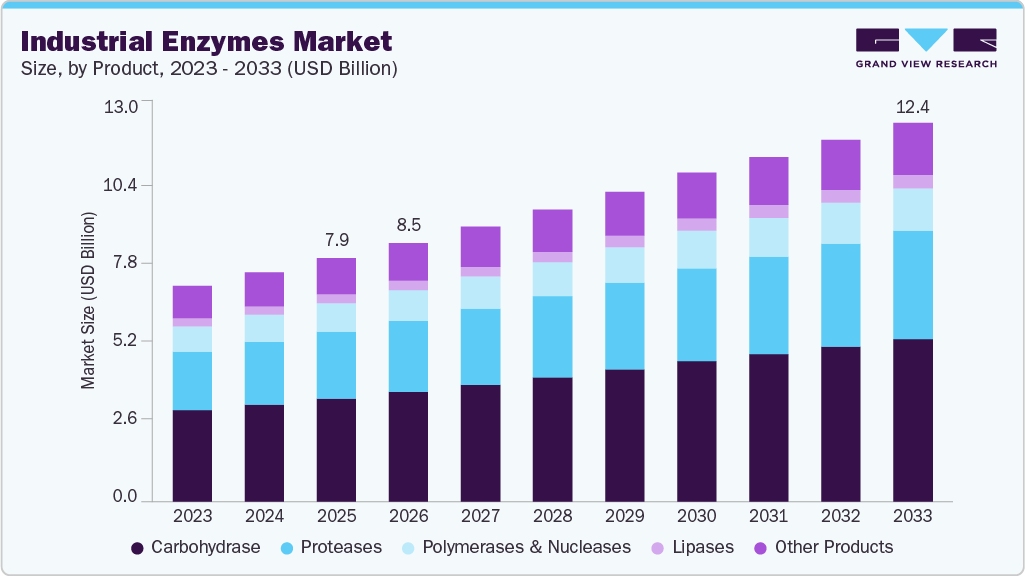

The global industrial enzymes market size was estimated at USD 7,530.3 million in 2024 and is projected to reach USD 12,640.2 million by 2033, growing at a CAGR of 6.2% from 2025 to 2033. Increasing global demand for proteases and carbohydrases in food products and beverages drives market growth worldwide.

Key Market Trends & Insights

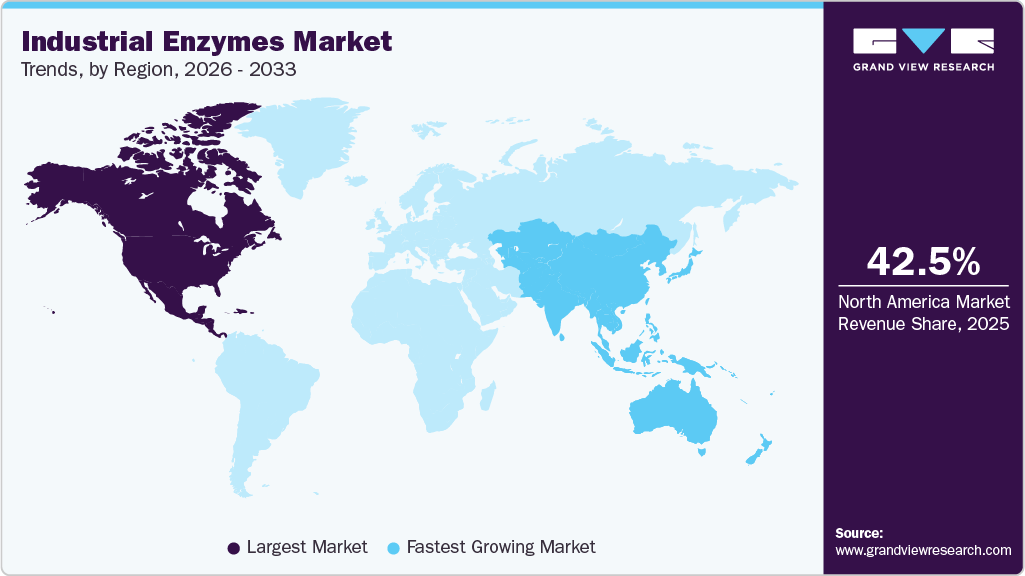

- North America dominated the industrial enzymes market with the largest revenue share of 42.6% in 2024.

- The market in the U.S. is expected to grow at a significant CAGR of 6.2% from 2025 to 2033.

- By product, the proteases segment is expected to grow at the highest CAGR of 6.8% from 2025 to 2033.

- By application, the food and beverage segment dominated the market with a revenue share of 22.2% in 2024.

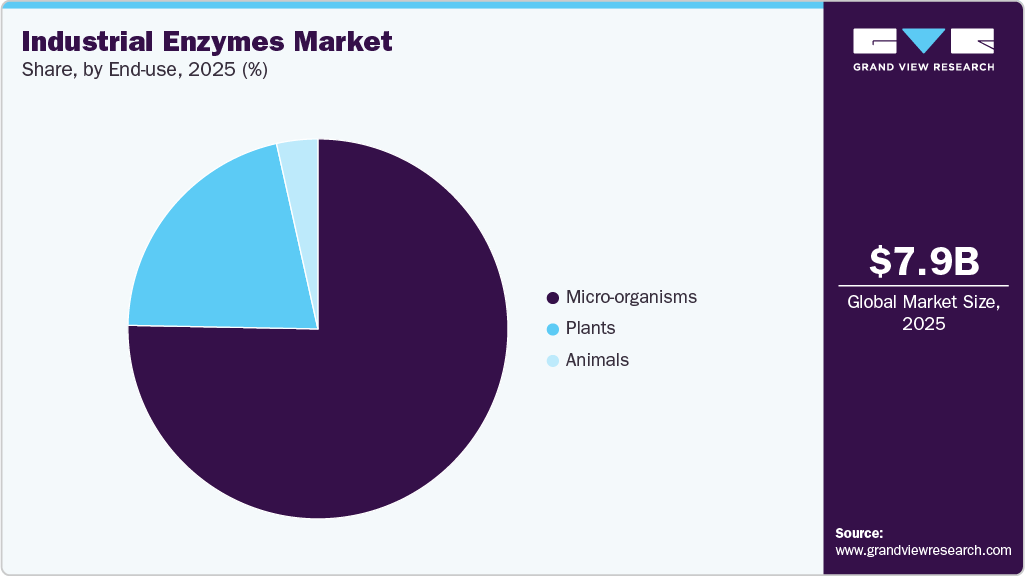

- By source, the micro-organism segment held the largest revenue share of 75.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7,530.3 Million

- 2033 Projected Market Size: USD 12,640.2 Million

- CAGR (2025-2033): 6.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Industrial enzymes are mainly utilized in the food & beverage industry to improve product quality and enhance shelf life. They are used in the food & beverages industry in baking and brewing applications, as well as in dairy products, starch, and sugar, which are extensively consumed by humans daily. In baking applications, enzymes provide specific properties to flour or dough. Biscuits and crackers help lower the flour's protein content, while using enzymes in bread improves or standardizes its quality and ensures its uniform browning.

The increasing demand for swine and poultry feed plays a vital role in the growth of the global feed industry. This is because feed helps improve swine and poultry animals' overall health and well-being. The animal feed industry caters to the nutritional requirements of livestock by offering nutrient-rich fodder. The growth of the global animal feed industry is expected to surge the demand for enzymes during the forecast period, thereby contributing to market growth.

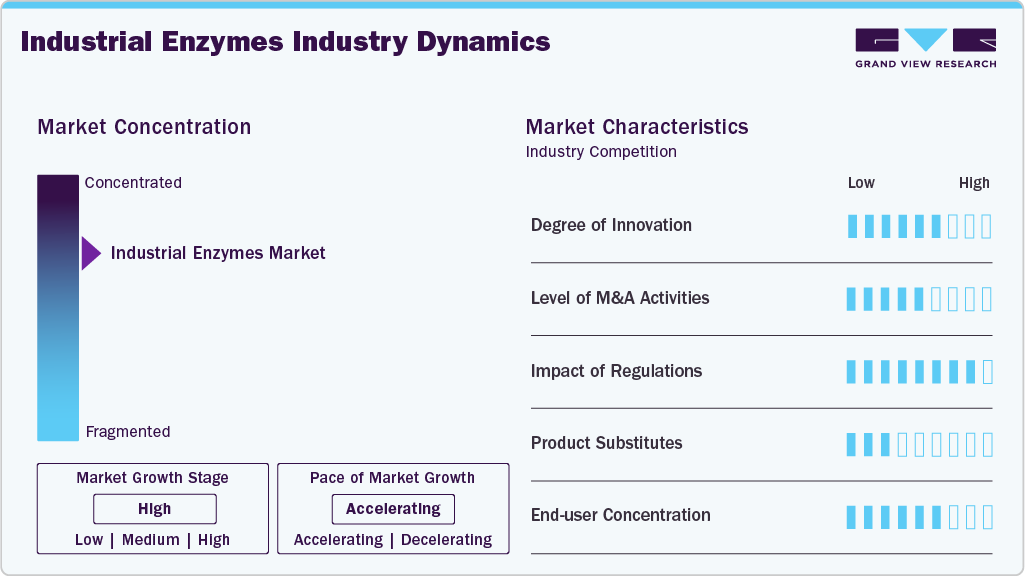

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as BASF SE, DSM, Novozymes, and DuPont Danisco, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the global industrial enzymes industry are adopting a combination of capacity expansion, product innovation, strategic partnerships, and sustainability initiatives to strengthen their market position. Companies such as ExxonMobil, Sasol, and PetroChina are investing in advanced refining technologies to enhance product purity and performance for high-end applications like cosmetics and phase change materials. Several players are expanding their production and distribution networks in these regions to cater to rising demand in Asia Pacific and the Middle East.

Product Insights

The carbohydrase segment dominated with a revenue market share of 42.3% in 2024. Carbohydrase enzymes, including cellulase, lactase, amylase, pectinase, and mannanases, play a crucial role in several industries such as animal feed, food and beverages, and pharmaceuticals. These enzymes act as catalysts for converting carbohydrates, like glucose and fructose, into sugar syrups, which find applications in the food and beverage and pharmaceutical sectors. They are also used to produce artificial sweeteners and prebiotic products like isomaltose for juices and wines.

Proteases is expected to grow fastest with a CAGR of 6.8% during the forecast period. Proteases are primarily employed for the enzymatic hydrolysis of protein peptides into amino acids, serving various applications across several industries, including detergents, chemicals, food, animal feed, and photography. Commonly utilized proteases include aspartate, glutamic acid, threonine, cysteine, serine, papain, and metalloprotease. The rise in awareness regarding declining nutrition levels among consumers globally has resulted in a surge in protein consumption, thereby driving the demand for proteases in the food industry.

Applications Insights

The food and beverage segment dominated the market with a revenue share of 22.2% in 2024. This is attributable to the increasing utilization of enzymes in producing food and beverage items. Cheese processing, vegetable and fruit processing, oil and fat processing, grain processing, and various other food processing sectors like baking, dairy, and brewing employ customized enzyme solutions and proprietary enzyme products.

Proteases are primarily employed for the enzymatic hydrolysis of protein peptides into amino acids. They serve various applications across several industries, including detergents, chemicals, food, animal feed, and photography. Commonly utilized proteases include aspartate, glutamic acid, threonine, cysteine, serine, papain, and metalloprotease. The rise in awareness regarding declining nutrition levels among consumers globally has resulted in a surge in protein consumption, thereby driving the demand for proteases in the food industry.

Source Insights

The micro-organism segment dominated with a revenue market share of 75.4% in 2024. These enzymes find extensive applications in the food, pharmaceutical, and detergent industries. Fungal enzymes, derived from mushrooms or fungi, include phenol oxidases, esterases, and hydrolases. The demand for fungal enzymes is rising, primarily due to their expanding usage across various end-use sectors. They play a vital role in preparing and manufacturing numerous food products such as soy sauce, beer, baked goods, processed fruits, and dairy items.

Plants is expected to grow fastest with a CAGR of 6.7% during the forecast period. Plant-derived enzymes, such as bromelain from pineapple and papain from papaya, are notable examples of enzymes sourced from plants. These enzymes include protease, lipase, cellulase, and amylase, which play important roles in the breakdown and absorption of starch, carbohydrates, proteins, and fats. Unlike naturally occurring enzymes in the human body, cellulase is primarily found in plant-based sources.

Regional Insights

North America is expected to dominate the market with a significant revenue share of 42.6% in 2024. North America is a highly lucrative industrial enzyme market due to the flourishing end-use industries such as food & beverage, laundry detergents, personal care, and cosmetics. The region offers ample opportunities for research and development activities, particularly in key economies.

US Industrial Enzymes Market Trends

The industrial enzymes market in the U.S. is experiencing notable growth owing to the country's favorable business environment, which promotes the usage of these enzymes in various applications in different industries. The growth of various end-use industries in the country has also contributed to increased consumption of industrial enzymes, making the U.S. a prominent market for them in North America.

Europe Industrial Enzymes Market Trends

The industrial enzymes market in Europe has experienced significant growth in recent years, owing to the surging demand for sustainable and environment-friendly solutions for various industries. Enzymes, renowned natural catalysts, have revolutionized industrial processes by enhancing their efficiency and promoting sustainability. This makes them indispensable components in numerous industries in Europe.

Germany industrial enzymes market is a mature and highly innovative segment, driven by robust demand from its well-established food & beverage, animal feed, textile, and detergent industries. A key focus is on developing highly efficient, sustainable enzyme solutions that reduce processing costs, improve product quality, and align with stringent environmental regulations and the circular economy initiatives within Germany and the EU.

Asia Pacific Industrial Enzymes Market Trends

The industrial enzymes market in Asia Pacific has experienced significant growth owing to continuous demand for these enzymes in various industries, including food and beverage, detergents, pulp and paper, personal care, and cosmetics. Enzymes, known for their remarkable catalytic properties, have become essential in optimizing different processes and enhancing their efficiency, as well as for promoting sustainability in these industries.

China industrial enzymes market has experienced significant growth in recent years, owing to several key factors. The country's ongoing industrialization and growing population, along with increasing emphasis on adopting sustainable practices, have contributed to the surging demand for industrial enzymes in China. This demand is diversified and spans the food & beverages, textiles, biofuels, and animal feed industries.

Latin America Industrial Enzymes Market Trends

The industrial enzymes market in Latin America is witnessing significant growth owing to its flourishing food and beverage, textiles, and detergent industries. Countries of the region, including Brazil, Argentina, and Chile, are experiencing a rise in consumer awareness about the benefits of using enzymes, which is further fueling the growth of the market in South America.

Middle East & Africa Industrial Enzymes Market Trends

The industrial enzymes market in the Middle East & Africa is an emerging and rapidly growing segment, primarily driven by the expansion of its food & beverage, animal feed, and biofuel sectors, along with increasing awareness of enzymes' benefits for process efficiency and sustainability. The region is seeing growing investments in industrial biotechnology, leading to a rising adoption of enzymes to optimize production costs, enhance product quality, and meet evolving environmental and consumer demands.

Key Industrial Enzymes Company Insights

Key players in the market include Novozymes, BASF SE, DuPont, DSM, and Associated British Foods Plc.

- Novozymes was established as a result of a demerger from a pharmaceutical company named Novo Nordisk, and today it is a prominent player in bioinnovation. It deals with industrial enzymes and microorganisms. The company discovers natural enzymes and improves them for further use in several end-use industries. Its enzymes are broadly utilized in dishwashing & laundry detergents and the food & beverage sector, especially in beer production, animal feed, and the production of biofuels.

Key Industrial Enzymes Companies:

The following are the leading companies in the industrial enzymes market. These companies collectively hold the largest market share and dictate industry trends.

- Novozymes

- BASF SE

- DuPont Danisco

- DSM

- NOVUS INTERNATIONAL

- Associated British Foods Plc

- Amano Enzyme Inc.

- Chr. Hansen Holding A/S

- Advanced Enzyme Technologies

- Lesaffre

- Adisseo

- Enzyme Development Corporation (EDC)

Recent Developments

- In January 2023, Novozymes announced its investment in microbial control technology from Lyras for “less downtime, more efficiency & cost savings.

Industrial Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,997.6 million

Revenue forecast in 2033

USD 12,640.2 million

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Novozymes; BASF SE; DuPont Danisco; DSM; NOVUS INTERNATIONAL; Associated British Foods Plc; Amano; Enzyme Inc.; Chr. Hansen Holding A/S; Advanced Enzyme Technologies; Lesaffre; Adisseo;

Enzyme Development Corporation (EDC)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Enzymes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global industrial enzymes market report based on product, source, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Carbohydrase

-

Proteases

-

Lipases

-

Polymerases & Nucleases

-

Other Products

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Plants

-

Animals

-

Micro-Organisms

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Detergents

-

Animal Feed

-

Biofuels

-

Textiles

-

Pulps & Papers

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global industrial enzymes market size was estimated at USD 7.53 billion in 2024 and is expected to reach USD 7.54 billion in 2024.

b. The global industrial enzymes market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 12.64 billion by 2033.

b. North America dominated the industrial enzymes market with a share of 42.6% in 2024. This is attributable to the strong presence of several end-use industries such as food & beverage, pharmaceuticals, laundry detergent, and personal care & cosmetics.

b. Some key players operating in the industrial enzymes market include BASF SE, DuPont Danisco, Novozymes, DSM, Associated British Foods plc, Adisseo, Novus International, Advanced Enzyme Technologies, Chr. Hansen Holding A/S, Enzyme Development Corporation, and Lesaffre among others.

b. Key factors that are driving the industrial enzymes market growth include increasing demand from food & beverage along with growing product penetration in the animal feed sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.