- Home

- »

- Clinical Diagnostics

- »

-

Laboratory Proficiency Testing Market Size Report, 2030GVR Report cover

![Laboratory Proficiency Testing Market Size, Share & Trends Report]()

Laboratory Proficiency Testing Market Size, Share & Trends Analysis Report By Industry (Clinical Diagnostics, Cannabis), By Technology (Cell Culture, PCR), By End-use (CROs, Hospitals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-287-3

- Number of Report Pages: 195

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Laboratory Proficiency Testing Market Trends

The global laboratory proficiency testing market size was estimated at USD 1.36 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030. Increasing focus on water testing, legalization of medical cannabis, growing number of cannabis testing laboratories, rising prevalence of foodborne illnesses, growing cases of chemical contamination of foods, and continuous introduction of new products & services are key factors expected to propel market growth. For instance, in March 2022, BIPEA launched a novel Proficiency Testing Scheme (PT 35d) dedicated to water microbiological testing laboratories. Moreover, the growing adoption of laboratory PT owing to stringent regulations is another factor estimated to boost market growth in the coming years.

Laboratory PT for endotoxin and pyrogen levels is crucial in water testing. Endotoxins are toxic components released from the outer membrane of certain bacteria, while pyrogens are substances that can cause fever and other adverse effects. PT ensures that laboratories accurately measure and assess endotoxin and pyrogen levels in water samples. It also verifies the laboratory’s competency in using appropriate testing methods, such as Limulus Amebocyte Lysate (LAL) assays, to detect and quantify these contaminants. Accurate endotoxin and pyrogen testing are vital for evaluating safety and quality of water, especially for pharmaceutical production, medical device manufacturing, and dialysis. PT in this area guarantees reliable and consistent results, enabling informed decisions to protect public health and ensure regulatory compliance in water-related industries.

Furthermore, PT is carried out to diagnose groundwater age with the help of tritium to map aquifer reserves & their vulnerability to surface pollution. According to the International Atomic Energy Agency (IAEA), half of the 78 laboratories carrying out this test meet the required analytical testing standards. Several organizations assist laboratories in ensuring calibration of instruments and verifying performance. For instance, in September 2020, IAEA offered training to laboratories in tritium testing and interpretation of data.

In addition, laboratory standards of practice, such as the Cannabis Laboratory Accreditation Program (CanNaLAP), specify the importance of proficiency testing and provide information regarding the types of samples that should be used for testing and the results that should be considered. Furthermore, several cannabis production facilities are frequently inspected by state governments. Organizations such as the American Council of Independent Laboratories (ACIL) collaborate with federal agencies to develop standards & protocols for handling, sampling, testing, and inspecting cannabis products.

Market Dynamics

A notable technology trend in laboratory PT is the integration of digital platforms and software solutions. These technologies are being utilized to streamline the process of PT, including test result submission, data analysis, and reporting. Digital platforms provide a more efficient and standardized approach, allowing laboratories to participate remotely, access real-time feedback, and compare their performance with peers. Furthermore, these solutions facilitate data management, quality control, and trend analysis, ultimately enhancing the accuracy and effectiveness of PT programs.

A future trend in laboratory PT is integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms. AI and ML can analyze vast amounts of proficiency testing data, identify patterns, and provide valuable insights for laboratories to improve their performance. These technologies can assist in identifying areas of improvement, predicting potential errors, and offering personalized recommendations. Integration of AI and ML in proficiency testing holds the potential to enhance laboratory quality and efficiency in near future.

Challenges in laboratory PT include maintaining participant engagement, ensuring sample integrity, and stability during transportation, and addressing inter-laboratory variability, as well as keeping up with rapidly evolving technologies & testing methodologies. In addition, resource constraints and participation cost can be barriers for smaller or resource-limited laboratories.

Industry Insights

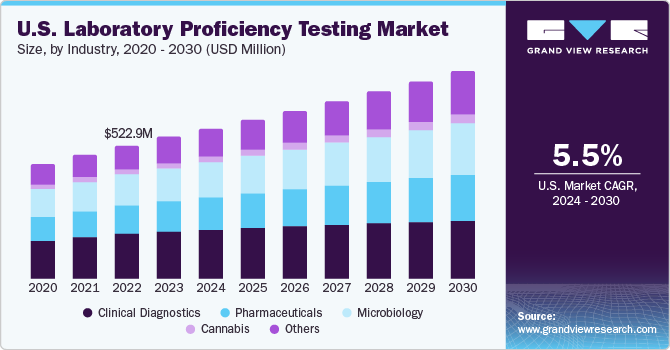

Clinical diagnostic segment held the largest market share of 33.32% of the market in 2023. Clinical diagnostic laboratories have demonstrated a lower likelihood of diagnostic errors compared to hospitals, and PT has become widely adopted to maintain accurate results and effective quality management.Recognizing the significance of PT, the Centers for Medicare and Medicaid Services (CMS) have proposed updates to the requirements for laboratories regulated under CLIA in July 2022. These updates aim to enforce stricter standards, enhance accuracy & reliability in laboratory testing, and ensure that CLIA laboratories meet the highest quality benchmarks.

Cannabis segment is anticipated to grow at the fastest CAGR during forecast period. As the legalization of cannabis is expanding, the demand for accurate and reliable testing has significantly increased. Laboratory PT plays a pivotal role in verifying the competence and accuracy of cannabis testing laboratories, enabling them to meet regulatory requirements and provide consumers with assurance regarding the quality and safety of cannabis products. For instance, In April 2023, Trust in Testing launched national standards for cannabis testing, aimed at enhancing the reliability and trustworthiness of testing practices across the industry.

Technology Insights

Cell culture segment dominated the market with a revenue share of 27.05% in 2023 and is expected to maintain its dominance throughout the forecast period. With the increasing adoption of cell-culture-based products, such as monoclonal antibodies, there is a growing demand for cell culture tests to optimize the production of microbial strain cultures. PT in this field focuses on assessing the efficacy of laboratories and identifying contaminants & impurities present in cell cultures.Minerva Biolabs GmbH is a notable provider of proficiency tests that are specifically designed to evaluate common contaminants and test the laboratory's sensitivity to yeast/fungi, bacteria, and mycoplasmas

However, chromatography segment is projected to experience the fastest growth rate during the forecast period. To ensure the efficacy of chromatography devices and the reliability of test results, PT materials are available. Merck, for instance, offers an extensive range of gas chromatography PT materials at affordable prices, starting as low as USD 257. These PT programs enable laboratories to validate their chromatography techniques, assess their performance, and enhance the accuracy & consistency of their analytical results.

End-use Insights

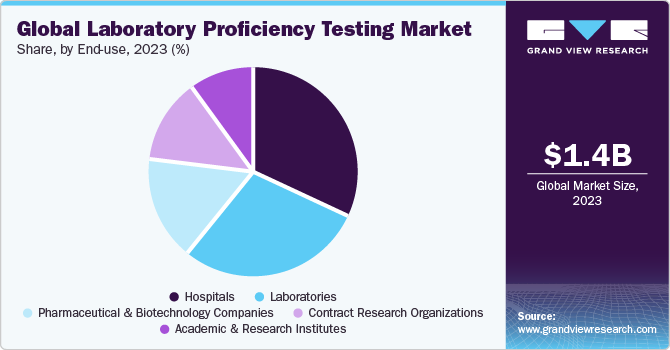

Hospitals segment dominated the laboratory proficiency testingmarket with a revenue share of 31.61% in 2023 owing to increasing need for regular competence evaluation in hospitals. Increasing number of tests offered by hospitals is further expected to drive the demand for PT. In September 2021, in Chandigarh, India, the government has taken steps to ensure the proficiency of outsourced staff in hospital laboratories, especially data entry operators. The Health Secretary introduced a computerized proficiency test conducted by SPIC for this personnel in government hospitals. This initiative aims to assess the competency and effectiveness of outsourced staff in data entry tasks, maintaining high standards of laboratory PT in the healthcare system.

The contract research organizations segment is projected to witness the fastest growth rate during the forecast period. Emerging economies like India and China have emerged as prominent hubs for CRO activities. With a growing emphasis on R&D and stringent FDA guidelines for clinical trials, laboratory PT in CROs is expected to gain significance. By implementing PT programs.CROs are exhibiting remarkable growth in the market as they play a vital role in conducting clinical trials, addressing factors such as cost & time constraints, patent expirations, and resource limitations in organizations.

Regional Insights

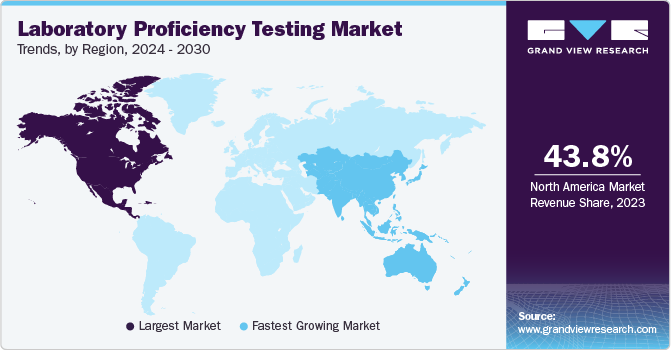

North America dominated the market with a revenue share of 43.78% in 2023. This can be attributed to the developed healthcare system and high PT adoption rate. The well-established regulatory framework also prioritizes quality management in this region, which influences market growth positively. The wide availability of PT programs in this region is another reason for the greater market potential of laboratory testing in North America. Furthermore, stringent environmental and water safety norms are also propelling the demand for laboratory tests and, thus, laboratory proficiency tests.

However, Asia Pacific is estimated to witness the fastest growth during the forecast period due to increasing healthcare awareness and a rising number of laboratories going for international accreditations in the region. Moreover, Asia Pacific is becoming a hub for international biopharmaceutical and pharmaceutical companies due to the low cost of labor and overall production of high-quality products. Thereby, the continuous laboratory testing of raw materials, finished products, & microbial cultures for production and approval from FDA becomes significant.

Key Companies & Market Share Insights

Key market players are adopting market strategies, such as new product launches, collaborations, and geographical expansions, to increase their global footprint.

-

In April 2023, BIPEAunveiled PTS 110A, a new Proficiency Testing Scheme that enables testing laboratories to assess their analytical capabilities by analyzing a rice sample. This initiative can empower laboratories to evaluate and enhance their performance in rice sample analysis, driving excellence in the field.

-

In January 2023, BIPEA introduced a novel proficiency test in surface microbiology, expanding its range of offerings. This new test allows professionals in the field to enhance their expertise and proficiency in surface microbiology analysis.

Key Laboratory Proficiency Testing Companies:

- LGC Limited

- Bio-Rad Laboratories, Inc.

- Randox Laboratories Ltd.

- QACS - The Challenge Test Laboratory

- Merck KGaA

- Weqas

- BIPEA

- NSI Lab Solutions

- Absolute Standards, Inc.

- INSTAND

Laboratory Proficiency Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.46 billion

Revenue forecast in 2030

USD 2.13 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Industry, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

LGC Ltd.; Bio-Rad Laboratories, Inc.; Randox Laboratories Ltd.; QACS - The Challenge Test Laboratory; Merck KGaA; Weqas; BIPEA; NSI Lab Solutions; Absolute Standards, Inc.; INSTAND

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Proficiency Testing Market Report Segmentation

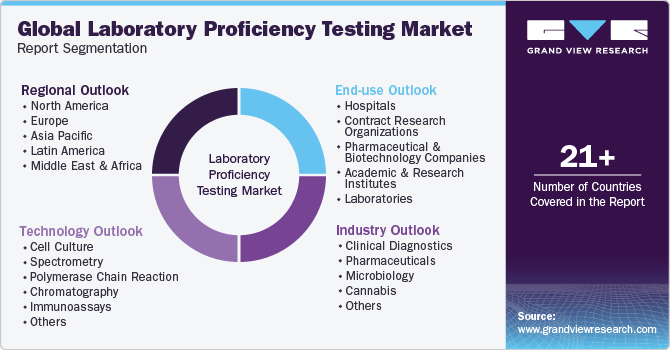

This report forecasts revenue growth and provides an analysis of the latest trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the laboratory proficiency testing market report based on industry, technology, end-use, and region:

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Diagnostics

-

Clinical chemistry

-

Immunochemistry

-

Hematology

-

Oncology

-

Molecular Diagnostics

-

PCR

-

Others

-

-

Coagulation

-

Others

-

-

Pharmaceuticals

-

Biological Products

-

Vaccines

-

Blood

-

Tissues

-

-

Others

-

-

Microbiology

-

Pathogen Testing

-

Sterility Testing

-

Endotoxin & Pyrogen Testing

-

Growth Promotion Testing

-

Others

-

-

Cannabis

-

Medical

-

Non-Medical

-

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Culture

-

Spectrometry

-

Polymerase Chain Reaction

-

Chromatography

-

Immunoassays

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Contract Research Organizations

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Laboratories

-

Independent Laboratories

-

Specialty Laboratories

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory proficiency testing market size was estimated at USD 1.36 billion in 2023 and is expected to reach USD 1.46 billion in 2024.

b. The global laboratory proficiency testing market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 2.13 billion by 2030.

b. Clinical diagnostics dominated the laboratory proficiency testing market with a share of 33.32% % in 2023. This is attributable to laboratory proficiency testing procedures being a common practice for quality management of clinical diagnostics.

b. Some key players operating in the laboratory proficiency testing market include LGC Limited, American Proficiency Institute, College of American Pathologists, QACS - The Challenge Test Laboratory, Bio-Rad Laboratories, Inc., Randox Laboratories Ltd., RCPA, and Merck & Co., Inc.

b. Key factors that are driving the laboratory proficiency testing market growth include increasing focus on water testing, legalization of medical cannabis & growing number of cannabis testing laboratories, increasing outbreaks of foodborne illnesses, and rising cases of chemical contamination of foods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."