- Home

- »

- Biotechnology

- »

-

Cell Culture Market Size And Share, Industry Report, 2033GVR Report cover

![Cell Culture Market Size, Share & Trends Report]()

Cell Culture Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Application (Biopharmaceutical Production, Drug Development, Tissue Culture & Engineering, Cell & Gene Therapy, Toxicity Testing), By Region, And Segment Forecasts

- Report ID: 978-1-68038-536-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Culture Market Summary

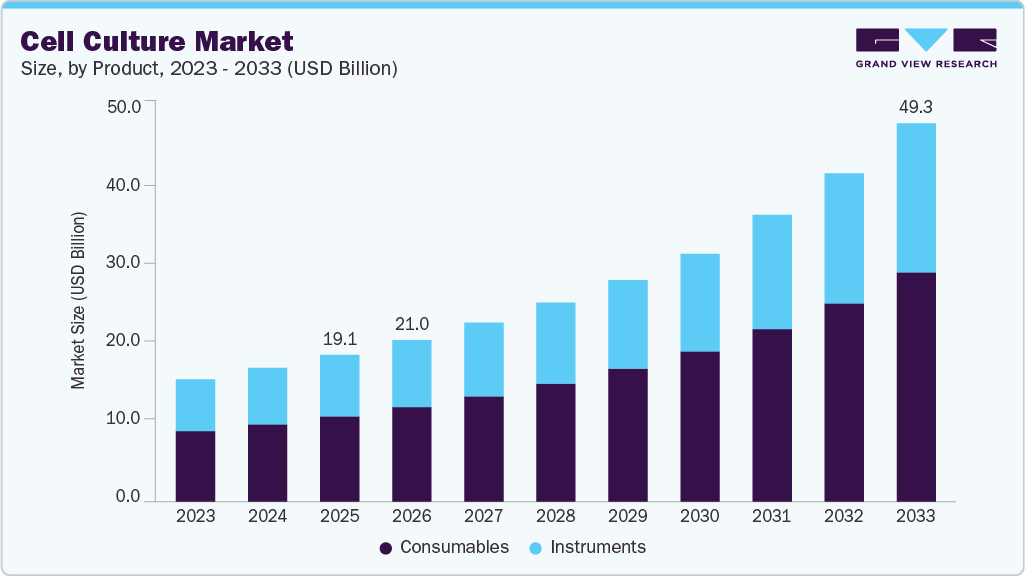

The global cell culture market size was estimated at USD 19.13 billion in 2025 and is projected to reach USD 49.33 billion by 2033, growing at a CAGR of 12.94% from 2026 to 2033. The industry is primarily driven by the rising demand for biopharmaceuticals, increasing adoption of cell-based assays in drug discovery, and advancements in cell culture technologies.

Key Market Trends & Insights

- The North America cell culture market held the largest share of 36.05% of the global market in 2025.

- The cell culture industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the consumables segment held the largest market share of 58.05% in 2025.

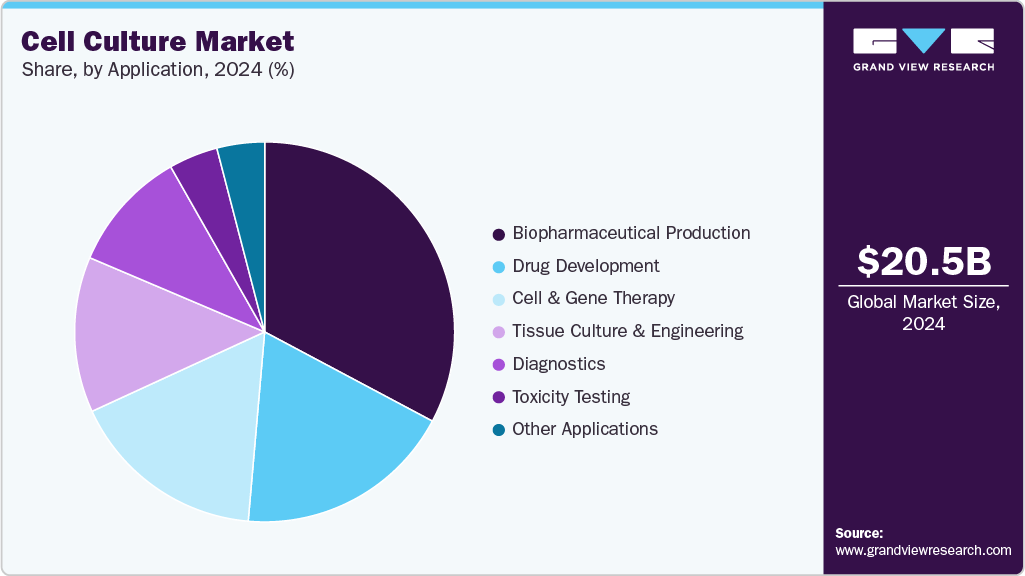

- Based on application, the biopharmaceutical production segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 19.13 Billion

- 2033 Projected Market Size: USD 49.33 Billion

- CAGR (2026-2033): 12.94%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Expansion in the Scope of Cell Culture Technology

The diverse applications and increasing flexibility of cell culture technology across various scientific and industrial fields are the main reasons for the market to grow. Cell culture, initially confined to primary biological research, has now become a necessity in various fields, including toxicity testing, the manufacture of biopharmaceuticals and vaccines, and regenerative medicine. The capability of technology to accurately control cellular environments has made experiments more effective and reproducible. Thus, research in cell-based products has yielded significantly more and purer output, thanks to the development of serum-free and chemically defined media, which are already in use in both academic and commercial laboratories.

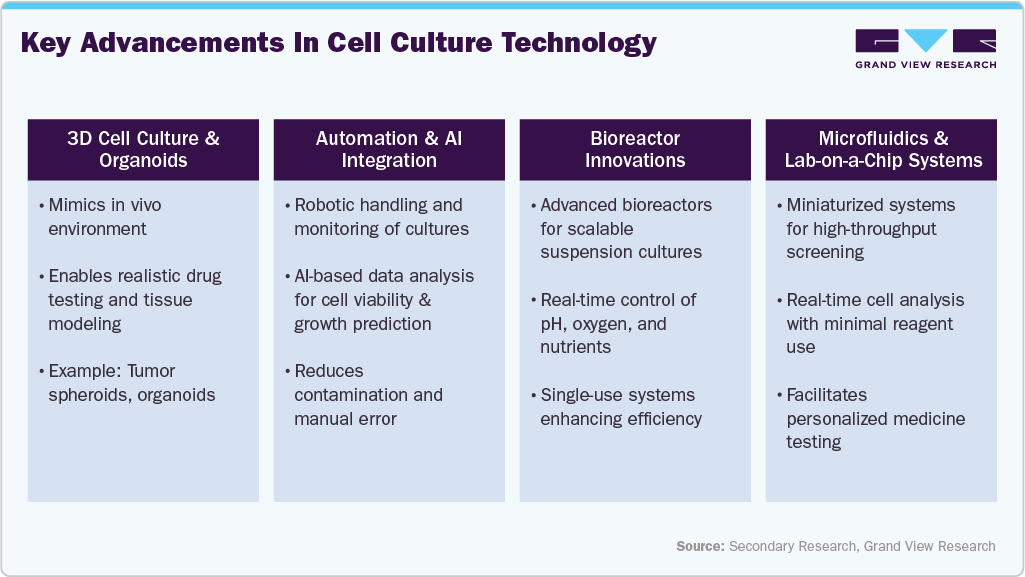

Furthermore, advances in culture platforms have improved the physiological relevance of in vitro models. The expanding 3D cell culture market highlights the adoption of spheroids, organoids, and scaffold-based systems that better replicate in vivo tissue structures. In addition, microfluidic “organ-on-a-chip” technologies driving growth in the organ-on-chip market enable dynamic and more predictive preclinical testing, reduce reliance on animal models, and support personalized and precision medicine development.

Rising Demand for Biopharmaceuticals, Artificial Organs, and Vaccine Production

One of the primary factors driving the cell culture market is the global increase in demand for biopharmaceuticals, including gene therapies, recombinant proteins, and monoclonal antibodies. Since living cells are used to produce biopharmaceuticals, cell culture products and technology are crucial components of the upstream bioprocessing process. The need for high-yield and scalable culture systems has increased due to the rise in biologics development brought on by the rising incidence of chronic diseases like cancer, autoimmune disorders, and metabolic conditions.

The development of stem cell biology and tissue engineering, which can lead to the creation of functional tissues and organoids as potential replacements for organ transplants, largely depends on advanced cell culture methods. At the same time, it is the main factor boosting market demand.

Market Concentration & Characteristics

The degree of innovation in the cell culture industry is high, fueled by advancements in 3D culture systems, organ-on-chip models, and automated bioreactors that enhance scalability and physiological relevance. For instance, in January 2025, Australia’s Inventia Life Science launched RASTRUM Allegro, an advanced 3D cell culture platform enhancing high-throughput drug discovery and disease research through improved scalability, reproducibility, and cost efficiency. These innovations are transforming cell culture into a cornerstone for the drug discovery services market.

Companies seeking to diversify their product lines, enhance their bioprocessing capabilities, and strengthen their global presence are the primary drivers of the moderate to high level of M&A activity in the cell culture industry. To support the growing demand for biologics and advanced therapies, and to streamline operations, strategic acquisitions in cell media, equipment, and cell therapy manufacturing are being made.

The impact of regulations on the industry is significant, as strict guidelines ensure the safety, quality, and ethical compliance of products. Regulatory bodies such as the FDA, EMA, and ISO mandate rigorous standards for raw materials, media components, and manufacturing processes used in biopharmaceutical and cell therapy production.

Continuous innovations are broadening the range of cell culture products, including advanced media, reagents, bioreactors, and 3D systems, which are designed to improve scalability and reproducibility. The increase in demand from stem cell research, cell therapies, and vaccine production is opening up applications in various areas, including biotechnology, pharmaceuticals, and academic research.

Growing investments in biotechnology and biopharmaceutical production in emerging economies are driving the regional growth of the industry. To keep pace with the growing demand for biologics, vaccines, and cell-based research, major market participants are expanding their production facilities, distribution systems, and alliances in these areas. In addition to decreasing supply chain reliance on North America and Europe, this regional diversification increases global market accessibility and competitiveness.

Product Insights

The consumables segment accounted for the largest market share in 2025 and is expected to witness significant growth during the forecast period, primarily due to recurring demand and purchase of consumables. Another factor propelling the segment growth is increased R&D expenditure by biotechnology & biopharmaceutical businesses to develop sophisticated biologics, such as monoclonal antibodies & vaccines.

The instruments segment is expected to witness significant growth, driven by the rising adoption of automated and high-throughput systems that enhance scalability and efficiency. Technological advancements, such as AI-based monitoring and integrated sensors, further boost demand by improving precision and reducing the need for manual intervention.

Application Insights

In 2025, the biopharmaceutical production application segment led the market for cell culture with a revenue share of 33.24%. Biopharmaceutical applications of cell culture techniques are anticipated to expand due to the use of mammalian cell lines, such as the Chinese hamster ovary, in the production of biopharmaceuticals and the increasing demand for alternative medicines.

The diagnostics segment is expected to register the fastest CAGR from 2026 to 2033, mainly due to the growing necessity for cell-based diagnostic assays, more disease screening programs, and persistent development in precision, molecular, and personalized diagnostics technologies.

Regional Insights

The North America cell culture market held the largest global market share of 36.05% in 2025, driven by its well-established pharmaceutical and biotechnology sectors and widespread adoption of advanced technologies in the U.S. Strong university-led cell therapy research and rising demand from research and clinical applications further supported market growth.

U.S. Cell Culture Market Trends

The U.S. cell culture industry is experiencing rapid growth due to the expansion of biopharmaceuticals and the increased adoption of cell-based technologies. For instance, in July 2023, Merck expanded its Lenexa, Kansas, facility to boost cell culture media production and establish its largest North American Center of Excellence.

Europe Cell Culture Market Trends

The cell culture industry in Europe is growing steadily, driven by strong regulations, research collaborations, and rising biopharmaceutical production. For instance, in June 2025, Sartorius expanded its Aubagne, France, facility, nearly doubling cleanroom space and strengthening manufacturing, logistics, and R&D capabilities for single-use bioprocess solutions.

The UK cell culture industry is expanding rapidly, driven by growing investments in cell therapy, biomanufacturing, and advanced drug discovery. Rising adoption of 3D culture systems, automation, and serum-free media further supports market growth.

The cell culture industry in Germany is growing steadily, driven by increasing investments in advanced manufacturing and rising demand for high-quality media, strengthening its position as a leading European hub for biomanufacturing innovation.

Asia Pacific Cell Culture Market Trends

The cell culture industry in the Asia-Pacific region is projected to expand at the fastest CAGR of 15.14% over the forecast period, driven by growing healthcare expenditure, rising awareness of cell and gene therapies, and a large potential for clinical research applications. Moreover, rapid adoption of advanced scientific technologies and emerging therapeutics, including regenerative medicines and cancer immunotherapies, is expected to further drive regional growth over the forecast period.

The China cell culture industry continues to dominate the regional landscape, supported by government programs such as “Made in China 2025” and extensive investments in cell therapy, biomanufacturing, and synthetic biology. For instance, in February 2025, Joinn Biologics acquired Lonza’s 183,000 sq. ft. manufacturing facility in Guangzhou, China, to expand biologics production capacity and strengthen its Asia-Pacific presence.

The cell culture industry in Japan is expanding rapidly, driven by advancements in regenerative medicine, tissue engineering, and stem cell therapies. Strong research infrastructure and government support continue to enhance innovation and global competitiveness.

Middle East And Africa Cell Culture Market Trends

The cell culture industry in the Middle East & Africa is growing rapidly due to various factors such as increased healthcare investments, high incidence of chronic diseases, and vaccine self-sufficiency measures. Besides, the formation of partnerships and training in the region is improving biomanufacturing skills and knowledge.

The Kuwait cell culture industry is emerging, supported by government initiatives in biotechnology, healthcare innovation, and academic collaboration, alongside growing investments in modern labs and international research partnerships.

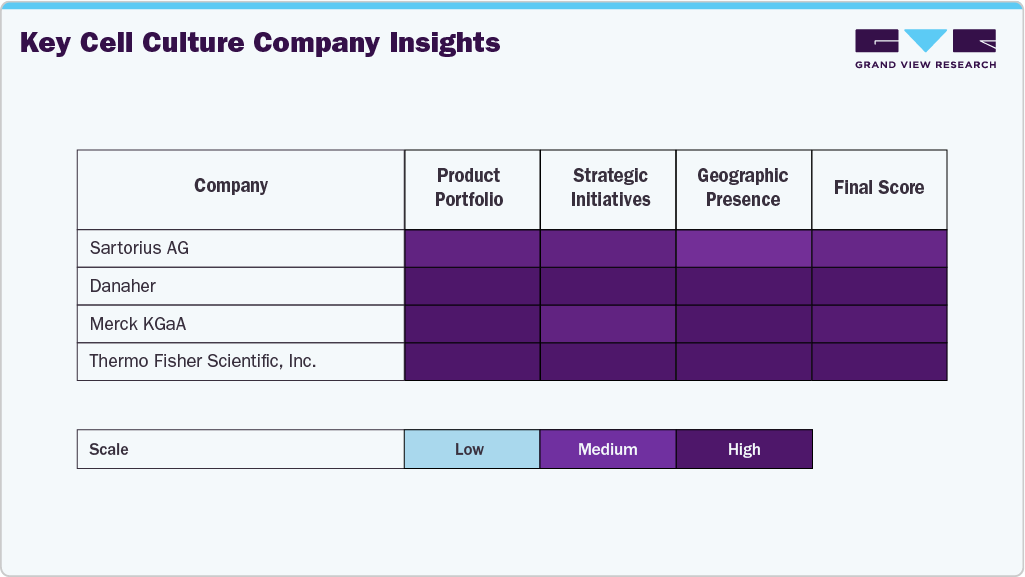

Key Cell Culture Company Insights

Key players operating in the cell culture industry are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling market growth.

The market is dominated by major players such as Sartorius AG, Danaher, Merck KGaA, Thermo Fisher Scientific, and Corning Inc., which provide cutting-edge solutions in cell culture media, bioreactors, reagents, and consumables used in biopharmaceutical production, diagnostics, and regenerative medicine applications, among others.

Avantor, BD, Eppendorf, Bio-Techne, and PromoCell are among the companies expanding their presence with specialized media, single-use devices, and cell-based assay platforms tailored for industrial, clinical, and academic applications. The firms that blend innovation with customer-oriented solutions will be at the forefront of growth in this changing industry.

Key Cell Culture Companies:

The following are the leading companies in the cell culture market. These companies collectively hold the largest market share and dictate industry trends.

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Corning Inc.

- Avantor, Inc.

- BD

- Eppendorf SE

- Bio-Techne

- PromoCell GmbH

Recent Developments

-

In December 2025, Hamilton launched GlucoSense in Switzerland, a reusable in situ glucose sensor for mammalian cell culture, providing real-time measurements to enhance bioprocess monitoring, analytics, and process control in R&D and early development.

-

In March 2025, U.S.-based Caron Scientific launched the 7406 Incubator Shaker, featuring dry hydrogen peroxide sterilization technology to enhance efficiency, contamination control, and reliability in cell culture production.

-

In December 2024, Germany-based Merck announced its agreement to acquire Netherlands-based HUB Organoids Holding B.V. to strengthen its cell culture and next-generation biology portfolio through advanced organoid technologies.

Cell Culture Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 21.05 billion

Revenue forecast in 2033

USD 49.33 billion

Growth rate

CAGR of 12.94% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; Corning Inc.; Avantor Inc.; BD; Eppendorf SE; Bio-Techne; PromoCell GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Culture Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global cell culture market report on the basis of product, application, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumables

-

Sera

-

Fetal Bovine Serum

-

Other

-

-

Reagents

-

Albumin

-

Others

-

-

Media

-

Serum-free Media

-

CHO Media

-

HEK 293 Media

-

BHK Medium

-

Vero Medium

-

Other Serum-free Media

-

-

Classical Media

-

Stem Cell Culture Media

-

Chemically Defined Media

-

Specialty Media

-

Other Cell Culture Media

-

-

-

Instruments

-

Culture Systems

-

Incubators

-

Centrifuges

-

Cryostorage Equipment

-

Biosafety Equipment

-

Pipetting Instruments

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical Production

-

Monoclonal Antibodies

-

Vaccines Production

-

Other Therapeutic Proteins

-

-

Drug Development

-

Diagnostics

-

Tissue Culture & Engineering

-

Cell and Gene Therapy

-

Toxicity Testing

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2021- 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell culture market size was estimated at USD 19.13 billion in 2025 and is expected to reach USD 21.05 billion in 2026.

b. The global cell culture market is expected to grow at a compound annual growth rate of 12.94% from 2026 to 2033 to reach USD 49.33 billion by 2033.

b. North America dominated the cell culture market with a share of 36.05% in 2025. This is attributed to a high extent of research and development investments, the presence of a well-established scientific infrastructure, significant demand for animal component-free media, and other factors.

b. Some key players operating in the cell culture market include Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Becton, Dickinson and Company; Merck KGaA; Sartorius AG; VWR International, LLC; Eppendorf SE; PromoCell GmbH; Bio-Techne Corporation; BioSpherix, Ltd.

b. Key factors that are driving the cell culture market growth include advancements in 3D cell culture technologies and their increasing adoption for biopharmaceutical production, drug discovery, and tissue engineering applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.