- Home

- »

- Renewable Energy

- »

-

Lithium Iron Phosphate Battery Market Size Report, 2030GVR Report cover

![Lithium Iron Phosphate (LiFePO4) Battery Market Size, Share & Trends Report]()

Lithium Iron Phosphate (LiFePO4) Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By End-use (Automotive, Power, Industrial), By Application (Portable, Stationary), By Region (Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-1-68038-468-0

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium Iron Phosphate Battery Market Summary

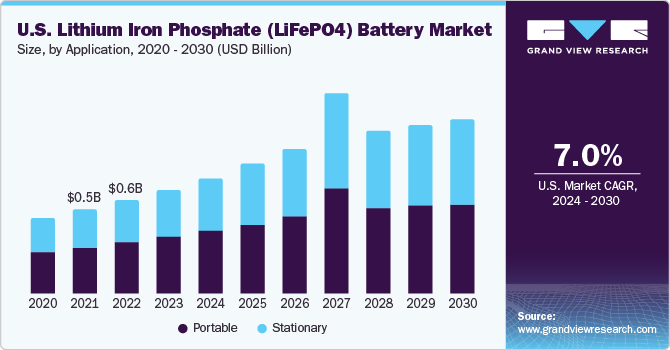

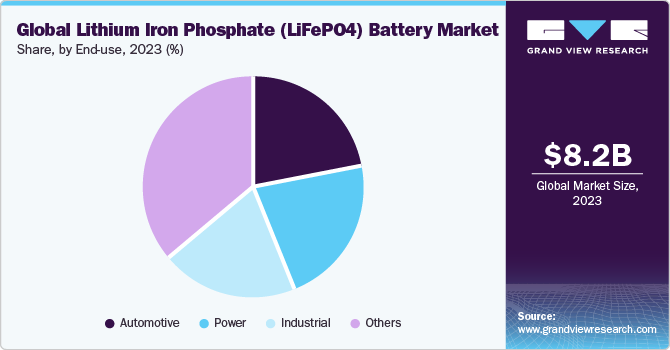

The global lithium iron phosphate battery market size was estimated at USD 8.25 billion in 2023 and is projected to reach USD 17.48 billion by 2030, growing at a CAGR of 10.5% from 2024 to 2030. An increasing demand for hybrid electric vehicles (HEVs) and electric vehicles (EVs) on account of rising environmental concerns, coupled with extensive requirements for LiFePO4 batteries in battery energy storage systems, are factors driving market expansion.

Key Market Trends & Insights

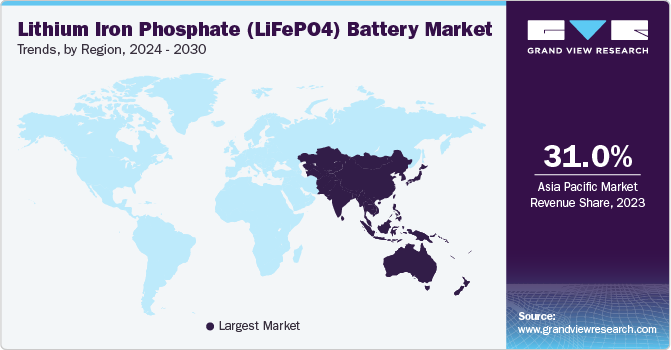

- Asia Pacific accounted for more than 31.0% share of the overall revenue in 2023.

- Europe is expected to register a CAGR of 10.4% from 2024 to 2030.

- Based on application, the portable application segment dominated the global market and accounted for more than 50.0% share of the overall revenue in 2023.

- Based on end-use, the others end-use segment dominated the market and accounted for over 35.0% share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.25 Billion

- 2030 Projected Market Size: USD 17.48 Billion

- CAGR (2024-2030): 10.5%

- Asia Pacific: Largest market in 2023

Hence, increasing focus on energy storage technologies is a major factor boosting industry growth. The market is expected to showcase substantial growth in the coming years due to several factors, including the ever-growing population that has resulted in a significant depletion of fossil fuel reserves. This has eventually led to a change in focus of various countries toward renewable electricity generation. A growing focus on renewable sources of energy generation to address stern concerns over climate change and improve energy conservation is likely to contribute to industry growth. Demand for LiFePO4 batteries in the U.S. was driven by increasing concerns regarding ecological degradation owing to pollution from fossil fuels. The presence of key producers and dealers with varied distribution networks will also boost product demand across the country.

The industry is extremely competitive with the presence of a large number of key players, mostly present in the U.S. and China. However, operations of companies are at numerous places with manufacturing plants and distribution carried out across several locations, along with third-party distribution agencies. Extensive research and development activities to develop high-quality and effective products are another initiation undertaken by producers. Such batteries find applications in portable and stationary battery systems.

Market Dynamics

The rising number of portable consumer electronics items that deploy batteries has resulted in an increased consumption of rechargeable batteries. Portable devices such as digital cameras, smartphones, MP3 players, and laptops need rechargeable batteries to provide efficient and effective power and performance. Battery technology is evolving continuously to meet the high performance and power density requirements of devices. Advancements in technologies are providing ample products for consumers that include wearables devices, virtual and augmented reality (VR & AR), 4k televisions, 3D printers, drones, and communication robots, which are likely to find a foothold among tech-savvy consumers. Since the development of new technologies reduces product lifecycle, consumer interests alter, and thus companies must be agile in their responses to stay competitive.

Rising demand for substitutes including lead acid batteries, lithium-air, flow batteries, solid-state batteries, and sodium nickel chloride batteries in EVs, energy storage, and consumer electronics is expected to restrain market growth to some extent. Lithium-air refers to the usage of oxygen as an oxidizer rather than a material. The result is that batteries are five times cheaper and lighter than lithium-ion and can make phones & cars last five times longer. Rising demand for flow batteries is likely to restrict market growth. The need for sodium-nickel chloride batteries is growing as their components (alumina, sodium chloride, and nickel) are easily available in the market and are less expensive for manufacturers than lithium-ion batteries, hindering industry growth.

Application Insights

Based on application, the market is categorized into portable and stationary. The portable application segment dominated the global market and accounted for more than 50.0% share of the overall revenue in 2023. This is attributed to the high demand for LiFePO4 batteries from the automotive segment, which is a key demand-generating segment. However, in coming years, the stationary application segment will compete with portable batteries, as demand increases greatly for renewable energy storage projects.

The stationary application segment is expected to witness substantial growth in years to come, on account of the need to shift to renewable sources of energy, including wind and solar energy, for sustainable and clean energy. Shift to renewable energy sources is expected to infuse significant investments from both private and public sectors, which is expected to boost demand for such batteries.

End-use Insights

Based on end-use, the market is categorized into automotive, power, industrial, and others. The others end-use segment dominated the market and accounted for over 35.0% share in 2023. This segment is projected to witness the highest growth from 2024 to 2030. The automotive segment is expected to witness significant growth in years to come owing to an increase in demand from the Asia Pacific regional market. Unconventional energy storage battery systems that can augment vehicle efficiency and performance are a significant area of focus for automotive manufacturers. On account of high energy density and long cycle time, LiFePO4 batteries are projected to be the most favored choice as an alternative energy storage battery system.

Therefore, growth in demand for automobiles across countries, such as China, is projected to fuel demand for LiFePO4 batteries. The power end-use segment is projected to expand at a CAGR of 10.8% from 2024 to 2030 as the use of lithium iron phosphate as a raw material has helped resolve issues of consequent explosions and overheating of such batteries. Demand for these batteries is increasing across power segments owing to their widespread usage in power generation plants and automobiles.

Regional Insights

Asia Pacific accounted for more than 31.0% share of the overall revenue in 2023. Asia Pacific is expected to witness significant growth from 2024 to 2030 owing to the established automotive sector and rising demand for consumer electronics across the region. Growing demand for consumer electronics from countries, such as Japan, India, and China, along with stringent government regulations, will also propel regional market growth.

Europe is expected to register a CAGR of 10.4% from 2024 to 2030. European Union dominated the automotive segment in 2023. Growing adoption of EVs is one of the major factors creating growth prospects, where each country has a supportive policy for EVs. Hence, it further drives demand for LiFePO4 batteries and creates growth prospects for all key manufacturers across the region. In North America, the U.S. is one of the largest markets with a high number of renewable energy battery storage projects, which are commissioned every year.

Key Companies & Market Share Insights

This industry has been characterized by high competition. High product quality, pricing, brand recognition, reliability, durability, and energy density are some of the key factors for LiFePO4 battery manufacturers to stay afloat in this market. As per trends, it has been observed that many manufacturers are continuously engaged in R&D activities. As this business entails extensive investments, and ROI is a time-consuming process, manufacturers are reliant on government funding to increase their facilities.

Key Lithium Iron Phosphate (LiFePO4) Battery Companies:

- BYD Company Ltd.

- A123 Systems LLC

- K2 Energy

- Electric Vehicle Power System Technology Co., Ltd.

- Bharat Power Solutions

- OptimumNano Energy Co., Ltd.

- k2battery

- LiFeBATT, Inc.

- LITHIUMWERKS

- CENS Energy Tech Co., Ltd

- RELiON Batteries

Lithium Iron Phosphate (LiFePO4) Battery Market Report Scope

Report Attribute

Details

Market revenue in 2024

USD 9.62 billion

Revenue forecast in 2030

USD 17.48 billion

Growth rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, application, and region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; Italy; France; Russia; China; India; Japan; South Korea; Australia; Brazil; Paraguay; Colombia; UAE; South Africa; Saudi Arabia; Egypt

Key companies profiled

BYD Company Ltd.; A123 Systems LLC; K2 Energy; Electric Vehicle Power System Technology Co., Ltd; Bharat Power Solutions; OptimumNano Energy Co., Ltd.; k2battery; LiFeBATT, Inc.; LITHIUMWERKS; CENS Energy Tech Co. Ltd.; RELiON Batteries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

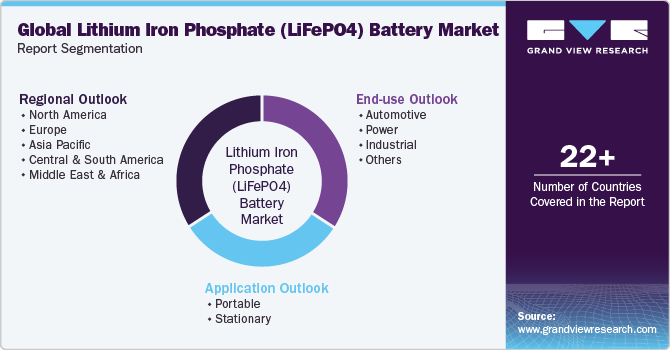

Global Lithium Iron Phosphate (LiFePO4) Battery Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the lithium iron phosphate (LiFePO4) battery market report based on end-use, application, and region:

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Power

-

Industrial

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Portable

-

Stationary

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central and South America

-

Brazil

-

Colombia

-

Paraguay

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global lithium iron phosphate battery market size was estimated at USD 8.25 billion in 2023 and is expected to reach USD 9.62 billion in 2024.

b. The global lithium iron phosphate (LiFePO4) battery market is expected to grow at a compounded annual growth rate of 10.5% from 2024 to 2030 to reach USD 17.48 billion by 2030.

b. Asia Pacific dominated the lithium iron phosphate battery market with the highest share of about 31.0% in 2023. A thriving automotive segment and rising demand for consumer electronics along with growing demand for consumer electronics from countries such as Japan, India, and China are expected to boost the regional market.

b. Some key players operating in the LiFePO4 battery market include BYD Company Ltd., A123 Systems LLC, K2 Energy, Electric Vehicle Power System Technology Co., Ltd, Bharat Power Solutions, OptimumNano Energy Co., Ltd., k2battery, LiFeBATT, Inc., LITHIUMWERKS, CENS Energy Tech Co. Ltd., RELiON Batteries among others.

b. Rising demand for hybrid electric and electric vehicles with growing environmental apprehensions and high requirements for LiFePO4 batteries in battery energy storage systems are driving the lithium iron phosphate battery market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.