- Home

- »

- Power Generation & Storage

- »

-

Battery Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Battery Market Size, Share & Trends Report]()

Battery Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Lead Acid, Lithium Ion, Nickel, Sodium-ion, Flow Battery), By End-use, By Application (Automotive Batteries, Industrial Batteries, Portable Batteries), By Region, And Segment Forecasts

- Report ID: 978-1-68038-846-6

- Number of Report Pages: 225

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Market Summary

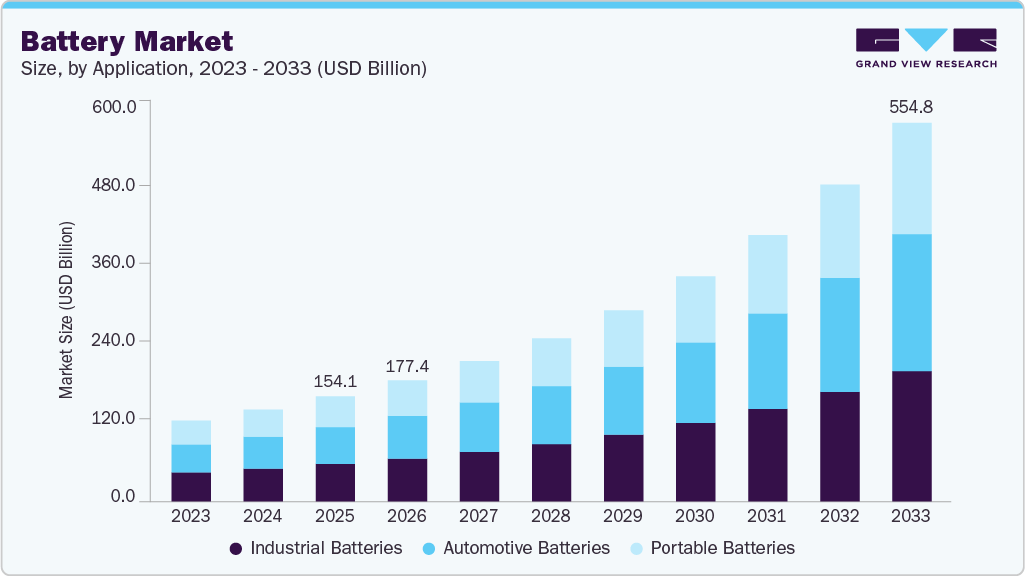

The global battery market size was estimated at USD 154.12 billion in 2025 and is projected to reach USD 554.83 billion by 2033, growing at a CAGR of 17.7% from 2026 to 2033, driven by the rising adoption of electric vehicles, expanding renewable energy storage deployments, and continued advancements in battery technologies. Sustainability is a key driver shaping the global battery market, as governments, industries, and consumers increasingly prioritize carbon reduction and the adoption of clean energy.

Key Market Trends & Insights

- The Asia Pacific battery market held the largest share of over 54.0% of the global market in 2025.

- The China battery market growth is attributed to a combination of government support, industrial policy, and technological innovation.

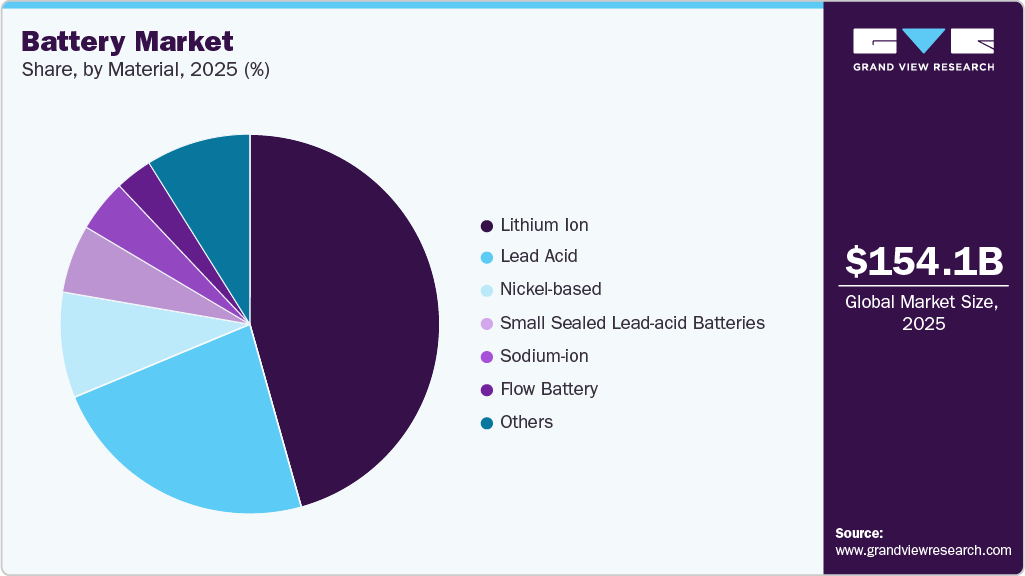

- Based on material, the lithium-ion batteries segment is holding a significant market share of over 45.0% in 2025.

- Based on end-use, the automobile segment captured over 32.0 % of the market share in 2025.

- Based on application, the industrial batteries segment captured over 35.0% of the market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 154.12 Billion

- 2033 Projected Market Size: USD 554.83 Billion

- CAGR (2026-2033): 17.7%

- Asia Pacific: Largest market in 2025

- Europe: Fastest growing market

Batteries play a critical role in enabling electric mobility, integrating renewable energy sources, and reducing dependence on fossil fuels. Growing investments in battery recycling, second-life applications, and circular economy initiatives are further supporting sustainable battery ecosystems, while regulatory frameworks and climate commitments continue to accelerate the transition toward low-emission energy solutions.

Technological advancements are significantly transforming the battery market, with continuous improvements in energy density, charging speed, safety, and lifespan. Innovations in lithium-ion chemistry, the development of solid-state batteries, and progress in alternative technologies, such as sodium-ion and flow batteries, are expanding performance capabilities across various applications. These advancements, along with the optimization of manufacturing processes and cost reductions, are enabling the wider adoption of batteries in electric vehicles, grid-scale energy storage, and industrial applications.

Drivers, Opportunities & Restraints

The battery market continues to be propelled by accelerated electrification and the adoption of clean energy, as evidenced by Chinese EV maker BYD’s delivery of approximately 2.26 million battery-electric vehicles in 2025, overtaking Tesla as the global leader in EV sales. Government incentives for EVs, renewable energy storage deployment, and strategic battery supply chain initiatives in markets such as the U.S., Europe, and the Asia Pacific are further stimulating demand for advanced batteries across transportation and stationary applications. In addition, growing consumer preference for sustainable mobility is accelerating EV adoption globally.

Emerging opportunities in the battery market are highlighted by the expansion of recycling infrastructure and traceability initiatives, such as India’s draft policy proposing unique lifecycle IDs for EV batteries to enhance recycling efficiency and sustainability. Investments in next-generation technologies, pilot solid-state battery development, and scaling of domestic manufacturing and recycling facilities-such as the lithium battery recycling plant opened by BatX Energies in Uttar Pradesh, India, in December 2024-create avenues for cost-effective growth and supply resilience. Further, partnerships between automakers and battery tech firms are driving innovation and accelerating the commercialization of advanced battery solutions.

Despite strong prospects, supply chain limitations and policy shifts present notable restraints. For example, the expiration of U.S. federal EV tax credits in late 2025 contributed to major companies, such as General Motors, announcing a USD 6 billion EV investment write-down in January 2026. Warnings from China’s Ministry of Industry in January 2026 about potential overcapacity in the battery sector reflect structural challenges in balancing production growth with sustainable market dynamics. In addition, fluctuations in raw material prices for lithium, cobalt, and nickel continue to pose cost pressures for battery manufacturers.

End-use Insights

The automobile segment accounted for over 32.0% of the global battery market in 2025, driven primarily by the rapid adoption of electric vehicles amid rising environmental concerns and increasingly stringent emission regulations worldwide. Government incentives, subsidies, and supportive policies have accelerated the shift from internal combustion engine vehicles to electric and hybrid models, significantly boosting demand for lithium-ion batteries due to their high energy density, long lifespan, and efficient performance.

In addition, declining battery costs and the introduction of new EV models across multiple price segments have expanded consumer adoption globally. Emerging markets are also witnessing accelerated EV penetration, further strengthening battery demand from the automotive sector.

Moreover, continuous advancements in battery technology, such as higher energy densities, faster charging capabilities, and extended battery life, have improved the affordability of EVs and their driving range, addressing key adoption barriers. Alongside the expansion of charging infrastructure and substantial investments by automakers in EV research and development, these factors have reinforced the automobile segment’s dominance. Looking ahead, the growing focus on vehicle electrification, coupled with stricter future emission norms, is expected to sustain strong battery demand in the automotive end use segment.

Application Insights

The industrial batteries segment accounted for over 35.0% of the global battery market in 2025, making it the largest application segment, driven by rising demand for reliable and uninterrupted power across industrial operations. Sectors such as manufacturing, telecommunications, data centers, and utilities increasingly rely on industrial batteries for backup power, load leveling, and grid stabilization to ensure operational continuity and efficiency. The growing adoption of automation, robotics, and heavy-duty equipment in manufacturing and warehousing has further accelerated demand for high-capacity batteries that can support continuous operations while minimizing downtime.

In addition, the rapid expansion of renewable energy projects, including solar and wind installations, has significantly increased demand for industrial batteries. As utilities and industries integrate intermittent renewable energy sources, advanced storage solutions, such as lithium-ion and flow batteries, play a critical role in balancing supply and demand by storing excess energy and releasing it when needed. This functionality supports optimized energy utilization, reduced reliance on fossil fuels, and improved grid resilience, positioning industrial batteries as a key enabler of the global energy transition.

Material Insights

Lithium-ion batteries accounted for over 45.0% of the global battery market in 2025, driven by their high energy density, long cycle life, and low self-discharge rates, making them well-suited for consumer electronics, electric vehicles, and renewable energy storage. Rising EV adoption, increasing demand for portable electronic devices, and continuous improvements in safety, as well as rapid technological advancements, are further reinforcing their dominance. In addition, large-scale investments in lithium-ion manufacturing capacity, combined with supportive government policies for clean energy and electrification, are expected to sustain the strong growth of this segment over the forecast period.

Another key factor supporting the dominance of lithium-ion batteries is the continued decline in production costs, driven by economies of scale and advancements in manufacturing processes, which have improved their affordability across a wide range of applications. As a result, lithium-ion batteries have become the preferred energy storage solution for electric vehicles and grid-scale storage, supported by growing sustainability initiatives and investments aimed at reducing carbon emissions, further reinforcing their leadership in the global battery market.

Regional Insights

The North American battery market is experiencing robust growth, driven by the increasing adoption of electric vehicles and the rapid expansion of renewable energy storage solutions. Significant investments in battery manufacturing, technology, and charging infrastructure, particularly in the U.S., supported by government incentives and subsidies, are accelerating EV deployment and large-scale energy storage projects. In addition, strong demand for consumer electronics and portable devices, along with increasing focus on advanced lithium-ion and emerging solid-state batteries for improved performance and safety, continues to support market expansion across the region.

U.S. Battery Market Trends

In the U.S., the battery market is driven by rapid growth in the electric vehicle industry and strong government support for renewable energy initiatives aimed at reducing carbon emissions. Increased investments in battery manufacturing and innovation, particularly in lithium-ion and emerging solid-state technologies, are strengthening domestic capabilities. In addition, efforts to build an integrated battery supply chain, spanning critical mineral sourcing, cell production, and recycling, are enhancing energy security and reducing reliance on imports.

Europe Battery Market Trends

Europe’s battery market is growing rapidly, driven by stringent environmental regulations and robust government initiatives aimed at reducing carbon emissions. The European Union’s Green Deal and supportive national policies are accelerating electric vehicle adoption and renewable energy storage deployment, leading to increased investments in battery manufacturing and R&D. In parallel, Europe is prioritizing the development of a localized battery supply chain, with significant investments in gigafactories across countries such as Germany, France, and Sweden to reduce import dependence and strengthen regional energy security.

Asia Pacific Battery Market Trends

The Asia Pacific battery market held the largest share of over 54.0% of the global market in 2025. The market is characterized by substantial investments in advanced battery technologies, including lithium-ion and solid-state batteries, driven by strong demand from electric vehicles, consumer electronics, and renewable energy storage applications. Robust government support, availability of critical raw materials, and well-established manufacturing infrastructure further strengthen market growth, positioning the Asia Pacific as the largest and most dynamic battery market globally.

Middle East & Africa Battery Market Trends

The MEA battery market is expected to grow, supported by rising investments in renewable energy and increasing demand for energy storage solutions. Although the market is still in its nascent stage, the expansion of solar and wind power projects is driving the need for efficient battery systems to address power intermittency. In addition, the growth of telecommunications infrastructure and data centers is driving demand for reliable backup power solutions. With a gradual shift toward sustainable energy practices, the Middle East & Africa region is emerging as a significant contributor to the global battery market.

Latin America Battery Market Trends

The Latin America battery market is witnessing steady growth, driven by increasing investments in renewable energy projects, rising adoption of electric vehicles, and expanding demand for energy storage solutions across industrial and commercial sectors. In addition, improving telecommunications infrastructure, gradual EV policy support, and increasing awareness of sustainable energy practices are supporting market expansion, positioning Latin America as an emerging growth region in the global battery market.

Key Battery Company Insights

Some of the key players operating in the global E-fuels market include A123 Systems LLC, BYD Company Limited, Duracell Inc., among others.

-

A123 Systems, LLC is a leading developer and manufacturer of advanced lithium-ion batteries and energy storage systems, catering to automotive, commercial, and industrial applications. The company specializes in high-power battery technologies designed for electric vehicles, grid storage, and specialty industrial use. Established in 2001, A123 Systems leverages proprietary Nanophosphate lithium-ion technology to deliver high performance, long life, and safety, with strategic partnerships across the automotive and energy storage sectors to expand global deployment.

-

BYD Company Limited is a global leader in electric vehicles, batteries, and renewable energy solutions, focusing on the design, production, and commercialization of lithium-ion batteries and electric mobility products. The company produces electric cars, buses, trucks, and energy storage systems, integrating its battery technology into a range of clean transportation and energy solutions. Founded in 1995, BYD has rapidly expanded its global footprint, with operations spanning Asia, Europe, and the Americas, and collaborates with governments and enterprises to accelerate the adoption of electrification and sustainable energy.

-

Duracell Inc. is a prominent manufacturer of primary and rechargeable batteries, serving consumer electronics, industrial, and medical applications. The company is recognized for delivering high-quality alkaline and lithium batteries with long shelf life and reliable performance. Established in 1924, Duracell continues to innovate in battery technology while maintaining a strong global presence, with strategic partnerships in consumer electronics, healthcare, and energy sectors to expand product adoption worldwide.

Key Battery Companies:

The following are the leading companies in the battery market. These companies collectively hold the largest market share and dictate industry trends.

- A123 Systems, LLC

- BSLBATT USA

- BYD Company Limited

- Clarios, LLC

- Crown Battery Manufacturing Company

- Discover Battery

- Duracell Inc.

- East Penn Manufacturing Co.

- EnerSys, Inc.

- Exide Industries Limited

Recent Developments

-

In January 2026, BYD Company Limited announced the launch of its new 1.5 GWh battery production facility in Shenzhen, China, aimed at scaling the supply of lithium-ion batteries for electric vehicles and renewable energy storage. The plant incorporates advanced automation and quality control technologies to enhance efficiency and reduce production costs, reinforcing BYD’s leadership in the global EV and battery market.

-

In December 2025, A123 Systems, LLC partnered with a major European automaker to supply high-power lithium-ion batteries for next-generation electric vehicles. The agreement includes joint testing and integration of A123’s Nanophosphate battery technology, enabling enhanced driving range, faster charging, and improved battery longevity for commercial EV deployment.

-

In November 2025, Duracell Inc. introduced a new line of high-capacity rechargeable lithium batteries for consumer electronics and industrial applications. The product launch emphasizes improved energy density, longer cycle life, and enhanced safety features, aligning with global trends toward sustainable and high-performance battery solutions.

Battery Market Report Scope

Report Attribute

Details

Market definition

The battery market size represents the global revenue generated from the manufacturing, sale, and deployment of batteries used for energy storage and power supply across consumer electronics, automotive, industrial, and grid-scale applications.

Market size value in 2026

USD 177.39 billion

Revenue forecast in 2033

USD 554.83 billion

Growth rate

CAGR of 17.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

USD million/billion, volume in thousand units, Capacity in MW, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Netherlands; Denmark; Sweden; Belgium; Poland; China; India; Japan; South Korea; Australia; Malaysia; Indonesia; Singapore; Vietnam; Brazil; Argentina; Colombia; Saudi Arabia; South Africa; UAE

Key companies profiled

A123 Systems, LLC; BSLBATT USA; BYD Company Limited; Clarios, LLC; Crown Battery Manufacturing Company; Discover Battery; Duracell Inc.; East Penn Manufacturing Co., Inc.; EnerSys Inc.; Exide Industries Limited

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Market Report Segmentation

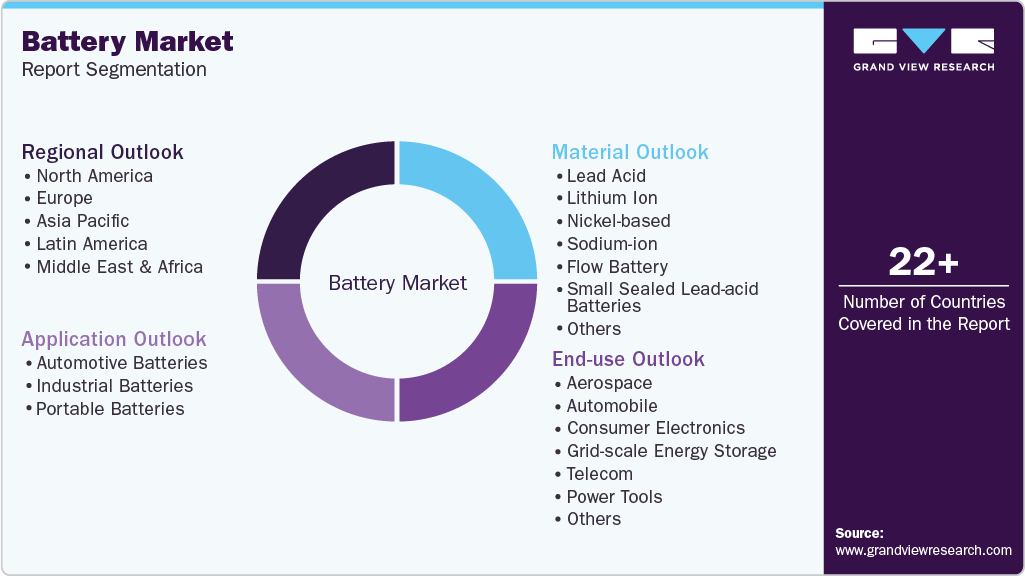

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global battery market report on the basis of product, end-use, application, and region:

-

Material Outlook (Volume, Thousand Units; Capacity, MW; Revenue, USD Million, 2021 - 2033)

-

Lead Acid

-

SLI

-

Stationary

-

Motive

-

-

Lithium Ion

-

Nickel-based

-

Sodium-ion

-

Flow Battery

-

Small Sealed Lead-acid Batteries

-

Others

-

-

End-use Outlook (Volume, Thousand Units; Capacity, MW; Revenue, USD Million, 2021 - 2033)

-

Aerospace

-

Automobile

-

ICE Engines

-

Passenger vehicles

-

Commercial vehicles

-

-

Electric vehicles

-

E-Bikes

-

E-Cars

-

E-Buses

-

E-Trucks

-

-

-

Consumer Electronics

-

Grid-scale Energy Storage

-

Telecom

-

Power Tools

-

Military & Defense

-

Others

-

-

Application Outlook (Volume, Thousand Units; Capacity, MW; Revenue, USD Million, 2021 - 2033)

-

Automotive Batteries

-

Industrial Batteries

-

Portable Batteries

-

-

Regional Outlook (Volume, Thousand Units; Capacity, MW; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Denmark

-

Sweden

-

Belgium

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Malaysia

-

Indonesia

-

Singapore

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global battery market size was estimated at USD 154.12 billion in 2025 and is expected to reach USD 177.39 billion in 2026.

b. The global battery market is expected to grow at a compound annual growth rate of 17.7% from 2026 to 2033 to reach USD 554.83 billion by 2033.

b. The battery market is primarily driven by the rising adoption of electric vehicles, the expansion of renewable energy projects that require efficient energy storage solutions, and ongoing advancements in battery technology that improve performance and reduce costs.

b. Based on material, the lithium-ion batteries segment is expected to hold a significant market share of over 45.0% by 2025.

b. Some of the key players operating in this industry include A123 Systems, LLC; BSLBATT USA; BYD Company Limited; Clarios, LLC; Crown Battery Manufacturing Company; Discover Battery; Duracell Inc.; East Penn Manufacturing Co., Inc.; EnerSys Inc.; Exide Industries Limited, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.