- Home

- »

- Plastics, Polymers & Resins

- »

-

Non-halogenated Flame Retardants Market Size Report 2030GVR Report cover

![Non-halogenated Flame Retardants Market Size, Share & Trends Report]()

Non-halogenated Flame Retardants Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-158-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global non-halogenated flame retardants market size was valued at USD 5.62 billion in 2023 and is projected to grow at a CAGR of 8.25% from 2024 to 2030. With stringent regulations and standards to ensure fire safety, there is a growing demand for effective yet environmentally friendly flame-retardant materials. Non-halogenated flame retardants are gaining popularity due to their lower toxicity levels than traditional halogenated counterparts, making them a preferred choice for manufacturers looking to meet regulatory requirements without compromising performance.

The non-halogenated flame retardant market is also driven by the growing demand from end-use industries such as construction, electronics, automotive, and textiles. These industries require flame-retardant materials to enhance the safety and durability of their products. As consumer awareness about fire safety increases, manufacturers are pressured to incorporate flame-retardant solutions into their products. Non-halogenated flame retardants offer a sustainable and effective alternative, driving their adoption across various sectors and contributing to the overall market growth. It is an opportunity for the non-halogenated flame retardant market due to the rising legislation ban on halogenated flame retardants. The use of non-halogenated flame retardants is increasing due to environmental concerns. In buildings, flame retardants are used for fire safety regulation; hence, rising demand for the construction industry might contribute to the growth of this market.

Product Insights

Aluminum hydroxide segment dominated the market and accounted for a share of 41.4% in 2023. Aluminum hydroxide offers an effective solution for enhancing various construction materials' fire safety properties without compromising performance or sustainability. The expanding construction industry, particularly in emerging economies, is driving the demand for aluminum hydroxide as a non-halogenated flame retardant. With rapid urbanization and infrastructure development projects underway in countries such as China, India, and Brazil, there is a growing need for fire-resistant materials in buildings and structures.

The phosphorous based segment is expected to witness growth at 8.5% CAGR. Phosphorous-based flame retardants are considered more environmentally friendly compared to halogenated options as they do not produce toxic gases when exposed to fire. With an increasing focus on sustainability and green initiatives, manufacturers increasingly opt for phosphorous-based flame retardants to meet regulatory requirements and consumer preferences.

Application Insights

Polyolefins technology accounted for the largest market revenue share in 2023. Technological advancements in developing polyolefin-based flame retardants have improved their performance characteristics, making them sustainable to end-users. These advancements include enhanced thermal stability, reduced smoke emission, and improved compatibility with polyolefin materials.

Epoxy resins is anticipated grow significantly over the forecast period. Flame retardant additives play a crucial role in improving the fire resistance of epoxy resins. These products protect the coatings from direct contact with a flame, making them suitable for use in tapes, wires, and pipelines. By incorporating flame retardant additives into epoxy resins, the risk of fire is significantly reduced, ensuring the safety and reliability of the final product.

End-use Insights

The electrical & electronics segment accounted for the largest market revenue share in 2023. The increasing demand for electronic devices such as smartphones, laptops, tablets, and other consumer electronics is propelling the growth of this segment. As technology advances and consumers seek more sophisticated electronic products, there is a higher need for flame-retardant materials to ensure the safety and reliability of these devices.

The construction industry is anticipated to grow significantly over the forecast period. The growing awareness among consumers, architects, and builders about the importance of fire safety measures further fuels the adoption of non-halogenated flame retardants in construction applications. Moreover, the expanding construction industry, particularly in emerging economies, propels the demand for non-halogenated flame retardants. The rapid urbanization, infrastructural development projects, and construction activities in regions such as Asia Pacific and Latin America drive the need for fire-resistant materials in buildings and structures.

Regional Insights

The North American non-halogenated flame-retardant market has a significant market revenue share globally. This increased demand in various industries is attributed to the need for effective fire protection measures and the shift towards non-halogenated alternatives due to increasing environmental concerns in North America. Additionally, the dominance of the North American flame retardants market region is expected due to consumers' rising consumption of electronics and electrical components. Furthermore, the increasing investments in electric vehicles (EVs) and private construction projects are boosting the demand for flame retardants in the region, particularly in the electrical and electronics segment.

U.S. Non-Halogenated Flame Retardants Market Trends

The U.S. non-halogenated flame retardant market dominated the North America market with a share of 86.2% in 2023. As concerns about halogenated flame retardants' toxicity and environmental impact have grown, regulatory bodies have imposed stricter regulations on their use. The implementation of regulations such as the Toxic Substances Control Act (TSCA) and various state-level regulations has significantly boosted the demand for non-halogenated flame retardants in multiple industries, including construction, electronics, automotive, and textiles in the country.

Europe Non-Halogenated Flame Retardants Market Trends

Europe non-halogenated flame retardant market is anticipated to grow significantly over the forecast period. The demand for non-halogenated flame retardants is bolstered by the rising consumption of automotive goods and supportive government regulations, particularly in the electrical and electronics segment. These factors are expected to boost overall market growth in Europe. The market growth of non-halogenated flame retardants in Europe is also influenced by the rising awareness of environmentally friendly flame retardants and the active research and development of non-halogenated alternatives.

The UK non-halogenated flame retardant market is expected to grow rapidly in the coming years. The growing adoption of electric vehicles in the UK is expected to boost the demand for non-halogenated flame retardants. Plastic components in electric vehicles need strong flame-retardant characteristics to mitigate fire hazards caused by heat generation. The UK government's push for electric vehicle adoption is anticipated further to drive the country's non-halogenated flame retardant market.

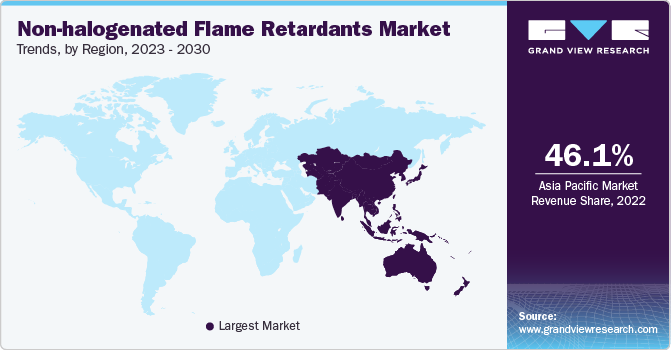

Asia Pacific Non-Halogenated Flame Retardants Market Trends

The Asia Pacific dominated the non-halogenated flame retardant market and accounted for the largest revenue share of 41.1% in 2023 and is anticipated to witness significant growth over the forecast period. As urbanization and industrialization continue to expand across the Asia Pacific, there is a growing emphasis on implementing stringent fire safety regulations in various industries, such as construction, electronics, automotive, and textiles. This has led to a rising demand for non-halogenated flame retardants, considered more environmentally friendly and increasingly preferred over traditional halogenated flame retardants. The rapid growth of the construction and automotive industries in countries such as China, India, and Southeast Asia has fueled the demand for non-halogenated flame retardants to enhance fire safety in buildings, electrical components, and automotive interiors.

China non-halogenated flame retardant market is expected to grow rapidly in the coming years. With increasing environmental awareness and regulations promoting non-toxic and non-hazardous flame retardants, manufacturers and end-users in China are increasingly turning to non-halogenated alternatives. This trend is particularly evident in the electronics and electrical industry, where there is a growing demand for non-halogenated flame retardants to comply with regulations and address consumer preferences for environmentally friendly products.

Key Non-halogenated Flame Retardants Company Insights

Some of the key companies in the market include Albemarle Corporation, ICL, Chemtura Corporation, CLARIANT, Italmatch Chemicals S.p.A, Huber Engineered Materials, BASF SE, LANXESS, DSM, DuPont. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Albemarle Corporation offers a wide range of products, including non-halogenated flame retardants. These products are designed to provide adequate fire protection in various applications while addressing environmental and health concerns associated with traditional halogenated flame retardants. They are used in electronics, construction, transportation, and textiles to meet regulatory requirements and enhance safety standards.

-

Clariant offers various products and solutions across multiple industries, including non-halogenated flame retardants. In this field, Clariant provides innovative solutions that prioritize safety and sustainability. These products offer high-performance fire protection while minimizing the impact on human health and the environment.

Key Non-halogenated Flame Retardants Companies:

The following are the leading companies in the non-halogenated flame retardants market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corporation

- ICL

- Chemtura Corporation

- CLARIANT

- Italmatch Chemicals S.p.A

- Huber Engineered Materials

- LANXESS

- BASF SE

- DSM

- DuPont

Recent Developments

-

In July 2022, BASF partnered with THOR GmbH to harness their expertise in non-halogenated flame retardant additives. The aim behind this partnership is to deliver a inclusive solution to customers, enhancing the sustainability and performance of specific plastic compounds while complying with stringent fire safety requirements. This collaboration underscores the surging demand for sustainable flame retardant chemicals, propelled by the global construction and automotive industries and increasingly strict fire safety standards.

Non-Halogenated Flame Retardants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.06 billion

Revenue forecast in 2030

USD 9.76 billion

Growth rate

CAGR of 8.25% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Albemarle Corporation, ICL, Chemtura Corporation, CLARIANT, Italmatch Chemicals S.p.A, Huber Engineered Materials, BASF SE, LANXESS, DSM, DuPont

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-halogenated Flame Retardants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-halogenated flame retardants market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Aluminum Hydroxide

-

Magnesium Dihydroxide

-

Phosphorous Based

-

Others

-

-

Application Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Polyolefin

-

Epoxy resins

-

UPE

-

PVC

-

ETP

-

Rubber

-

Styrenics

-

Others

-

-

End Use Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Electricals & Electronics

-

Construction

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global non-halogenated flame retardants market size was estimated at USD 5.62 billion in 2023 and is expected to reach USD 6.06 billion in 2024.

b. The global non-halogenated flame retardants market is expected to grow at a compound annual growth rate of 8.25% from 2024 to 2030 to reach USD 9.76 billion by 2030.

b. Construction dominated the non-halogenated flame retardants market with a share of 36.72% in 2023. This is attributable to its increasing demand for safety materials for pipe and wires used in the electrical industry, coupled with developing electricity infrastructure.

b. Some key players operating in the non-halogenated flame retardants market include Albemarle, ICL, Chemtura, Clariant International Ltd., Italmatch Chemicals, Albemarle Corporation, Huber Engineered Materials, BASF, Thor Group Ltd., Lanxess AG, DSM, FRX Polymers, Nabaltec AG, Delamin, and Dupont.

b. Key factors that are driving the market growth include increasing use of the product to restrain or delay flame production to avert the spread of fire in many end use industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.