- Home

- »

- Plastics, Polymers & Resins

- »

-

Epoxy Resin Market Size And Share, Industry Report, 2033GVR Report cover

![Epoxy Resin Market Size, Share & Trends Report]()

Epoxy Resin Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Paints & Coatings, Wind Turbines, Composites, Construction, Electrical & Electronics, Adhesives), By Region And Segment Forecasts

- Report ID: 978-1-68038-171-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Epoxy Resin Market Summary

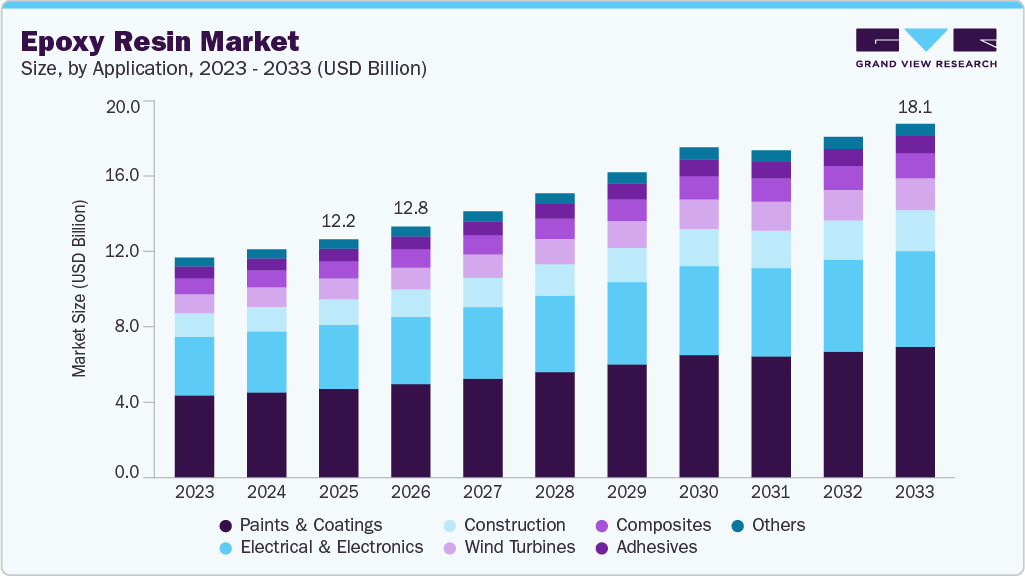

The global epoxy resin market size was estimated at USD 12.17 billion in 2025 and is expected to reach USD 18.07 billion by 2033, growing at a CAGR of 5.0% from 2026 to 2033. The increasing demand for paints & coatings is anticipated to significantly drive market growth during the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the epoxy resin market with the largest revenue share of 62.06% in 2025.

- The epoxy resin market in China is expected to grow at a substantial CAGR of 3.8% from 2026 to 2033.

- By application, the construction segment is expected to grow at the fastest CAGR of 5.9% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 12.17 Billion

- 2033 Projected Market Size: USD 18.07 Billion

- CAGR (2026 - 2033): 5.0%

- Asia Pacific: Largest market in 2025

- Europe: Fastest growing market

The increasing demand for epoxy resins is attributed to growing construction spending, particularly in residential construction, in North America and Western Europe. The rapid growth in global manufacturing activities is expected to drive demand for paints & coatings used in the production of motor vehicles and other durable goods, as well as in industrial maintenance applications. This is expected to boost the demand for epoxy resins globally.Asia Pacific has been the leading consumer of epoxy resins, fueled by increasing demand from China and India. Infrastructure development along with increasing automotive production has fueled paints & coatings demand in the region. Increasing disposable income and willingness to spend are expected to drive the market over the coming years.

In the recent past, global automotive production increased rapidly due to growing demand from middle-class families and rising disposable income across emerging nations such as China, India, Brazil, Vietnam, and others. The rise in automotive demand propelled the consumption of paints & coatings across automotive industry, thereby fueling the demand for epoxy resins. However, volatile raw material price of epoxy resin is expected to restraint the market growth during the forecast period.

In addition, the outbreak of COVID-19 negatively impacted the demand for epoxy resin in various applications, including paints & coatings, adhesives, wind turbines, and others, owing to the stalled manufacturing activities, restrictions in supply and transportation, and economic slowdown across the globe in 2020. Moreover, the recommencing industrial operation is projected to positively influence the demand for the epoxy resin market over the forecast period.

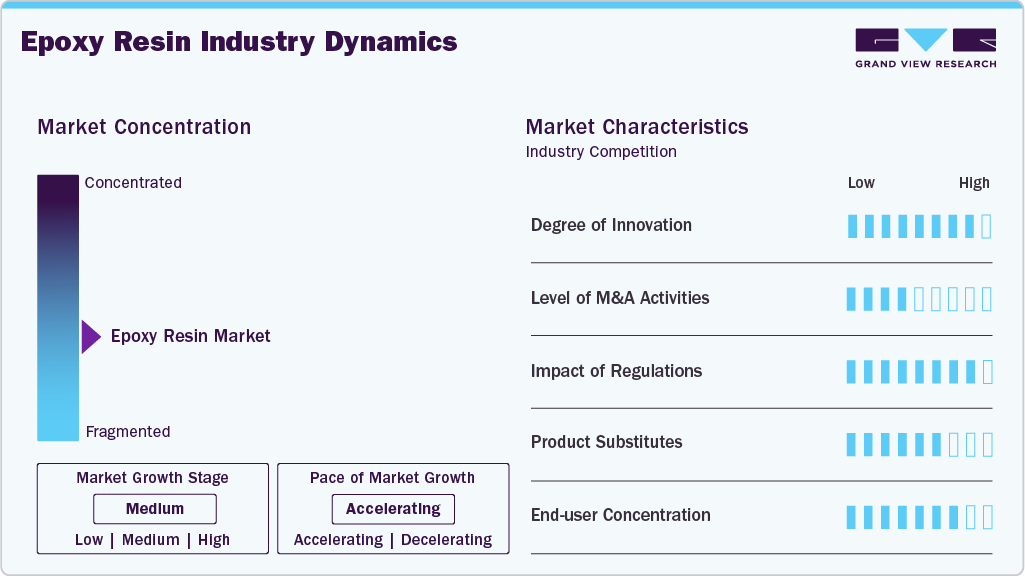

Market Concentration & Characteristics

The market space is moderately consolidated with the presence of key companies, such as 3M, Aditya Birla Management Corp. Pvt. Ltd, BASF SE, and Sika AG. These companies adopt various strategic initiatives, such as new product launches, partnerships, capacity expansions, and collaborations, to expand their presence in the market. For instance, in March 2024, Safic-Alcan announced its expansion by collaborating with BB Resins Srl. BB Resins Srl is a manufacturer of epoxy resin hardeners, which boasts an extensive range of products specifically designed for the coatings, construction, and adhesives sectors. With this collaboration, Safic-Alcan aims to expand its business across Poland.

The industry is characterized by high degree of innovation. Technological advancement, upgradation of electronic products, and circuit assembly have propelled the PCB fabrication technology toward micro via, fine-trace, high-density tracing, and multi-layers. The usage of epoxy resins enhances thermal dissipation, dimensional stability, and dielectric loss, therefore, propelling the demand for epoxy resins in the manufacture of CCL. In recent years, the electronic industry has grown rapidly, thereby increasing the demand for PCBs across the globe.

In addition, stringent regulations shape the demand and supply dynamics in the epoxy resins market. Stricter regulations on volatile organic compounds (VOCs) and hazardous substances can limit the use of certain raw materials and formulations. This can lead to a shift in market preferences towards eco-friendly and compliant products. For instance, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation requires comprehensive data on the safety of chemical substances, pushing manufacturers to innovate and produce safer epoxy resin formulations.

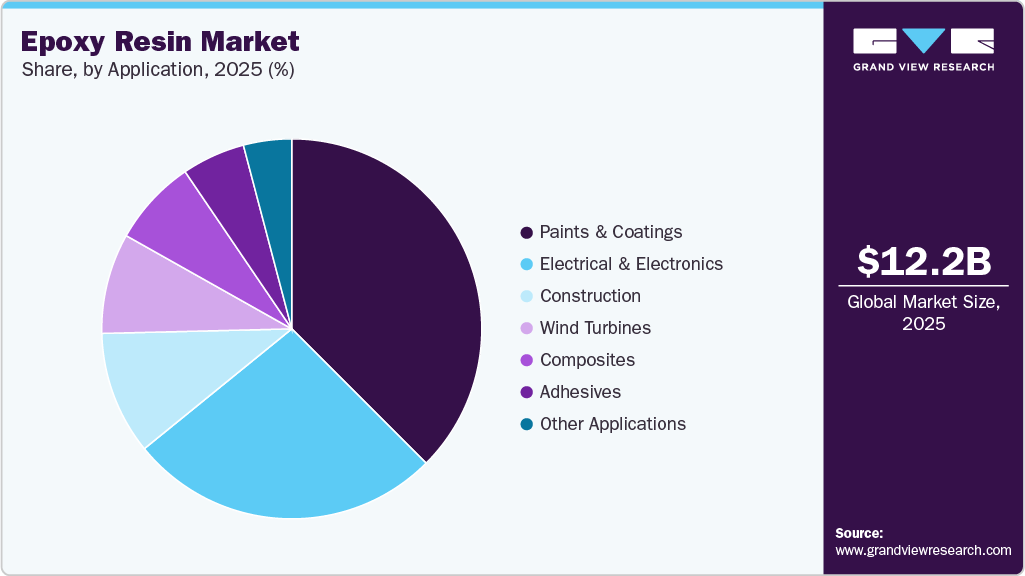

Application Insights

The paints and coatings application segment led the market, accounting for a 37.33% revenue share in 2025. Epoxy resin-based paints & coatings are widely utilized in residential & commercial buildings, shipbuilding industries, automotive, and wastewater treatment plants, among others, owing to their excellent resistance to stains, cracks, extreme temperatures, blistering, and chemicals. They offer excellent adhesion, high anti-corrosion performance, and a low content of volatile organic compounds.

Epoxy resin-based paints & coatings are used to coat interior and exterior surfaces of commercial, residential, institutional, and industrial buildings. The application of these paints & coatings not only increases the aesthetic appeal of surfaces but also protects them from soaking rains, freezing winters, blistering summers, and UV radiation, without them peeling, fading, or cracking.

Emerging regions, such as the Asia Pacific and the Middle East & Africa, are witnessing significant growth in their non-residential sectors, including IT, telecom, and retail, resulting in increased demand for paints & coatings. In addition, ongoing industrialization, increasing government infrastructure spending, and surging foreign direct investments (FDI), especially in the Asia Pacific, are expected to contribute to the demand for epoxy resin-based paints & coatings, thereby fueling the growth of the epoxy resin market during the forecast period.

The construction application is expected to grow at the fastest CAGR of 7.3% over the forecast period. In construction, epoxy resins are used as sealers, hardeners, grouts, mortars, and laminates for walls, roofs, and decks. Low water permeability, excellent cleaning properties, chemical resistance, good mechanical properties, low cure shrinkage, and excellent adhesion are some of the properties that drive the demand for epoxy resins in construction applications.

Regional Insights

The North America Epoxy Resin Market is poised to grow over the forecast period owing to the rapid construction and infrastructure development in the U.S. and Mexico. The construction industry in the region is expected to experience significant growth over the coming years, driven by high demand for non-residential construction projects, including hospitals, commercial buildings, and colleges.

U.S. Epoxy Resin Market Trends

The U.S. dominated the North America epoxy resin market in 2025 with a share of 85.72%. The rising demand for epoxy resin in paints & coatings, wind turbines, construction, electrical & electronics, composites, and adhesive applications in the U.S. is expected to drive the market over the forecast period.

Asia Pacific Epoxy Resin Market Trends

The Asia Pacific region dominated the Epoxy Resin Market and accounted for the largest revenue share of 62.06% in 2025.Rising construction activities and growing demand from the automotive sector in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period.Furthermore, the easy availability of raw materials has provided a huge opportunity for the use of epoxy resin-based products in various end-use sectors.

The Epoxy Resin Market in China dominated the regional market in 2025.The rising number of infrastructure development projects and the growing manufacturing industry are expected to drive market growth over the forecast period. China’s construction market is likely to outperform other Southeast Asian countries, thanks to government initiatives and funding aimed at sustaining its development.

India epoxy resin market is expected to witnesssubstantial growth over the forecast period, owing to the rapidly flourishing construction industry. According to Invest India, as of 2024, India allocated an investment budget of USD 1.4 trillion to infrastructure, with 24% allocated to renewable energy, 18% to highways & roads, 17% to urban infrastructure, and 12% to railways.

Europe Epoxy Resin Market Trends

Europe is the second-largest market for epoxy resin, after Asia Pacific. Increasing demand for epoxy resin in various applications, including paints & coatings, construction, wind turbines, electrical & electronics, and others, is expected to drive the epoxy resin market in Europe over the forecast period.

The Epoxy Resin Market in Germany held the largest market share in 2023. Germany is the manufacturing hub of Europe and is the largest manufacturer of automobiles in the region. Technology advancements, such as EVs and self-driving cars, are anticipated to boost the growth of the automotive industry in the country, which is anticipated to create demand for paints & coatings over the forecast period.

The UK Epoxy Resin Market is anticipated to grow at a significant CAGR over the forecast period. The presence of major automobile manufacturers, including Jaguar, Land Rover, MINI, Aston Martin, Bentley, Rolls-Royce, and Lotus Cars, in the UK is likely to fuel the demand for paints & coatings in the automotive industry in the coming years, which is expected to create demand for epoxy resins. Initiatives focused on product development, such as driverless cars, are expected to boost investments in the automotive industry.

Central & South America Epoxy Resin Market Trends

The Central & South America Epoxy Resin Market is growing substantial rate. The emergence of construction companies in Chile and Peru is expected to create growth potential for the epoxy resins market over the forecast period. The presence of various paint & coating key players in the region, including The Sherwin-Williams Company, AkzoNobel NV, and RPM International, Inc., is expected to propel the demand for epoxy resins.

Middle East & Africa Epoxy Resin Market Trends

The Middle East & Africa Epoxy Resin Market is poised to grow through the forecast period. Industrial manufacturing in the Middle East & Africa has witnessed steady growth in the past few years. A shift in focus toward the non-oil private sector in the region is expected to boost manufacturing and other end-use industries, as well as diversify the regional economy.

Key Epoxy Resin Company Insights

Key companies are adopting various organic and inorganic growth strategies, including new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

- In March 2025, BASF and Sika collaborated to create a new amine building block intended for curing epoxy resins, which is currently available for purchase under the BASF brand name Baxxodur EC 151. This innovative product is especially noteworthy for use in flooring applications, such as in manufacturing facilities, storage and assembly areas, and parking structures.

Key Epoxy Resin Companies:

The following are the leading companies in the epoxy resin market. These companies collectively hold the largest Market share and dictate industry trends.

- 3M

- Aditya Birla Management Corporation Pvt. Ltd.

- Atul Ltd

- BASF SE

- Solvay

- Huntsman International LLC

- KUKDO CHEMICAL CO., LTD.

- Olin Corporation

- Sika AG

- NAN YA PLASTICS CORPORATION

- Jiangsu Sanmu Group Co., Ltd.

- Jubail Chemical Industries LLC

- China Petrochemical & Chemical Corporation (SINOPEC)

- Hexion

- Kolon Industries, Inc.

- Techstorm

- NAGASE & CO., LTD.

Epoxy Resin Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 12.82 billion

Revenue forecast in 2033

USD 18.07 billion

Growth rate

CAGR of 5.0% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; France; China; India; Japan; Taiwan; South Korea

Key companies profiled

3M; Aditya Birla Management Corporation Pvt. Ltd.; Atul Ltd; BASF SE; Solvay; Huntsman International LLC; KUKDO CHEMICAL CO., LTD.; Olin Corporation; Sika AG; NAN YA PLASTICS CORPORATION; Jiangsu Sanmu Group Co., Ltd.; Jubail Chemical Industries LLC; China Petrochemical & Chemical Corporation (SINOPEC); Hexion; Kolon Industries, Inc.; Techstorm; NAGASE & CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Epoxy Resin Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, providing an analysis of the latest industry trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global epoxy resin market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Paints & Coatings

-

Wind Turbines

-

Composites

-

Construction

-

Electrical & Electronics

-

Adhesives

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some key players operating in the epoxy resin market include 3M, Aditya Birla Management Corporation Pvt. Ltd., Atul Ltd, BASF SE, Solvay, Huntsman International LLC, KUKDO CHEMICAL CO., LTD., Olin Corporation, Sika AG, NAN YA PLASTICS CORPORATION.

b. Key factors that are driving the epoxy resin market growth include rising demand from the automotive and industrial applications on account of superior heat resistance as compared to its counterparts.

b. The global epoxy resin market size was estimated at USD 12.17 billion in 2025 and is expected to reach USD 12.82 billion in 2026.

b. The global epoxy resin market is expected to grow at a compound annual growth rate of 5.0% from 2026 to 2033, reaching USD 18.07 billion by 2033.

b. The paints & coatings segment dominated the epoxy resin market, accounting for 37.33% in 2025. This is attributable to the growing demand for floor coatings, protective coatings, architectural & decorative coatings, marine coatings, and powder coatings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.