- Home

- »

- Clinical Diagnostics

- »

-

Liquid Biopsy Market Size & Share, Industry Report, 2030GVR Report cover

![Liquid Biopsy Market Size, Share & Trends Report]()

Liquid Biopsy Market (2025 - 2030) Size, Share & Trends Analysis Report By Biomarker (Circulating Tumor Cells, Extracellular Vehicles), By Technology, By Sample Type, By Application, By Clinical Application, By End-use, By Product, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-105-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Biopsy Market Summary

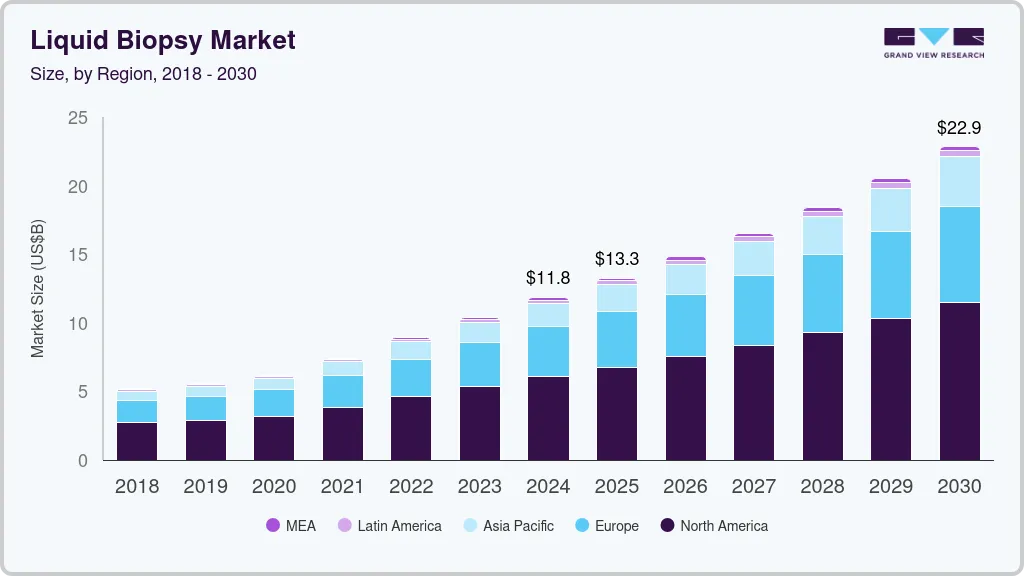

The global liquid biopsy market size was estimated at USD 11.85 billion in 2024 and is projected to reach USD 22.88 billion by 2030, growing at a CAGR of 11.5% from 2025 to 2030. The market is witnessing growth due to factors such as the growing prevalence of cancer, technological advancements in cancer diagnostics, and rising preference for minimally invasive cancer diagnostics.

Key Market Trends & Insights

- North America dominated the liquid biopsy market with the largest revenue share of 51.15% in 2024.

- The liquid biopsy market in the U.S. accounted for the largest market revenue share in North America in 2024.

- Based on technology, the multi-gene-parallel analysis (NGS) segment led the market with the largest revenue share of 76.17% in 2024.

- Based on biomarker, the circulating tumor cells (CTC) biomarker segment led the market with the largest revenue share of 35.67% in 2024.

- Based on application, the cancer segment led the market with the largest revenue share of 86.31% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.85 Billion

- 2030 Projected Market Size: USD 22.88 Billion

- CAGR (2025-2030): 11.5%

- North America: Largest market in 2024

Moreover, ongoing research for the development of liquid biopsy assays and tests, aided by the rising adoption and development of multi-cancer early detection tests, is providing a major opportunity for the growth of the overall market.

Liquid biopsy is an advanced testing technology for the detection of genetic alterations related to tumors. It has also been utilized to stratify tumors and deliver precise cancer treatment. For instance, in January 2023, Guardant Health received FDA approval for Guardant360 CDx, its liquid biopsy assay as a companion diagnostic for ESR1 mutant breast cancer diagnosis. These recent innovations, advancements, and expansions in the industry promoting the use of liquid biopsy are driving the market.

For various applications, such as breast, colorectal, ovarian cancer, non-small-cell lung, and prostate cancer, liquid biopsy is used for diagnostic & screening, making it an important tool. After various studies and speculations, it has been derived that the liquid biopsy technique could provide an improved outcome of diagnosis. Data show that screening techniques should be used on high-risk patients who have an ancestral history of cancer. Moreover, over the past several years, studies have shown positive outcomes of liquid biopsy platforms. The government and various regulatory bodies have also shown interest in the area by promoting multiple breakthrough devices for the rapid development of the technology.

Furthermore, Multi Cancer Early Detection (MCED) provides major opportunities for the growth of the liquid biopsy industry. The MCED market represents an upcoming field of interest for the diagnostics industry, which not only allows early detection of cancer but also facilitates early treatment of these patients by saving time and minimizing the risk of requiring invasive medical or surgical procedures. There are a number of limitations to single cancer tests, such as high false-positive rates and optimized sensitivity. In addition, diagnosis is usually conducted with a focus on just one type of cancer; hence, other cancers are left undiagnosed. Hence, these single cancer detection tests are failing to meet the changing needs of the consumers. Thus, opportunities presented by these MCED tests are significant.

Liquid biopsies are progressively being studied as a tool that can determine tumor evolution and guide systemic treatment. According to a study by ASCO, it is insufficient to prove the clinical utility for most of the ctDNAs in advanced-stage cancers and early-stage disease screening. For ctDNA and CTC, there is a requirement to regulate preanalytical variables for cross-platform comparison studies. However, to address these challenges, initiatives are being undertaken in the U.S and Europe. Low concentration of ctDNA and CTCs in biological samples is expected to limit the usage of liquid biopsy in early-stage cancer diagnosis. Moreover, increasing the ctDNA or CTC volume by drawing a large amount of blood from the patients is not clinically advisable. Such challenges in early-stage diagnosis are expected to restrain growth to a certain extent.

Market Characteristics & Concentration

The liquid biopsy industry shows high innovation, driven by advanced technologies like ctDNA and exosome analysis. New diagnostic platforms, such as NGS-based tests, are improving cancer detection and monitoring. Companies like Guardant Health and Foundation Medicine are leading in innovation, enhancing test sensitivity and specificity, which is crucial for early cancer intervention and personalized treatment.

Mergers and acquisitions are robust in the liquid biopsy space, aimed at enhancing technological capabilities and market reach. For instance, Illumina’s acquisition of GRAIL in 2021 sought to integrate early cancer detection tools into mainstream diagnostics. Such activities accelerate product commercialization, facilitate regulatory navigation, and allow access to wider patient populations, strengthening competitive positions.

Regulations significantly shape the market, ensuring test accuracy and safety. Agencies like the FDA and EMA are increasingly involved, especially in approving companion diagnostics. The FDA’s 2020 guidance on liquid biopsy for minimal residual disease detection marked a pivotal step, fostering trust but also necessitating rigorous clinical validation, which can slow down market entry for newer players.

Companies are diversifying their offerings to cover more cancer types and stages. From non-small cell lung cancer to colorectal and breast cancer, tests are becoming tumor-agnostic. Examples include Guardant360 and Signatera expanding indications across solid tumors. This broadening of applications drives demand, especially in recurrence monitoring and therapy selection, aiding long-term market sustainability.

North America leads in adoption due to strong R&D and reimbursement infrastructure. However, Asia-Pacific is emerging fast, driven by rising cancer incidence and growing healthcare investments. Firms are partnering locally to meet regulatory norms and cost sensitivities. For example, Chinese firms are developing cost-effective assays, widening access, and boosting the market’s global footprint.

Technology Insights

Based on technology, the multi-gene-parallel analysis (NGS) segment led the market with the largest revenue share of 76.17% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. NGS technology allows the detection of various tumor-causing mutations and the identification of potential emergence of post-treatment resistance mechanisms from pre-existing clones. Rapid developments in NGS technology have led to significant cost reductions in sequencing with high accuracy. Furthermore, key players operating in the market are focusing on developing innovative products to meet the growing demand for diagnosis and maintain their position with an expanded product portfolio, thus driving the market. For instance, in January 2023, Agilent Technologies collaborated with Quest Diagnostics to provide access to Agilent Resolution ctDx FIRST, an NGS liquid biopsy test in the U.S.

The single gene analysis (PCR Microarrays) segment is anticipated to grow at a significant CAGR during the forecast period. Technological advancements in PCR are expected to propel market growth over the coming years. The recently introduced Droplet Digital PCR (ddPCR) is an advanced technology that allows absolute quantification of nucleic acids with high sensitivity and precision. This PCR technique has been developed as a rapid & precise tool for detecting and monitoring several types of cancers.For instance, Bio-Rad’s ddPCR technology detects cancer subtypes, monitors residual disease, optimizes drug treatment plans, and studies tumor evolution. ddPCR assays have advantages when used in liquid biopsies, enabling measurement of Circulating Tumor Cells (CTCs) and Circulating Nucleic Acids (cfDNA) in blood samples.

Biomarker Insights

Based on biomarker, the circulating tumor cells (CTC) biomarker segment led the market with the largest revenue share of 35.67% in 2024. The growth of the segment is attributed to widespread applications associated with circulating tumor DNA (ctDNA) in the liquid biopsy of cancer. Translational cancer researchers are identifying ctDNA from tumors using liquid biopsy. The discovery of ctDNA offers new opportunities in future liquid biopsy applications for cancer diagnosis by acting as a possible biomarker. CtDNA has been suggested as an alternative source in cancer patients for molecular profiling of tumor DNA, as opposed to invasive techniques. A new technique for the early detection of cancer and the monitoring of disease has been made possible by the identification of aberrant ctDNA from cancer cells.

The exosomes/microvehicles segment is anticipated to grow at the fastest CAGR of 13.82% over the forecast period.Exosomes show significant advantages in liquid biopsy. Exosomes are present in almost all body fluids, including plasma, cerebrospinal fluid, and urine. They possess high stability and are encapsulated by lipid bilayers. Exosomes act as a common central participant between cells during cancer progression and metastasis. The complex signaling pathway network between exosome-mediated cancer cells and the tumor microenvironment acts as a crucial factor in cancer progression at all stages.

Application Insights

Based on application, the cancer segment led the market with the largest revenue share of 86.31% in 2024, owing to the rising adoption of liquid biopsy in the detection of cancer, aided by the rising prevalence of cancer globally. Liquid biopsy technology is one of the most evolving technologies in diagnostics and has made considerable headway in recent years, showing a significant growth in adoption in clinical applications. This approach is a fast-emerging precision oncology tool that allows for longitudinal monitoring and less invasive molecular diagnostics for therapy purposes. Furthermore, in June 2022, Elypta raised USD 21 million for the development of the MCED test, with the LEVANTIS-0087A study in progress for MCED.

The reproductive health segment is anticipated to grow at the fastest CAGR of 12.75% over the forecast period, owing to the promising R&D in the field of liquid biopsy is being considered for treating and maintaining reproductive health. The reproductive application segment is expected to grow profitably throughout the projection period. Furthermore, alliances and partnerships among reproductive health industry actors promote segment expansion. For instance, in September 2021, Bionano Genomics and NuProbe entered into a partnership on reproductive health and oncology liquid biopsy testing to give an option for the discovery of variations that NGS cannot detect.

End-use Insights

Based on end use, the hospitals and laboratories segment led the market with the largest revenue share of 42.44% in 2024. Hospitals are preferred for care due to the availability of various services under one roof. The biggest benefit of hospitals conducting cancer diagnosis is that they can offer results for tests even in emergencies. Liquid biopsy is helping doctors by giving them a highly precise cancer diagnosis in a shorter turnaround time, thereby reducing the treatment lag time. Cancer patients in the hospitals undergo routine monitoring for analysis of resistance to treatment. Chemotherapy has long been a successful and dependable cancer treatment. Chemotherapy may be used to treat cancer or to improve quality of life by symptom management. In addition, chemotherapy can improve the efficacy of other treatments like surgery or radiation therapy.

The specialty clinics segment is anticipated to grow at the fastest CAGR of 12.16% over the forecast period. An increase in awareness of personalized medicine, technological advancements, and a rise in demand for affordable services are some of the key factors expected to drive the growth of the specialty clinics segment. Another major factor expected to drive market growth is the increase in government initiatives to provide various facilities, such as compensation for diagnostic tests. Moreover, a number of healthcare institutions are working with laboratories to incorporate different clinical tests, such as microbiology testing.

Clinical Application Insights

Based on clinical application, the therapy selection segment led the market with the largest revenue share of 33.69% in 2024. The market's growth is attributed to the selection of treatment options that can be affected by liquid biopsies to improve patient outcomes. Cancer is the second leading cause of mortality in the U.S. and the most expensive disease to cure. Several advancements in cancer detection and biomarkers have been developed to aid in the study of cancer progression and the creation of successful treatment options. Liquid biopsies can assist improve cancer therapies by enabling early intervention, enhancing treatment control, and moving decision-making away from reactionary acts and toward more proactive early interventions. Early detection is also facilitating market growth.

The early screening segment is expected to grow at the fastest CAGR of 12.38% over the forecast period. The growth of the segment is attributed to the rise in prevalence of multiple cancers and the increase in need to provide efficient methods to detect them at early stages, to enable timely, appropriate treatment is anticipated to drive the market. For instance, according to the International Agency for Research on Cancer (IARC), over 20.7 million new cancer cases are expected in 2023. The need to develop diagnostic options that can detect cancer at an early stage, which can help improve disease management & reduce mortality, is likely to propel the overall market.

Product Insights

The instruments product segment dominated the market with the largest revenue share of 46.74% in 2024. The dominance of the segment is attributed to the launch of new instruments and the advancement of existing products. For instance, in 2022, Tempus added xF+, a liquid biopsy panel made up of 523 genes, a brand-new non-invasive test that focuses on pathogenic mutations in cfDNA, to its array of comprehensive genomic profiling services.

The kits and reagents product segment is expected to grow at a significant CAGR during the forecast period, owing to the increasing research and development activities by key market players for the development of advanced forms of kits and reagents. For instance, in 2021, Sysmex Inostics GmbH, along with Sysmex Europe GmbH, launched the Plasma-SeqSensei liquid biopsy kits for thyroid, non-small cell lung cancer, colorectal cancer, and melanoma cancer, only for research use. The recurring cost associated with kits and reagents further propels the growth of the market segment.

Sample Type Insights

Based on sample type, the blood sample segment led the market with the largest revenue share of 71.44% in 2024 and is projected to maintain its dominance over the forecast period. Blood-based liquid biopsy has remarkable advantages over traditional biopsy methods. Blood-based liquid biopsies are noninvasive, painless, and has no risk. In addition, it reduces time taken and cost for diagnosis. Exomes, CTCs, and cfDNAs, as well as microvesicles, in a blood sample can be detected, thus increasing adoption of blood-based liquid biopsy. Circulating biomarkers play a vital role in the understanding of tumorigenesis and metastasis, which further can help determine tumor dynamics at the time of treatment and disease progression. Moreover, the concentration of biomarkers in blood might allow quick detection of cancer stage and enable more favorable prediction regarding prognosis in patients.

The others segment is anticipated to grow at the fastest CAGR of 12.51% over the forecast period. Other’s segment includes urine, saliva, and Cerebrospinal Fluid (CSF)-based tests. Urine has also been used extensively for urinalysis and has proven applications in medical diagnosis. While it is not as commonly used in liquid biopsy studies, a few companies focus on developing urine-based liquid biopsy products. Collection of urine samples in large quantities is noninvasive, easier, and inexpensive. For instance, in August 2021, Nonacus entered a partnership with University of Birmingham to develop a noninvasive urine-based test for detection of bladder cancer.This test makes use of the company’s liquid biopsy technology and a panel of biomarkers approved by a team of scientists at the Bladder Cancer Research Centre of the University of Birmingham to diagnose the disease from a urine sample.

Regional Insights

North America dominated the liquid biopsy market with the largest revenue share of 51.15% in 2024, owing to high cancer prevalence, rapid technological advancements, and growing government initiatives. Moreover, the market is led by the U.S. owing to greater investments and the presence of several biotechnology companies that are developing advanced tests. Various organizations, including as the American Society of Clinical Oncology (ASCO), are working to support the deployment of liquid biopsy, which is expected to increase revenue in this market. The market is expected to grow during the forecast period owing to intense competition between biotechnology companies and increasing investments by governments in healthcare institutes to develop more sophisticated tests.

U.S. Liquid Biopsy Market Trends

The liquid biopsy market in the U.S. accounted for the largest market revenue share in North America in 2024. Rapid technological advancements, recent FDA approvals for liquid biopsy tests, and intense competition between companies are expected to boost market growth over the forecast period. For instance, in November 2023, Illumina, Inc. announced the launch of the next generation of its distributed liquid biopsy, TruSight Oncology 500 ctDNA v2 (TSO 500 ctDNA v2). The research assay enables noninvasive comprehensive genomic profiling of ctDNA from blood to complement tissue-based testing. Moreover, in November 2020, the FDA approved liquid biopsy NGS-based FoundationOne Liquid CDx test for multiple cancers and biomarkers. According to the American Cancer Society, in 2021, 235,760 people were estimated to be diagnosed with non-small cell lung cancer, the most common form of lung cancer in the U.S. Overall, around 1 in 17 men and 1 in 15 women are at risk of developing lung cancer in their lifetime. Thus, the need for the implementation of liquid biopsy tests is growing to diagnose and eradicate cancer in the target population.

Europe Liquid Biopsy Market Trends

The liquid biopsy market in Europe is expected to grow at an exponential CAGR during the forecast period, owing to an increase in the number of approvals by regulatory bodies, intense competition between companies to increase market share, government initiatives, and an improving reimbursement scenario. Collaborations between payers, hospitals, and companies are contributing to market growth. Moreover, it is believed that this technique can effectively replace solid tumor tests in most cancer screenings.

The UK liquid biopsy market is anticipated to grow at a significant CAGR during the forecast period. The presence of sophisticated healthcare infrastructure, collaborations between key market players, and the launch of novel products are anticipated to contribute to market growth in the UK. Government support & initiatives are expected to further propel the country’s cancer diagnostics market in the coming years. Commercial partnerships between the government and key players for routine use of liquid biopsy in the country are anticipated to drive market growth.

The liquid biopsy market in Germany is among the leading countries in the European market, owing to the increasing number of companies striving to enter the market and government-sponsored aid for developing these tests. Moreover, government negotiations with payers to improve reimbursement scenarios, as these tests are expensive, are expected to drive the adoption of liquid biopsy tests. In Germany, Merck and Sysmex Inostics received the first CE approval for liquid biopsy tests for patients with colorectal cancer. Furthermore, intense competition between various biotechnology companies, such as Epigenomics and Roche, is expected to boost market growth. Increasing collaborations between key market players in this region are expected to fuel market growth by increasing research opportunities and developing better test procedures.

Asia Pacific Liquid Biopsy Market Trends

The liquid biopsy market in Asia Pacific is expected to grow at the fastest CAGR of 13.02% over the forecast period, due to various factors, such as improving healthcare reforms. Some of the other factors contributing to market growth are increasing population, improving healthcare infrastructure, and the entry of new players. Asia Pacific has a large population and a high prevalence of cancer. According to Global Cancer Statistics, the estimated number of new cases of cancer in Asia in 2022 was 10.5 million. Government initiatives, such as free screening for breast cancer, cervical cancer, & lung cancer, and improved collaborations between the government, research institutes, & companies for the distribution & supply of these tests for screening cancers, have increased in the past few years.

The Japan liquid biopsy market is expected to grow at a rapid CAGR over the forecast period, owing to high government spending to reduce cancer prevalence. Many initiatives, such as government grants to various research institutes and companies, can help develop practical solutions to battle cancer. Multiple companies have collaborated with regional private universities to establish and provide liquid biopsy techniques. For instance, in March 2021, Japan’s Waseda University and Lucence partnered to develop a high-speed liquid biopsy laser-based imaging platform for early cancer diagnosis.

The liquid biopsy market in China is expected to grow at a significant CAGR during the forecast period. The rising prevalence of cancer and the need to accelerate clinical development processes to enhance patient treatment options are major factors expected to fuel the market. In 2020, around 4.5 million cancer cases were diagnosed in China, with lung cancer being most common among men, accounting for 5,40,000 cases, and breast cancer being most common among females, with more than 4,00,000 cases being diagnosed. This increase in incidence is likely to propel the need for effective diagnostics further. For instance, in September 2023, Adicon Holdings Limited, a clinical laboratory company, announced offering liquid biopsy tests from Guardant Health to advance clinical research in the country by providing access to comprehensive genomic profiling in patients with advanced solid cancers and supporting investigational drug studies.

Latin America Liquid Biopsy Market Trends

The liquid biopsy market in Latin America is projected to grow at a significant CAGR during the forecast period, owing to the increased prevalence of various types of cancer in the region. Several surveys by various government and nonprofit organizations revealed that overall cancer mortality in Latin America is almost twice that of high-income countries.

MEA Liquid Biopsy Market Trends

The liquid biopsy market in the Middle East and Africa is one of the regions with tremendous growth opportunities, as the majority of the market is untapped due to the unavailability of organized cancer screening programs in this region, especially in underdeveloped African countries. In recent years, countries such as the UAE, Morocco, & South Africa have implemented organized cancer screening programs. Collaborations of various companies with government institutes to supply these tests are also expected to boost the market. These initiatives are anticipated to lead to the development of newer liquid biopsy tests.

Key Liquid Biopsy Company Insight

The liquid biopsy industry is driven by a mix of established leaders and emerging innovators, each employing distinct strategies to enhance their market footprint. Major players such as ANGLE plc, Oncimmune Holdings PLC, Guardant Health, Myriad Genetics, Inc., Biocept, Inc., Lucence Health Inc., Freenome Holdings, Inc., F. Hoffmann-La Roche Ltd., QIAGEN, Illumina, Inc., Thermo Fisher Scientific, Inc., Epigenomics AGmaintain dominance through continuous test innovations, acquisitions, and strategic partnerships aimed at expanding service offerings and reinforcing their global presence. For instance, in November 2023, Illumina Inc. announced the new TruSight Oncology 500 ctDNA v2, a new generation of its liquid biopsy assay for genomic profiling.

Key Liquid Biopsy Companies:

The following are the leading companies in the liquid biopsy market. These companies collectively hold the largest market share and dictate industry trends.

- ANGLE plc

- Oncimmune Holdings PLC

- Guardant Health

- Myriad Genetics, Inc.

- Biocept, Inc.

- Lucence Health Inc.

- Freenome Holdings, Inc.

- F. Hoffmann-La Roche Ltd.

- QIAGEN

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Epigenomics AG

Recent Development

-

In April 2025, Labcorp announced the expansion of announced the expansion of its precision oncology portfolio with two new offerings. The first is Labcorp Plasma Detect, a clinical test designed to help evaluate the risk of disease recurrence in patients with stage III colon cancer. The second is PGDx elio plasma focus Dx, the first and only FDA-authorized kitted liquid biopsy test for pan-solid tumors, which supports the identification of patients who may be eligible for targeted therapies.

-

In January 2025, Tempus AI, Inc. announced the launch of its FDA-approved next-generation sequencing (NGS)-based in vitro diagnostic test, xT CDx. The test is available to all ordering clinicians across the U.S. xT CDx provides comprehensive genomic insights through one of the largest FDA-approved gene panels currently on the market.

-

In February 2024, Myriad Genetics, Inc., collaborated with the National Cancer Center Hospital East in Japan to initiate a SCRUM-MONSTAR-SCREEN-3 study for the prognostic and predictive value of molecular residual disease testing.

-

In January 2024, QIAGEN opened its regional headquarters in Saudi Arabia and signed an MoU with the Ministry of Health of Saudi Arabia to support public health initiatives.

-

In January 2024, Myriad Genetics, Inc., acquired the Intermountain Precision Genomics (IPG) laboratory business from Intermountain Health, including the Precise liquid test and IPG’s CLIA-certified laboratory in Utah.

Liquid Biopsy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.26 billion

Revenue forecast in 2030

USD 22.88 billion

Growth rate

CAGR of 11.54% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sample type, biomarker, technology, end-use, application, clinical application, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

QIAGEN; Myriad Genetics, Inc; BIOCEPT, Inc; Guardant Health; F. Hoffmann-La Roche Ltd; Illumina, Inc; ANGLE plc; Oncimmune Holdings PLC; Thermo Fisher Scientific, Inc.; Lucence Health, Inc.; Freenome Holdings, Inc.; Epigenomics AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Biopsy Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global liquid biopsy market report based on sample type, biomarker, technology, application, end-use, clinical application, product, and region:

-

Sample Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Blood Sample

-

Others

-

-

Biomarker Outlook (Revenue, USD Billion, 2018 - 2030)

-

Circulating Tumor Cells (CTCs)

-

Circulating Tumor DNA (ctDNA)

-

Extracellular Vehicles (EVs)

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Multi-gene parallel Analysis (NGS)

-

Single Gene Analysis (PCR Microarrays)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cancer

-

Lung Cancer

-

Prostate Cancer

-

Breast Cancer

-

Colorectal Cancer

-

Leukemia

-

Gastrointestinal Cancer

-

Others

-

-

Reproductive Health

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals and Laboratories

-

Specialty Clinics

-

Academic and Research Centers

-

Others

-

-

Clinical Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Therapy Selection

-

Treatment Monitoring

-

Early Cancer Screening

-

Recurrence Monitoring

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instruments

-

Consumables Kits and Reagents

-

Software and Services

-

-

Regional Outlook (Revenue, USD Billion, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global liquid biopsy market size was estimated at USD 11.85 billion in 2024 and is expected to reach USD 13.26 billion in 2025.

b. The global liquid biopsy market is expected to grow at a compound annual growth rate of 11.54% from 2025 to 2030 to reach USD 22.88 billion by 2030.

b. North America dominated the liquid biopsy market with a share of 51.15% in 2024. This is attributable to high cancer prevalence, rapid technological advancements, and growing government initiatives. Moreover, the market is led by U.S. owing to greater investments and presence of several biotechnology companies that are developing advanced tests.

b. Some key players operating in the liquid biopsy market include QIAGEN; Myriad Genetics, Inc; BIOCEPT, Inc; Guardant Health; F. Hoffmann-La Roche Ltd; Illumina, Inc; ANGLE plc; Oncimmune Holdings PLC; Thermo Fisher Scientific, Inc.; Lucence Health, Inc.; Freenome Holdings, Inc.; Epigenomics AG

b. Key factors that are driving the market growth include factor such as the growing prevalence of cancer, technological advancements in cancer diagnostics, and rising preference for minimally invasive cancer diagnostics. Moreover, ongoing research for the development of liquid biopsy assays and tests aided with the rising adoption and development of multi-cancer early detection tests is providing a major opportunity for growth of overall market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.