- Home

- »

- Biotechnology

- »

-

Circulating Tumor Cells Market Size, Industry Report, 2033GVR Report cover

![Circulating Tumor Cells Market Size, Share & Trends Report]()

Circulating Tumor Cells Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Clinical, Research), By Specimen (Bone Marrow, Blood), By Product (Kits & Reagents, Blood Collection Tubes), By Technology, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-287-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Circulating Tumor Cells Market Summary

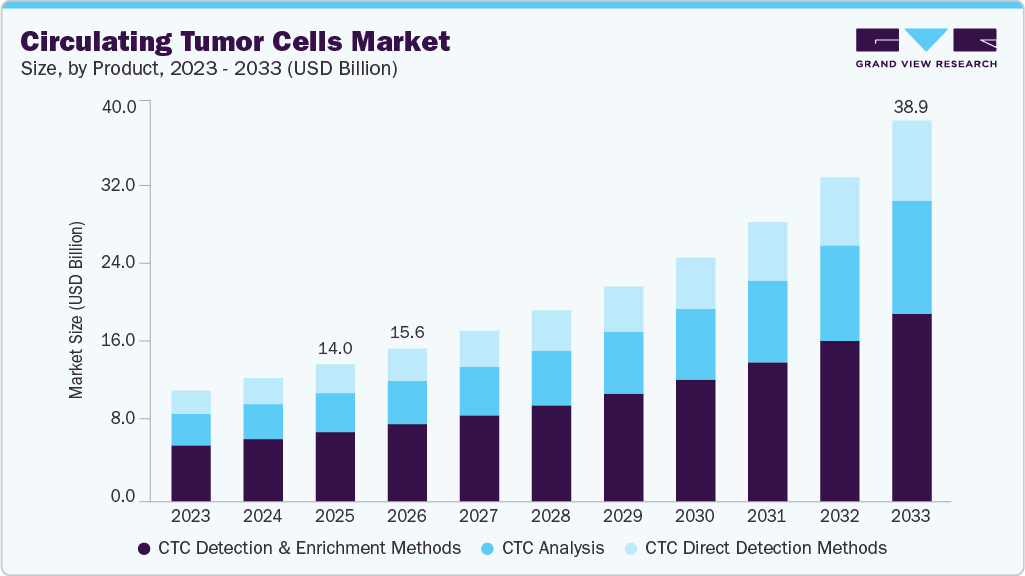

The global circulating tumor cells market size was estimated at USD 14.04 billion in 2025 and is projected to reach USD 38.95 billion by 2033, expanding at a CAGR of 13.92% from 2026 to 2033, owing to the non-invasiveness and advantages offered by circulating tumor cells (CTC), it is considered a promising tool in cancer diagnosis. In addition, technological advancements in chip technology are another key factor driving market growth.

Key Market Trends & Insights

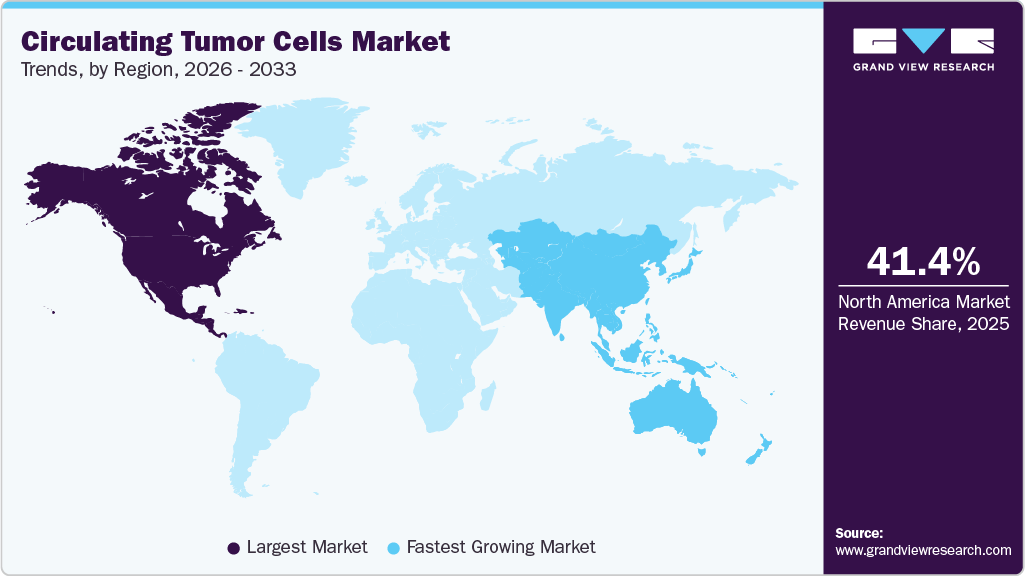

- The North America circulating tumor cells market held the largest share of 41.40% of the global market in 2025.

- The circulating tumor cells industry in the U.S. is expected to grow significantly over the forecast period.

- By application, clinical segment dominated the market and captured the largest revenue share of 68.40% in 2025.

- By product, the kits & reagents segment dominated the market and accounted for the largest revenue share in 2025.

- By specimen, the blood segment dominated the market and accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 14.04 Billion

- 2033 Projected Market Size: USD 38.95 Billion

- CAGR (2026-2033): 13.92%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

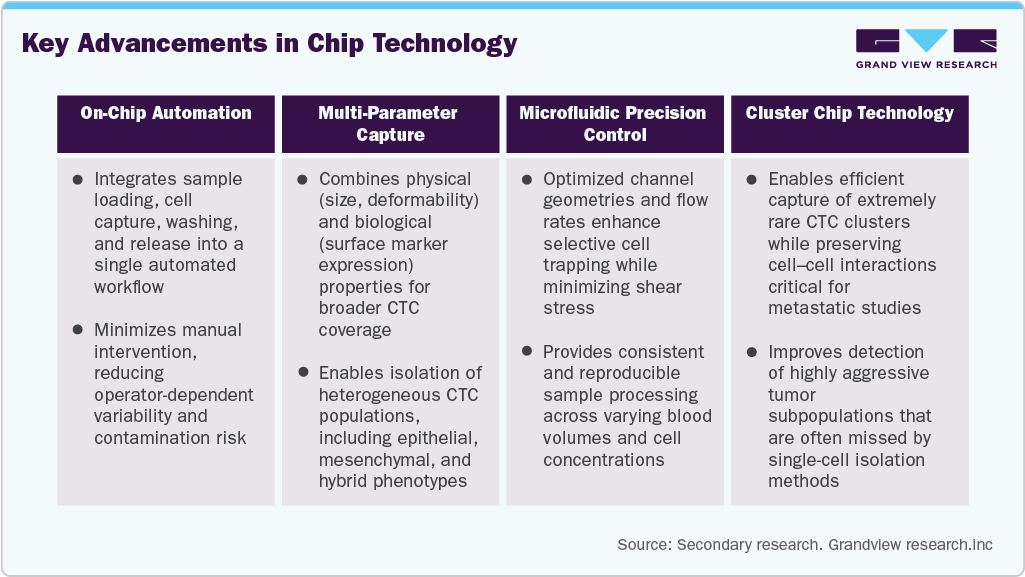

Advancements In Chip Technology

The ongoing advancements in chip technology have positively impacted market growth. Cluster chip technology plays a role in capturing the exceptionally rare group of cells, such as CTCs. Isolation of CTCs is a cumbersome process and requires high accuracy. Chip technology helps perform precise CTC isolation but also helps overcome the challenges associated with isolation devices developed by key companies. The challenges include lower sensitivity, the inability to capture CTCs of all sizes & types, high manufacturing costs, and difficulty retrieving captured CTCs from the devices for further laboratory analysis. Moreover, the white blood cells that contaminate trapped CTCs, which are similar in size, can be mistakenly regarded as CTCs, a limitation associated with these devices.

Moreover, advancements in microfabrication, surface chemistry, and biomaterial engineering have further enhanced the performance of CTC isolation chips. In addition, the development of label-free and hybrid capture approaches allows isolation of heterogeneous CTC populations without reliance on a single biomarker, thereby reducing false negatives. These innovations, combined with improved scalability and compatibility with downstream molecular analysis, are strengthening the clinical and research adoption of chip-based CTC technologies and supporting sustained market growth.

Growing demand for early and rapid cancer diagnosis

The rising emphasis on early and rapid cancer diagnosis is driving the circulating tumor cells (CTCs) market. CTCs, shed from primary or metastatic tumors into the bloodstream, act as minimally invasive biomarkers that provide real-time insights into tumor progression. Early detection enables timely treatment and better patient outcomes, increasing the adoption of CTC-based technologies in clinical settings.

Advancements in CTC detection and isolation platforms, such as microfluidic devices and immunoaffinity-based chips, are enabling faster and more accurate diagnostics. Integration with molecular and genomic profiling further supports personalized treatment by revealing tumor heterogeneity and drug resistance, boosting market growth.

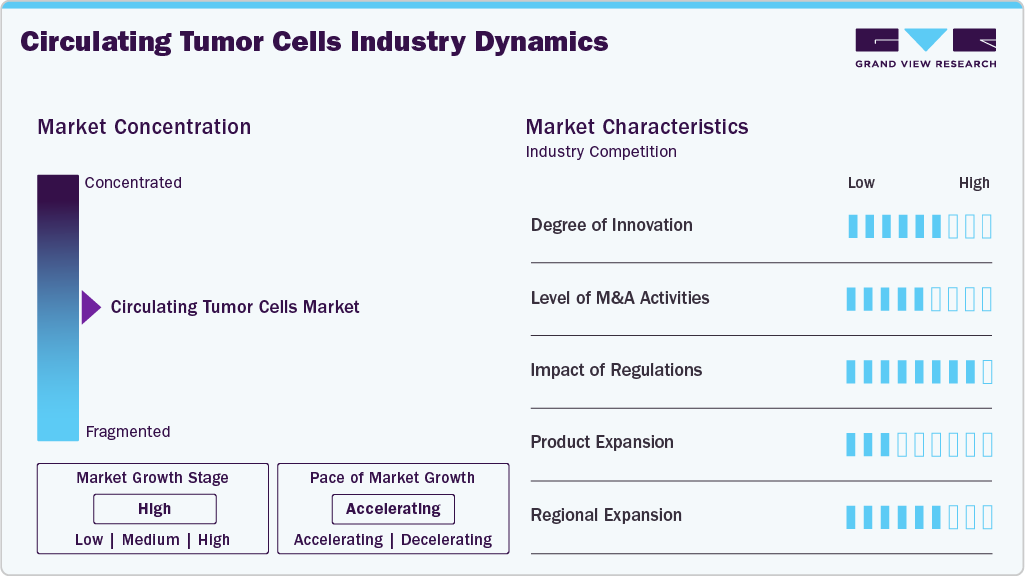

Market Concentration & Characteristics

The CTC industry has seen notable innovations, including microfluidic chips for capture, advanced imaging for detection, and machine learning for analysis. These technologies improve accuracy and reliability in assessing a patient’s cancer status.

The circulating tumor cells industry is marked by active M&A, driving focus on applications such as early detection, treatment monitoring, and personalized medicine. For instance, in May 2023, Menarini Silicon Biosystems partnered with Alivio Health to offer CELLSEARCH liquid biopsy tests, enabling noninvasive CTC analysis for earlier diagnosis and improved treatment decisions.

Regulations can have a significant impact on the CTC industry. Regulatory bodies such as the FDA play a crucial role in determining the safety and efficacy of CTC products. Stringent regulations can lead to delays in approving new CTC products, which can slow innovation and limit the options available to patients and healthcare providers.

As the circulating tumor cells industry evolves, companies are expanding their product offerings through new technologies, strategic collaborations, and integration with multi-omics approaches. For instance, in December 2021, Epic Sciences launched DefineMBC, a blood-based test designed to improve care for patients with metastatic breast cancer.

As the CTC market grows, regional expansion plays a crucial role in increasing market penetration, regulatory approvals, and adoption rates. Increasing adoption in developing countries due to rising cancer cases & government initiatives is a major driver for regional expansion. For instance, China: CFDA (NMPA) has approved CellSearch for CTC detection, boosting hospital adoption.

Technology Insights

The CTC detection and enrichment methods segment accounted for the largest revenue share of 50.68% in 2025. The availability of different approaches to enrich circulating tumor cells in cancer detection is expected to significantly impact segment growth over the forecast period. Various techniques for CTC detection include magnetic beads-based centrifugal force, enrichment, filtration, and other physical properties such as density, deformity, size, & electric charges.

CTC analysis is expected to register the fastest CAGR during the forecast period. Understanding sub clonal intratumor heterogeneity using CTC detection can help clinicians determine the underlying reasons for unresponsive patients subjected to targeted therapy, eventually leading to enhanced cancer therapies. Hence, CTC analysis is a minimally invasive method in repetitive analysis and a validated technology for tumor study & clinical decision-making.

Application Insights

Clinical applications dominated the market and captured the largest revenue share in 2025. In a liquid biopsy, the analysis of CTCs in a cancer patient’s bloodstream has received significant attention for their potential clinical utility. The number of CTCs in a patient’s blood can differ based on cancer type, stage, and treatment. The number of CTCs found in the patient’s bloodstream indicates the state of the disease. Patients in the later stages of cancer show a higher number of CTCs than patients in the early stages of cancer.

The research segment is expected to grow significantly, as CTCs serve as key biomarkers for cancer metastasis, therapy monitoring, and early detection of metastases, often outperforming conventional imaging. Focus has shifted to CTC characterization and isolation, creating opportunities in predictive testing. For example, in April 2021, Bio-Techne acquired Asuragen for USD 215 million to enhance its molecular testing solutions for researchers and clinicians.

Product Insights

The kits & reagents segment dominated the market and accounted for the largest revenue share of 44.96% in 2025 and expected to grow at the fastest CAGR throughout the forecast period. This can be attributed to frequent purchases and high usage rates. For instance, CellSearch Circulating Tumour Cell Kit, authorized by the U.S. FDA, is one of the most popular products produced in the U.S. In addition, the availability of a robust product portfolio coupled with advancements in microfluidics technology is expected to propel market growth.

The devices or systems segment is expected to grow at a significant CAGR during the forecast period. The introduction of fabricated glass microchips to overcome the challenges and to increase technical completeness for mass production is expected to propel the segment growth. The development of automated instruments that eliminate the use of additional blood collection tubes reduces the cost of blood collection tubes.

Specimen Insights

The blood specimen segment dominated the market and accounted for the largest revenue share of 47.98% in 2025. A large concentration of these cells in blood samples compared with other biospecimens is responsible for the largest penetration of this specimen type. Approaches for tumor cell identification in blood samples are considered important in current cancer research, as they aid in predicting prognosis and determining the response to systemic chemotherapy. However, using whole blood as a specimen poses a challenge when combined with microfluidic technology.

The bone marrow segment is expected to register a strong CAGR during the forecast period, as bone marrow CTC analysis is widely used in cancer research and clinical trials to study metastasis and support novel therapy development. In addition, growing demand for CTC analysis using other body fluid specimens, such as blood and cerebrospinal fluid, is further supporting overall segment growth.

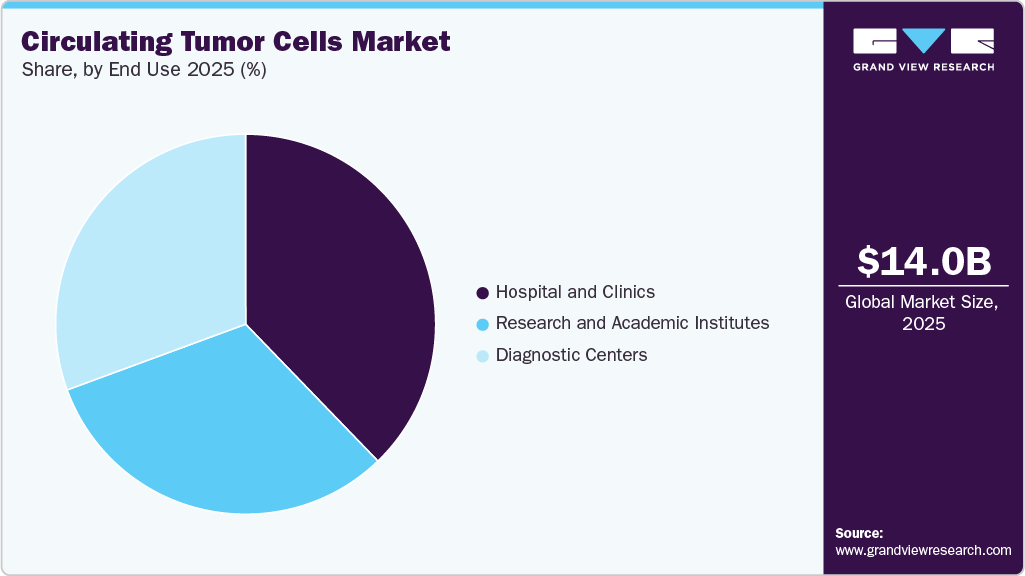

End Use Insights

Hospitals and clinics dominated the market and accounted for the largest revenue share of 37.78% in 2025. The large share of the segment is due to direct patient care, treatment planning, and integration with oncology departments. Moreover, the increasing adoption of liquid biopsy for cancer monitoring is also attributed to segment growth.

Research and academic institutes.is expected to register the fastest CAGR during the forecast period. This can be attributed to the increasing focus on research and development activities for cancer diagnosis and treatment. These institutes invest heavily in advanced technologies and equipment to enhance CTC detection and analysis accuracy and efficiency.

Regional Insights

North America accounted for the largest market share of 41.40% in 2025, driven primarily by the U.S. Key players in the region are implementing strategic initiatives to strengthen their market presence. The U.S. is expected to remain the primary growth contributor due to the rising cancer burden, ongoing product approvals, and increased R&D activity.

U.S Circulating Tumor Cells Market Trends

The circulating tumor cells industry in the U.S. benefits from extensive clinical research activities and the strong presence of biotechnology firms developing innovative CTC isolation technologies. The country's favorable regulatory environment for liquid biopsy products and growing investment in precision oncology is accelerating the adoption of CTC-based tests for monitoring treatment response and detecting minimal residual disease.

Europe Circulating Tumor Cells Market Trends

The CTC market in Europe is expanding due to the increasing adoption of liquid biopsy solutions for cancer management. Research institutions and healthcare providers across the region are actively exploring CTC technologies for early detection, prognosis, and therapy monitoring.

The UK circulating tumor market is experiencing significant growth due to growing investments in precision medicine initiatives. Collaborative research projects drive the development of CTC-based diagnostic tools.

The circulating tumor market in Germany is growing due to its well-established healthcare infrastructure, coupled with strong academic research in oncology, which is propelling the adoption of CTC analysis.

Asia Pacific Circulating Tumor Cells Market Trends

The circulating tumor cells market in the Asia Pacific is witnessing fastest growth with the CAGR of 13.23% throughout the forecast period, owing to the demand for CTC technologies due to an increasing cancer burden, rising healthcare expenditure, and expanding research initiatives. Countries such as China and Japan invest heavily in developing liquid biopsy tools, boosting market growth. Government support for cancer diagnostics and growing awareness about non-invasive testing further propel adoption.

China circulating tumor cells industry growth is driven by increasing investments in biotechnology research and collaborations between domestic and international firms. The country's focus on precision medicine and rising cancer incidence has created significant demand for CTC-based diagnostic tools, particularly for lung and gastric cancers.

The circulating tumor cells market in Japan is growing due to advancements in molecular diagnostics and strong research capabilities. The country's emphasis on early cancer detection and personalized medicine has increased the integration of CTC analysis in clinical practice, particularly for breast and prostate cancer.

MEA Circulating Tumor Cells Market Trends

The circulating tumor cells (CTC) market in the Middle East & Africa is gaining momentum due to increasing investments in healthcare infrastructure and growing awareness of advanced cancer diagnostics. Partnerships between healthcare institutions and global biotech firms are further accelerating the adoption of liquid biopsy solutions.

The circulating tumor cells market in Kuwait is growing significantly due to the growing prevalence of cancer and increasing investments in diagnostic innovations. The country's healthcare sector is expanding its focus on precision oncology, with medical institutions exploring noninvasive methods such as CTC analysis to improve cancer diagnosis, prognosis assessment, and treatment monitoring.

Key Circulating Tumor Cells Company Insights

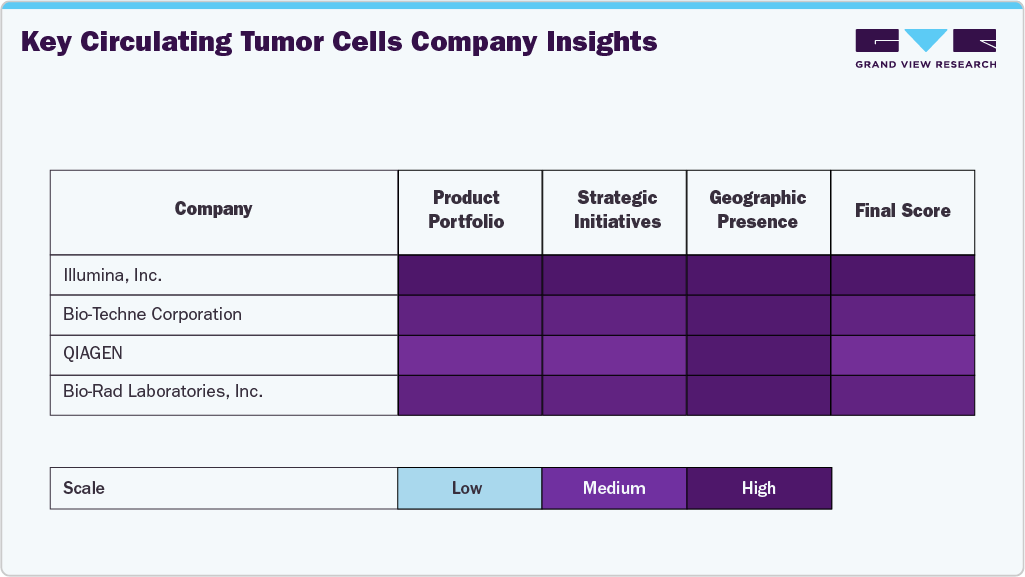

QIAGEN, Bio-Rad Laboratories, and Miltenyi Biotec exhibit high scores across all parameters, indicating a strong product portfolio, strategic initiatives, and global presence.

These companies are well positioned in the market due to their broad offerings and international reach. Ikonisys Inc. and Creative Biolarray show medium rankings in strategic initiatives while maintaining high scores in other areas. This suggests that while they have strong market penetration, they may need to enhance their strategic initiatives to remain competitive. Bio-Techne Corporation and Epic Sciences have room for growth in expanding collaborations, partnerships, and innovation strategies.

Key Circulating Tumor Cells Companies:

The following are the leading companies in the circulating tumor cells market. These companies collectively hold the largest Market share and dictate industry trends.

- QIAGEN

- Bio-Techne Corporation

- Precision Medicine Group, LLC.

- Bio-Rad Laboratories, Inc.

- Natera, Inc.

- Illumina, Inc.

- Cell Microsystems

- Greiner Bio One International GmbH

- Ikonisys Inc.

- Miltenyi Biotec

Recent Developments

-

In March 2024, Bio-Rad Laboratories, Inc. launched validated antibodies for rare cell and circulating tumor cell (CTC) enumeration, enhancing tools available for CTC research and diagnostics.

-

In August 2023, Cell Microsystems acquired Fluxion Biosciences, Inc. This acquisition enabled precise measurement of electrical currents across cell membranes, providing insights into ion channel activity and cell signaling.

-

In June 2023, Bio-Techne announced the acquisition of LunaPhore, a Swiss company developing advanced tissue imaging and analysis technologies. By integrating LunaPhore's expertise into its existing portfolio, Bio-Techne aimed to create a comprehensive, end-to-end workflow for researchers studying tissues. The acquisition is expected to close in the first quarter of 2024.

-

In March 2023, Miltenyi Biotec acquired Lino Biotech AG. This acquisition of Lino Biotech's innovative biosensor technology was expected to help develop new & improved assays and quality control processes in the field.

Circulating Tumor Cells Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 15.64 billion

Revenue forecast in 2033

USD 38.95 billion

Growth rate

CAGR of 13.92% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, product, specimen, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

QIAGEN; Bio-Techne Corporation; Precision Medicine Group, LLC.; Bio-Rad Laboratories, Inc.; Natera, Inc.; Illumina, Inc.; Cell Microsystems; Greiner Bio One International GmbH; Ikonisys Inc.; Miltenyi Biotec

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Circulating Tumor Cells Market Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global circulating tumor cells market on the basis of technology, application, product, specimen, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Circulating Tumor Cells CTC Detection & Enrichment Methods

-

Immunocapture (Label-based)

-

Positive Selection

-

Negative Selection

-

-

Size-based Separation (Label-free)Density-based Separation (Label-free)

-

Membrane-based

-

Microfluidic-based

-

-

Density-based Separation (Label-free)

-

Combined Methods

-

-

CTC Direct Detection Methods

-

CTC Analysis

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical

-

Risk Assessment

-

Screening and Monitoring

-

-

Research

-

Cancer Stem Cell & Tumorogenesis Research

-

Drug/Therapy Development

-

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Kits & Reagents

-

Blood Collection Tubes

-

Devices or Systems

-

-

Specimen Outlook (Revenue, USD Million, 2021 - 2033)

-

Blood

-

Bone Marrow

-

Other Body Fluids

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Research and Academic Institutes

-

Hospital and Clinics

-

Diagnostic Centers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global circulating tumor cells market size was estimated at USD 14.04 billion in 2025 and is expected to reach USD 15.64 billion in 2026.

b. The global circulating tumor cells market is expected to grow at a compound annual growth rate of 13.92% from 2026 to 2033 to reach USD 38.95 billion by 2033.

b. In 2025, the CTC detection and enrichment methods segment accounted for the largest revenue share of 50.68%. The availability of different methods for the enrichment of circulating tumor cells in cancer detection is expected to significantly impact segment growth over the forecast period.

b. Some key players operating in the CTCs market include QIAGEN; Bio-Techne Corporation; Precision Medicine Group, LLC.; Bio-Rad Laboratories, Inc.; Natera, Inc.; Illumina, Inc.; Cell Microsystems; Greiner Bio One International GmbH; Ikonisys Inc.; Miltenyi Biotec;

b. Key factors that are driving the circulating tumor cells market growth include rising cancer prevalence, increasing preference for non-invasive cancer diagnosis, and technological advancements in CTC isolation and analysis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.