- Home

- »

- Bulk Chemicals

- »

-

Paraxylene Market Size, Trends & Outlook, Industry Report, 2012-2022GVR Report cover

![Paraxylene Market Size, Share & Trends Report]()

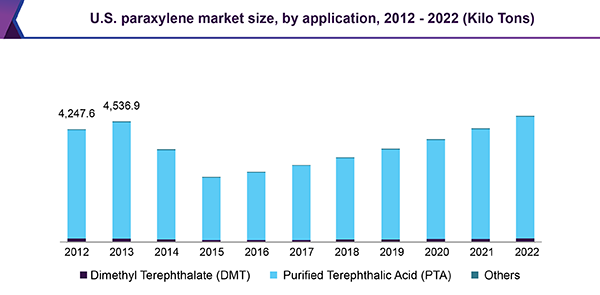

Paraxylene Market Size, Share & Trends Analysis Report By Application (Dimethyl Terephthalate, Purified Terephthalic Acid), By Region (North America, APAC, Europe, MEA, CSA), And Segment Forecasts, 2012 - 2022

- Report ID: 978-1-68038-693-6

- Number of Pages: 72

- Format: Electronic (PDF)

- Historical Data: 2014-2016

- Industry: Research

Report Overview

The global paraxylene market size was valued at USD 36.1 billion in 2016 and is expected to develop at an estimated CAGR of 10.5% over the forecast period. Stable demand from polyester manufacturers emerged as one of the major driving factors for product demand. Paraxylene (PX) is primarily utilized in the production of purified terephthalic acid (PTA) and dimethyl terephthalate (DMT). These products are used in polyester manufacturing. PX is used as a solvent in the production of herbicides and di-paraxylene.

Polyester is primarily used for PET resin, fibers, films along with other plastic applications. The product is projected to witness high demand owing to a wide range of applications such as textiles, construction material, and packaging. Growing demand for polyester fiber in emerging economies such as India, Vietnam, Bangladesh, and Brazil is providing substantial growth potential for paraxylene.

Development in applications such as PET and polyester, primarily in Asia Pacific is anticipated to drive the PX market growth over the coming years. Developing countries are providing monitory benefits for PX and PTA production. This is creating substantial growth prospects for the market. Usage of non-traditional feedstock and lower feedstock consumption are projected to boost demand for paraxylene over the coming years.

Rising demand for natural substitutes to conventional products and development of bio-based products are projected to hamper growth of the market for paraxylene in near future. PX being moderately hazardous to aquatic organisms and environment, several regulatory bodies strictly monitor production units to control plant-generated emission. Rising concerns about non-disposability of PET and prices of resin are creating requirement for bio-based PET. This is pushing manufacturers to develop bio routes to PX and PTA, which are key raw materials for PET. Major users of PET such as PepsiCo and Coca-Cola have announced joint ventures and partnerships with renewable chemical technology developers such as Virent, Gevo, and Avantium.

PET industry has witnessed increased consumption from various applications such as textiles, packaging, and construction materials over the past few years. A similar trend is estimated to continue over the forecast period. Growing polyester fiber demand in emerging markets of India, Bangladesh, Vietnam, and Brazil has provided sufficient impetus for the market to penetrate into these segments.

Increasing demand for mixed xylene, a key raw material for paraxylene production, is expected to hinder market growth in the near future. Capacity expansion in emerging markets of Asia Pacific, Middle East, and Latin America is aimed at supply chain debottlenecking and providing downstream sectors stable long-term raw material availability. Innovative production technologies to minimize resource waste and meet stringent emission standards are believed to foster paraxylene market growth.

Application Insights

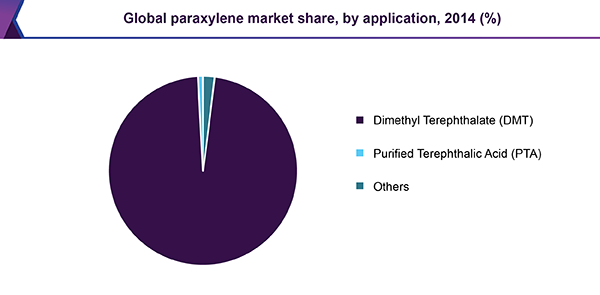

By application, the market is segmented into PTA, DMT, and others. PTA emerged as the dominant application segment with a market share of more than 97% in 2016. Other applications include herbicides and di-paraxylene. Virtually, PTA is the sole driver for product demand as around 97% of the total PX demand goes into PTA production.

High demand for PTA in polyester application is providing substantial growth potential for this product segment. PET is widely utilized in bottling and packaging of soft drinks. Growth in the beverage industry along with development in packaging and bottling technologies is projected to develop demand for PTA over the coming years.

In comparison to DMT, PTA has better production economics and lower capital cost which makes it a preferred feedstock for numerous end-use industries. Polyester manufacturers prefer PTA over DMT owing to its economic nature which is restricting growth of DMT application. However, demand from manufacturing of engineering polymers such as polybutylene terephthalate is anticipated to propel growth of DMT over the forecast period.

Regional Insights

In 2016, Asia Pacific emerged as the largest market for paraxylene with a share of more than 79%. The industry is projected to witness oversupply of the product owing to planned capacity expansion in India and China over the forecast period. Rising demand for polyester in packaging and textile applications and rapid industrialization are projected to further foster regional market development. In Southeast Asian nations such as Vietnam, Indonesia, and Thailand, huge demand for polyester is projected to impel growth over the coming years.

North America accounted for more than 11% of the global market in 2016. Capacity underutilization in Europe and North America owing to unstable feedstock supply over the past few years has resulted in tight supply of paraxylene. Stringent Registration, Evaluation, Authorisation and restriction of CHemicals (REACH) regulations mainly in EU27 nations regarding burning and manufacturing of petrochemicals is acting as a restraint for the market.

Key Companies & Market Share Insights

The market is highly fragmented among numerous industry participants. Entry of numerous new small-scale companies has resulted in oversupply of paraxylene. This oversupply has reduced demand for PTA, which is pushing manufacturers to reduce their operating rates.

Major companies operating in the global market for paraxylene include BP, CNPC, JX Nippon Oil & Energy Corp., S-Oil, and Reliance Industries Ltd. Other notable companies include Dragon, NPC Iran, GS Caltex, FCFC, ONGC, Orpic, Jurong Aromatics Corp., KPPC, China National Offshore Oil Corporation (CNOOC), Lotte KP Chemical, PTT, Yanbu Aramco Sinopec Refining Company Ltd., Toyo, Pertamina, and Teijin Fibers.

These companies have been investing heavily in capacity expansions and R&D activities to meet increasing demand. Companies have also been exploring ways to develop bio-based paraxylene to reduce dependency on petrochemical feedstock and to ensure sustainability.

Paraxylene Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 48.72 billion

Revenue forecast in 2022

USD 66.94 billion

Growth Rate

CAGR of 10.5% from 2017 to 2022

Base year for estimation

2016

Historical data

2013 - 2015

Forecast period

2017 - 2022

Quantitative units

Revenue in USD billion and CAGR from 2017 to 2022

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; France; China; India; Japan; Brazil;

Key companies profiled

BP, CNPC, JX Nippon Oil & Energy Corp., S-Oil, Reliance Industries Ltd., Dragon, NPC Iran, GS Caltex, FCFC, ONGC, Orpic, Jurong Aromatics Corp., KPPC, China National Offshore Oil Corporation (CNOOC), Lotte KP Chemical, PTT, Yanbu Aramco Sinopec Refining Company Ltd., Toyo, Pertamina, and Teijin Fibers.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2012 to 2022. For the purpose of this study, Grand View Research has segmented the global paraxylene market report on the basis of application and region:

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2012 - 2022)

-

Dimethyl Terephthalate (DMT)

-

Purified Terephthalic Acid (PTA)

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2012 - 2022)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

France

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global paraxylene market size was estimated at USD 48.72 billion in 2019 and is expected to reach USD 53.87 billion in 2020.

b. The global paraxylene market is expected to grow at a compound annual growth rate of 10.5% from 2017 to 2022 to reach USD 66.94 billion by 2022.

b. Asia Pacific dominated the paraxylene market with a share of 82.3% in 2019. This is attributable to rising demand for polyester in packaging and textile applications and rapid industrialization.

b. Some key players operating in the paraxylene market include BP, CNPC, JX Nippon Oil & Energy Corp., S-Oil, Reliance Industries Ltd., Dragon, NPC Iran, GS Caltex, FCFC, ONGC, Orpic, Jurong Aromatics Corp., KPPC, China National Offshore Oil Corporation (CNOOC), Lotte KP Chemical, PTT, Yanbu Aramco Sinopec Refining Company Ltd., Toyo, Pertamina, and Teijin Fibers.

b. Key factors that are driving the market growth include rising demand for polyester from textiles, construction material, and packaging industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."