- Home

- »

- Advanced Interior Materials

- »

-

Textile Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Textile Market Size, Share & Trends Report]()

Textile Market (2026 - 2033) Size, Share & Trends Analysis Report By Raw Material (Cotton, Wool, Chemical, Silk), By Product (Natural Fibers, Polyester, Nylon), By Application (Household, Technical, Fashion & Clothing), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-736-0

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Textile Market Summary

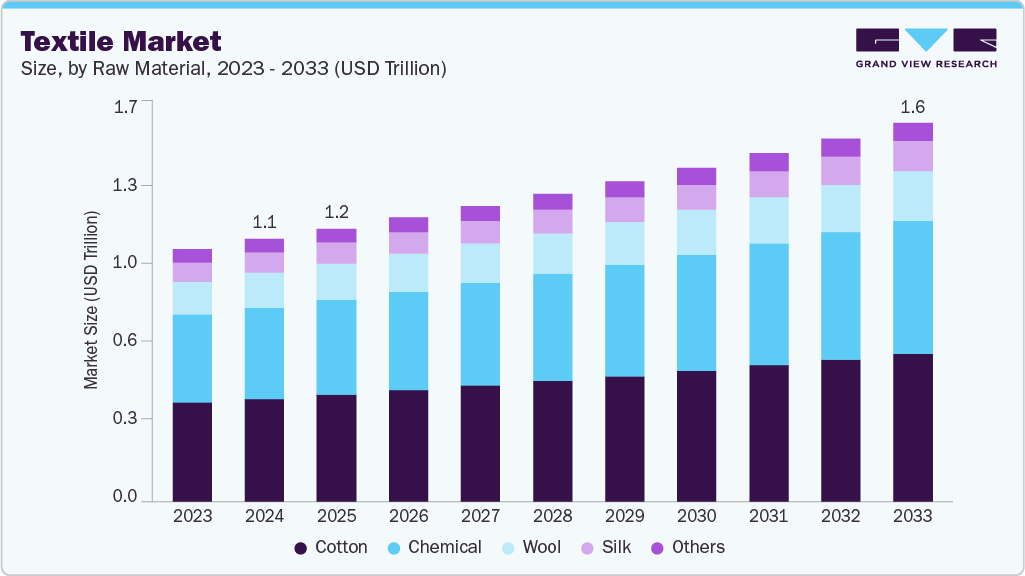

The global textile market size was estimated at USD 1.16 billion in 2025 and is projected to reach USD 1.61 billion by 2033, growing at a CAGR of 4.2% from 2026 to 2033. The demand for textiles is rising due to fast fashion, growing urbanization, and increasing disposable incomes in emerging economies.

Key Market Trends & Insights

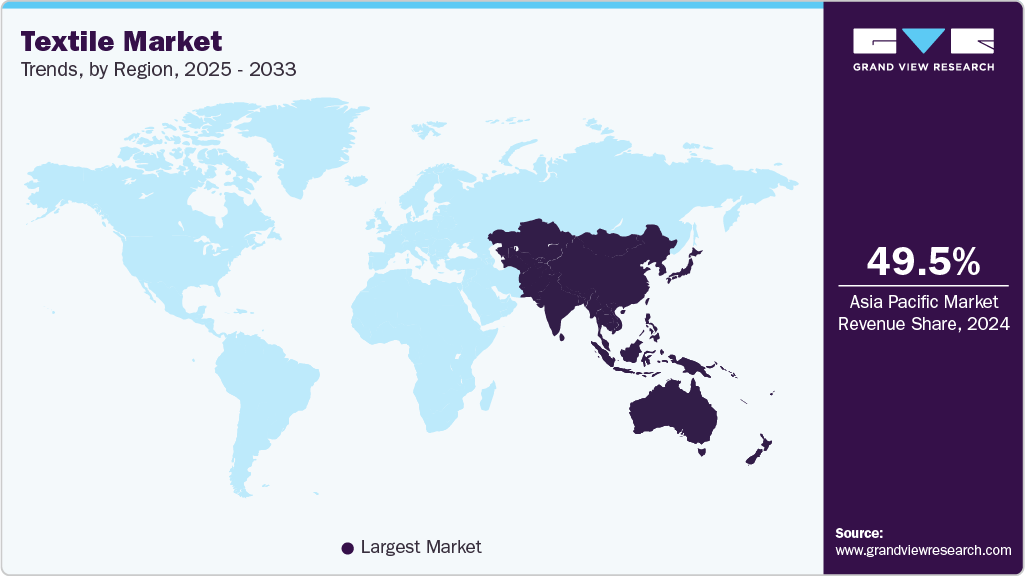

- Asia Pacific dominated the textile market with the largest revenue share of 49.9% in 2025.

- By raw material, the silk segment is expected to grow at the fastest CAGR of 4.5% from 2026 to 2033.

- By product, the nylon segment is expected to grow at the fastest CAGR of 4.9% from 2026 to 2033.

- By application, the household segment is expected to grow at the fastest CAGR of 4.9% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 1.16 Billion

- 2033 Projected Market Size: USD 1.61 Billion

- CAGR (2025-2033): 4.2%

- Asia Pacific: Largest Market in 2025

Consumer preferences are shifting toward trendy, comfortable, and affordable clothing, driving demand for retail apparel. Additionally, the rise of e-commerce platforms has made textile products more accessible globally. There’s also increasing use of technical textiles in industries such as automotive, construction, and healthcare. Population growth and higher per capita clothing consumption are accelerating textile production. Seasonal fashion cycles and influencer-led marketing have further escalated demand. Moreover, post-pandemic recovery is reviving both consumer and industrial textile usage.

Key growth drivers for the textile industry include a booming apparel industry, technological advancements in textile manufacturing, and the expansion of organized retail. Sustainability is a growing driver as eco-friendly and organic fibers attract environmentally conscious consumers. Industrial uses of textiles-like geotextiles, medical textiles, and automotive interiors-are growing rapidly. Government policies that support textile parks and offer export incentives also play a significant role. The increased demand for home décor and furnishing textiles also contributes. Additionally, demand for antibacterial, fire-resistant, and water-repellent fabrics is increasing across various sectors, particularly in the defense and healthcare industries.

There is a strong trend toward smart textiles, such as fabrics integrated with sensors and conductive fibers for health and fitness monitoring. Bio-based and recycled fibers are gaining momentum, with brands adopting closed-loop systems. Digital textile printing is revolutionizing custom apparel and reducing water waste. Blockchain is being tested for textile traceability and transparency. Fashion brands are launching biodegradable and zero-waste collections. Growth in 3D knitting technology enables faster, on-demand production with reduced material wastage. Additionally, collaborations between fashion and tech companies are creating innovative wearable technologies.

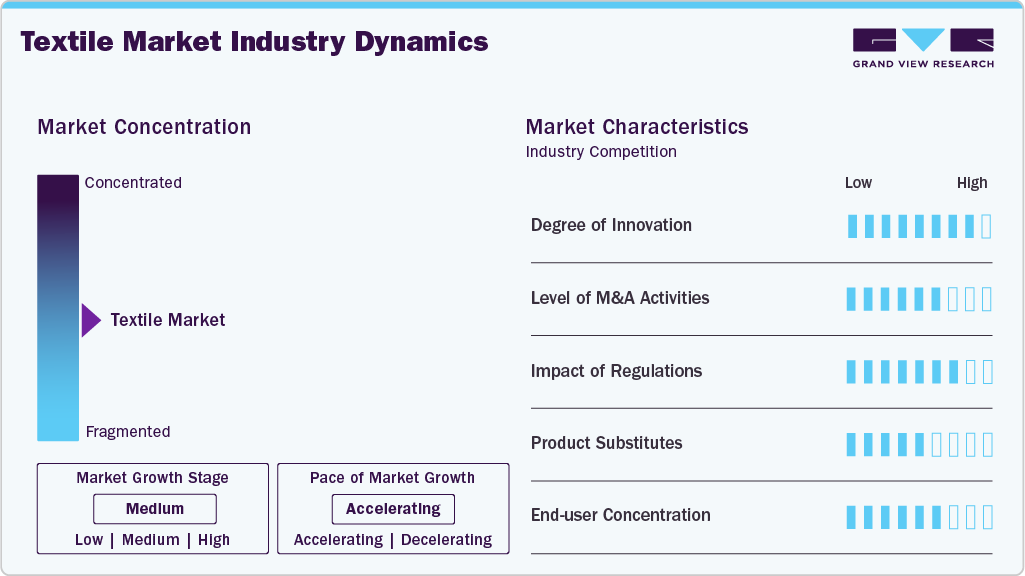

Market Concentration & Characteristics

The textile market is moderately fragmented, with a mix of large multinational corporations and a vast number of SMEs, particularly in Asia-Pacific. Companies like Arvind Ltd., Reliance Industries, Toray Industries, and Luthai Textiles have a strong presence. While the apparel and retail textile segments are dominated by large players, segments such as technical and home textiles still exhibit significant fragmentation. Vertical integration by large manufacturers is increasing, but localized and unorganized players continue to hold a notable share, especially in developing economies.

The threat of substitutes is moderate. While synthetic and natural fibers compete with each other, innovations in bio-based materials may challenge the conventional dominance of cotton and polyester. Leather alternatives are reducing textile usage in specific segments, such as footwear. However, due to the unique characteristics, cost efficiency, and comfort that textiles provide, outright substitution is rare. A greater threat arises from consumers choosing multifunctional or minimalist wardrobes, which impacts volume demand in the fashion industry. Nevertheless, continuous R&D and innovation in textiles mitigate this risk effectively.

Raw Material Insights

The cotton segment dominated the global textile industry, accounting for the largest revenue share of 39.2% in 2025. This is due to its natural origin, breathability, softness, and widespread consumer preference, particularly in the apparel and home textiles sectors. It is particularly favored in tropical and subtropical regions for its comfort in warm climates. Cotton's versatility allows its use across diverse segments, from casual wear to medical and industrial applications. Additionally, global efforts to promote sustainable and organic cotton farming are enhancing its market appeal. Major producing countries, such as India, China, and the U.S., support a steady supply chain. Despite competition from synthetic fibers, cotton maintains a strong market share due to its biodegradability and eco-friendly perception.

The silk segment is expected to grow at the fastest CAGR of 4.5% over the forecast period, driven by rising demand for premium, eco-friendly, and luxurious fabrics. Increasing consumer preference for natural and sustainable materials in high-end fashion, home décor, and personal accessories is fueling this growth. The expansion of the affluent middle class, particularly in Asia Pacific and the Middle East, is boosting silk consumption. Additionally, innovations in sericulture, the production of peace silk, and blended silk fabrics are enhancing accessibility and affordability. Silk’s hypoallergenic properties and lightweight comfort make it desirable in both traditional and contemporary fashion. E-commerce platforms are further accelerating global exposure and sales of silk products.

Product Insights

The natural fibers segment dominated the textile market, accounting for the largest revenue share of 44.7% in 2025, due to their biodegradability, renewability, and consumer demand for sustainable materials. These fibers are widely used in apparel, home textiles, and industrial applications owing to their comfort, insulation, and moisture absorption properties. Governments and fashion brands are increasingly promoting eco-conscious choices, leading to a shift away from synthetic alternatives. Moreover, advancements in organic farming and certifications, such as the Global Organic Textile Standard (GOTS), are enhancing the market appeal of natural fibers. Strong production bases in countries such as India, China, and Bangladesh also contribute to the dominance.

The nylon segment is expected to grow at the fastest CAGR of 4.9% over the forecast period, due to its high strength, elasticity, and durability, making it ideal for performance wear, intimate apparel, automotive textiles, and industrial fabrics. The rising demand for activewear and athleisure clothing is significantly driving nylon consumption, especially in urban youth markets. Nylon’s quick-drying and wrinkle-resistant properties also make it a preferred choice for travel and outdoor gear. Innovations like bio-nylon and recycled nylon are making the fiber more environmentally acceptable. Additionally, nylon’s cost-effectiveness and ease of blending with other fibers are boosting its demand in both developed and emerging economies.

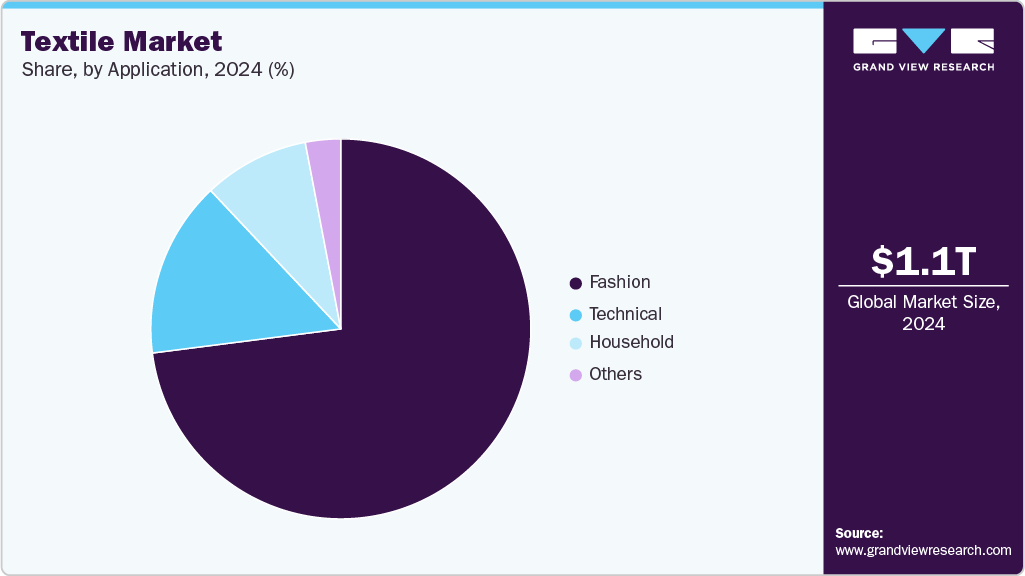

Application Insights

The fashion segment dominated the textile market, accounting for the largest revenue market share of 72.7% in 2025, driven by high global demand for apparel across casual, formal, and seasonal categories. Fast fashion trends, celebrity endorsements, and social media influence have significantly accelerated clothing consumption cycles. Brands are constantly launching new collections to meet changing consumer preferences, contributing to higher textile usage. The availability of affordable clothing through both physical retail and online platforms also supports this dominance. Additionally, the rise of branded and designer apparel in emerging markets is further boosting demand. Fashion’s integration with sustainability and digital customization continues to reinforce its leading market position.

The household segment is the fastest-growing in the textile industry, driven by increased spending on home improvement, urban housing development, and a focus on interior aesthetics. Products such as curtains, bed sheets, upholstery, towels, and carpets are in high demand due to rising living standards and lifestyle upgrades. The growth of real estate and hospitality sectors globally is further supporting this surge. Consumers are also prioritizing comfort and sustainability, leading to increased demand for natural and antimicrobial fabrics in home textiles. E-commerce growth has made household textile shopping more convenient, especially in emerging markets. Additionally, DIY home décor trends are contributing to the segment’s expansion.

Regional Insights

Asia Pacific dominated the textile market, accounting for the largest revenue share of approximately 49.9% in 2025, due to its vast manufacturing base, low labor costs, and robust export infrastructure. Countries like China, India, and Bangladesh dominate global production and exports. The rise of domestic consumption in Southeast Asia and India is creating a dual demand-driver. Government incentives and industrial clusters further strengthen the region's leadership. Innovations in digital printing and automation are being gradually adopted. However, environmental compliance and sustainable production are becoming critical priorities. Regional players are expanding exports to Western markets and tapping into e-commerce-led sales. Demand for functional and technical textiles is also increasing.

The China textile market is projected to grow over the forecast period. China is the world's largest textile manufacturer and exporter, benefiting from economies of scale and advanced production systems. The government’s push for green manufacturing is influencing the selection and processing of fibers. China's domestic market is also growing rapidly, driven by fashion-forward youth and urbanization. There is a strong shift toward automation and AI-driven production to counter rising labor costs. Investments in synthetic fiber production and high-performance textiles are on the rise. Chinese firms are also expanding globally through partnerships and overseas acquisitions. However, geopolitical tensions and trade regulations with the U.S. and EU could impact exports.

North America Textile Market Trends

North America is focusing on sustainable textiles, smart fabrics, and reshoring of manufacturing. U.S. manufacturers are investing in technical and protective textiles for automotive, defense, and healthcare sectors. The U.S.-Mexico-Canada Agreement (USMCA) supports textile trade within the region. There's a rising demand for organic and recycled apparel products among consumers. Fashion brands are shifting toward digital customization and on-demand manufacturing. Labor shortages and high costs pose significant challenges to domestic production. Nonetheless, textile R&D, especially in smart and wearable fabrics, is a key strength for this region.

U.S. Textile Market Trends

The U.S. textile industry is shifting toward domestic innovation, sustainability, and technical textiles. Government contracts for defense and medical textiles provide a stable revenue stream. Growth in eco-conscious apparel is fueling demand for organic cotton and recycled fibers. Major retailers are promoting U.S.-made collections to enhance traceability. Textile imports from Asia continue to dominate the apparel segment, but efforts to reshore production are on the rise. U.S. firms are also investing in automation to improve competitiveness. The focus on circular fashion and waste reduction is reshaping product strategies in the country.

Europe Textile Market Trends

Europe is emphasizing circular textiles, biodegradable materials, and eco-certifications. EU Green Deal regulations are pushing companies to adopt sustainable practices. High demand for luxury fashion and home textiles supports innovation. Countries like Italy and Germany are leaders in textile machinery and high-quality fabrics. Technical textiles are gaining traction in automotive and industrial applications. European consumers are highly aware of ethical sourcing and environmental impact. Digital transformation is driving innovative smart textiles across the region.

Germany’s textile market is known for engineering precision in textile machinery and technical fabrics. The country is a key player in the industrial, medical, and automotive textiles sectors. Focus on sustainability and digitalization is driving innovation. Companies are developing high-performance fibers for demanding applications. Public and private R&D collaboration supports cutting-edge development. Export demand from Europe and North America remains strong. Germany is also exploring bio-based and recyclable materials for future growth.

Central & South America Textile Market Trends

Central & South America’s textile industry is recovering steadily, led by Brazil and Mexico. Trade agreements with the U.S. are aiding exports. The domestic fashion industry is growing in Brazil, Colombia, and Argentina. High raw material availability supports regional manufacturing. However, production is often challenged by inconsistent policies and logistics issues. Eco-friendly and cultural designs are attracting niche international buyers. There is an increasing investment in modernizing infrastructure and technology. E-commerce is becoming a strong growth channel.

Middle East & Africa Textile Market Trends

The Middle East is emerging as a textile trade hub, particularly the UAE, with strong re-export capabilities. Turkey remains a key textile producer with high export volumes to Europe. In Africa, Ethiopia and Kenya are gaining attention as textile manufacturing destinations due to low labor costs. Governments are offering tax incentives and industrial parks to attract FDI. Local markets are growing for modest fashion and traditional wear. The region is also starting to adopt sustainable practices, though at an early stage. Demand for basic apparel and textiles is growing with rising income levels.

Key Textile Company Insights

Some of the key players operating in the market include Hengli Petrochemical Co., Ltd. and Chargeurs SA.

-

Hengli Petrochemical is one of the world’s largest producers of polyester and textile raw materials. It operates an integrated petrochemical complex that includes refining, PTA (purified terephthalic acid), and polyester production. The company supplies polyester chips, yarn, and films used in the textile and packaging industries. Hengli is recognized for its scale, cost efficiency, and vertical integration, spanning the entire value chain from crude oil to polyester fibers.

-

Chargeurs SA is a global industrial group specializing in high-performance textiles and technical materials. Its textile division, Chargeurs PCC, is a leading manufacturer of interlinings and technical fabrics used in garments for the fashion, luxury, and sportswear sectors. The company emphasizes sustainability and innovation, offering eco-responsible solutions and smart textile components to brands worldwide.

Toray Industries, Inc. and Sasa Polyester Sanayi A.Ş. are some of the emerging participants in the textile market.

-

Toray is a leading multinational in advanced materials, particularly synthetic fibers and textiles. It produces nylon, polyester, and carbon fiber materials used in various applications, including fashion, industry, and high-tech sectors. Toray is recognized for its strong R&D capabilities and sustainability initiatives, including the development of recycled and bio-based fibers, as well as textiles for the medical, automotive, and aerospace sectors.

-

Sasa Polyester is one of Turkey’s largest polyester producers, manufacturing fibers, filament yarns, and specialty polymers. It serves textile, automotive, packaging, and industrial applications. The company has been investing heavily in expanding production capacity and integrating upstream operations, such as PTA and PET production. Sasa is also focusing on sustainability with initiatives in recycling and bio-based polymers.

Key Textile Companies:

The following are the leading companies in the textile market. These companies collectively hold the largest market share and dictate industry trends.

- Hengli Petrochemical Co., Ltd.

- Shenzhou International Group Holdings Ltd

- Toray Industries, Inc.

- Inditex

- Chargeurs SA

- Far Eastern New Century Corporation

- Sasa Polyester Sanayi A.Ş.

- Eclat Textile Co. Ltd

- TJX Companies

- Vardhman Textiles

Recent Developments

-

In June, 2024, Hengli restarted its No. 1 polypropylene (PP) unit at Changxing Island following maintenance, with a capacity of 450,000 t/year.

-

In June 2024, Chargeurs SA completed the acquisition of two business units from Cilander, strengthening its technical interlining and smart textiles portfolio.

-

In February 2024, Toray announced a chemical recycling technology for nylon 66.

Textile Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.21 billion

Revenue forecast in 2033

USD 1.61 billion

Growth rate

CAGR of 4.2% from 2026 to 2033

Base year for estimation

2025

Actual estimates/Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, application, and region

Regional scope

Global

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea

Key companies profiled

Hengli Petrochemical Co., Ltd.; Shenzhou International Group Holdings Ltd; Toray Industries, Inc.; Inditex; Chargeurs SA; Far Eastern New Century Corporation; Sasa Polyester Sanayi A.Ş.; Eclat Textile Co., Ltd; TJX Companies; Vardhman Textiles

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Textile Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the textile market report based on raw material, product, application, and region:

-

Raw Material Outlook (Volume, Million Tons; Revenue, USD Million, 2021 - 2033)

-

Cotton

-

Chemical

-

Wool

-

Silk

-

Others

-

-

Product Outlook (Volume, Million Tons; Revenue, USD Million, 2021 - 2033)

-

Natural Fibers

-

Polyesters

-

Nylon

-

Others

-

-

Application Outlook (Volume, Million Tons; Revenue, USD Million, 2021 - 2033)

-

Household

-

Bedding

-

Kitchen

-

Upholstery

-

Towel

-

Others

-

-

Technical

-

Construction

-

Transport

-

Medical

-

Protective

-

-

Fashion & Clothing

-

Apparel

-

Ties & Clothing

-

Handbags

-

Others

-

-

Others

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global textile market size was estimated at USD 1.16 billion in 2025 and is expected to reach USD 1.21 billion in 2026.

b. The global textile market is expected to grow at a compound annual growth rate of 4.2% from 2026 to 2033 to reach USD 1.61 billion by 2033.

b. Cotton dominated the global textile market and accounted for the largest revenue share of 39.2% in 2025, due to its natural origin, breathability, softness, and widespread consumer preference, especially in apparel and home textiles.

b. Some of the key players operating in the textile market include Hengli Petrochemical Co., Ltd.; Shenzhou International Group Holdings Ltd; Toray Industries, Inc.; Inditex; Chargeurs SA; Far Eastern New Century Corporation; Sasa Polyester Sanayi A.S.; Eclat Textile Co. Ltd; TJX Companies; Vardhman Textiles.

b. Key factors driving the textile market include rising disposable incomes, fast fashion trends, e-commerce expansion, demand for sustainable fabrics, and growth in technical and home textiles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.