- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyethylene Terephthalate Market, Industry Report, 2030GVR Report cover

![Polyethylene Terephthalate Market Size, Share & Trends Report]()

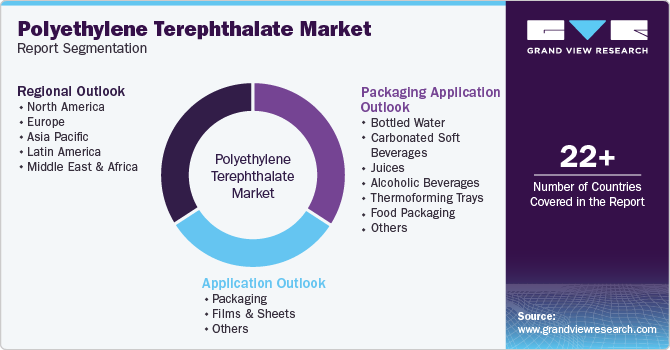

Polyethylene Terephthalate Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Packaging, Films & Sheets), By Packaging Application (Bottled Water, Juices, Alcoholic Beverages, Thermoforming Trays), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-780-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyethylene Terephthalate Market Summary

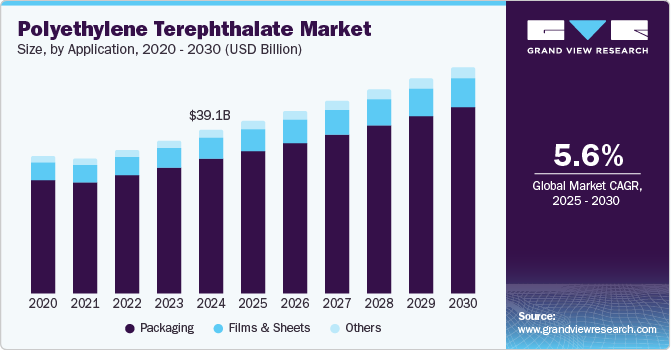

The global polyethylene terephthalate market size was valued at USD 39.12 billion in 2024 and is projected to reach USD 54.47 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. This growth can be attributed to the increasing consumer demand for sustainable packaging solutions is pushing companies to adopt recyclable materials such as PET.

Key Market Trends & Insights

- The Asia Pacific polyethylene terephthalate market dominated the global market and accounted for the largest revenue share of 38.0% in 2024.

- The Middle East and Africa polyethylene terephthalate market is expected to grow at a CAGR of 6.3% over the forecast period.

- The polyethylene terephthalate market in Europe held a significant revenue share of 26.3% in 2024.

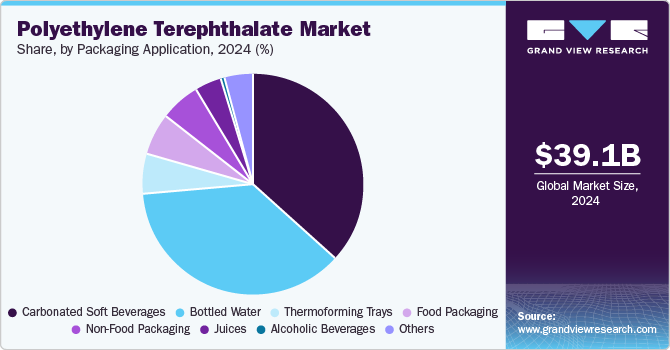

- Based on packaging application, the carbonated soft beverages packaging segment led the packaging segment and accounted for the largest revenue share of 36.6% in 2024.

- In terms of application, the packaging segment dominated the market and accounted for the largest revenue share of 82.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 39.12 billion

- 2030 Projected Market Size: USD 54.47 billion

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

In addition, its widespread packaging, textiles, automotive, and electronics applications further enhance its market appeal. Furthermore, rapid urbanization and economic growth in developing regions lead to higher packaged goods consumption. Moreover, advancements in production technologies and the rising demand for processed foods contribute to the PET market's overall expansion.

Polyethylene terephthalate (PET) is a versatile polymer widely used in various applications, particularly in packaging, textiles, and consumer goods. The increasing demand for recycled PET from sectors such as packaging, food and beverages, and automotive is creating substantial growth opportunities in the market. PET is recognized for its recyclability, making it a preferred choice compared to other polymers.

The packaging industry significantly drives the demand for PET, as it is commonly molded into bottles and containers for beverages, personal care products, and food items. In addition, its cost-effectiveness, high strength, and lightweight properties make it an ideal material for packaging solutions requiring reduced transportation costs. The rise of e-commerce has further fueled the use of PET containers due to their convenience and efficiency in shipping.

Furthermore, the consumption of PET straps in trade applications is on the rise. These straps are essential for safely shipping various metal products used across industries such as automotive and construction. With their high tensile strength and shock-absorbing capabilities, PET straps ensure secure transport while being recyclable and cost-effective compared to metal alternatives. Moreover, the combination of growing awareness around sustainability, increased consumption of packaged goods, and advancements in recycling technologies positions the polyethylene terephthalate market for continued expansion in the coming years.

Application Insights

The packaging segment dominated the market and accounted for the largest revenue share of 82.4% in 2024. This growth can be attributed to the increasing demand for sustainable and recyclable materials. In addition, as consumers become more environmentally conscious, industries are shifting towards eco-friendly packaging solutions, with PET being a leading choice due to its recyclability and lightweight properties. Furthermore, the rise in e-commerce has boosted the need for durable packaging that ensures product safety during transit. Moreover, the versatility of PET in various applications, such as food and beverage containers, further enhances its market presence, making it an essential material in modern packaging solutions.

The films and sheets segment is expected to grow at a CAGR of 5.5% over the forecast period, owing to its superior mechanical strength and flexibility, which make it ideal for a variety of applications, including pressure-sensitive adhesives and magnetic tapes. In addition, the increased use of stretched PET in producing biaxially-oriented films (BoPET) also contributes to market growth. Furthermore, the rising adoption of PET sheets in consumer goods packaging and the need for reliable straps in heavy-load applications highlight the material's versatility. Moreover, as industries continue to seek lightweight and durable solutions, the films and sheets segment of the PET market is poised for significant expansion.

Packaging Application Insights

The packaging application segment is further categorized into carbonated soft beverages, juices, thermoforming trays, alcoholic beverages, bottled water, food packaging, and non-food packaging. The carbonated soft beverages packaging segment led the packaging segment and accounted for the largest revenue share of 36.6% in 2024, primarily driven by the increasing demand for lightweight and durable packaging solutions. In addition, PET bottles are preferred for carbonated drinks due to their excellent barrier properties, which help maintain carbonation and freshness. Furthermore, PET's versatility allows manufacturers to create bottles in various shapes and sizes, catering to consumer preferences. Moreover, the shift from glass and metal containers to PET is also influenced by its cost-effectiveness and recyclability, making it an ideal choice for beverage companies seeking sustainable packaging options.

The juices packaging segment is expected to grow at a CAGR of 5.9% from 2025 to 2030, owing to the rising demand for convenient and portable beverage options. In addition, PET's lightweight nature and high clarity make it an attractive choice for juice packaging, ensuring product visibility while maintaining quality. Furthermore, PET is easier to recycle compared to other materials, aligning with the growing consumer preference for eco-friendly packaging solutions. Moreover, the expanding health-conscious consumer base is also driving demand for juice products, further enhancing the need for effective and sustainable packaging solutions such as PET.

Regional Insights

The Asia Pacific polyethylene terephthalate market dominated the global market and accounted for the largest revenue share of 38.0% in 2024. This growth can be attributed to rising consumer demand for sustainable packaging solutions. In addition, the region's booming population and increasing disposable income are driving the demand for packaged goods, particularly in the food and beverage sector. Furthermore, the growing emphasis on recycling and eco-friendly materials aligns with government initiatives promoting sustainability. Moreover, the expansion of the e-commerce industry also contributes to higher PET consumption as it requires efficient and reliable packaging solutions for product delivery.

China Polyethylene Terephthalate Market Trends

The polyethylene terephthalate market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its rapid industrial growth and urbanization. As one of the largest consumers of PET globally, China’s expanding packaging, automotive, and electronics sectors are major drivers of demand. In addition, the country’s focus on environmental sustainability has led to increased investments in recycling technologies, enhancing PET's appeal as a recyclable material. Furthermore, the rise in health-conscious consumers is boosting the demand for bottled beverages and packaged foods, further propelling the growth of the PET market in China.

North America Polyethylene Terephthalate Market Trends

The North America polyethylene terephthalate market is expected to grow significantly over the forecast period, owing to an increasing focus on sustainability among consumers and businesses alike. In addition, the growing popularity of bottled beverages and ready-to-eat meals fuels the demand for efficient packaging solutions that maintain product quality. Furthermore, regulatory pressures encouraging recycling initiatives have led manufacturers to invest in technologies that enhance PET recyclability.

U.S. Polyethylene Terephthalate Market Trends

The U.S. polyethylene terephthalate market led the North American market and accounted for the largest revenue share in 2024, driven by the rising trend of health-conscious consumers seeking bottled water and natural juices. Furthermore, innovations in lightweighting technologies allow manufacturers to produce more efficient packaging while reducing material usage. This combination of factors positions the U.S. as a significant contributor to the overall growth of the polyethylene terephthalate market in North America.

Middle East & Africa Polyethylene Terephthalate Market Trends

The Middle East and Africa polyethylene terephthalate market is expected to grow at a CAGR of 6.3% over the forecast period, owing to the increasing urbanization and a growing population. Furthermore, the demand for packaged foods and beverages is rising as lifestyles change, leading to greater consumption of convenient products. Moreover, regional governments are implementing regulations to promote recycling and reduce plastic waste, encouraging manufacturers to adopt PET for its recyclability. Investments in infrastructure and manufacturing capabilities are also enhancing the availability of PET products in this region.

Europe Polyethylene Terephthalate Market Trends

The polyethylene terephthalate market in Europe held a significant revenue share of 26.3% in 2024, primarily driven by stringent regulations to reduce plastic waste and promote recycling initiatives. The European Union's commitment to sustainability has led to increased consumer awareness regarding eco-friendly packaging solutions. in addition, the demand for recycled PET is on the rise, particularly in food and beverage packaging, as brands seek to enhance their sustainability profiles. Furthermore, technological advancements in recycling processes are improving the efficiency of PET reuse, further driving market growth.

Germany polyethylene terephthalate market dominated the European market and accounted for the largest revenue share in 2024 due to its strong manufacturing base and commitment to sustainability. In addition, the country’s rigorous environmental regulations encourage companies to adopt recyclable materials such as PET in their packaging solutions. With a robust beverage industry, Germany sees a high demand for lightweight and durable PET bottles that meet consumer preferences for convenience. Furthermore, innovations in production technologies enhance PET products' quality and performance, supporting their widespread adoption across various sectors.

Key Polyethylene Terephthalate Company Insights

Key players in the global polyethylene terephthalate industry include DAK Americas, Nan Ya Plastics Corporation, SABIC, and others. These companies are adopting various strategies to improve their market presence. These include investing in advanced recycling technologies to improve sustainability and reduce environmental impact. In addition, companies are also forming strategic partnerships and collaborations to expand their product offerings and distribution networks. Furthermore, they are focusing on capacity expansions to meet the increasing demand for PET across diverse applications, particularly in packaging, textiles, and automotive sectors.

-

Far Eastern New Century Corporation (FENC) specializes in the production of food-grade recycled PET resin and various PET products. The company operates in multiple segments, including PET resin, sheets, and preforms, catering to diverse applications such as packaging for beverages and food items. The company focuses on innovative solutions that enhance its products' recyclability and environmental performance, positioning itself as a key player in the global market.

-

Lotte Chemical Corporation manufactures high-quality PET resins and related products. The company operates across various segments, including packaging materials for food and beverages, textiles, and industrial applications. The company emphasizes technological advancements and sustainable practices in its production processes and meets the growing demand for eco-friendly materials.

Key Polyethylene Terephthalate Companies:

The following are the leading companies in the polyethylene terephthalate market. These companies collectively hold the largest market share and dictate industry trends.

- Indorama Ventures

- Far Eastern New Century

- DAK Americas

- Nan Ya Plastics Corporation

- SABIC

- Dupont

- Lotte Chemical Corporation

- LAVERGNE, Inc.

- Amcor plc

- Reliance Industries

- Octal Petrochemicals

- Jiangsu Sanfangxiang Group Co., Ltd.

- Eastman Chemical Company

Recent Developments

-

In May 2024, Pact Collective and Eastman announced the qualification of clean, multicolor polyethylene terephthalate (PET) waste as feedstock for Eastman’s methanolysis technology. This innovative process addresses the recycling challenges posed by multicolored PET, which is often unsuitable for mechanical recycling. The collaboration aims to convert this waste into high-quality copolyesters and PET for the beauty industry, promoting sustainability and reducing reliance on less eco-friendly disposal methods. This initiative represents a significant step toward a circular economy in beauty packaging.

-

In August 2023, Indorama Ventures announced the expansion of its polyethylene terephthalate (PET) recycling facility in Juiz de Fora, Brazil, nearly tripling its capacity from 9,000 to 25,000 tons per year. This initiative, supported by a 'Blue Loan' from the International Finance Corporation (IFC), aimed to enhance sustainability by utilizing post-consumer recycled PET material.

-

In April 2023, SABIC introduced its new LNP ELCRIN WF0051iQ compound, enhancing sustainability in the electrical industry by incorporating post-consumer polyethylene terephthalate (PET) water bottles. This innovative compound features thin-wall, non-brominated/non-chlorinated flame retardance and contributes to SABIC's goal of diverting over 400 million PET bottles from landfills. The compound reduces the carbon footprint by 11% compared to traditional fossil-based resins, showcasing SABIC's commitment to chemical upcycling and sustainable practices in manufacturing electrical components and medical devices.

Polyethylene Terephthalate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41.54 billion

Revenue forecast in 2030

USD 54.47 billion

Growth Rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, packaging application, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa

Country scope

U.S., Canada, China, India, Japan, Southeast Asia, Germany, France, UK, Spain, Italy, Brazil, and Mexico

Key companies profiled

Indorama Ventures; Far Eastern New Century; DAK Americas; Nan Ya Plastics Corporation; SABIC; Dupont; Lotte Chemical Corporation; LAVERGNE, Inc.; Amcor plc; Reliance Industries; Octal Petrochemicals; Jiangsu Sanfangxiang Group Co., Ltd.; Eastman Chemical Company.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyethylene Terephthalate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global polyethylene terephthalate market report based on application, packaging application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Films & Sheets

-

Others

-

-

Packaging Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bottled Water

-

Carbonated Soft Beverages

-

Juices

-

Alcoholic Beverages

-

Thermoforming Trays

-

Food Packaging

-

Non-Food Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Italy

-

France

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.