- Home

- »

- Biotechnology

- »

-

Point Of Care Lipid Test Market Size, Industry Report, 2033GVR Report cover

![Point Of Care Lipid Test Market Size, Share & Trends Report]()

Point Of Care Lipid Test Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Application (Hyperlipidemia, Hypertriglyceridemia, Tangier Disease), By Disease Indication, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-750-6

- Number of Report Pages: 136

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Point of Care Lipid Test Market Summary

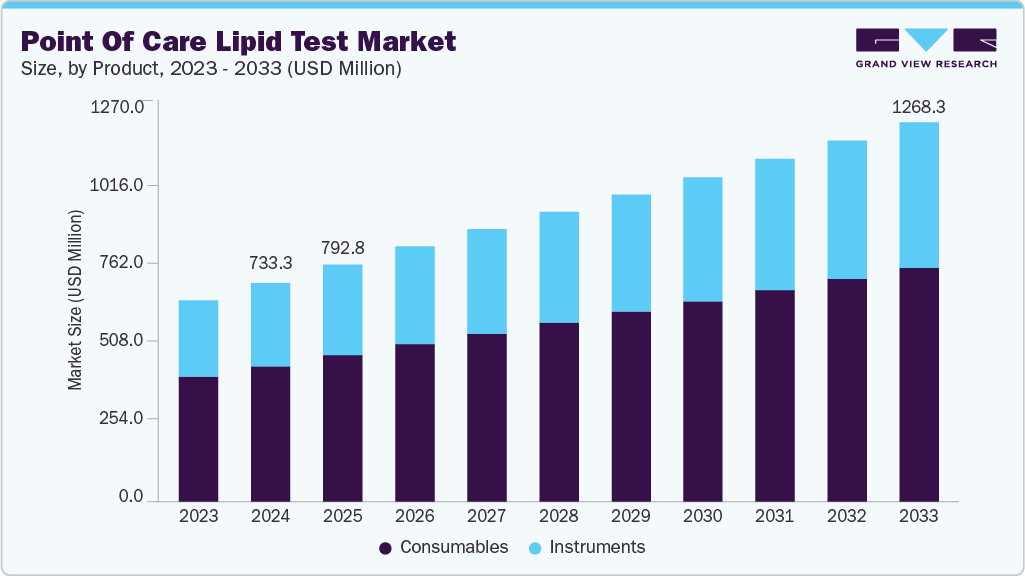

The global point of care lipid test market size was estimated at USD 733.3 million in 2024 and is projected to reach USD 1,268.33 million by 2033, growing at a CAGR of 6.05% from 2025 to 2033. Market growth is driven by rising demand for rapid and accessible lipid profiling in both clinical and non-clinical settings, especially for early detection and monitoring of cardiovascular conditions.

Key Market Trends & Insights

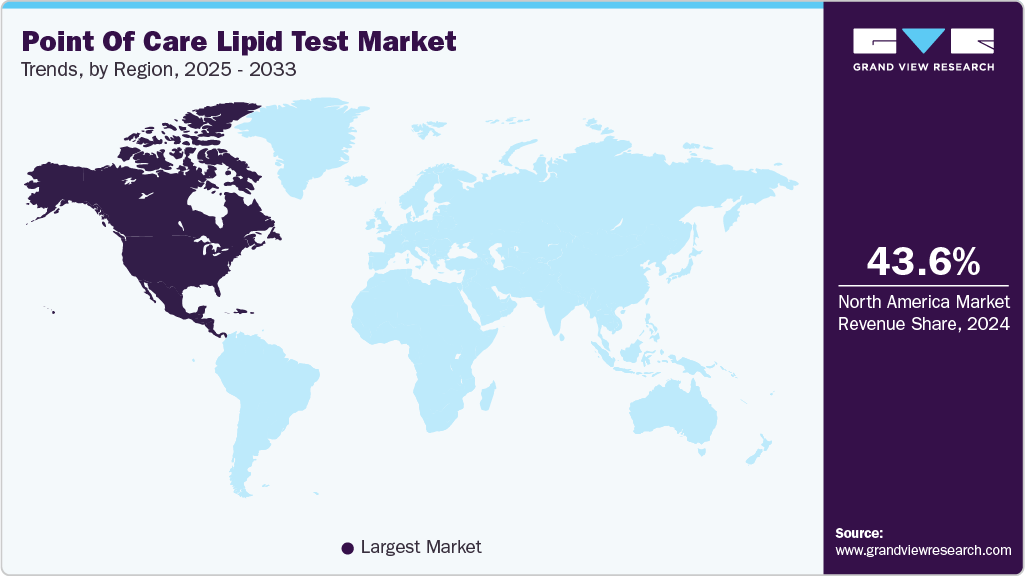

- North America dominated the point of care lipid test market with the largest revenue share of 43.58% in 2024.

- The U.S. accounted for the largest market revenue share in North America in 2024.

- Based on product, the consumables segment led the market with the largest revenue share of 61.94% in 2024.

- Based on application, the hyperlipidemia segment led the market with the largest revenue share of 46.87% in 2024.

- Based on disease indication, the lipid and lipoprotein disorders segment led the market with the largest revenue share of 38.73% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 733.33 Million

- 2033 Projected Market Size: USD 1,268.33 Million

- CAGR (2025-2033): 6.05%

- North America: Largest market in 2024

Point of care lipid testing offers convenience, reduced turnaround time, and immediate clinical decision-making support, contributing to its adoption across primary care centers, pharmacies, and community health programs.The increasing prevalence of dyslipidemia and lifestyle-related disorders, combined with growing awareness of cardiovascular risk management, supports the market’s momentum. Integration of these tests with digital health platforms and mobile diagnostics is further enabling decentralized screening and preventive care delivery, particularly in underserved and rural regions.

Point of care (POC) lipid testing allows healthcare professionals to measure cholesterol and related lipid levels directly at the patient's location, without sending samples to a lab. These tests use small blood samples, usually taken from a finger prick, and provide quick results through portable devices. This helps doctors make faster decisions about treatment, especially for managing cholesterol problems and reducing heart disease risk.

POC lipid tests are commonly used in regular check-ups, chronic disease management, and emergency care. They are especially helpful in remote areas where lab access is limited. Ongoing improvements in technology are making these tests smaller, more accurate, and easier to use. With better connectivity to digital health systems and more advanced testing features, POC lipid testing is becoming an important part of preventive.

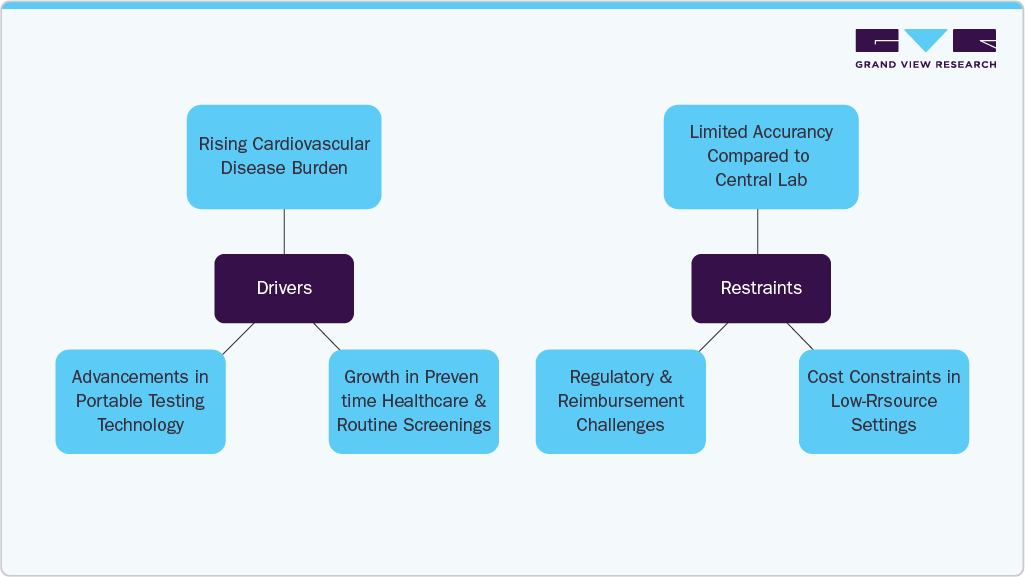

Market Drivers

Rising Cardiovascular Disease Burden: The global increase in cardiovascular diseases is creating a strong demand for rapid lipid testing solutions that support early diagnosis and ongoing monitoring.

Growth in Preventive Healthcare and Routine Screenings: Expanding awareness around preventive health, particularly for cholesterol and heart health, is pushing the use of point of care tests in primary care and community settings.

Advancements in Portable Testing Technology: Ongoing improvements in device accuracy, ease of use, and digital connectivity are making POC lipid tests more practical and reliable across various clinical and non-clinical environments.

Market Restraints

Limited Accuracy Compared to Central Labs: While POC tests offer speed, they may lack the precision and depth of analysis provided by centralized laboratory equipment, which may affect clinical confidence in borderline cases.

Cost Constraints in Low-Resource Settings: The cost of devices and consumables may be a barrier in low-income or rural areas, limiting widespread adoption despite the need for accessible testing.

Regulatory and Reimbursement Challenges: Variability in regulatory approvals and unclear reimbursement policies in some regions can hinder market growth and slow the introduction of new devices.

Together, these drivers and restraints shape the development of the point of care lipid test industry. While growing demand for rapid and accessible lipid testing supports market expansion, challenges related to accuracy, affordability, and regulatory clarity continue to limit broader adoption. Addressing these barriers will be key to ensuring wider reach and sustained growth across various healthcare settings.

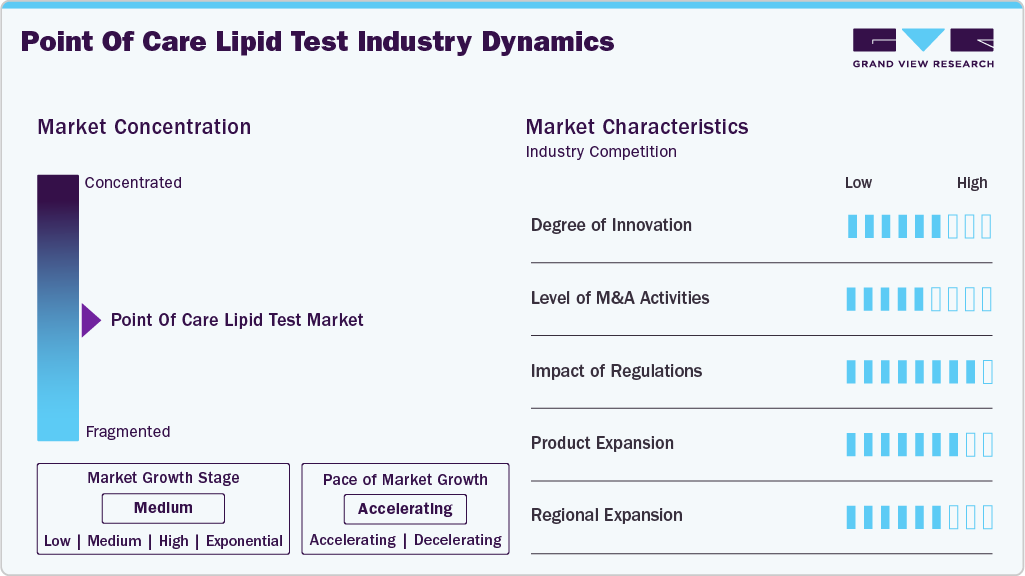

Market Concentration & Characteristics

Innovation in point of care lipid test industry is strong, driven by the need for faster, more reliable, and easy-to-use devices. Developments such as smartphone-compatible readers, compact biosensor technology, and real-time data integration are enhancing the testing experience. The shift toward self-monitoring and digital health platforms is also pushing manufacturers to design connected, user-friendly tools suitable for remote use and home-based testing.

Mergers and acquisitions are moderately active, with diagnostic firms acquiring specialized point of care technology companies to strengthen their cardiovascular testing portfolios. These deals aim to expand product lines, improve access to emerging markets, and speed up innovation. Partnerships between diagnostic companies and digital health platforms are also gaining momentum, focused on integrating data sharing, remote monitoring, and EHR compatibility.

Regulation plays a crucial role in shaping the point of care lipid test industry. Approval processes from agencies such as the FDA and CE influence product development timelines and market entry. In many regions, growing emphasis on preventive care has led to clearer guidelines for point of care devices, supporting their adoption in primary care. However, differences in regional standards and reimbursement policies may pose challenges for manufacturers trying to scale across borders.

Product development in the point of care lipid test industry is gaining momentum, with a focus on portable devices, integrated digital readers, and user-friendly designs for both clinical and home use. Companies are introducing multi-analyte systems capable of measuring multiple lipid markers in a single test, improving efficiency and patient monitoring. Enhanced connectivity features, such as Bluetooth-enabled devices that sync with mobile apps or electronic health records, are also supporting remote care and telehealth services.

Regional expansion is increasing, especially in Asia-Pacific, Latin America, and parts of Africa, where demand for accessible cardiovascular screening tools is rising. Manufacturers are entering these markets with affordable, easy-to-use POC kits that support basic lipid monitoring outside traditional hospital settings. Public health initiatives focused on early detection of heart disease are further encouraging adoption. While North America and Europe continue to lead in terms of adoption and innovation, emerging markets offer strong potential for growth due to rising disease burden and improving healthcare access.

Product Insights

The consumables segment led the market with the largest revenue share of 61.94% in 2024, driven by the rising frequency of testing due to the increasing prevalence of cardiovascular diseases and lipid disorders. Frequent use of test strips, reagents, and cartridges contributes to higher demand. Furthermore, the expanding adoption of point-of-care testing in home and clinical settings encourages regular monitoring, leading to recurring purchases. Moreover, the shift toward rapid, user-friendly testing methods also boosts the need for disposable and single-use consumables.

The instruments segment is expected to grow at the fastest CAGR of 6.13% over the forecast period, owing to the advancements in diagnostic technologies and the growing emphasis on preventive healthcare. In addition, enhanced accuracy, portability, and connectivity features in modern analyzers make them ideal for decentralized settings. Furthermore, increasing healthcare investments, especially in developing regions, support the procurement of these instruments. Moreover, the trend toward integrating digital health platforms and real-time monitoring encourages the adoption of sophisticated lipid testing instruments across diverse healthcare environments.

Application Insights

The hyperlipidemia segment led the market with the largest revenue share of 46.87% in 2024, primarily driven by the increasing prevalence of hyperlipidemia due to high-fat diets and sedentary lifestyles. In addition, rising awareness about cardiovascular risks associated with prolonged hyperlipidemia and the expanding geriatric population susceptible to high cholesterol and cardiovascular disorders further boost demand. Furthermore, the growing need for quick, efficient management of chronic diseases like cardiovascular disease and diabetes propels market expansion in this application segment.

The hypertriglyceridemia segment is expected to grow at the fastest CAGR of 6.55% over the forecast period, due to the rising demand for rapid and accurate point-of-care lipid testing, especially in countries with high unmet clinical needs such as India, China, and Brazil. Increasing prevalence of hypertriglyceridemia linked to unhealthy lifestyles and metabolic disorders, alongside advancements in testing technologies that enhance speed and user-friendliness, contribute significantly to this segment’s expansion. The need for early diagnosis and management to prevent cardiovascular complications also drives growth.

Disease Indication Insights

The lipid and lipoprotein disorders segment led the market with the largest revenue share of 38.7% in 2024. These conditions are major risk factors for cardiovascular diseases, prompting the need for regular monitoring and early detection. Furthermore, point-of-care tests offer rapid and convenient screening, enabling timely interventions and personalized treatment plans. Moreover, the growing emphasis on preventive healthcare and patient empowerment further accelerates the adoption of these testing solutions.

The atherosclerosis segment is expected to grow at the fastest CAGR of 6.3% from 2025 to 2030, owing to the buildup of plaque in the arteries, which is a leading cause of cardiovascular diseases. The rising incidence of risk factors like hypertension, diabetes, and obesity contributes to the increasing prevalence of atherosclerosis. In addition, point-of-care lipid tests facilitate early detection by measuring lipid levels associated with plaque formation. Furthermore, the ability to assess cardiovascular risk promptly allows healthcare providers to implement preventive measures and treatment strategies effectively, thereby driving the demand for point-of-care lipid testing devices in managing atherosclerosis.

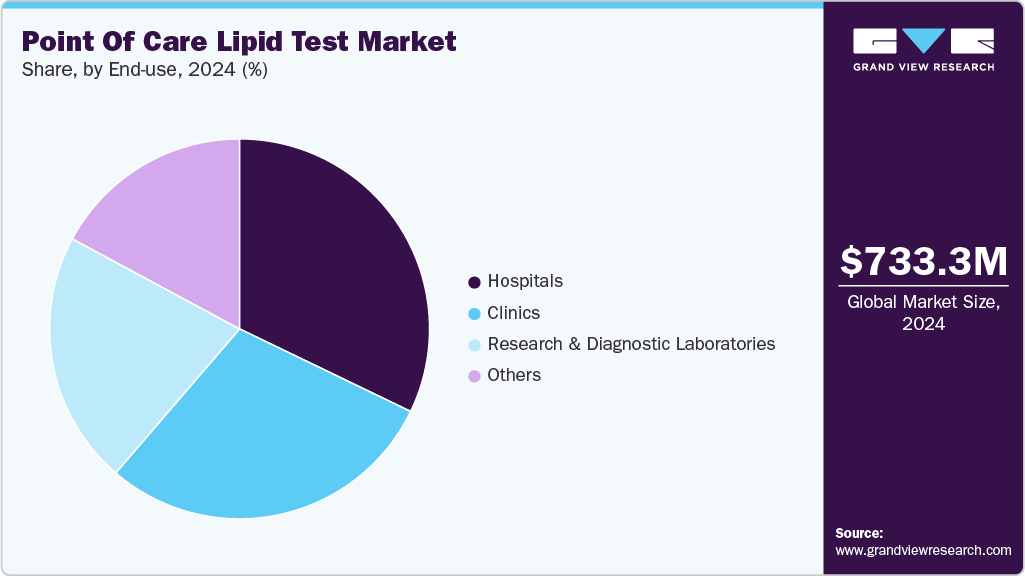

End Use Insights

The hospitals segment led the market with the largest revenue share of 32.16% in 2024, attributed to the increasing cardiovascular disease prevalence and rising patient inflow in healthcare facilities. In addition, hospitals require rapid, accurate lipid testing to enable timely diagnosis and management of chronic conditions, improving patient outcomes. Furthermore, expansion of healthcare infrastructure, government investments, and rising geriatric populations further boost demand. Moreover, technological advancements in point-of-care devices enhance efficiency and reduce hospital stay durations, making lipid testing more accessible and routine in hospital settings.

The clinics segment is projected to grow at the fastest CAGR of 6.27% over the forecast period, owing to the increasing number of outpatient visits and the need for quick, on-site lipid profiling to manage cardiovascular and metabolic disorders effectively. Clinics benefit from portable, user-friendly point-of-care lipid tests that facilitate immediate decision-making and personalized treatment plans. Furthermore, rising health awareness and preventive care initiatives encourage routine lipid monitoring in clinics. Moreover, clinics in emerging markets are expanding due to improved healthcare access and government support, driving demand for convenient lipid testing solutions.

Regional Insights

North America dominated the point of care lipid test market with the largest revenue share of 43.58% in 2024. This growth is attributed to the advanced healthcare infrastructure and high awareness of cardiovascular diseases. The region benefits from substantial healthcare investments, fostering the adoption of innovative diagnostic technologies. Furthermore, the growing prevalence of hyperlipidemia and a strong emphasis on preventive healthcare further propel market growth. Moreover, the integration of point-of-care testing with telehealth platforms enhances accessibility and patient engagement, contributing to the widespread adoption of lipid testing solutions across the continent.

U.S. Point of Care Lipid Test Market Trends

The point of care lipid test market in the U.S. leads the global market, supported by a high number of people with heart-related conditions and a strong push for preventive care. These tests are used widely in clinics, pharmacies, and even at home to check cholesterol levels quickly and support early diagnosis. In 2024, the CDC reported that about 86 million adults aged 20 and older in the U.S. had total cholesterol levels above 200 mg/dL, and nearly 25 million had levels over 240 mg/dL-putting them at higher risk for heart disease.

This growing health concern is making more people aware of the importance of regular testing. As a result, demand for point of care lipid test kits is rising, especially ones that are fast and easy to use. More people now prefer convenient testing tools that help detect problems early and avoid long clinic visits. This shift toward simpler and more accessible care is helping drive market growth across the country.

Europe Point of Care Lipid Test Market Trends

The point of care lipid test market in Europe is seeing steady growth, driven by rising rates of cardiovascular diseases and a growing focus on preventive healthcare. Many countries are promoting routine cholesterol screening as part of national health programs, which is pushing demand for quick and easy-to-use testing solutions. Point of care lipid tests are being adopted in primary care clinics, pharmacies, and mobile health units to support early detection and regular monitoring.

Countries such as Germany, the UK, and France are leading the way, using these tools to reach patients both in urban and rural areas. The use of portable devices, along with digital platforms that store and share results, is improving access to care. Growing comfort with self-testing and the use of simple blood-based devices is also helping expand adoption across the region. These factors together are supporting wider use of point of care lipid testing across Europe.

The UK point of care lipid test market is growing steadily, supported by rising cardiovascular health concerns and efforts to promote early screening. The government's focus on preventive care and digital health tools is encouraging wider use of rapid testing in clinics, pharmacies, and home settings. Easy-to-use devices and growing public awareness are helping drive adoption across the country.

The point of care lipid test market in Germany is showing strong growth, supported by a well-developed healthcare system and rising focus on early detection of heart disease. Routine screening in clinics and employer health programs is driving demand. The use of portable, digital testing tools is also expanding, making lipid monitoring faster and more accessible.

Asia Pacific Point of Care Lipid Test Market Trends

The point of care lipid test market in Asia Pacific is expected to grow at the fastest CAGR of 8.8% over the forecast period, owing to the rapid urbanization and rising healthcare awareness. The growing need for affordable and easy-to-use testing tools is helping more people check their cholesterol levels, especially in areas with limited access to labs. In Japan, for example, the World Economic Forum reported in 2023 that 1 in 10 people are aged 80 or older, making up nearly a third of the population. As the number of older adult’s increases, so does the number of people with high cholesterol and related health problems. This is leading to more demand for quick and accessible tests like point of care lipid kits. Government efforts to improve preventive care and invest in local health services are further supporting market growth across the region.

The Japan point of care lipid test market is growing gradually, driven by its aging population and rising focus on early detection of heart-related conditions. With more older adults at risk for high cholesterol, the need for quick and reliable testing tools is increasing. Compact devices and user-friendly kits are becoming more common in clinics and home care settings, supporting broader adoption.

Thepoint-of-care lipid test market in China accounted for the largest market revenue share in Asia Pacific in 2024, primarily due to the country's large population and increasing prevalence of lifestyle-related diseases. The government's focus on enhancing healthcare infrastructure and promoting preventive care initiatives supports market growth. In addition, advancements in diagnostic technologies and the development of affordable testing solutions make lipid monitoring more accessible.

Latin America Point of Care Lipid Test Market Trends

Thepoint-of-care lipid test market in Latin America is seeing moderate grow, driven by rising cases of heart disease and better access to basic healthcare. Countries such as Brazil and Argentina are promoting routine screenings through public health programs. Easy-to-use and low-cost test kits are helping expand access in rural and underserved areas, making quick cholesterol testing more widely available across the region.

The Brazil point of care lipid test market is growing steadily, supported by rising cases of high cholesterol and greater focus on preventive healthcare. Public health campaigns are encouraging regular screening, and easy-to-use test kits are gaining popularity in clinics and pharmacies. The use of home-based testing and digital tools is also increasing, helping people monitor their heart health more easily. These factors make Brazil an important market for point of care lipid testing in Latin America.

Middle East and Africa Point of Care Lipid Test Market Trends

The point of care lipid test market in the Middle East and Africa is showing early signs of growth, driven by rising awareness of heart health and improving access to basic healthcare. Countries such as South Africa, the UAE, and Saudi Arabia are adopting quick testing tools in clinics and health centers to support early detection of cholesterol problems. Although infrastructure gaps remain in some areas, the need for simple and affordable diagnostic solutions is increasing, especially in rural and underserved regions.

Key Point of Care Lipid Test Company Insights

Key players in the global point of care lipid test industry include Callegari Sinocare Inc., Abbott Laboratories, Mico Bio Med, and others. These companies employ strategies such as product development and innovation, strategic collaborations and partnerships, acquisitions, and geographic expansion.

-

Abbott Laboratories manufactures diagnostic devices and test cassettes designed for quick, reliable cholesterol, HDL, LDL, triglycerides, and glucose measurement from small blood samples. Abbott’s offerings cater to healthcare professionals in hospitals, clinics, and wellness programs, focusing on cardiovascular disease and diabetes management through efficient point of care testing solutions.

-

Nova Biomedical Corporation develops and markets portable analyzers that deliver rapid and precise measurements of blood lipids and other critical biomarkers. Nova Biomedical operates primarily in the healthcare diagnostics segment, providing solutions for hospitals, clinics, and laboratories to support timely clinical decisions and chronic disease management, particularly in cardiovascular and metabolic health monitoring.

Key Point of Care Lipid Test Companies:

The following are the leading companies in the point of care lipid test market. These companies collectively hold the largest market share and dictate industry trends.

- Callegari Srl

- Sinocare Inc.

- Abbott Laboratories

- MiCoBio

- Nova Biomedical

- VivaChek Biotech (Hangzhou) Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- Menarini Group

- SD Biosensor, Inc.

Recent Developments

-

In July 2024, Roche completed the acquisition of LumiraDx’s Point-of-Care technology, enhancing its diagnostics portfolio. This integration introduces a versatile platform capable of conducting multiple immunoassay and clinical chemistry tests on a single device, with potential for future molecular testing.

-

In January 2023, Cipla Limited launched Cippoint, an advanced point-of-care testing device designed to broaden diagnostic capabilities for various health conditions, including metabolic markers.

Point of Care Lipid Test Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 792.75 million

Revenue forecast in 2033

USD 1,268.33 million

Growth rate

CAGR of 6.05% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, disease indication, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Callegari Sri; Sinocare Inc.; Abbott Laboratories; MiCoBio; Nova Biomedical Corporation; VivaChek Biotech (Hangzhou) Co., Ltd.; F. Hoffmann-La Roche Ltd.; Menarini Group; SD Biosensor, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point of Care Lipid Test Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global point of care lipid test market report based on product, application, disease indication, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Consumables

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Hyperlipidemia

-

Hypertriglyceridemia

-

Tangier Disease

-

Hyperlipoproteinemia

-

Familial Hypercholesterolemia

-

Others

-

-

Disease Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Lipid and Lipoprotein Disorders

-

Atherosclerosis

-

Liver and Renal Diseases

-

Diabetes Mellitus

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Clinics

-

Research and Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global POC lipid test market size was estimated at USD 733.3 million in 2024 and is expected to reach USD 792.75 million in 2025.

b. The global POC lipid test market is expected to grow at a compound annual growth rate of 6.05% from 2025 to 2033 to reach USD 1,268.33 million by 2033.

b. Consumables dominated the global market and accounted for the largest revenue share of 61.9% in 2024, driven by the rising frequency of testing due to the increasing prevalence of cardiovascular diseases and lipid disorders.

b. Some key players operating in the POC lipid test market include Callegari Sinocare Inc.; Abbott Laboratories; MiCoBio; Nova Biomedical Corporation; VivaChek Biotech (Hangzhou) Co., Ltd.; F. Hoffmann-La Roche Ltd.; Menarini Group; SD Biosensor, Inc.

b. Key factors that are driving the POC lipid test market growth include the increasing prevalence of target diseases such as cardiovascular diseases, diabetes, and dyslipidemia and the presence of favorable regulatory initiatives pertaining to the diagnosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.