- Home

- »

- Healthcare IT

- »

-

Digital Health Market Size And Share, Industry Report, 2030GVR Report cover

![Digital Health Market Size, Share & Trends Report]()

Digital Health Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Healthcare Analytics, mHealth), By Component (Hardware, Software, Services), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-886-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Health Market Summary

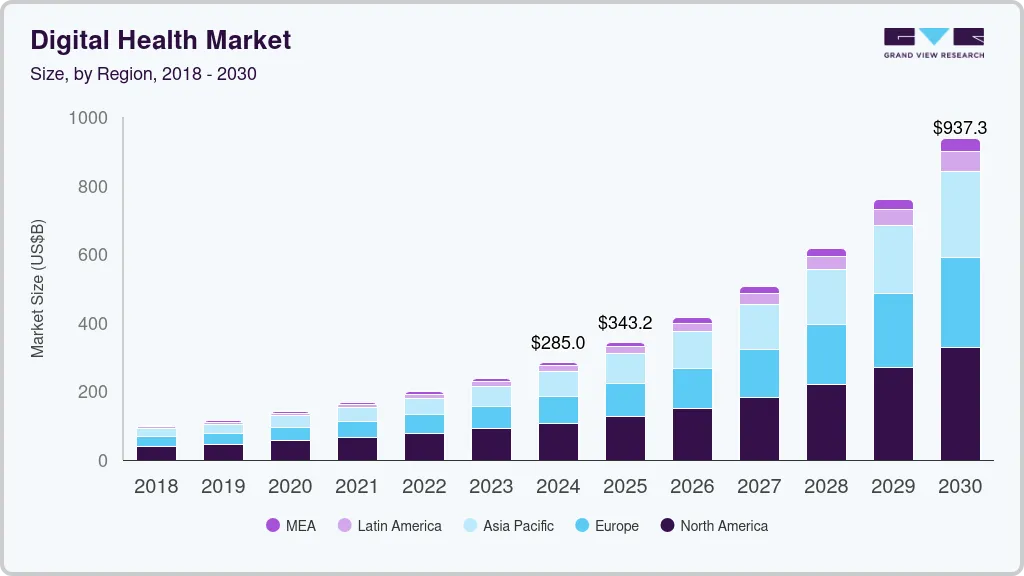

The global digital health market size was estimated at USD 288.55 billion in 2024 and is projected to reach USD 946.04 billion by 2030, growing at a CAGR of 22.2% from 2025 to 2030. The market is driven by several factors, such as a strong domestic digital health market for telehealthcare platform developers, mHealth app providers, wearable device manufacturers, and e-prescription systems.

Key Market Trends & Insights

- North America digital health market dominated global market in 2024 with a revenue share of 37.7%.

- The U.S. dominated the digital health market in North America region in 2024.

- By component, the services segment accounted for the largest revenue share of 37.9% in 2024.

- By technology, the tele healthcare segment dominated the market with a revenue share of 45.0% in 2024.

- By application, the diabetes segment dominated the market with the largest share of 24.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 288.55 Billion

- 2030 Projected Market Size: USD 946.04 Billion

- CAGR (2025-2030): 22.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

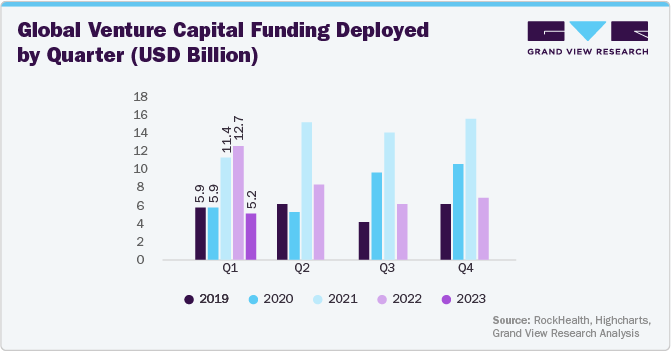

Moreover, the healthcare industry exhibits high growth potential for the IT industry due to supportive government initiatives across all regions. The growing trend of preventive healthcare & the rise in funding for mHealth startups are other factors boosting the market. For instance, according to ROCK HEALTH, a venture capitalist company, in 2024, U.S. digital health startups secured USD 10.1 billion in funding across 497 deals following a total of USD 1.8 billion raised in 118 deals in Q4.

The rising incidence of chronic conditions such as diabetes, heart disease, and cancer is fueling the demand for remote monitoring and management solutions. Digital health tools can help patients track their health, adhere to treatment plans, and communicate more effectively with healthcare providers.

Some statistics related to chronic conditions

-

Global statistics: According to the WHO Noncommunicable diseases cause 41 million deaths annually, constituting 74% of global fatalities. Seventeen million of these deaths occur before the age of 70, with 86% transpiring in low- and middle-income countries, and the majority of NCD deaths (77%) are concentrated in these regions. The leading contributors to NCD-related deaths include cancers (9.3 million), chronic respiratory diseases (4.1 million), diabetes (2.0 million, including diabetes-induced kidney disease deaths), and cardiovascular diseases (17.9 million).

-

Economic impact: The National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP) in the U.S highlights the substantial economic impact of chronic diseases. Annually, heart disease and stroke, claiming over 877,500 lives, represent one-third of all deaths and generate a USD 216 billion economic burden on the healthcare system. Cancer, diagnosed in 1.7 million people yearly, ranks as the second leading cause of death, anticipating a cost exceeding USD 240 billion by 2030. Diabetes, affecting 37 million Americans with an additional 96 million at risk, incurred a total estimated cost of USD 327 billion in 2017, encompassing medical expenses and lost productivity.

-

Individual impact: Beyond the economic factors, chronic conditions significantly impact patients' quality of life. These conditions necessitate daily management, demanding ongoing attention, lifestyle modifications, and adherence to treatment plans. The continuous effort required to cope with chronic illnesses can lead to physical and emotional challenges, affecting not only the individuals but also their families and support networks. Moreover, if left unmanaged, chronic conditions often give rise to complications, further escalating the overall burden on patients and potentially diminishing their overall well-being.

Leveraging Digital Health Solutions for Optimal Impact

-

Remote monitoring: Digital tools such as wearable devices and connected sensors allow patients to track vital signs, blood sugar levels, or other critical data in real-time, empowering them to manage their health proactively.

-

Improved adherence: Medication reminders, educational resources, and personalized coaching apps can help patients stay on track with treatment plans, leading to better health outcomes.

-

Enhanced communication: Telehealth platforms and secure messaging apps facilitate seamless communication between patients and healthcare providers, allowing for timely consultations, adjustments to treatment plans, and addressing concerns without physical visits.

-

Empowerment and engagement: By providing patients with accessible tools and information, digital health fosters a sense of control and engagement in their own health journey, motivating them to actively participate in their care.

Specific Examples Across Chronic Conditions

-

Diabetes: Glucose monitoring apps such as Dexcom and continuous glucose monitors (CGMs) enable real-time blood sugar tracking, insulin dose adjustments, and dietary insights.

-

Heart Disease: Wearable ECG monitors including Apple Watch can detect arrhythmias, while blood pressure cuffs like Omron connect to smartphones for remote monitoring and timely intervention.

-

Cancer: Symptom tracking apps such as Carevive help patients identify and address side effects early, while telehealth platforms like CancerCare offer virtual support groups for emotional well-being.

Furthermore, as per statistics published by the GSM Association report, The Mobile Economy 2023, the number of people connected to mobile services surpassed 5.4 billion in 2022, and the number of unique mobile subscribers is expected to reach 6.3 billion by 2030 (73% of the global population). The penetration of smartphones is also rising significantly. As per The Mobile Economy 2018, smartphone penetration was 57% in 2016 and is expected to reach 77% by 2025. The increasing adoption of smartphones by consumers is driving the uptake of mHealth applications in the digital health market. Furthermore, continuous improvement in network infrastructure and growing network coverage are boosting the demand for mHealth services. Mobile network operators view mHealth as an opportunity for investment owing to growing smartphone adoption and boosting fitness awareness.

The landscape of venture funding for digital health startups is undergoing fluctuations, featuring both surges and declines. Instances such as Aidoc securing USD 20 million in a Series B funding round in September 2020 and McKesson Venture's investment of approximately USD 20 million in Propeller Health in June 2018 highlight a sustained trend of increasing capital in the digital health sector. This trend not only signifies financial opportunities but also indicates a growing confidence in digital health solutions. Physicians with expertise in investments or company operations actively support digital health startups, contributing to market vitality.

However, amidst this positive trend, there was a recent downturn in digital health funding. Starting from its peak at USD 15.71 billion in Q4 2021, funding consistently declined throughout 2022, reaching USD 6.92 billion in Q4. This trend persists into Q1 2023, with global venture capital deployed in digital health further decreasing to USD 5.20 billion. Despite these declining figures, Q1 2023 should be interpreted not as a sign of diminishing interest but as a reflection of ongoing adjustments in venture valuations within the complex landscape faced by venture capital firms. The dynamic relationship between rising interest and recent funding fluctuations suggests a complex and evolving landscape for digital health startups in the upcoming years.

Nevertheless, as of 2024, the landscape of venture funding presents a dynamic overview marked by various trends and shifts. With transition funding options diminishing, digital health startups face a pivotal juncture. Some are turning to labeled fundraises at adjusted valuations, employing innovative strategies, or aligning with policy changes to attract investors. The acceleration of mergers and acquisitions (M&A) activity offers a potential exit route for financially strained companies, albeit potentially at reduced prices. Meanwhile, the public market group is undergoing modification, with struggling companies considering delisting, and late-stage players anticipating public exits after a year without one. This highlights the imperative for adaptability and strategic evolution among digital health startups in the evolving funding landscape of 2024.

Case Studies

Case Study 1: South Africa

MomConnect: Empowering Mothers in South Africa

- The Challenge: Pregnant women and new mothers in South Africa often lack access to timely health information and quality services, impacting both their well-being and their babies' survival.

- The Solution: MomConnect, a national mobile health program, connects pregnant women and new mothers with critical information and services.

Key Features

-

Stage-based health messages: Regular texts provide vital information tailored to each stage of pregnancy and early motherhood.

-

Helpdesk: Users can text questions and receive prompt answers from trained health professionals.

-

Health information library: Access various resources through an easy-to-use menu.

-

Service rating system: Users can provide feedback on their clinic experiences, fostering accountability.

-

National reach: Integrated with the health system, MomConnect serves over 65% of pregnant women and new mothers in South Africa.

The Impact

-

Over 2 million subscribers: High engagement demonstrates the program's value.

-

27% of users complete service ratings: Feedback drives improvements in healthcare facilities.

-

Over 500,000 helpdesk messages: Addresses individual concerns and provides personalized support.

-

Constant innovation: MomConnect pilots new technologies like WhatsApp to stay ahead of the curve.

-

Global expansion: The program's success paves the way for implementation in other countries like Nigeria and Uganda.

Case Study 2: Indonesia

Halodoc: Bridging the Healthcare Gap in Indonesia

Challenge: Indonesia faces major hurdles in healthcare access, including:

-

Limited doctors: Only 2 doctors per 10,000 people, far below global averages.

-

Uneven distribution: Rural areas lack facilities and professionals.

-

Traffic congestion: Megacities make physical access difficult.

-

Cost barriers: Traditional care can be expensive.

Solution: Halodoc, a mobile-based platform, combines telemedicine and pharmacy delivery:

-

Teleconsultations: Connect with licensed doctors for video consultations.

-

Prescription delivery: Get medication delivered within 40 minutes.

-

Affordable: Consultations start at $1.75, lower than traditional clinics.

-

Seamless integration: Links with insurance for cashless transactions.

-

Expansive network: Covers 30 cities and partners with 1,400 hospitals.

Impact

-

Reaches 40 million users: Covers nearly 40% of the target population.

-

Improves access: Provides care in remote areas and reduces travel time.

-

Lowers costs: Makes healthcare more affordable.

-

Partnerships: Collaborates with national health insurance for wider reach.

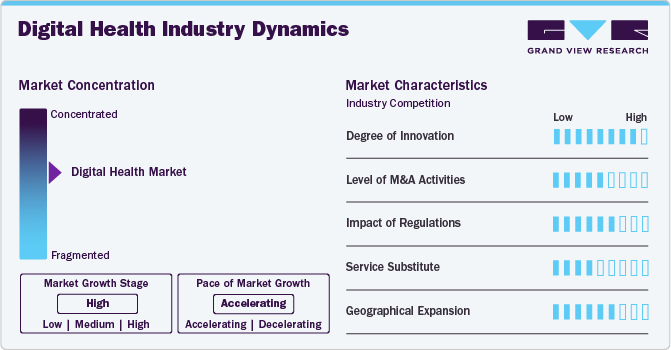

Market Concentration & Characteristics

The global digital health market is characterized by continuous innovation, with a strong focus on user-friendly telehealth technologies. These advancements simplify the adoption process for patients and healthcare providers. The widespread use of mobiles and tablets allows convenient access to telemedicine services, health apps, and wearable health tech. This technological convergence empowers individuals to monitor their health and receive medical consultations remotely. Furthermore, various prominent players are introducing innovative products, solutions, and services to sustain a competitive advantage. For instance, in October 2023, NextGen Healthcare introduced NextGen Ambient Assist, an ambient listening solution that interprets real-time patient-provider conversations for efficient appointment summaries and care plan documentation.

Mergers and acquisitions (M&A) activities continue to shape the business landscape, with companies seeking strategic partnerships and acquisitions to enhance market presence and drive growth. Notable strategies include new product launches, expansions, and M&As. The market observes a moderate level of M&A activities among leading players. For instance, in September 2023, Enovacom, a subsidiary of Orange Business, acquired NEHS Digital and Xperis to enhance healthcare solutions and strengthen its e-health position. Despite expectations for increased M&A activity at the end of 2022, driven by startups facing depleted cash reserves and favorable acquisition opportunities, the surge did not materialize in 2023. Notable acquisitions, such as Minded and Binx Health in Q4, occurred, but the M&A volume was 23% lower than in 2022, potentially influenced by prolonged high-interest rates and volatile capital markets.

Digital health technologies are subject to diverse regulatory frameworks across countries or regions. The structured regulatory framework positively impacts market access, growth, and compliance. For instance,

-

In the U.S., the Food and Drug Administration (FDA) has developed guidelines for digital health technologies.

-

In Australia, Therapeutic Goods Administration (TGA) regulates digital health technologies.

-

In Canada, Health Canada developed a regulatory framework for digital health technologies.

-

In Germany: Medical apps and digital health products often fall under the regulations of the EU's Medical Devices Regulation (MDR) and In Vitro Diagnostics Regulation (IVDR). These EU regulations, directly applicable in Germany, are complemented by the German Act on the Implementation of EU Medical Devices Law (MPDG).

An external substitute for digital health involves opting for non-digital alternatives in healthcare, relying on traditional services and interventions. This entails utilizing conventional methods like face-to-face consultations, traditional medical treatments, or paper-based health records, instead of integrating digital technologies into healthcare processes.

Traditional healthcare delivery

-

In-person consultations with doctors and other healthcare professionals: This would involve physical visits to clinics, hospitals, or other healthcare facilities.

-

Paper-based medical records and communication: Information would be exchanged through physical documents and face-to-face interactions.

-

Traditional diagnostic and treatment methods: These might involve non-digital tools and procedures.

Community-based healthcare

-

Support groups and peer-to-peer networks: Individuals connect and share information and experiences without relying on digital platforms.

-

Local health education and outreach programs: Communities organize workshops, events, and campaigns to promote health awareness and behavior change.

-

Traditional healing practices and herbal remedies: Some communities utilize established non-digital healthcare practices.

The global expansion of the digital health sector is propelled by the potential for improved accessibility, cost-effectiveness, and outcomes. Established industry leaders are venturing into emerging markets, indigenous startups are experiencing growth, and technology is being tailored to diverse contexts. Achieving harmonization through collaborative efforts, national strategies, and addressing challenges such as data privacy, digital inequality, and regulatory complexities is vital. The expansion is generally done through launching facilities, or plants in new geographies or through merging or acquiring companies based in different locations. Several market players are adopting geographical expansion strategies to strengthen their positions in the market. For instance, in March 2022, Telefonica Tech acquired Incremental, a digital transformation and data analysis company, for USD 232 million (EUR 209 million). Through this acquisition, both companies significantly increased their scale and offering of Microsoft technologies in the UK.

Component Insights

The services segment accounted for the largest revenue share of 37.9% in 2024, owing to the growing demand for services, such as installation, staffing, training, maintenance, and other services. Market players are either providing these services as standalone or in packages. The growing demand for advanced software solutions and platforms, such as Electronic Medical Records (EMRs), EHR, and the increasing need for upgradation & training required to run these software solutions, are contributing to segment growth. As per 2021 HealthIT.gov report, nearly 88% of U.S. office-based doctors use EHRs, within that 78% using certified EHRs. Key players provide a wide array of pre- & post-installation services, covering project planning, staffing, implementation, training, and resource allocation & optimization.

The software segment is anticipated to register the fastest growth rate over the forecast period due to the rapid adoption of software systems among patients, healthcare facilities, providers, and insurance payers. Growing healthcare expenses and the trend of healthcare digitalization are contributing to the growth of the software segment. Growing consumer demand for personalized medicine and the transition to value-based care is driving segment growth. In emerging economies, healthcare facilities readily adopt these advanced software solutions and platforms to streamline their organizational workflows and enhance their clinical, operational, & financial outcomes.

Technology Insights

The tele healthcare segment dominated the market with a revenue share of 45.0% in 2024 and is expected to register the fastest CAGR over the forecast period. This growth rate is attributed to advancing internet connectivity, growing smartphone penetration, advanced technology readiness, a growing shortage of healthcare providers, increasing medical expenses, easy availability of telehealth applications, and rising adoption of these technologies by patients & physicians. The constant evolution of telehealth applications and rapid technological innovations further boost segment growth. Government support, policies promoting healthcare digitization, and growing healthcare IT spending are major factors driving segment growth.

The mHealth segment held the second largest position in terms of revenue share in 2024 in the digital health market. Growing penetration of smartphones & internet connectivity and rising adoption of mHealth technologies by physicians & patients are factors driving segment growth. According to Mobile UK, a trade association, there are 111.8 million mobile subscriptions in the UK, and 98% of the adult population have a smartphone. Increasing trend of preventive healthcare & rising funding for mHealth startups are other factors boosting the market.

Application Insights

The diabetes segment dominated the market with the largest share of 24.7% in 2024 and is expected to register the fastest growth over the forecast period. The prevalence of diabetes and its associated complications has positioned it as the largest segment in the digital health space. For instance, according to the International Diabetes Federation, the total number of individuals living with diabetes is expected to increase to 643 million by 2030. Digital health technologies offer innovative solutions to address the needs of individuals with diabetes. Digital health tools, ranging from smartphone applications for glucose monitoring to wearable devices that track physical activity and offer real-time health data, enable patients to actively engage in managing their diabetes. Moreover, these technologies facilitate remote patient monitoring, enabling healthcare providers to receive timely data, make informed decisions, and offer timely interventions, ultimately contributing to more effective diabetes management.

The obesity segment is the second largest in application due to high global prevalence and the rising need for effective weight management solutions. According to the Health Survey for England conducted in 2022, 28% of adults were obese, and 36% were overweight in England. Digital health technologies offer personalized interventions, ranging from mobile applications for dietary tracking to wearable devices monitoring physical activity, driving the segment's growth. Moreover, a shift beyond conventional applications in weight management is evident, with a growing number of companies adopting personalized approaches. This includes the use of metabolic testing, glucose monitoring, and innovative technologies such as Prism Lab’s body mapping and Spren’s smart mirror to customize treatment plans. Remote monitoring companies such as Qardio and Rimidi utilize smart scales to track weight and aggregate data for risk factor assessment. Integration with medications enhances their role in stratifying appropriate care and monitoring adherence. All these factors collectively drive the growth of the obesity segment in the digital health landscape.

End Use Insights

The patient segment held the largest share of 34.5% in 2024 and is expected to witness the fastest CAGR over the forecast period, owing to the shift toward patient-centered care and high awareness of managing health among individuals. Digital health technologies have revolutionized the healthcare landscape by providing patients with tools for remote monitoring, self-management, and access to health information. From mobile health apps that track vital signs to telehealth platforms facilitating virtual consultations, the focus on the patient segment reflects the industry's commitment to enhancing patient engagement, promoting proactive health management, and fostering a more collaborative and informed healthcare experience.

The providers segment held the significant market share of the digital health market and is expected to maintain their market share over the forecast period. The growth is propelled by the widespread adoption of innovative technologies, such as telemedicine and digital therapeutics. Healthcare providers are increasingly leveraging digital solutions to offer remote consultations, personalized treatment plans, and evidence-based therapies outside traditional care settings. The integration of digital tools allows providers to deliver more accessible and tailored care, contributing to improved patient outcomes.

Regional Insights

North America digital health market dominated global market in 2024 with a revenue share of 37.7% owing to technological advancements, growing healthcare IT expenditure to advance infrastructure, favorable government initiatives, emergence of startups, readiness to adopt advanced technological solutions, options for growing smartphone penetration, advancements in internet connectivity, and lucrative funding. In addition, government aid and collaborations are prompting app developers and healthcare providers to develop better digital solutions. For instance, in June 2021, the U.S. Department of Health and Human Services introduced a new form of public-private partnership. It is expected to attract investments in developing healthcare IT and other digital health technologies.

U.S. Digital Health Market Trends

The U.S. dominated the digital health market in North America region in 2024. Key players are involved in developing advanced healthcare products, such as innovative and secure data storing & sharing platforms of EHR, building network infrastructure, and promoting the adoption of various remote health & telemedicine services in the U.S. For instance, in January 2023, AVIA launched AVIA Marketplace, a nationwide digital health marketplace for innovators in healthcare settings for selection, validation, and research of digital health solutions.

Europe Digital Health Market Trends

The digital health market in Europe is expected to grow significantly over the forecast period. European markets and governments mainly focus on digitalizing monitoring services linked with chronic diseases, offering solutions that would ease access to health records and avoid the repetition of unwanted prescriptions & tests. Moreover, the rising geriatric population is one of the key factors driving the demand for digital health in chronic care management, diagnostic solutions, and post-acute care management.

The digital health market in the Spain is expected to grow significantly during the forecast period. The government is taking various initiatives to boost the adoption of digital health. For instance, in 2023, EIT Health Spain launched the F3T project in Barcelona, which stands for Framework for Fast-Track of Digital Health Solutions. This initiative aims to bring together health innovation experts and stakeholders to establish a framework to accelerate the integration of digital health applications in Spain.

Asia Pacific Digital Health Market Trends

Asia Pacific digital health market is expected to witness the fastest growth rate during the forecast period in the digital health market. This surge is attributed to the increasing adoption of eHealth platforms and a rise in healthcare expenditure across the region. Moreover, the increasing adoption of EMR and EHR is considered a key growth factor for digital health in the region. Countries such as Singapore and Australia have a standard national EHR program, and countries such as Malaysia & Japan have already established a national warehouse that enables data sharing between public hospitals.

India digital health market is anticipated to register considerable growth during the forecast period. The increased smartphone penetration, improved network coverage, and favorable government initiatives (such as Digital India and Disha) are boosting the adoption of digital healthcare services in the country. DISHA aims to regulate digital health data into a federal structure. It regulates a National level Healthcare Authority (NeHA) and a State level Healthcare Authority (SeHA). Under this act, national- and state-level executive committees are expected to aid & assist NeHA and SeHA in performing their functions under DISHA.

Latin America Digital Health Market Trends

The Latin America digital health market is expected to witness considerable growth over the forecast period. Government support for expanding telehealth & digital health networks is boosting market growth. For instance, the telemedicine network in Bolivia provided improved access to specialty care in health centers using tele-education and teleconsultation.

Brazil digital health market is anticipated to register considerable growth during the forecast period. Favorable government initiatives and the growing adoption of digital solutions to manage the rising prevalence of chronic diseases is expected to drive market growth in Brazil. For instance, GilcOnLine is an app that allows individuals to manage diabetes by enabling them to view their sugar levels and calculate insulin doses & calorie intakes.

Middle East and Africa Digital Health Market Trends

The digital health market in the Middle East and Africa is expected to witness considerable growth over the forecast period. This growth is driven by factors such as the increasing adoption of digital technologies, a growing awareness of healthcare solutions, and efforts to improve healthcare infrastructure. Digital health is revolutionizing healthcare in MEA, facilitated by improving internet connectivity and government initiatives. Telemedicine, wearable devices, mHealth apps, and Artificial Intelligence (AI) are key trends transforming healthcare access, costs, & outcomes. Despite challenges including infrastructure, affordability, and data privacy, digital health’s potential to improve MEA healthcare is substantial.

The digital health market in Saudi Arabia is undergoing substantial growth and is anticipated to experience rapid expansion. The country launched an initiative such as Saudi Vision 2030. With the launch of this initiative the Kingdom of Saudi Arabia has recognized the importance of digital health in transforming its healthcare system. The vision places a significant emphasis on leveraging technology to enhance healthcare services, improve efficiency, and ensure better health outcomes for the population. Key initiatives related to digital health within Saudi Vision 2030 include:

-

E-Health Services: The development and implementation of electronic health services to streamline processes, improve patient care, and enable efficient healthcare delivery.

-

Telemedicine: The promotion of telemedicine to facilitate remote consultations, monitor patients' health remotely, and increase access to healthcare services, especially in remote areas.

-

Health Information Exchange (HIE): Creating a strong health information exchange system to facilitate the seamless sharing of patient information among healthcare providers, leading to better-informed decision-making.

List of Countries and Digital Health Industry Outlook

Country

State of Adoption

Challenges

Future Outlook

UK

Steady growth in telehealth, focus on NHS integration

Lack of awareness, uneven internet access in rural areas

Focus on scaling existing initiatives and improving accessibility

China

Rapid adoption of wearables and AI-powered solutions

Data security concerns, limited access for rural populations

Continued government investment and development of homegrown solutions

Japan

Emphasis on telemedicine and remote patient monitoring

Traditional healthcare culture, strict data privacy regulations

Gradual integration with focus on maintaining quality and patient trust

Germany

Rising adoption of telehealth and electronic health records

Fragmented insurance landscape, data governance complexities

Streamlining data exchange and addressing interoperability issues

France

Mixed reception for telehealth, strong emphasis on patient-physician relationships

Concerns about dehumanization of healthcare, limited infrastructure in rural areas

Pilot programs and targeted initiatives to address concerns and bridge gaps

Canada

Moderate telehealth adoption, focus on chronic disease management

Public healthcare funding limitations, regional disparities in access

Continued investment in telehealth infrastructure and digital skill development

Australia

Growing adoption of mHealth apps for self-management

Rural access limitations, privacy concerns among older demographics

Focus on community-based telehealth programs and culturally appropriate solutions

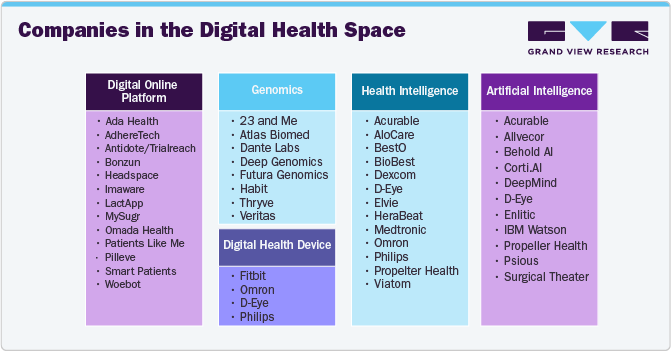

Key Digital Health Company Insights

Key players are adopting new product development, partnership, and merger & acquisition strategies to increase their market share. Apple, Inc., Google, Inc., and Qualcomm Technologies, Inc. are market leaders with a presence in more than 30 countries, including headquarters, manufacturing sites, distribution centers, and office locations. The Apple App Store features over 40,000 apps in the healthcare segment. In March 2023, to improve digital health, Apple Inc. announced plans to upgrade AirPods by adding ambient light sensors with health tracking features, including motion detectors, temperature monitors, blood oxygen level, and perspiration & heart rate, by 2025. In addition, H2O Therapeutics, a Turkey-based startup, received U.S. FDA clearance for its Parky app. This Apple Watch app monitors Parkinson’s disease symptoms, such as dyskinesia and tremors. Furthermore, Samsung Electronics Co. Ltd., Qualcomm Technologies, Inc., and Vodafone Group Plc. are the emerging market players.

Key Digital Health Companies:

The following are the leading companies in the digital health market. These companies collectively hold the largest market share and dictate industry trends.

- Telefónica S.A.

- Epic Systems Corporation

- QSI Management, LLC

- AT&T

- AirStrip Technologies

- Google, Inc.

- Hims & Hers Health, Inc.

- Orange

- Softserve

- Computer Programs and Systems, Inc.

- Vocera Communications

- IBM Corporation

- CISCO Systems, Inc.

- Apple Inc.

- Oracle Cerner

- Veradigm

- Mckesson Corporation

- Vodafone Group

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

Companies in the Digital Health Space

Recent Developments

-

In January 2024, JD Health introduced a new elderly care channel on its app to provide a comprehensive platform for the various healthcare needs of China's aging population.

-

In January 2024, 98point6 Technologies announced the acquisition of Bright.md. to accelerate the launch of 98point6’s asynchronous care module. This development enables healthcare organizations to license an integrated, purpose-built clinician solution supporting multiple care delivery models.

-

In April 2023, Microsoft collaborated with Epic Systems Corporation to integrate AI into EHR, enabling healthcare practitioners to improve their productivity and patient communication with AI-enabled solutions.

-

In March 2023, BlueRock Therapeutics LP entered a collaboration with Emerald Innovations and Rune Labs with a major focus on innovations using contactless & invisible, wearable digital health technology to improve monitoring of Parkinson's disease.

-

In March 2023, Google launched Open Health Stack, an open-source program for developers to build health-related apps by including strategies, such as AI partnerships focusing on cancer screening.

-

In March 2023, Nabla Technologies launched Copilot, a digital assistant tool, as a Chrome extension using GPT-3 for doctors to make patients' conversations turn into action.

-

In March 2022, Samsung unveiled its latest innovation, a smart healthcare TV and advanced digital health solutions for healthcare facilities, at the Healthcare Information and Management Systems Society (HIMSS) Global Conference in Florida. Furthermore, Samsung and ShareSafe partnered to develop a secure solution for casting from mobile devices to Samsung Smart Healthcare TV

-

In March 2022, Epic Systems Corporation launched Garden Plot, which provides small independent healthcare groups access to Epic software solutions and an interoperability network.

-

In March 2022, Vocera Communications, a part of Stryker, introduced Minibadge. This compact, portable, voice-driven wearable device integrates with clinical and operational workflows of healthcare facilities & enables hands-free communication.

Digital Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 347.35 billion

Revenue forecast in 2030

USD 946.04 billion

Growth rate

CAGR of 22.2% from 2025 to 2030

Historical data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; Australia; Singapore; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Oracle Cerner; Veradigm; Apple Inc.; Telefonica S.A.; McKesson Corp.; Epic Systems Corp.; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd.; Hims & Hers Health, Inc.; Orange; Qualcomm Technologies, Inc.; Softserve; Computer Programs and Systems, Inc.; Vocera Communications; IBM Corp.; CISCO Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global digital health market report on the basis of technology, component, application, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Tele-healthcare

-

Tele-care

-

Activity Monitoring

-

Remote Medication Management

-

-

Tele-health

-

LTC Monitoring

-

Video Consultation

-

-

-

mHealth

-

Wearables & Connected Medical Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep trackers

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal & Obstetric Devices

-

Neuromonitoring Devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

mHealth Apps

-

Medical Apps

-

Women's Health

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Menopause

-

Disease Management

-

Others

-

-

Chronic Disease Management Apps

-

Diabetes Management Apps

-

Blood Pressure & ECG Monitoring Apps

-

Mental Health Management Apps

-

Cancer Management Apps

-

Obesity Management Apps

-

Other Chronic Disease Management Apps

-

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

Fitness Apps

-

Exercise & Fitness

-

Diet & Nutrition

-

Lifestyle & Stress

-

-

-

Services

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-Acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

-

Digital Health Systems

-

EHR

-

E-prescribing Systems

-

-

Healthcare Analytics

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obesity

-

Diabetes

-

Cardiovascular

-

Respiratory Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital health market size was estimated at USD 288.55 billion in 2024 and is expected to reach USD 347.35 billion in 2025.

b. The global digital health market is expected to grow at a compound annual growth rate of 22.2% from 2025 to 2030 to reach USD 946.04 billion by 2030.

b. Tele-healthcare dominated the digital health market with a share of 45.0% in 2024. The growing demand for advanced software solutions and platforms, such as Electronic Medical Records (EMRs), EHR, and the increasing need for upgradation & training required to run these software solutions, are contributing to segment growth.

b. Some key players operating in the digital health market include Apple Inc.; AirStrip Technologies; Allscripts; Google Inc.; Orange; Qualcomm Technologies Inc.; Mqure; Samsung Electronics Co. Ltd.; Telefonica S.A.; Vodafone Group; Cerner Corporation; and McKesson Corporation.

b. Key factors that are driving the digital health market growth include increasing adoption of digital healthcare, favorable initiatives, and technological advancements for developing innovative digital solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.