- Home

- »

- Healthcare IT

- »

-

Telehealth Services Market Size, Share, Growth Report, 2030GVR Report cover

![Telehealth Services Market Size, Share & Trends Report]()

Telehealth Services Market Size, Share & Trends Analysis Report By Service Type (Remote Patient Monitoring, Real Time Interactions), By Delivery Mode (Web-based, Cloud-based), By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-972-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Telehealth Services Market Size & Trends

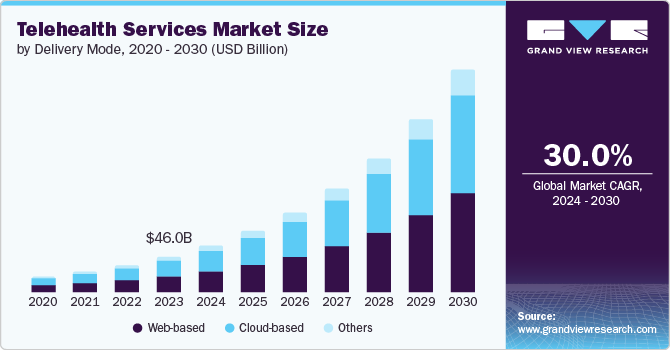

The global telehealth services market size was estimated at USD 46.03 billion in 2023 and is projected to grow at CAGR of 30.0% from 2024 to 2030. The rapidly developing healthcare digitalization, rising smartphone penetration coupled with increasing mobile internet users, growing demand for simplified disease management & value-based care, the widening shortage of healthcare personnel, and numerous advances in the healthcare IT infrastructure are driving the growth. For instance, in March 2023, Royal Philips unveiled Philips Virtual Care Management, offering a wide range of adaptable solutions and services for health systems, providers, payers, and employer groups to engage and support patients effectively from any location.

Additionally, the need for remote patient monitoring and the expanding use of telemedicine services in the wake of the COVID-19 pandemic has also contributed to the market's expansion. The COVID-19 pandemic positively impacted the telehealth market. The COVID-19-related restrictions, such as social distancing norms & minimal physical contact, supported the adoption of virtual health solutions and online consultations. Moreover, the increased risk of infection and growing shortage of healthcare facilities during the COVID-19 pandemic drove healthcare workers and medical centers to incorporate digital care technologies and maintain patient care.

In addition, aging societies with the rising prevalence of chronic and non-communicable diseases and an increasing shortage of healthcare workers are hindering the accessibility and availability of healthcare services. According to the World Health Organization (WHO) estimates, expected shortage of 10 million health workers by 2030, especially in low- and middle-income nations. Moreover, emerging economies and developing nations need more providers to deliver care to remote and rural healthcare settings. For instance, the American Hospital Association estimates a projected shortage of up to 124,000 doctors by 2033. In addition, it estimates the anticipated need to hire a minimum of 200,000 nurses a year to meet increasing demands. This drives healthcare facilities to enforce digital health technologies, enhancing patient-provider engagement and care delivery efficiency.

Remote patient monitoring is a commonly used telehealth service involving real-time patient health data collection via smart wearables. This data is analyzed & consolidated by care providers, utilized in their decision-making procedures, and allows for accurate diagnosis. Moreover, remote patient monitoring helps bridge the care gap and improves patient-provider engagement. In addition, telehealth service, physician-to-physician contact, allows providers to collaborate virtually with healthcare professionals to improve the patient care experience. However, this emerging technology encounters a few challenges in its adoption path, such as insufficient resources & expertise, a lack of adequate digital infrastructure, and a lack of reliable networking infrastructure restricting connectivity & service delivery.

Telehealth services provide personalization, real-time audio & video communications, and machine learning & artificial intelligence integrations allowing care providers to improve the patient experience. Remote accessibility and improved quality care, availability of timely & urgent care, lowered overall healthcare expenses, and improved provider productivity via automatic sharing of health data, self-service pre-screenings, and data-driven decision-making. These are some benefits associated with telehealth services promoting their adoption widely. Virtual care solutions are accessible and convenient to both providers and patients. According to a study conducted by Cisco , 74% of the respondents favored adopting teleconsultations and virtual visits over physical visits. Virtual visits facilitate seamless communication, increased follow-up visits, real-time data collection, and enhanced engagement.

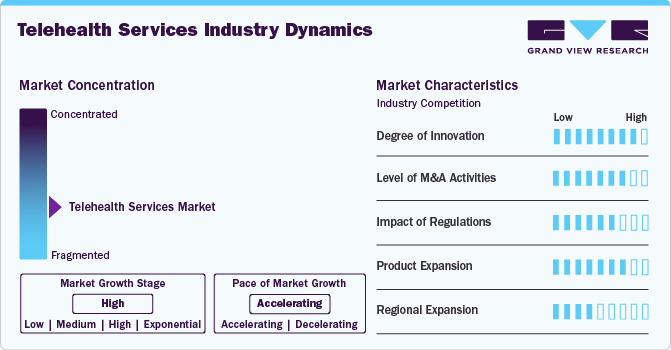

Market Concentration & Characteristics

The telehealth services market is a relatively fragmented market, with a large number of small and medium-sized companies operating in the space. This fragmentation is driven by the diverse range of services offered by these companies, including telemedicine platforms, remote monitoring solutions, and patient engagement platforms. The lack of a dominant player in the market creates opportunities for new entrants to establish themselves and gain market share.

The telehealth services market is characterized by a high degree of innovation, driven by the rapid advancement of digital technologies and the need for healthcare providers to adapt to changing patient needs and expectations. For instance, in September 2022, CareCloud, Inc. introduced its new Remote Patient Monitoring (RPM) solution as part of the company’s Wellness product lineup. This latest offering complements the existing Chronic Care Management (CCM) solutions, providing healthcare providers with the tools to monitor patients' health remotely and enhance the quality of care they receive beyond traditional clinical visits. The market is witnessing the development of new and innovative solutions, such as artificial intelligence-powered chatbots, virtual reality therapy, and wearable devices with remote monitoring capabilities.

The regulation of telehealth services has a significant impact on the market. The lack of standardized regulations and laws has created a challenging environment for companies to operate in. The Health Insurance Portability and Accountability Act (HIPAA) and the Telemedicine Health Parity Act (THPA) have provided some guidance, but there is still a need for more comprehensive regulations.

The level of M&A activities in the telehealth services market is increasing, driven by the growing demand for remote healthcare services and the need for companies to scale and expand their offerings. For instance, O'Melveny provided counsel to EyecareLive, a digital vision care platform, as it merged with Visibly, a healthcare technology company, in January 2024. The deal brings together innovative solutions for eye care professionals, patients, and pharmaceutical companies. In recent years, there have been a significant number of acquisitions and partnerships between telehealth companies, health systems, and payers.

The product expansion in the telehealth services market is moderate. The market is growing rapidly, driven by increasing demand for remote healthcare services, technological advancements, and regulatory changes. For instance, in January 2024, Pylo Health, a company specializing in remote patient monitoring devices and a partner of Prevounce, unveils the release of two advanced patient devices: the Pylo 900-LTE blood pressure monitor and the Pylo 200-LTE weight scale. However, there are still significant barriers to adoption, such as reimbursement issues, concerns about data security, and limited awareness of telehealth services among some patients and healthcare providers.

Global expansion in the telehealth services market is high. The market is experiencing rapid growth. Telehealth services are being adopted globally, particularly in regions with limited access to healthcare facilities, such as rural areas and developing countries. Additionally, the COVID-19 pandemic has accelerated the adoption of telehealth services worldwide, creating a surge in demand for global telehealth expansion. As a result, companies are investing heavily in international expansion, partnering with local providers, and developing tailored products and services to meet the needs of diverse patient populations.

Delivery Mode Insights

The web-based segment held the largest share of 45.78% in 2023. The demand for web-based delivery services is due to the availability of various telehealth platforms and virtual care applications on the web. Web-based platforms enable users with direct access to care solutions. The rise of digital health technologies has led to a surge in demand for web-based telehealth services, enabling patients to access healthcare services remotely through online platforms. For instance,in March 2022, Opear Holdings, Inc. launched a web-based version of its "Opear for Providers" app, catering to the needs of doctors and APRNs (Advanced Practice Registered Nurses). The Opear for Providers platform is designed as an all-in-one solution for healthcare professionals to establish and operate low-overhead telehealth practices, offering a convenient and accessible way to deliver virtual care to patients. Developments in the smartphone industry, coupled with enhancing internet penetration and connectivity in distant locations, are contributing to the growth of the segment.

The cloud-based telehealth services segment is projected to grow at the fastest CAGR from 2024 to 2030. The factors responsible for the segment's growth are enhanced accessibility, the emergence of cutting-edge platforms, increased bandwidth, rising awareness levels amongst care personnel & patients, and enhanced data privacy & security. For instance, in February 2022, Masimo unveiled a significant enhancement to its Masimo SafetyNet platform, which now integrates robust and secure video conferencing capabilities. This expanded platform offers a comprehensive telehealth and telemonitoring solution, enabling healthcare providers to remotely monitor patients and deliver high-quality care. Web-based platforms and applications are more susceptible to data breaches than cloud-deployed solutions, driving the growth of the cloud-deployed segment. Patient monitoring and teleconsultations using cloud-deployed platforms have improved medical care accessibility in rural areas.

Service Type Insights

The real-time interactions segment accounted for the largest revenue share of 28.33% in 2023. The dominance of the segment is due to the overall adoption to address chronic conditions, advances in digital health infrastructure, growing demand for real-time monitoring, the rising number of mobile internet users, and increasing demand to minimize healthcare expenditure. In addition, incorporating ML/AI algorithms into telehealth services helps care providers construct real-time data-backed decisions, enhance clinical outcomes, and improve the patient care journey. For instance, in November 2023, Lee Health introduced a groundbreaking telemedicine service, enabling patients to engage in real-time messaging with Lee Health physicians. This innovative platform provides patients with the convenience of direct communication with healthcare professionals, allowing for seamless and timely exchanges of information and concerns. An increase in real-time provider-patient audio/video consultations, live patient health data collection, and skyrocketing virtual visits fuels the segment's growth. Telehealth platforms can seamlessly integrate patient health information from live virtual interactions across multiple care settings using configuration tools.

The remote patient monitoring segment is expected to grow at the fastest CAGR from 2024 to 2030. The segment's growth is anticipated due to the consistent development of digital health space and the rising development of multiple tools & platforms to track & monitor patients' health. For instance,in October 2023, Ricoh USA, Inc. introduced RICOH Remote Patient Monitoring (RPM) Enablement, a comprehensive managed services solution tailored for health systems. This new offering aims to enhance RPM workflows, promoting greater efficiency and sustainability while positively impacting both patient and care delivery team experiences. Growing healthcare costs and increasing demand for precise real-time patient health monitoring support the adoption of these services.

Application Insights

The teleradiology held the largest revenue share of 24.33% in 2023 due to the rising diagnostic imaging centers, the rapid incorporation of tele-radiology workflow by healthcare providers, and the introduction of supporting teleradiology practices. Medical imaging solutions is the pioneering medical field to adopt telehealth solutions and virtual care readily. For instance, in February 2024, Yellowcross Healthcare Commerce, a provider of telemedicine practice management services, launched a new consultancy service designed to empower medical groups and healthcare facilities to enhance their remote care capabilities. This new venture, founded by experienced telemedicine professionals, aims to support healthcare providers in addressing the growing shortage of radiologists and improving patient care through the adoption of innovative telemedicine solutions. Moreover, integrating advanced AI/ML algorithms and implementing a Picture Archiving and Communication System (PACS) into tele-radiology solutions is anticipated to drive the demand for the segment's growth.

The telepsychiatry segment is expected to register lucrative growth from 2024 to 2030, owing to the rising prevalence of behavioral diseases and mental health conditions. The growing awareness amongst care providers and patients towards tele-psychiatry solutions is expanding segment growth. For instance, MDLive, a telehealth company, provides virtual consultations with a comprehensive team of counselors and psychiatrists to address various mental diseases.

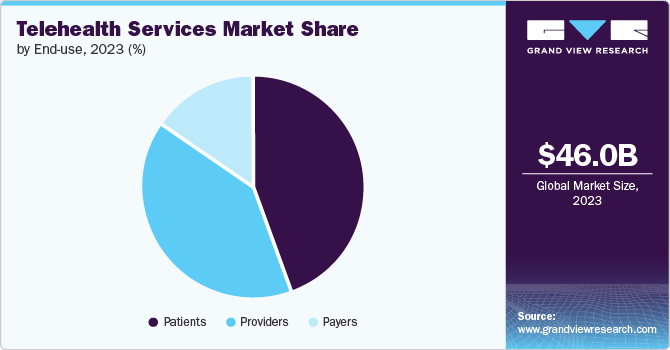

End Use Insights

The patients' segment accounted for a revenue share of 44.18% and it is anticipated to grow at the fastest growth rate from 2024 to 2030. The segment's dominance is due to the increasing adoption rates of telehealth applications & virtual care platforms and increased affordability, convenience, & accessibility of care solutions. For instance, in January 2022, OMRON Healthcare, Inc. introduced remote patient monitoring services with an advanced mobile app and connected blood pressure monitors globally. The growth of the segment is attributable to rising smartphone penetration & internet connectivity, increasing technology-friendly users, awareness & health consciousness, and the growing number of active subscribers. These virtual solutions have successfully bridged the care & communication gaps existing between providers and patients.

The rising digitalization of healthcare and overall adoption of mobile health (mHealth) technologies have facilitated the seamless exchange of medical information. The emergence of virtual care centers and multiple pilot programs to adopt teleconsultation and telemedicine platforms enhance the affordability and accessibility of care services for patients.

The providers segment is anticipated to witness significant CAGR from 2024 to 2030. This is driven by increased demand for remote care options and the need for more efficient and cost-effective healthcare delivery. As a result, healthcare organizations are investing in advanced telemedicine technologies, including virtual reality, artificial intelligence, and machine learning, to enhance patient engagement, improve outcomes, and reduce healthcare disparities.

Regional Insights

North America telehealth services market dominated the overall global market and accounted 51.24% revenue share in 2023. This is attributable to the rise in healthcare IT expenses, the presence of prominent market players, advances in health infrastructure, high-quality network connectivity, and the growing incidence of chronic conditions. The presence of cloud-deployed virtual care applications and solutions and increasing awareness of digital health propels the region’s market.

U.S. Telehealth Services Market Trends

The telehealth services market in the U.S. held a significant share of North American market in 2023. This growth is attributed to the increasing adoption of telehealth services by patients, healthcare providers, and payers, as well as the rising need for remote healthcare services due to the COVID-19 pandemic. Additionally, the increasing use of digital health technologies, such as artificial intelligence and virtual reality, is also expected to drive growth in the telehealth services market. For instance, in August 2022, Medtronic PLC forged a strategic partnership with BioIntelliSense, a pioneer in continuous health monitoring, to acquire the exclusive U.S. rights to distribute BioIntelliSense's BioButton multi-parameter wearable for continuous, connected monitoring in U.S. hospitals and 30-day post-acute hospital-to-home settings.

Europe telehealth Services Market Trends

The Europe telehealth services market is witnessing growth fueled due to advancements in technology. The market is driven by the increasing adoption of wearable devices, mobile apps, and telemedicine platforms that enable patients to monitor their health remotely and receive personalized care. For instance, in November 2023, AstraZeneca announced the launch of Evinova, a cutting-edge health-tech business designed to accelerate innovation in the life sciences sector and improve patient outcomes. Evinova will focus on developing digital solutions, including remote patient monitoring and digital therapeutics, with a robust pipeline of innovative products in these areas.

The telehealth services market in the UK is one of the major markets in the region, driven by an increasing demand for personalized and preventive healthcare. Key drivers of this growth include the rise of digital health technologies, such as wearables and mobile apps, which are enabling patients to take a more active role in their health management. For instance[SK15] , in April 2023, BT Group unveiled a virtual wards program, designed to support healthcare providers across the UK. This initiative is a key component of BT's commitment to collaborate with the National Health Service (NHS) to create innovative, patient-centric services that are more efficient, safer, and better equipped to meet the needs of all users.

The Germany telehealth services market is expected to grow significantly from 2024 to 2030 driven by the increasing demand for digital healthcare services and the need for personalized wellness solutions. To capitalize on this trend, a company could partner with leading German healthcare providers. For instance[SK16] , .in January 2024, Implicity, a remote patient monitoring (RPM) company specializing in cardiac data management solutions, formed a strategic partnership with the German Society of Cardiologists in Private Practice, a professional organization and founding member of the European Society of Cardiology's Council for Cardiology Practice.

Asia Pacific Telehealth Services Market Trends

The telehealth services market in the Asia Pacific region is expected to grow considerably from 2024 to 2030, driven by factors such as the increasing adoption of digital health technologies, growing awareness of preventive healthcare, and rising demand for personalized healthcare services. The region's large and aging population, combined with the prevalence of chronic diseases such as diabetes and cardiovascular disease, is also driving demand for telehealth services. Additionally, the Asia Pacific region's high smartphone penetration and rapid adoption of mobile health technologies. For instance, in March 2023, Fujitsu unveiled a cloud-based platform, designed to facilitate the secure collection and utilization of health-related data, to accelerate digital transformation in the healthcare industry. These are further fueling the growth of the telehealth services market.

The China telehealth services market is expected to grow at the fastest rate from 2024 to 2030 due to the investment of tech giants and healthcare companies. These investments are expected to drive innovation, improve healthcare outcomes, and increase access to healthcare services for the Chinese population.

The telehealth services market in Japan is expected to grow from 2024 to 2030, driven by factors such as an aging population, increasing healthcare costs, partnerships between companies, and the need for remote monitoring and personalized care. For instance, in November 2023, Tochtech Technologies, partnered with Mediva Inc. to launch a project in Japan, aimed at validating the efficacy of Tochtech's Vericare platform in enhancing safety and health outcomes for seniors, with a focus on improving their quality of life.

Latin America Telehealth Services Market Trends

The Latin America telehealth services marketis experiencing significant growth attributed to various factors. Partnering with local healthcare providers or tech companies could provide an invaluable entry point For instance, in April 2023, a collaboration between FAPESP and Hapvida NotreDame Intermédica, a health plan operator in Brazil, was launched at the Federal University of Ceará (UFC) in Fortaleza. The Reference Center on Artificial Intelligence (CEREIA) was established to drive innovation and research in AI. The center will focus on six key areas, including the development of intelligent systems for remote patient monitoring, enabling more effective and efficient healthcare services.

Middle East & Africa Telehealth Services Market Trends

The telehealth services market in MEA is expected to showcase the fastest growth rate from 2024 to 2030. Growing healthcare IT costs and digital readiness amongst MEA countries drive the region's growth. For instance, the Saudi Arabian government established the Kingdom’s Vision 2030 initiative to promote and expand e-health services and transform the patient experience while enhancing overall efficiency.

The Saudi Arabia telehealth services market is anticipated to expand from 2024 to 2030. The country's healthcare system is undergoing a transformation, driven by innovative technologies such as telehealth services, remote monitoring devices, and AI-driven healthcare platforms. These advancements enable remote consultations, real-time health monitoring, and personalized treatment plans, thereby enhancing accessibility and efficiency in healthcare delivery.

Key Telehealth Services Company Insights:

The scenario in the market is highly competitive, with key players such as Teladoc Health; American Well; Medtronic plc; Koninklijke Philips N.V.; Siemens Healthineers; GE Healthcare, and Health Tap holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Telehealth Services Companies:

The following are the leading companies in the telehealth services market. These companies collectively hold the largest market share and dictate industry trends.

- Teladoc Health

- American Well

- Medtronic plc

- Koninklijke Philips N.V.,

- Siemens Healthineers,

- Doxy.me

- Doctor On Demand

- Cerner Corporation

- Cisco Systems.

- Practo

- GE Healthcare

- Zoom

- MDlive

- PlushCare

- Global Med

- Health Tap

Recent Developments

-

In January 2024, O'Melveny provided counsel to EyecareLive, a digital vision care platform, as it merged with Visibly, a healthcare technology company. The deal brings together innovative solutions for eye care professionals, patients, and pharmaceutical companies.

-

In April 2024, Tembo Health, a telemedicine provider catering to seniors, entered into a strategic partnership with Springwell Senior Living, a 250-resident senior living community in northwest Baltimore. The community, which offers independent living, assisted living, and memory care services, will integrate Tembo Health's telemedicine services to provide residents with convenient and accessible healthcare solutions.

-

In March 2024, Garmin Malaysia unveiled the HRM-Fit, a new heart rate monitor specifically designed for women. With a clip-on design, it can be easily attached to medium- and high-support sports bras for optimal comfort, ensuring precise tracking of real-time heart rate and workout information.

Telehealth Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 60.48 billion

Revenue forecast in 2030

USD 291.37 billion

Growth rate

CAGR of 30.0% from 2024 to 2030

Actual Data

2018 - 2023

Forecast Data

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, delivery mode, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

American Well; Medtronic plc; Koninklijke Philips N.V; Siemens Healthineers,; Doxy.me; Doctor On Demand; Cerner Corporation; Cisco Systems.; Practo; GE Healthcare; Zoom; MDlive; PlushCare; Global Med; Health Tap

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telehealth Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global telehealth services market report based service type, delivery mode, application, end use, and region.

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Remote Patient Monitoring

-

Real Time Interactions

-

Store and Forward

-

Video/ Audio Consultations

-

Physician-to-physician Contact

-

Patient Medical Data Collections

-

Appointment Scheduling

-

Other Telehealth Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Teleradiology

-

Telepsychiatry

-

Telepathology

-

Teledermatology

-

Telecardiology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Payers

-

Providers

-

Patients

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include rapidly growing healthcare digitalization era, increasing smartphone penetration coupled with growing mobile internet users, rising demand for value-based care & simplified disease management, growing shortage of healthcare personnel

b. The global telehealth services market size was estimated at USD 46.03 billion in 2023 and is expected to reach USD 60.48 billion in 2024.

b. The global telehealth services market is expected to grow at a compound annual growth rate of 30.0% from 2024 to 2030 to reach USD 291.36 billion by 2030.

b. North America dominated the telehealth services market with a share of 51.2% in 2023. This is attributable to the presence of renowned market players, the emergence of entrepreneurial ventures, an increase in healthcare IT expenditures, advancements in digital health infrastructure, high-quality internet connectivity, and growing technology-friendly smartphone users.

b. Some key players operating in the telehealth services market include American Well, Teladoc Health, Koninklijke Philips N.V., Doctor On Demand, Siemens Healthineers, Doxy.me, Cerner Corporation, and Cisco Systems

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."