- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyvinyl Alcohol Films Market Size, Industry Report, 2033GVR Report cover

![Polyvinyl Alcohol Films Market Size, Share & Trends Report]()

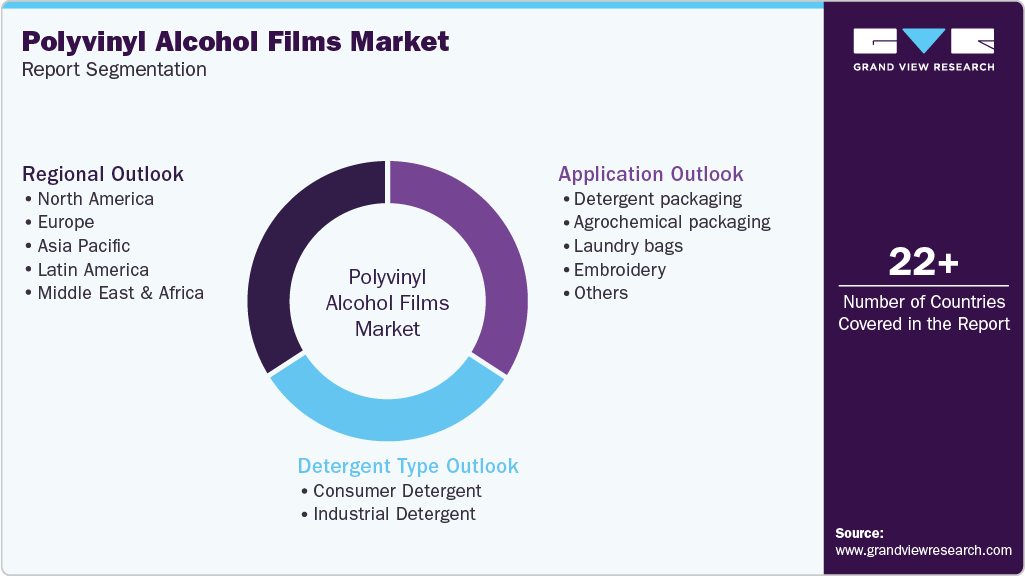

Polyvinyl Alcohol Films Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Detergent Packaging, Agrochemical Packaging, Laundry Bags, Embroidery), By Detergent Type (Consumer Detergent, Industrial Detergent), By Region, And Segment Forecasts

- Report ID: 978-1-68038-020-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyvinyl Alcohol Films Market Summary

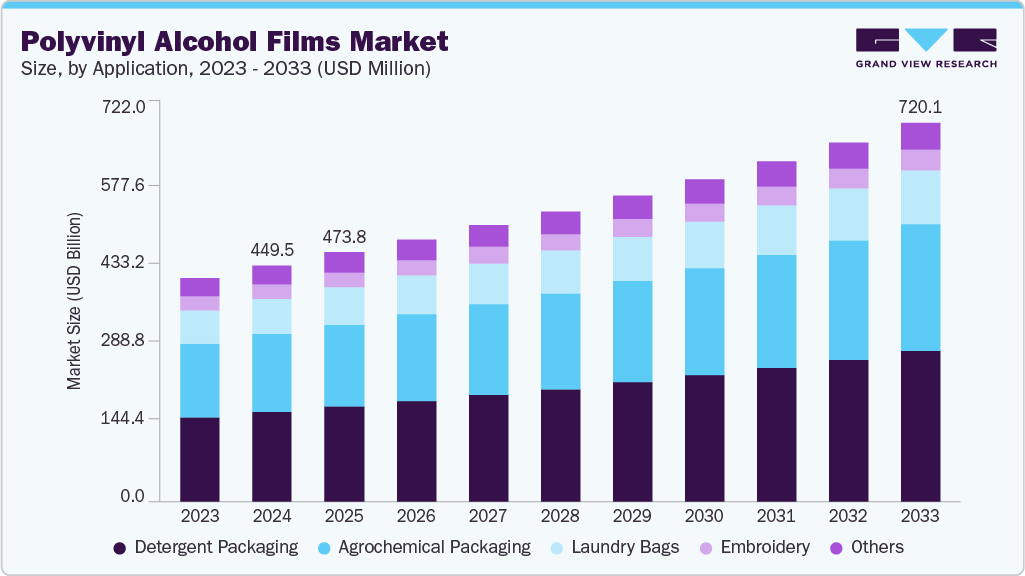

The global polyvinyl alcohol films market size was estimated at USD 449.5 million in 2024 and is projected to reach USD 720.1 million by 2033, growing at a CAGR of 5.4% from 2025 to 2033. Advances in polymer modification and coating technologies are enabling PVA films to meet tougher performance requirements at scale.

Key Market Trends & Insights

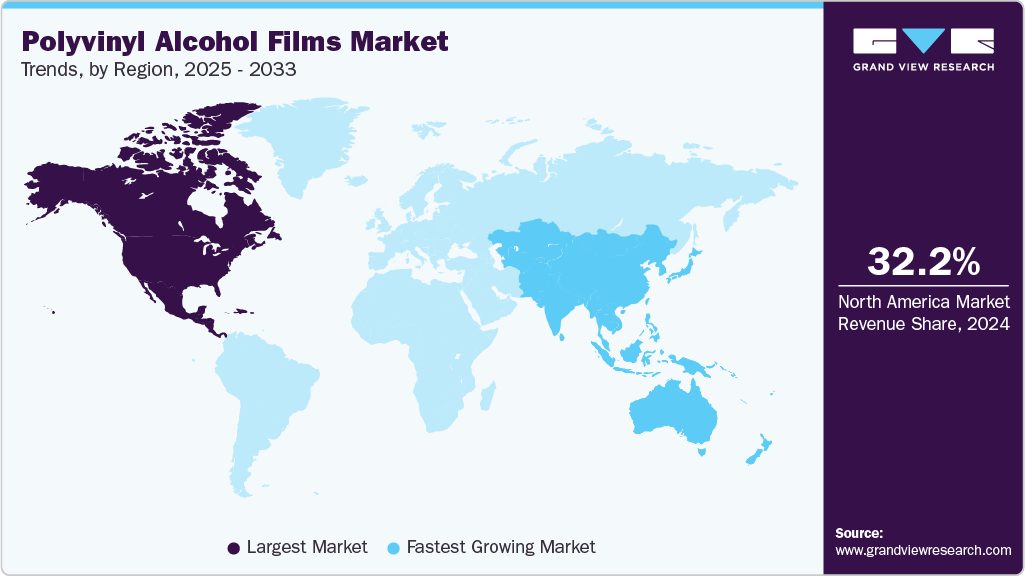

- North America dominated the polyvinyl alcohol films market with the largest revenue share of 32.2% in 2024.

- The polyvinyl alcohol films industry in India is expected to grow at a substantial CAGR of 6.9% from 2025 to 2033.

- By application, the detergent packaging segment is expected to grow at a considerable CAGR of 5.9% from 2025 to 2033 in terms of revenue.

- By detergent type, the consumer detergent segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 449.5 Million

- 2033 Projected Market Size: USD 720.1 Million

- CAGR (2025-2033): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest market

Improved barrier properties and processing stability lower conversion risk and cost for manufacturers, making PVA a more attractive substitute in broader packaging and industrial applications. The polyvinyl alcohol films industry is evolving from a niche product to a broader industrial material as formulators improve film performance and processing consistency. Manufacturers are investing in improved film extrusion and coating processes to close the gap with conventional polymers in mechanical strength and barrier performance. At the same time, demand is shifting toward applications where controlled water solubility and clean dissolution are important, such as unit-dose packaging and capsules for industrial chemicals. This combination of technical refinement and expanded end-use applications is supporting the steady product migration from specialty labs into mainstream packaging and industrial supply chains.

Drivers, Opportunities & Restraints

Regulatory pressure and corporate sustainability commitments are the key commercial drivers for the adoption of PVA films, as the material offers an alternative to conventional plastics in applications where water solubility or rapid degradation are advantageous. Brand owners seeking less waste after use are incentivizing sourcing teams to test PVA for single-use formats, detergent and cleaning dispensing, and certain disposable medical devices. At the same time, PVA's inherent functional properties-good film-forming ability, transparency, and tunable solubility-make it attractive to formulators seeking predictable performance. These combined forces of policy and product adaptation are accelerating the switch in target segments.

There is significant potential to expand PVA films into the rapidly growing single-use and controlled-release niches, where end-of-life behavior is as important as performance. Innovations in additive packages and multilayer constructions can yield films with improved moisture resistance, targeted dissolution rates, and active barrier functions, paving the way for pharmaceutical unit-doses, active packaging for perishable goods, and customized industrial dispensing systems. Geographical expansion into emerging markets with strong demand for detergents and consumer goods also offers manufacturers economies of scale. Strategic partnerships between PVA suppliers, processors, and brand owners can therefore unlock new value chains and premium pricing for differentiated film solutions.

The main limitation of PVA films is their sensitivity to ambient humidity, which complicates storage, logistics, and use in humid climates, as well as certain food packaging applications. Competing biopolymers and conventional plastics often offer better moisture barrier properties and are more cost-effective, putting pricing and performance pressure on PVA suppliers.

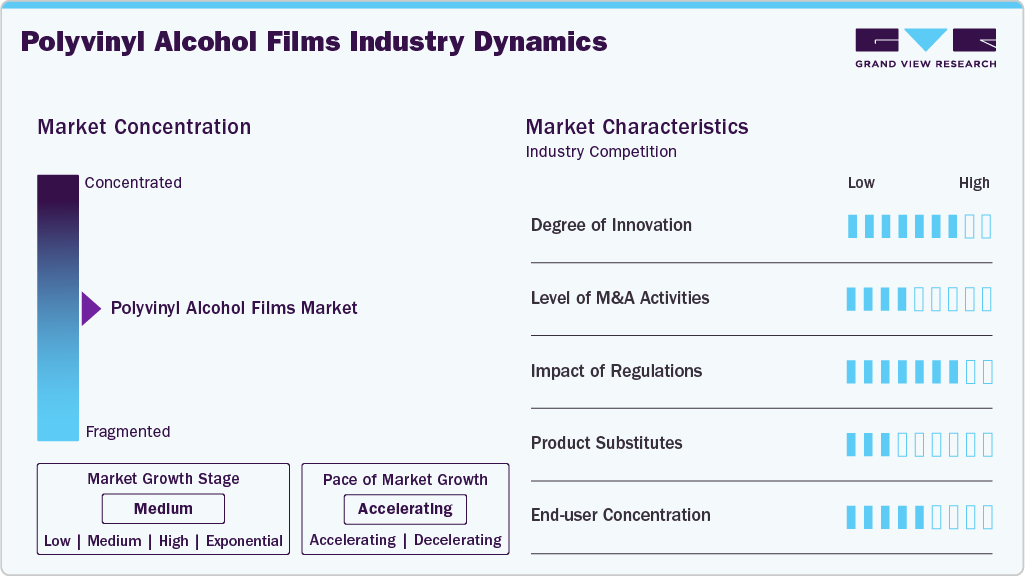

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The polyvinyl alcohol films market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies like Kuraray Co., Ltd., Mitsubishi Chemical Group Corporation, Aicello Corporation, Sekisui Chemical Co., Ltd., Nippon Synthetic Chemical Industry Co., Ltd., MonoSol LLC, Chang Chun Group, Jiangmen Proudly Water-Soluble Plastic Co., Ltd., Foshan Polyva Materials Co., Ltd., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovations in PVA films today are pragmatic and application-oriented: Suppliers combine polymer engineering with multilayer laminates and surface coatings to tailor water solubility, mechanical strength, and temporary barrier properties to specific end applications. Advances in additive systems and controlled hydrolyzable films enable formulators to create solution profiles tailored to wash cycles, tank mixing, or dirt contact. Converters are improving extrusion and sealing to improve handling in logistics. At the same time, integration into automated dispensing and pouch-packing lines is accelerating, reducing switchover risk for large-scale buyers and enabling higher-value, performance-differentiated product formats.

Recent regulatory measures are tightening the commercial calculations for the adoption of PVA films: The new EU Packaging and Packaging Waste Regulation (PPWR) tightens the requirements for recyclability, labeling, and compostability, and requires clearer evidence from packaging suppliers, which, on the one hand, increases the demand for low-waste solutions and increases the compliance burden for novel polymers.

Application Insights

Detergent packaging dominated the polyvinyl alcohol films industry with a revenue share of 38.06% in 2024 and is forecasted to grow at a 5.9% CAGR from 2025 to 2033. The biggest commercial driver for PVA films in detergent packaging is the increasing adoption of pre-measured, single-dose formats that combine consumer convenience with high formulation concentration. Brand owners and converters prefer water-soluble films because they enable compact, lightweight formats, reduce transportation costs, and simplify dosing. This supports premium positioning and lowers the total cost of ownership for retailers.

The agrochemical packaging segment is anticipated to grow at a substantial CAGR of 5.6% through the forecast period. The main advantage of PVA films is operational reliability and dosing precision: Thanks to pre-measured soluble capsules and sachets, users can add the product directly into tanks without having to manually measure or expose it to contact. This reduces operator risk and the danger of drift when handling concentrated chemicals. Regulators and large agricultural buyers are increasingly placing value on packaging solutions that reduce contamination and simplify disposal. This makes water-soluble films attractive for targeted formulations such as seed treatments and foliar sprays.

Detergent Type Insights

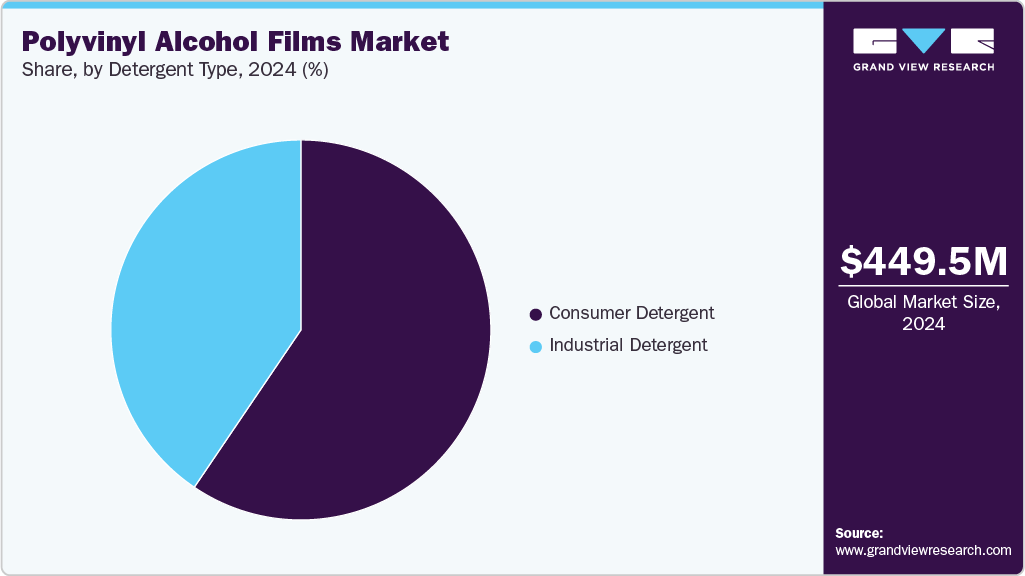

Consumer detergent led the polyvinyl alcohol films market with a revenue share of 59.48% in 2024 and is expected to grow at a CAGR of 6.2% through the forecast period. For consumer detergents, the key factor is the shift in behavior toward consumer-friendly formats, especially laundry and dishwasher tablets, which offer consistent dosing and a cleaner user experience. This demand has prompted major film manufacturers to improve their solubility and handling robustness so that the pods can withstand storage and transport and dissolve reliably during the wash cycle.

The industrial detergent segment is expected to expand at a substantial CAGR of 5.4% through the forecast period. Industrial and institutional cleaning customers are increasingly turning to PVA films because water-soluble pouches eliminate the need for routine handling of concentrated chemicals and enable precise dosing, reducing chemical waste and variability in cleaning results. Facility managers appreciate the operational efficiencies: reduced storage requirements, simplified training, and fewer chemical spills lead to lower overall operating costs.

Regional Insights

North America held the largest share of 32.2% in terms of revenue of the polyvinyl alcohol films market in 2024. This can be attributed to the ongoing shift by retailers and brand owners to concentrated, pre-measured, single-dose formats, which offer clear supply chain and usage advantages. Procurement teams prioritize packaging that reduces shipping volume and shelf space while ensuring consumer convenience. Therefore, converters and film suppliers are investing in cold-water soluble grades and tighter quality controls to ensure retail acceptance. This dynamic is creating a ripple effect from brands to upstream PVA producers as companies compete for a reliable supply of high-quality films.

A clear growth factor for the North America polyvinyl alcohol films industry is acceptance among institutional and industrial buyers, who value soluble pouches for their dispensing accuracy, reduced spill risk, and simplified compliance. Facility managers and commercial laundries appreciate that water-soluble films reduce handling risks, lower chemical waste, and reduce training requirements. This promotes the acquisition of integrated dispensing systems and compatible film formats. This use case is attracting specialty processors and equipment manufacturers to collaborate on higher-throughput solutions to bring PVA films into non-consumer channels.

U.S. Polyvinyl Alcohol Films Market Trends

In the US, regulatory and safety frameworks shape product specifications: High-profile recalls and toxicity warnings have prompted brands to require stronger outer packaging, improved film integrity, and comprehensive child safety testing prior to market launch. These stringent controls increase the technical requirements for PVA films but also create a premium market for suppliers that can demonstrate robust performance under real-world handling and storage conditions. Brands willing to invest in certified, higher-quality films and secondary packaging are therefore more likely to switch from conventional packaging.

Europe Polyvinyl Alcohol Films Market Trends

European policy is a clear economic driver, as new packaging regulations require brand owners to demonstrate recyclability and minimize end-of-life waste. This regulatory pressure encourages procurement teams to test packaging concepts that reduce uncontrolled plastic leakage. This, in turn, increases interest in water-soluble films for specific, controlled applications. At the same time, the need to meet recycling criteria means that PVA suppliers must provide life-cycle evidence and harmonized labeling to win European contracts.

Asia Pacific Polyvinyl Alcohol Films Market Trends

In the Asia Pacific polyvinyl alcohol films industry, the key growth driver is the rapid consumer adoption of convenience formats combined with a strong regional manufacturing base for films and packaging. Rising disposable incomes, the proliferation of e-commerce, and the shift toward concentrated household care products are prompting brands to introduce unit-dose and pouch formats at scale. Local processors and PVA producers are leveraging cost-effective capacity expansions and regional logistics networks to meet demand from both domestic brands and export-oriented manufacturers.

Key Polyvinyl Alcohol Films Company Insights

The polyvinyl alcohol films market is highly competitive, with several key players dominating the landscape. Major companies include Kuraray Co., Ltd., Mitsubishi Chemical Group Corporation, Aicello Corporation, Sekisui Chemical Co., Ltd., Nippon Synthetic Chemical Industry Co., Ltd., MonoSol LLC, Chang Chun Group, Jiangmen Proudly Water-Soluble Plastic Co., Ltd., and Foshan Polyva Materials Co., Ltd. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Polyvinyl Alcohol Films Companies:

The following are the leading companies in the polyvinyl alcohol films market. These companies collectively hold the largest market share and dictate industry trends.

- Kuraray Co., Ltd.

- Mitsubishi Chemical Group Corporation

- Aicello Corporation

- Sekisui Chemical Co., Ltd.

- Nippon Synthetic Chemical Industry Co., Ltd.

- MonoSol LLC

- Chang Chun Group

- Jiangmen Proudly Water-Soluble Plastic Co., Ltd.

- Foshan Polyva Materials Co., Ltd.

Recent Developments

-

In October 2024, The Mitsubishi Chemical Group expanded its production facility for OPL Film optical PVOH film at its Central Japan-Ogaki (Kanda) Plant in Gifu Prefecture, Japan. The upgraded facility, with the largest single-line capacity of 27 million square meters per year, is scheduled to start operations in the second half of fiscal year 2027 to meet growing demand from larger liquid crystal display screens. After the expansion, the group's total OPL Film production capacity is expected to reach 154 million square meters per year, improving both quality and productivity.

-

In July 2024, Colorcon, Inc. launched a new titanium dioxide (TiO2)-free, high-opacity film coating system for pharmaceutical tablets based on polyvinyl alcohol (PVA) in January 2024. This new Opadry coating addressed regulatory uncertainties around TiO2 use in the EU and offered benefits such as strong adhesion, fast processing, and moisture protection.

Polyvinyl Alcohol Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 473.8 million

Revenue forecast in 2033

USD 720.1 million

Growth rate

CAGR of 5.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Report Segmentation

Application, detergent type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Germany; UK; China; India; Japan; Brazil

Key companies profiled

Kuraray Co., Ltd.; Mitsubishi Chemical Group Corporation; Aicello Corporation; Sekisui Chemical Co., Ltd.; Nippon Synthetic Chemical Industry Co., Ltd.; MonoSol LLC; Chang Chun Group; Jiangmen Proudly Water-Soluble Plastic Co., Ltd.; Foshan Polyva Materials Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyvinyl Alcohol Films Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the polyvinyl alcohol films market report based on application, detergent type, and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Detergent packaging

-

Agrochemical packaging

-

Laundry bags

-

Embroidery

-

Others

-

-

Detergent Type Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Consumer detergent

-

Industrial detergent

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global polyvinyl alcohol films market size was estimated at USD 449.5 million in 2024 and is expected to reach USD 473.8 million in 2025.

b. The global polyvinyl alcohol films market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033 to reach USD 720.1 million by 2033.

b. Some key players operating in the PVA films market include Kuraray Co., Ltd., Mitsubishi Chemical Group Corporation, Aicello Corporation, Sekisui Chemical Co., Ltd., Nippon Synthetic Chemical Industry Co., Ltd., MonoSol LLC, Chang Chun Group, Jiangmen Proudly Water-Soluble Plastic Co., Ltd., and Foshan Polyva Materials Co., Ltd.

b. Key factors that are driving the PVA films market growth include polyvinyl alcohol film application for water disposal and detergent packaging including household and industrial detergents.

b. North America held the largest share of 32.22% in terms of revenue of the polyvinyl alcohol films market in 2024. This can be attributed to the ongoing shift by retailers and brand owners to concentrated, pre-measured, single-dose formats, which offer clear supply chain and usage advantages.

b. Consumer detergent led the polyvinyl alcohol films market across the detergent type segmentation in terms of revenue, accounting for a market share of 59.48% in 2024 and is expected to grow at a CAGR of 6.2% through the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.