- Home

- »

- Disinfectants & Preservatives

- »

-

Sodium Chlorite Market Size, Share, Industry Report, 2012-2025GVR Report cover

![Sodium Chlorite Market Report]()

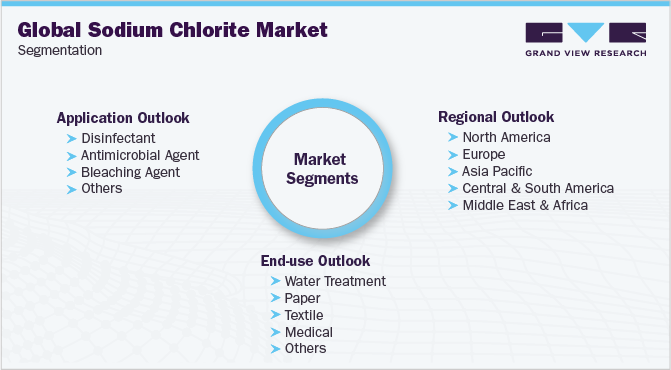

Sodium Chlorite Market Analysis By Application (Disinfectant, Antimicrobial Agent, Bleaching Agent), End-Use (Water treatment, Paper, Textile, Medical), By Region (North America, Europe, Asia Pacific, Latin America, Africa), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-682-0

- Number of Pages: 170

- Format: Electronic (PDF)

- Historical Range: 2012 - 2016

- Industry: Bulk Chemicals

Report Overview

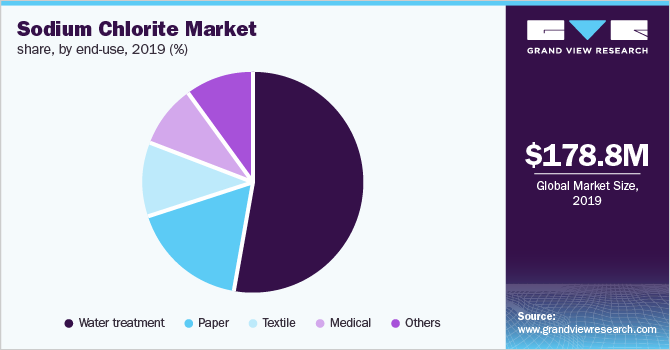

The global sodium chlorite market size was estimated at USD 178.8 million in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 6.0% from 2020 to 2025. High demand for the chemical in wastewater treatment and water purification applications owing to its biocidal and antimicrobial properties is expected to fuel the demand for sodium chlorite over the forecast period.

The industry has the presence of a large number of small and medium-scale manufacturers, which are primarily located in China. Sodium chlorite prices vary across the commercial grades with 80% concentrated being the highest consumed grade amongst all. Raw material and operational and transportation costs are the key factors defining the final value of the products.

OxyChem is the only domestic manufacturer for sodium chlorite in the U.S. The country imports sodium chlorite primarily from China in order to meet the undersupply. Stringent regulations by the governments of various U.S. states and environmental protection agencies limit the production and consumption of the chemical in this region.

The industry is highly competitive in terms of pricing, as cost is a key factor influencing the buyer’s decision. The product prices are relatively low in Asia Pacific, especially in China, owing to low raw material and labor costs along with the presence of numerous manufacturers in the region.

The industry has very few major manufacturers, which are established globally. However, the presence of several, and medium scale manufacturers in Asia Pacific is expected to be a key barrier for new entrants. However, the scope of the product in niche segments, including the metal processing and electronics industry, is expected to open new avenues for upcoming players.

The chemical has to adhere to various regulations given by FDA, Resource Conservation and Recovery Act (RCRA), Federal Water Pollution Control Act (FWPCA), and OSHA. The presence of a large number of stringent government regulations in the developed economies is expected to hamper the growth over the forecast period.

Sodium Chlorite Market Trends

Sodium chlorite is an important specialty chemical owing to its wide range of applications in industries such as water treatment, food & beverages, electronics, medical, healthcare, and pulp & paper, among others. This anhydrous salt is a powerful oxidizer, which does not absorb water and remains stable for up to ten years.

The healthcare industry has undergone major transformation in the past few years owing to demographic shift and societal changes. The growing geriatric population in developing and developed countries is accelerating the demand for healthcare services. Rising consumer awareness and increasing health concerns are expediting greater influence on health systems and driving new business models. The global healthcare expenditure is projected to increase in the next few years owing to the growing prevalence of chronic disorders and diseases, infrastructure improvements, and technological advancements in the medical field.

Rapid industrialization in developing countries, including India and China, has resulted in air and water pollution, which in turn, has affected rainfall patterns and the purity of natural water resources. Increasing demand for clean and safe drinking water owing to the rising population and declining fresh water resources is expected to have a positive impact on water treatment industry, thereby influencing sodium chlorite market growth over the forecast period.

Approximately 70% of all the diseases in emerging economies are associated with poor sanitation and impure water conditions. Improper wastewater disposal from residential, agricultural, and commercial sectors is a key issue in these countries, which is a major cause of waterborne diseases such as cholera, anemia, hepatitis, diarrhea, arsenicosis, and malaria. Rising demand for safe drinking water in developing countries such as India and China to curb waterborne diseases including typhoid and diarrhea is projected to fuel the demand for water treatment chemicals, thereby boosting the need for sodium chlorite over the forecast period.

Regulations are a key factor influencing the application of chemicals in various end-use industries. Governments in various regions have laid down several regulations, which must be adhered to, owing to rising government concerns regarding the discharge of industrial waste and handling of hazardous materials. Sodium chloride is classified as a hazardous material and its application in the end-use industry has to adhere to 49 CFR 172.101 of FDA regulations and 40 CFR Parts 405 through 471 for effluent limitations. The presence of a large number of stringent government regulations is expected to hamper the market growth over the forecast period.

Increase in raw material prices is also expected to be a key concern for industry players in the next few years. Sodium hydroxide, an important precursor for sodium chlorite, also finds application in the production of aluminum. Recent recovery of the aluminum industry has resulted in higher production volumes of aluminum, thereby increasing the demand for sodium hydroxide. The growth of pulp & paper industry in recent years in developing countries has boosted the demand for sodium hydroxide, thereby resulting in a demand-supply gap for the product. These factors have contributed to the rise in sodium hydroxide prices and this trend is expected to continue over the forecast period, thereby affecting sodium chlorite market growth in the coming years.

Application Insights

Rising demand for antimicrobial agents in the food processing industry to improve the shelf life of packaged products is expected to have a positive impact on industry growth. An acidic form of the chemical does not hamper the nutritional quality of food thereby driving its application in food & beverage applications.

The demand for the chemical as a bleaching agent is expected to grow at a CAGR of 4.6% from 2017 to 2025, owing to its superior oxidizing properties. The product is used for both cotton and synthetic fabrics as it does not affect the quality of the fabric. The aforementioned factors are likely to propel demand in textile applications over the forecast period.

The chemical is also used as a healing agent and insecticide in the medical and pest control manufacturing industries. The product in combination with zinc chloride is used as a component in mouthwashes, toothpaste, gels, and sprays. The rising demand for the product as a preservative in the manufacturing of nasal and eye drops is expected to drive the market.

The presence of sodium hydroxide in the chemical increases the pH levels of water thereby enabling its application as a disinfectant. It is diluted with water and used for disinfection purposes in operation theatres, intensive care units, water treatment plants, and swimming pools. The aforementioned factors are thus expected to drive industry growth.

End-Use Insights

The chemical finds a wide range of application scope in water treatment, pulp & paper, textiles, electronics, food processing, and fertilizer. The growing demand for the chemical to generate chlorine dioxide at pulp processing and textile bleaching plants is expected to drive the industry growth over the next eight years.

The demand for the product in the paper industry stood for USD 290.6 million in 2019 and is expected to grow at a CAGR of 6.9% from 2017 to 2025. Sodium chlorite is used for on-site production of chlorine dioxide, which is further used as a bleaching agent in paper and straw production. Furthermore, rising demand for the product in the paper recycling process is likely to propel growth.

The product is used as a disinfectant for sanitizing operation theatres, intensive care units, and hospital rooms. Sodium chlorite is used to treat malaria, hepatitis, tuberculosis, arthritis, and HIV/AIDS in the medical industry. In addition, the chemical is used to treat common ailments including cold and chronic fatigue, thus propelling its demand in medical application.

The chemical finds application in the food & beverage, pesticides, electronics, and metal processing industries. In the food and beverage industry it is used as bleaching, and antimicrobial agents. However, stringent regulations associated with the quantities of the chemical used in food items, owing to its toxic nature are expected to hamper product demand.

Regional Insights

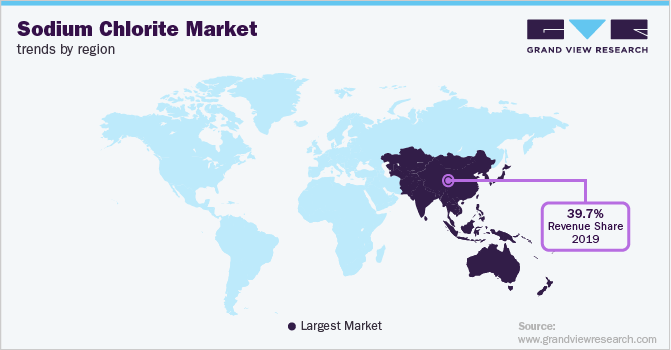

Asia Pacific dominated the sodium chlorite market and accounted for the largest revenue share of 38.66% in 2016. The region is anticipated to continue its dominance over the forecast period. The rising pulp & paper industry application in the region is expected to drive the market.

The availability of land, low raw material, and labor cost along with the favorable government outlook are the key factors associated with high production volumes of sodium chlorite in China. Numerous small-scale and medium-scale manufacturers in China contribute to the production volumes offered by the country in the domestic as well international market.

Europe sodium chlorite market is expected to foresee growth owing to the growing paper industry in the region. The European paper industry is growing significantly due to a rise in demand from the packaging industry. However, the demand for wood, a key raw material used in the paper industry has witnessed an increasing demand in the bioenergy market in the region, which is expected to restrain the market growth. In addition, the recycling rate of paper is rising owing to technological innovation in the sector, which in turn is likely to propel the market growth.

The consumption of the chemical in Europe is very high as compared to domestic production. The demand in the region was USD 30.85 million in 2016, which was primarily met through the imports from Asian manufacturers. China has been a key sodium chlorite supplier in the region, and this trend is expected to continue over the forecast period.

The Middle East and Africa rely on imports for the chemical owing to the lack of raw material availability and production units in the region. However, increasing foreign investments in the manufacturing sectors in these regions are expected to have a positive impact on industry growth over the projected period.

The market in North America is expected to be driven by high consumption levels of sodium chlorite for water treatment. In North America, water treatment was the largest application segment as of 2016 and the trend is expected to remain the same over the forecast period owing to increasing practice of rainwater harvesting in the region. Stringent government regulations associated with the utilization of water encourages rainwater harvesting thereby propelling water treatment, which in turn is expected to fuel sodium chlorite market growth. Moreover, the rise in the paper industry owing to growing packaging and tissue packaging is expected to propel the sodium chlorite market.

Occidental Chemical Corporation is the largest producer of sodium chlorite in North America. The company produces various grades of the product in dry and liquid forms marked as 50%, 31%, and 18% grades respectively. It serves various industries in the region for applications such as the treatment of portable water, bacterial control, bacterial slime, food processing, and waste treatment. In addition, the growth in water treatment is likely to drive the sodium chlorite market owing to increase in water storage system in the region such as portable water storage, hydraulic fracture storage, and fire suppression storage.

Key Companies & Market Share Insights

The industry players are concentrated in Asia Pacific region owing to the ease of raw material availability, favorable government scenario, and high-end- use demand. The companies in this region face high competitive rivalry as the market players offer their products at competitive pricing. Geographical reach is an important parameter for the players, which helps them strengthen their presence in the market.

Commercially, it is available in liquid and solid grades. Pricing and quality are the key parameters for the market, which influence the decision of buyers. Low material pricing offered by the manufacturers in China in the domestic, as well as international markets, offers them a competitive edge over the other players.

OxyChem, Dupont and American Elements are the key major players involved in the manufacturing of sodium chlorite in North America. The strong foothold of these players in the market as well as their established consumer base is a key factor that offers these companies a competitive edge over other market players.

Sodium Chlorite Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 178.8 Billion

Revenue forecast in 2025

USD 256.4 Billion

Growth Rate

CAGR of 6.0% from 2017 to 2025

Base year for estimation

2019

Historical data

2012 - 2018

Forecast period

2020 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2020 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Germany, UK, France, Italy, China, India, , Brazil, Mexico, UAE, Saudi Arabia, Kuwait, Qatar, Oman

Key companies profiled

OxyChem, Dupont, and American Elements.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sodium Chlorite Market SegmentationThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2012 to 2025. For the purpose of this study, Grand View Research has segmented the global sodium chlorite market on the basis of application, end-use, and region.

-

Application Outlook (Volume, Tons; Revenue, USD Thousands, 2012 - 2025)

-

Disinfectant

-

Antimicrobial agent

-

Bleaching agent

-

Others

-

-

End-use Outlook (Volume, Tons; Revenue, USD Thousands, 2012 - 2025)

-

Water treatment

-

Paper

-

Textile

-

Medical

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousands, 2012 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

Mexico

-

-

Middle East

-

United Arab Emirates

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

- Africa

-

Frequently Asked Questions About This Report

b. The global sodium chlorite market size was estimated at USD 178.8 million in 2019 and is expected to reach USD 189.2 billion in 2020.

b. The global sodium chlorite market is expected to grow at a compound annual growth rate of 6.0% from 2017 to 2025 to reach USD 256.4 million by 2025.

b. Asia Pacific dominated the sodium chlorite market with a share of 39.7% in 2019. This is attributable to rising pulp & paper industry in the region.

b. Some key players operating in the sodium chlorite market include OxyChem, Dupont, and American Elements.

b. Key factors that are driving the market growth include high demand for the chemical in wastewater treatment and water purification applications owing to its biocidal & antimicrobial properties .

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."