- Home

- »

- Disinfectants & Preservatives

- »

-

Bleaching Agents Market Size, Share & Growth Report, 2030GVR Report cover

![Bleaching Agents Market Size, Share & Trends Report]()

Bleaching Agents Market (2023 - 2030) Size, Share & Trends Analysis Report By Form (Powder, Liquid), By Product (Hydrogen Peroxide, Chlorine Dioxide), By End-use (Pulp & Paper, Food & Beverages, Textile), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-146-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bleaching Agents Market Summary

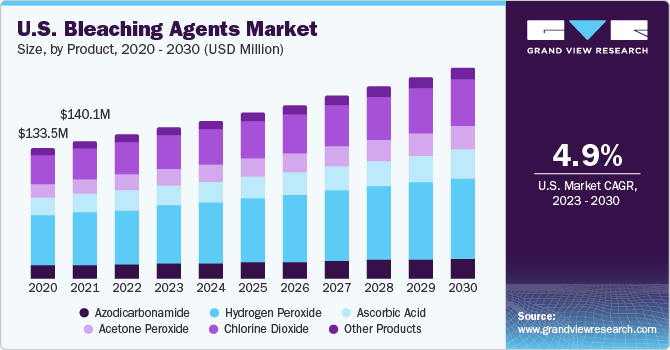

The global bleaching agents market size was estimated at USD 887.7 million in 2022 and is projected to reach USD 1,350.1 million by 2030, growing at a CAGR of 5.4% from 2023 to 2030. The market demand is owing to the varied product applications in industries including paper & pulp, textiles & apparel, water treatment, food & beverages, and personal care.

Key Market Trends & Insights

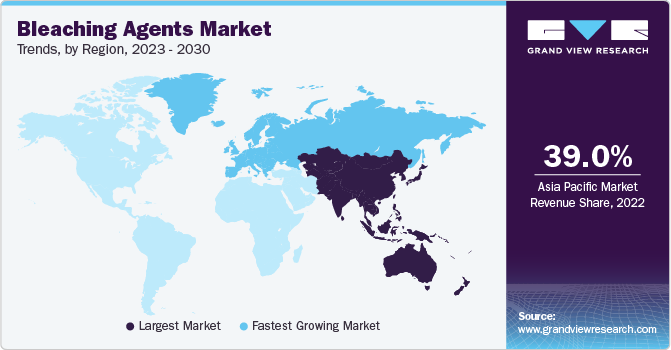

- The Asia Pacific region accounted for the largest revenue share of around 39% in 2022.

- Europe holds a significant position in the global market.

- By form, the powder segment accounted for the largest revenue share of more than 60% in 2022.

- By product, the hydrogen peroxide segment accounted for the largest share of 38.2% in 2022.

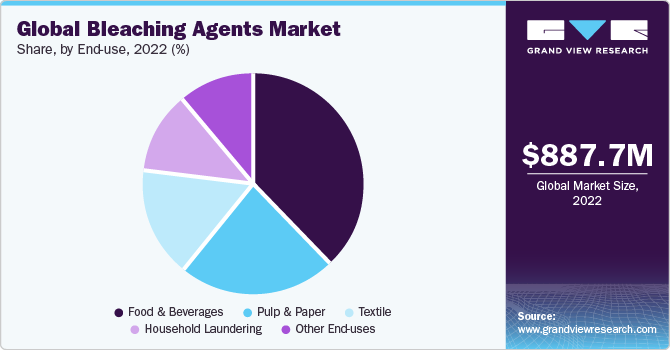

- By end-use, the food & beverages segment accounted for the largest revenue share of 37.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 887.7 Million

- 2030 Projected Market Size: USD 1,350.1 Million

- CAGR (2023-2030): 5.4%

- Asia Pacific: Largest market in 2022

It is primarily used to remove or lighten the color of substances and work by altering or completely breaking down the chromophores responsible for providing color to the material. The manufacturing procedure for bleaching agents varies according to the chemical compound on which it is based. Some of the common base chemicals used for its production are chlorine, sodium hypochlorite, hydrogen peroxide and ozone. Various processes are then performed on raw materials depending upon the material to make them into desired products.

For instance, hydrogen peroxide is formed through the reaction of hydrogen and oxygen in the presence of a catalyst. The textile industry's global growth has been a major driver for product consumption. India is ranked second globally in the textile sector, contributing 12% of the manufacturing industry's GDP in the country. In June 2022, the Indian government announced its intention to build 75 textile hubs across the nation. Bangladesh is another leading regional economy regarding textiles, with this industry employing around 3 million workers. Supportive initiatives undertaken by economies in these developing regions to advance the textile industry present a major opportunity for market growth.

Over the past few years, there has been a noticeable shift in the chemical industry to more sustainable and environment-friendly processes, which includes the production and utilization of bleaching agents. This trend has been mainly driven by the rising awareness regarding the health and environmental impact associated with conventional bleaching agents such as chlorine-based compounds, and the prompt efforts to shift to eco-friendly alternatives to minimize these effects. Numerous nations have embraced rigorous standards, including the EU Ecolabel and Forest Stewardship Council (FSC) certification, to promote the utilization of chlorine-free or elemental chlorine-free (ECF) bleaching methods. These rules serve to incentivize the adoption of eco-friendly practices and diminish the discharge of detrimental emissions into the environment.

Form Insights

The powder segment accounted for the largest revenue share of more than 60% in 2022. This is attributed to the mass use of powdered bleaching agents in laundry and textile industries as well other major applications such as water treatment around the world. Powdered agents tend to have a higher shelf life of about 1-3 years from the date of production. Other qualities such as ease of handling as well as precise control over concentration makes the powder form of bleaching agents a lucrative option for usage in manufacturing applications.

Liquid bleaching agents are used in consumer products such as household cleaning products, hair, and beauty products as well as sanitization purposes. They have a faster action as compared to powdered form as they are already dissolved, and their ease of handling makes them ideal for use in household and manufacturing applications. Liquid chlorine is a leading example of liquid bleaching agent which is primarily used to clean swimming pools and hot tubs.

Product Insights

The hydrogen peroxide segment accounted for the largest share of 38.2% in 2022. This is attributed to its usage as a disinfectant in various industries, such as food processing, paper & pulp as well as healthcare, due to its strong oxidizing characteristics. Hydrogen peroxide’s application has also increased due to the increasing environmental consciousness, which has encouraged the use of eco-friendly chemicals. It is also used as an important reactant in the production of other chemicals, such peracetic acid as well as polyurethanes.

Chlorine dioxide is another bleaching agent used primarily for wastewater treatment purposes as well as in the medical sector for disinfection and decontamination of medical equipment. Chlorine dioxide uses oxidation to kill viruses in medical equipment and its usage is bound to increase as the usage of batteries becomes more and more profound. Other methods of sterilization, such as heat, become useless in such condition, which has resulted in a subsequent rise in usage of chlorine dioxide as an alternative, which was approved by the Food & Drug Administration in 2021.

End-use Insights

The food & beverages segment accounted for the largest revenue share of 37.5% in 2022. This is attributed to product application in the F&B industry for removing unwanted odor, color, and impurities to improve the quality as well as appearance of food products. Hydrogen peroxide, chlorine dioxide, as well as natural compounds, such as activated carbon and clay, are primarily used as bleaching agents in the food industry. The paper & pulp industry is another major end-user of the product market and uses chlorine, oxygen, hydrogen peroxide, and ozone in their manufacturing process.

They are used to remove impurities and unwanted color from the pulp. The industry is widely spread in China, India, and Europe, employing 6, 47,000 workers in 21,000 companies across the continent of Europe alone. China has the world’s largest paper & pulp industry, which produced 283.91 million tons of paper in 2022, and is a major user of bleaching agents in the country. The growth of educational institutions in developing countries is expected to drive the product consumption during the forecast period.

Regional Insights

The Asia Pacific region accounted for the largest revenue share of around 39% in 2022 due to the large textiles and paper industries in the region, which are major end-users of bleaching agents. South Asia has an expansive textile industry, with economies such as India and Bangladesh being the regional leaders. Bangladesh carried out garment exports worth USD 42 billion in 2022 and this number is expected to cross USD 100 billion by 2030, as per the Bangladesh Garment Manufacturers and Exporters Association. The continued growth of end-use industries is expected to drive the product consumption in the region.

Europe holds a significant position in the global market, with countries like Germany, Austria, and the Netherlands driving its growth. The water treatment operations in Europe act as a major end-user for bleaching agents. Chlorine-based compounds, such as sodium hypochlorite and chlorine dioxide, are extensively used to disinfect drinking water supplies. In this region, 90% of urban wastewater is collected and treated to comply with the EU wastewater treatment directive. The increasing percentage of wastewater treatment is expected to drive market growth in the region.

Key Companies & Market Share Insights

Strategically investing in the development of cost-effective and environmentally sustainable products offer significant growth potential for major manufacturers. In addition, these companies prioritize the manufacturing of bleaching agent products that are both biodegradable and characterized by lower toxicity levels. Notably, the global market is currently dominated by key players, such as Evonik Industries, Solvay, and BASF SE. Prominent players exercise significant control, leveraging diverse strategic actions like product introductions, expansion endeavors, and mergers & acquisitions. For instance, in September 2022 Solenis completed the acquisition of Clearon Corp., which helped it expand the product portfolio for commercial & residential pool water treatment.

Key Bleaching Agents Companies:

- Evonik Industries

- Solvay

- Kemira

- CHT Group

- Mitsubishi Gas Chemical Company, Inc.

- National Peroxide Ltd.

- Soleni

- Christeyns

- BASF SE

- WelChem GmbH

Bleaching Agents Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 934.3 million

Revenue forecast in 2030

USD 1,350.1 million

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Evonik Industries; Solvay; Kemira; CHT Group; Mitsubishi Gas Chemical Company, Inc.; National Peroxide Ltd.; Solenis; Christeyns; BASF SE; WelChem GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bleaching Agents Market Report Segmentation

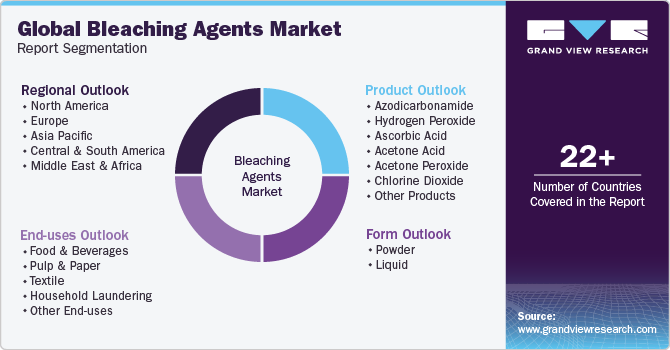

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bleaching agents market report on the basis of form, product, end-use, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Azodicarbonamide

-

Hydrogen Peroxide

-

Ascorbic Acid

-

Acetone Acid

-

Acetone Peroxide

-

Chlorine Dioxide

-

Other Products

-

-

End-uses Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pulp & Paper

-

Textile

-

Household Laundering

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Asia Pacific region dominated the global bleaching agents market with a share of more than 39% in 2022. This is attributed to the large textiles and paper industry in the region which are major end users of bleaching agents in their manufacturing process.

b. The global bleaching agents market is currently dominated by key industry leaders such as Evonik Industries, Solvay, and BASF SE, to name a few.

b. The rise of the textile industry all over the world has acted as a major driver for the increasing consumption of bleaching agents.

b. The global bleaching agents market size was estimated at USD 887.7 million in 2022 and is expected to reach USD 934.30 million in 2023.

b. The global bleaching agents market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 1,350.11 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.