- Home

- »

- Petrochemicals

- »

-

Specialty Gas Market Size, Share And Trends Report, 2030GVR Report cover

![Specialty Gas Market Size, Share & Trends Report]()

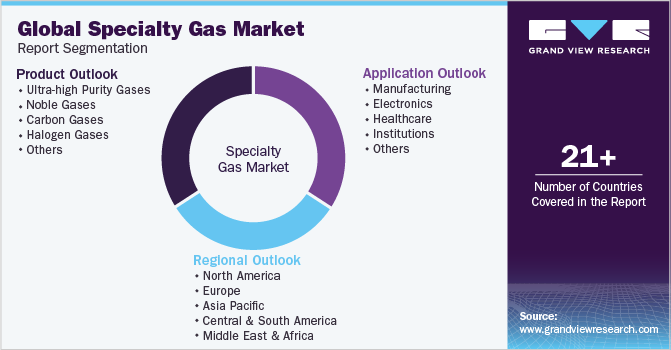

Specialty Gas Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Ultra-high Purity Gases, Carbon Gases), By Application (Electronics, Healthcare), By Region (Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68038-469-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Gas Market Summary

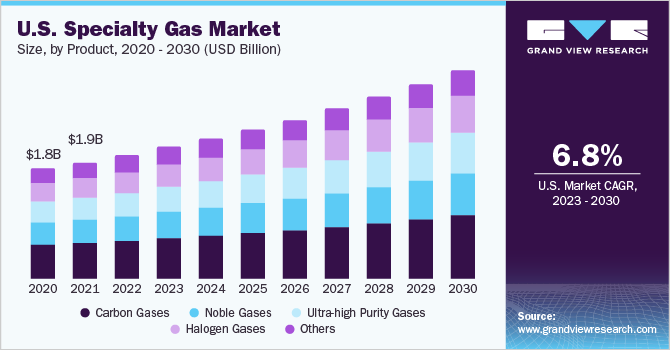

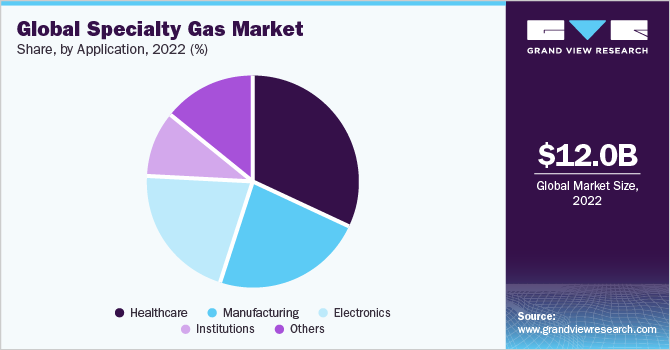

The global specialty gas market size was estimated at USD 12.03 billion in 2022 and is projected to reach USD 21.81 billion by 2030, growing at a CAGR of 7.7% from 2023 to 2030. The increasing adoption of specialty gas in electronics, manufacturing, and healthcare applications is anticipated to drive market growth.

Key Market Trends & Insights

- The Asia Pacific specialty gas market held the largest revenue share of 38.5% in 2022.

- The specialty gas industry in Asia Pacific is expected to grow at the fastest CAGR of 8.5% from 2023 to 2030.

- By product, the carbon gases segment held the largest revenue share of 30.2% in 2022.

- By application, the healthcare segment held the largest revenue share of 32.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 12.03 Billion

- 2030 Projected Market Size: USD 21.81 Billion

- CAGR (2023-2030): 7.7%

- Asia Pacific: Largest market in 2022

The expanding markets for semiconductors and displays play a significant role in increasing the usage of specialty gases in electronics applications. Moreover, the growing healthcare industry and advances in clinical treatments are driving the market growth. The specialty gas industry supplies different sectors, such as petrochemical, oil & gas, analytical research, and consumer electronics.

The recent increase in demand for specialty gases can be largely attributed to a rise in the demand for semiconductors and LEDs. The semiconductor industry is one of the world’s most dynamic, competitive, and sophisticated industries. As it expands, so does the demand for ultra-pure gases and chemicals. Moreover, high-purity gases are crucial in the manufacturing processes for consumer electronics as well. The recent growth of the consumer electronics industry helps propel the growth of the specialty gas industry.

The COVID-19 pandemic had a negative impact on the overall market. The pandemic led to disruption of the supply chain related to different industries, such as consumer electronics, oil & gas, petrochemicals, and manufacturing. The manufacturing industry was impacted in several ways due to the pandemic, which resulted in low-scale operations and, eventually, a detrimental impact on output levels. Index for Industrial Production (IIP) in India fell to -1.40% for the year 2019-20. The negative impact of the pandemic on various end-use industries also impacted the demand for specialty gases.

Product Insights

Based on product, the market has been segmented into ultra-high purity gases, noble gases, carbon gases, halogen gases, and others. The carbon gases segment accounted for the largest revenue share of 30.2% in 2022 and is expected to retain its dominance over the forecast period. Carbon gases are widely used in medical equipment, such as nuclear magnetic resonance imaging, magnetic resonance imaging, ophthalmology, and others. The demand for carbon gases is high in sectors, such as electronics, manufacturing, healthcare, and chemicals.

The growing application scope of carbon gases for instrument calibration is propelling the carbon gas demand. The ultra-high purity gases segment is expected to grow at the highest CAGR of 8.5% over the forecast period. Ultra-high purity gases are used for insulation, lighting, and cooling in various industries, such as electronics, metal processing, chemical, and oil & gas. Also, ultra-high purity gases play a major role in the manufacturing of semiconductors. The expansion of the semiconductor industry is expected to drive the demand for ultra-high purity gases.

Application Insights

Based on application, the market has been segmented into manufacturing, electronics, healthcare, institutions, and others. The healthcare segment accounted for the largest revenue share of 32.1% in 2022 and is expected to retain its dominance over the forecast period. The healthcare sector uses different specialty gases, such as oxygen, medical nitrous oxide, medical air, and medical helium. The increased healthcare expenditure by governments across the globe and the utilization of improved medical technologies are expected to be the major driving factors for the market.

The electronics segment is expected to grow at a CAGR of 8.3% over the forecast period. A variety of specialty gases, such as nitrogen trifluoride, tungsten hexafluoride, and hydrogen chloride, are used in the electronics industry. These gases are used in the production of a variety of electronic devices and components, including semiconductors, display devices, LED panels, and solar panels. Apart from traditional electronic devices, the specialty gas market is likely to be driven by new-age product innovations, such as wearables, connected homes, control systems, and connected industrial systems.

Regional Insights

Asia Pacific accounted for the largest revenue share of 38.5% in 2022 and is anticipated to grow at the fastest CAGR of 8.5% over the forecast period. The region is home to many electronic manufacturing hubs situated in China, Japan, and India. Also, local governments are supporting the growth of various end-use industries, such as consumer electronics, oil & gas, manufacturing, and healthcare, in the region through Production-Linked Incentives (PLI), subsidies, and favorable Foreign Direct Investment (FDI) policies. All these factors are contributing to the growth and dominance of the specialty gas industry in the region.

In January 2023, Taiyo Nippon Sanso Corporation announced the establishment of a business site and a logistics site for specialty gases in Kumamoto, Japan, to boost its logistics activities for specialty gases in the Kyushu area. Europe is expected to grow at the second-fastest CAGR of 7.9% over the forecast period. The region is focusing on increasing its production capacity to cater to the growing demand from different end-use industries. Also, the growing investments in the healthcare & pharmaceutical sectors are expected to boost the product demand in the region. In June 2021, the French government announced USD 8.33 billion public funding plan for the healthcare sector to advance the healthcare system in the country.

Key Companies & Market Share Insights

The market is highly competitive as it features various global and regional players. The world’s leading companies are undertaking partnerships, collaborations, acquisitions, mergers, and agreements as strategies to withstand the intense competition and increase their market share. Moreover, specialty gas manufacturers are spending extensively to increase production capacities to cater to the growing product demand. For instance, in December 2022, Air Products and Chemicals, Inc. and AES Corporation announced USD 4.0 billion investment to develop the first mega-scale green hydrogen production facility in Texas, U.S. This plant is being developed to meet the growing requirement for zero-carbon-intensity fuels from the transportation and industrial sectors of the country. Some of the prominent players operating in the global specialty gas market are:

-

Air Products and Chemicals, Inc.

-

Air Liquide

-

Messer Group GmbH

-

Linde plc

-

Taiyo Nippon Sanso Corporation

-

MESA Specialty Gases & Equipment

-

Weldstar

-

Norco Inc.

-

Coregas

-

Showa Denko K.K.

Specialty Gas Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12,915.4 million

Revenue forecast in 2030

USD 21.81 billion

Growth rate

CAGR of 7.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Air Products and Chemicals, Inc.; Air Liquide; Messer Group GmbH; Linde plc; Taiyo Nippon Sanso Corp.; MESA Specialty Gases & Equipment; Weldstar; Norco Inc.; Coregas; Showa Denko K. K.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Gas Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global specialty gas market based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultra-high Purity Gases

-

Noble Gases

-

Carbon Gases

-

Halogen Gases

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Electronics

-

Healthcare

-

Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global specialty gas market size was estimated at USD 12.03 billion in 2022 and is expected to reach USD 12.91 billion in 2023

b. The global specialty gas market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 21.81 billion by 2030

b. Asia Pacific accounted for the largest share of 38.5% in 2022 owing to the increasing growth of the end-use industries in the region.

b. Some of the key players operating in the specialty gas market include Air Products and Chemicals, Inc., Air Liquide, Messer Group GmbH, Linde plc, TAIYO NIPPON SANSO CORPORATION, MESA Specialty Gases & Equipment, Weldstar, Norco Inc., Coregas, and SHOWA DENKO K.K.

b. Increasing adoption of specialty gas in electronics, manufacturing, and healthcare applications is anticipated to drive market growth. The expanding markets for semiconductors and displays play a significant role in driving up the usage of specialty gases in electronics applications. Moreover, the growing healthcare industry and advances in clinical treatments are driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.