- Home

- »

- Medical Imaging

- »

-

Magnetic Resonance Imaging Market Size Report, 2030GVR Report cover

![Magnetic Resonance Imaging Market Size, Share & Trends Report]()

Magnetic Resonance Imaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Architecture (Open Systems, Closed Systems), By Field Strength (Low, Mid, High) By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-370-6

- Number of Report Pages: 210

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Magnetic Resonance Imaging Market Summary

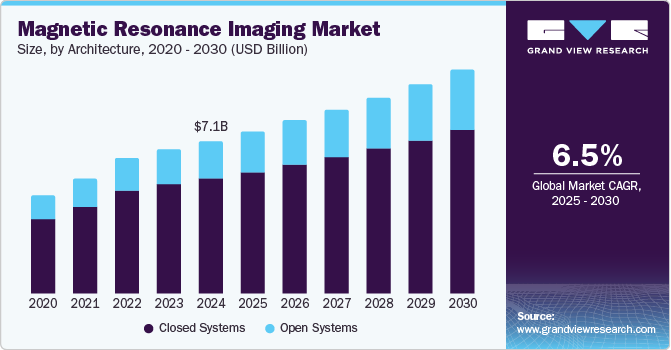

The global magnetic resonance imaging market size was valued at USD 7.1 billion in 2024 and is projected to reach USD 10.3 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. Magnetic Resonance Imaging (MRI) is a highly effective diagnostic tool for identifying conditions such as spinal lesions, tumors, and stroke, which affect blood vessels and the brain.

Key Market Trends & Insights

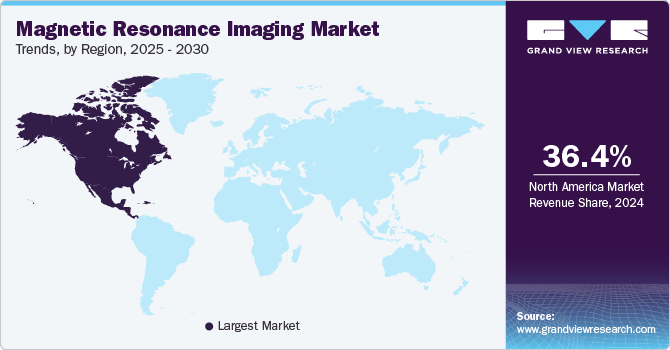

- North America magnetic resonance imaging market dominated the market with the largest revenue share of 36.4% in 2024.

- U.S. magnetic resonance imaging market accounted for the largest share in 2024.

- By architecture, the closed systems segment dominated the market with the largest revenue share of 75.6% in 2024.

- By application, the brain & neurological segment accounted for the largest revenue share in 2024.

- By end-use, the hospitals segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.1 Billion

- 2030 Projected Market Size: USD 10.3 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing prevalence of these diseases is expected to play a significant role in market growth. For instance, according to the National Center for Health Statistics, in 2023, almost 1,958,310 new cancer cases and 609,820 cancer deaths were estimated to occur in the U.S. In addition, the growing demand for quick and effective diagnostic procedures is expected to contribute to the adoption of MRI machines.As per OECD, in 2021, the number of MRI units installed in the U.S. was 38 per million population. Ongoing technological advancements, such as the integration of Artificial Intelligence (AI) in MRI, are further expected to contribute to the overall market growth. For instance, in August 2023, FUJIFILM Healthcare Americas Corporation received U.S. FDA clearance for its 1.5 Tesla MRI system, the ECHELON Synergy. The system utilizes Synergy DLR, a technology developed by Fujifilm that leverages AI for Deep Learning Reconstruction (DLR). This technology enhances image sharpness and accelerates scanning, improving throughput, image quality, and patient satisfaction. Most recent advancements in MRI technology are primarily focused on software improvements.

Furthermore, the introduction of MRI systems that are compatible with cardiac pacemakers is anticipated to drive market expansion within the cardiology segment. MRI manufacturers have continued to innovate with newer technology and AI-based solutions. This helped radiologists to effectively and efficiently understand COVID-19-related diseases and residual symptoms.

Moreover, advancements in MRI machines to enhance their usage for various applications are projected to drive market growth during the forecast period. Recent innovations, such as diffusion and diffusion tensor imaging with tractography; perfusion imaging; neuroimaging techniques, including MR spectroscopy; and functional imaging employing the Blood Oxygenation Level Dependent (BOLD) technique, are anticipated to significantly bolster magnetic resonance imaging industry growth in the coming years. In addition, the development of intraoperative MRI and its diverse applications in neurosurgery are expected to drive market growth during the forecast period. Diffusion-weighted MR imaging is primarily utilized to detect stroke within 30 minutes of onset rapidly.

Architecture Insights

The closed systems segment dominated the market with the largest revenue share of 75.6% in 2024, driven by its superior ability to offer enhanced safety, reduced contamination risks, and more controlled environments for imaging procedures. These systems operate within a sealed environment and ensure optimal conditions for accurate diagnostic imaging. The growing demand for enhanced image quality, patient safety, and infection control, particularly in hospitals and diagnostic centers, has driven their widespread adoption. Besides, advancements in closed system technology have improved operational efficiency, contributing to their dominance in the market.

The open systems segment is anticipated to emerge as the fastest-growing segment, with a CAGR of 7.8% from 2025 to 2030, propelled by increasing demand for patient comfort, versatility, and ease of access. Open MRI systems offer a more spacious design, reducing claustrophobia and improving patient experience. Moreover, advancements in technology are enhancing the imaging capabilities of open systems, making them more attractive for various clinical applications. The focus of healthcare facilities on patient-centered care is driving an increase in demand for open MRI systems, which in turn fosters innovation and expands the market share of this segment.

Field Strength Insights

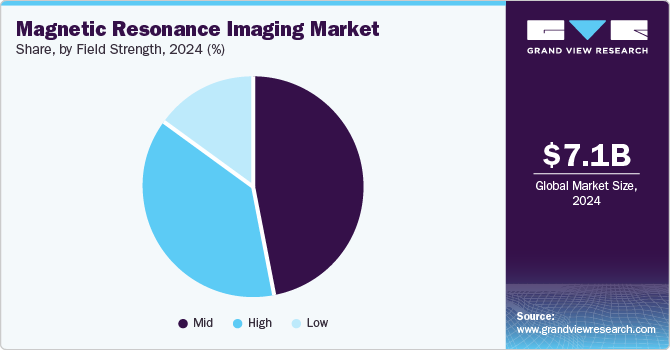

MRI machines are categorized based on their field strength, with low-field strength MRI machines having a field strength lower than 1.5T, mid-field MRI machines ranging from 1.5T up to 3T, and high-field MRI machines with a field strength exceeding 3T. The mid-segment held the largest revenue share in 2024, which can be attributed to its balanced performance, affordability, and versatility. These MRI machines, typically operating at 1.5 Tesla, offer high-quality imaging while being more cost-effective than high-field alternatives. They are widely used in routine diagnostics, including neuroimaging, musculoskeletal imaging, and cancer imaging, making them popular in hospitals and clinics. Their lower operational costs and efficiency in delivering accurate results have contributed significantly to their dominant market position, attracting a broad range of healthcare providers.

The high segment is projected to grow at the fastest CAGR during the forecast period due to advancements in MRI technology and increasing demand for higher-resolution imaging. High-field MRI systems, typically operating at 3 Tesla and above, offer superior image quality, enabling more accurate diagnosis, particularly in neurology, oncology, and orthopedics. Healthcare providers' focus on early disease detection and precision medicine is expected to boost the demand for high-field strength MRI systems, fueling market growth and innovation in this segment.

Application Insights

The brain & neurological segment accounted for the largest revenue share in 2024, owing to the rising prevalence of neurological disorders such as Alzheimer's, Parkinson's, and multiple sclerosis. The ability of MRI to provide detailed, noninvasive imaging of the brain and spinal cord makes it an essential tool for diagnosing and monitoring these conditions. In addition, technological advancements in MRI, such as higher resolution imaging and functional MRI (fMRI), have further expanded its application in neurology, propelling growth of this segment of the magnetic resonance imaging industry.

The breast segment is set to witness notable expansion over the forecast period, fueled by increasing breast cancer awareness, early detection initiatives, and advancements in MRI technology. The growing adoption of MRI for breast imaging, particularly among high-risk patients, is expected to drive substantial growth in the segment. MRI provides superior soft tissue contrast and helps detect early-stage breast cancer, offering better accuracy compared to traditional mammography. The rising demand for noninvasive diagnostic methods further fuels the expansion of this segment.

End Use Insights

The hospitals segment held the largest market share in 2024, attributed to their critical role in providing comprehensive healthcare services. Hospitals are equipped with advanced MRI technologies to diagnose a wide range of medical conditions, from neurological to musculoskeletal disorders. The increasing volume of patients and the growing demand for accurate and noninvasive diagnostic procedures drive hospitals to invest in state-of-the-art MRI systems. Furthermore, hospitals benefit from skilled radiologists and specialists, enhancing their ability to offer high-quality imaging services and further solidifying their dominant market position.

The imaging centers segment is projected to be the fastest-growing segment from 2025 to 2030, propelled by the increasing demand for noninvasive diagnostic procedures. These centers are becoming increasingly popular as healthcare providers seek to offer affordable and accessible MRI services to patients. The rising prevalence of chronic diseases, along with advancements in MRI technology, drives the demand for more specialized imaging services. Furthermore, the growth of outpatient imaging centers and partnerships with hospitals is set to propel the magnetic resonance imaging industry, offering greater convenience and improved patient outcomes.

Regional Insights

North America magnetic resonance imaging market dominated the market with the largest revenue share of 36.4% in 2024. This share is attributable to the high prevalence of chronic diseases and the integration of AI in imaging. The increasing incidence of conditions such as cancer, cardiovascular diseases, and neurological disorders in the region has heightened the demand for advanced diagnostic tools, particularly, MRI. Moreover, the adoption of AI in imaging enhances the accuracy, speed, and efficiency of MRI scans, leading to better patient outcomes. These factors, coupled with advancements in technology, are accelerating the growth of the magnetic resonance imaging industry in North America.

U.S. Magnetic Resonance Imaging Market Trends

TheU.S. magnetic resonance imaging market accounted for the largest share in 2024, fueled by the growing preference for noninvasive diagnostic methods and a strong focus on patient comfort. MRI offers a safe, noninvasive alternative to traditional diagnostic methods such as biopsies or surgeries, making it highly sought after for early disease detection. In addition, advancements in MRI technology, such as quieter and more compact machines, are improving patient comfort and accessibility. This shift toward less invasive procedures and enhanced patient experience is fueling the demand for MRI services across the U.S. healthcare system.

Europe Magnetic Resonance Imaging Market Trends

Europe magnetic resonance imaging market is projected to witness significant expansion over the forecast period, owing to the shift toward open MRI systems and remote diagnostic imaging. Open MRI systems offer improved patient comfort, particularly for those with claustrophobia or mobility issues, while providing high-quality imaging. Moreover, the rise of remote diagnostic imaging enables healthcare providers to offer services in underserved regions, helping overcome the shortage of radiologists and enhancing access to healthcare. These advancements are anticipated to boost the adoption of MRI technologies, expanding market size and improving patient care across Europe.

Asia Pacific Magnetic Resonance Imaging Market Trends

Asia Pacific magnetic resonance imaging market is set to grow at a significant CAGR of 7.2% from 2025 to 2030 due to increasing healthcare investments and the rising incidence of chronic diseases. Governments and the private sector are enhancing healthcare spending and improving access to advanced medical technologies. In addition, the growing prevalence of chronic conditions, such as cancer, cardiovascular diseases, and neurological disorders, fuels the demand for early and accurate diagnostic tools, including MRI. The development of healthcare infrastructure is expected to enable more patients to access advanced imaging solutions, thereby driving the expansion of the MRI market in the region.

India Magnetic Resonance Imaging Market Trends

India magnetic resonance imaging market is projected to grow at the fastest CAGR from 2025 to 2030, driven by the development of advanced technologies, such as micro-MRI technology. Micro-MRI offers higher resolution imaging and more precise diagnosis, making it ideal for early-stage detection of diseases, especially in small and intricate body areas. Furthermore, innovations such as portable MRI machines, faster imaging processes, and reduced costs are expected to increase accessibility and adoption across healthcare facilities in India, further expanding the market and improving patient outcomes nationwide.

Key Magnetic Resonance Imaging Company Insights

Some of the key companies in the magnetic resonance imaging industry include GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; CANON MEDICAL SYSTEMS CORPORATION; Hitachi Healthcare (Hitachi High-Tech Corporation); Hologic, Inc.; Bruker; Esaote SPA; Fujifilm Holdings Corporation; Shimadzu Corporation; and Aurora Imaging Technologies, Inc. (AURORA HEALTHCARE US CORP).

-

GE HealthCare provides innovative medical technologies and services, including imaging solutions, monitoring systems, and diagnostics. Its products support healthcare professionals in improving patient outcomes through advanced imaging, ultrasound, anesthesia, and medical data management tools.

-

Siemens Healthineers AG offers innovative medical technology and healthcare solutions, including imaging systems, laboratory diagnostics, and advanced therapies. It focuses on enhancing healthcare outcomes through cutting-edge technologies in areas such as radiology, oncology, and personalized medicine.

Key Magnetic Resonance Imaging Companies:

The following are the leading companies in the magnetic resonance imaging market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips N.V.

- Canon Medical Systems

- Hitachi Healthcare (Hitachi High-Tech Corporation)

- Hologic Inc.

- Bruker Corporation

- Esaote SPA

- Fujifilm Holdings Corporation

- Shimadzu Corporation

- Aurora Imaging Technologies, Inc.

Recent Developments

-

In March 2025, Polarean Imaging plc expanded its Xenon MRI imaging platform to support pharma-sponsored research. This expansion, in partnership with VIDA Diagnostics, included the introduction of a new service model to enable the use of the device in enhanced research applications.

-

In October 2023, Siemens Healthineers and Cardiff University formed a strategic partnership to advance medical technologies, building on their decade-long collaboration in diagnostics. The partnership focuses on imaging research and precision diagnostics, with Cardiff’s Brain Research Imaging Centre (CUBRIC) driving innovation in MR technology and brain mapping.

-

In June 2023, Imagion Biosystems Limited expanded its collaboration with Siemens Healthineers, extending its existing agreement with Siemens Healthcare Pty Ltd in Australia for 2 more years. The partnership now includes collaboration in the U.S. through Siemens Medical Solutions USA.

-

In April 2023, Siemens Healthineers expanded its manufacturing presence in India by launching an MRI facility in Bengaluru, supported by the Government of India’s PLI scheme. The company has also introduced a new production line at the Bengaluru facility for manufacturing MRI machines.

Magnetic Resonance Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.5 billion

Revenue forecast in 2030

USD 10.3 billion

Growth Rate

CAGR of 6.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Architecture, field strength, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; CANON MEDICAL SYSTEMS CORPORATION; Hitachi Healthcare (Hitachi High-Tech Corporation); Hologic, Inc.; Bruker; Esaote SPA; Fujifilm Holdings Corporation; Shimadzu Corporation; and Aurora Imaging Technologies, Inc. (AURORA HEALTHCARE US CORP).

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Magnetic Resonance Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global magnetic resonance imaging market report on the basis of architecture, field strength, application, end use, and region:

-

Architecture Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Systems

-

Closed Systems

-

-

Field Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Low

-

Mid

-

High

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obstructive Sleep Apnea

-

Brain & Neurological

-

Spine & Musculoskeletal

-

Vascular

-

Abdominal

-

Cardiac

-

Breast

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centers

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.