- Home

- »

- Healthcare IT

- »

-

Teleradiology Services Market Size & Share Report, 2030GVR Report cover

![Teleradiology Services Market Size, Share & Trends Report]()

Teleradiology Services Market Size, Share & Trends Analysis Report By Type (Onshore, Offshore), By Modality (CT, Ultrasound), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-930-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global teleradiology services market size was estimated at USD 24.2 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 2.1% from 2023 to 2030. The adoption of teleradiology services has increased in recent years owing to the shortage of radiologists in several countries such as the U.S., the UK, and others. Teleradiology services enable online consultations that facilitate the treatment of patients without being present at the site. According to the Radiological Society of North America, Europe has 13 radiologists per 100,000 population, and in the UK, the rate is 8.5 per 100,000 population, which is a lot less than the required number. The rise in the geriatric population and an increasing number of chronic diseases globally are further anticipated to drive the growth of the market.

Some of the factors such as the growing need for after-working-hour radiologist coverage, low reporting costs, and short Turn-Around-Time (TAT) have led to an increase in the outsourcing of teleradiology services. In addition, the uneven distribution of radiologists in several countries, such as India and Canada has increased the uptake of onshore teleradiology services by hospitals and radiology centers especially situated in rural areas. The increase in consumer awareness and easy availability is another key driver for the rise in global demand for the market.

Favorable government initiatives for teleradiology are anticipated to continue to fuel the market growth in the coming years. For instance, according to an article published by the Economic Times in April 2022, the Andhra Med Tech Zone (AMTZ) and Teleradiology Solutions (TRS) signed an agreement to establish a dedicative zone focusing on providing remote radiology image reads for government and public sectors. Saudi Arabia has been working with the state governments to set up teleradiology services in several parts of the country. In June 2023, the Ministry of Health in Saudi Arabia awarded a 10-year concession to a local company named Altakassusi Alliance Medical for a diagnostic imaging public-private partnership project.

In recent years, the penetration of Picture Archiving & Communication Systems (PACS) and Radiology Information Systems (RIS) has increased significantly in developed countries, such as Italy, Germany, and the UK. The increasing availability of PACS also indicates the surge in demand for exchanging scanned reports, across departments or other territories, for reading the report remotely. According to Sectra AB, more than 500 institutions are connected to the company's digital medical imaging sharing system, which is used to share approximately 47 million images every week across the UK.

The rising prevalence of chronic diseases such as cancer, liver disorders, and brain injuries, has increased the need for medical imaging. However, insufficient radiologist staff to cater to the increasing patient needs is becoming a major concern for hospitals and imaging centers. Several radiology centers and hospitals are adopting teleradiology services to streamline their radiology workflow to overcome these constraints.

Some African countries such as Tanzania, Uganda, and Zimbabwe have a high prevalence of chronic diseases, thereby witnessing a high need for medical imaging. However, due to the presence of a smaller number of radiologists to interpret these radiology scans, these countries generally opt for offshore services to manage their radiology workflow effectively and meet the medical imaging needs of the patients.

In recent years, teleradiology providers have increased their focus on geographical expansion to boost their presence in the market. For instance, in February 2021, a global AI-enabled radiology software provider, Telerad Tech (T2), announced its expansion in four countries including Saudi Arabia, South Africa, Israel, and Egypt.

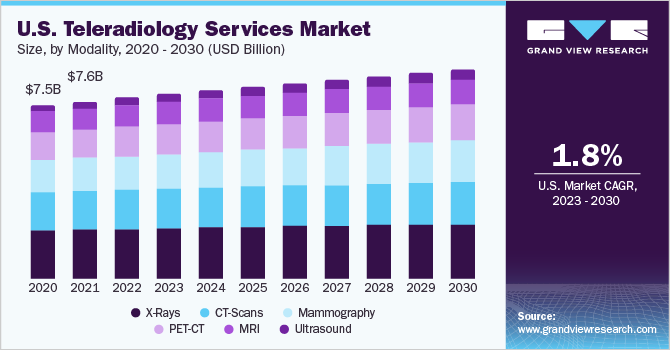

Modality Insights

Based on modality, the market is segmented into CT scans, X-rays, MRI, ultrasound, mammography, and PET-CT. The mammography segment held the largest revenue share in 2022 owing to the growing prevalence of breast cancer, increasing diagnosis rate for breast cancer among women, and the absence of skilled onsite radiologists to interpret mammograms are among the factors driving the growth for this segment. For instance, several emerging and developing economies have a shortage of on-site radiologists for reporting mammograms, in such cases, onshore or offshore services are adopted for interpreting mammography scans.

Imaging scans of modalities, such as CT, MRI, and X-rays are widely interpreted using these remote radiology reading services. However, the adoption rate of teleradiology for each modality varies at the country level. For instance, in France, X-ray images are widely interpreted using teleradiology services in comparison to other imaging modalities.

The ultrasound segment is anticipated to register the fastest CAGR over the forecast period from 2023 to 2030 owing to the growing prevalence of chronic diseases, increasing utilization of ultrasound for monitoring several diseases such as kidney disorders, liver cancer, and others, and shortage of skilled radiologists to interpret ultrasound scans, especially in the emerging regions is anticipated to drive the growth of this segment.

Type Insights

Based on type, the market is segmented into inhouse, onshore, and offshore. The onshore segment held the largest revenue share of 48.6% in 2022 owing to the uneven distribution of radiologists. In rural areas, there is a shortage of radiologists and medical centers. Even if a medical center is present, it may not have the necessary equipment required to conduct imaging. People living in rural areas travel long hours to avail these facilities, which eventually drives the market growth toward the onshore segment in cities. For instance, according to a Healthcare IT News article published in March 2020, the adoption of PACS-RIS was very low in Vietnam, which implies less than 10% of total hospitals utilized these services in 2019.

Inhouse services are widely adopted in some European countries, such as the UK, Italy, Germany, and Spain. Factors such as the presence of a sufficient radiologist workforce coupled with the availability of teleradiology infrastructure in hospitals are anticipated to drive the regional market growth in the forthcoming years. Moreover, the growing adoption of PACS and RIS among healthcare institutes and increasing uptake of onshore services by hospitals situated in rural and remote parts can help in further driving the growth of this segment.

The offshore segment is estimated to register the fastest CAGR of 4.4% over the forecast period. Factors such as a shortage of radiologists in various countries, a growing number of foreign-trained and certified radiologists in developing countries such as India and Australia, an increasing need for night-time coverage, and rising demand for low reporting costs are propelling the market growth. According to the Royal College of Radiologists (RCR), the UK can face a shortfall of 39% of radiologists by 2026. This shortfall can result in offshoring to countries with sufficient radiologists resulting in the growth of the segment.

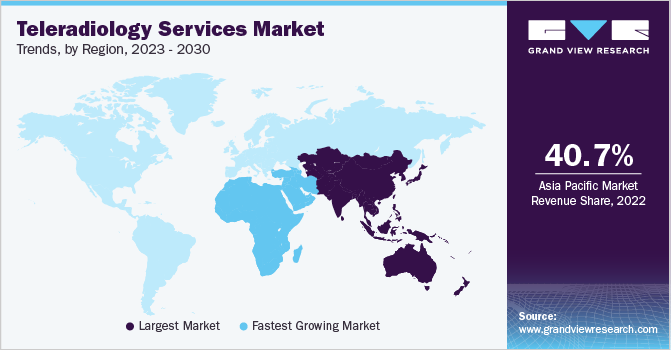

Regional Insights

Based on region, the Asia Pacific region dominated the market with a revenue share of 40.7% in 2022. Factors such as the presence of a large number of teleradiology providers especially in countries such as India and Australia, the presence of several foreign-trained radiologists, and high adoption of teleradiology services due to even distribution of radiologists are supporting the regional growth.

In Japan, a smaller number of radiologists are working with a higher number of imaging devices as compared to other countries. This gap between medical imaging devices and the distribution of radiologists has led to an increase in the adoption of onshore and offshore teleradiology services in hospitals in the country. Moreover, according to the National Library of Medicine, India has a distinct advantage due to lower costs, cheap labor, and skilled support staff, which has led to the growth of the outsourcing market.

The Middle East and Africa region is expected to grow at the fastest CAGR of 3.6% over the forecast period from 2023 to 2030 owing to the growing adoption of teleradiology services by hospitals based in countries, such as UAE, South Africa, Kenya, and Saudi Arabia. Furthermore, the development of healthcare IT infrastructure, expansion of major market players in this region, and government initiatives for teleradiology are expected to further boost regional growth over the forecast period. In June 2023, Rology announced the acquisition of Arkan United, a teleradiology service provider in Saudi Arabia. This acquisition is likely to help accelerate people’s access to treatments in this region and add to the development of the radiology services market.

Key Companies & Market Share Insights

The market has the presence of several global and local players competing to increase their share in the market. Most of the prominent players focus on strategic initiatives, such as geographical expansion through partnerships and agreements with hospitals and imaging centers. In June 2023, a private equity firm Grovecourt Capital Partners announced the acquisition of Premier Radiology, which interprets approximately 2 million images every year. The strategy is expected to help the company with further expansion of its business activities and strengthen its position in the market. In addition, in 2021, Medica Group plc joined hands with Integral Diagnostics Limited to launch MedX, a platform to provide teleradiology reporting services, and increased reporting capacity in countries such as the UK, Australia, and New Zealand. In November 2020, Medica Group plc acquired Global Diagnostics, expanding its geographical reach, customer base, and service offering. Some prominent players in the global teleradiology services market include:

-

Teleradiology Solutions

-

Virtual Radiologic

-

Medica Trading LLC

-

Everlight Radiology

-

Telemedicine Clinic

-

USARAD

-

TeleDiagnosys Services Pvt Ltd.

-

ONRAD, Inc.

-

StatRad.

-

Aris Radiology

-

NightShift Radiology

Teleradiology Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.7 billion

Revenue forecast in 2030

USD 28.7 billion

Growth rate

CAGR of 2.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, modality, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teleradiology Solutions; Virtual Radiologic; Medica Trading LLC, Everlight Radiology; Telemedicine Clinic; USARAD; TeleDiagnosys Services Pvt Ltd; ONRAD, Inc; StatRad; Aris Radiology; NightShift Radiology.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

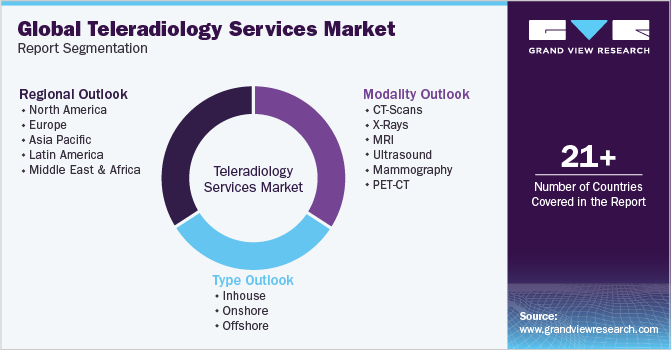

Global Teleradiology Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global teleradiology services market report based on type, modality, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inhouse

-

Onshore

-

Offshore

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

CT-Scans

-

X-Rays

-

MRI

-

Ultrasound

-

Mammography

-

PET-CT

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global teleradiology services market size was estimated at USD 24.2 billion in 2022 and is expected to reach USD 24.7 billion in 2023.

b. The global teleradiology services market is expected to grow at a compound annual growth rate of 2.1% from 2023 to 2030 to reach USD 28.7 billion by 2030.

b. Asia Pacific held the dominant market share of 40.7%. The factors such as the presence of a large number of teleradiology providers especially in countries such as India and Australia, the presence of several foreign-trained radiologists, and the high adoption of teleradiology services due to even distribution of radiologists are supporting the regional growth.

b. Teleradiology Solutions; Virtual Radiologic Corp; Medica Group; Everlight Radiology; Telemedicine Clinic (TMC); USARAD Holdings Inc.; Argus Radiology; TeleDiagnosys Services Pvt. Ltd.; ONRAD, Inc.; StatRad, LLC; Aris Radiology; and NightShift Radiology are some of the major market players.

b. Growing need for working hours’ radiologist coverage, low reporting costs, and short Turn-Around-Time (TAT) have led to an increase in the outsourcing of teleradiology services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."