- Home

- »

- Medical Devices

- »

-

Teleradiology Market Size & Share, Industry Report, 2030GVR Report cover

![Teleradiology Market Size, Share & Trends Report]()

Teleradiology Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ultrasound, MRI, CT, X-ray), By Report Type (Preliminary, Final), By End-use (Hospital, Radiology Clinics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-852-7

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Teleradiology Market Summary

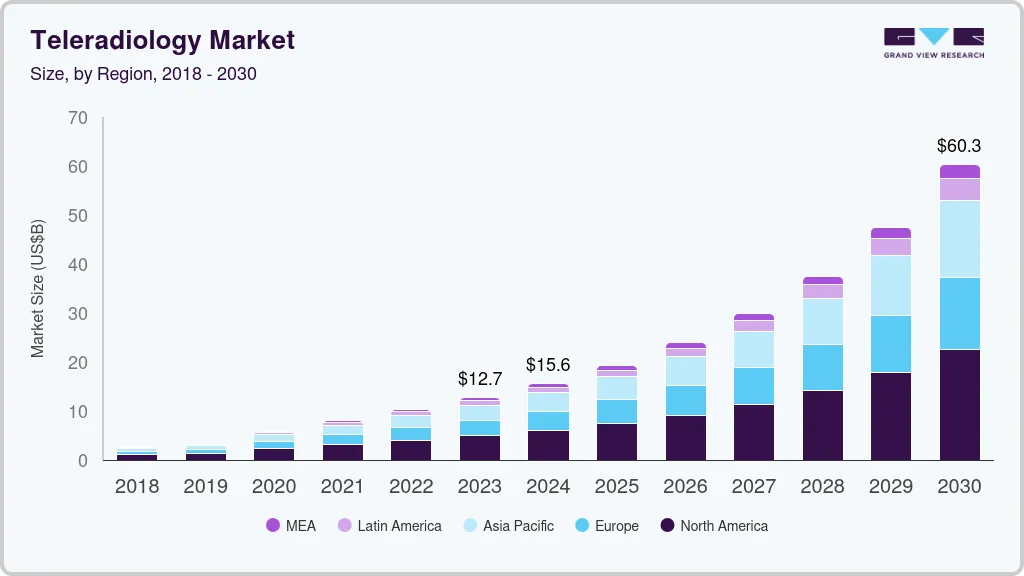

The global teleradiology market size was estimated at USD 15.6 billion in 2024 and is projected to reach USD 60.3 billion by 2030, growing at a CAGR of 25.7% from 2025 to 2030. The teleradiology industry’s growth is majorly driven by the increasing prevalence of target diseases and the rising demand for teleradiology for second opinions and emergencies.

Key Market Trends & Insights

- North America teleradiology market accounted for the largest share, 38.5% in 2024.

- The U.S. teleradiology market is expected to grow as the healthcare landscape in the U.S. is witnessing a shift towards value-based care.

- By product, the x-ray segment dominated the market in 2024 with a market share of around 28.6%.

- By report type, the preliminary report segment held the largest market share in 2024.

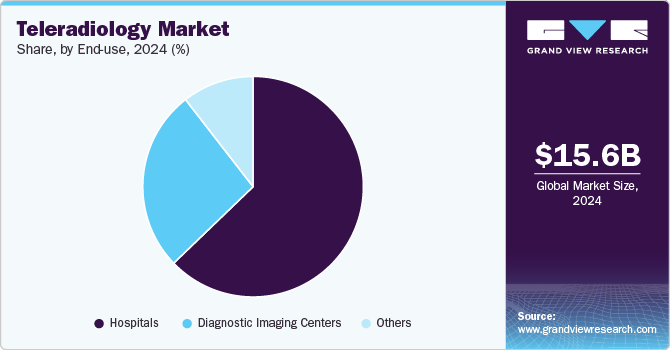

- By end use, hospitals held the largest market share, about 62.8%.

Market Size & Forecast

- 2024 Market Size: USD 15.6 Billion

- 2030 Projected Market Size: USD 60.3 Billion

- CAGR (2025-2030): 25.7%

- North America: Largest market in 2024

Moreover, the COVID-19 pandemic emphasized the importance of teleradiology. The shortage of healthcare professionals, especially in the sub-specialist segment, such as pediatric, neurology, and musculoskeletal radiology, is leading to the adoption of teleradiology services. This is because teleradiology helps these healthcare professionals access patient information irrespective of distance, thereby improving diagnostic coverage. Therefore, the growing adoption of teleradiology for early diagnosis is expected to drive market growth during the forecast period.

Teleradiology applications comprise teleconsultation, telemonitoring, and telediagnosis, which enable radiologists to perform their daily work effectively. Teleradiology provides effective on-site solutions globally via cloud networks and real-time interpretation. Increasing incidence of chronic diseases, including breast cancer, cellulitis, & osteomyelitis, and a growing number of emergency cases in less developed areas are expected to drive the market further. For instance, according to the International Agency for Research on Cancer, breast cancer ranked one globally amongst all other cancers in women, with about 2,296,840 new cases in 2022.

Integration of artificial intelligence (AI) into teleradiology, implementation of picture archiving and communication systems (PACS), and growing R&D activities pertaining to eHealth are several other factors expected to boost the demand for teleradiology services over the forecast period. For instance, 5C Network, an Indian teleradiology provider, launched an artificial intelligence-powered platform called Prodigi, which uses advanced technology to ensure that no radiology image is unreported for more than 2-3 hours. However, data security is a major concern for this market. Healthcare settings capture and store data regarding patients and their radiology images. Security of PACS is important to avoid misusing a patient’s information. Several complaints have been filed regarding the data security of radiology images.

Teleradiology and AI are changing how healthcare is provided, diagnosed, and managed in the medical industry. AI's ability to quickly and accurately analyze large amounts of data is reshaping various aspects of healthcare. It assists in diagnosing diseases and provides personalized treatment suggestions, improving the accuracy and efficiency of medical procedures. In addition, AI-powered technologies simplify administrative tasks, optimize resource use, and improve patient outcomes. As AI advances, it has the potential to revolutionize healthcare delivery, encourage significant medical breakthroughs, and ultimately enhance patient care globally. Therefore, the combined impact of Teleradiology and AI is expected to fuel market growth, leading to a new era of innovation and progress in healthcare.

The introduction of favorable government initiatives such as the Health Insurance Portability and Accountability Act of 1996 of the U.S. ensures that all the information related to patient health and personal information is end-to-end protected from cybercrimes. Therefore, every teleradiology service in the U.S. must comply with this Act. Such initiatives improve patients' and physicians' confidence in teleradiology services, increasing their adoption rate during the forecast period. Similarly, healthcare coverage over teleradiology services in countries such as the U.S. and Australia is also expected to support market development.

In real-time teleradiology, medical images are captured at a healthcare facility using specialized equipment and then securely transmitted over networks, typically through Picture Archiving and Communication Systems (PACS) or secure internet connections. Radiologists, often working remotely, receive these images and interpret them using specialized software. They provide diagnoses and detailed reports, sometimes consulting with healthcare providers or specialists as needed. These reports are then transmitted back to the referring healthcare facility, becoming part of the patient’s medical record for prompt decision-making and treatment planning by attending physicians. Moreover, teleradiology services often implement quality assurance measures to ensure accurate and timely interpretations, adhering to industry standards and protocols.

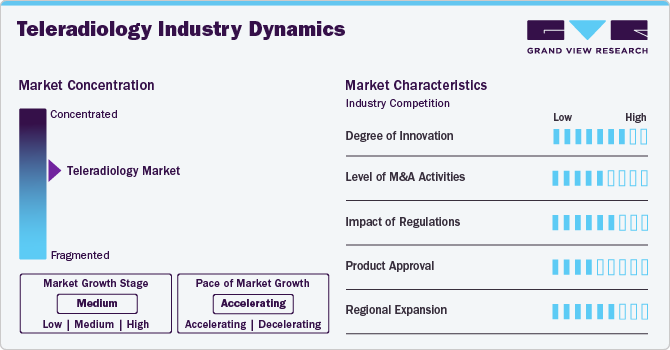

Market Concentration & Characteristics

The teleradiology industry's growth stage is high, and the pace of growth is accelerating. The industry has been expanding owing to the increasing number of healthcare providers and patients adopting teleradiology services. Advancements in digital imaging technology and the widespread availability of high-speed internet have made it easier and more efficient for radiologists to receive, interpret, and report on medical images from a distance. This technological progress has improved the quality and speed of diagnoses and expanded the reach of radiology services to remote and underserved areas.

The growing number of partnerships and collaborative efforts among companies is expected to significantly boost industry growth. This trend can be seen in various industries, where players realize the benefits of working together to improve their competitiveness. By partnering, companies can combine resources, share knowledge, and utilize each other's strengths, which helps in innovation and creating new products or services. For instance, in November 2021, Virtual Radiologic (vRad) expanded its partnership with Radiobotics to create a comprehensive set of software algorithms aimed at improving the speed and accuracy of bone fracture X-ray analyses.

The teleradiology industry has undergone significant innovation due to ongoing technological advancements, placing it at the forefront of medical diagnostics. Improved data transmission technologies enable quicker and more secure sharing of medical images over long distances, allowing for timely consultations and second opinions from specialists anywhere. Furthermore, incorporating artificial intelligence and machine learning into teleradiology has resulted in advanced algorithms that help radiologists detect anomalies with increased precision and speed. For instance, in December 2023, Telerad Group introduced an AI-based solution to improve the detection of pulmonary embolism in radiology. This innovation is designed to assist radiologists globally, enhancing their workflow and increasing the accuracy and efficiency of pulmonary embolism detection.

Teleradiology manufacturing companies are engaging in mergers and acquisitions as a strategic move to enhance their technological capabilities, broaden their industry presence, and stay competitive. For instance, in July 2023, IK Partners announced the acquisition of Medica Group Plc by the IK IX Fund. Medica is a leading teleradiology provider in the UK and Ireland and supplies imaging solutions for clinical trials in the US.

Regulatory frameworks play a vital role in standardizing procedures and ensuring the quality and consistency of diagnostic services across various providers. Adhering to regulations like patient data privacy laws (e.g., HIPAA in the United States or GDPR in Europe) is crucial for protecting sensitive patient information during transmission and storage, which builds trust and confidence among patients and healthcare providers. Moreover, regulations often require the certification and licensing of teleradiologists, guaranteeing that only qualified professionals interpret medical images, thereby enhancing patient safety and care quality.

Owing to the increasing demand and adoption of teleradiology, manufacturers are pursuing government approvals for their products to maintain competitiveness in the industry. For instance, in October 2023, Rology, an AI-assisted teleradiology platform serving the Middle East and Africa, announced that its Teleradiology Platform has obtained FDA approval as a Class II Medical image management and processing system.

Teleradiology's geographical reach has been expanding moderately to highly. For instance, in February 2021, Telerad Tech (T2), a healthcare provider specializing in AI-enabled teleradiology software, announced its expansion into four additional countries: Saudi Arabia, South Africa, Israel, and Egypt.

Product Insights

The X-ray segment dominated the market in 2024 with a market share of around 28.6% and is expected to continue its dominance over the forecast period. Economical pricing, high usage in primary diagnosis, and the introduction of innovative systems, such as filmless X-ray systems, are some factors contributing to the segment’s dominance. Moreover, this technique has wide applications in various healthcare domains, such as chest imaging, orthopedics, cancer screening, cardiovascular diagnostics, and dental imaging.

Computed Tomography (CT) is expected to witness the fastest growth of CAGR of 26.4% over the forecast period. CT provides faster and clearer images of complex body organs, such as the brain, cardiac cavities, and lungs, contributing to its growth. Increasing technological advancements and digitalization in this field are also expected to support the growth of this segment. The ultrasound market segment is also expected to grow significantly during the forecast period. The ability of ultrasound to quickly access critical health parameters without radiation exposure makes it an important technology in limited-resource settings. Moreover, teleradiology-based ultrasound devices are being extensively used to deliver training and education programs to health workers in remote areas. For instance, Philips, in collaboration with PURE (a non-profit organization), delivers training on the usage of tele-ultrasound technology to healthcare workers in Rwanda, Africa.

Report Type Insights

The preliminary report segment held the largest market share in 2024 and is expected to continue its dominance over the forecast period. Preliminary reports are a general practice in emergency care, as they are generated much faster than final reports and are economical. Providers get improved insurance coverage at hospitals and imaging centers during non-business hours. Thus, it is anticipated to grow at a faster rate.

The final report segment is expected to grow at the fastest CAGR of 27.0% as many providers are now inclined towards final reads due to accurate and in-depth results with reduced errors. Medicare policies are shifting from more reimbursement to final and preliminary reads with extensive radiologist reports than traditional preliminary reads. Growing competition in teleradiology services has led to technological advancements that make it simpler for off-site radiologists to communicate with the facilities for which they read, thus encouraging teleradiology providers to deliver more final reads.

End Use Insights

Hospitals held the largest market share, about 62.8%. Hospitals use teleradiology services for urgent care, primary diagnosis, and secondary opinion. However, teleradiology services are generally preferred in emergency care. For instance, if a patient visits a hospital with severe head trauma in the absence of a neuroradiologist, then teleradiology services help in quicker diagnosis and delivering treatment promptly. Therefore, the rising number of emergency hospital visits is expected to drive the market growth over the forecast period. In addition, hospitals save the cost of hiring radiologists by adopting teleradiology services.

Ambulatory Imaging Center (AIC) is expected to grow fastest during the forecast period. Rising demand for imaging procedures, cost-effectiveness, and shortage of radiologists are the major factors contributing to the segment's growth. The major problem faced during an imaging procedure is the time taken for its diagnosis. For instance, as per the NCBI report, in the UK, the average time taken by a radiologist in a normal setting to report an MRI is 21 days. AICs help reduce this diagnosis time, leading to their adoption in various imaging procedures.

Radiology clinics is also expected to grow significantly over the forecast period. Fatty salaries of radiologists, coupled with rising imaging costs, are expected to drive the segment's growth over the forecast period. According to an NCBI report, the average monthly pay of an Indian radiologist (5 years of experience) is approximately USD 5000, and around 10-15% of the salary is added to the total bill of each scan. Therefore, rising demand to reduce healthcare costs is expected to aid the market's growth in the long run.

Regional Insights

North America teleradiology market accounted for the largest share, 38.5% in 2024. Technological advancements in imaging technology and telecommunications infrastructure have facilitated the seamless transmission of medical images, enabling healthcare providers to access radiological expertise remotely. This has led to increased adoption of teleradiology services by healthcare facilities, driving market expansion.

U.S. Teleradiology Market Trends

The U.S. teleradiology market is expected to grow as the healthcare landscape in the U.S. is witnessing a shift towards value-based care and patient-centric models, which prioritize efficiency, accessibility, and quality of care. Teleradiology aligns with these objectives by offering timely and remote access to radiological expertise, enabling healthcare providers to deliver faster diagnoses and treatment plans to patients across geographical boundaries.

The teleradiology market in Canada is expected to grow owing to the shortage of radiologists in certain parts of Canada, particularly in rural and remote areas. This shortage has created a need for teleradiology solutions to overcome staffing challenges and ensure timely interpretations of medical images. By leveraging remote radiology services, healthcare providers can improve patient access to radiological expertise and optimize workflow efficiency, ultimately enhancing patient care and outcomes.

Europe Teleradiology Market Trends

The teleradiology market in Europe also held a significant market share in 2024.The growing aging population and increasing prevalence of chronic diseases in Europe have led to a rise in medical imaging procedures, driving the demand for teleradiology services.

The UK teleradiology market is expected to grow as the National Health Service (NHS) has been actively adopting teleradiology solutions to address challenges such as radiologist shortages, particularly in remote and underserved areas.

The teleradiology market in Germany is expected to grow. The COVID-19 pandemic has accelerated the adoption of telehealth and remote healthcare services in Germany, including teleradiology, as healthcare providers seek to minimize in-person interactions and adhere to social distancing guidelines.

France teleradiology market is expected to grow lucratively over the forecast period. The regulatory initiatives aimed at promoting telemedicine and digital healthcare solutions have supported market growth in France.

Asia Pacific Teleradiology Market Trends

The teleradiology market in Asia Pacific is expected to grow at a lucrative rate over the forecasted period. This can be attributed to the region's rapidly expanding healthcare infrastructure, increasing investments in healthcare technology and digitalization, and driving the adoption of teleradiology solutions.

China teleradiology market is expected to grow due to increasing investments in healthcare infrastructure and technology and the growing demand for diagnostic imaging services.

The teleradiology market in Japan is expected to grow due to the growing aging population. Japan is experiencing a demographic shift characterized by a rapidly increasing elderly population and a declining birth rate. This demographic trend has resulted in a growing demand for healthcare services, including diagnostic imaging, as elderly individuals often require more frequent medical assessments and monitoring.

India teleradiology market is expected to be driven by both public and private investments. This has led to establishing numerous hospitals, diagnostic centers, and clinics in urban and rural areas. This expansion of medical facilities translates to a greater demand for diagnostic imaging services, creating opportunities for teleradiology providers to offer remote radiology interpretations and consultations.

Latin America Teleradiology Market Trends

The teleradiology market in Latin America is expected to growdue to the strategic advantages derived from the region's geographical proximity to North America. This proximity offers teleradiology providers significant benefits, as it facilitates smooth communication and collaboration between healthcare facilities in Latin America and radiologists in North America.

MEA Teleradiology Market Trends

The teleradiology market in the MEA is expected to grow owing to the rising prevalence of chronic diseases and acute medical conditions in the MEA region, which is driving the demand for diagnostic imaging services, including teleradiology. As the incidence of diseases such as cardiovascular disorders, cancer, and trauma continues to rise, there is a corresponding need for timely and accurate diagnostic imaging to aid in disease detection, monitoring, and treatment planning.

Key Teleradiology Company Insights

The presence of major and emerging players in the teleradiology industry, along with their various initiatives to remain competitive, is anticipated to significantly contribute to the overall market growth. These market leaders are continuously engaging in various strategic initiatives to enhance their offerings, expand their market reach, and stay ahead of the competition. One notable strategy involves collaboration between major and emerging players. For instance, in January 2024, HealthEdge partnered with Radsource, marking an exciting entry into the expanding market.

Key Teleradiology Companies:

The following are the leading companies in the teleradiology market. These companies collectively hold the largest market share and dictate industry trends.

- Virtual Radiologic (vRad)

- Agfa-Gevaert Group

- ONRAD, Inc.

- Everlight Radiology

- 4ways Healthcare Ltd.

- RamSoft, Inc.

- USARAD Holdings, Inc.

- Koninklijke Philips N.V.

- Matrix (Teleradiology Division of Radiology Partners)

- Medica Group PLC

- Teleradiology Solutions

- All-American Teleradiology

Recent Developments

-

In March 2024, RamSoft, a supplier of cloud-based RIS/PACS radiology solutions catering to imaging centers and teleradiology providers, has revealed that Premier Radiology Services has entered into a 5-year agreement to utilize RamSoft’s OmegaAI and cloud-based PowerServer PACS platform across its network of over 1,000 teleradiology locations.

-

In June 2023, Grovecourt Capital Partners, a private equity firm, announced that it acquired Premier Radiology Services, a nationwide teleradiology company headquartered in Miami, FL.

-

In March 2022, Qure.ai has broadened its presence in the U.S. market by partnering with USARAD Holdings Inc., showcasing its dedication to improving radiological decision-making.

Teleradiology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.2 billion

Revenue forecast in 2030

USD 60.3 billion

Growth rate

CAGR of 25.7% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, report type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Virtual Radiologic (vRad); Agfa-Gevaert Group ONRAD, Inc.; Everlight Radiology; 4ways Healthcare Ltd.; RamSoft, Inc.; USARAD Holdings, Inc.; Koninklijke Philips N.V.; Matrix (Teleradiology; Division of Radiology Partners); Medica Group PLC;

Teleradiology Solutions; All-American Teleradiology

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Teleradiology Market Report Segmentation

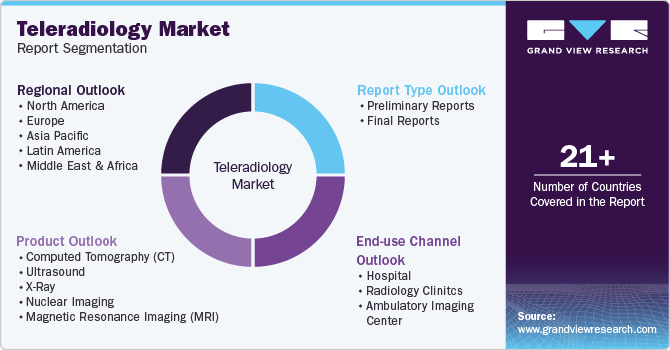

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global teleradiology market report based on product, report type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Computed Tomography (CT)

-

Ultrasound

-

X-Ray

-

Nuclear Imaging

-

Magnetic Resonance Imaging (MRI)

-

-

Report Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Preliminary Reports

-

Final Reports

-

-

End Use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Radiology Clinics

-

Ambulatory Imaging Center

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global teleradiology market size was estimated at USD 15.6 billion in 2024 and is expected to reach USD 19.2 billion in 2025.

b. The global teleradiology market is expected to grow at a compound annual growth rate of 25.7% from 2025 to 2030 to reach USD 60.3 billion by 2030.

b. North America dominated the teleradiology market with a share of 38.5% in 2024. This is attributable to growing target population base, increasing prevalence of chronic disorders and presence of major market players in the region.

b. Some key players operating in the teleradiology market include Virtual Radiologic (vRad); Agfa-Gevaert Group ONRAD, Inc.; Everlight Radiology; 4ways Healthcare Ltd.; RamSoft, Inc.; USARAD Holdings, Inc.; Koninklijke Philips N.V.; Matrix (Teleradiology; Division of Radiology Partners); Medica Group PLC; Teleradiology Solutions; All-American Teleradiology

b. Key factors that are driving the market growth include rising demand for teleradiology in cases of second opinion and emergencies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.