- Home

- »

- Healthcare IT

- »

-

Radiology Information Systems Market Size Report, 2030GVR Report cover

![Radiology Information Systems Market Size, Share & Trends Report]()

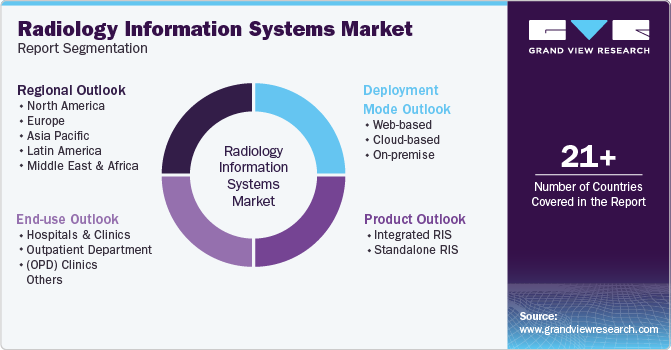

Radiology Information Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Integrated RIS, Standalone RIS), By Deployment Mode, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-854-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Radiology Information Systems Market Summary

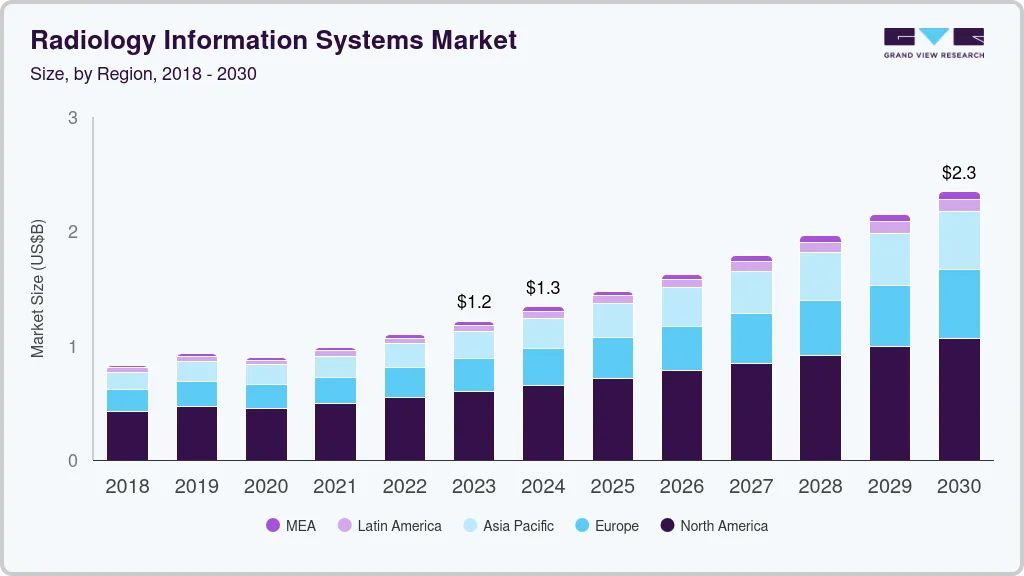

The global radiology information systems market size was estimated at USD 1.21 billion in 2023 and is projected to reach USD 2.35 billion by 2030, growing at a CAGR of 9.78% from 2024 to 2030. Growing government initiatives promoting RIS usage have led to increased investments in healthcare infrastructure by both private providers and governments.

Key Market Trends & Insights

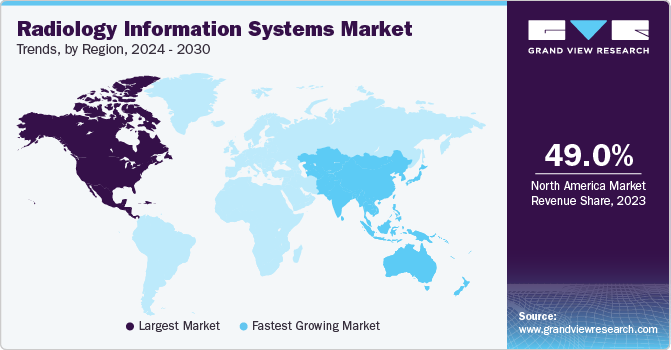

- The radiology information systems market in North America held the largest share of over 49% in 2023.

- The U.S. radiology information systems market held the largest share of the North America regional market revenue in 2023.

- Based on deployment mode, the web-based segment held the largest revenue share of over 77% in 2023.

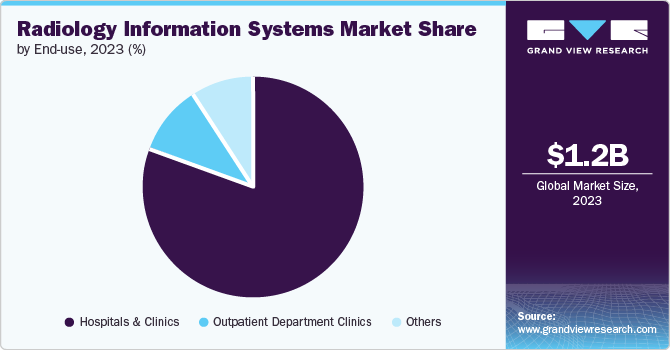

- Based on end-use, the hospitals & clinics end use segment dominated the market with a revenue share of over 81% in 2023.

- Based on product, the integrated RIS segment held the largest revenue share of over 67% in 2023 and is anticipated to grow at the fastest CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 1.21 Billion

- 2030 Projected Market Size: USD 2.35 Billion

- CAGR (2024-2030): 9.78%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, there has been a rise in the number of radiology professionals and practices and a growing preference for cloud-based solutions. Moreover, the number of patients diagnosed with chronic diseases, such as cancer, COPD, arthritis, and osteoporosis, has increased significantly in recent years. This is augmenting the demand for medical imaging, which, in turn, drives market growth. Computerized medical imaging provides secure and convenient interactive documents accessible across various healthcare departments.

RIS serves as a communication link between primary physicians and imaging departments, facilitating better care coordination, which is beneficial for the timely diagnosis or treatment of patients. The rising number of radiology procedures and increased accessibility to these services have led to the development of new systems to meet the demand. For instance, in January 2024, Vertex in Healthcare, a healthcare technology provider, launched VRIS, a radiology information system in the UK. This system is designed to assist imaging departments in reducing bottlenecks and improving the efficiency of diagnostic report processing. Furthermore, hospitals are progressively using cloud technology and related services to improve operational efficiency.

In addition, heavy investment by medical institutions in developed countries is boosting market growth. For instance, in June 2024, Konica Minolta Healthcare Americas partnered with Apollo Enterprise Imaging Corp. to provide the Exa Platform. This platform integrates RIS, PACS, and Billing solutions with a single database across all modules. The solution enables secure management, acquisition, and access of clinical content throughout the enterprise via Arc, benefiting customers with improved connectivity and interoperability across all clinical departments. The partnership aims to unify patient information across clinical specialties, including non-DICOM devices, to create a comprehensive, image-enabled electronic medical record (EMR).

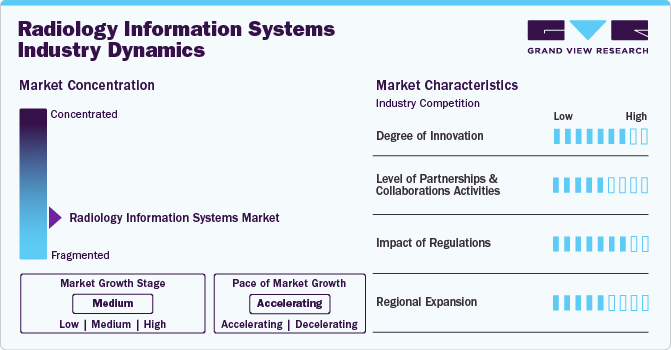

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnership & collaboration activities, degree of innovation, and regional expansion. The RIS market is fragmented, with the presence of several emerging service providers dominating the market. The degree of innovation and the level of partnership & collaboration activities are high. The impact of regulations on the industry is high, and the regional expansion of the industry is moderate.

The degree of innovation in the industry is high. Integrating advanced technologies, particularly artificial intelligence (AI), greatly enhances RIS's capabilities. This integration improves diagnostic effectiveness and expands the scope for innovation within the market. For instance, in July 2024, MIM Software Inc., a medical imaging analysis and AI solutions provider, launched MIM Symphony HDR Prostate. This new solution is designed to assist with high dose-rate (HDR) brachytherapy. The aim is to enhance clinician confidence and improve patient outcomes by enabling direct visualization of tumors from MRI scans in ultrasound procedures for HDR prostate treatments.

The level of partnerships & collaborations in the industry is high. This is due to improving patient care by enhancing the efficiency and effectiveness of radiology workflows. Additionally, the rapid pace of innovation and the presence of emerging players further expand market reach and access to a wider customer base. Partnering with healthcare organizations allows RIS providers to better understand the specific needs of different regions and tailor their solutions accordingly.

Regulations significantly impact the market as they ensure that RIS solutions comply with healthcare standards, which are crucial for patient safety and data security. Stringent compliance requirements force companies to constantly update their systems, ensuring they meet the latest healthcare protocols and patient privacy laws, such as HIPAA in the U.S.

The level of regional expansion in the industry is moderate due to increasing healthcare investments in emerging markets, growing demand for efficient diagnostic imaging solutions, and technological advancements. As countries in regions like Asia Pacific, Europe, and Latin America improve their healthcare infrastructure, there is a significant push towards modernizing radiology departments with integrated RIS solutions. For instance, in June 2024, Incepto Medical and DeepHealth partnered to deliver expanded access to DeepHealth clinical AI and radiology informatics software in Europe. This collaboration offers access to an expanded AI-powered portfolio, including integrated AI clinical solutions and workflow tools, to help address the challenges encountered by radiologists and staff throughout Europe.

Deployment Mode Insights

Based on deployment mode, the web-based segment held the largest revenue share of over 77% in 2023 due to its intrinsic flexibility and accessibility. Unlike traditional systems, web-based solutions are accessed remotely, which allows radiologists and medical staff to access patient data and manage workflows from any location with an internet connection. This capability significantly enhances efficiency and response times, improving patient care. In addition, web-based systems offer lower upfront costs compared to on-premises solutions, as there is less need for extensive hardware installations and maintenance. The nature of these systems also facilitates easier updates and upgrades, ensuring that users can benefit from the latest features and security enhancements without major disruptions or investments. These advantages make web-based RIS an appealing choice for healthcare facilities seeking to improve their radiological services with a cost-effective, scalable, and user-friendly solution.

The cloud-based segment is anticipated to grow at the fastest CAGR from 2024 to 2030. Compared to the direct purchase model, cloud-hosted services are very affordable. Instead of purchasing the entire model, consumers can subscribe to the latest version at a low price. Since data is stored on external servers, cloud-based systems are easily accessible online. Cloud-based RIS can be integrated with Artificial Intelligence (AI) algorithms to form comprehensive software. Such AI tools allow physicians to provide accurate and faster diagnosis and can be integrated with any third-party AI tool. For instance, in April 2024, Bayer AG and Google partnered to develop AI solutions that support radiologists and benefit patients. The collaboration aims to help organizations overcome challenges in developing scalable and compliant AI-powered medical imaging software products using advanced data security capabilities.

End Use Insights

The hospitals & clinics end use segment dominated the market with a revenue share of over 81% in 2023. The segment growth is attributed to the increasing demand for streamlined workflows and improved patient care. Hospitals and clinics face constant pressure to enhance diagnostic accuracy while reducing the time and costs associated with radiological procedures. Implementing RIS helps these institutions manage patient data and imaging files efficiently, schedule appointments effectively, and improve communication between radiologists and other healthcare professionals. Big healthcare IT corporations are involved in the integration of all hospital databases that connect all the systems and equipment of a care setting.

For instance, Infosys HIS focuses mainly on the EMR and IT-driven clinical transformation to maximize value for products by including RIS, Laboratory Information System (LIS), Pharmacy Information System (PIS), and Practice Management System (PMS). The Outpatient Department (OPD) clinics end use segment is anticipated to grow at the fastest CAGR over the forecast years. This growth can be attributed to a rise in the number of outpatient visits. Furthermore, a gradual shift of patients towards outpatient settings and improving health coverage are favoring segment growth.

Product Insights

The integrated RIS segment held the largest revenue share of over 67% in 2023 and is anticipated to grow at the fastest CAGR from 2024 to 2030. The demand for efficient workflow processes in radiology departments has led to the development of integrated RIS that combines Picture Archiving and Communication Systems (PACS) into a unified solution. This integrated approach simplifies the management of images and associated data, reducing the need for manual coordination between separate systems and improving workflow efficiency. The increasing use of EHR platforms and digitized imaging has highlighted the need for integrated systems to seamlessly manage the clinical workflow across the entire medical facility. Integrating RIS solutions enhances productivity by allowing staff to concentrate on patient care, reduces errors, and improves communication across departments, making them highly sought after in the healthcare industry.

The standalone segment is anticipated to grow significantly over the forecast years owing to its tailored approach to meet the specific operational needs of radiology departments. These standalone solutions offer cost-effectiveness, ease of implementation, and the ability to efficiently manage patient scheduling, tracking, and reporting independently of other hospital systems. In addition, it provides scalability and customization options that cater to the varying sizes and workflow demands of different facilities. This specialization and technological advancements, such as enhanced analytics and cloud-based options, make standalone RIS a compelling choice for facilities looking to optimize their radiological services without the complexities and higher costs associated with integrated systems.

Regional Insights

The radiology information systems market in North America held the largest share of over 49% in 2023. This is due to the advancements in RIS, along with an increase in the number of radiologists and the introduction of new software systems by current providers, which led to significant improvements in medical imaging procedures. The launch of comprehensive RIS with integrated PACS has made the process more systematic and easier, resulting in better patient compliance and driving regional growth.

U.S. Radiology Information Systems Market Trends

The U.S. radiology information systems market held the largest share of the North America regional market revenue in 2023 owing to the shift from a volume-based to a value-based care model, which emphasizes the efficiency and quality of care. RIS is crucial in achieving these goals by streamlining radiology department operations and improving patient care coordination. In addition, the high prevalence of chronic diseases, which require extensive imaging procedures, drives market growth.

Europe Radiology Information Systems Market Trends

The radiology information systems market in Europe is anticipated to grow significantly due to the increasing adoption of RIS by healthcare providers and clinics in many European countries. This adoption aims to improve workflow within healthcare systems. In addition, there is a shift towards cloud-based solutions, increased integration with PACS & EHR, and incorporation of advanced technologies like AI & ML to improve the diagnostic capabilities and operational efficiency of radiologists and service providers, which is expected to drive market growth.

The UK radiology information systems market held the largest market share in 2023 owing to a rise in demand for modern medical imaging departments to enhance the effectiveness and efficiency of radiology services due to a large volume of diagnostic imaging tests being performed in the UK.

The radiology information systems market in Germany held a significant market share in 2023 owing to the government’s strong commitment to healthcare digitalization. This commitment is exemplified by legislative measures, such as the Krankenhauszukunftsgesetz (Hospital Future Act), which earmarks significant financial investments for modernizing digital infrastructure in hospitals. By focusing on the enhancement of hospital IT systems and the efficiency of patient care through advanced technologies, this act facilitates the accelerated deployment and widespread integration of RIS within German healthcare facilities.

Asia Pacific Radiology Information Systems Market Trends

The Asia Pacific radiology information systems market is expected to witness the fastest growth over the forecast period. The expansion of healthcare infrastructure, particularly in emerging economies, such as India, Philippines, and Indonesia, and increasing investments in healthcare IT solutions to improve patient care quality are significant drivers of the regional market growth. The demand for digital and integrated RIS is also driven by the need to efficiently manage the growing volume of medical images and data.

The radiology information systems market in China held the largest share of the APAC regional market in 2023 due to the high demand for effective and efficient management of medical imagery and associated data. The rapid growth in the volumes of diagnostic imaging procedures performed in China, coupled with the rising prevalence of chronic diseases, necessitates robust systems for managing the vast volumes of radiological data generated, thereby augmenting market demand.

The India radiology information systems market growth is driven by the increasing digitization of healthcare records and processes within the rapidly expanding healthcare sector of the country. Moreover, rising demand for streamlined diagnostic processes, improved patient care, and efficient management of medical images and associated data help support market growth.

Latin America Radiology Information Systems Market Trends

The radiology information systems market in Latin America is anticipated to grow significantly due to the rising need for efficient healthcare IT systems to enhance patient care and workflow efficiency. This is further supported by the growing emphasis on reducing diagnostic errors, increasing healthcare expenditure, and growing adoption of EMRs across the region’s healthcare facilities.

The Brazil RIS marketradiology information systems market is anticipated to grow significantly due to the rapid adoption of telemedicine, particularly in response to the COVID-19 pandemic. This has led to an increased demand for RIS. Telemedicine enables remote access to radiographic expertise and diagnostic services, which helps address the shortage of trained radiologists and meet the rising demand for medical imaging services.

MEA Radiology Information Systems Market Trends

The radiology information systems market in Middle East & Africa is expected to grow considerably due to the increasing investment in healthcare infrastructure and information technology. Countries in the region are making significant strides in modernizing their healthcare systems, which includes adopting advanced digital solutions like RIS. These investments are aimed at improving the efficiency & quality of healthcare services, addressing the rising demand for diagnostic imaging, and facilitating better management of patient data & interoperability across various healthcare systems.

The Saudi Arabia radiology information systems market is anticipated to grow significantly over the forecast period. There's an increasing demand for diagnostic imaging services in Saudi Arabia due to a rise in the cases of chronic diseases, such as cardiovascular diseases (CVDs), diabetes, and cancer. This has necessitated the adoption of advanced systems like RIS to efficiently manage the growing volume of diagnostic procedures.

Key Radiology Information Systems Company Insights

The market is fragmented with the presence of several large-scale and emerging companies. High investments in R&D by manufacturers drive market growth. Companies adopt various strategies, such as collaborations, acquisitions, partnerships, and new device launches, to stay ahead of the competition.

Key Radiology Information Systems Companies:

The following are the leading companies in the radiology information systems market. These companies collectively hold the largest market share and dictate industry trends.

- DeepHealth

- Epic Systems Corporation

- General Electric Company

- IBM

- Koninklijke Philips N.V.

- Mckesson Corporation

- MedInformatix, Inc.

- Oracle

- Pro Medicus, Ltd.

- Siemens Healthineers AG

- Veradigm LLC

Recent Developments

-

In July 2024, DeepHealth, a subsidiary of RadNet, Inc. and a provider of AI-powered health and radiology informatics, opened a new office in Bengaluru to expand into the Indian market. This technology hub drives innovative advancements and supports DeepHealth’s mission to revolutionize care delivery

-

In June 2024, DeepHealth, a subsidiary of RadNet, Inc., launched its integrated portfolio in Italy. The portfolio includes the innovative cloud-native DeepHealth OS, which unifies clinical data and personalizes AI-powered workspaces. The solutions focus on improving patient outcomes in lung, breast, prostate health, and brain, to enhance disease detection through large-scale screening and diagnosis programs in the U.S. and Europe

-

In February 2024, Pro Medicus, Ltd. launched Visage Ease VP for Apple Vision Pro. This launch enhances spatial, immersive experiences for diagnostic imaging and multimedia and provides end users with an imaging experience unlike any other application

Radiology Information Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.34 billion

Revenue forecast in 2030

USD 2.35 billion

Growth rate

CAGR of 9.78% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment mode, product, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Russia; Italy; Spain; The Netherlands; Switzerland; Belgium; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Singapore; Philippines; Malaysia; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Veradigm LLC; Oracle; Epic Systems Corp.; Mckesson Corporation; DeepHealth; Siemens Healthineers AG; Koninklijke Philips N.V.; Pro Medicus, Ltd.; MedInformatix, Inc.; General Electric Company; IBM

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radiology Information Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the radiology information systems market report based on deployment mode, product, end use, and region:

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

On-premise

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated RIS

-

Standalone RIS

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Outpatient Department (OPD) Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

Italy

-

Spain

-

The Netherlands

-

Switzerland

-

Belgium

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Singapore

-

Philippines

-

Malaysia

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global radiology information systems market size was estimated at USD 1.21 billion in 2023 and is expected to reach USD 1.34 billion in 2024.

b. The global radiology information systems market is expected to grow at a compound annual growth rate of 9.78% from 2024 to 2030 to reach USD 2.35 billion by 2030.

b. North America dominated the radiology information systems market with a share of 49.1% in 2023. This is attributable to the advancement in the RIS, an increase in the number of radiologists, and the introduction of new software systems by current providers.

b. Some key players operating in the radiology information systems market are Allscripts; Cerner Corporation; Epic Systems Corporation; McKesson Corporation; GE Healthcare; Siemens Healthcare; Philips Healthcare; Merge Healthcare; and MedInformatix, Inc.

b. Key factors that are driving the market growth include the rising population, investments in R&D activities, rising number of radiology professionals and practices, and preference for web based solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.