- Home

- »

- Next Generation Technologies

- »

-

U.S. Custom Printing Market Size, Industry Report, 2030GVR Report cover

![U.S. Custom Printing Market Size, Share & Trends Report]()

U.S. Custom Printing Market Size, Share & Trends Analysis Report By Printing Technique, By Printing Design (Graphic Design, Artwork), By Application, By End-use, By Commercial Enterprise Size, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-219-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Custom Printing Market Size & Trends

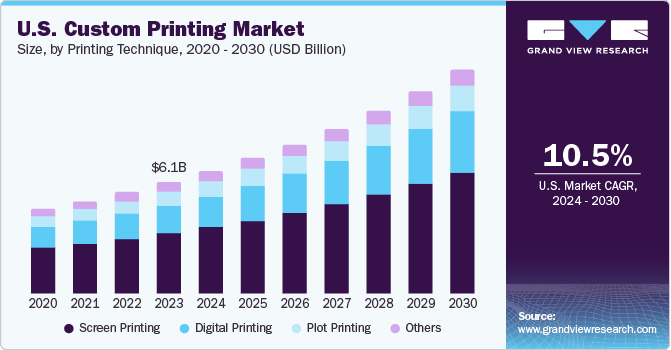

The U.S. custom printing market size was valued at USD 6.10 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.5% from 2024 to 2030. The major factors driving the market growth include the increasing use of customized t-shirts as an advertising and branding tool by companies and the rising preference of people toward wearing fashionable custom-printed clothes. Moreover, the increasing need from businesses and enterprises for advertising materials such as banners, posters, brochures, pamphlets, and business cards is driving the demand for custom printing services, which in turn, is fueling the industry growth.

The U.S. accounted for approximately 17.6% share of the global custom printing market. Custom printing platforms in the U.S. provide custom-design printing solutions to customers. Factors such as rising disposable income, increasing internet penetration and smartphone adoption, and inclination toward fashion apparel and unique products are fueling the demand for custom printing. The growing e-commerce sales are also fueling the growth of the custom printing industry.

The rapid adoption of custom printing in the packaging industry is boosting the growth of the custom printing market. Attractive packaging helps create uniqueness for the product entering a competitive market, gain competitive advantage, engage customers, develop a brand identity, and improve the overall experience. Moreover, changing consumer preferences play a crucial role in adopting products delivered in good packaging. Consumers are willing to pay higher for appealing product packaging than generic packaging, which is propelling the adoption of custom printing in packaging industry.

Custom printing services increase customer engagement and capture granular details to target the right set of audience. Custom printing is ideally utilized by SMEs and large enterprises for effective advertising. The increasing utilization of custom-printed materials such as posters, flyers, and banners as branding tools is expected to propel the growth of the market over the forecast period. Custom printing enables enterprises to offer distinctive customization; designing; and printing services on various objects and materials, such as stationery items, letterheads, visiting cards, clothing, ceramic & metallic items, and notebooks.

Although custom printing has become among the most inspiring & innovative methods, offering multiple benefits to various industries and sectors, there exist a few factors hindering the growth of the market. Material constraints, limitations of the machinery, and complexity of designs are among the factors hampering the market growth. Moreover, a high initial investment is one of the major market restraints owing to the costlier material prices, lack of materials availability, and higher prices of the custom printers.

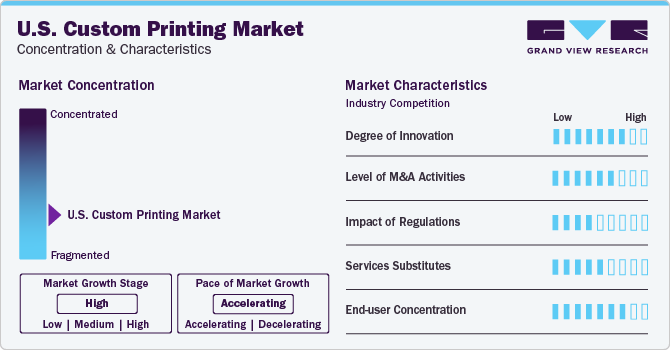

Market Concentration & Characteristics

The growth stage for the custom printing industry is high and the rate of growth is accelerating. As the market for custom printing in the U.S. is fragmented, there are various companies in the market, big and small, vying for an increased market share. The market is witnessing high activities of mergers and acquisitions by companies to consolidate market share or gain access to the latest innovations in custom printing techniques and technologies related to it.

Various innovative techniques for custom printing are being adopted by early-stage companies and startups. A large concern in the printing industry is the environmental harm from traditional petroleum-based inks. They release VOCs that cause air pollution and are often difficult to recycle. Therefore, the printing industry is adopting innovations in eco-friendly inks such as soy-based ink, water-based inks, and more that are emerging as sustainable alternatives. Therefore, the custom printing industry is witnessing a high degree of innovation as more and more R&D investment is being made for developing new techniques in printing as well as for refining them.

The end-user concentration for custom printing is diverse and spans across various industries. Commercial segment as well as personalized segments are expected to increase the demand for the U.S. custom printing industry. For example, as the U.S. is a leading country in sports, the printing market is poised for unprecedented growth in the coming years owing to the rising trend of wearing custom-designed jerseys and t-shirts with unique designs and logos of sports teams. Thus, the growing popularity of sports is also expected to increase the demand for custom-printed t-shirts.

Printing Techniques Insights

The screen-printing segment held the largest revenue share of 54.3% in 2023 and is anticipated to continue its dominance over the coming years. Screen printing is used for producing eye-catching canvases, posters, artwork, and printing onto fabrics and textiles. The introduction of advanced machinery and printing inks has resulted in improved printing efficiency and quality. The popularity of screen-printing can be attributed to a variety of reasons, the most appealing of which is the wide range of colors that may be employed in screen-printing. It is also widely utilized for apparel and textile printing as it facilitates excellent detailing for custom and complex designs. Apart from this, versatility and better print quality are also among the numerous advantages associated with screen printing, which are expected to play a decisive role in driving the growth of the segment.

Digital printing is anticipated to grow at the fastest CAGR of 12% over the projected period. Digital printing offers more options, functionality, and flexibility over conventional printing technologies, such as offset printing and flexographic printing. Digital printing is gaining popularity as it is less labor-intensive and allows the production of multiple designs in small batches. Constant advancements, such as on-demand printing, along with a significant push toward environmental and sustainable operations through safer chemicals and mild solvents than those used in conventional technologies are playing a vital role in driving the segment growth. The shift toward green solutions and cost-effective production is also expected to open new opportunities for the growth of the segment.

Printing Design Insights

The graphic design segment held the largest revenue share of about 56.3% in 2023 and is anticipated to continue its dominance over the coming years. Graphic design helps in communicating information in an easy-to-understand manner, for instance, through infographics. As such, graphic design can play a vital role in branding and advertising. While a graphic design can be printed on notebooks, posters, glass, ceramics, stickers, paper bags, and t-shirts, among other surfaces, it can also be hosted on websites, thereby helping organizations in building their brand and reputation. These factors help in the growth of the segment.

The artwork segment is anticipated to witness the fastest CAGR of 11.5% over the projected period. Artwork can be performed on diverse materials, such as wood walls, textiles, t-shirts, and ceramics. The artwork segment also covers custom artwork developed by individuals to be printed on a particular material or a product. These factors aid in the growth of the segment.

Application Insights

The clothing segment dominated the market with a revenue share of 37.2% in 2023. The clothing segment includes t-shirts, jerseys, sweatshirts & hoodies, and other custom-printed clothing. The fashion industry is witnessing a shift toward wearing customized clothing. As a result, people prefer wearing customized t-shirts printed with specific logos or slogans, which in turn, is propelling the custom printing industry growth. Custom-printed jerseys are widely adopted by sports organizations and gaming clubs. The growth of the segment can be attributed to the growing adoption of such jerseys by end-users for various purposes, including brand awareness, representation of a group, or status symbol.

The packaging segment is expected to witness the fastest CAGR of 12.5% during the forecast period. The packaging segment comprises labels, stickers, boxes, paper bags, and other packaging products. Packaging includes the process of labeling the packages with electronic, graphical, or written representations. It is utilized by various industries and sectors, such as education, healthcare, manufacturing, and retail, to create brand awareness, address the list of ingredients of medicines, and provide product information. Moreover, the integration of augmented reality, Radio-Frequency Identification (RFID) tags, bars, and QR codes into smart packaging has contributed largely to generating revenue for aesthetic packaging.

Commercial Enterprise Size Insights

Based on enterprise size, the custom printing market has been further segmented into micro enterprise, small enterprise, medium enterprise, and large enterprise. The large enterprises segment held the largest market share of 57.7% in 2023. Along with multiple benefits of custom printing, it acts as a low-cost alternative for companies that spend huge amounts on advertising of products, offering abundant printing options, including screen & digital printing, and customization. Custom printing services increase customer engagement and capture granular details to target the right set of audience. Large enterprises have adequate budgets to spend on custom-printed products, such as pens, travel mugs, notebooks, calendars, backpacks, hats, and t-shirts, which can be used to retain customers, reward loyal customers, and acquire new customers. The abovementioned factors aid in the growth of the segment.

The medium enterprises segment is anticipated to register the fastest CAGR of 11.5% over the projected period. Medium enterprises majorly focus on custom-printed drinkware, staff name tags, t-shirts, and other items, such as lanyards, magnets, and postcards, for promotion and marketing. Having realized that custom-printed products can potentially help companies in promoting their brand and increase their customer base, custom printing providers are working with their clients on an individual basis to design and produce custom-printed materials meeting their specific requirements and budgets. Therefore, as custom printing offers various budget-friendly options, a growing number of medium enterprises are increasingly adopting custom printing, aiding in segment growth.

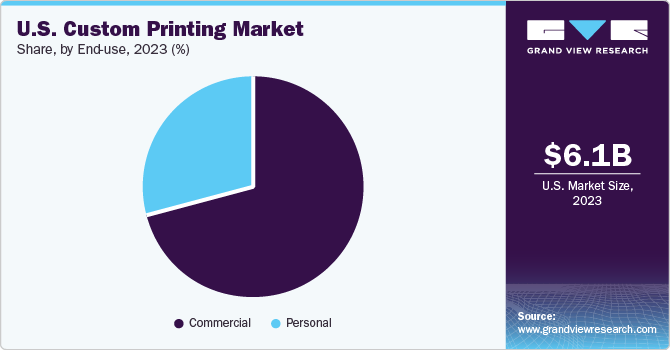

End-use Insights

The commercial segment dominated the market with a revenue share of 70.8% in 2023. Commercial end-users of custom printing include enterprises, corporations, and businesses opting for custom printing for marketing and advertising purposes. Businesses of all sizes rely heavily on custom printing for effective marketing and advertising. Custom printing can also help in augmenting sales and in improving brand awareness without incurring any significant costs. Apart from low-cost marketing, custom printing can also help businesses in instant brand recognition and building customer loyalty.

Key market players are offering custom printing solutions designed to help businesses and institutions with better and more effective marketing.

The personal segment is anticipated to witness the fastest CAGR of 11.5% over the projected period. The personal segment includes individual users opting for custom printing services to produce custom-printed notebooks, t-shirts, textiles, glass, ceramics, and home décor accessories, among other items. According to a Deloitte study conducted in 2021, 36% of buyers would typically consider purchasing customized goods or services. In addition, one in five customers is willing to pay 20% more for personalized products than their conventional equivalents. Meanwhile, 48% of clients are prepared to wait longer for customized products. These statistics demonstrate a paradigm shift in consumers' thinking and indicate how consumers are shifting their focus away from price and toward value

Key U.S. Custom Printing Company Insights

Some of the major companies include Cafepress, Custom Ink, LLC., and Shutterfly, Inc., among others.

-

CafePress is an online marketplace that offers diverse custom designs for promotional products and engaging merchandise. The company provides a wide array of expressive gifts, accessories, and personalized products, including t-shirts, apparel, mugs, drinkware, and home goods such as bed coverings and shower curtains. It has partnered with several entertainment companies, including MARVEL, PIXAR, Warner Bros. Entertainment Inc., CBS Interactive, 20th Century Fox, ABC, Peanuts, Pixar, and Universal Pictures.

-

Shutterfly Inc. is a photo retailer that enables users to store, print, and share pictures online. In addition, the company enables users to create and order prints of photos, design invites, and cards, custom print pictures on materials such as mugs, and build personalized canvas prints and photo books. It is also engaged in the development of an e-commerce platform that offers custom design and personalized products.

Canva and Growforge are some of the emerging companies in the U.S. market for Custom Printing:

-

Canva is an online designing and publishing tools provider. The company offers services to create curved text generator, trim videos, add texts and frames to photos, convert videos to MP4, enhance images, and add photo effects, among others. Its product category comprises ready-made design templates for offices & businesses, education, marketing, and social media.The custom print category offers professional print quality and doorstep shipping services. The company features custom-printed products such as business cards, flyers, logos, photo books, calendars, invitations, mugs, t-shirt mockups, postcards, stickers, and yard signs.

-

Glowforge is a manufacturer of laser printers intended to offer print on wood, rubber, fabric, food, and leather. The company's printers utilize software and sensors, laser cutter, and engraver technology to cut, engrave, and shape designs from a variety of materials, enabling users to print and decorate any materials.

Key U.S. Custom Printing Companies:

- CafePress

- Vistaprint

- GotPrint

- Zazzle Inc.

- PsPrint

- UPrinting.com

- Shutterfly Inc.

- Overnight Prints

- Canva

- CustomInk, LLC

Recent Developments

-

In March 2023, Zazzle, the global online marketplace for creating unique designs and products made on demand, announced a new addition to its offering- Instant Downloads for invitations and other related designs. Consumers can now personalize and download digital templates directly from Zazzle's website, including cards, invitations, handouts, and more. The addition of Instant Downloads offers Zazzle customers even more opportunities to celebrate life’s memorable moments and can be shared in minutes.

-

In September 2022, Canva introduced the Canva print products within its on-demand printing services. The company aimed to expand their print catalog, offer doorstep delivery, provide free in-store pickup with automated proofing, and offer a turnaround of 1 – 3 days at affordable prices.

-

In January 2022, Custom Ink acquired Printfection (Denver), a platform for swag management that enabled clients to develop and distribute branded items. The financial terms of the agreement were not disclosed.

U.S. Custom Printing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6102.2 million

Revenue forecast in 2030

USD 12,235 million

Growth rate

CAGR of 10.5 % from 2024 to 2030

Actual estimates/Historic data

2017 - 2022

Forecast period

2024 - 2030

Market representation

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Printing technique, printing design, application, end-use, commercial enterprise size

Country scope

U.S.

Key companies profiled

CafePress; Vistaprint; GotPrint; Zazzle Inc.; PsPrint; UPrinting.com; Shutterfly Inc.; Overnight Prints; Canva; CustomInk, LLC

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

U.S. Custom Printing Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. custom printing market report based on printing technique, printing design, application, end-use, and commercial enterprise size:

-

Printing Technique Outlook (Revenue, USD Million, 2017 - 2030)

-

Screen Printing

-

Digital Printing

-

Plot Printing

-

Others

-

-

Printing Design Outlook (Revenue, USD Million, 2017 - 2030)

-

Graphic Design

-

Artwork

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Clothing

-

T-Shirts

-

Jerseys

-

Sweatshirts and Hoodies

-

Others

-

-

Business Cards

-

Standard

-

Premium

-

-

Marketing Material

-

Banners

-

Signage

-

Poster

-

Others

-

Brochures & Booklets

-

Catalogues

-

Flyers & Pamphlets

-

Menus

-

Others

-

-

-

Packaging

-

Labels

-

Stickers

-

Boxes

-

Paper Bags

-

Others

-

-

Stationery

-

Letterheads

-

Notebooks

-

Envelopes

-

Others

-

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Personal

-

-

Commercial Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Micro Enterprises

-

Small Enterprises

-

Medium Enterprises

-

Large Enterprises

-

Frequently Asked Questions About This Report

b. The U.S. custom printing market size was estimated at USD 6.10 billion in 2023 and is expected to reach USD 6.72 billion in 2024.

b. The U.S. custom printing market is expected to grow at a compound annual growth rate of 10.5% from 2024 to 2030 to reach USD 12,235 million by 2030.

b. The screen-printing segment held the largest revenue share of 54.3% in 2023 and is anticipated to continue its dominance over the coming years. Screen printing is used for producing eye-catching canvases, posters, artwork, and printing onto fabrics and textiles. The introduction of advanced machinery and printing inks has resulted in improved printing efficiency and quality.

b. Some of the key companies in the U.S. Custom Printing Market include, CafePress, Vistaprint, GotPrint, Zazzle Inc., PsPrint, UPrinting.com, Shutterfly Inc., Overnight Prints, Canva, and CustomInk, LLC.

b. The major factors driving the U.S. custom printing market growth include the increasing use of customized t-shirts as an advertising and branding tool by companies and the rising preference of people toward wearing fashionable custom-printed clothes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."