- Home

- »

- Next Generation Technologies

- »

-

Custom Printing Market Size, Share And Trends Report, 2030GVR Report cover

![Custom Printing Market Size, Share & Trends Report]()

Custom Printing Market (2025 - 2030) Size, Share & Trends Analysis Report By Printing Technique (Screen Printing, Digital Printing), By Printing Design (Graphic Design, Artwork), By Application, By End Use (Commercial, Personal), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-039-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Custom Printing Market Summary

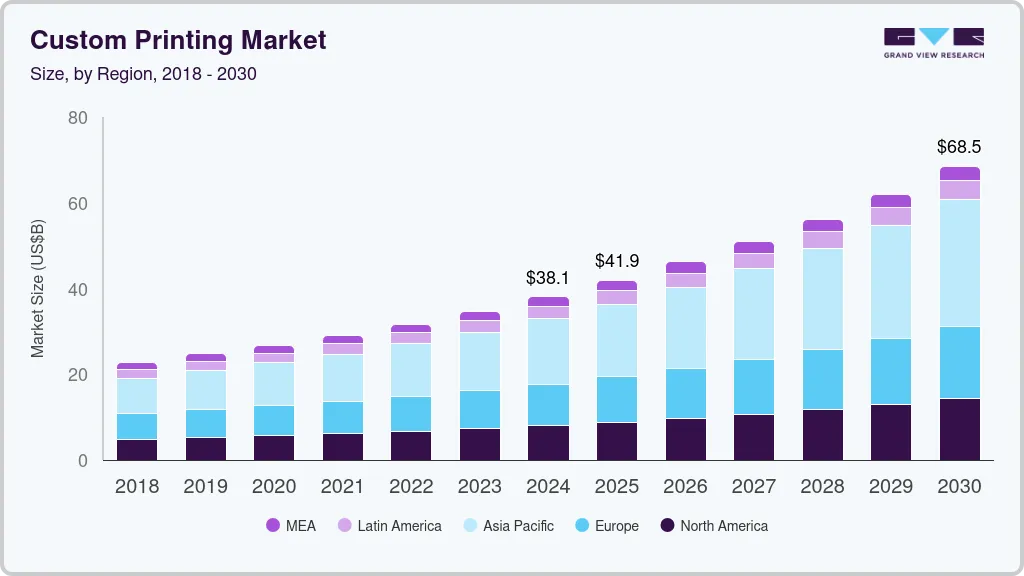

The global custom printing market size was estimated at USD 38.10 billion in 2024 and is projected to reach USD 68.46 billion by 2030, growing at a CAGR of 10.3% from 2025 to 2030. Increasing demand for personalized products drives market growth. Consumers adopt unique items that reflect their tastes, preferences, and identities.

Key Market Trends & Insights

- The custom printing market in Asia Pacific held a significant revenue share of around 39.9% in 2024.

- The custom printing market in the U.S. is experiencing significant growth owing to the rise of on-demand printing.

- Based on printing technique, the screen printing segment dominated the market with a revenue share of 54.4% in 2024.

- Based on application, the clothing segment dominated the market in terms of revenue, with a revenue share of 36.9% in 2024.

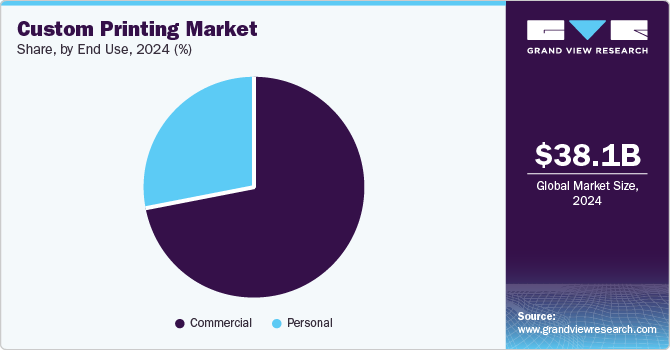

- Based on end use, the commercial segment dominated the market in terms of revenue, with a revenue share of 71.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.10 Billion

- 2030 Projected Market Size: USD 68.46 Billion

- CAGR (2025-2030): 10.3%

- Asia Pacific: Largest market in 2024

This trend spans various sectors, including fashion, home decor, and promotional merchandise. Custom printing allows customers to express their creativity and personalize products, such as clothing with custom designs, personalized gifts for special occasions, or branded merchandise that resonates with their target audience. As personalization continues to gain traction, businesses are investing in custom printing solutions to cater to this growing demand, ultimately driving market growth.

Technological advancements in printing methods have significantly impacted the custom printing market. Innovations such as digital printing, direct-to-garment (DTG) printing, and 3D printing have enhanced the quality, speed, and cost-effectiveness of producing custom products. Digital printing, in particular, enables quick turnaround times for small orders, allowing businesses to offer on-demand printing services without needing a large inventory. As printing technology evolves, it allows more complex designs and customization options, attracting a broader customer base.

Additionally, the rise of personalized items for events and special occasions is another key driver in the custom printing market. Products such as custom invitations, banners, photo books, and party favors are increasingly popular for weddings, birthdays, corporate events, and other celebrations. As people seek unique ways to commemorate special moments, custom printing provides an avenue for creativity and personalization. This trend is particularly pronounced among millennials and Generation Z, who often prioritize experiences and personal expression. The growing demand for customized event items will continue to support the expansion of the custom printing market.

Furthermore, the rapid expansion of e-commerce has transformed the custom printing landscape, enabling consumers to access and order personalized products. Online platforms and marketplaces specializing in custom printing have gained popularity, allowing users to design and order products from the comfort of their homes. These platforms often provide user-friendly design tools, making it simple for consumers to create unique items. Additionally, the convenience of online shopping, combined with the ability to customize products, has significantly contributed to the growth of the custom printing market. E-commerce has also enabled businesses to reach a global audience, expanding their customer base and driving demand for custom printing services. According to an article published by the Commerce Department stated that U.S. e-commerce sales accounted for 15.4% of total sales in 2023 and 14.7% in 2022.

Printing Technique Insights

Based on printing technique, the market is segmented into screen printing, digital printing, plot printing, and others. The screen printing segment dominated the market with a revenue share of 54.4% in 2024. Advancements in screen printing technology have also played a crucial role in its growth within the custom printing market. Innovations such as automatic screen printing machines, digital hybrid printing, and advanced ink formulations have enhanced printing efficiency, precision, and quality. These technological advancements allow printers to produce complex designs with fine details and vibrant colors, catering to the increasing demands of customers. Additionally, integrating digital technology into traditional screen printing processes has expanded capabilities, enabling businesses to offer more diverse and customized products. As technology evolves, the demand for screen printing in the custom printing market will increase.

The digital printing segment is anticipated to register significant growth over the forecast period. Rapid prototyping and sampling are increasingly important in the product development cycle across various industries. Digital printing allows businesses to create quick prototypes of their designs, enabling them to test concepts, gather feedback, and make necessary adjustments before committing to larger production runs. This agility is particularly advantageous in the fashion and consumer goods industries, where trends change rapidly. By facilitating faster iterations and reducing the time to market, digital printing supports innovation and responsiveness, making it an essential tool for businesses seeking to stay competitive. As the demand for speed and efficiency in product development continues to rise, digital printing will play a pivotal role in meeting these needs.

Printing Design Insights

Based on printing design, the market is segmented into graphic design and artwork. The growing interest in home decor and interior design has fueled the demand for custom artwork. Artwork transforms a room, creates a focal point, and conveys a specific mood or theme. This trend has led to the popularity of art prints, canvas prints, and wall art, easily customized to individual tastes. As homeowners continue to invest in creating personalized environments, the artwork segment within the custom printing market is expected to grow during the forecast period. The growing interest in home decor and interior design has fueled the demand for custom artwork. Artwork transforms a room, creates a focal point, and conveys a specific mood or theme. This trend has led to the popularity of art prints, canvas prints, and wall art, easily customized to individual tastes. As homeowners continue to invest in creating personalized environments, the artwork segment within the custom printing market is expected to grow during the forecast period.

The artwork segment is expected to grow significantly, with a CAGR of over 11.2% over the forecast period. According to Contemporary Art Issue, artists usually create between 25 and 50 artworks annually. With around 5 million active artists in 2023, this produces approximately 125 to 250 million new artworks each year.

Application Insights

Based on application, the market is divided into clothing, business cards, marketing material, packaging, stationery, and others. The clothing segment dominated the market in terms of revenue, with a revenue share of 36.9% in 2024. The demand for custom clothing extends beyond individual consumer preferences to include promotional and event-based apparel. Businesses and organizations increasingly use custom-printed clothing for branding, employee uniforms, and event merchandise. Custom t-shirts and other garments featuring logos or slogans can effectively promote brand identity and create a sense of unity among employees or event participants. This trend has been particularly evident during corporate events, trade shows, and community gatherings. As companies continue to recognize the value of customized apparel in enhancing brand visibility and engagement, the clothing segment within the custom printing market will increase.

The packaging segment is expected to register the highest growth over the forecast period. The popularity of subscription services across various industries has significantly impacted the packaging segment. Companies offering subscription boxes need functional packaging solutions for shipping and storage. Custom packaging allows these businesses to create memorable unboxing experiences for subscribers, enhancing customer retention and brand loyalty. This demand for unique packaging solutions tailored to subscription models contributes to the growth of the packaging segment within the custom printing market as brands seek to differentiate themselves in a crowded marketplace. According to a 2022 industry report by PipeCandy, direct-to-consumer (DTC) companies that offer subscription services account for 4% of the U.S. e-commerce market, indicating significant potential for growth. There are over 7,000 DTC subscription retailers in the U.S., catering to 225 million subscriptions and 61 million subscribers, which averages nearly four subscriptions per buyer. Millennials and Gen Z are the primary spenders in this segment, representing 42% of the U.S. population, and they appreciate the convenience, variety, and personalization that automated purchasing provides.

End Use Insights

Based on end use, the market is divided into commercial and personal. The commercial segment dominated the market in terms of revenue, with a revenue share of 71.7% in 2024. The surge in e-commerce and direct-to-consumer (DTC) brands creates new opportunities for the commercial segment of the custom printing market. As businesses transition to online platforms, they require customized packaging and promotional materials that resonate with their target audience. Custom-printed packaging enhances the unboxing experience and serves as a marketing tool. This shift towards e-commerce and DTC models drives demand for innovative and personalized printing solutions that cater to the unique needs of online consumers, thus contributing to market growth.

The personal segment is expected to register the highest growth over the forecast period. The rise of the do-it-yourself (DIY) trend has played a pivotal role in driving the personal segment of the custom printing market. With increased access to online resources, tutorials, and platforms supporting DIY projects, consumers create personalized items for themselves. This movement promotes creativity and self-expression, leading to a growing interest in custom-printed products that can be designed and produced with minimal effort. Consumers are more inclined to engage in personalized projects, such as creating custom home décor or personalized gifts, which propels the demand for custom printing services. According to the Farnsworth Group, 75% of homeowners try DIY projects, with younger homeowners being more likely to do so. The largest group of DIYers is between the ages of 31.

Regional Insights

North America custom printing market is expected to grow at a considerable growth rate during the forecast period. Expanding niche markets is a significant driver of the custom printing sector in North America. As consumers become more specific about their needs and preferences, businesses increasingly target specialized segments with tailored products, such as eco-conscious consumers, sports enthusiasts, and pet owners. This focus on niche markets allows companies to differentiate themselves from competitors and capture specific audiences, ultimately driving growth in the custom printing market.

U.S. Custom Printing Market Trends

The custom printing market in the U.S. is experiencing significant growth owing to the rise of on-demand printing. This model allows businesses to print items only as needed, reducing inventory costs and waste. On-demand printing aligns perfectly with the increasing consumer demand for personalized products. This flexibility supports creative expression and helps companies test new designs quickly, driving innovation and responsiveness in the custom printing sector.

Asia Pacific Custom Printing Market Trends

The custom printing market in Asia Pacific held a significant revenue share of around 39.9% in 2024. The increasing demand for event-specific custom printed products drives market growth in the region. As celebrations such as weddings, birthdays, and corporate events become more personalized, consumers seek unique items that commemorate these occasions. Custom printed materials, such as invitations, banners, and party favors, play a crucial role in enhancing the personalization of events.

The trend towards more personalized and meaningful celebrations drives demand for these products, encouraging businesses to offer tailored solutions for various events. This growth in event-specific custom printing is a key contributor to the market's overall expansion. According to Qikink, custom t-shirt printing is a fundamental aspect of e-commerce platforms and marketplaces. Notably, one in five consumers is open to paying an additional 20% for a personalized product, which has gained popularity among diverse customer demographics in India.

Key Custom Printing Company Insights

Some of the key players operating in the market include Vistaprint, Adobe, CafePress, MOO Inc., among others.

-

Vistaprint specializes in personalized print products and marketing services to small businesses and consumers. The company's flagship offerings include business cards, which can be customized with various designs, finishes, and shapes. In addition to traditional print products, Vistaprint provides a range of marketing materials, such as postcards, posters, signage, and promotional items like branded apparel, mugs, and tote bags. Vistaprint also offers digital services, including website design, social media graphics, and email marketing solutions, allowing businesses to create cohesive branding across multiple platforms. The user-friendly online platform enables customers to easily design and order their products, often with quick turnaround times and competitive pricing.

GotPrint and CustomInk, LLC are some of the emerging market participants in the target market.

-

GotPrint is an online printing service provider based in the United States that specializes in custom printing solutions for businesses and individuals. GotPrint’s product portfolio encompasses a diverse array of printed materials tailored to meet the needs of its clients. The company provides customizable options for various products, allowing customers to choose sizes, finishes, and quantities to suit their specific requirements. In addition to standard printing services, GotPrint offers specialty products such as stickers, labels, and promotional items, making it a one-stop shop for all custom printing needs.

Key Custom Printing Companies:

The following are the leading companies in the custom printing market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- CafePress, MOO Inc.

- Vistaprint

- GotPrint

- Zazzle Inc.

- PsPrint

- UPrinting.com

- Shutterfly Inc.

- Overnight Prints

- Canva

- 4imprint Inc.

- CustomInk, LLC

Recent Development

-

In July 2024, Adobe announced users can order printed products on Adobe Express through add-ons developed with Adobe Express Embed SDK partners. With the Adobe Express Embed SDK, print service providers can enable their customers to design and modify creations for business cards, flyers, posters, cards, and invitations, leveraging access to hundreds of thousands of Adobe's premium templates, fonts, and stock images within their platforms.

-

In May 2024, HP Inc. announced a multi-year global partnership with Canva, the all-in-one visual communication platform, to enhance the experience of millions of Canva users. This collaboration will enable seamless design and printing, allowing users to create visual content on Canva and print it through HP Print Service Providers (PSPs) worldwide. By 2026, Canva aims to expand its print services to 150 countries, ensuring faster turnaround times and a reduced carbon footprint through localized printing operations.

Custom Printing Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 41.93 billion

Revenue Forecast in 2030

USD 68.46 billion

Growth Rate

CAGR of 10.3% from 2025 to 2030

Actual Data

2017 - 2024

Forecast Period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Printing technique, printing design, application, end use, and region

Regional Scope

North America, Europe, Asia Pacific, South America, MEA

Country Scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

CafePress, MOO Inc.; Vistaprint; GotPrint; Zazzle Inc.; PsPrint; UPrinting.com; Shutterfly Inc.; Overnight Prints; Canva; 4imprint Inc.; CustomInk, LLC

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Custom Printing Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global custom printing market report based on printing technique, printing design, application, end use, and region.

-

Technique Outlook (Revenue, USD Million, 2017 - 2030)

-

Screen Printing

-

Digital Printing

-

Plot Printing

-

Others

-

-

Printing Design Outlook (Revenue, USD Million, 2017 - 2030)

-

Graphic Design

-

Artwork

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Clothing

-

T-Shirts

-

Jerseys

-

Sweatshirts and Hoodies

-

Others

-

-

Business Cards

-

Standard

-

Premium

-

-

Marketing Material

-

Banners

-

Signage

-

Poster

-

Others

-

Brochures & Booklets

-

Catalogues

-

Flyers & Pamphlets

-

Menus

-

Others

-

-

-

Packaging

-

Labels

-

Stickers

-

Boxes

-

Paper Bags

-

Others

-

-

Stationery

-

Letterheads

-

Notebooks

-

Envelopes

-

Others

-

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Micro Enterprises

-

Small Enterprises

-

Medium Enterprises

-

Large Enterprises

-

-

Personal

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global custom printing market size was estimated at USD 38.10 billion in 2024 and is expected to reach USD 41.93 billion in 2025.

b. The global custom printing market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2030 to reach USD 68.46 billion by 2030.

b. The screen printing segment dominated the market with a revenue share of 54.4% in 2024. Advancements in screen printing technology have also played a crucial role in its growth within the custom printing market.

b. Some key players operating in the custom printing market include CafePress, MOO Inc., Vistaprint, GotPrint, Zazzle Inc., PsPrint, UPrinting.com, Shutterfly Inc., Overnight Prints, Canva, 4imprint Inc., and CustomInk, LLC.

b. Key factors that are driving custom printing market growth include increasing need for advertising materials by businesses, increasing demand for personalized products from inidviduals, and proliferation of digital printing technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.