- Home

- »

- Automotive & Transportation

- »

-

U.S. Forklift Market Size And Share Analysis, Report, 2030GVR Report cover

![U.S. Forklift Market Size, Share & Trends Report]()

U.S. Forklift Market Size, Share & Trends Analysis Report By Class (Class 1, Class 2, Class 3, Class 4/5), By Power Source (ICE, Electric), By Load Capacity, By Electric Battery Type, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-199-4

- Number of Pages: 104

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Technology

U.S. Forklift Market Size & Trends

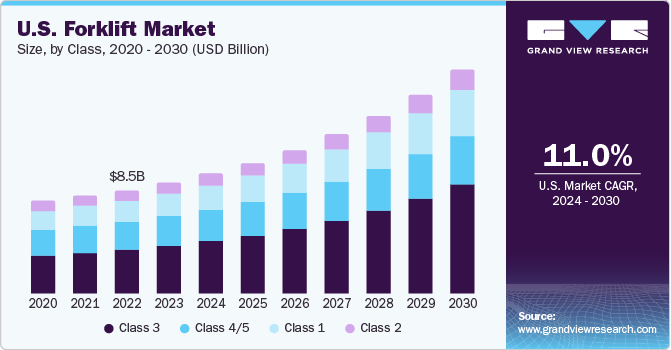

The U.S. forklift market size was valued at USD 9.11 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.0% from 2024 to 2030. The retail and e-commerce sector in the country has witnessed significant growth in the past few years, leading to an increasing presence of warehousing and storage facilities. The U.S. Census Bureau has stated that e-commerce sales in the country grew sharply from USD 480 billion in 2019 to over USD 800 billion in 2022, highlighting the rapidly changing landscape in the country’s retail environment. Thus, the e-commerce sector’s expansion has led to an increasing demand for forklifts, as they are vital for loading and unloading raw materials, pallets, crates, and moving workers.

A substantial shift has been observed towards the use of electric forklifts in recent years from gas- and diesel-powered forklifts, aided by a rising emphasis on sustainability and environmental concerns. In contrast to the electrification of large off-road equipment, compact-sized forklifts that are generally used indoors do not present issues of recharging infrastructure and range, driving their demand. Furthermore, advancements in battery technology such as lithium-ion and lead acid have pushed more businesses in the U.S. towards the use of electric equipment, driving market expansion.

For example, in January 2024, Hyster Company introduced the 3-wheeled J32-40UTTL and the 4-wheeled J30-70UTL to its integrated lithium-ion forklift range. These trucks, powered by factory-installed li-ion battery, are available in the capacity ranges of 1450-1850 kg and 1360-3175 kg respectively. Such solutions are in high demand among end-users looking to integrate sustainability in their processes. There have been several such instances of environment-friendly product launches over the past few years that propel the U.S. market’s growth.

Forklifts are a vital requirement in housing, roadways, and railways infrastructure. They are used for carrying heavy materials such as steel, beams, wood, and bricks, among others. Additionally, they can also transport site workers across different locations. As per a report published in October 2023 by the United States Census Bureau, the national spending on construction equipment exceeded USD 2 trillion, which included spending on both non-residential and residential projects. Such projects extensively utilize heavy machinery and equipment such as forklifts, leading to market growth. Moreover, there have been steady improvements in the country’s transport infrastructure. The Bipartisan Infrastructure Law (BIL) signed by the Biden Administration in 2021 directed USD 1.2 trillion for energy, transportation, and climate infrastructure projects. This is also expected to act as a major driver for the market.

Forklifts are an important part of the material handling process, as they help streamline distribution channels of the supply chain ecosystem, while also improving operational efficiencies at critical locations such as warehouse and distribution centers. The explosive growth of the e-commerce industry, accelerated by the COVID-19 pandemic, has translated to a higher volume of products being stored at such locations. The rising trend of offering personalized experience to online shoppers and importance of social commerce is creating significant growth avenues for the e-commerce sector. This has led to an increased demand for advanced material handling equipment in storage facilities, which is supporting industry expansion.

Market Concentration & Characteristics

Market growth stage in the U.S. is medium, and pace of the market growth is accelerating. There is a significant innovation progress being made in the forklift market in the U.S. The introduction of autonomous equipment in the material handling process is expected to open new opportunities for market expansion. For instance, in May 2021, Toyota Material Handling, an American subsidiary of Toyota Corporation, announced a partnership with Bastian Solutions to develop two autonomous vehicles. These solutions were designed explicitly for operations in manufacturing facilities and distribution centers.

The market is also characterized by a healthy number of product launch activities by key industry participants, in order to drive revenue and increase geographical footprint. For instance, in January 2023, Crown Equipment Corporation, an American company, launched an electric counterbalance forklift with application-focused ergonomics, such as an intuitive control system, compact mast, and suspension adjustable seat, offering better safety and productivity for workers and reducing operator fatigue and strain.

There have been several instances of workplace injuries and property damage due to inadequate forklift driver training. The Occupational Safety & Health Administration (OSHA) states that 35,000 - 62,000 injuries take place annually due to unsafe forklift usage. As a result, regulatory organizations have made it compulsory for operators to undertake training programs for ensuring a safer operational environment at workplaces.

The threat of product substitutes is expected to remain moderate, owing to the availability of alternative equipment for material handling, such as automated guided systems and conveyor systems. Tugger carts and industrial trailers can be used to move multiple packages, pallets, and loose materials. Another solution that can be used for specific tasks is lift table, while higher capacities can be efficiently handled with order picking carts. On the other hand, forklifts are able to perform all these functions, and with companies aiming to launch compact solutions, their demand is expected to grow during the forecast period.

Major end-use industries, such as construction, automotive, and warehouse & logistics, comprise the major end-use areas of forklifts. Based on their operational requirements, businesses drive the demand for different forms of this equipment. For instance, while the construction industry generally requires high-capacity forklifts, small- and medium-sized businesses generally avail low-capacity ones. End-users are expected to efficiently utilize and service forklifts to ensure their optimal durability and performance.

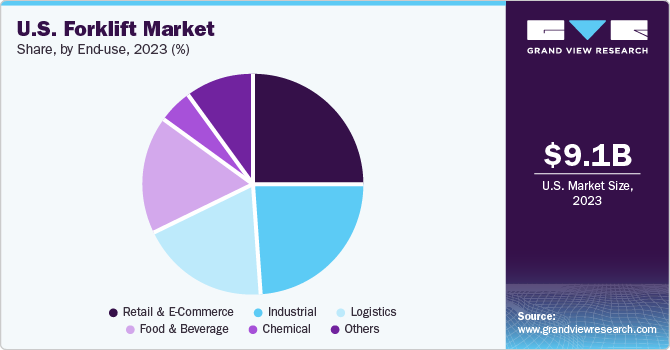

End-use Insights

The retail and e-commerce segment held the largest revenue share of 24.71% in 2023. Forklifts are widely utilized for carrying out material handling and warehousing functions in this space. In recent years, the trend of online shopping has expanded greatly, owing to changing consumer preferences. The U.S. has witnessed a significant growth in its online shopper base, aided by the increasing use of social media platforms and the cost and convenience benefits offered by brands. According to an article by Tidio, as of 2023, there are over 268 million online shoppers in the country, an increase of 16.2% from 2020. Moreover, 70% of the U.S. population shops online. This has led to a significant expansion of warehousing facilities in retail and e-commerce, leading to high demand for forklifts.

The logistics segment is expected to expand at a growth rate of 11.7% through 2030. Logistics companies in the U.S. rely heavily on efficient material handling solutions to ensure smooth supply chain operations. They generally deal with containers of varying sizes and weights. Forklifts equipped with container handlers or reach stackers are utilized to efficiently move and stack containers in ports and logistics hubs, resulting in streamlined cargo handling and storage space optimization. They are vital in cross-docking facilities, where goods are transferred directly from inbound trucks to outbound trucks with minimal storage time. The U.S. has a trillion dollar logistics industry, highlighting the strong demand for material handling equipment in this sector.

Class Insights

The Class 3 segment accounted for a market share of 43.24% in 2023. Electric motorized hand trucks, specifically pallet jacks and tow tractors (tuggers), are the most common types of class 3 forklifts. Pallet stackers are another type of class 3 equipment and are useful in rapidly unloading and transferring carts or pallets horizontally as well as vertically in warehouses. They are very compact and their load capacity ranges from 4500 lbs to 10000 lbs, making them an ideal option in smaller spaces. These types of forklifts are widely utilized to move items that require low raises and can conveniently transfer goods across the warehouse floor without any need to place the product on a high rack or shelf.

The class 1 segment is expected to grow at a CAGR of 11.8% through 2030. Class 1 forklifts are widely used in major industrial segments such as food & beverage, retail, and warehousing, offering benefits such as low noise, low maintenance requirement, and zero emissions. Class 1 equipment such as 3-wheel electric forklifts are beneficial for indoor, smooth-floor production applications in smaller spaces that require a larger turn radius. Their load capacity ranges from 1,500 lbs to 4,000 lbs. On the other hand, 4-wheel electric forklifts are more suited for rugged terrains and outdoor applications. These forklifts offer a higher load capacity, ranging from 3,000 lbs to 12,000 lbs.

Power Source Insights

In terms of power source, electric forklifts accounted for a dominant revenue share of 73.15% in the market in 2023. Electricity-powered forklifts offer several benefits over their ICE-powered counterparts, such as zero emissions, lower noise levels, zero maintenance, and low running costs. There has been an increasing focus on environmental issues and depleting fossil fuel resources in the United States, driving the need for sustainable, efficient, and long-lasting solutions. As per the American Journal of Transportation, it is estimated that around 250,000 out of 330,000 forklifts that would be sold in 2029 in the country would be battery-electric. This highlights the preference of businesses towards use of environment-friendly solutions in forklifts.

Several regulations implemented in the country in the past few years have played a role in driving the popularity of electric forklifts. California is a leading state in this regard, having regulations for forklift electrification; additionally, the CARB (California Air Resources Board) has been developing a legislation to completely stop the sale of LSI (large spark-ignition) forklifts starting in 2026. Another program, the Clean Off-Road Equipment (CORE) Voucher Incentive Project in California, envisages companies in the state buying or leasing zero-emission off-road equipment. Such factors are driving the demand for electric forklifts in the United States.

Load Capacity Insights

The 5-15 ton load capacity segment accounted for a revenue share of 60.61% in 2023. Growth in residential and commercial projects in the U.S. has created demand for forklifts in this capacity range, as they can conveniently handle materials such as steel, pallets, and bricks, which are major components in building structures. In terms of mechanized loading and transportation over short distances, such forklifts are considered highly efficient. The nature of the material to be handled is an important factor in selecting forklifts of such capacities. Advances in materials and technologies concerning forklift construction have also become a major contributor to increasing load capacities.

The below 5 ton segment is expected to register the highest growth rate of 11.6% through 2030 in the U.S. market. These forklifts are highly compact and versatile and enable organizations to efficiently handle different load sizes. Innovations in materials, power systems, and ergonomics are leading contributors to the development of more efficient and robust forklifts capable that can lift heavier loads while maintaining maneuverability. Factors such as safety regulations by OSHA, evolving industry demands, and environmental considerations also have helped in shaping segment growth.

Electric Battery Type Insights

Lead-acid battery held the largest revenue share of 62.86% in the market in 2023. These batteries are widely considered a reliable source of energy, as they can offer a high-power surge. This has resulted in their large-scale usage in electric forklifts. The storage of large energy quantities in smaller spaces is also made easier in such batteries, due to their high energy density. Additionally, they present comparatively lower upfront costs when compared to li-ion batteries, while also being a very durable option due to their high tolerance to vibrations, shocks, and extreme temperatures.

The lithium-ion segment is anticipated to grow at the highest CAGR of 13.5% through 2030. Rising awareness regarding environment issues has led eco-conscious customers to integrate lithium-ion battery forklifts into their processes, driving market expansion. Lead-acid batteries generally consist of toxic chemicals such as sulfuric acid and lead, which can cause major environment issues if disposed carelessly. This makes li-ion batteries a cleaner alternative. These batteries also are maintenance-free, offer better lifespan, and are more efficient than lead acid batteries. Moreover, the chemistry of these batteries allows acceptance of higher current rates, leading to faster charging and better operating times per charge. These advantages have helped in driving their overall demand.

Key U.S Forklift Company Insights

Some notable companies in the U.S. market include Toyota Material Handling, KION North America, Mitsubishi Logisnext Americas, Hyster-Yale Materials Handling, and Crown Equipment Corporation.

-

Toyota Material Handling, Inc., based in Columbus, Indiana, is a subsidiary of Toyota Industries Corporation. The company offers an extensive product range of forklifts and business services, such as forklift renting, selling used forklifts, fleet management solutions, financing, along with equipment maintenance services. The company’s product portfolio includes an industrial vehicle line-up of forklifts, materials handling systems, and tow trucks.

-

Crown Equipment Corporation, based in Ohio, U.S., is a designer, manufacturer, distributor, and aftermarket service provider of counterbalance forklifts, VNA trucks, reach trucks, order pickers, stackers, and tow trucks. The company also develops lithium-ion batteries and chargers. It further offers fleet management services, connected services, automation solutions, and financing options.

Combilift and Hangcha Forklift America are notable emerging players in the United States forklift industry.

- Hangcha Forklift America is a subsidiary of the China-based Hangcha Group and headquartered in North Carolina. The company serves major industry verticals such as retail, warehousing, food, pharmaceuticals, logistics, and automotive, along with ports & terminals. The company maintains a product portfolio of pallet trucks, stackers, reach trucks, order pickers, and forklifts, while also having a large spare parts inventory.

Key U.S. Forklift Companies:

- HELI AMERICA Inc.

- Clark Equipment Handling Company

- Crown Equipment Corporation

- Doosan Industrial Vehicle America Corporation

- Hangcha Forklift America

- Hyster-Yale Materials Handling, Inc.

- KION North America

- Komatsu Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Toyota Material Handling

Recent Developments

-

In September 2023, Toyota Material Handling introduced a new range of electric pneumatic forklifts in 48V and 80V models. These offerings feature six lift capacities in the range of 3000 to 7000 pounds and have been designed to function efficiently in different weather conditions. The new line utilizes Toyota’s System of Active Stability (SAS) and Operator Presence Sensing System (OPSS) to offer convenience and enhanced safety to operators

-

In April 2023, Crown Equipment announced the opening of a sales and service location in Stow, Ohio. This facility offers solutions for warehousing and material handling to regional customers. The company is known for its rental and Encore refurbished forklifts, electric and internal combustion forklifts, parts and services, InfoLink operator and fleet management systems, and warehouse products and design services

-

In December 2022, Clark Material Handling Company launched its SEC20-35 four-wheel electric forklift, expanding its S-SERIES portfolio. The forklift is built in a capacity range of 4,000 to 7,000 pounds, and is designed for operator ergonomics, comfort, and safety. It features programmable performance modes, including a turtle mode feature; the CLARK Performance Enhancement Package; and an integrated Dampening Block Stability, along with other advanced features to improve efficiency and ease of operation

-

In August 2022, Hyster-Yale Group, Inc. announced the launch of a lithium-ion-based forklift truck that has been designed for the trucking industry and has a lifting capacity of 4000 lbs. The J40XNL supports functions such as loading and unloading goods from trailers and trucks, while prioritizing operator comfort, improving acceleration, and reducing energy consumption

U.S. Forklift Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 18.39 billion

Growth rate

CAGR of 11.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Class, power source, load capacity, electric battery type, end-use

Country scope

The U.S.

Key companies profiled

HELI AMERICA Inc.; Clark Equipment Handling Company; Crown Equipment Corporation; Doosan Industrial Vehicle America Corporation; Hangcha Forklift America; Hyster-Yale Materials Handling, Inc.; KION North America; Komatsu Ltd.; Mitsubishi Logisnext Co., Ltd.; Toyota Material Handling

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Forklift Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. forklift market report based on class, power source, load capacity, electric battery type, and end-use:

-

Class Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Class 1

-

Class 2

-

Class 3

-

Class 4/5

-

-

Power Source Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Load Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 5 Ton

-

5-15 Ton

-

Above 16 Ton

-

-

Electric Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Li-ion

-

Lead Acid

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Logistics

-

Chemical

-

Food & Beverage

-

Retail & E-Commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. forklift market size was estimated at USD 9.11 billion in 2023 and is expected to reach USD 9.84 billion in 2024.

b. The U.S. forklift market is expected to grow at a compound annual growth rate of 11.0% from 2024 to 2030 to reach USD 18.39 billion by 2030

b. The electric segment led the market and accounted for 73.2% in 2023. Rising environmental concerns and depleting fossil fuel resources are driving the need for sustainable, efficient, and durable forklifts, which can also ensure a healthier, emission-free environment for employees.

b. Some key players operating in the U.S. forklift market include Anhui Heli Co., Ltd., Clark Material Handing Company, (Clark Equipment Company), Crown Equipment Corporation, Doosan Corporation, Hangcha Forklift, Hyster-Yale Materials Handling, Inc.(Hyster-Yale Group, Inc.), Jungheinrich AG, KION Group AG, Komatsu Ltd., Mitsubishi Logisnext Co., Ltd.

b. Rapid advancements in battery technology are revolutionizing the forklift market in the U.S. Lithium-ion batteries, which are known for their high energy density and extended lifespan, are becoming increasingly prevalent, providing superior performance and energy efficiency compared to traditional lead-acid batteries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."