- Home

- »

- Organic Chemicals

- »

-

Sulfuric Acid Market Size And Share, Industry Report, 2033GVR Report cover

![Sulfuric Acid Market Size, Share & Trends Report]()

Sulfuric Acid Market (2026 - 2033) Size, Share & Trends Analysis Report By Raw Material (Elemental Sulfur, Pyrite Ore, Base Metal Smelters), By Application (Fertilizers, Automotive, Textile Industry), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-231-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sulfuric Acid Market Summary

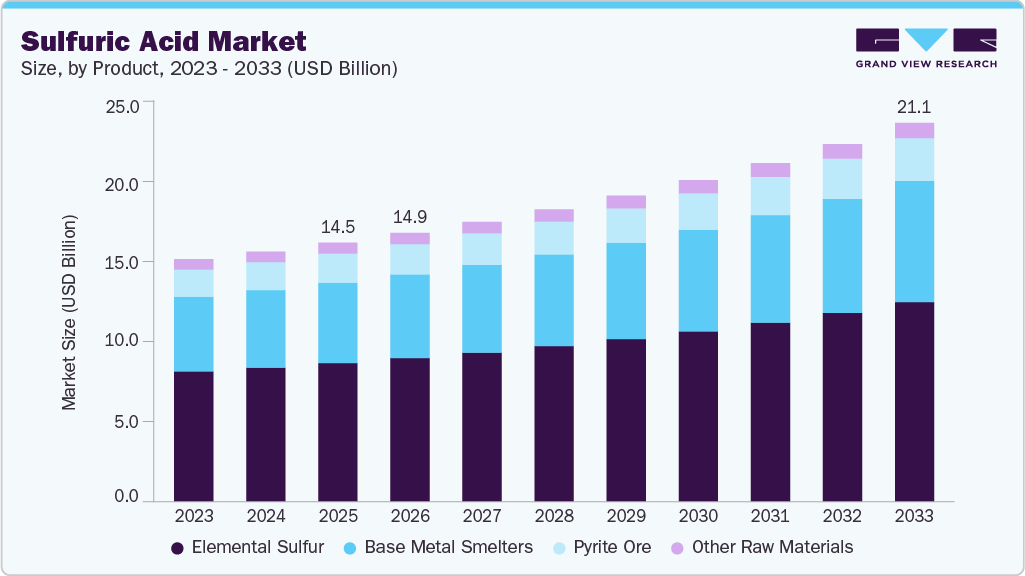

The global sulfuric acid market size was estimated at USD 14,445.4 million in 2025 and is anticipated to reach USD 21,148.04 million by 2033, growing at a CAGR of 5.0% from 2026 to 2033. The market growth is driven by expanding metals and mining activities, particularly in copper and non-ferrous metal processing where sulfuric acid is a critical input for leaching and refining.

Key Market Trends & Insights

- Asia Pacific dominated the sulfuric acid market with the largest revenue share of 47.7% in 2025.

- The market in China is expected to grow at a significant CAGR of 6.0% from 2026 to 2033.

- Based on raw material, the elemental sulfur segment held the largest revenue share of 53.5% in 2025.

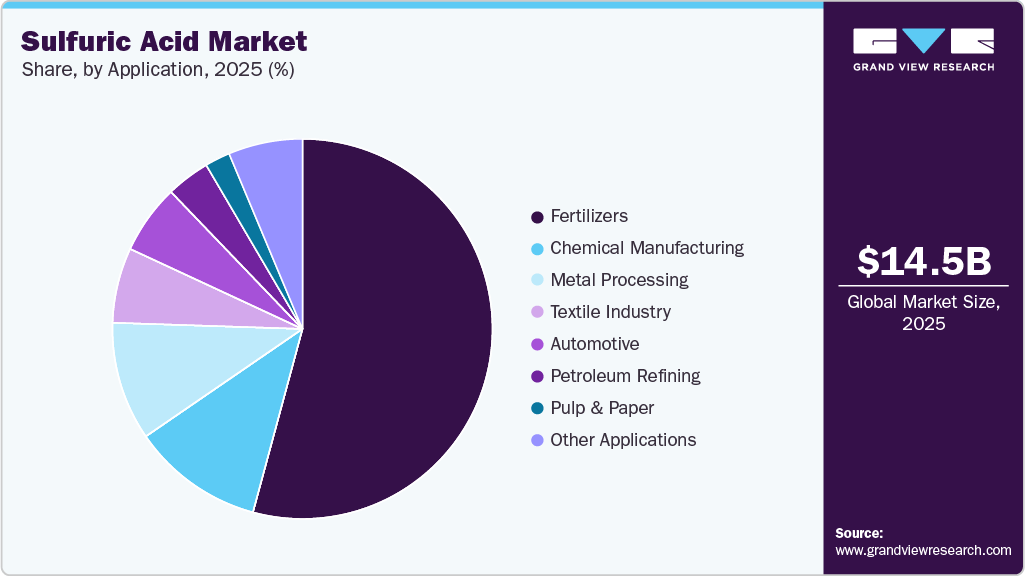

- Based on application, the fertilizers segment held the largest revenue share of 54.2% in 2025 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 14,445.4 Million

- 2033 Projected Market Size: USD 21,148.0 Million

- CAGR (2026-2033): 5.0%

- Asia Pacific: Largest market in 2025

Rising demand for metals from infrastructure development, electric vehicles, renewable energy systems, and battery manufacturing is leading to higher mining output and smelting capacity, thereby increasing consistent, large-volume consumption of sulfuric acid across key industrial regions.

Sulfuric acid demand is significantly supported by its extensive use in phosphate fertilizer production. With growing global food demand and the need to improve agricultural productivity, fertilizer manufacturers are increasing output, directly driving steady sulfuric acid consumption.

The accelerating adoption of electric vehicles and energy storage systems presents a key growth opportunity for the sulfuric acid market. Increasing production of lead-acid batteries and upstream metal refining for battery materials is expected to create sustained incremental demand.

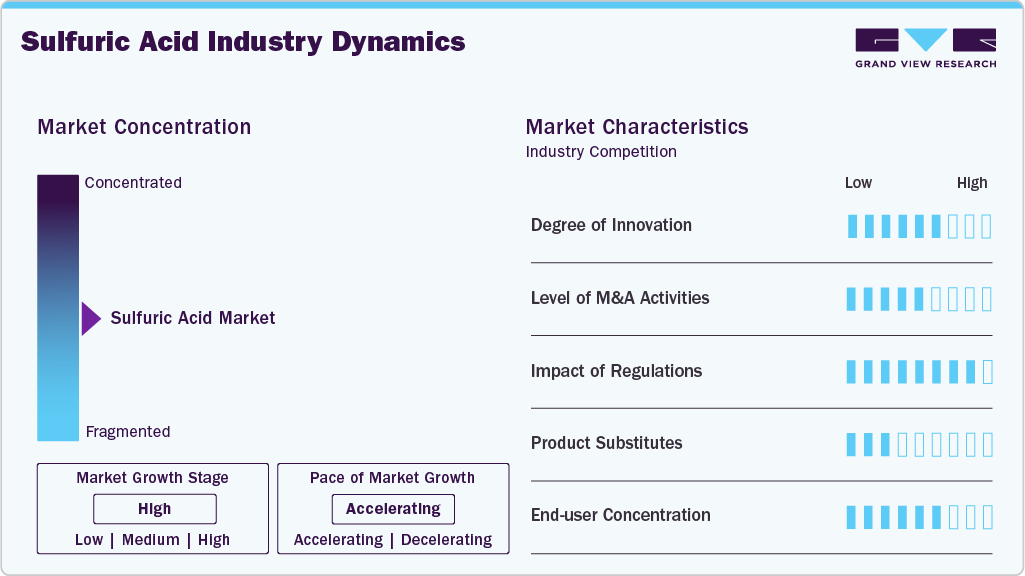

Market Concentration & Characteristics

The sulfuric acid market is moderately concentrated, led by large integrated producers such as The Mosaic Company and BASF SE, which leverage scale, raw material integration, and extensive distribution. Smaller regional players serve niche industrial and specialty applications, providing localized flexibility.

The market is capital-intensive and highly regulated, with production tied to elemental sulfur and smelter byproducts. Demand is driven by fertilizers and metal processing, while emerging applications in energy storage offer growth opportunities. Price and supply are influenced by feedstock costs, regulations, and regional industrial activity.

Raw Material Insight

The elemental sulfur segment dominated the market with a revenue share of 53.5% in 2025, due to its cost efficiency, stable availability from oil & gas refining, and high purity levels. Strong integration with refinery operations ensures a reliable supply, supporting large-scale and consistent sulfuric acid manufacturing.

Base metal smelters segment is growing at the fastest CAGR of 5.4% over the forecast period, as expanding copper and non-ferrous metal smelting capacities generate sulfur dioxide as a byproduct. Increasing focus on emissions control and acid recovery is accelerating sulfuric acid production from smelters, strengthening supply growth.

Application Insight

The fertilizer segment dominates sulfuric acid with revenue share of 54.2%, due to its essential role in phosphoric acid and phosphate fertilizer production. Large-scale agricultural demand, rising food security concerns, and continuous capacity utilization by integrated fertilizer producers are sustaining high, stable sulfuric acid demand.

Metal processing is the fastest-growing application for sulfuric acid with revenue CAGR 6.2%, driven by expanding copper and non-ferrous metal production. Rising demand from electric vehicles, renewable energy infrastructure, and battery materials are accelerating sulfuric acid usage in leaching and refining operations.

Regional Insight

Asia Pacific dominated the sulfuric acid market with revenue share of 47.7% in 2025, due to rapid industrialization and expanding agricultural activity. Strong growth in phosphate fertilizer production, particularly in China and India, is driving large-scale consumption. Increasing base metal smelting and infrastructure development are further boosting demand. The region’s growing manufacturing base ensures sustained, high-volume sulfuric acid usage.

China registered CAGR of 6.0%, in terms of revenue in 2025. The sulfuric acid market in China is driven by extensive phosphate fertilizer manufacturing to support agricultural demand. The country’s large non-ferrous metal smelting base also generates significant sulfuric acid as a byproduct. Continued infrastructure development and industrial production sustain high consumption levels. Strong domestic demand ensures large-scale, integrated market growth.

North America Sulfuric Acid Market Trends

The sulfuric acid market in North America is driven by strong demand from phosphate fertilizer production, supported by large-scale agricultural activity. The region also benefits from a well-established metals and mining sector, particularly copper processing, which relies heavily on sulfuric acid for leaching operations. In addition, growth in battery manufacturing and chemical processing is reinforcing consumption. Integrated refinery and smelter infrastructure ensures stable supply and long-term market sustainability.

U.S. Sulfuric Acid Market Trends

In the U.S., sulfuric acid demand is supported by phosphate fertilizer production and copper mining operations. Growing investments in battery materials and energy storage applications are creating additional consumption. A mature chemical manufacturing base further reinforces demand. Reliable supply from refineries and smelters supports market stability.

Europe Sulfuric Acid Market Trends

Europe’s sulfuric acid market is supported by its advanced chemical manufacturing and metal processing industries. The region’s strict environmental regulations promote sulfur recovery from refineries and smelters, increasing captive sulfuric acid production. Demand is further strengthened by its use in specialty chemicals, industrial processing, and wastewater treatment. Stable industrial output across major economies underpins consistent market demand.

Sulfuric acid market in Germany is driven by its strong specialty chemicals and advanced manufacturing sectors. The chemical industry relies on sulfuric acid for high-value processing and intermediate production. Demand is also supported by metal treatment, refining, and environmental applications. Consistent industrial output ensures steady market growth.

Latin America Sulfuric Acid Market Trends

Latin America’s sulfuric acid market is primarily driven by large-scale mining activities, especially copper production in countries such as Chile and Peru. Sulfuric acid is critical for heap leaching and ore processing operations. Ongoing investments in mining capacity expansion are sustaining long-term demand. The region’s resource-driven industrial growth supports steady market development.

Middle East & Africa Sulfuric Acid Market Trends

Sulfuric acid demand in the Middle East & Africa is driven by expanding oil refining capacity, which increases the availability of elemental sulfur. Rising investments in phosphate fertilizers and mining projects are supporting consumption growth. Industrial diversification initiatives across the region are also increasing chemical demand. These factors collectively strengthen regional market expansion.

Key Sulfuric Acid Company Insights

Key players, such as The Mosaic Company, AkzoNobel N.V., BASF SE, PVS Chemical Solution, Solvay, Nutrien Ltd., and INEOS are dominating the market.

-

The Mosaic Company is a dominant player in the sulfuric acid market, driven by its vertically integrated phosphate fertilizer operations. Sulfuric acid is a critical input in phosphoric acid and fertilizer production, enabling Mosaic to consume large captive volumes while also supplying excess output to industrial markets. Its large-scale production capacity, strong raw material integration, and established logistics infrastructure support cost efficiency and consistent supply. This integration positions Mosaic as a key volume leader in the global sulfuric acid market.

-

BASF SE is a leading sulfuric acid producer with a strong presence across industrial, chemical, and specialty applications. The company leverages its integrated chemical production network to manufacture sulfuric acid both as a primary product and as a byproduct of other chemical processes. BASF’s focus on operational efficiency, product quality, and downstream integration ensures stable demand across multiple end-use industries. Its global manufacturing footprint reinforces its dominant position in the sulfuric acid market.

Key Sulfuric Acid Companies:

The following are the leading companies in the sulfuric acid market. These companies collectively hold the largest market share and dictate industry trends.

- The Mosaic Company

- AkzoNobel N.V.

- BASF SE

- PVS Chemical Solution

- Solvay

- Nutrien Ltd.

- INEOS

Recent Developments

- In May 2025, Sumitomo Corporation signed a joint venture agreement with Thailand’s NFC Public Company Limited to operate a sulfuric acid tank terminal business in Map Ta Phut Port (Rayong). This expands regional logistics infrastructure and supports improved storage, safety, and distribution services across Asia.

Sulfuric Acid Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 14,996.5 million

Revenue forecast in 2033

USD 21,148.0 million

Growth rate

CAGR of 5.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in million tons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Russia; China; India; Japan; Saudi Arabia

Key companies profiled

The Mosaic Company; AkzoNobel N.V.; BASF SE; PVS Chemical Solution; Solvay; Nutrien Ltd.; INEOS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sulfuric Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global sulfuric acid market report based on raw material, application, and region:

-

Raw Material Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2033)

-

Elemental Sulfur

-

Base Metal Smelters

-

Pyrite Ore

-

Other Raw Materials

-

-

Application Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2033)

-

Fertilizers

-

Chemical Manufacturing

-

Metal Processing

-

Petroleum Refining

-

Textile Industry

-

Automotive

-

Pulp & Paper

-

Other Applications

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global sulfuric acid market size was valued at USD 14,445.4 million in 2025 and is expected to reach USD 14,996.5 million in 2026.

b. The global sulfuric acid market is expected to grow at a compound annual growth rate of 3.7 % from 2026 to 2033 to reach USD 21,148.0 million by 2033.

b. Asia Pacific dominated the market with revenue share of 47.7% in 2025, due to rapid industrialization and expanding agricultural activity. Strong growth in phosphate fertilizer production, particularly in China and India, is driving large-scale consumption. Increasing base metal smelting and infrastructure development are further boosting demand. The region’s growing manufacturing base ensures sustained, high-volume sulfuric acid usage.

b. Some key players operating in the sulfuric acid market include The Mosaic Company, Chemtrade Logistics, AkzoNobel N.V., BASF SE, PVS Chemical Solution, Solvay, Agrium Inc., INEOS.

b. The market is driven by expanding metals and mining activities, particularly in copper and non-ferrous metal processing where sulfuric acid is a critical input for leaching and refining. Rising demand for metals from infrastructure development, electric vehicles, renewable energy systems, and battery manufacturing is leading to higher mining output and smelting capacity, thereby increasing consistent, large-volume consumption of sulfuric acid across key industrial regions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.