- Home

- »

- Next Generation Technologies

- »

-

U.S. Music Streaming Market Size, Industry Report, 2030GVR Report cover

![U.S. Music Streaming Market Size, Share & Trends Report]()

U.S. Music Streaming Market Size, Share & Trends Analysis Report By Service (On-demand Streaming, Live Streaming), By Platform (Apps, Browsers), By End-use (Commercial, Individual), By Content Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-224-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Music Streaming Market Size & Trends

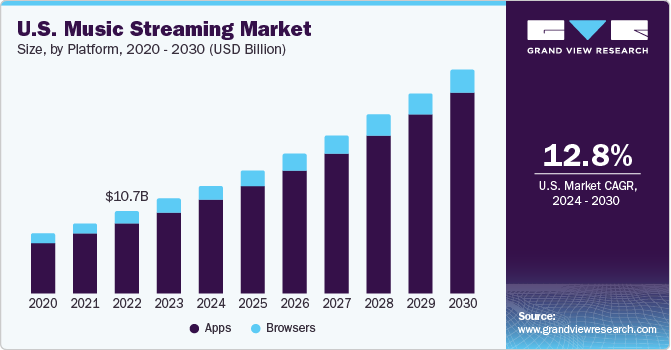

The U.S. music streaming market size was estimated at USD 12.28 billion in 2023 and is expected to grow at a CAGR of 12.8% from 2024 to 2030. The market is expected to grow due to the growing adoption of digital platforms and the widespread utilization of smart devices that allow users to see music videos and listen to podcasts along with audio files. Attractive features such as personalized song recommendations, automatic playlist customization, and seamless accessibility across various applications and web browsers are offered by these platforms, which is expected to boost the growth of the market.

In 2023, the U.S. accounted for over 30% of the music streaming market. Due to the rising adoption of high speed internet connectivity, key companies in the market have started new music services that offer music streams and downloads for music enthusiasts. With the significant speed and data transmission capabilities, companies can provide high-quality music streams for their users. These advancements in technologies and connectivity are expected to further drive the market growth.

The market is expected to witness substantial growth over the forecast period as internet access and usage has become widespread and more music streaming apps have hit the market. The proliferation of free music streaming platforms with advertisements is expected to appeal to users and increase the market growth substantially. The industry has come a long way in the modes of providing the service and as well as reducing piracy in the music industry.

Music streaming apps offer high-definition audio if the user’s internet connection is strong, while also not taking up too much data storage in today’s limited storage smart devices. The music streaming platforms offer on-demand streaming as well as live streaming from various artists around the world. The ability to play music on demand or tune into live music streams is an important factor pushing the growth of the music streaming market.

The COVID-19 pandemic also provided an opportunity for digital services to benefit. The outbreak led to a rise in music streaming platforms investing significantly to add video content to their services as an addition. For instance, Apple Music and Spotify, both offer audio and video based content. Additionally, Spotify has also begun to buy the rights to many podcasts to make it exclusively available only on their platform as a method to bring over new, loyal consumers of the podcasts.

Market Concentration & Characteristics

The market is characterized by a moderate level of innovation. Major technological trends impacting businesses include the advent of 5G networks and affordable internet access for individuals worldwide. These trends are vital for the industry as they will allow more people to have access to streaming services.

For instance, in May 2023, Google launched MusicLM, an AI-based model that can generate high-fidelity music with the help of text. This technology can convert a series of written descriptions into a cohesive musical story or narrative, utilizing existing melodies, whether they are communicated through whistling, humming, singing, or instrumental playing.

Degree of merger and acquisition activities is also moderate in the industry. For instance, in May 2022, SoundCloud announced the acquisition of Singapore based music AI company Musiio, with the aims of increasing features on the site such as discovery features.

The impact of regulations is also not high on the market as new licensing policies for music IP holders are still developing. For instance, the United States Copyright Office expects this new licensing system to be fully functioning to lower overall costs to ensure satisfactory and accurate payment to right holders.

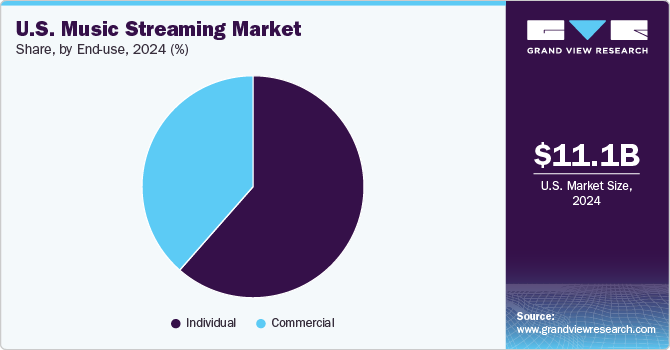

The market is characterized by a high degree of end-use concentration. Based on the end-use, the industry is categorized into individual and commercial. Online music streaming services have made it easier for users to access millions of songs on a touch. The commercial sector is expected to grow at a promising rate due to the development of commercial buildings, restaurants, gymnasiums, health clubs, and supermarkets. All these stores use music streaming services to provide their customers with an enjoyable environment.

Service Insights

Based on services, the on-demand streaming segment accounted for the largest revenue share of around 70.0% in 2023 and is expected to dominate the market over the forecast period. The on-demand music stream allows the users to listen to songs on the digital service provider's website (DSP) without any limited time or playing capacity. They can pause, skip, rewind, and create playlists without copying the digital file.

The live streaming segment is expected to grow with the highest CAGR during the forecast period. The live streaming segment is expected to gain strength due to increased investment from key companies in the market that has a positive impact on market growth. Live streaming is the process of bringing live content to individuals online in real-time. The increase in popularity of live videos has encouraged artists to stream live on social media websites such as Instagram, YouTube Live, Twitter, and Facebook Periscope.

Content Type Insights

The audio segment accounted for the largest revenue share in 2023 and is expected to dominate the market over the forecast period. This is due to the segment’s convenience in catering to the multitasking tendencies of listeners. It enables users to engage in various activities, such as exercising, studying, driving, commuting, or performing household chores that require audio content to provide a seamless and convenient entertainment experience.

The video content segment is anticipated to grow at the highest CAGR during the forecast period. The growing popularity of OTT and short video platforms are expected to enhance the component growth. Music broadcasts are mostly done using household items such as TVs and smartphones during the closure. This is evidenced by the number of subscribers in various forums such as Amazon Music, Tencent Music Entertainment, and Spotify, etc.

End-use Insights

Based on the end-use, the industry is categorized into individual and commercial, and the individual segment accounted for the largest revenue share in 2023. This is expected to continue the same trend over the forecast period. The enhanced personalized experience offered by music streaming apps creates demand among youth, further accelerating market growth.

Many companies have started allowing their employees to work while listening to music using earphones. As wireless networks become more accessible and mobile devices become more popular, the market is becoming increasingly popular in the digital music market.

Platform Insights

The apps segment accounted for the largest revenue share in 2023 owing to the preference for easy accessibility with apps over browsers and numerous features that enhance the overall user experience while streaming music. Some of the key features provided by apps include customizable playlists, high-quality audio streaming, offline playback, social sharing options, and integration with other applications and devices. Such features are expected to augment the segment growth over the forecast period.

Due to the widespread adoption of 5G, which offers lucrative opportunities for service providers, and emerging technological advances such as artificial intelligence, virtual reality, and machine learning, the browsers segment is also expected to grow during the forecast period. These technologies are expected to enable service providers to provide personalized playlists and seamless user information, thus boosting market growth.

Key U.S. Music Streaming Company Insights

Some of the leading companies in the market include Spotify AB, Apple, Inc., Amazon.com, Inc. and Google LLC.

-

Amazon facilitates musicians, app developers, filmmakers, authors, and others to publish and sell content through its branded websites. The company offers Amazon prime, which is an annual membership program.

-

Apple Music is a video and music streaming service that allows users to choose music to stream on-demand or listen to existing playlists. The company’s product portfolio includes iPad, Mac, TVs, and iPhones. It delivers and sells applications and digital content through the iBook Store, iTunes Store, Mac App Store, App Store, Apple Music, and TV App Store.

Tidal, SoundCloud Global Limited & Co. KG, and iHeartMedia, Inc. are some other companies in the U.S. music streaming market.

-

Tidal offers a monthly subscription that grants access to a music library. The company also provides a service for users to watch ad-free music videos and access music selections, including new tracks and albums across various genres.

-

SoundCloud’s platform enables the promotion, record, upload, and share created music with friends privately or publicly on sites, blogs, and social networks, allowing artists to promote and distribute their work while also assisting customers in discovering it.

Key U.S. Music Streaming Companies:

- Amazon.com, Inc.

- Apple, Inc.

- Deezer SA

- Google LLC

- iHeartMedia, Inc.

- Pandora Media, Inc.

- SoundCloud Global Limited & Co. KG

- Spotify AB

- Tencent Music Entertainment Group

- Tidal

Recent Developments

-

In January 2023, TIDAL, a U.S.-based music streaming service, partnered with Universal Music Group (UMG). With this partnership, the two companies are expected to work together to explore an innovative new economic model for music streaming that might better reward the value provided by artists and more closely reflect the engagement of TIDAL subscribers with those artists and music they love.

-

In November 2021, Tencent Music Entertainment Group collaborated with Apple, Inc. to expand its catalog globally through Apple Music.

U.S. Music Streaming Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.28 billion

Revenue forecast in 2030

USD 29.93 billion

Growth rate

CAGR of 12.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, platform, content type, end-use

Regional scope

U.S.

Key companies profiled

Apple, Inc.; Amazon.com, Inc.; Google LLC; Spotify AB; Deezer; SoundCloud Limited; Pandora Media, Inc.; Tencent Music Entertainment Group; iHeartMedia, Inc.; Tidal

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Music Streaming Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S music streaming market report on the basis of service, platform, content type, and end-use:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-demand streaming

-

Live streaming

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Apps

-

Browsers

-

-

Content Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Audio

-

Video

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Individual

-

Commercial

-

Frequently Asked Questions About This Report

b. The global U.S. music streaming market size was valued at USD 12.28 billion in 2023 and is expected to reach USD 14.06 billion in 2024.

b. The global U.S. music streaming market is expected to grow at a compound annual growth rate (CAGR) of 12.8% from 2024 to 2030 to reach USD 29.93 billion by 2030.

b. The on-demand streaming segment accounted for the largest revenue share of around 70% in 2023 and is expected to dominate the market over the forecast period. The on-demand music stream allows the users to listen to songs on the Digital Service Provider's website (DSP) without any limited time or playing capacity.

b. Some key players operating in the U.S. music streaming market include Amazon.com, Inc., Apple, Inc., Deezer SA, Google LLC, iHeartMedia, Inc., Pandora Media, Inc., SoundCloud Global Limited & Co. KG, Spotify AB, Tencent Music Entertainment Group, Tidal

b. The growing adoption of digital platforms and the widespread utilization of smart devices that allow users to see music videos and listen to podcasts along with audio files is driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."