- Home

- »

- Next Generation Technologies

- »

-

Music Streaming Market Size & Share, Industry Report, 2030GVR Report cover

![Music Streaming Market Size, Share & Trends Report]()

Music Streaming Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (On-demand Streaming, Live Streaming), By Platform (Apps, Browsers), By Content, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-218-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Music Streaming Market Summary

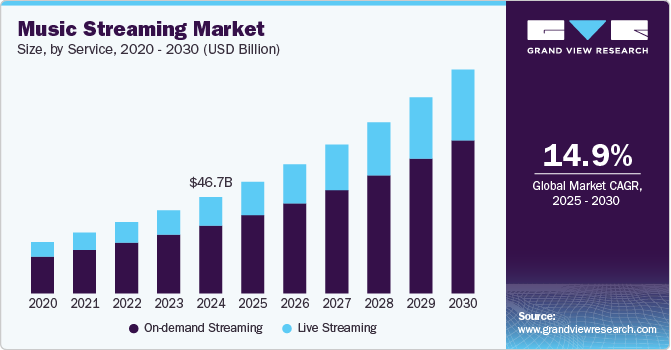

The global music streaming market size was estimated at USD 46.66 billion in 2024 and is projected to reach USD 108.39 billion by 2030, growing at a CAGR of 14.9% from 2025 to 2030.This growth is largely driven by the increasing consumption of digital music across various devices.

Key Market Trends & Insights

- North America music streaming market dominated globally with a share of over 33.0% in 2024.

- The U.S. music streaming market is expected to grow at a CAGR of 13% over the forecast period.

- By service, the on-demand streaming segment accounted for the largest share of 70.0% in 2024.

- Based on platform, the apps segment accounted for the largest market share in 2024.

- Based on content, the audio segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 46.66 Billion

- 2030 Projected Market Size: USD 108.39 Billion

- CAGR (2025-2030): 14.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With the proliferation of smartphones, internet access, and high-speed data networks, more consumers are choosing music streaming platforms such as Spotify AB, Apple, Inc., and Amazon.com, Inc. (Amazon Music) over traditional media sources. The convenience of having instant access to millions of songs and the flexibility to create personalized playlists is further driving the music streaming industry expansion.

The growing adoption of subscription-based models is further enhancing the music streaming industry expansion. Services that offer premium, ad-free experiences along with exclusive content are enticing more users to upgrade from free, ad-supported versions. The freemium model, where users can access basic features for free but are prompted to subscribe for additional benefits, is particularly effective. This shift is increasing user retention and enhancing the revenue streams for streaming platforms. As more users opt for subscriptions, streaming services continue to refine their pricing structures and content offerings to attract and maintain loyal customers.

Artificial intelligence (AI) and machine learning have revolutionized how music streaming platforms recommend songs and playlists. By analyzing user behavior, preferences, and listening patterns, AI enables services to curate highly personalized music experiences, ensuring that users discover new artists and tracks based on their individual tastes. This level of customization is increasingly gaining traction as consumers expect more relevant content. In addition, AI-driven playlists and smart assistants enhance user engagement, contributing to the sustained growth of the market by making the listening experience more enjoyable and tailored to each listener’s preferences. These trends collectively enhance user experience and drive the music streaming industry's growth.

Furthermore, the rise of podcasts and other non-music audio content has significantly impacted the music streaming landscape. Platforms are increasingly diversifying their offerings to incorporate spoken word content, including podcasts, audiobooks, and even live-streamed events. This trend aligns with the growing demand for audio content that extends beyond music, catering to diverse interests such as storytelling, news, entertainment, and education. As consumers spend more time on streaming platforms, they seek out various types of content, further propelling the market's expansion into new audio formats.

Moreover, companies in the music streaming industry are forming strategic partnerships with artists, record labels, and even other tech companies to enhance their content offerings and expand their reach. Collaborations with artists allow platforms to offer exclusive content, early releases, and special events that attract new subscribers. Moreover, the global expansion of music streaming services into emerging markets, particularly in Asia-Pacific and Latin America, is accelerating the ongoing international music streaming industry expansion. Such strategies by key companies are expected to drive the music streaming industry growth in the coming years.

Service Insights

The on-demand streaming segment accounted for the largest market share of over 70% in 2024. This dominance is driven by the increasing consumer preference for personalized music experiences. With platforms offering vast libraries of songs and playlists, users can listen to what they want when they want. This shift towards on-demand consumption is accelerated by the growth of smartphones, improved internet access, and the convenience of streaming platforms offering tailored recommendations using AI algorithms. In addition, the growing number of subscription-based models and freemium services are boosting revenue in this segment.

The live streaming segment is expected to witness the fastest CAGR of over 16% from 2025 to 2030. Live streaming in music is gaining traction owing to the growing demand for real-time, interactive experiences. Factors driving this segment include the popularity of live concerts, virtual events, and the ease of access through streaming platforms during the pandemic era. Artists are also leveraging live streaming for global reach, allowing them to connect with fans without geographical limitations. The incorporation of real-time fan engagement tools, such as chat and virtual tips, further propels the growth of this segment, while platforms are investing in high-quality streaming infrastructure to deliver seamless experiences.

Platform Insights

The apps segment accounted for the largest market share in 2024. The increase in app-based music consumption is driven by convenience, portability, and the fact that many platforms offer exclusive content or features that are only available through their apps. These apps also integrate with various other services, such as social media and smart devices, driving user engagement. In addition, continuous updates and the introduction of new features, like AI-driven recommendations and offline listening, are boosting the popularity of music streaming apps.

The browsers segment is expected to witness the fastest CAGR from 2025 to 2030. The browser-based segment of music streaming platforms benefits from its accessibility and ease of use, especially for desktop users who prefer music streaming while working or multitasking. The main driver of this segment is the seamless integration of browser-based platforms with other productivity tools, enabling users to enjoy music without switching between apps. As many streaming services continue to offer web-based versions of their platforms alongside mobile apps, the convenience of accessing music directly from a browser without needing additional downloads or software contributes to the steady growth of this segment.

Content Insights

The audio segment accounted for the largest market share in 2024, owing to the long-standing popularity of music as an audio-based medium. Music streaming services continue to drive growth with a vast catalog of songs, podcasts, and exclusive content, offering a wide variety of genres and artists. The shift toward higher-quality audio formats and integration with smart speakers and other IoT devices is fueling this segment's growth. In addition, the rise of podcasts and audiobooks is expanding the diversity of content within music streaming, attracting more users, and increasing monetization opportunities for service providers.

The video segment is expected to witness the fastest CAGR from 2025 to 2030. driven by the rise of music videos, live performances, and visual albums that offer an immersive experience. Platforms focus on delivering high-quality video content, including exclusive behind-the-scenes footage, interviews, and live streaming events, further enhancing the user experience. The increasing adoption of video streaming services, as well as the popularity of platforms, has made video an integral part of music consumption, pushing service providers to diversify their offerings and attract new subscribers.

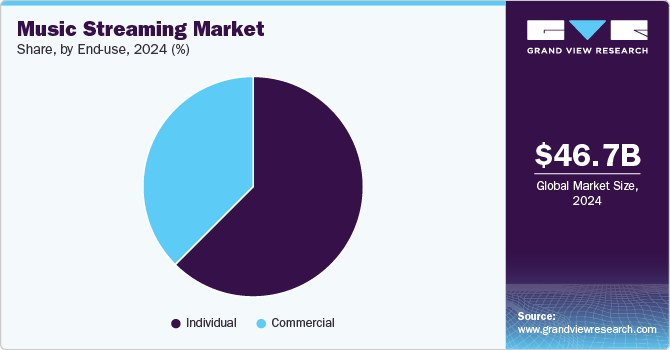

End-use Insights

The individual segment accounted for the largest market share in 2024. The growing popularity of music streaming among younger generations, who are integrating music into their daily lives, is a major driver. This trend is further fueled by the increasing availability of wireless internet and the widespread use of mobile devices, leading to significant growth in the individual user segment.

The commercial segment is expected to register the fastest CAGR from 2025 to 2030. The expansion of the commercial segment, encompassing businesses such as restaurants, salons, and gyms, is driven by the use of data and analytics in music streaming. These tools provide valuable insights into popular music, customer preferences, and engagement, allowing businesses to make informed decisions about their music selection and enhance the customer experience. This data-driven approach is a key factor in the segment's growth.

Regional Insights

North America music streaming industry dominated globally with a share of over 33% in 2024, primarilydriven by the high smartphone penetration, fast internet speeds, and the shift from physical media to digital platforms. The preference for on-demand, personalized music experiences and the rise of subscription models are major contributors to growth. In addition, the popularity of podcasts and audio content within streaming platforms is becoming more pronounced. Integration with smart speakers, voice assistants, and other connected devices is further fueling the market growth. The increasing trend of exclusive artist content, live event streaming, and video integration are key trends shaping the market.

U.S. Music Streaming Market Trends

The U.S. music streaming industry is expected to grow at a CAGR of over 13% from 2025 to 2030, driven by the widespread use of smartphones and high-speed internet, alongside the shift from traditional music formats to digital streaming. Consumers are increasingly attracted to the convenience, affordability, and vast content libraries offered by streaming services. Additionally, there is a rising trend of integrating music streaming with smart home devices, and podcasts and video content are gaining popularity within music platforms in the U.S.

Europe Music Streaming Market Trends

Europe music streaming industry is expected to grow at a CAGR of over 15% from 2025 to 2030, fueled by widespread internet access, a strong mobile user base, and a cultural shift towards digital music consumption. Affordability, ease of access, and the ability to explore diverse music genres have made streaming services extremely popular. Trends include growing demand for personalized playlists, podcasts, and exclusive content such as live performances or early releases. Furthermore, the integration of music streaming with smart devices and the increasing use of music streaming for social interaction are influencing the market's development across European countries.

The music streaming industry in the UK is expected to grow at a significant rate in the coming years, fueled by the demand for instant access to a wide range of music, driven by high internet penetration and a culture of music appreciation. Consumers are transitioning from physical music purchases to subscription-based streaming models, seeking affordability and convenience. Exclusive content, live event streaming, and artist collaborations are becoming significant trends. Additionally, the increasing integration of music services into connected devices and the influence of social media platforms in promoting music are important factors in the market's growth.

The music streaming industry in Germany is characterized by strong digital infrastructure, high internet usage, and a shift away from illegal downloading toward legal streaming services. A growing number of consumers prefer subscription-based models to access high-quality music without interruptions. There is also a notable trend of users favoring personalized content such as curated playlists and podcasts. The increasing interest in niche music genres and tailored listening experiences further contribute to the evolution of the German music streaming market.

Asia-Pacific Music Streaming Market Trends

Asia-Pacific music streaming industry is expected to grow at the fastest CAGR of over 14% during the forecast period, driven by a combination of high mobile device usage, tech-savvy consumers, and a strong gaming and entertainment culture. Countries in the region are at the forefront, adopting AR/VR to enhance e-commerce, retail, and gaming experiences. Additionally, APAC’s rapidly growing middle class, coupled with the region’s focus on technological innovation, has accelerated the adoption of music streaming across various industries.

The Japan music streaming industry is gaining traction driven by a combination of advanced technology adoption and a rich culture of music consumption. The shift from physical music sales to streaming is accelerating, supported by the desire for convenience and affordability. Consumers are increasingly drawn to localized content, such as region-specific playlists and popular international music genres. There is also a growing preference for high-quality audio and exclusive content. Trends in Japan include the integration of music streaming with gaming and other digital entertainment and a strong focus on discovering both local and international artists.

The China music streaming industry is rapidly expanding, propelled by the large, digitally connected youth population, high mobile internet usage, and the popularity of streaming as a primary way to consume music. The market is characterized by strong investments in exclusive content, social interaction features, and user-generated content, which contribute to increasing consumer engagement. Live streaming and the blending of music with social media, gaming, and e-commerce are key trends in China. Additionally, the tightening of government regulations regarding licensing and content distribution is influencing the direction of the market's growth.

Key Music Streaming Company Insights

Some of the key players operating in the market are Spotify AB and Apple, Inc., among others.

-

Spotify AB is a global music streaming service provider that provides users with access to millions of tracks and episodes of music and podcasts. Available on various devices, the company allows users to choose what they want to listen to or be surprised by curated content. Users can also explore collections from friends, artists, and celebrities or create personalized radio stations. The company operates on a freemium model, offering both free (ad-supported) and subscription-based (ad-free) access. Spotify USA, Inc. caters to users in the United States, while Spotify AB serves users in all other markets.

-

Apple, Inc. (Apple Music) is Apple's subscription-based music streaming service, offering users access to over 100 million songs. Subscribers can listen ad-free, both online and offline, and enjoy features like Spatial Audio for an immersive listening experience and lossless audio for high-fidelity sound. The platform includes original content such as exclusive interviews, live concerts, and radio shows. A unique feature, Apple Music Sing, allows users to sing along with real-time lyrics. Apple Music is accessible across all Apple devices, as well as on other platforms, making it a versatile option for music lovers.

Tidal and YouTube Music are some of the emerging market participants in the music streaming industry.

-

TIDAL is a global music streaming service committed to connecting artists and fans through unparalleled sound quality and immersive experiences. With a library of over 110 million tracks, TIDAL offers best-in-class sound formats, including lossless, HiRes FLAC, and Dolby Atmos. Subscribers enjoy ad-free listening, offline playback, personalized mixes, curated playlists, and live sessions. TIDAL provides various subscription options, including Individual, Family, and Student plans, with add-ons like the DJ Extension. New users can explore the platform through a 30-day free trial.

-

YouTube Music is a music streaming service developed by Google that provides users with access to a vast library of songs, albums, live performances, and music videos. It allows users to listen to their favorite music, discover new artists, and create personalized playlists. YouTube Music also offers features such as offline playback, background listening, and integration with other Google services.

Key Music Streaming Companies:

The following are the leading companies in the music streaming market. These companies collectively hold the largest market share and dictate industry trends.

- Spotify AB

- Apple, Inc. (Apple Music)

- Amazon.com, Inc. (Amazon Music)

- Deezer SA

- Pandora Media, Inc.

- Tencent Music Entertainment Group

- Tidal

- SoundCloud Global Limited & Co. KG

- iHeartMedia, Inc.

- YouTube Music

Recent Developments

-

In February 2025, Spotify launched "Mi Primer Escenario" (My First Stage) in Argentina, a music contest designed to support emerging artists. The contest offers up-and-coming Argentine musicians the chance to showcase their talent and connect with listeners, with the grand prize being a performance slot at Quilmes Rock, a major music festival, alongside established acts.

-

In December 2024, Apple, Inc. (Apple Music) expanded its live global radio offering with the launch of three new stations: Apple Música Uno, Apple Music Club, and Apple Music Chill. These stations join Apple Music 1, Hits, and Country to provide listeners with more exclusive shows hosted by a diverse range of artists. Apple Música Uno focuses on Latin music, with Becky G as the launch host, while Apple Music Club caters to dance and electronic music enthusiasts with mixes from top DJs. Apple Music Chill offers a calming escape with a continuous flow of relaxing music.

-

In August 2024, Amazon.com, Inc. (Amazon Music) launched Maestro, an AI playlist generator currently in beta for select U.S. customers on iOS and Android. Additionally, Amazon Music is introducing AI-generated "Topics" tags for podcasts, allowing listeners to discover related content by tapping on these tags beneath episode descriptions. Users can find these tags on popular podcasts like The Daily, SmartLess, and This American Life by updating to the latest version of the Amazon Music app and navigating to the podcast section.

Music Streaming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 54.08 billion

Revenue forecast in 2030

USD 108.39 billion

Growth rate

CAGR of 14.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, service, content, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

Spotify AB; Apple Inc. (Apple Music); Amazon.com, Inc. (Amazon Music); Deezer SA; Pandora Media, Inc.; Tencent Music Entertainment Group; Tidal; SoundCloud Global Limited & Co. KG; iHeartMedia, Inc; YouTube Music

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Music Streaming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global music streaming market report based on service, platform, content, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

On-demand streaming

-

Live streaming

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Apps

-

Browsers

-

-

Content Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio

-

Video

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global music streaming market size was estimated at USD 46.66 billion in 2024 and is expected to reach USD 54.08 billion in 2023.

b. The global music streaming market is expected to grow at a compound annual growth rate of 14.9% from 2025 to 2030 to reach USD 108.39 billion by 2030.

b. Some key players operating in the music streaming market include Spotify AB, Apple, Inc., Amazon.com, Inc., Google LLC, Deezer, Pandora Media, Inc., and Tencent Music Entertainment Group.

b. North America dominated the music streaming market with a share of over 33% in 2024. This is attributable to the rising adoption of music streaming mobile applications integrated with state-of-the-art technologies for a better consumer experience.

b. Key factors that are driving the music streaming market growth include the growing adoption of digital music services, the rise in online content consumption, and technological advancements in the music streaming industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.