- Home

- »

- Next Generation Technologies

- »

-

U.S. Sports Betting Market Size, Industry Report, 2030GVR Report cover

![U.S. Sports Betting Market Size, Share & Trends Report]()

U.S. Sports Betting Market Size, Share & Trends Analysis Report By Platform, By Betting Type (Fixed Odds Wagering, Exchange Betting, Live/In-Play Betting, eSports Betting), By Sports Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-220-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Sports Betting Market Size & Trends

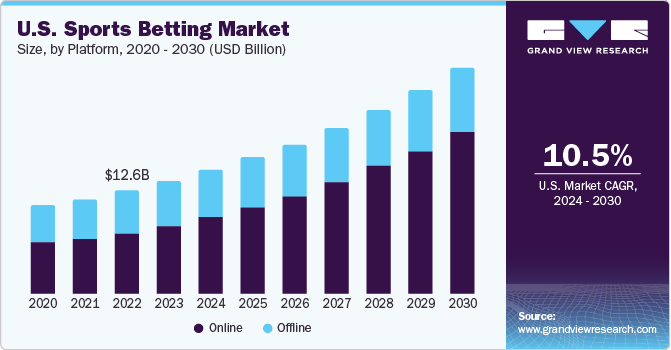

The U.S. sports betting market size was estimated at USD 13.76 billion in 2023 and is expected to expand at a CAGR of 10.5% from 2024 to 2030. The major shift in the regulatory landscape of the gambling sector, coupled with the developing digital infrastructure, is expected to impact the market positively. Online sports betting gained popularity during the COVID-19 pandemic due to an upsurge in e-sports and similar forms of betting. Moreover, the increasing usage of smartphones has also led to the wide availability and accessibility of sports betting, consequently propelling the global market growth.

In 2023, the U.S. accounted for over 15% of the sports betting market. The growing trends of digitalization, technological advancements, and the growing number of smartphone users have enabled sports betting operators to simplify their platforms and provide an enjoyable betting experience to users. Moreover, the relaxation in regulatory frameworks to regulate betting and gambling activities is also expected to offer lucrative opportunities for the industry. For instance, according to the U.S. Gaming Association, as of January 2023, sports betting is legal in 36 states. In 2021, it was legal in 32 states only.

The increase in the number of sports events and leagues, such as the NFL, FIFA World Cup, Carabao Cup, etc., has positively influenced the growth of the market. Furthermore, an increase in disposable income of people is also providing opportunity to the market. The rising usage of AI and blockchain technologies to improve the prediction algorithms in betting software is likely to boost the growth of the market during the forecast period.

Market Concentration & Characteristics

The degree of innovation is moderate to high in the U.S. sports betting industry due to advancements in technology and rising trends of online betting. Data analytics and artificial intelligence (AI) are set to play a key role in the future of sports betting.

New participants are also entering the market due to the opportunities. For instance, in August 2018, Kindred Group announced a partnership with the Hard Rock Hotel & Casino Atlantic City, marking the company's first entrance to the U.S. sports betting industry by entering the New Jersey sports betting market.

In addition, mergers and acquisition activities are also high in the market. In September 2023, Flutter Entertainment Plc announced that it had acquired an initial 51% stake in an omni-channel sports betting and gaming operator, MaxBet. Similarly, in February 2020, Betsson acquired Gaming Innovation Group B2C assets.

The market is characterized by a high impact of regulations. As the Supreme Court of the United States (SCOTUS) overturned the Professional and Amateur Sports Protection Act (PASPA) in 2018, companies involved in the eSports and sports betting industry have begun collaborating with sports teams and players to promote betting. After this, each state has the opportunity to create and enforce its own sports betting laws.

Platform Insights

Based on platforms, the online platform segment dominated the market with the largest revenue share of 58.0% in 2023. The segment is also expected to witness the highest CAGR over the forecast period. This segment is witnessing growth due to the quick adoption of internet-connected gadgets like smartphones, laptops, and tablets. Online betting streaming on smartphones and tablets has significantly impacted the market growth.

The convenience and accessibility provided by online platforms have made it easier for customers to bet on their favorite sports, which has resulted in an increase in the number of people participating in online sports betting. Moreover, the availability of a wide range of sports events and betting options has also attracted people looking for enjoyment and extra income. The increasing digitization of the economy, coupled with the growing adoption of easy and quick online transactions, has facilitated the growth of the industry.

Sports Type Insights

Based on sports type, the basketball segment dominated the industry with the largest market share in 2023, as this game is extremely popular in the U.S. Basketball is one of the most followed sports, garnering millions of audience in the country. Leagues such as National Basketball Association (NBA) have made this game popular internationally.

Baseball was the second largest category in this segment in 2023 as it is the national game of the country. However, football is also becoming increasingly popular sports in the U.S. Numerous bets are placed on this game in the United States during major events and the trend is expected to rise in upcoming years with several major states exploring the possibility of legalizing eSports and Sports betting to tap the potential of the market and increase their revenues.

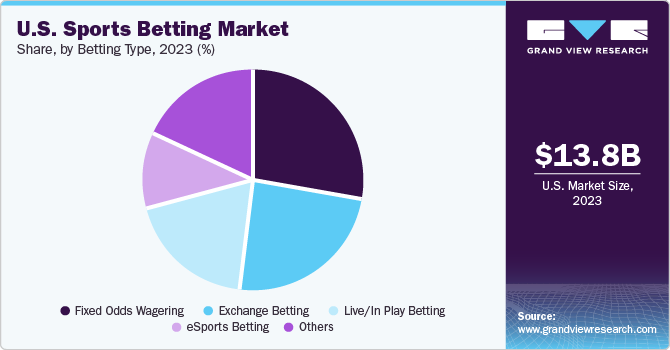

Betting Type Insights

Based on type, the fixed odds wagering segment dominated the industry in 2023 and is expected to continue its dominance over the forecast period. Fixed-odds wagering betting is a form of betting in which bettors place bets on the outcome of an event at predetermined odds. In such type of betting, the odds are fixed and determined at the time of placing the bet, regardless of any changes in the odds leading up to the event.

The eSports betting segment is anticipated to grow with the highest CAGR during the forecast period. The majority of bettors with internet access and digital devices are engaged in betting activities like eSports betting and actively seeking extra income apart from enjoyment.

Key U.S. Sports Betting Company Insights

Some of the leading companies in the market include 888 Holdings Plc, Bet365, Betsson AB, and Churchill Downs Incorporated.

-

888 Holdings is a global sports betting and gambling company that owns brands such as 888casino, 888poker, 888sport, Mr Green, and William Hill. In 2018, the company expanded its U.S. online poker business by becoming the sole owner of the All American Poker Network.

-

Churchill Downs Incorporated is a multi-American-state-wide company. It is a publicly traded company with racetracks, casinos and an online wagering company among its portfolio of businesses.

IGT, Kindred Group Plc, Sportech Plc, and William Hill Plc are other companies in the U.S. sports betting market.

-

Kindred Group is an online betting operator which consists of brands, such as Unibet, Maria Casino and 32Red. The company offers products such as online casino, online poker, online bingo, and sports betting. The company has major offices in Gibraltar, London, and Stockholm, apart from the U.S.

Key U.S. Sports Betting Companies:

- 888 Holdings Plc

- Bet365

- Betsson AB

- Churchill Downs Incorporated

- DraftKings

- Entain plc

- FanDuel Group

- Flutter Entertainment Plc

- IGT

- Kindred Group Plc

- Sportech Plc

Recent Developments

-

In July 2022, 888 Holdings acquired William Hill, creating a global betting and gaming leader by bringing together two highly complementary businesses and combining two of the industry’s leading brands.

-

In August 2021, Entain announced to acquire US-based esports betting company Unikrn. The company plans to acquire Unikrn’s technology platform, products and team, citing a lack of existing scale among skill-based wagering platforms.

U.S. Sports Betting Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 27.5 billion

Growth rate

CAGR of 10.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, betting type, sports type

Country scope

U.S.

Key companies profiled

888 Holdings Plc; Bet365; Betsson AB; Churchill Downs Incorporated; Entain plc; Flutter Entertainment Plc; IGT, Kindred Group Plc; Sportech Plc; William Hill Plc; FanDuel Group; DraftKings

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sports Betting Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. sports betting market report based on platform, betting type, and sports type:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Betting Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed Odds Wagering

-

Exchange Betting

-

Live/In Play Betting

-

eSports Betting

-

Others

-

-

Sports Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Football

-

Basketball

-

Baseball

-

Horse Racing

-

Cricket

-

Hockey

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. sports betting market size was valued at USD 13.76 billion in 2023 and is expected to reach USD 15.09 billion in 2024.

b. The global U.S. sports betting market is expected to grow at a compound annual growth rate (CAGR) of 10.5% from 2024 to 2030 to reach USD 27.5 billion by 2030.

b. The online platform segment dominated the market with the largest revenue share of 58.0% in 2023. This segment is witnessing growth due to the quick adoption of internet-connected gadgets like smartphones, laptops, and tablets.

b. Some key players operating in the U.S. sports betting market include 888 Holdings Plc, Bet365, Betsson AB, Churchill Downs Incorporated, DraftKings, Entain plc, FanDuel Group, Flutter Entertainment Plc, IGT, Kindred Group Plc, Sportech Plc

b. The major shift in the regulatory landscape of the gambling sector, the developing digital infrastructure, and the increasing usage of smartphones are the factors driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."