- Home

- »

- Next Generation Technologies

- »

-

Esports Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Esports Market Size, Share & Trends Report]()

Esports Market (2025 - 2030) Size, Share & Trends Analysis Report By Revenue Source (Sponsorship, Advertising, Merchandise & Tickets, Media Rights), By Streaming, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-647-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Esports Market Summary

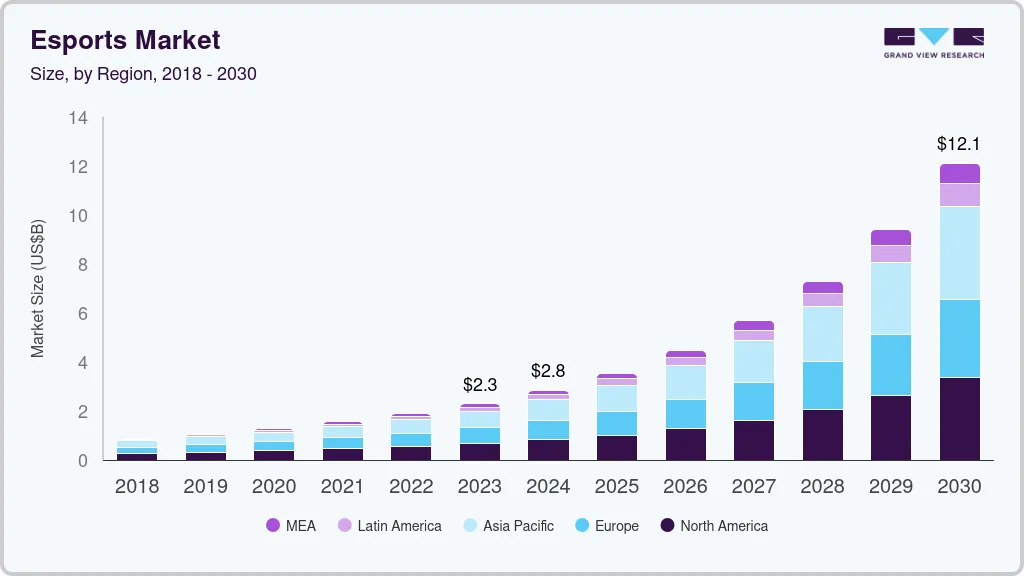

The global esports market size was estimated at USD 2.13 billion in 2024 and is projected to reach USD 7.46 billion by 2030, growing at a CAGR of 23.1% from 2025 to 2030. The market growth is primarily driven by the increasing live streaming of games, rising audience reach, engagement activities, and infrastructure for league tournaments, which influence market growth.

Key Market Trends & Insights

- North America accounted for the largest share of over 30% in 2024.

- The U.S. esports market is expected to grow significantly from 2025 to 2030.

- Based on revenue source, the sponsorship segment dominated global revenue, with a market share of more than 40% in 2024.

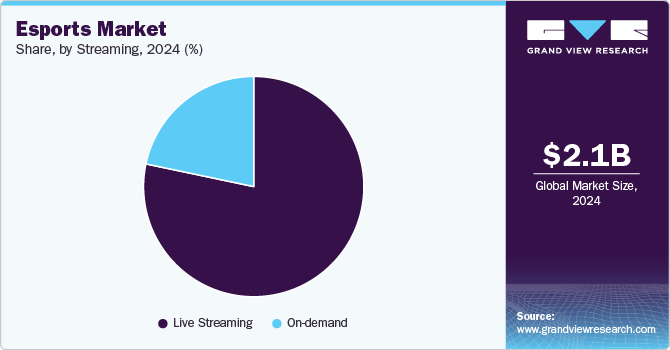

- Based on streaming, the live streaming segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.13 Billion

- 2030 Projected Market Size: USD 7.46 Billion

- CAGR (2025-2030): 23.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing popularity of mobile gaming and the widespread availability of high-speed internet have significantly contributed to increased esports participation and viewership. Moreover, strategic partnerships between game developers and esports organizations, coupled with the rising adoption of cloud gaming platforms, are expected to further fuel the growth of the esports industry in the coming years.

The growing trend of live streaming is significantly transforming the esports industry, with an increasing number of gamers and fans engaging with content on platforms such as Twitch Interactive Inc. and YouTube, LLC. This surge in streaming activity enhances visibility and extends audience reach while facilitating real-time interaction between players and viewers. The interactive nature of these platforms strengthens viewer engagement and contributes to the development of dedicated fan communities, thereby supporting sustained esports industry growth.

In addition, substantial investments from global stakeholders fuel the esports ecosystem's development. Venture capitalists, media companies, and major brands recognize the lucrative potential of esports and are investing in infrastructure, content creation, and talent development. These formidable investments are accelerating the commercialization and professionalization of esports, thrusting the market forward.

Furthermore, increasing audience reach and higher engagement levels are key growth drivers in the esports sector. As digital platforms expand and internet access improves globally, esports events attract millions of viewers actively engaging with the content. This growing and involved fanbase supports monetization through advertising and sponsorships and strengthens the esports industry's position as a prominent part of the mainstream entertainment industry.

Moreover, developing league tournament infrastructure and organized events fosters a structured and credible esports ecosystem. The rise of professional teams, consistent competitions, and dedicated academic programs creates new career opportunities while enhancing participation and viewership. Combined with high-profile tournaments and sponsorships, these advancements support industry appeal and revenue generation, collectively contributing to the sustained growth of the esports industry.

Revenue Source Insights

The sponsorship segment dominated global revenue, with a market share of more than 40% in 2024, driven by increased brand investments, growing viewership, and strategic partnerships. Booths, interactive advertising, posters, freebies, video displays, and other creative methods enable the brand to target potential customers. The increasing competition in the sponsorship industry has led brands to seek differentiation and authenticity through sponsorships in the esports and gaming industry. Many non-endemic brands entered eSports on familiar ground through a digital extension of traditional sponsorship relationships, thereby strengthening the dominance of this segment.

The media rights segment is projected to grow at a CAGR of over 25%, emerging as a key revenue driver in the market. This growth is fueled by rising demand for exclusive broadcasting deals, increasing viewership, and strategic partnerships with streaming platforms. Traditional sports networks and tech companies are investing heavily, drawn by esport’s appeal to younger audiences and advanced streaming technologies that enhance content delivery and viewer engagement.

Streaming Insights

The live streaming segment accounted for the largest market share in 2024, driven by increasing demand for real-time esports content, enhanced viewer interaction, and substantial investments in streaming infrastructure. The widespread adoption of platforms such as Twitch and YouTube, combined with rising audience engagement and global accessibility, continues to strengthen the segment’s position as a key contributor to market growth.

The on-demand segment is expected to witness significant CAGR from 2025 to 2030, driven by the rising popularity of game streaming, increasing mobile access, and demand for flexible, user-driven content. Improved internet infrastructure, expanding global viewership, and availability of diverse platforms further accelerate the growth of this segment within the market.

Regional Insights

North America accounted for the largest share of over 30% in 2024, primarily driven by the region's focus on technological innovation and digital infrastructure. The widespread adoption of high-speed internet and 5G connectivity enhances streaming quality and viewer engagement, supporting the growth of esports platforms. Additionally, integrating esports programs in educational institutions and establishing dedicated gaming venues further solidify North America's leadership in the market.

U.S. Esports Market Trends

The U.S. esports market is expected to grow significantly from 2025 to 2030, driven by the country's strong focus on innovation and technological advancement. Additionally, the expansion of high-tech training facilities, increased investment in intellectual esports programs, and the concentration of professional leagues and tournaments contribute to the rising demand for esports infrastructure and services in the U.S. The growing involvement of traditional sports organizations and media companies further accelerates market development.

Europe Esports Market Trends

The Europe esports industry is expected to grow significantly from 2025 to 2030, driven by several key factors. The region's advanced digital infrastructure and widespread high-speed internet access facilitate seamless online gaming experiences. Additionally, the increasing popularity of mobile-friendly games attracts a diverse demographic, expanding the player base. Investments in esports infrastructure, such as arenas and gaming centers, by both private and public sectors, further propel market growth. Moreover, integrating virtual reality (VR) and augmented reality (AR) technologies enhances spectator experiences, making esports more immersive and appealing. European educational institutions also contribute by offering esports-related courses and degree programs, thereby cultivating a skilled workforce to support the industry's expansion.

The UK esports market is expected to grow at the highest rate in the coming years, supported by a robust digital infrastructure, widespread smartphone adoption, and a strong online gaming culture. The country's active gaming community and increasing integration of brand sponsorships into esports tournaments and teams are further propelling market expansion. Additionally, the UK's position as a hub for international esports competitions enhances its global appeal and contributes to sustained esports industry growth.

The market for esports in France is fueled by the country's strong digital infrastructure, high internet penetration, and a dynamic gaming community supporting grassroots and professional-level competitions. Government-backed initiatives, including developing a national esports strategy and introducing esports-specific visas, aim to attract international talent and position France as a global esports hub. Additionally, esports have been integrated into mainstream media, such as national broadcasts of major tournaments and the active participation of prominent French teams. These factors contribute to the sustained growth and professionalization of the country's esports sector.

Asia Pacific Esports Market Trends

The Asia Pacific esports industry is expected to grow at the highest CAGR from 2025 to 2030, driven by rapid digital transformation, rising mobile gaming adoption, and strong institutional backing. The region is experiencing significant growth in competitive gaming due to widespread smartphone penetration, expanding internet access, and increasing popularity of mobile-first esports titles. Additionally, a growing youth population with strong digital engagement and rising sponsorship deals and brand partnerships further accelerates market development in Asia Pacific.

The Japan esports market is gaining traction fueled by a strong gaming culture, government support, and strategic collaborations. Eased regulations, integration into education, and advanced infrastructure promote professional leagues and talent development. These factors collectively contribute to the sustained expansion of Japan's esports market, positioning it as a significant player in the global esports industry.

The market for esports in India is witnessing significant growth, owing to its large, digitally literate youth population, widespread smartphone penetration, and affordable data access. Government initiatives to expand digital infrastructure and recognize esports as a legitimate industry further boost its development. Additionally, increased investment, rising popularity of mobile gaming, and the emergence of organized tournaments create a supportive environment for sustained market expansion across the country.

Key Esports Company Insights

Some of the key players operating in the market include Activision Blizzard, Inc., and Tencent Holding Limited.

-

Activision Blizzard, Inc. is a developer and publisher of interactive entertainment content, and it is prominent for iconic franchises like Call of Duty, World of Warcraft, and Overwatch. The company delivers immersive gaming experiences across console, PC, and mobile platforms. With a strong presence in esports and digital distribution, the company leverages cutting-edge technology, live services, and global reach to engage millions of players worldwide, driving innovation in the gaming industry.

-

Tencent Holding Limited is a technology and entertainment company specializing in social networking, gaming, digital content, and cloud services. Through subsidiaries like Riot Games and investments in numerous gaming studios, it is a major player in the esports and online gaming industry. With a strong digital ecosystem, Tencent integrates AI, cloud computing, and big data to enhance user engagement. Its vast international presence and strategic innovation make it a dominant force in the digital economy.

Cloud9 Esports and G Esports Holding GmbH are some emerging market participants in the esports industry.

-

Cloud9 Esports is an American esports organization based in Santa Monica, California. It operates competitive teams in titles such as League of Legends, Valorant, and Counter-Strike. The organization participates in professional leagues and international tournaments, contributing to the growing commercialization of esports. Cloud9 is part of an industry driven by rising global viewership, increasing brand investments, advanced streaming technologies, and expanding tournament infrastructure that support continued market growth.

-

G2 Esports is an emerging esports organization that has built a strong brand around its competitive teams in games such as League of Legends, CS: GO, and Valorant. The organization focuses on content creation, fan engagement, and participation in international competitions, which has helped it gain significant influence in the market. G2’s strategic approach to team building and branding, and its international presence have positioned it as a rising powerhouse in the esports industry.

Key Esports Companies:

The following are the leading companies in the esports market. These companies collectively hold the largest market share and dictate industry trends.

- Activision Blizzard, Inc.

- Electronic Arts Inc.

- Gameloft SE

- HTC Corporation

- Intel Corporation

- Modern Times Group (MTG)

- Nintendo of America Inc.

- NVIDIA Corporation

- Tencent Holding Limited

- Valve Corporation

- Cloud9 Esports

- G Esports Holding GmbH.

Recent Developments

-

In April 2025, Nintendo highlighted its esports initiatives during a Nintendo Switch 2 Direct event, introducing new IPs and enhancing Splatoon with esports features like improved matchmaking and live streaming integration. This expansion aims to tap into the growing competitive gaming market, strengthening Nintendo's position in esports through strategic partnerships and global audience engagement.

-

In April 2025, Modern Times Group (MTG) announced the acquisition of Plarium, a leading gaming studio. This strategic move aims to strengthen MTG's position in the gaming industry by expanding its portfolio and enhancing its direct-to-consumer platform, Plarium Play.

-

In March 2025, Gameloft launched a new mobile esports platform for Asphalt 9: Legends, focusing on community-driven tournaments and competitive play. This initiative aims to enhance the mobile esports ecosystem and attract a larger audience by offering regular in-app events, live streaming, and player rewards.

Esports Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.64 billion

Revenue forecast in 2030

USD 7.46 billion

Growth rate

CAGR of 23.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Revenue source, streaming, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Activision Blizzard, Inc.; Electronic Arts Inc.; Gameloft SE; HTC Corporation; Intel Corporation; Modern Times Group (MTG); Nintendo of America Inc.; NVIDIA Corporation; Tencent Holding Limited; Valve Corporation; Cloud9 Esports; G Esports Holding GmbH.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Esports Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global esports market report based on revenue source, streaming, and region:

-

Revenue Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Sponsorships

-

Advertising

-

Merchandise & Tickets

-

Publisher Fees

-

Media Rights

-

-

Streaming Outlook (Revenue, USD Million, 2018 - 2030)

-

On-demand

-

Live Streaming

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global esports market size was estimated at USD 2,125.6 million in 2024 and is expected to reach USD 2.64 billion in 2025.

b. The global esports market is expected to grow at a compound annual growth rate of 23.1% from 2025 to 2030 to reach USD 7.46 billion by 2030.

b. The key players in the esports market include Activision Blizzard, Inc.; Electronic Arts Inc.; Gameloft SE; HTC Corporation; Intel Corporation; Modern Times Group (MTG); Nintendo of America Inc.; NVIDIA Corporation; Tencent Holding Limited; Valve Corporation; Cloud9 Esports; G Esports Holding GmbH.

b. North America accounted for the largest share of over 35% in 2024, primarily driven by the region's focus on technological innovation and digital infrastructure. The widespread adoption of high-speed internet and 5G connectivity enhances streaming quality and viewer engagement, supporting the growth of esports platforms. Additionally, the integration of esports programs in educational institutions and the establishment of dedicated gaming venues further solidify North America's leadership in the esports market.

b. Key factors driving market growth include the increasing live streaming of games, enhanced infrastructure for league tournaments, growing popularity of mobile gaming, widespread availability of high-speed internet, and the rising adoption of cloud gaming platforms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.