- Home

- »

- Automotive & Transportation

- »

-

Intelligent Transportation System Market Size Report, 2030GVR Report cover

![Intelligent Transportation System Market Size, Share & Trends Report]()

Intelligent Transportation System Market (2025 - 2030) Size, Share & Trends Analysis Report By Mode of Transportation (Roadways, Airways, Railways, Maritime), By Offering (Hardware, Software), By System Type (ATMS, APTS), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-036-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intelligent Transportation System Market Summary

The global intelligent transportation system market size was valued at USD 54.5 in 2024 and is projected to reach USD 90.4 billion by 2030, growing at a CAGR of 9.2% from 2025 to 2030. Growing demand for traffic control solutions & smart vehicles, the improved safety and monitoring offered by License Plate Recognition (LPRs), modern cameras, and the emergence of smart cities, are contributing to the growth.

Key Market Trends & Insights

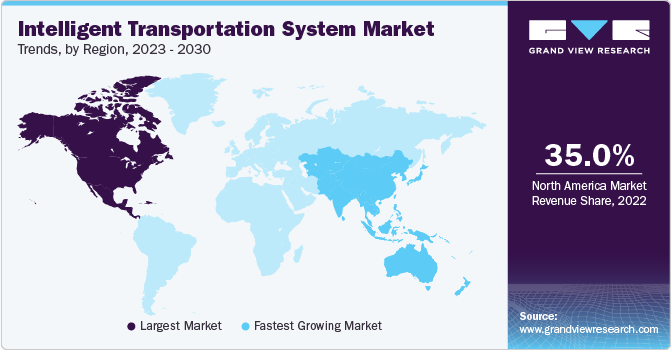

- North America Intelligent Transportation System (ITS) market held the majority revenue share of over 35.2% in 2024.

- Based on mode of transportation, the roadway segment accounted for the largest revenue share of 39.4% in 2024.

- Based on roadway offering, the hardware segment accounted for the largest revenue share in 2024.

- Based on roadway system type, the Advanced Traffic Management System (ATMS) segment accounted for the largest revenue share in 2024.

- Based on roadway application, the traffic management segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 54.5 Billion

- 2030 Projected Market Size: USD 90.4 Billion

- CAGR (2025-2030): 9.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Intelligent Transportation System (ITS) provides traffic management solutions that enable enhanced road safety, traffic flow, and mobility, creating a positive market outlook.

The growing number of vehicles, boats, planes & rails, aging infrastructure, and a looming lack of traffic data management are some of the other factors anticipated to contribute to the ITS market’s growth. As a result, the rising need for traffic management solutions across various transport modes such as airways, maritime, roadways & railways has triggered the need for advanced traffic management solutions. The implementation of smart technologies and several efforts have been taken by both public and private organizations, by varying measures, demonstrating that the role of technology will help in the intelligent transportation system market growth.

Expanding rail networks across the globe to address the rising need for efficient public transportation networks is creating robust opportunities for the intelligent transportation system market. The players operating in the ITS market focus on enhancing transportation through the railway network by establishing strategic partnerships with technology providers. For instance, in October 2023, freight railroad company CSX Corporation collaborated with digital technology & automation company Siemens AG for railway traffic optimization across more than 20,000 miles of track in North America using Siemens AG’s TPS.live, rail traffic network optimization solution, and Controlguide Core Dispatch System (CDS).

For ITS setup, which includes the Traffic Management Center (TMC), can deal with real-time data and assist vehicles in finding alternate ways to reduce traffic congestion. This system also guides planes and boats for better route optimizations, especially amid some natural disasters such as thunderstorms, floods, and heavy rain. This TMC implementation includes a set of video surveillance systems, sensors, weather detection systems, vehicle probes, navigation systems, and other systems & components. The data collected through devices is analyzed, processed, and communicated to the user through dynamic signboards, the internet, or mobile telephony.

Integration of intelligent vehicles and ITS enables dynamic traffic signal control. Taking into account information from connected cars, signals can be adapted to the current traffic situation in real time. This helps optimize signal times and improve traffic flow. Advancements in sensing and telecommunications technologies are particularly expected to encourage the adoption of the ITS over the forecast period. However, the growing preference for digitization of various attributes for implementing intelligent transport system (ITS) solutions is one of the major factors for the ITS market’s growth.

An effective transportation and traffic management system is critical for the socioeconomic development of any country. While the growing number of traffic congestions increases carbon emissions and leads to a high degree of environmental pollution, the costs associated with traffic congestions, including fuel consumption and travel time, can also be a major issue for any nation. Nevertheless, advanced traffic management systems capable of utilizing real-time data can efficiently address traffic issues. However, implementing the latest, advanced real-time traffic management technology often requires restructuring the existing infrastructure. Transportation authorities may have to upgrade the existing infrastructure to ensure effective deployment and management of advanced technologies, slowing down the ITS market growth.

Mode of Transportation Insights

The roadway segment accounted for the largest revenue share of 39.4% in 2024. The constant increase in traffic congestion and greenhouse gas emissions is driving the adoption of roadway intelligent transportation systems, including the use of electric vehicles, Advanced Traffic Management Systems (ATMS), Advanced Public Transportation Systems (APTS), and the deployment of smart infrastructure, among others. The use of big data analytics in traffic management is increasing. Intelligent Traffic Signal System uses data from a variety of sources, including sensors, cameras, and connected cars, to gain insights into traffic patterns and enable more informed decisions about signal control and overall traffic management. Furthermore, governments of several countries are heavily investing in road infrastructure projects to support sustainable transport, enhance interoperability among various systems, and improve road safety.

The maritime segment is anticipated to register considerable growth with a substantial CAGR over the forecast period. This significant growth can be attributed to the high adoption of Internet-of-Things (IoT) & digital technologies to enhance communication and connectivity between ports, logistics networks, and ships. Further, the proliferation of remote-controlled shipping operations and autonomous vessels is creating robust opportunities for intelligent transportation solutions in the maritime sector.

Roadway Offering Insights

The hardware segment accounted for the largest revenue share in 2024. Increasing public and private investment in smart cities and the growing need to improve the roadway infrastructure to manage the increasing number of vehicles are driving the growth of the hardware segment. Hardware’s abilities to satisfy different computational requirements of ML algorithms in various ITS systems are expected to contribute towards segment growth in the roadway intelligent transportation system market through 2030.

The services segment is anticipated to register considerable growth over the forecast period. The significant growth of the roadway ITS services can be attributed to the shifting focus of public authorities to use the ITS services to minimize their operational costs, smooth deployment of the roadway ITS hardware systems, and enhance the operational efficiency of their Intelligent Transportation System (ITS) solutions.

Roadway System Type Insights

The Advanced Traffic Management System (ATMS) segment accounted for the largest revenue share in 2024. Favorable government initiatives to develop traffic infrastructures and the increased adoption of adaptive traffic controls & analytics are among the major drivers of traffic monitoring systems. ATMS combines communication technologies, data processing technology, and sensors to ensure real-time management of transportation network operations, supporting the industry trend.

The Advanced Public Transportation System (APTS) segment is expected to register the highest CAGR over the forecast period. Advanced Public Transportation System helps enhance the efficiency, quality of travel, comfort, and overall customer experience through the digital transformation strategies of the public transportation sector, supporting the segment growth in the roadway ITS market.

Roadway Application Insights

The traffic management segment accounted for the largest revenue share in 2024. The integration of advanced technologies, including sensors, cameras, and other monitoring devices, is enhancing the safety and sustainability of transportation networks. Through analysis and processing of real-time traffic data such as traffic flow, congestion, and other incidents, traffic authorities can smoothly manage traffic signal timings, divert routes, and improve the flow of vehicles during peak hours, supporting the segment growth.

The automotive telematics segment is anticipated to witness the highest CAGR from 2025 to 2030. Intelligent transportation system applications in automotive telematics include vehicle telematics, integrated GPS systems, wireless telematics devices, onboard vehicle diagnostics, and black box technologies to capture and send vehicle data, including location, speed, maintenance needs, and internal behavior. This data is analyzed in real-time to enhance driver safety, reduce costs, and optimize the performance of vehicles, creating a positive outlook for automotive telematics solutions in the roadway intelligent transportation system market.

Railway Offering Insights

The hardware segment accounted for the largest revenue share in 2024. The high revenue shares of the hardware segment in the railway ITS market can be attributed to the growing concern related to railway collision, which has propelled the adoption of digital signaling & control systems and Positive Train Control (PTC) & Automatic Train Control (ATC) systems. Moreover, the adoption of reliable and high-speed communication networks for robust data exchange between control centers, trains, and infrastructure is further driving the segment growth.

The services segment is anticipated to register considerable growth at a CAGR during the forecast period. The services segment includes design, deployment, maintenance, and support for the railway ITS system that includes hardware such as cameras & surveillance systems, storage, & communication equipment, and software such as signaling software, network management, central traffic management, and scheduling software, among others. Railway authorities prefer intelligent transportation system services to deploy the ITS solutions that align with their allocated budgets and improve the interoperability of railway networks, supporting the industry trend.

Railway System Type Insights

The ATMS segment accounted for the largest revenue share in 2024. The increasing road network across the globe is creating a need for robust ATMS, driving the segment growth. In October 2022, freight railroad company BNSF Railway Company announced an investment of USD 1.5 billion to construct an advanced rail facility, Barstow International Gateway, in Southern California, over 4,500 acres of land to improve the operational efficiency of the rail network and supply chain ecosystem.

The APTS segment is expected to register the highest CAGR from 2025 to 2030. Significant urbanization, a supportive government initiative to enhance the rail infrastructure, and growing intermodal connectivity are driving the APTS segment growth in the railway intelligent transportation system market. Further, APTS assists in accelerating economic growth by improving connectivity, facilitating tourism & trade, and creating jobs.

Railway Application Insights

The rail-running operation and collision avoidance segment accounted for the largest revenue share in 2024. Rising concerns over the increasing rail accidents and strict regulations for rail safety & security have played a key role in driving the growth of the rail-running operation and collision avoidance segment. Moreover, companies operating in the railway ITS market are focusing on developing advanced collision avoidance solutions to attract potential business clients and achieve higher profitability from this potential market. For instance, in May 2023, a mobility technology company, EYYES GmbH, showcased its camera-based front collision warning system for trains at the SIFER 2023 Expo in France.

The smart ticketing segment is anticipated to witness the highest CAGR from 2025 to 2030. Smart ticketing systems have various benefits, such as streamlining the ticketing process, reducing fare evasion, and enriching the passenger experience, supporting the growth of the smart ticketing segment. Smart ticketing allows operators to generate higher revenue during peak travel times, allows dynamic pricing, and offers flexible payment options to passengers, further driving the segment growth.

Airway Offering Insights

The hardware segment accounted for the largest revenue share in 2024. The improved air traffic management & safety, continuous increase in air travel demand, and heightened concerns related to aviation safety & security are resulting in a higher market share of the hardware segment. Moreover, advancements in navigation and satellite communication systems are expected to create lucrative opportunities for segment growth in the forecast period.

The services segment is anticipated to register considerable growth over the forecast period. The notable segment growth in the airway intelligent transportation market can be attributed to the significant digitization, which is leading to the increasing usage of cost-effective cloud & professional services to remotely manage the various ITS solutions, such as cybersecurity, remote tower services, weather control systems, and crisis management services, among others.

Airway System Type Insights

The ATMS segment accounted for the largest revenue share in 2024. The high revenue share of the ATMS segment in the airway intelligent transportation system market can be attributed to the increasing number of flights led by high consumer preference towards flight travel and the emergence of Unmanned Aerial Vehicles (UAVs) and Remotely Piloted Aircraft Systems (RPAS). In September 2023, the U.S. Trade and Development Agency (USTDA) awarded a technical grant to the Vietnam Air Traffic Management Corporation (VATM) to assist them in upgrading the air traffic management infrastructure in Vietnamese airspace.

The Advanced Traveler Information System (ATIS) segment is expected to register the highest CAGR from 2025 to 2030. The ATIS segment in airways is experiencing higher demand owing to the shifting focus of airlines on enhancing the passenger experience by offering crowd management services, smart luggage tracking, and mobile apps & platforms for ticket management & entertainment.

Airway Application Insights

The aircraft traffic management segment accounted for the largest revenue share in 2024. The airway ITS solutions in aircraft traffic management offer various benefits such as improved safety by providing precise guidance to pilots to avoid collisions, clear routes for airplanes in medical emergencies, robust resource utilization, and automation & advanced tools to reduce potential human error, thereby supporting the industry trend.

The traveler information management segment is anticipated to witness the highest CAGR from 2025 to 2030. The airlines emphasize offering a unified platform to provide end-to-end traveler services to enhance their brand reputation. For instance, in September 2022, private & luxury jet services provider Luxaviation Group from Luxembourg unveiled an integrated online management system that provides a single point of contact to the clients for various customer support services.

Maritime Offering Insights

The hardware segment accounted for the largest revenue share in 2024. The high revenue shares of hardware in the maritime ITS market can be attributed to the increasing demand for specialized hardware such as control systems, interface boards, cameras, and sensors, owing to the automated port operations and proliferation of autonomous ships.

The services segment is anticipated to register significant growth over the forecast period. Maritime companies are actively seeking maritime intelligent transportation system services to reduce fuel consumption, optimize routes & ship performance, manage inventory, adhere to compliance requirements, and improve the efficiency of emergency response & safety systems, thereby supporting the segment growth.

Maritime System Type Insights

The ATMS segment accounted for the largest revenue share in 2024. The growing number of vessels and enhanced navigation systems are playing a key role in driving the growth of the ATMS segment in the maritime intelligent transportation market. Market players emphasize collaborating with government authorities to gain high-value contracts and increase their revenue streams.

The ATIS segment is expected to register the highest CAGR from 2025 to 2030. Rapid digitalization in the maritime industry for port optimization, weather forecasting, and sustainable shipping is anticipated to drive the segment growth rapidly through 2030. With advanced ATIS systems, vessel transportation companies can enhance their decision-making to provide enriched support services to the passengers.

Maritime Application Insights

The emergency notification segment accounted for the notable revenue share in 2024. Emergency Medical Systems (EMS) allow boats to share information with other boats, port infrastructure, and sensors using ad-hoc networks to avoid accidents, supporting the industry trend. Advancements in emergency response systems, such as telemedicine and air evacuation, among others, are further driving the segment growth.

The container movement scheduling segment is anticipated to witness the highest CAGR from 2025 to 2030. Shipping and logistics providers focus on real-time visibility into container movements to optimize the vessels & container flows, which is anticipated to propel the segment growth from 2025 to 2030. Moreover, the implementation of cybersecurity solutions to protect the record of the container’s journey and other sensitive data is further accelerating the ITS solutions adoption in the segment.

Regional Insights

North America Intelligent Transportation System (ITS) market held the majority revenue share of over 35.2% in 2024. The region is home to major global players, and is well-equipped with several technologies for the development and implementation of the latest and advanced technologies, such as machine learning, big data, and cloud computing, to manage the increasing traffic and public transportation system. Strong emphasis of the regional governments on improving transportation infrastructure is driving the growth of the ITS market.

U.S. Intelligent Transportation System (ITS) Market Trends

International express delivery in North America is driven by B2C and B2B flows across U.S.-Canada and U.S.-Mexico corridors, along with global trade links to Asia and Europe. Express carriers are enhancing international transit capabilities through cross-border zone optimization, allowing faster customs pre-processing and outbound dispatch. Air express capacity is being expanded through dedicated terminals and sorting infrastructure at major airports like LAX, JFK, and Toronto Pearson. Increasing demand for cross-border returns management is also leading to specialized express solutions tailored for international reverse logistics.

Europe Intelligent Transportation System (ITS) Market Trends

Intelligent Transportation System (ITS) market in Europe is experiencing a significant challenge in terms of traffic congestion, leading to higher traffic volumes, longer commuting times, and waste of energy and non-renewable resources. In response, governments and transportation authorities are shifting to ITS technologies to optimize traffic flow, reduce congestion, and modernize existing infrastructure. Furthermore, key companies in the region are actively participating in the region’s drive against environmental protection and focusing on minimizing energy consumption.

The Intelligent Transportation System (ITS) market in the UK accounted for a significant revenue share of the European market in 2024. The expanding transportation infrastructure, favorable economic policies, and government initiatives for digitization and sustainability transportation infrastructure have boosted the growth of the intelligent transportation market in the UK.

The Intelligent Transportation System (ITS) market in Germany is experiencing high demand due to rising traffic congestion, road safety concerns, and growing pollution. Furthermore, the growth of the urban population is placing additional pressure on the existing transportation system and infrastructure. These factors are expected to drive the demand for intelligent transportation systems in Germany.

The Intelligent Transportation System (ITS) market in France is emphasizing integrating advanced technologies into transportation infrastructure to enhance efficiency and reduce traffic-related problems. The integration of Internet of Things (IoT) devices and connected vehicles has also played a pivotal role in the growth of the ITS market in France.

Asia Pacific Intelligent Transportation System (ITS) Market Trends

The Asia Pacific Intelligent Transportation System (ITS) market is anticipated to witness the highest CAGR from 2025 to 2030. The increasing demand for advanced technology and the continued expansion of transportation networks are expected to drive the regional growth. The economic benefits stemming from the deployment of ITS are particularly notable in countries such as China, India, and Japan. Furthermore, rising pollution levels and the adverse effects of greenhouse gas emissions on the environment have propelled the demand for environmentally friendly transportation in the region, creating robust opportunities for the ITS market.

The Intelligent Transportation System (ITS) market in China is supported by growing initiatives including the development of a highly efficient charging network, promoting the use of green vehicles and smart traffic management systems across the country. This enhances the integration of intercity passenger services and optimizes urban road networks. Such initiatives are expected to boost the adoption of intelligent transportation systems in China.

The Intelligent Transportation System (ITS) market in Japan is experiencing significant growth in the coming years. Japan is known for its breakthrough innovations, efficient transportation system, and technology integrations across the public infrastructure, traffic systems, and transportation systems. This includes advanced traffic management systems, real-time data analysis, and smart signaling. Furthermore, key players in the country are receiving various contracts and driving initiatives for sustainability, energy saving, road safety, and infrastructure development programs to support the growing demand for sustainable and efficient transportation facilities in Japan.

The Intelligent Transportation System (ITS) market in India is experiencing increasing urbanization, traffic congestion, consumer preference toward buying vehicles, and the number of dual-income families have increased the burden on roads and infrastructure. The concerns related to the higher cost of hiring private cabs and taxis, long waiting hours, and traffic congestion in cities such as Delhi, Mumbai, and Bangalore are prompting the need for smart, efficient, and reliable transportation systems in India. Thus, the government in the country is taking initiatives to develop a sustainable, fast, reliable, and affordable transport system, which is propelling the growth of the intelligent transportation market in India.

Key Intelligent Transportation Systems (ITS) Company Insights

The key players operating in the intelligent transportation system (ITS) market include Thales Group, Hitachi, Ltd., NEC Corporation, Siemens AG, and others.

-

Thales Group has a diverse portfolio of solutions spanning various aspects of transportation, including traffic management, rail signaling, communication systems, navigation, and aerospace. This comprehensive range allows Thales to offer end-to-end solutions for complex ITS requirements.

-

NEC Corporation provides advanced traffic management systems that leverage real-time data, analytics, and communication technologies. These systems aim to optimize traffic flow, reduce congestion, and enhance overall transportation efficiency.

Key Intelligent Transportation Systems Companies:

The following are the leading companies in the intelligent transportation systems market. These companies collectively hold the largest market share and dictate industry trends.

- L3Harris Technologies, Inc.

- KONGSBERG

- NEC Corporation

- Teledyne Technologies Incorporated

- Thales Group

- Siemens AG

- Advantech Co., Ltd.

- Aireon

- Indra Sistemas, S.A.

- Hitachi, Ltd.

Recent Developments

-

In July 2023, Hitachi Rail, a division of Hitachi, Ltd., announced the expansion of its digital transport app named 360Pass. Based on this development, Hitachi Rail signed a new contract with Genoa’s (U.S.) city transit authority to connect Genoa's whole public transport infrastructure, including 600,000 citizens and 3,500,000 annual visitors, with the 360-pass digital transport app.

-

In August 2023, Hitachi Rail, a division of Hitachi, Ltd., announced that it had won a contract worth USD 1.96 billion to design and implement digital signaling systems and tracks for a new High Speed/Capacity (HS/C) line traversing the Italian city of Vicenza.

-

In August 2023, NEC Corporation was selected by the UP State Road Transport Corporation (UPSRTC) as a master system integrator for the VLT-PSIS project. This will help curb safety concerns for buses and improve the overall experience as well.

-

In October 2023, DENSO CORPORATION and KOITO MANUFACTURING CO., LTD., a lighting equipment manufacturer for the automobile sector, collaborated to introduce a system to improve nighttime driving safety by enhancing the object recognition accuracy of vehicle image sensors through the coordination of lamps and sensors.

Intelligent Transportation System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 58.3 billion

Revenue forecast in 2030

USD 90.4 billion

Growth rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Transportation mode, roadway offering, roadway system type, roadway application, railway offering, railway system type, railway application, airway offering, airway system type, airway application, maritime offering, maritime system type, maritime application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

L3Harris Technologies, Inc.; KONGSBERG; NEC Corporation; Teledyne Technologies Incorporated; Thales Group; Siemens AG; Advantech Co., Ltd.; Aireon; Indra Sistemas, S.A.; Hitachi, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intelligent Transportation System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intelligent transportation system (ITS) market report based on mode of transportation roadway offering, roadway system type, roadway application, railway offering, railway system type, railway application, airway offering, airway system type, airway application, maritime offering, maritime system type, maritime application, and region.

-

Mode of Transportation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Roadway

-

Railway

-

Airway

-

Maritime

-

-

Roadway Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Interface Boards

-

Sensors

-

Surveillance Cameras

-

Telecommunication Networks

-

Monitoring and Detection Systems

-

Others

-

-

Software

-

Visualization Software

-

Video Detection Management Software

-

Transit Management Software

-

Others

-

-

Services

-

Cloud services

-

Business services

-

Professional services

-

-

-

Roadway System Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Advanced Traveler Information System (ATIS)

-

Advanced Traffic Management System (ATMS)

-

Advanced Transportation Pricing System (ATPS)

-

Advanced Public Transportation System (APTS)

-

Emergency Medical System (EMS)

-

-

Roadway Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Traffic Management

-

Road Safety and Security

-

Freight Management

-

Public Transport

-

Environment Protection

-

Automotive Telematics

-

Parking Management

-

Road Tolling Systems

-

Others

-

-

Railway Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Interface Boards

-

Sensors

-

Surveillance Cameras

-

Telecommunication Networks

-

Monitoring and Detection Systems

-

Others

-

-

Software

-

Visualization Software

-

Video Detection Management Software

-

Transit Management Software

-

Others

-

-

Services

-

Cloud services

-

Business services

-

Professional services

-

-

-

Railway System Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Advanced Traveler Information System (ATIS)

-

Advanced Traffic Management System (ATMS)

-

Advanced Transportation Pricing System (ATPS)

-

Advanced Public Transportation System (APTS)

-

Emergency Medical System (EMS)

-

-

Railway Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rail-running Operation and Collision Avoidance

-

Passenger Information Management

-

Smart Ticketing

-

Security Surveillance

-

Emergency Notification

-

Others

-

-

Airway Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Interface Boards

-

Sensors

-

Surveillance Cameras

-

Telecommunication Networks

-

Monitoring and Detection Systems

-

Others

-

-

Software

-

Visualization Software

-

Video Detection Management Software

-

Transit Management Software

-

Others

-

-

Services

-

Cloud services

-

Business services

-

Professional services

-

-

-

Airway System Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Advanced Traveler Information System (ATIS)

-

Advanced Traffic Management System (ATMS)

-

Advanced Transportation Pricing System (ATPS)

-

Advanced Public Transportation System (APTS)

-

Emergency Medical System (EMS)

-

-

Airway Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Security Surveillance

-

Shuttle Bus Tracking

-

Traveler Information Management

-

Aircraft Traffic Management

-

Smart Ticketing

-

Emergency Notification

-

Others

-

-

Maritime Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Interface Boards

-

Sensors

-

Surveillance Cameras

-

Telecommunication Networks

-

Monitoring and Detection Systems

-

Others

-

-

Software

-

Visualization Software

-

Video Detection Management Software

-

Transit Management Software

-

Others

-

-

Services

-

Cloud services

-

Business services

-

Professional services

-

-

-

Maritime System Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Advanced Traveler Information System (ATIS)

-

Advanced Traffic Management System (ATMS)

-

Advanced Transportation Pricing System (ATPS)

-

Advanced Public Transportation System (APTS)

-

Emergency Medical System (EMS)

-

-

Maritime Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Freight Arrival & Transit

-

Real-time Weather Information Tracking

-

Container Movement Scheduling

-

Emergency Notification

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UKM

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global intelligent transportation system market size was estimated at USD 54.48 billion in 2024 and is expected to reach USD 58.3 billion in 2025.

b. The global intelligent transportation system market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2030 to reach USD 90.4 billion by 2030.

b. The roadway segment accounted for the largest market share of 39.4% in 2024. The constant increase in traffic congestion and greenhouse gas emissions is driving the adoption of roadway intelligent transportation systems, including the use of electric vehicles, Advanced Traffic Management Systems (ATMS), Advanced Public Transportation Systems (APTS), and the deployment of smart infrastructure, among others.

b. Key players operating in the intelligent transportation system market include L3Harris Technologies, Inc.; KONGSBERG; NEC Corporation; Teledyne Technologies Incorporated; Thales Group; Siemens AG; Advantech Co., Ltd.; Aireon; Indra Sistemas, S.A.; and Hitachi, Ltd.

b. The rising need for traffic management solutions across various transport modes such as airways, maritime, roadways & railways has triggered the need for advanced traffic management solutions, driving the growth of the market. The latest technologies, such as electronic toll collection, Next-Generation Air/Ground Communication (NEXCOM), drone traffic management, and blind-spot detection, have resulted in heightened expectations for efficient traffic and transportation networks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.