- Home

- »

- Organic Chemicals

- »

-

Acetone Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Acetone Market Size, Share & Trends Report]()

Acetone Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade, By Application (Solvents, Methyl Methacrylate, Bisphenol A), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-857-2

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Acetone Market Summary

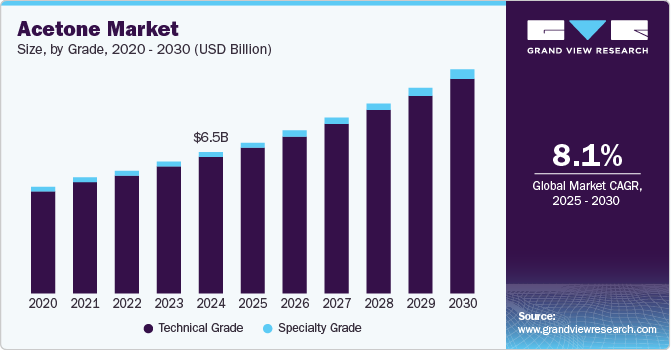

The global acetone market size was estimated at USD 6,464.82 million in 2024 and is projected to reach USD 10.23 billion by 2030, growing at a CAGR of 8.1% from 2025 to 2030. The increasing use of acetone in the production of personal care products, along with the growth of end-use industries such as paints and coatings and pharmaceuticals in emerging economies in the Asia Pacific region, is expected to drive market growth during the forecast period.

Key Market Trends & Insights

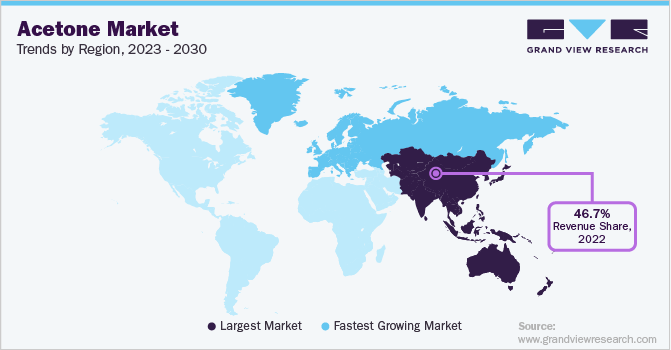

- Asia Pacific acetone market accounted for the largest revenue share of 47.5% in 2024.

- By grade, the technical grade segment accounted for the largest revenue market share of 97.2%, in 2024.

- By application, solvents segment held a revenue share of over 33.6% in 2024.

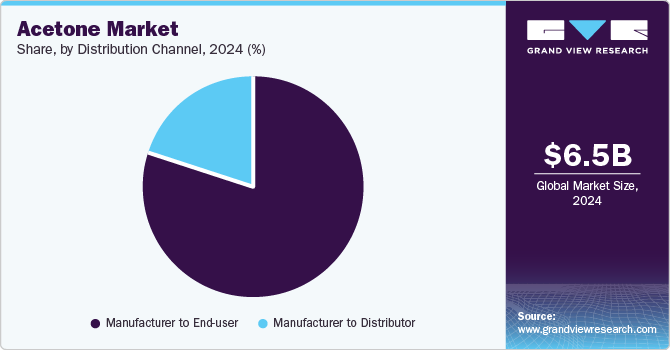

- By distribution channel, the distribution channel from manufacturer to distributor and end-user plays a vital role in product distribution.

Market Size & Forecast

- 2024 Market Size: USD 6,464.82 Million

- 2030 Projected Market Size: USD 10.23 Billion

- CAGR (2025-2030): 8.1%

- Asia Pacific: Largest market in 2024

The most common and significant aliphatic ketone is 2-propanone, known as acetone or dimethyl ketone. Acetone is produced by alkylating benzene with propylene to form cumene, which is then subjected to an air oxidation process that yields acetone and phenol. Typically, facilities that produce acetone also integrate phenol production. Acetone is widely used to manufacture bisphenol-A (BPA), methyl methacrylate (MMA), and solvents for rubber, oils, lacquers, resins, fats, cement, and waxes.

The product is used to manufacture BPA, which is then used to produce polycarbonate. Polycarbonate has various applications in the automotive industry, including windows, sunroofs, headlights, and taillights. The increasing demand for polycarbonates is expected to drive up the production of BPA.

Acetone is widely used in the industrial sector for various applications, including paints and coatings, adhesives, disinfectants, and thinners. It serves as a solvent in pharmaceutical products, such as hand sanitizers, and acts as an excipient in medications. Acetone is primarily employed as a solvent for plastics, resins, varnishes, lacquers, fats, oils, rubber cement, and waxes. Additionally, it is utilized as an intermediate in producing polymethyl methacrylate (PMMA) within the industrial sector.

Acetone is a solvent commonly used in the cosmetics industry. It is the primary ingredient in nail polish remover and various skin cream products. Additionally, it is utilized in skin peeling treatments to help combat acne. The growing demand for acetone in these applications will drive market growth in the coming years.

Drivers, Opportunities & Restraints

The pharmaceutical industry is experiencing significant growth, primarily driven by an increased demand for solvents used in the production of drugs and formulations. Solvents are crucial in various processes, including extraction, purification, and synthesis of active pharmaceutical ingredients (APIs). As the demand for new and innovative medications rises, especially in the wake of global health challenges, the need for high-quality solvents becomes even more critical. The push for advanced drug delivery systems and biopharmaceuticals further amplifies the requirement for specialized solvents. This trend is expected to continue, presenting a strong growth opportunity for solvent manufacturers within the pharmaceuticals sector.

Acetone is safe when consumers and manufacturers adhere to the appropriate guidelines. However, inhaling or ingesting acetone can lead to mild irritation and may depress the central nervous system. Additionally, acetone is a highly flammable liquid. It can behave like an explosive liquid at temperatures exceeding its flashpoint, potentially causing flash fires. This risk may hinder market growth. On a positive note, acetone has a high ignition initiation energy point, meaning it does not auto-ignite. Industrial-grade dimethyl ketone contains a small amount of water, which helps inhibit ignition.

The acetone market presents various opportunities driven by increasing demand from the pharmaceutical, cosmetic, and automotive industries. As a key solvent and precursor for manufacturing chemicals like methyl methacrylate, the growth of the acrylic market further enhances acetone's relevance. Additionally, the rising trend of nail care products and the push for eco-friendly solvents open new avenues for innovative uses of acetone. Furthermore, advancements in production techniques and the exploration of bio-based acetone offer the potential for sustainability and cost reduction, making it an attractive area for investment and expansion.

Grade Insights

The technical grade segment accounted for the largest revenue market share of 97.2%, in 2024 and is expected to continue to dominate the industry over the forecast period. The increase in the consumption of technical products for MMA (methyl methacrylate) and BPA (bisphenol A) is notable. The widespread availability of these technical-grade products at lower costs contributes to their more significant market share. Technical-grade materials are primarily used in applications such as lacquers, adhesives, and floor polishing, among others.

The increasing construction activities are expected to drive demand for technical-grade acetone due to its use in adhesive cement and concrete admixtures. As construction activities resume worldwide following the lockdown, this trend will likely continue to boost demand for acetone in the construction sector during the forecast period.

Application Insights

Solvents held a revenue share of over 33.6% in 2024. The increase in demand for acetone can be attributed to its role as a key ingredient in the production of hand sanitizer and as an excipient in pharmaceuticals. Active fillers use acetone as a solvent to ensure that each dose of medication contains the correct amount. Additionally, isopropyl alcohol (IPA), also used in hand sanitizer manufacturing, is expected to further drive the demand for acetone as a raw material in the production of IPA.

Methyl methacrylate is projected to experience a CAGR of 8.2% during the forecast period. This growth is primarily due to its application in the automotive industry for manufacturing various components. Acetone serves as a key raw material in the production of methyl methacrylate, which is subsequently utilized in exterior car coatings, auto glazing, and essential car parts, including headlamps, bulletproof glass, windows, taillights, and sunroofs.

Distribution Channel Insights

The distribution channel from manufacturer to end user in the acetone market is crucial for ensuring product availability and transparency. Manufacturers produce acetone in large quantities and may supply it directly to end users, such as chemical companies or manufacturers in various industries, thereby eliminating intermediaries. This direct channel facilitates better pricing and quicker delivery times and fosters strong relationships between manufacturers and end users. Additionally, this approach allows for tailored solutions to meet specific customer needs and promotes efficient inventory management. The direct distribution channel enhances the supply chain's effectiveness, benefiting both parties.

The distribution channel from manufacturer to distributor and end-user plays a vital role in product distribution. Manufacturers produce acetone in bulk and often sell it to distributors, who then handle the logistics of delivering it to various end users, such as chemical companies and manufacturers across different sectors. This intermediary step allows distributors to manage inventory and provide localized support, ensuring that acetone is readily available where it's needed. Additionally, this channel can enhance market reach and provide end users with various options, thus improving overall service and responsiveness to demand. Furthermore, it enables manufacturers to focus on production while leveraging distributors' expertise in distribution and customer relationships.

Regional Insights

Asia Pacific Acetone Market Trends

Acetone market in the Asia Pacific is growing due to high demand from various end-user industries, including pharmaceuticals, personal care and cosmetics, and automotive. This demand has been particularly strong in China, India, and Japan. China is the largest consumer of acetone and is expected to further boost product consumption due to growth in its pharmaceutical and electronics sectors.

North America Acetone Market Trends

Acetone market in North America is witnessing demand from solvent manufacturing companies. The United States is a major hub for automotive manufacturers, producing 9.2 million vehicles in 2022, a 4.0% increase compared to 2021. This growth is expected to boost the demand for acetone within the automotive industry. The increasing demand for personal care, skincare, and beauty products is anticipated to drive product demand in Canada and the U.S.

Europe Acetone Market Trends

Acetone market in Europe is growing due to the rising demand from sectors like skincare, lifestyle, and cosmetics. Increasing awareness of skin and beauty care among the population is expected to further boost European demand for these products.

Latin America Acetone Market Trends

Acetone market in Latin America is witnessing a significant growth of the cosmetic and personal care industry, mainly in Brazil, due to the increasing demand for cosmetics and personal care products. Brazil and other regional countries are likely to enhance the personal care industry in Latin America during the forecast period.

Middle East & Africa Acetone Market Trends

Middle East & Africa acetone market has diverse climates and environmental conditions contribute to varying skincare needs, prompting consumers to seek effective moisturizing solutions that can address issues like dryness and irritation.

Key Acetone Company Insights

Some of the key players operating in the market include INEOS, Honeywell International Inc, and CEPSA Quimica, S.A.

-

INEOS is a British multinational conglomerate that manufactures chemicals, oil products, and other goods for a wide range of industries, including chemicals, operations, fuel, packaging, food, construction, and automotive. INEOS' products are used in many industries that touch our daily lives, including medicines, mobile phones, agriculture, automotive, construction, technology, and textiles.

-

Shell Plc, formerly Royal Dutch Shell Plc, is an integrated oil and gas company. It explores and produces oil and gas from both conventional fields and unconventional sources, such as tight rock, shale, and coal formations. Shell operates refining and petrochemical complexes worldwide and offers a variety of products, including lubricants, bitumen, liquefied petroleum gas, and petrochemical products that serve as raw materials for plastics, coatings, and detergents. The company is also a significant producer of biofuels in Brazil and is interested in various liquefied natural gas (LNG) and gas-to-liquids (GTL) projects. Shell is vital in the energy sector and has a global presence.

Key Acetone Companies:

The following are the leading companies in the acetone market. These companies collectively hold the largest market share and dictate industry trends.

- INEOS

- Shell plc

- Honeywell International Inc

- Mitsui Chemicals, Inc.

- CEPSA Quimica, S.A.

- SABIC

- Arkema

- Solvay

- DOMO Chemicals

- Kumho P&B Chemicals

Recent Developments

-

In January 2024, Haldia Petrochemicals Ltd, located in Kolkata, launched a significant phenol plant in India. The plant is expected to be completed by the first quarter of 2026. Once operational, the plant will produce 185,000 tons per annum (KTPA) of acetone and 300,000 tons of phenol yearly.

-

In December 2023, PTT Global Chemical (PTTGC), based in Thailand, announced its plans to resume acetone and phenol production at 90% capacity by the end of the month. This initiative aims to enhance resource allocation and improve operational efficiency. The company's manufacturing facility has an annual production capacity of 150,000 tons of acetone and 250,000 tons of phenol.

Acetone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,920.69 million

Revenue forecast in 2030

USD 10.23 billion

Growth Rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Belgium; CIS Nations; China; India; Japan; South Korea; Taiwan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

INEOS; Shell plc; Honeywell International Inc.; Mitsui Chemicals, Inc.; CEPSA Quimica S.A.; SABIC; Arkema; Solvay; DOMO Chemicals; Kumho P&B Chemicals.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

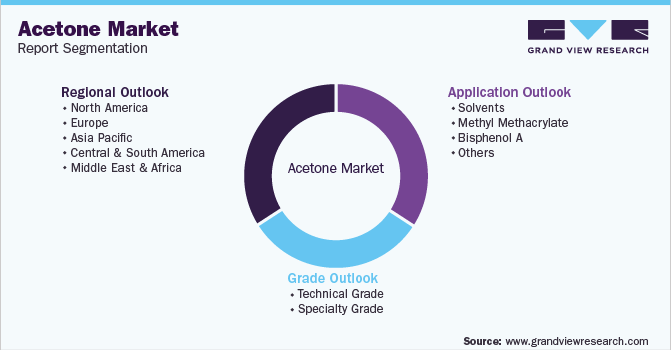

Global Acetone Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acetone market report based on grade, application, distribution channel, and region.

-

Grade Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Technical Grade

-

Specialty Grade

-

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Solvents

-

Methyl Methacrylate

-

Bisphenol A

-

Other Applications

-

-

Distribution Channel Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Manufacturer to Distributor

-

Manufacturer to End User

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Belgium

-

CIS Nations

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the acetone market include INEOS, Shell Plc, Honeywell International, Inc., Mitsui Chemicals, Inc., SABIC, Solvay, and others.

b. Key factors that are driving the market growth include the rising utilization of acetone in the production of personal care products and growing end-use industries including paints & coatings and pharmaceutical industries in the emerging economies of Asia Pacific.

b. The global acetone market size was estimated at USD 6,464.82 million in 2024 and is expected to reach USD 6,920.69 million in 2025.

b. The global acetone market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 10.23 billion by 2030.

b. Asia Pacific dominated the acetone market with a share of 47.5% in 2024. This is attributable to growing industrialization and shifting of manufacturing units to the region due to affordable infrastructure and labor costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.