- Home

- »

- Organic Chemicals

- »

-

Alcohol Ethoxylates Market Size & Share, Industry Report, 2018 - 2025GVR Report cover

![Alcohol Ethoxylates Market Size, Share & Trends Report]()

Alcohol Ethoxylates Market (2018 - 2025) Size, Share & Trends Analysis Report By Product (Fatty Alcohol, Lauryl Alcohol, Linear Alcohol), By Application (Emulsifier, Dispersing Agent, Wetting Agent), By End-use, And Segment Forecasts

- Report ID: GVR-1-68038-950-0

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2025

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

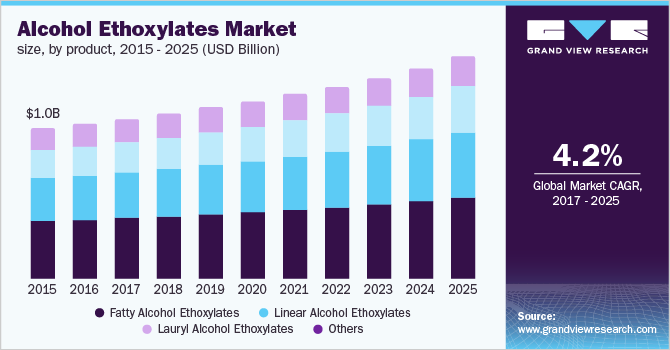

The global alcohol ethoxylates market size to be valued at USD 7.45 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% during the forecast period. Growing demand for the product of high-grade industrial & institutional and household cleaners is expected to drive the market growth over the forecast period. In addition, the rising demand for biodegradable surfactants by the application industries is expected to drive the market growth. The demand for lauryl alcohol ethoxylates for cleaning purposes in industrial & institutional and household detergents is expected to drive the market growth. Growing demand for the low foam and low rinse products is expected to result in an increase in the demand for such products over the forecast period. In addition, the favorable biodegradable nature of the aforementioned product is expected to lead to rising demand for the product over the next eight years.

The industry in the U.S. is highly diverse and includes a number of primary product manufacturing industries accounting for high consumption levels of alcohol ethoxylates. The manufacturers involved in the production exhibit high levels of integration and are involved in the production of raw materials such as ethylene oxide thereby raising their profit margins.

The industry is characterized by the presence of stringent regulations governing the extent of toxic chemicals used in the surfactants. Consumers in the economy lay high emphasis on the use of environmentally safe products which leads to the production of low VOC content alcohol ethoxylates.

A large number of manufacturers are integrated into the production of raw materials including ethylene oxide which leads to a lowering of the production cost. A high proportion of total production cost for alcohol ethoxylates comprises the cost involved in raw material sourcing. The demand for ethylene oxide for alternate industries is expected to restrain the market growth.

The price for the product is expected to grow on account of the rising prices of ethylene oxide and fatty alcohols. Growing prices of crude palm oil and palm kernel oil coupled with upstream volatility observed in the fatty alcohol market resulted in an increase in the product price in 2016. The prices for ethylene oxide were increasing at a slow rate with the cumulative effect leading to the growth in the price for alcohol ethoxylates.

Alcohol Ethoxylates Market Trends

The rising demand for high-quality household and industrial cleaning products and the growing demand for biodegradable surfactants, the rise in low-rinse detergents, high demand for low-foam, and rising awareness about hygiene are the primary factors driving the market growth. Other key factors driving the global market growth include increasing applications of alcohol ethoxylates in agricultural industries, pharmaceuticals, cosmetics, and textiles as well as stringent government regulations prohibiting the use of surfactants containing toxic chemicals.

The product’s environmental impact is one of the factors that hinders the market growth. Nonylphenol ethoxylates are used in the production of soaps, detergents, and other cleaning agents. This is becoming a significant impediment to the market growth of alcohol ethoxylates. Similarly, raw material price volatility is a limiting factor to the growth of the market.

The demand for low volatile organic compound (VOCs) products like alcohol ethoxylate is expected to rise owing to the low volatility when compared with other organic compounds. Moreover, there is a huge growth opportunity for low VOC products as the key market players are investing significantly in untapped market segment. Alcohol ethoxylates are widely used in the paint and coating sectors as pigment dispersing agents that generate opportunities for the market growth.

The market is facing a number of challenges that are stifling its growth. One of the factors such as the availability of lower-cost alternatives. Furthermore, strict government regulations related to the manufacturing of toxic chemicals are expected to be the most significant challenge to the growth of the market.

Product Insights

Fatty alcohol ethoxylates are the most widely used products on account of their superior properties that aid in cleaning in the household and industrial applications and generated a revenue of USD 1,936.4 Million in 2016. The products find extensive applications for cleaning in industries on account of low levels of toxicity. The use of the product in cream bases in the personal care industry is expected to drive growth over the forecast period.

The demand for advanced low foaming detergents and cleaners in industrial applications is expected to drive the market growth for lauryl alcohol ethoxylates. The product is available in colorless liquid or water-soluble white waxy physical states with the color change due to the number of carbon atoms attached to the chemical composition. The product finds extensive use in a variety of applications including emulsification, industrial and institutional cleaners, and agricultural chemicals.

Linear alcohol ethoxylates can be manufactured through both natural and synthetic sources and find high use in cleaning applications. The use of the product for detergent formulations coupled with low to negligible toxicity levels associated with the products is expected to drive market growth over the forecast period.

Linear alcohol ethoxylates are extensively manufactured by major players such as Stepan Company and Evonik AG for a range of applications across industries. The products exhibit a high degree of primary and ultimate biodegradability with around 80% degradation in around 25 days, thereby accounting for high adoption by major consumers across the globe.

Application Insights

The demand for the product for emulsifiers is expected to register a growth of 4.5% from 2017 to 2025, due to the high stabilizing characteristics of oil-water emulsions exhibited by the product. The HLB value of such products based on oil-water emulsions can be varied for any hydrophobic part, with the chemicals exhibiting low reactivity with impurities in both oil and aqueous phases such as ion, thereby making them an ideal choice for emulsions.

The demand for the products as dispersing agents is expected to be driven by the rising consumption of paints and industrial coatings. The market for products such as tridecyl alcohol ethoxylate is expected to exhibit growth due to the development of the building & construction industry. In addition, superior stabilizing action of the products is in dispersions is expected to drive growth.

High demand for fatty alcohols as wetting agents due to superior low foaming characteristics is expected to drive the market growth with the segment expected to realize a revenue of USD 2,033.3 Million by 2025. The demand for branched alcohol ethoxylates for hard surface wetting agents is expected to emerge as the major growth driver over the forecast period.

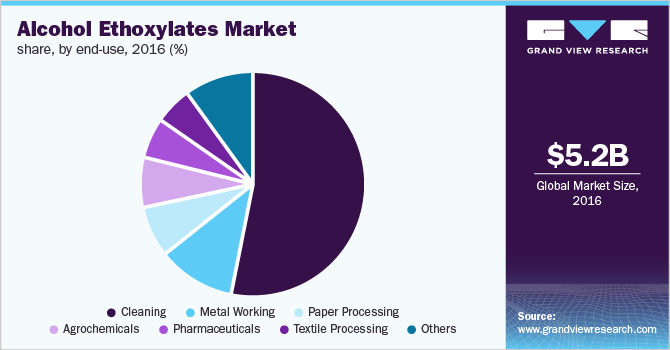

End-use Insights

The product finds extensive use in metalworking fluids accounting for 11.3% of the market revenue in 2016, due to its superior performance in oil-based emulsions used in such formulations. The metalworking industry requires a considerable volume of fluids to aid in processing involving cutting, drawing, forging, drilling, rolling, etc. The use of fluids for such processes leads to a reduction in the damage caused by friction.

The market for the product in the paper and pulp industry is expected to grow on account of product use in de-inking of waste paper. The segment accounts for limited use of alcohol ethoxylates thereby casting a limited effect on the market dynamics. The advent of advanced technology devices has reduced the demand for paper leading to a reduction in the demand for the product.

The demand for the product in the pharmaceutical industry is expected to emerge as one of the major growth drivers over the forecast period. The products find high use in pharmaceutical formulations such as creams, lotions, and ointments. Superior performance and emulsification properties exhibited by the product are expected to lead to increased demand over the forecast period.

The use of alcohol ethoxylates for waxes improves the stability characteristics of wax emulsions thereby accounting for product consumption. The products also find use in the paint industry wherein it is used as a pigment dispersion. The growth of the construction industry is expected to emerge as the major growth driver for the industry over the forecast period.

Regional Insights

The industry in North America is expected to grow on account of the rising demand for low rinse and low foam detergents. Growing consumption of industrial cleaners in the region driven by the prevalence of a large number of manufacturers is expected to drive growth over the forecast period.

The market in Europe accounted for 34.7% of the global revenue in 2016, driven by the high adoption levels of the product coupled with the presence of a highly developed industrial sector. The market is expected to register limited growth on account of the rising maturity levels of the application industries in the region.

The market for ethoxylates in the region is expected to be driven by the rapid industrial development in economies including China, India, and Japan, with the region expected to grow at a CAGR of 5.6% from 2017 to 2025. Growing demand for front loading washing machines primarily in the developing economies is expected to drive the demand for detergents leading to growth.

Key Companies & Market Share Insights

The industry is highly competitive with the presence of a number of multinational companies across the major economies. The companies operate in multiple locations through a combination of manufacturing facilities and sales offices. The product distribution is carried out by several sales locations across the area of operation that employ direct distribution and third-party distribution agencies.

The companies provide the product at competitive prices to increase the annual revenues. In addition, the development of advanced ethoxylates with minimal VOC contents by major manufacturers is expected to drive growth over the forecast period.

Recent Developments

-

In March 2022, Huntsman announced doubling the size of its repurchase authorization to USD 2 billion from an older plan of USD 1 billion in 2022.

-

In October 2022, Stepan Company announced plans to operate and construct a new alkoxylation plant in Texas and Pasadena facility. Alkoxylates are a type of surfactant that is widely used in oilfield, construction, agricultural, and home appliances. Stepan's USD 220.0 million investment will stipulate 75,000 metric tonnes per year of flexible capacity capable of propoxylation and ethoxylation, and enhance the company to cater to the increasing demands for polymer and surfactant businesses.

Alcohol Ethoxylates Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 5.75 billion

Revenue forecast in 2025

USD 7.45 billion

Growth Rate

CAGR of 4.2% from 2018 to 2025

Base year for estimation

2016

Historical data

2014 - 2016

Forecast period

2017 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, End-Use, Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, South Korea, Brazil, Argentina, South Africa

Key companies profiled

AkzoNobel N.V., BASF SE, Clariant AG, Dow Chemical Company, E.I. du Pont de Nemours and Company, Evonik Industries AG, Huntsman International LLC, India Glycols Limited, Mitsui Chemicals, Inc., Royal Dutch Shell plc, SABIC, Sasol Limited, Solvay S.A., and Stepan Company.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Alcohol Ethoxylates Market SegmentationThis report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global alcohol ethoxylates market on the basis of product, application, end-use, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Fatty Alcohol Ethoxylates

-

Lauryl Alcohol Ethoxylates

-

Linear Alcohol Ethoxylates

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Emulsifier

-

Dispersing Agent

-

Wetting Agent

-

Others

-

-

End-use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Cleaning

-

Metal Working

-

Textile Processing

-

Paper Processing

-

Agrochemicals

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global alcohol ethoxylates market size was estimated at USD 5.75 billion in 2019 and is expected to reach USD 5.97 billion in 2020.

b. The global alcohol ethoxylates market is expected to grow at a compound annual growth rate of 4.2% from 2017 to 2025 to reach USD 7.45 billion by 2025.

b. Asia Pacific dominated the alcohol ethoxylates market with a share of 33.4% in 2019. This is attributable to rapid industrial development in economies including China, India, & Japan and growing demand for front loading washing machines primarily in the developing economies.

b. Some key players operating in the alcohol ethoxylates market include AkzoNobel N.V., BASF SE, Clariant AG, Dow Chemical Company, E.I. du Pont de Nemours and Company, Evonik Industries AG, Huntsman International LLC, India Glycols Limited, Mitsui Chemicals, Inc., Royal Dutch Shell plc, SABIC, Sasol Limited, Solvay S.A., and Stepan Company.

b. Key factors that are driving the market growth include growing demand for the product for high grade industrial & institutional and household cleaners.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.