- Home

- »

- Agrochemicals & Fertilizers

- »

-

Ammonium Sulfate Market Size, Share, Growth Report, 2030GVR Report cover

![Ammonium Sulfate Market Size, Share & Trends Report]()

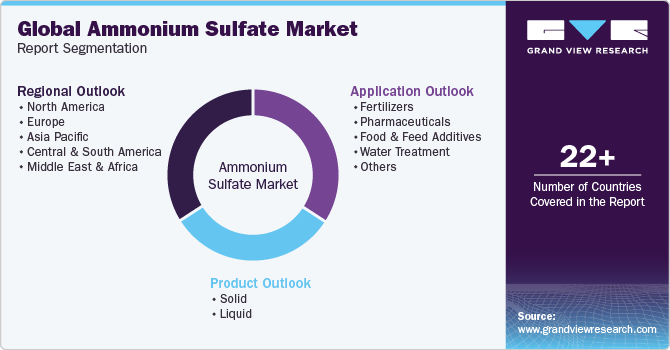

Ammonium Sulfate Market (2025 - 2030) Size, Share & Trends Analysis Report By End-use (Solid, Liquid), By Application (Fertilizer, Pharmaceutical, Food & Feed Additive), By Region, And Segment Forecasts

- Report ID: 978-1-68038-702-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ammonium Sulfate Market Summary

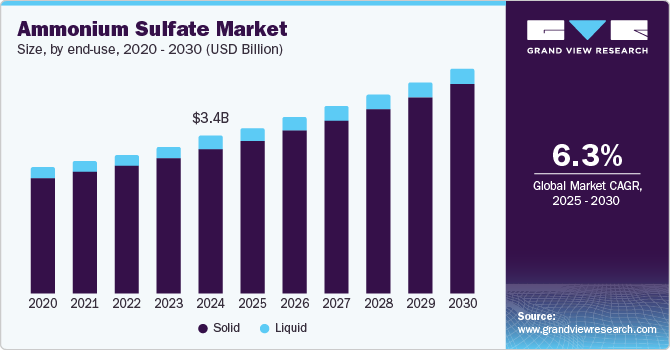

The global ammonium sulfate market size was estimated at USD 3.36 billion in 2024 and is projected to reach USD 4.81 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. This growth is attributed to the increasing agricultural activities and the rising demand for nitrogen-based fertilizers are significant contributors, as ammonium sulfate effectively addresses nitrogen and sulfur deficiencies in crops.

Key Market Trends & Insights

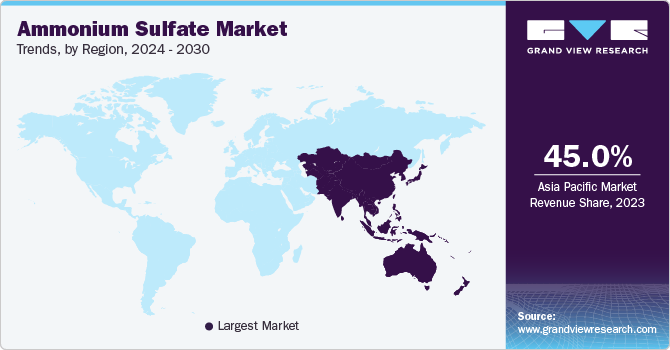

- Asia Pacific dominated the global ammonium sulfate market, with a revenue share of 38.1% in 2024.

- By end use, the solid end use segment led the market, with a revenue share of 91.7% in 2024.

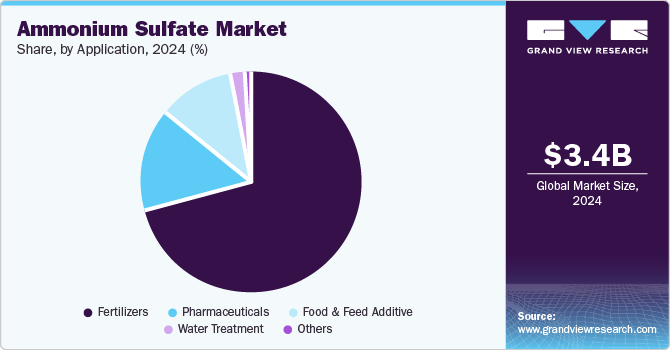

- By application, the fertilizers application segment led the market, with a revenue share of 70.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.36 Billion

- 2030 Projected Market Size: USD 4.81 Billion

- CAGR (2025-2030): 6.3%

- Asia Pacific: Largest market in 2024

In addition, its expanding applications in industrial sectors, such as chemical manufacturing and water treatment, further propel market growth. Furthermore, the trend towards sustainable agriculture and the adoption of eco-friendly fertilizers also enhance the demand for ammonium sulfate, positioning it as a key component in both agricultural and industrial applications.

Ammonium sulfate is a chemical compound commonly used as a fertilizer. It consists of nitrogen and sulfur, which are essential nutrients for plant growth. The market for ammonium sulfate is growing due to advancements in production techniques, particularly the vacuum thermal stripping and vacuum absorption processes. These innovative methods enable manufacturers to produce high-purity ammonium sulfate granules efficiently. By utilizing vacuum thermal stripping, ammonia can be extracted from digestate and absorbed into sulfuric acid, forming high-quality crystals.

In addition, ammonium sulfate production relies heavily on the crude oil industry for energy and raw materials. This dependency creates opportunities for optimizing production processes to minimize carbon footprints by incorporating renewable energy sources and bio-based raw materials. Furthermore, the agricultural sector is also a significant driver of market growth, as ammonium sulfate serves as an effective fertilizer for restoring nitrogen-deficient soils, particularly in alkaline conditions. With the growing global population and the subsequent need for food crops, the demand for agrochemicals such as ammonium sulfate is expected to rise.

Moreover, the industrial sector's increasing adoption of ammonium sulfate for diverse applications such as wood preservation, water treatment, and flame retardants contributes to market expansion. In water treatment processes, ammonium sulfate is combined with chlorine to produce disinfectants, enhancing public awareness of purified water consumption. Its use as a flame retardant improves material combustion characteristics while reducing weight loss during burning.

End-use Insights

The solid end-use segment dominated the market and accounted for the largest revenue share of 91.7% in 2024. This growth is attributed to its effectiveness as a fertilizer, particularly in agriculture. Solid ammonium sulfate is widely utilized to provide essential nitrogen and sulfur nutrients to crops, improving soil fertility and enhancing agricultural productivity. In addition, as global food demand rises due to population growth, the need for efficient fertilizers becomes increasingly critical. Furthermore, solid ammonium sulfate is favored for its ease of application and storage, making it a preferred choice among farmers seeking reliable nutrient solutions for their crops.

The liquid end-use segment is expected to grow at a CAGR of 4.3% over the forecast period, owing to its applications in various industrial processes, including water treatment and chemical manufacturing. Liquid ammonium sulfate is often used as a flocculating agent in water purification, aiding in the removal of impurities and enhancing water quality. In addition, its versatility extends to use in pharmaceuticals and food processing, where it serves as an acidity regulator and nutrient source. Furthermore, the growing emphasis on clean water access and sustainable industrial practices further drives the adoption of liquid ammonium sulfate, positioning it as a valuable component across multiple sectors.

Application Insights

The fertilizers application segment led the market and accounted for the largest revenue share of 70.6% in 2024, primarily driven by its effectiveness as a nitrogen and sulfur source for crops. Ammonium sulfate is particularly beneficial for alkaline soils, helping to restore soil fertility and enhance agricultural productivity. As global food demand increases due to population growth, farmers are increasingly adopting ammonium sulfate to improve crop yields. The rising awareness of sustainable agricultural practices further boosts its popularity, positioning ammonium sulfate as a preferred choice among fertilizers in modern farming.

The pharmaceuticals application segment is expected to grow at a CAGR of 7.6% from 2025 to 2030, owing to its versatile uses in drug formulation and production processes. It is an important ingredient in various pharmaceutical applications, including protein purification and a buffering agent. In addition, the increasing focus on developing new medications and vaccines drives the need for high-quality raw materials such as ammonium sulfate. Furthermore, its role in wastewater treatment processes enhances its appeal within the pharmaceutical industry, contributing to the overall growth of the ammonium sulfate market across diverse applications.

Regional Insights

The Asia Pacific ammonium sulfate market dominated the global market and accounted for the largest revenue share of 38.1% in 2024. This growth is attributed to the increasing agricultural activities and a rising demand for nitrogen-based fertilizers. As the region experiences rapid industrialization and population growth, effective fertilizers are critical to enhance crop yields. In addition, government initiatives supporting sustainable agricultural practices and improving soil health further propel the adoption of ammonium sulfate. Furthermore, the region's significant agricultural output, particularly in countries such as India and China, reinforces the demand for this essential nutrient source.

The China ammonium sulfate market led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by the country's robust agricultural sector and its focus on enhancing food production. As one of the largest consumers of fertilizers globally, China’s increasing need for effective nitrogen sources drives the demand for ammonium sulfate. Furthermore, government policies to improve agricultural productivity and sustainability encourage farmers to adopt advanced fertilizers. Moreover, the combination of a growing population and limited arable land intensifies the pressure on farmers to maximize yields, further boosting ammonium sulfate consumption.

Europe Ammonium Sulfate Market Trends

TheEurope ammonium sulfate market is expected to grow at a CAGR of 7.0% over the forecast period, owing to stringent regulations promoting sustainable farming practices and reducing environmental impacts. The European Union’s commitment to sustainability encourages using eco-friendly fertilizers, including ammonium sulfate, which effectively improves soil quality. In addition, the rising demand for organic farming methods and high-quality food bolsters the market as farmers seek reliable nutrient sources. Furthermore, the emphasis on reducing carbon footprints in agriculture also supports the adoption of ammonium sulfate as a preferred fertilizer option.

The France ammonium sulfate market dominated the European market and accounted for the largest revenue share in 2024, due to a strong agricultural tradition and a focus on enhancing crop yields through effective fertilization. The country's diverse agricultural landscape, including vineyards and cereal production, creates a consistent demand for nitrogen-rich fertilizers such as ammonium sulfate. Furthermore, French government initiatives promoting sustainable agriculture and environmental stewardship encourage farmers to utilize efficient nutrient sources. Moreover, the rising consumer preference for high-quality food products further drives the need for reliable fertilizers that enhance soil fertility and crop productivity.

North America Ammonium Sulfate Market Trends

The North America ammonium sulfate market is expected to grow significantly over the forecast period, driven by an increasing focus on sustainable agriculture practices and growing awareness of soil health. Farmers are increasingly adopting ammonium sulfate as an effective nitrogen fertilizer to improve crop yields while addressing specific soil deficiencies. In addition, the rise in organic farming practices in North America promotes the use of environmentally friendly fertilizers such as ammonium sulfate. Furthermore, the growing demand for food products due to population growth further supports market expansion as agricultural producers seek reliable nutrient sources for optimal crop performance.

U.S. Ammonium Sulfate Market Trends

The U.S.ammonium sulfate market dominated the North American market and held the largest revenue share in 2024, owing to significant agricultural activity and a strong emphasis on enhancing crop productivity. As one of the largest consumers of fertilizers worldwide, U.S. farmers increasingly rely on ammonium sulfate to provide essential nutrients for various crops. Furthermore, government programs supporting sustainable farming practices encourage the adoption of efficient fertilizers that improve soil quality. Moreover, the continuous innovation in agricultural technologies also contributes to increased demand for ammonium sulfate as farmers seek effective solutions to optimize their yields amidst changing environmental conditions.

Key Ammonium Sulfate Company Insights

Key players in the global ammonium sulfate industry include Evonik, Sumitomo Corporation, Lanxess, and others. These companies are implementing various strategies to enhance their competitive positioning. These strategies include forming partnerships and collaborations to expand market reach, investing in research and development for innovative product offerings, and optimizing production processes for efficiency. In addition, companies are focusing on geographical expansion to tap into emerging markets and increase their operational footprint. Furthermore, mergers and acquisitions are common as firms seek to consolidate resources and capabilities, strengthening their overall market presence.

-

Evonik specializes in the production of liquid ammonium sulfate solutions, specifically blueSulfate, and potassium-based fertilizers such as AgraLi. These products are co-products derived from the company’s methionine production process, which primarily serves the animal nutrition sector. The company operates within the agricultural segment, focusing on providing effective and sustainable nutrient solutions for crops.

-

Sumitomo Corporation manufactures and distributes various chemical products, including fertilizers. The company operates across multiple segments, focusing on agricultural chemicals and fertilizers that support crop growth and soil health. The company’s ammonium sulfate offerings cater to diverse agricultural needs, providing essential nutrients to enhance crop yields.

Key Ammonium Sulfate Companies:

The following are the leading companies in the ammonium sulfate market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Evonik

- Sumitomo Corporation

- Lanxess

- Domo Chemicals

- Arkema

- Fibrant

- Royal DCM

- Novus International

- ArcelorMittal

Recent Developments

-

In March 2023, Enva announced the commencement of construction on a groundbreaking fertilizer manufacturing facility in Greenogue, Dublin. This investment was expected to produce agricultural fertilizer pellets containing ammonium sulfate recovered from industrial liquid wastes. Enva's initiative aligned with circular economy goals and enhances Ireland's self-sufficiency in fertilizer production, minimizing the need for imported virgin materials.

Ammonium Sulfate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.54 billion

Revenue forecast in 2030

USD 4.81 billion

Growth Rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, China, India, Japan, Indonesia, Vietnam, Germany, UK, France, Netherlands, Italy, Brazil, Argentina, Iran, Egypt

Key companies profiled

BASF; Evonik; Sumitomo Corporation; Lanxess; Domo Chemicals; Arkema; Fibrant; Royal DCM; Novus International; ArcelorMittal

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ammonium Sulfate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the ammonium sulfate market report based on end-use, application, and region.

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solid

-

Liquid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fertilizers

-

Pharmaceuticals

-

Food & Feed Additive

-

Water Treatment

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Netherlands

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Iran

-

Egypt

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.