- Home

- »

- Agrochemicals & Fertilizers

- »

-

Agrochemicals Market Size, Share & Growth Report, 2030GVR Report cover

![Agrochemicals Market Size, Share & Trends Report]()

Agrochemicals Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fertilizers, Crop Protection Chemicals), By Application (Cereal & Grains, Oilseeds & Pulses, Fruits & Vegetables), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-935-7

- Number of Report Pages: 204

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Agrochemicals Market Summary

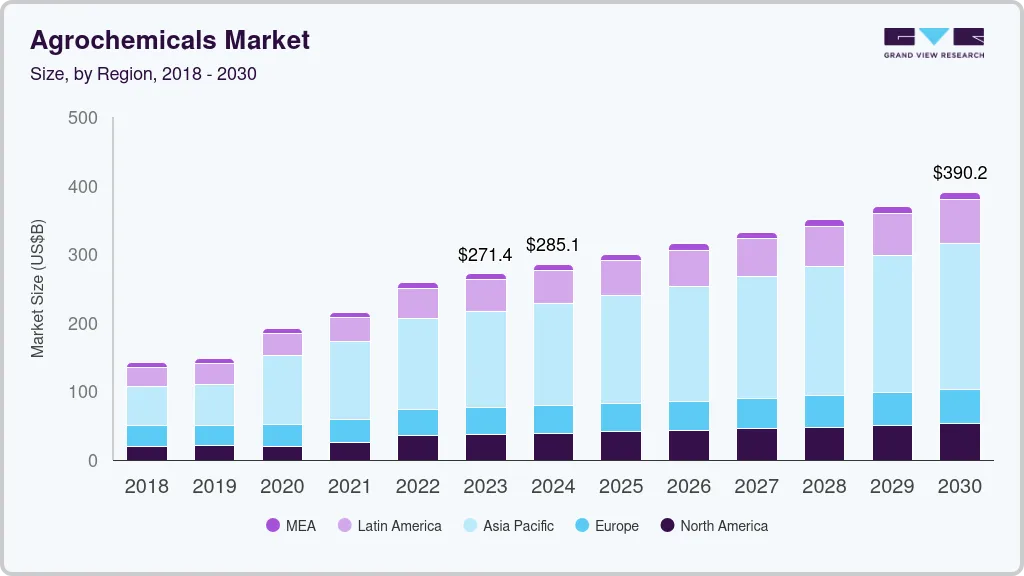

The global agrochemicals market size was valued at USD 271.42 billion in 2023 and is projected to reach USD 390.17 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. This is attributable to growing demand for fertilizers and crop protection products globally.

Key Market Trends & Insights

- The Asia Pacific agrochemicals market held a substantial share of 51.98% of revenue in 2023.

- The presence of agrochemical manufacturers in the U.S. has a significant impact on the market by reducing dependency on other countries for agrochemical imports.

- In terms of products, the fertilizers segment dominated the market with a revenue share of 76.98% in 2023.

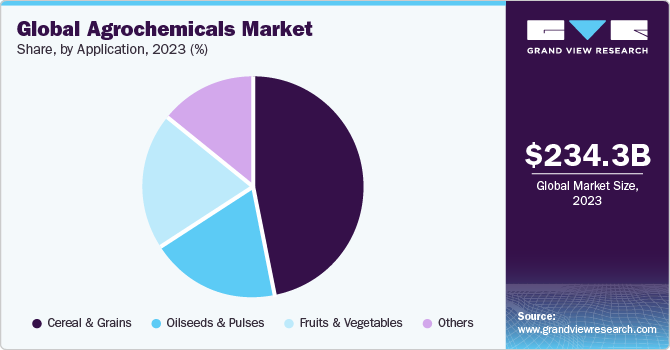

- In terms of application, the cereal & grains segment held a lion's share of 47.02% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 271.42 Billion

- 2030 Projected Market Size: USD 390.17 Billion

- CAGR (2024-2030): 4.7%

- Asia Pacific: Largest market in 2023

Moreover, rising adoption of precision farming methods along with shrinking agricultural land and increasing demand for food to cater the rising population are further expected to bolster the market growth in the coming years. Agrochemicals, also known as crop protection chemicals, are developed to safeguard crops from insects, diseases, and weeds. These chemical agents, such as fungicides and insecticides, are utilized to manage organisms that can harm crops, including fungi, nematodes, mites, insects, rodents, and viruses. The use of agrochemicals has become essential for successful crop cultivation, and they play a significant role in modern agriculture.

Growing demand for fertilizers is one of the key growth drivers. Currently, around 50% of the global population depends on synthetic fertilizers. Fertilizers (organic or inorganic) are commonly employed to enhance soil productivity and support crop growth. Organic fertilizers encompass manure, fish meal, granite meal, and seaweed, while inorganic fertilizers consist of nitrogen, potassium, phosphorus, and others. Inorganic fertilizers are often preferred for their ability to deliver more immediate results compared to organic alternatives. In terms of product, the estimated All-India usage of urea (based on DBT sale) stood at 35.73 million MT, and DAP at 10.53 million MT during 2022-23. This marked a 4.5% increase for urea and a 13.6% increase for DAP over the 2021-22 period.

Additionally, the industry growth is driven by increasing global demand for crop protection products and the use of effective insecticides to prevent crop loss from pests. Around 25% of the world's crop output is lost annually due to diseases, pests, and weeds. The rising use of pesticides in agriculture to increase crop production and yield is also contributing to the demand for agrochemicals such as fertilizers, pesticides, plant growth promoters, and adjuvants, which improve crop yield. Adjuvants are added to crop protection chemicals to increase their effectiveness, and various types are used for different purposes.

However, synthetic agrochemicals, including fertilizers, pesticides, and plant growth regulators, face increasing regulatory scrutiny due to their potential harm to crops, consumers, and the environment. European countries like Germany and the UK are advocating for organic alternatives, while Asia Pacific countries, such as China and India, are also restricting synthetic agrochemical use. Also, organic products face challenges in Asia Pacific due to higher costs and limited availability. These measures are expected to hinder market growth in the future.

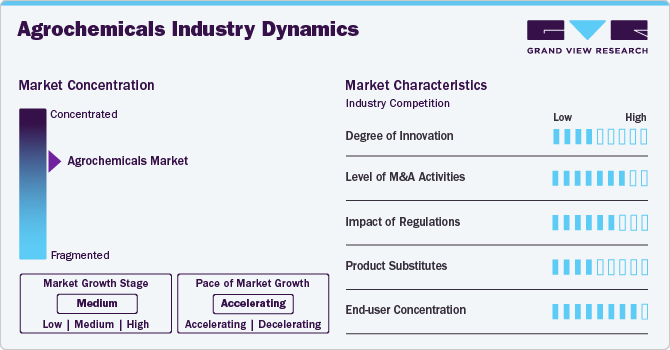

Market Concentration & Characteristics

The global agrochemicals market is significantly competitive with the presence of a large number of players. Key players include Solvay, Clariant AG, Huntsman International LLC, The Dow Chemical Company, BASF SE, Evonik Industries AG, and Bayer AG.

The market growth stage is high, and the pace of growth is accelerating. The product market is governed by a considerable degree of M&A activities along with high end-user concentration. Several large players such as Solvay and Huntsman International LLC are doing mergers, acquisitions and expanding their distribution networks and global reach to cater to a wider customer base.

The companies operating in the agrochemicals market demonstrate a commitment to ongoing research and development, aiming to produce innovative and environmentally friendly products. One notable example is Clariant, which offers the bio-based green agricultural adjuvant "Synergen OS," derived from methylated seed oil.

Significant regulations pertaining to agrochemical usage and production are likely to negatively impact the industry growth. For instance, in Brazil, the regulatory framework for adjuvants was aligned with that of agrichemicals until 2018. Subsequently, the Ministry of Agriculture, Livestock, and Supply (MAPA) initiated efforts to address the regulation of agricultural adjuvants in Brazil. Consequently, various regulatory authorities such as the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), as well as the Environmental Protection Agency (EPA), among others, are engaged in the mapping and monitoring of toxicity emissions within permissible limits.

However, the rising demand for environmentally friendly agricultural adjuvants is expected to spur industry growth in the near future. This increase is attributed to the growing emphasis on health and wellness among consumers. There is a gradual shift towards organically produced foods in the U.S., prompting companies to concentrate on the development of eco-friendly adjuvants, such as organo-modified siloxanes, modified vegetable oils, and methylated seed oil.

Product Insights

The fertilizers segment dominated the market with a revenue share of 76.98% in 2023. This is mainly attributed to increasing attention from farmers to enhance crop yields within a shorter timeframe. The escalating global demand for crops and food is exerting pressure on agricultural land, prompting farmers to increase their use of fertilizers to improve the productivity and yields of diverse crops.

The fertilizer segment encompasses nitrogenous, phosphatic, potassic, secondary fertilizers, and others. The nitrogenous fertilizer segment is anticipated to demonstrate rapid growth over the forecast period. Nitrogenous fertilizers are widely available and contribute to accelerated plant growth and improved yields. Nonetheless, the increased use of nitrogenous fertilizers can have adverse effects on the surrounding environment, including water bodies.

Application Insights

The cereal & grains segment held a lion's share of 47.02% in 2023. This is attributed to the growing consumption of cereal and grains, such as rice, wheat, rye, corn, oats, sorghum, and barley in various regions. Agrochemicals are predominantly used for cereals and grains in Asia Pacific and North America due to the high cultivation of wheat and corn in countries like China and the U.S. Non-ionic surfactants, along with agrochemicals, are primarily recommended for cereals and grains.

Oilseeds and pulses encompass a diverse range of seeds, including sunflower seeds, soybeans, and leguminous crops (pulses). The market is anticipated to be influenced by the escalating attention of farmers towards oilseed production. Brazil, China, and the U.S. stand as prominent global oilseed producers. Consequently, there is an expectation of a substantial demand for agrochemicals from these countries during the forecast period.

The growth in the agrochemicals market can be attributed to the rising global consumption of vegetarian foods, as well as the increasing awareness of health among consumers. This heightened awareness is driving the demand for fruits and vegetables, which in turn is expected to have a positive impact on the agrochemicals market. Furthermore, the increasing production of fruit and vegetable crops is anticipated to further contribute to the growth of the agrochemicals market.

The others segment includes herbs, tea, spices, coffee, and more crops in which agrochemicals are used. Increasing preference for beverages such as tea and coffee coupled with rising hospitality industry growth is expected to bolster the demand for agrochemicals in this application segment.

Regional Insights

The North American region is characterized by the presence of many agrochemicals manufacturers. This region, due to stringent environmental regulations, is expected to be the largest market for organic agrochemicals including bio-fertilizers and bio-pesticides. The growing dairy industry, coupled with favorable climatic conditions for crops such as corn and maize has been the key driver of the market in this region.

U.S. Agrochemicals Market Trends

The presence of agrochemical manufacturers in the U.S. has a significant impact on the market by reducing dependency on other countries for agrochemical imports. This allows farmers and businesses in the agricultural sector to access products within their domestic market. Also, growing consumer preference for organically produced foods, further leads companies to focus on developing bio-based, eco-friendly agrochemical products such as organo-modified siloxanes, modified vegetable oils, and methylated seed oil, among others.

Asia Pacific Agrochemicals Market Trends

The Asia Pacific agrochemicals market held a substantial share of 51.98% of revenue in 2023. This is attributed to a large population, increasing food demand, and rising agricultural production, particularly in countries like India, China, Japan, and Australia. Also, as per University of Melbourne and Zhejiang researcher Baojing Gu, China plays a significant role in pesticide use, accounting for about 30% of global pesticide and fertilizer consumption and supplying over 90% of the world's technical raw material needs.

China is a significant player in the global fertilizer and pesticide industry, being a major consumer, exporter, and producer of these agricultural inputs. The country's extensive use of fertilizers and crop protection chemicals is driven by its large agricultural output, which is necessary to meet the demands of a growing population. As the need for food grains and other agricultural products continues to rise, so does the demand for fertilizers and agrochemicals.

Europe Agrochemicals Market Trends

European countries, such as Germany, France, UK and Italy, were the major contributor in the market growth in 2023 However, countries such as Spain, Bulgaria, Romania, among others have witnessed rapid growth on account of increasing investments in the agricultural sector and better water preservation techniques. These factors have resulted in growing agricultural activities in this region, consequently boosting the demand for agrochemicals

The growth of agrochemicals in France is driven by the increasing agricultural production in the country. France is the largest producer of crops in Western Europe, with approximately 7% of the population earning from the agricultural sector. The country specializes in sugar beets, cereals, and oilseeds, with a production of around 38 million tons of sugar beets. Farmers are focusing on increasing crop yields, which is expected to drive the agrochemicals market.

Central & South America Agrochemicals Market

Brazil, Argentina and Colombia are the major contributor for the regional market growth. The strong agriculture industry market growth mainly in Brazil is the key driving factor for the CSA agrochemicals market.

The demand for agrochemicals in Brazil is increasing due to the rising demand and production of Brazilian soybeans. The trade tensions between the U.S. and China have led to China imposing higher tariffs on soybeans and other agricultural products in response to U.S. tariffs on Chinese products. As a result, Brazil has experienced increased demand for soybeans from China.

Middle East & Africa Agrochemicals Market Trends

The Middle East & Africa agrochemicals market is expected to grow at a significant pace over the forecast period. The consumption of pesticides is increasing in Saudi Arabia and Oman, and trend is seen steady for South Africa, Kuwait, and Qatar pesticides consumption. In addition to this, there is tremendous growth in the consumption of pesticides in Ghana.

South Africa heavily relies on its agricultural sector, which accounts for over 60% of all jobs in the region. The demand for agrochemicals is increasing due to new farming techniques, improved irrigation facilities, and the growth of more resilient food crops. South Africa exports major crops such as citrus, apples, corn, table grapes, and other agricultural products.

Key Agrochemicals Company Insights

The global agrochemicals market is moderately fragmented with several tier-1 and tier-2 players, such as Clariant AG, Royal Dutch Shell plc, SABIC, Yara International, Solvay, Merck KGaA, and Adjuvants Plus Inc. The players face intense competition from each other and regional players, who have strong distribution networks and good knowledge of suppliers and regulations.

-

Clariant AG was formed in 1995 and is headquartered in Muttenz, Switzerland. Clariant has five business units including oil and mining services, industrial & consumer specialties, functional minerals, catalysts, and additives. These units are reported in three business areas catalysis, care chemicals, and natural resources. The company offers agricultural adjuvants under industrial & consumer specialties.

-

Solvay was established in 1863 and is headquartered in Brussels, Belgium. Solvay has a global presence in 64 countries, with major markets in Asia Pacific, Europe, and North America. The company specializes in chemicals, materials, and solutions, offering its products to various industries including automotive, healthcare, and water treatment. Solvay is committed to developing safer, cleaner, and sustainable solutions. Within its crop protection product line, Solvay offers agricultural adjuvants, including bioactivator adjuvants and tank-mix adjuvants.

Helena Agri-Enterprises, LLC, Land O’ Lakes, Inc., Stepan Company, and Ingevity are some of the emerging market participants in the global agrochemicals market.

-

Helena Agri-Enterprises, LLC was established in 1957 and is headquartered in Collierville, U.S. The company offers agronomic solutions. It manufactures and sells products that improve agricultural productivity for higher returns to the growers. Its product portfolio includes fertilizers, adjuvants, seed treatments, and crop enhancement products. It also provides financial services and precision

-

Land O’ Lakes Inc. was founded in 1921 and is headquartered in Saint Paul, U.S. The company's diverse business lines include agrochemicals, dairy foods, feed, and other products. After merging with United Suppliers in 2016, a new brand, WinField United, was established to consolidate the crop protection products and seed business. WinField United, under Land O' Lakes, offers a variety of agricultural products such as adjuvants, herbicides, fungicides, insecticides, and plant growth regulators.

Key Agrochemicals Companies:

The following are the leading companies in the agrochemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Royal Dutch Shell plc

- OCP Group

- SABIC

- PhosAgro

- Yara International

- Rashtriya Chemical Fertilizer Ltd.

- Adjuvants Plus Inc.

- Merck KGaA

- Praxair Technology, Inc.

- Southern Agricultural Insecticides, Inc.

- NCP Chlorchem (Pty) Ltd

- Ineos Group Ltd

- Royal Dutch Shell plc

- Graham Chemical Corporation

- Evonik Industries

- Cargill Incorporated

- Targray Technology International Inc

Recent Developments

-

In March 2024, Yara India launched ‘Kissan ka Sachcha Yaar’ which is aimed at empowering farmers to produce high-quality yields that are sustainable and nutritious. The campaign coincides with the launch of FarmCare 2.0, an app designed to support farmers with real-time weather updates, soil management guidance, and efficient fertilizer use.

-

In May 2023, Yara launched a biostimulant for seed treatment at the BAW 2023, during the BioAg World Congress in Rio de Janeiro. The product, NRhizo, is the first of 15 launches planned this year, aiming to offer premium solutions to Brazilian rural producers.

Global Agrochemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 285.06 billion

Revenue forecast in 2030

USD 390.17 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, and Region

Country scope

U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, South Africa

Key companies profiled

Royal Dutch Shell plc, OCP Group, SABIC, PhosAgro, Yara International, Rashtriya Chemical Fertilizer Ltd., Adjuvants Plus Inc., Merck KGaA, Praxair Technology, Inc., Southern Agricultural Insecticides, Inc., NCP Chlorchem (Pty) Ltd, Ineos Group Ltd, Royal Dutch Shell plc, Graham Chemical Corporation, Evonik Industries, Cargill Incorporated, Targray Technology International Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agrochemicals Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agrochemicals market report on product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Fertilizers

-

Nitrogenous

-

Phosphatic

-

Potassic

-

Secondary Fertilizers (Calcium, Magnesium, and Sulfur Fertilizers)

-

Others

-

-

Crop Protection Chemicals

-

Herbicides

-

Insecticides

-

Fungicides

-

Others

-

-

Plant Growth Regulators

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Cereal & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Frequently Asked Questions About This Report

b. The global agrochemicals market size was estimated at USD 271.42 billion in 2023 and is expected to reach USD 285.06 billion in 2024.

b. The global agrochemicals market is anticipated to grow at a compounded annual growth rate (CAGR) of 5.4% from 2024 to 2030 to reach USD 390.17 billion by 2030.

b. The Asia Pacific dominated the market and accounted for a over 27% share of global revenue in 2023. The region is the major producer of agricultural products in the world. Countries such as India, China, and Japan are contributing the majority of the market share in the Asia Pacific agrochemicals market.

b. Some prominent players in the agrochemicals market include Clariant AG, BASF SE, Huntsman International LLC, Bayer AG, The DOW Chemical Company, Solvay, Nufarm, Evonik Industries AG, Croda International Plc, Helena Agri-Enterprises, LLC, Ashland Inc., Land O’ Lakes Inc., FMC Corporation, ADAMA Ltd., and Stepan Company.

b. The agrochemicals market growth is dependent on pest attacks, crop yields, agriculturists’ awareness level, and capacity to buy products depending on their availability of credit. Increasing demand for insecticides across the globe is also a major factor for market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.